Your Silver Coins May Be Worth More Than You Think

Scrap silver coin prices are based on the current silver spot price, the coin's weight, and its silver content. Here's a look at what your coins could be worth:

| Coin Type | Silver Content | Approximate Value per $1 Face Value |

|---|---|---|

| Pre-1965 US Quarters/Dimes | 90% Silver | $22.89 |

| 1965-1970 Kennedy Half Dollars | 40% Silver | $8.74 |

| Pre-1967 Canadian Coins | 80% Silver | $17.49 |

| 1968 Canadian Coins | 50% Silver | $10.96 |

| Sterling Silver Items | 92.5% Silver | $0.94 per gram |

Prices shown are at the time of this publication.

That old jar of coins in your closet could be a hidden treasure, potentially worth hundreds or even thousands of dollars. The key is that a coin's true value often lies in its precious metal content, not its face value.

When silver coins were removed from circulation in 1965, many people saved them. Today, these "junk silver" coins are worth far more than their printed denominations. For example, a pre-1965 quarter isn't worth 25 cents—it contains about $5.72 worth of silver at current prices.

Knowledge is the difference between getting a fair price and getting scrapped. Unscrupulous dealers may offer pennies on the dollar to sellers who don't know their coins' true melt value.

I'm Eric Roach. After a decade on Wall Street in precious metals markets, I've seen how wildly scrap silver coin prices can vary. At Summit Metals, we provide transparent pricing to ensure you get the full value for your silver, whether you're selling an inheritance or building a portfolio.

What is Scrap Silver vs. Collectible Silver?

Scrap silver and collectible silver are valued differently, much like a junkyard car versus a museum piece. The coin world's terminology can be confusing, but knowing this distinction could mean the difference between getting $100 for your coins versus $1,000. When it comes to scrap silver coin prices, two value systems are at play.

Melt Value Explained

Melt value is the base value of the silver if it were melted down. It's the foundation of all scrap silver pricing. The terms junk silver or constitutional silver refer to common-date coins valued for their metal content. They are often worn or tarnished from circulation, but what matters is the silver inside. A beat-up 1964 quarter has the same amount of silver as a pristine one.

Melt value is your safety net; a coin is always worth at least the value of the silver it contains. The calculation is simple: weight × purity × current silver spot price = melt value.

Numismatic Value Explained

Numismatic value is the premium collectors pay for coins with special appeal beyond their melt value. Factors like rarity, condition, mint marks, and historical significance create this added value. A coin worth $5 in silver could sell for $500 if it's rare and in perfect condition.

Coin grade is critical for numismatic value. A professionally graded MS-70 (perfect) coin commands a high premium, while the same coin in average condition might only be worth its melt value.

Here's the reality check: most coins found in old jars and inherited collections fall into the scrap silver category. They are valuable for their metal, not their collectibility. The good news is that pre-1965 U.S. coins and pre-1967 Canadian coins have substantial silver content, so even "junk" silver is valuable.

Want to learn more about why constitutional silver remains popular with investors? Check out our detailed guide: More info about Constitutional Silver.

The bottom line: start with melt value as your baseline, then investigate if any coins have collector appeal. This ensures you don't leave money on the table.

Key Factors Influencing Scrap Silver Coin Prices

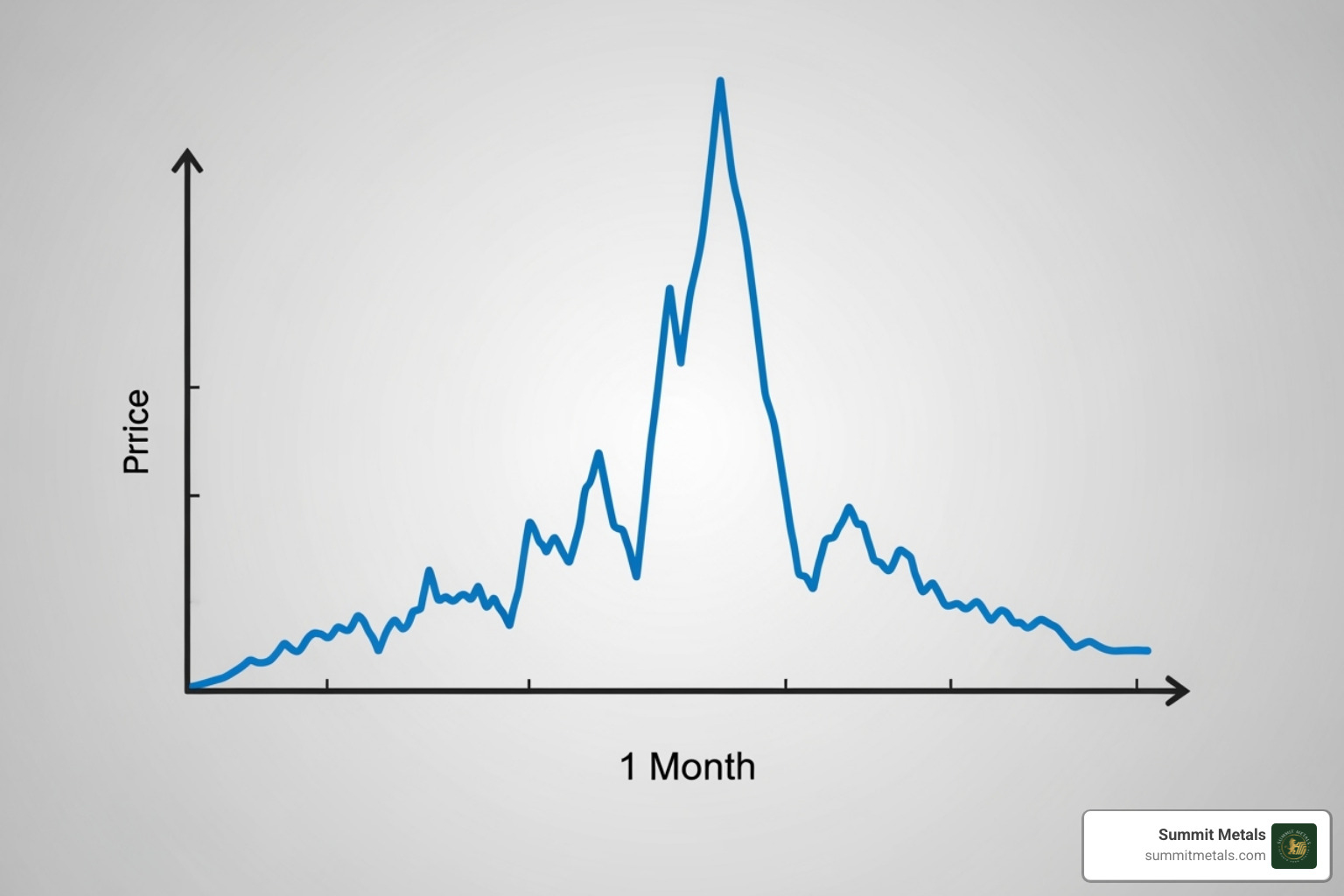

Scrap silver coin prices are dynamic, influenced by global markets, economic events, and political tensions. Understanding these factors helps you make smarter decisions, whether you're selling inherited coins or building your portfolio with a strategy like our Autoinvest program.

The Role of the Silver Spot Price

The silver spot price is the live market price for one troy ounce of pure silver. It's determined on global exchanges like COMEX and the London Bullion Market Association (LBMA), where trading occurs around the clock. This continuous trading is why your coins' value can change throughout the day. For reference, see COMEX silver futures at the CME Group and the LBMA price pages: COMEX Silver Futures and LBMA Prices.

Factors like industrial demand (for electronics and solar panels), geopolitical uncertainty, and currency fluctuations all impact the spot price. This price is the foundation for calculating the value of any silver item, from a 1964 quarter to a Canadian silver dollar.

Understanding Purity: From Sterling to 90% Coin Silver

The purity (or fineness) of your silver determines how much of the spot price applies to your items. Not all silver is created equal.

- Fine Silver (99.9% pure): The standard for modern investment coins like the American Silver Eagle.

- Sterling Silver (92.5% pure): Common in jewelry and silverware, often marked with "STERLING" or ".925". The remaining 7.5% is typically copper for durability.

- 90% Coin Silver: Found in U.S. dimes, quarters, half dollars, and dollars minted in 1964 and earlier. These are often called "junk silver" or "constitutional silver."

- 40% Silver: U.S. Kennedy half dollars from 1965-1970 contain this lower, but still valuable, silver content.

- Canadian Silver: Pre-1967 coins are typically 80% silver, while some from 1967-1968 are 50% silver.

Knowing the purity of your coins is crucial for an accurate valuation.

Weight Matters: Troy Ounces and Grams

Precious metals are measured in troy ounces, not the standard "avoirdupois" ounce used in cooking. A troy ounce is heavier, weighing 31.1035 grams compared to 28.35 grams. Using the wrong unit will lead to incorrect calculations.

Grams are useful for smaller items and provide greater precision. Many dealers, including Summit Metals, quote prices per gram for easier calculations. For accurate measurements, use a digital scale that can weigh in both grams and troy ounces. Precision is key, as small errors add up when dealing with precious metals. New to troy ounces? See the background here: Troy ounce.

Prices shown are at the time of this publication.

A Step-by-Step Guide to Calculating Your Coins' Melt Value

Let's walk through the practical steps to determine the melt value of your silver coins. This process transforms dusty keepsakes into tangible assets.

Step 1: Identify Common Silver Coins

Knowing which coins contain silver is the first step. For U.S. and Canadian coins, the mintage year is key. Look for the following:

- U.S. 90% Silver: Dimes, quarters, and half dollars from 1964 and earlier. Also includes Morgan and Peace dollars (1878-1935).

- U.S. 40% Silver: Kennedy half dollars minted between 1965-1970.

- U.S. 35% Silver: "Wartime" nickels from 1942-1945, identifiable by a large mint mark (P, D, or S) above Monticello on the reverse.

- Canadian 80% Silver: Dimes, quarters, half dollars, and dollars from 1966 and earlier.

- Canadian 50% Silver: Some coins from 1967 and some dimes and quarters from 1968.

Always double-check the dates. The difference between a 1964 quarter (worth ~$5.72 in silver) and a 1965 quarter (worth 25 cents) is just one year. For official U.S. coin compositions and specs, see the U.S. Mint: Coin Specifications.

Step 2: Weigh Your Silver

Use a quality digital scale that measures in grams and troy ounces. For accurate calculations, group your coins by purity (e.g., all 90% coins together) before weighing. Record the total weight for each group. Circulated coins weigh slightly less than uncirculated ones due to wear, which can affect the total value of a large batch.

Step 3: Calculate the Current Scrap Silver Coin Prices

With your coins identified and weighed, you can now calculate their melt value. The formula is:

(Total Weight in Grams) x (Purity as a Decimal) x (Silver Spot Price per Gram) = Melt Value

Let's use an example. Imagine you have found a bag of 90% U.S. silver quarters weighing 100 grams.

- Purity: 90% becomes 0.90.

- Spot Price per Gram: If the silver spot price is $26.54 per troy ounce, the price per gram is $26.54 / 31.1035 ~ $0.8532.

- Calculation: 100 grams x 0.90 x $0.8532/gram = $76.79

Your 100 grams of 90% silver quarters have a melt value of about $76.79. This is the baseline value of your coins' silver content. When you sell to a reputable dealer like Summit Metals, you can expect to receive a high percentage of this melt value, typically between 90-98%.

Maximizing Your Return: Selling and Investing in Silver

Once you know your scrap silver coin prices, you can decide what to do next. Whether selling or investing, choosing the right partner is crucial for getting a fair deal.

Understanding Bid vs. Ask Prices

In precious metals, you'll encounter two prices: the bid price (what a dealer pays you) and the ask price (what you pay a dealer). The difference, or "spread," covers the dealer's costs. At Summit Metals, we prioritize transparency, so you always understand how we arrive at our bid prices with no hidden fees.

Best Methods for Selling Scrap Silver

While you have options like pawn shops or local coin dealers, selling directly to a reputable online dealer like Summit Metals offers key advantages:

- Transparent Process: We explain exactly how we value your silver.

- Competitive Offers: Our high volume and market expertise allow us to offer better rates.

- No Hidden Fees: The price we quote is the price you get.

- Security: Based in Wyoming with a location in Salt Lake City, we authenticate all metals, protecting both buyers and sellers.

Our streamlined process makes selling your silver straightforward and secure.

Why Coins Can Be a Smarter Investment Than Bars

If you're considering reinvesting, government-minted coins often have advantages over bars for most investors.

| Feature | Silver Coins | Silver Bars |

|---|---|---|

| Divisibility | Excellent (smaller units, easier to trade/sell parts) | Fair (larger units, harder to break down) |

| Government Guarantee | Yes (purity and weight backed by government mints) | No (backed by a private refiner) |

| Numismatic Potential | Yes (some coins can develop collector value over time) | No (purely based on melt value) |

| Fraud Protection | High (intricate designs and face value deter counterfeiting) | Moderate (easier to counterfeit than complex coins) |

To help you compare across metals, here's a quick look at gold as well:

| Feature | Gold Coins | Gold Bars |

|---|---|---|

| Divisibility | Excellent (1/10 oz, 1/4 oz, 1/2 oz, 1 oz options) | Good to Fair (most cost-efficient in larger sizes) |

| Government Guarantee | Yes (legal tender with stated face value; purity and weight guaranteed) | No (depends on private refiner/assayer) |

| Resale Flexibility | Broad retail audience; easy to sell singly | Best for bulk sales; fewer buyers for odd sizes |

| Fraud Protection | High (detailed designs, security features, legal tender status) | Moderate (simple shapes are easier to counterfeit) |

Silver and gold coins from Summit Metals offer government backing and strong anti-counterfeit features, plus excellent divisibility if you need to sell part of your holdings.

Grow Your Holdings with Dollar-Cost Averaging

Instead of trying to time the market, smart investors use dollar-cost averaging—making consistent, regular purchases over time. This strategy, common in 401k investing, smooths out your average purchase price.

Summit Metals makes this easy with our Autoinvest program. Set up automatic monthly purchases of authenticated gold and silver—buy every month just like contributing to a 401k. Our bulk purchasing power keeps rates competitive, and our authentication process ensures you receive genuine precious metals every time.

Frequently Asked Questions about Scrap Silver Coin Prices

Here are answers to the most common questions about valuing scrap silver.

Does the face value of a silver coin affect its scrap value?

No. The face value on a silver coin is a historical artifact and has no bearing on its scrap value. Scrap silver coin prices are based solely on the coin's silver content (weight and purity) and the current spot price. For example, a pre-1965 quarter marked "25 cents" contains about $5.72 in silver at today's prices, making its face value irrelevant.

How does wear and tear affect my coins' value?

Wear and tear does reduce a coin's value, but only slightly. Decades of circulation can rub off a small amount of metal, reducing the coin's weight and, therefore, its silver content. For a single coin, the difference is often just a few cents. However, with large quantities, this weight loss can add up. Reputable buyers like Summit Metals will account for average wear in their assessments.

Can I sell heavily damaged or melted silver coins?

Absolutely. The value of scrap silver is in the metal itself, not its condition. Bent, scratched, tarnished, or even partially melted silver items still contain their full silver content and can be sold for their melt value. At Summit Metals, we buy silver in almost any condition because it will ultimately be melted and refined back to pure silver.

Conclusion: Turn Your Scrap into a Smart Investment

You now have the knowledge to transform forgotten pocket change into real value. Understanding scrap silver coin prices comes down to identifying your coins, weighing them, and applying the current spot price. This information is your best defense against lowball offers.

Armed with this knowledge, you can confidently approach any transaction knowing what your silver is worth. Whether you inherited a collection or found coins while cleaning, you're now in control. At Summit Metals, we operate on transparency, which is why we've shared these methods. Our goal is to ensure you receive a fair price for your assets.

But why stop at selling? Consider using the proceeds from your scrap silver to start a strategic precious metals portfolio. This transforms a one-time windfall into a long-term investment strategy.

Our Autoinvest program allows you to build a silver portfolio with consistent monthly purchases, similar to a 401k. This approach smooths out market volatility and helps you intentionally build wealth over time.

Whether you're ready to sell your coins or begin your investment journey, we're here to help with transparent pricing and competitive rates.

Ready to sell or start investing? Explore your options with us.