Why Tangible Assets Matter in Today's Economy

Physical precious metals are tangible investment assets—including gold, silver, platinum, and palladium—that you can hold in your hands. This offers direct ownership without counterparty risk. Unlike paper assets or ETFs, these metals provide true diversification and have served as a hedge against inflation and economic uncertainty for millennia.

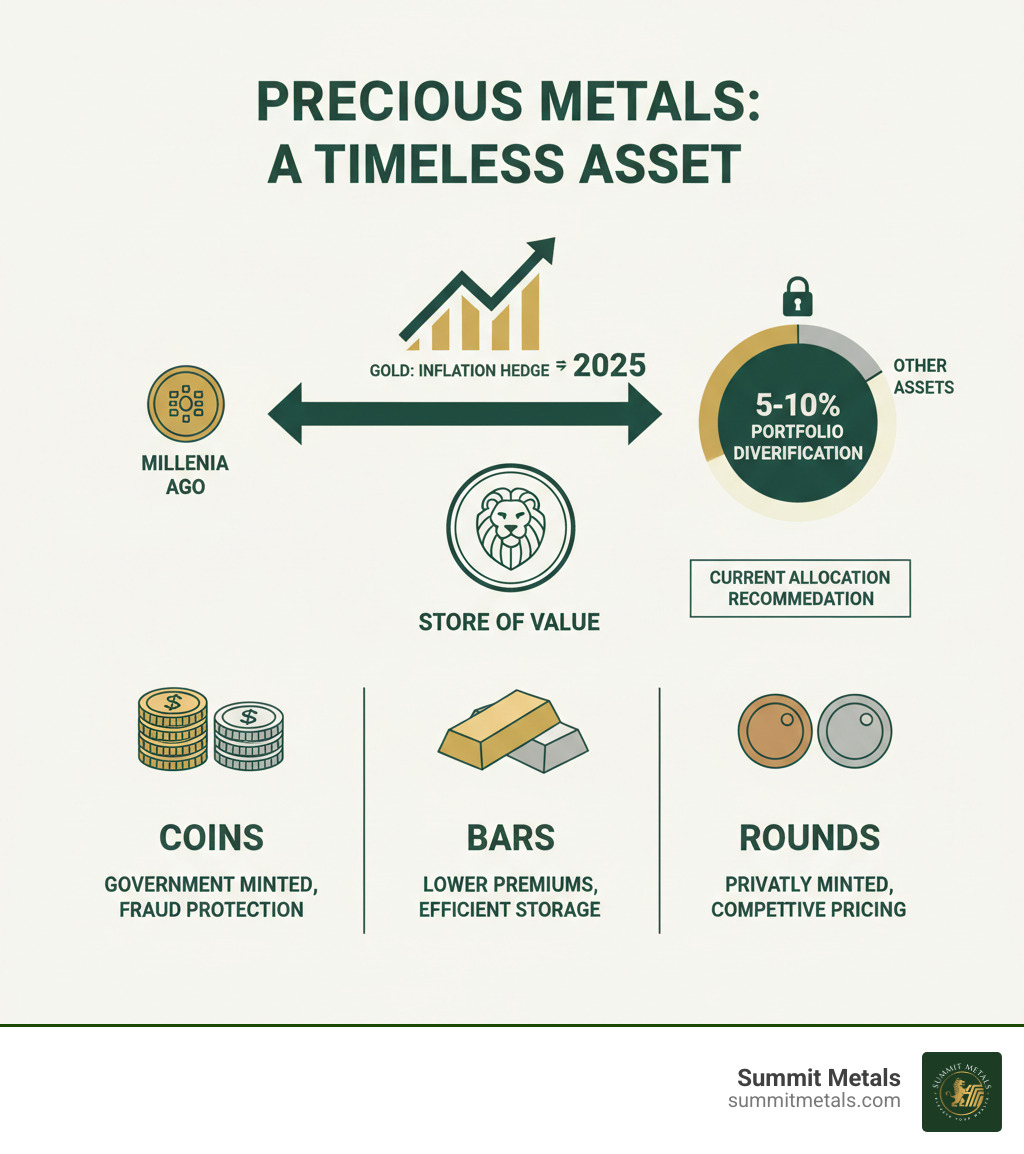

Key Types of Physical Precious Metals:

- Gold: The traditional store of value, available as coins, bars, and rounds.

- Silver: Valued for both industrial demand and investment appeal, with a lower entry cost.

- Platinum: A rare metal with significant automotive and jewelry applications.

- Palladium: Driven by high industrial demand, particularly in catalytic converters.

Common Forms Available:

- Coins: Government-minted with face value and advanced fraud protection.

- Bars: Offer lower premiums and efficient storage in various sizes.

- Rounds: Privately minted with competitive pricing.

Economic uncertainty has made tangible assets more appealing than ever. With inflation eroding purchasing power and traditional investments facing volatility, many investors are turning to physical metals as a wealth preservation strategy. The strong performance of precious metals reflects growing concerns about currency debasement and economic instability, attracting both individual investors and central banks seeking portfolio diversification.

Understanding the Landscape of Physical Precious Metals

Investing in physical precious metals means owning assets with intrinsic value that you can hold in your hands. Unlike currencies or digital assets that rely on institutional trust, these metals derive their worth from scarcity and inherent properties. This direct ownership is especially valuable during times of economic uncertainty.

The market is driven by both investment demand from those seeking safe-haven assets and industrial applications that create steady consumption. Understanding these key factors influencing gold & silver prices helps investors make informed decisions. Modern trends like fractional ownership and dollar-cost averaging are also making precious metals more accessible than ever.

The Core Four: Gold, Silver, Platinum, and Palladium

Four metals dominate the investment landscape, each with unique portfolio roles.

Gold: The ultimate store of value and safe-haven asset. Gold often performs well when inflation rises or markets are volatile, with some analysts forecasting significant price increases. Our ultimate guide to gold explores its enduring appeal. Popular forms include the 99.99% pure Gold American Buffalo and the 91.6% pure Gold American Eagle.

Silver: A compelling entry point with a dual role as a monetary and industrial metal. Its use in electronics, solar panels, and EVs creates steady demand. Bank of America has projected prices could reach $35 per ounce by 2026. Learn more about why silver makes a good investment. The Silver American Eagle is 99.9% pure.

Platinum: Rarer than gold, its price is closely tied to global economic health due to heavy use in automotive catalytic converters and jewelry. Mastering platinum bullion trading requires understanding these industrial drivers. The Platinum American Eagle coin is 99.95% pure.

Palladium: Even scarcer than platinum, this metal shares similar automotive applications and can experience extreme price volatility due to supply constraints. The Palladium Canadian Maple Leaf offers 99.95% purity.

Forms of Ownership: Coins, Bars, and Rounds

Choosing the right form for your physical precious metals depends on your goals.

Government-Minted Coins: Products like the American Eagle or Canadian Maple Leaf carry legal tender status and nominal face values, offering superior fraud protection and global recognition. They command higher premiums but provide maximum liquidity.

Bars: Produced by reputable mints like PAMP Suisse, bars prioritize metal content. Their rectangular shape is storage-efficient, and lower premiums mean you get more metal for your money, making them ideal for large-scale accumulation.

Rounds: Privately minted pieces like Buffalo Rounds resemble coins but lack legal tender status. They typically offer the lowest premiums, perfect for investors prioritizing metal content over government guarantees. Our guide on where to purchase silver rounds offers buying strategies.

The gold bars vs. coins debate centers on this trade-off: government backing versus lower cost.

Decision Chart: Gold Coin vs. Gold Bar

| Factor | Gold Coin (e.g., American Gold Eagle) | Gold Bar (e.g., PAMP Suisse) |

|---|---|---|

| Premiums | Higher (due to minting costs, collectibility) | Lower (especially on larger sizes) |

| Liquidity | Excellent (universally recognized) | Excellent (widely accepted) |

| Government Backing | Yes (legal tender with face value) | No (privately minted) |

| Fraud Protection | Superior (complex anti-counterfeiting features) | Good (relies on assay cards) |

| Storage Efficiency | Good | Excellent (designed for stacking) |

| Best For | Investors prioritizing security and recognizability. | Investors focused on accumulating maximum ounces for the lowest cost. |

Physical Bullion vs. 'Paper' Assets

While ETFs and mining stocks offer exposure to precious metals, they introduce counterparty risk—reliance on a third-party institution. Many ETFs cannot be redeemed for physical metal, may hold derivatives instead of bullion, and are subject to different tax rules.

Physical ownership of physical precious metals eliminates this risk. You have complete control over your assets, independent of any financial institution's stability. This direct control is a key feature, not a burden, providing ultimate security in an uncertain world.

The Buyer's Playbook: Key Factors Before You Purchase

Investing in physical precious metals requires due diligence to ensure you acquire authentic metals at fair prices. A strategic approach protects your investment and builds a foundation for real wealth. Our guide on how to buy gold and silver online safely details these essential steps.

Decoding the Price: Spot Price vs. Premiums

Two numbers determine the final price of physical precious metals:

Spot Price: The live market price for one troy ounce of a raw precious metal. This price fluctuates constantly based on global supply, demand, and economic events. You can track these movements with a live gold price chart.

Premium: The amount charged above the spot price. This covers the costs of minting, fabrication, dealer operations, and profit. Premiums vary based on product type (coins vs. bars), size (smaller items have higher premiums per ounce), and market demand.

At Summit Metals, our bulk purchasing power allows us to offer competitive premiums. Our transparent pricing ensures you always know what you're paying.

Essential Quality Checks: Purity, Weight, and Mint Origin

Verifying quality is critical when buying tangible assets. Focus on three key areas:

Purity: Ensure the metal meets investment-grade standards, typically .999 (99.9%) or .9999 (99.99%) fineness. Gold purity is also measured in karats (24-karat is pure gold). Learn more about understanding karats and purity in gold.

Weight: Precious metals are priced by the troy ounce (31.1035 grams). Verify that the product's weight matches its specification.

Mint Origin: Stick to products from reputable government mints (e.g., U.S. Mint, Royal Canadian Mint) or recognized private mints (e.g., PAMP Suisse). These sources include security features like mint marks and serial numbers that are difficult to counterfeit. Knowing how to tell if gold is real provides crucial peace of mind.

Strategic Indicators: Using the Gold-to-Silver Ratio

Smart investors use tools to guide their purchasing decisions. The gold-to-silver ratio is one of the most powerful.

This ratio indicates how many ounces of silver it takes to buy one ounce of gold. Historically, it has fluctuated within a broad range. A high ratio (e.g., 80:1) suggests silver may be undervalued relative to gold, while a low ratio suggests the opposite. Many investors use these extremes as signals to rebalance their holdings between the two metals.

This tool can also inform your diversification strategy, helping you allocate funds more intelligently. Our article on the gold and silver ratio explains how to apply this strategy.

For those who want to leverage this strategy systematically, Summit Metals' Autoinvest program allows you to set up automatic monthly purchases. This dollar-cost averaging approach helps you build your position over time while taking advantage of relative value shifts between gold and silver.

Owning and Managing Your Precious Metals Portfolio

Acquiring physical precious metals is the first step; effective management is key to long-term preservation and security. This involves smart storage, understanding tax implications, and integrating metals into your retirement plan. The goal is always long-term asset protection and leveraging the strategic role of gold in long-term portfolio management.

Secure Storage: Protecting Your Physical Precious Metals

Because these are physical assets, secure storage is non-negotiable. You have several options:

Home Storage: A high-quality home safe offers immediate access and complete privacy. However, this option carries risks related to theft, fire, or natural disasters, and standard homeowner's insurance may not provide adequate coverage.

Bank Safe Deposit Box: This provides excellent physical security at a financial institution. Drawbacks include limited access during banking hours and the fact that contents are not typically FDIC-insured.

Third-Party Depository: The preferred choice for serious investors. These high-security facilities are designed specifically for precious metals and offer full insurance, regular audits, and options for segregated storage (your metals are kept separate from others'). This provides the highest level of security and peace of mind.

Our ultimate guide to precious metals storage explores these options in greater detail.

Navigating U.S. Tax Implications

Understanding how the IRS treats physical precious metals is crucial. In the U.S., most investment-grade bullion is classified as a "collectible."

This means that when you sell metals held for more than one year, any profit is taxed at the collectibles capital gains rate of 28%. This is significantly higher than the 15% or 20% long-term rates for most other investments, as Investopedia explains. Certain large transactions may also trigger reporting requirements. Given these complexities, consulting a qualified tax professional is highly recommended.

Rolling into Retirement: Precious Metals in an IRA

A Self-Directed Individual Retirement Account (IRA) allows you to hold physical precious metals within a tax-advantaged retirement portfolio.

To be included, metals must meet strict IRS purity and type requirements. For example, Gold American Eagles, Gold American Buffalos, Silver American Eagles, and Platinum American Eagles are generally IRA-approved, as are certain bars and rounds of sufficient purity.

Setting up a precious metals IRA requires an IRS-approved custodian to administer the account and an approved depository to store the metals—you cannot store them at home. Contribution limits follow standard IRA rules. This strategy combines the security of physical assets with the tax benefits of a retirement account. Our rulebook for precious metals IRA investors provides comprehensive guidance.

The Marketplace: Buying and Selling with Confidence

Navigating the marketplace is as important as understanding the metals themselves. Confidence comes from working with reputable dealers, knowing how to liquidate your assets, and using smart investment strategies. While online dealers offer convenience and competitive pricing, it's crucial to be vigilant and avoid common precious metals scams.

Finding a Reputable Dealer: What to Look For

Choosing the right dealer is critical. Look for these key qualities:

- Transparent Pricing: The dealer should clearly display real-time prices, including premiums over spot. At Summit Metals, we pass on savings from our bulk purchasing power to our customers with transparent, competitive rates.

- Strong Reputation: Check for extensive positive customer reviews and a long history of reliable service. Leaders like APMEX and GoldSilver.com have built trust over many years.

- Industry Credentials: Membership in organizations like the ICTA (Industry Council for Tangible Assets) or status as an Authorized Purchaser of a government mint signals credibility. You can also check a firm's background on FINRA's BrokerCheck.

- Clear Buyback Policy: A reputable dealer will have a straightforward process for liquidating your metals.

- Educational Resources: Dealers committed to investor education demonstrate a long-term partnership approach.

For those in Utah, Summit Metals offers in-person service at our Salt Lake City location.

The Selling Process: How to Liquidate Your Assets

When it's time to convert your physical precious metals back to cash, you have several options:

- Sell to Dealers: Most reputable online dealers have buyback programs, offering immediate liquidity. Their buyback price will be below the current spot price to cover their costs.

- Local Coin Shops: A good option for smaller transactions or when you need cash instantly, avoiding shipping and insurance hassles.

- Online Marketplaces: Peer-to-peer platforms may yield higher prices but come with greater risks of fraud and authentication challenges.

Always get multiple quotes before selling. Our guide on where to sell gold coins for the best price offers practical strategies.

A Modern Approach: Dollar-Cost Averaging with Autoinvest

Instead of trying to time the market, use dollar-cost averaging (DCA) to build your portfolio systematically. By investing a fixed amount at regular intervals, you buy more ounces when prices are low and fewer when they are high. This strategy reduces risk from volatility and can lower your average cost per ounce over time.

Summit Metals' Autoinvest program makes this effortless. It functions like a 401k contribution: you set up automatic monthly purchases of physical precious metals, and we handle the rest. This subscription model allows you to build your holdings consistently without the stress of market timing.

It's a simple, automated way to build tangible wealth. Start building your precious metals portfolio with our Autoinvest program today and take the guesswork out of investing.

Frequently Asked Questions about Physical Precious Metals

Here are answers to some of the most common questions from new investors in physical precious metals.

What is the best precious metal for a beginner to buy?

Both silver and gold are excellent starting points.

Silver: Often called the "gateway metal" due to its lower price point, making it accessible for smaller initial investments. It tends to be more volatile than gold, which can offer greater upside potential (and risk).

Gold: The classic store of value, known for its stability during economic uncertainty. While the initial investment per ounce is higher, its performance as a safe-haven asset is a primary draw for many investors.

A common strategy is to start with silver to get comfortable with physical ownership, then diversify into gold for long-term wealth preservation. Our decision guide for investing in gold and silver provides a more detailed comparison.

How do I know my precious metals are authentic?

Authenticity is rarely an issue when you follow best practices:

- Buy from Reputable Dealers: This is your most important safeguard. Established dealers like Summit Metals stake their reputation on selling only verified, authentic products.

- Look for Assay Cards: Many bars are sealed in tamper-evident packaging with an assay card that certifies their weight and purity.

- Choose Government-Minted Coins: Products like American Eagles and Canadian Maple Leafs feature complex, anti-counterfeiting designs that are extremely difficult to replicate.

Our guide on identifying reputable bullion dealers and avoiding counterfeits offers more tips and red flags to watch for.

How much of my net worth should be in precious metals?

While this is a personal decision, most financial advisors suggest an allocation of 5% to 10% of your net worth to physical precious metals for diversification.

Your ideal allocation depends on your risk tolerance, investment goals, and financial situation. The primary role of precious metals is to act as a hedge and a store of value, balancing the volatility of other assets like stocks and bonds.

You can start small and increase your allocation over time. Programs like our Autoinvest service make it easy to build your position gradually through dollar-cost averaging. For a deeper analysis, see our article How Much Gold/Silver Should I Have? and consult with a qualified financial advisor.

Conclusion: Building a Resilient Portfolio with Tangible Wealth

Physical precious metals are powerful tools for building a resilient portfolio. They offer what paper assets cannot: real, tangible ownership of a valuable asset that serves as a hedge against inflation, provides portfolio diversification, and preserves long-term value.

From gold's safe-haven status to silver's dual investment and industrial appeal, these metals have proven their worth for millennia. Whether you choose government-backed coins, low-premium bars, or cost-effective rounds, the key to success is due diligence. This means understanding pricing, verifying authenticity, and working with reputable dealers.

At Summit Metals, we are committed to building trust through transparency. We provide authenticated gold and silver with real-time pricing and competitive rates achieved through our bulk purchasing power. We empower investors with both high-quality products and the education needed to succeed.

For a systematic and stress-free way to invest, our Autoinvest program allows you to dollar-cost average into metals with automated monthly purchases, similar to a 401k plan. This takes the guesswork out of market timing and helps you build your stack consistently.

The path to financial resilience is built with sound strategy and reliable partners. You can build a portfolio that stands strong, regardless of the economic challenges ahead.

Start building your precious metals portfolio with our Autoinvest program today