Why Platinum Bullion Deserves Your Attention as a Trader

Learning to trade platinum bullion introduces you to one of the world's rarest and most industrially critical precious metals. Platinum stands apart from gold and silver due to its dual nature: it's both a precious metal and an essential industrial commodity.

This unique position creates distinct trading opportunities. Key strategies include:

- Owning physical assets like coins (American Platinum Eagles) and bars (lower premiums).

- Using dollar-cost averaging to smooth out price volatility with regular purchases.

- Holding for the long-term as a store of value.

- Actively trading on industrial demand cycles and geopolitical events.

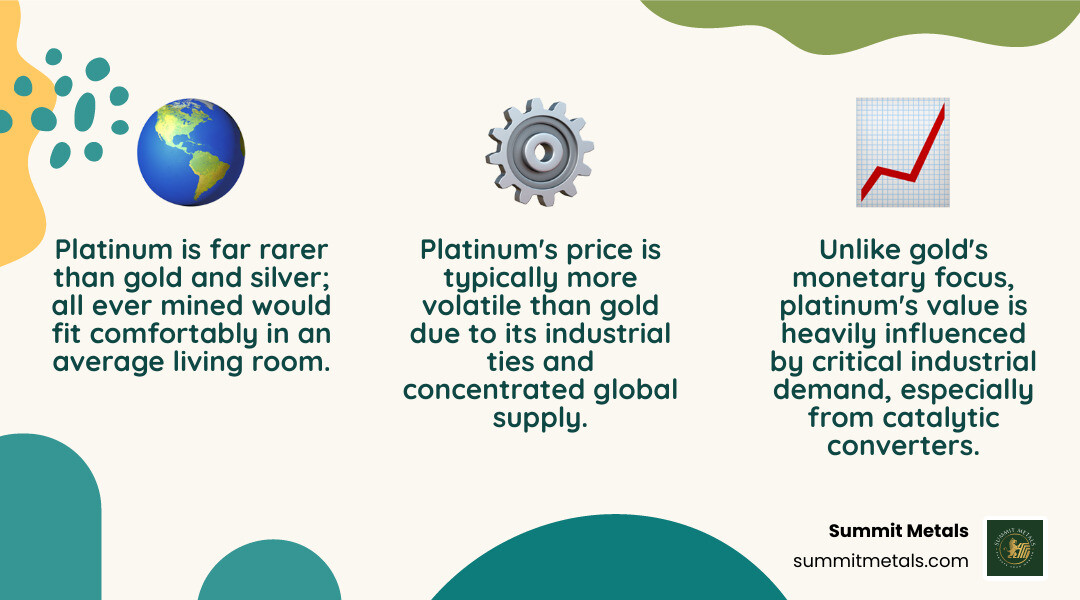

Platinum's value is heavily tied to its use in catalytic converters, medical equipment, and aerospace. Its price can move dramatically based on automotive demand or disruptions in South Africa, which supplies 80% of the world's platinum. This rarity is astounding—all platinum ever mined would fit in an average living room. Its price moves independently of stock markets, making it an excellent portfolio diversifier.

I'm Eric Roach. After a decade on Wall Street advising on precious metals strategies, I now help individual investors trade platinum bullion using disciplined, institutional-level approaches for wealth protection.

Understanding Platinum Bullion: Rarity, Value, and History

Platinum's most shocking characteristic is its rarity. All the platinum ever mined would fit inside an average American living room, making gold look common by comparison. Its name, from the Spanish "platina" or "little silver," belies its true value.

What sets platinum apart is its dual personality. It's a store of value like gold, but it's also a workhorse in the industrial world. This industrial demand creates a fascinating dynamic when you trade platinum bullion. About 40% of its demand comes from automotive catalytic converters, which reduce harmful emissions. It's also vital for medical equipment, pacemakers, and even cancer-fighting drugs.

What Makes Platinum a Valuable Investment?

Platinum's value stems from its remarkable physical properties:

- It is denser than gold, packing more value into less space, which is ideal for storage.

- It is completely hypoallergenic, making it perfect for jewelry and medical implants.

- Its high melting point and corrosion resistance ensure that platinum products last for generations, maintaining their value.

This diverse demand from multiple industries helps support its long-term value. For more context on safe-haven assets, see our guide on why gold and silver serve as safe haven assets.

A Brief History of "Rich Man's Gold"

Platinum was valued by ancient civilizations, with artifacts found in Egyptian tombs and Incan ceremonies. However, 16th-century Spanish explorers in Colombia dismissed it as "platina"—worthless little silver—because their equipment couldn't melt it.

The metal's modern era began in 1924 with the findy of massive deposits in South Africa. This transformed platinum into a globally traded commodity, leading to the creation of investment coins like the American Platinum Eagle and Canadian Platinum Maple Leaf. Investors who learned to trade platinum bullion in the late 1990s saw prices soar from around $300 to over $2,000 per ounce within a decade, demonstrating its potential for significant gains. For more on the history of precious metals, read our article on gold's monetary history.

Platinum vs. Other Precious Metals: A Trader's Comparison

While gold and silver get most of the attention, platinum offers a distinct set of characteristics for a savvy investor. Unlike gold (a primary safe haven) or silver (a hybrid), platinum's value is heavily tied to industrial cycles. This means its price dynamics, volatility, and liquidity are unique, and its price often moves independently of the stock market, making it a valuable portfolio diversifier.

Here's a quick comparison:

| Metric | Platinum | Gold | Silver |

|---|---|---|---|

| Rarity | Rarest of the three; All mined fits a living room | Rare, but more abundant than platinum | Most abundant of the three |

| Industrial Demand | Very high (catalytic converters, medical) | Lower (some electronics, dentistry) | High (electronics, solar, medical, photography) |

| Price Volatility | High (tied to industrial cycles, geopolitics) | Moderate (safe-haven, economic uncertainty) | High (mix of industrial and investment demand) |

| Liquidity | Lower (smaller market, wider spreads) | High (large, active global market) | Moderate to High (active market, but smaller than gold) |

| Storage Requirements | Small volume for high value | Small volume for high value | Larger volume for similar value (bulkier) |

The Critical Gold-to-Platinum Ratio

When you trade platinum bullion, the gold-to-platinum ratio is a key indicator. Historically, platinum traded at a premium to gold due to its rarity. In recent times, however, platinum has occasionally traded below gold's price. A low ratio may suggest platinum is undervalued, signaling a potential buying opportunity. For example, on March 4, 2008, platinum hit a record $2,276 per ounce, more than double gold's price. These swings are often tied to industrial demand, making the ratio a key strategic tool. Learn more about these indicators in our guide on Understanding the Gold Silver Ratio.

Liquidity and Market Size

Platinum's market is smaller than gold's or silver's, which can mean wider bid-ask spreads (the difference between a dealer's buying and selling price). For instance, the premium on platinum bars might be around 5%. Because the market is less liquid, choosing a reputable dealer with transparent pricing and clear buy-back policies is essential when you trade platinum bullion. At Summit Metals, we offer transparent, real-time pricing to ensure you get the value you deserve. Our article on why liquidity matters offers more helpful insights.

Key Factors Driving the Platinum Market

To successfully trade platinum bullion, you must understand what moves its price. Unlike gold, which is sensitive to monetary policy, platinum's value is driven by a unique mix of industrial demand and supply-side constraints.

The Powerful Influence of Industrial Demand

Industrial applications are the primary driver of platinum demand. About 50% of all platinum is used in automotive catalytic converters. This direct link means that when car sales rise, platinum prices often follow. The gradual shift to electric vehicles presents both a long-term risk and a short-term trading opportunity as markets adjust.

Other key uses include:

- Jewelry: About 34% of global production.

- Electronics: Roughly 2.7% for hard drives and other components.

- Medical: A critical component in up to 50% of anti-cancer drugs. Learn more about the role of platinum in anti-cancer drugs.

- Refining: Used as a catalyst in petroleum and chemical refining.

This diverse demand base means prices respond to real-world production needs, not just investor sentiment.

Economic and Geopolitical Price Drivers

Supply is highly concentrated, making the market sensitive to geopolitics. About 80% of the world's platinum is mined in South Africa, with Russia as another major producer. Any mining strikes, power outages, or political instability in these regions can cause prices to spike.

Other economic drivers include:

- Currency Strength: Platinum is priced in U.S. dollars, so a stronger dollar can dampen demand and lower prices, while a weaker dollar is supportive.

- Economic Health: Strong global growth boosts manufacturing and, therefore, platinum demand. Economic slowdowns have the opposite effect.

These factors explain why platinum can be more volatile than gold. When you trade platinum bullion, you are positioning yourself within a complex web of industrial, geopolitical, and economic cycles. You can view historical prices to see these trends in action, and our guide on key factors influencing gold & silver prices offers more insight.

How to Trade Platinum Bullion: Products and Strategies

When you decide to trade platinum bullion, you can choose from various products and strategies. At Summit Metals, our goal is to clarify these choices so you can build a strong portfolio.

Choosing Your Platinum: Coins vs. Bars

The most common ways to own physical platinum are through government-minted coins or privately-refined bars.

Platinum Coins, like the American Platinum Eagle and Canadian Platinum Maple Leaf, are globally recognized. They carry a government guarantee of weight and purity (typically .9995 fine) and are easy to trade. While they are beautiful and sometimes collectible, they carry higher premiums over the spot price due to minting costs.

Platinum Bars are produced by reputable private refiners like Valcambi and PAMP. Available in sizes from 1 ounce to 1 kg, they are a cost-effective choice for investors focused purely on acquiring weight, as they have lower premiums than coins. Each bar is stamped with its weight, fineness, and a unique serial number for security. For more on this topic, see our article on Gold Bars vs. Coins.

Developing a Strategy to Trade Platinum Bullion

A disciplined approach is key to success. While some investors prefer long-term holding as a store of value or active trading on short-term price swings, we believe one of the most powerful strategies is Dollar-Cost Averaging.

This approach removes the stress of trying to time the market. Instead of making one large purchase, you invest a fixed amount of money into platinum at regular intervals. When prices are high, you buy less; when prices are low, you buy more. Over time, this smooths out your average purchase price.

At Summit Metals, we built our Autoinvest program around this very principle. It allows you to set up automatic monthly purchases of platinum, similar to contributing to a 401k. It's a simple, disciplined method to build significant wealth over time by turning market volatility into an advantage. Learn more about The Power of Dollar Cost Averaging in Gold and Silver Investments.

Navigating the Purchase: Dealers, Premiums, and Storage

Once you're ready to trade platinum bullion, the next step is the purchase. This involves finding a trustworthy dealer, understanding the costs, and arranging for secure storage.

Finding a Reputable Dealer

Choosing the right dealer is the most critical decision. A reputable dealer is a partner who ensures authenticity and provides peace of mind. Look for dealers who offer:

- Guaranteed Authenticity: At Summit Metals, we sell only authenticated precious metals, meeting the highest industry standards.

- Transparent Pricing: You should see clear, real-time pricing without hidden fees. We offer competitive rates due to our bulk purchasing power.

- A Clear Buy-Back Policy: This ensures you can easily liquidate your investment when you choose to sell.

- A Strong Reputation: Check customer reviews and satisfaction ratings. Our guide on Identifying Reputable Bullion Dealers can help.

Understanding Costs: Spot Price, Premiums, and Fees

When you buy physical platinum, you pay more than the spot price (the live market price for raw metal). The final price includes a premium, which covers the costs of minting, shipping, insurance, and the dealer's operations. Premiums vary based on:

- Product Type: Coins generally have higher premiums than bars.

- Size: Larger bars typically have lower per-ounce premiums.

- Market Conditions: Supply and demand can affect premiums.

Understanding these costs is key to making a smart investment. Learn more in our article: Spot Price vs. Premium: How Precious Metals Pricing Works.

Securing Your Investment: Storage Solutions

Protecting your platinum is paramount. You have several options:

- Home Storage: A secure safe can work for small quantities, but verify your homeowner's insurance covers precious metals, as many policies have low limits.

- Safety Deposit Box: Offers off-site security, but access is limited to bank hours and contents are not typically insured by the bank.

- Third-Party Depositories: The recommended option for larger holdings. These specialized vaults offer high security, full insurance, and independent audits. Our partners provide professional vaults that meet London Platinum & Palladium Market (LPPM) standards.

- IRA Storage: If including platinum in a Precious Metals IRA, you must use an IRS-approved depository.

For a complete overview, see The Ultimate Guide to Gold and Other Precious Metals Storage.

Risks and Rewards: Selling Your Platinum Bullion

An effective exit strategy is just as important as your purchase decision when you trade platinum bullion. Understanding the potential risks and how to sell effectively is key to maximizing your returns.

Common Risks When You Trade Platinum Bullion

Be aware of the challenges before you invest:

- Price Volatility: Platinum's price can swing dramatically due to its ties to industrial demand and geopolitical events. It hit a record high of $2,276 in 2008 before falling significantly.

- Liquidity Concerns: The market for platinum is smaller than for gold, which can mean wider spreads or more effort to find a buyer, especially for local coin shops.

- Industrial Demand Shifts: Long-term changes, like a full transition to electric vehicles or the development of cheaper catalysts, could reduce demand.

- High Premiums: The premium on retail products means the spot price must rise to break even. A round trip on flat prices can cost an investor at least 7% on small coins or bars.

Effectively Selling Your Platinum

When you're ready to sell, your success depends on a few factors:

- Resale Value: This is determined by the current spot price and the premium your product commands. Government-minted coins like the American Platinum Eagle often have better liquidity.

- Selling to Dealers: This is the safest and most efficient method. Reputable dealers like Summit Metals offer fair, transparent buy-back programs with insured shipping.

- Timing the Market: While challenging, selling when prices are high or the gold-to-platinum ratio is favorable can boost returns. Focus on your long-term strategy rather than trying to catch every peak.

For more on this, read When Is the Best Time to Sell Your Silver & Gold?.

Frequently Asked Questions about Trading Platinum Bullion

Here are answers to common questions about investing in platinum.

Is platinum a better investment than gold right now?

It depends on your goals. Gold is primarily a safe-haven asset that performs well during economic uncertainty. Platinum's price is more volatile, driven by industrial demand. Historically, platinum often traded at a premium to gold due to its rarity. Some investors see its current price ratio to gold as an indicator that it is undervalued. A diversified portfolio might include both: gold for stability and platinum for growth potential tied to industrial cycles.

What is the easiest way to start investing in platinum?

For beginners, the simplest approach is to buy a 1 oz government-minted coin, like an American Platinum Eagle, or a 1 oz bar from a reputable refiner. These products are highly recognizable, easy to trade, and have guaranteed purity.

An even better way to build your holdings consistently is with our Autoinvest program. It allows you to make regular, automatic purchases of platinum, applying the dollar-cost averaging strategy. This removes the guesswork of market timing and helps you build wealth steadily, much like a 401k contribution. It's a simple, disciplined approach for long-term success.

How do I know if my platinum bullion is real?

The most important step is to purchase from a trusted dealer like Summit Metals, where we sell only authenticated precious metals. Real platinum has distinct physical properties: it is extremely dense (feeling heavy for its size), non-magnetic, and features precise markings from the mint or refiner indicating its weight and purity (.9995). Many bars also come in a sealed assay card for further verification. By starting with a reputable source, you eliminate the risk of counterfeits.

Conclusion

We've covered the essential aspects of the platinum market, from its unique rarity and history to its critical role in industry. You now understand how to trade platinum bullion by comparing it to other metals, analyzing market drivers, and choosing between products like coins and bars.

We've also discussed practical strategies, including the power of dollar-cost averaging with our Autoinvest program, which simplifies building your holdings over time. Finally, we've walked through the crucial steps of purchasing from a reputable dealer, understanding costs, securing your investment, and planning your exit strategy.

Here at Summit Metals, based in Wyoming, USA, with a location in Salt Lake City, Utah, we are dedicated to making precious metals investing transparent and secure. We offer authenticated gold and silver with clear, real-time pricing. Our goal is to empower you to build your wealth with confidence.

We hope this guide has equipped you to consider platinum as a valuable part of your portfolio. Ready to take the next step? Learn more with our guide: Bullion Investing 101: How to Safely Stack Your Wealth.