Why the Silver Bar vs Coin Decision Matters for Your Investment Strategy

When investing in precious metals, the Silver Bar vs Coin choice is a critical decision. This guide breaks down what you need to know to align your purchase with your investment goals.

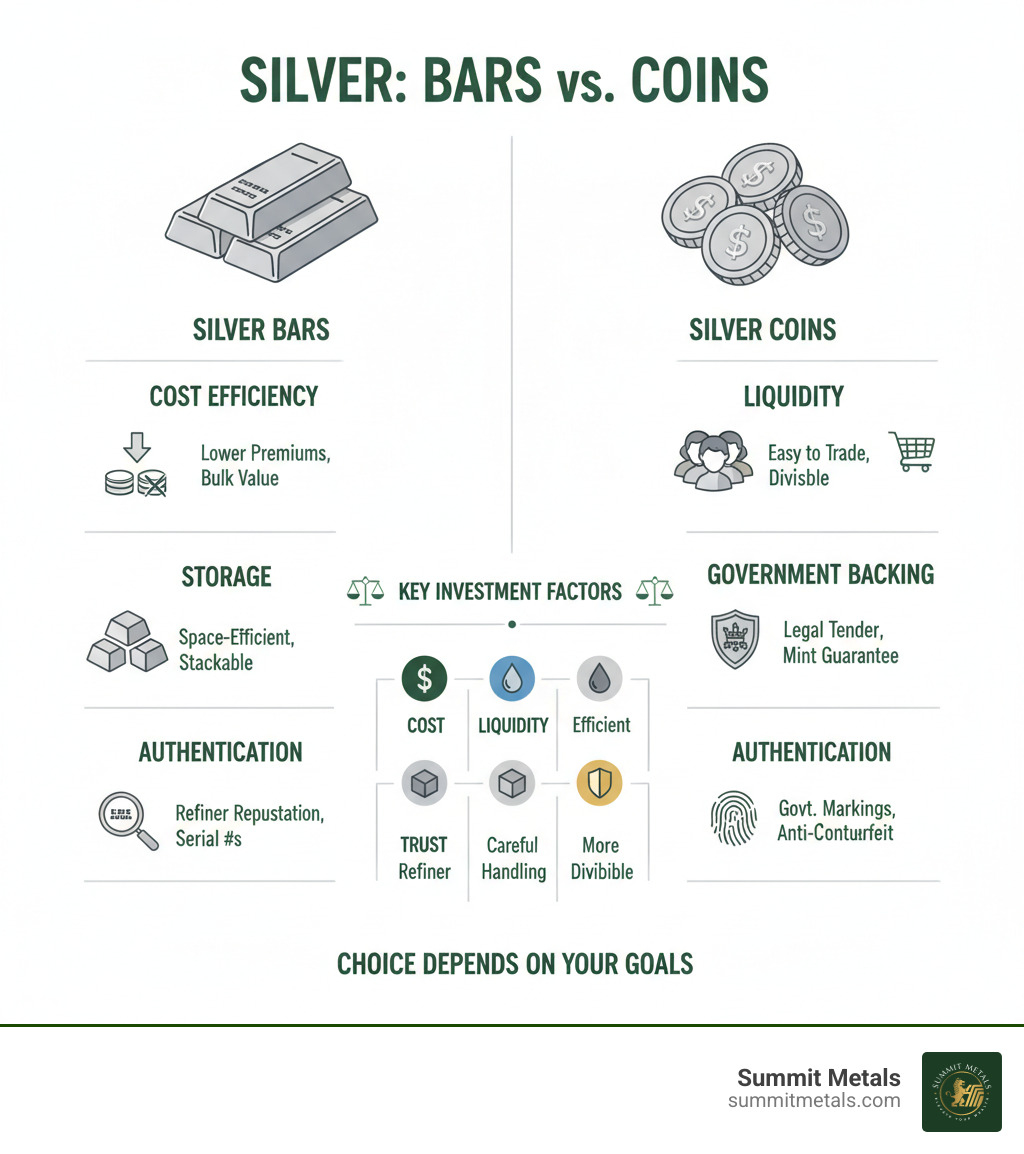

| Factor | Silver Bars | Silver Coins |

|---|---|---|

| Cost per ounce | Lower premiums (especially larger bars) | Higher premiums due to minting costs |

| Liquidity | Good for large transactions | Excellent for small transactions |

| Storage | More efficient stacking | Requires more careful handling |

| Authenticity | Relies on refiner reputation | Government backing and legal tender status |

| Divisibility | Less flexible for partial sales | Easy to sell in small quantities |

Silver is significantly more accessible than gold. Silver bars typically offer the lowest cost per ounce, especially in larger weights, making them ideal for bulk accumulation. In contrast, silver coins provide superior liquidity and government-backed authenticity, which many investors find reassuring.

The choice isn't about which is "better," but which is right for you. Bars help you maximize the quantity of silver for your dollar, while coins offer flexibility and widespread recognition. This guide will help you steer the practical considerations of physical silver ownership to build a resilient precious metals portfolio.

Cost, Production, and Appearance

The most immediate differences between silver bars and coins are their appearance and cost, which are tied to their manufacturing process. Understanding these aspects is the first step in deciding if a Silver Bar vs Coin is right for your portfolio.

Production and Design

Silver bars are the straightforward, no-nonsense option. Most are made by pouring molten silver into molds, which are then stamped with essential information like weight, purity (.999 fine silver), and the refiner's mark. This utilitarian design gives bars an industrial appearance, and poured bars often have unique textures from the cooling process.

Silver coins, by contrast, are struck using precision dies to create intricate artwork. These designs often feature national symbols, historical figures, or commemorative themes, turning each coin into a miniature work of art.

Government mints like the U.S. Mint produce most silver coins, ensuring consistent quality and official backing. Private refineries handle most silver bar production, where their reputation depends on their brand rather than a government guarantee. This is why researching a refiner's accreditation is crucial when considering products like The Mmtc Pamp 1kg Silver Bar Purity, Weight, and Worth.

Premiums and Cost Per Ounce

Every physical silver product's price starts with the spot price (the market price for one troy ounce), plus a premium. Premiums cover manufacturing, distribution, and dealer margins.

Silver bars are the budget-friendly choice, especially in larger weights. Their simpler production process leads to lower manufacturing costs and better economies of scale, delivering more ounces for your dollar.

Silver coins carry higher premiums due to their detailed minting process, legal tender status, and government backing. Some coins also have collectibility appeal that can add numismatic value beyond their silver content.

The difference in premiums is significant:

| Product Type | Typical Premium Over Spot | Why the Difference? |

|---|---|---|

| 1 oz Silver Coin | 15% - 30% | Intricate design, government backing, collectibility |

| 1 oz Silver Bar | 10% - 20% | Simpler design, private mint production |

| 10 oz Silver Bar | 5% - 12% | Economies of scale kick in |

| 1 Kilo Silver Bar | 3% - 8% | Maximum efficiency and bulk production |

Premiums fluctuate based on market demand.

Even collectors can be cost-conscious by learning The Savvy Collector's Secret: Where to Buy Silver Coins for Less. Understanding these premium differences allows you to make informed decisions that align with your investment strategy and budget.

The Great Debate: Silver Bar vs Coin for Investment

Beyond cost, the core of the Silver Bar vs Coin debate is their performance as investments. Factors like liquidity, divisibility, and appreciation potential define how they fit into your financial strategy.

Liquidity, Divisibility, and Market Demand

Liquidity is how quickly you can convert silver to cash at a fair price. Silver coins are the clear winners in the retail market. An American Silver Eagle is instantly recognized and valued by dealers worldwide, ensuring quick sales.

The divisibility of coins is a major advantage. You can sell a few coins to cover a small expense without liquidating your entire holding.

Silver bars excel in wholesale markets and large transactions. Their standardization, or fungibility, makes them efficient for institutional trading. However, a large bar cannot be partially sold, which limits flexibility for smaller needs. For serious stackers, this standardization is a major advantage when they buy 15 kilos of silver bars.

Government Backing and Numismatic Value

Silver coins have a key advantage: government backing. A coin from a sovereign mint like the Royal Mint or U.S. Mint is a government-guaranteed product with legal tender status and a face value. This backing provides confidence in the coin's weight and purity.

Crucially, this status also offers protection. Counterfeiting legal tender carries severe penalties, making fake coins much less common than counterfeit bars.

Coins also have numismatic value potential. While a silver bar's value is tied to its silver content, certain coins can become worth more to collectors due to rarity or design. For example, The American Silver Eagle is a collector's dream and an investment gem.

Silver bars are purely bullion investments, with their value tracking the spot price. This offers straightforward, predictable pricing without the complexity of collector premiums.

Potential for Appreciation

Both bars and coins rise and fall with the silver spot price, but their total appreciation can differ.

Silver bars offer pure, uncomplicated exposure to silver's price movements. Their value is directly tied to the commodity market, making them ideal for investors who want to bet purely on the metal's price.

Silver coins offer dual appreciation potential. They track the spot price but can also gain numismatic value if they become sought-after by collectors. This means a coin could potentially outperform the spot price of silver itself.

Understanding these smart strategies for investing in precious metals helps you choose the right form for your goals. To build wealth systematically and smooth out price volatility, our Autoinvest program allows you to dollar-cost average into silver, similar to a 401(k), building your position over time regardless of market fluctuations.

Practical Considerations for Silver Investors

Owning physical silver involves verifying, storing, and eventually selling your assets, along with understanding the tax implications. These realities can influence your Silver Bar vs Coin decision.

Purity and Authenticity Verification

Ensuring your silver is authentic and pure (.999 fine or higher) is critical. Silver coins from government mints have a clear advantage due to sophisticated anti-counterfeiting features like micro-engraving and security edges. As legal tender, faking them is a federal crime, providing a strong deterrent. The advanced coin authentication features on modern coins make them extremely difficult to counterfeit convincingly.

Silver bars can be more challenging to verify. While reputable refiners stamp bars with serial numbers and purity, these are easier to fake than coin designs. Verifying a bar's authenticity may require professional methods like XRF analysis. This is why buying certified silver bars from trusted dealers who work with accredited refiners is so important.

Storage, Insurance, and Security

Safe storage is essential. Silver bars are storage-efficient due to their uniform, stackable shape. A 100-ounce bar takes up far less space than 100 individual coins, reducing storage costs for large quantities. However, the loss of a single large bar is a more significant event.

Silver coins require more space and protective casing (capsules or tubes) to prevent scratches, especially if they have numismatic value. This adds to storage costs but offers diversification; losing a few coins is less devastating than losing one large bar. Storage options for both include a home safe, a bank deposit box, or professional vaulting services, each with its own costs and security levels. Understanding the basics of gold and silver stacking helps in planning an efficient strategy.

Tax and Legal Implications

Understanding the tax treatment of silver is crucial for your returns. In the U.S., profits from selling precious metals are typically subject to Capital Gains Tax, often at a higher "collectibles" rate of up to 28%.

In some jurisdictions, coins have a tax advantage. For example, in the UK, legal tender coins are CGT exempt, a benefit that does not apply to bars. While we primarily serve U.S. customers from our Wyoming base, this shows how legal tender status can offer tax benefits.

Other considerations include reporting requirements for large transactions in the U.S. and IRA eligibility. Both bars and coins can be held in a Precious Metals IRA if they meet .999 purity standards and are stored in an approved depository. Always consult a tax professional to understand the laws in your jurisdiction.

Making Your Choice: Which Silver Form is Right for You?

The best form of silver is the one that aligns with your investment strategy. Whether you prioritize low cost, flexibility, or long-term appreciation will guide your Silver Bar vs Coin decision. Let's explore what makes sense for different investors.

The Silver Bar vs Coin Choice for Beginners

For those new to silver, we recommend starting with recognizable, government-minted silver coins. An American Silver Eagle or Canadian Maple Leaf offers instant credibility and superior liquidity worldwide. The lower entry cost of a single 1-ounce coin allows you to start small and build your stack as you learn. Most importantly, government backing provides peace of mind through anti-counterfeiting features and legal tender status. Our guide to buying silver coins online can help you make your first purchase with confidence.

The Silver Bar vs Coin Choice for Bulk Investors

If your goal is to accumulate thousands of ounces, the equation shifts in favor of silver bars. For large-scale investors, lower premiums compound into substantial savings. The difference between a 5% premium on bars and a 20% premium on coins can mean acquiring over 100 extra ounces of silver on a $25,000 investment.

Larger bars (100 oz or kilo) offer the best cost-effectiveness due to economies of scale. Their compact, stackable nature also makes storage more efficient and affordable. For those ready to make a substantial investment, we've compared the 7 best places to buy silver bars to help you find the best value.

A Balanced Strategy: Dollar-Cost Averaging with Autoinvest

Instead of choosing one form, many smart investors use portfolio diversification by owning both bars and coins. This strategy is improved by Dollar-Cost Averaging (DCA), which involves investing a fixed amount at regular intervals to smooth out market volatility.

Building a mixed stack over time offers the best of both worlds: cost-effective bars for bulk accumulation and liquid coins for flexibility. Our Autoinvest program makes this effortless. Similar to a 401(k), you can set up automated monthly purchases to grow your silver holdings without trying to time the market. This disciplined approach leverages the power of dollar-cost averaging in gold and silver investments, helping you build wealth systematically.

Ready to put your silver investing on autopilot? You can set up your automated silver investment plan with us today.

Frequently Asked Questions about Silver Investing

Here are answers to common questions about the Silver Bar vs Coin decision.

What is the main risk of investing in physical silver?

The primary risks are price volatility and logistics. Silver's price can be more volatile than gold's because it's both a precious metal and an industrial commodity, reacting to economic trends and industrial demand. Additionally, physical silver does not pay dividends; returns depend solely on price appreciation. Finally, investors must manage the logistical challenges and costs of secure storage and insurance.

Do silver bars hold their value as well as coins?

Both track the spot price of silver, so their intrinsic value is the same. However, coins often have better resale value due to their high recognition, government backing, and liquidity. Coins also have potential numismatic value, meaning some can become worth more to collectors over time, a feature bars typically lack. Bars are valued almost exclusively for their metal content, offering simple, predictable pricing.

Is it cheaper to buy silver bars or coins?

It is almost always cheaper to buy silver bars on a per-ounce basis. Bars have a simpler manufacturing process, which results in lower premiums over the spot price. Coins require intricate minting, security features, and government backing, all of which contribute to higher premiums. The cost difference is most significant with larger bars (e.g., 100 oz), which offer the lowest premiums, making them ideal for maximizing the amount of silver you can buy.

Conclusion: The Final Verdict in the Silver Bar vs. Coin Debate

There is no single "best" choice in the Silver Bar vs Coin debate—only the best choice for you, based on your goals and budget.

Choose silver bars if your primary goal is to maximize your silver ounces at the lowest cost. They offer the lowest premiums, especially in larger sizes, and are the most storage-efficient option for bulk accumulation.

Choose silver coins if you value flexibility, liquidity, and government-backed authenticity. Their universal recognition makes them easy to sell, and they offer the potential for numismatic appreciation.

The smartest approach often combines both. Build a core holding with cost-effective bars and add government-issued coins for liquidity. This balanced strategy is even more powerful with our Autoinvest program, which allows you to dollar-cost average into both forms through automated monthly purchases, removing emotion from your investment decisions.

At Summit Metals, our mission is to make precious metals investing straightforward and secure. Based in Wyoming and serving investors nationwide, we offer transparent, real-time pricing on a full selection of authenticated silver bars and coins. Our competitive rates ensure you receive exceptional value.

Ready to build your ideal silver portfolio? We're here to help you make the right choice for your financial future.