The Timeless Allure of Gold

Gold has captivated humanity for over 6,000 years, serving as the ultimate symbol of wealth, power, and permanence. From ancient Egyptian pharaohs to modern investors, this precious metal continues to hold its place as one of the most sought-after assets on Earth.

What is gold?

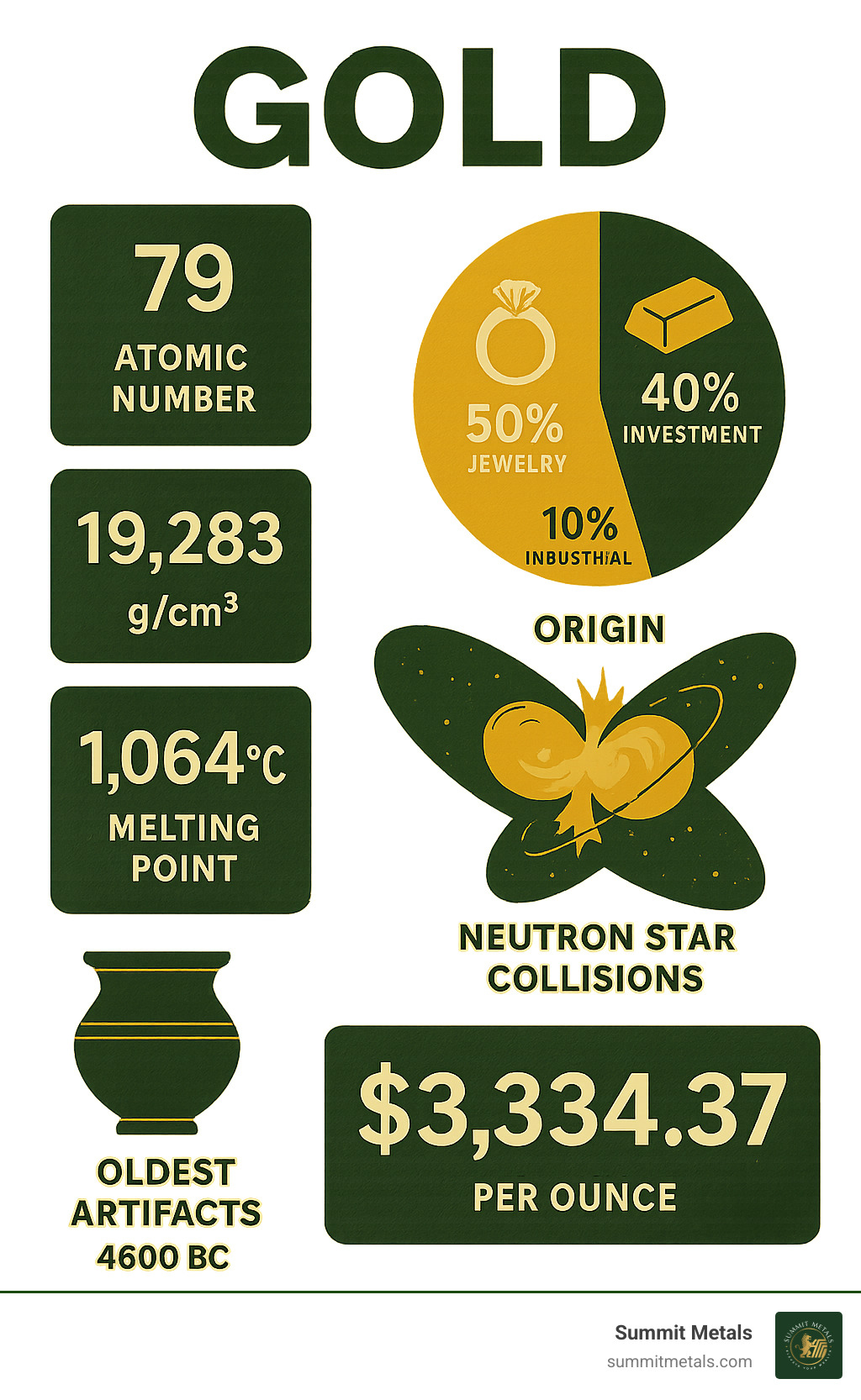

- Chemical element with symbol Au and atomic number 79

- Density: 19.283 g/cm³ at 20°C - one of the heaviest metals

- Origin: Created in cosmic events like neutron star collisions and supernovas

- Current price: $3,334.37 per ounce (prices shown are at the time of this publication)

- Primary uses: 50% jewelry, 40% investment, 10% industrial applications

Gold's unique properties make it virtually indestructible. It doesn't rust, tarnish, or corrode, which explains why ancient Roman coins still gleam today. The metal's rarity and beauty have made it a store of value across every civilization - from the oldest gold artifacts found in Bulgaria dating to 4,600 BC to the modern global economy where central banks hold over 35,000 tonnes in reserves.

Unlike paper currencies that can be printed at will, gold's supply is limited by physics itself. The neutron star merger event GW170817 generated between 3 and 13 Earth masses of gold, showing just how rare and precious these cosmic forging events truly are.

Why gold matters for your portfolio:

- Hedge against inflation - maintains purchasing power over time

- Safe haven asset - performs well during economic uncertainty

- Portfolio diversification - moves independently of stocks and bonds

- Tangible asset - physical ownership you can hold

I'm Eric Roach, and during my decade as an investment banking advisor on Wall Street, I've guided Fortune-500 clients through complex hedging strategies that often included gold as a cornerstone defensive asset. Today, I help individual investors harness these same institutional-grade strategies to protect and grow their wealth through precious metals.

The Science of Gold: From Cosmic Forges to Earthly Veins

The Fundamental Properties of Gold

When you hold a piece of gold, you're holding one of nature's most remarkable achievements. This precious metal sits at position 79 on the periodic table, and those 79 protons in its nucleus give gold properties that have fascinated humans for millennia.

Gold is incredibly dense - at 19.283 g/cm³, it's nearly 20 times heavier than water. This density explains why gold nuggets sink to the bottom of streams while lighter materials wash away. The atomic weight of gold is precisely 196.966570±0.000004, making it one of the most accurately measured elements.

What makes gold truly special is how easily it can be shaped. This noble metal is so malleable that a single ounce can be hammered into a sheet covering 300 square feet - thin enough to see through. Its ductility is equally impressive: that same ounce can be drawn into a wire stretching 50 miles long.

The distinctive yellow color of gold comes from something called relativistic effects. While most metals appear silvery, gold's unique electron behavior causes it to absorb blue light and reflect yellow and red wavelengths. This gives gold its unmistakable warm glow that has captivated civilizations for thousands of years.

As a noble metal, gold resists corrosion and oxidation even when exposed to air, moisture, or most chemicals. This is why ancient gold artifacts still gleam today, looking as brilliant as the day they were crafted. Gold is also an excellent conductor of electricity, making it invaluable in modern electronics.

Cosmic Origins and Earthly Arrival

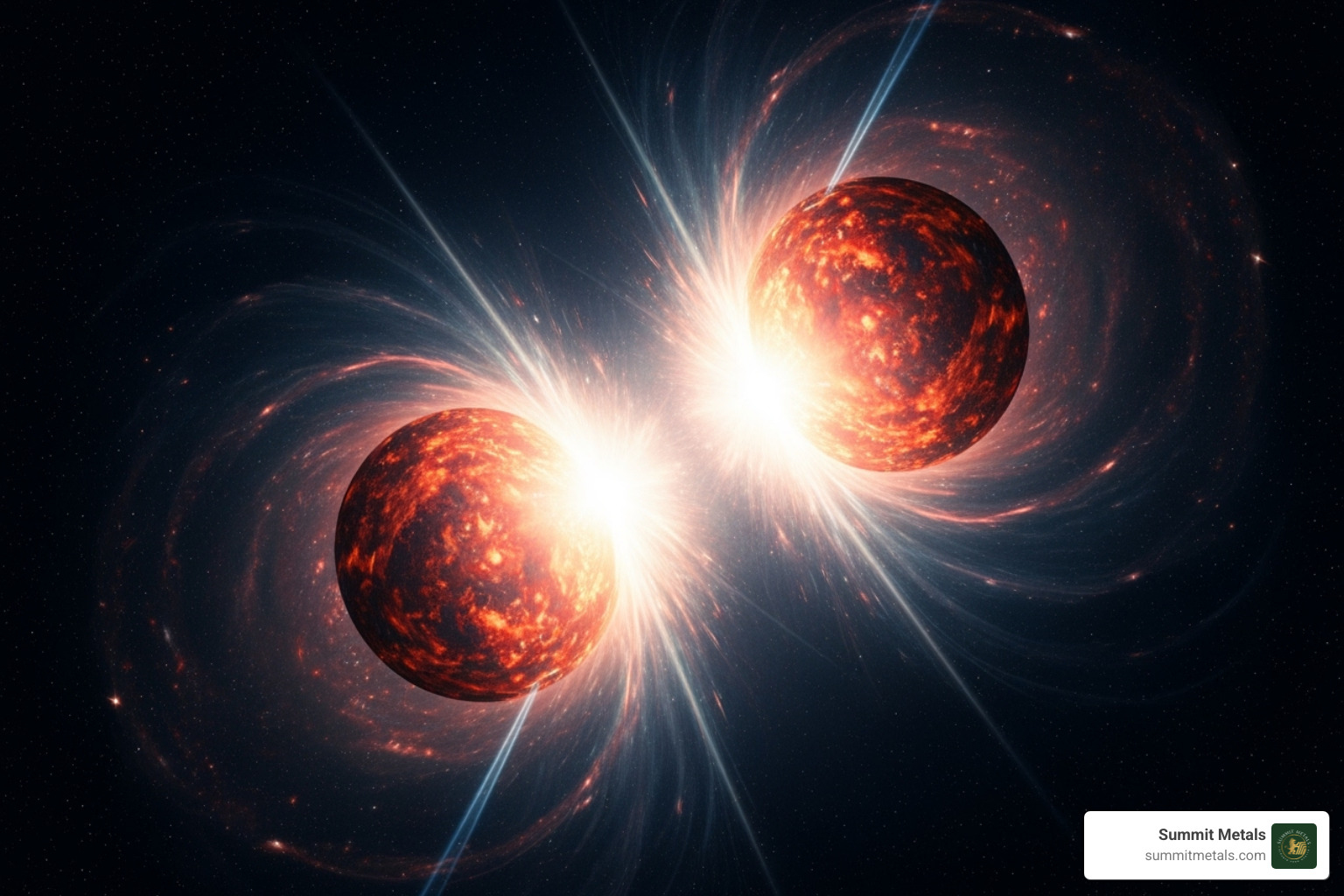

Every atom of gold in your jewelry or investment portfolio has an incredible origin story. This precious metal wasn't formed on Earth - it was forged in the most violent events in the universe.

Gold is created through stellar nucleosynthesis, specifically during catastrophic cosmic events. When massive stars explode in supernova explosions, the extreme conditions allow rapid neutron capture to occur, building up heavy elements like gold. But scientists now believe most gold comes from an even more dramatic source.

Neutron star collisions are cosmic events so violent they literally shake the fabric of space-time. When two of these ultra-dense stellar remnants spiral into each other, they create conditions perfect for gold formation. The famous GW170817 event detected in 2017 gave us front-row seats to this cosmic alchemy in action.

This single neutron star merger generated between 3 and 13 Earth masses of gold in just seconds. The gravitational waves from this collision traveled 130 million light-years to reach our detectors, confirming that these cosmic forges are responsible for most of the gold in our universe.

But how did this cosmic gold reach Earth? The answer lies in our planet's violent early history. During the Late Heavy Bombardment period about 4 billion years ago, Earth was pelted by asteroid bombardment carrying precious metals from space. These cosmic deliveries brought gold and other heavy elements to our planet's surface, where they would eventually be concentrated into the deposits we mine today.

How Gold is Found in Nature

Gold doesn't just sit around waiting to be picked up (though sometimes it does!). This precious metal occurs naturally in two main forms, each with its own treasure hunt story.

Lode deposits are where gold plays hard to get. These primary deposits hide the precious metal in quartz veins deep underground. The gold is typically locked up with other minerals like pyrite in hard rock formations. This is where serious mining operations come in, with complex extraction processes needed to free the gold from its rocky prison.

The famous Witwatersrand Basin in South Africa is the ultimate example of a lode deposit. This geological wonder contains an astounding 22% of all known gold on Earth. The mining and extraction processes here have been perfected over more than a century.

Placer deposits are where gold gets a bit more cooperative. These secondary deposits form when weathering breaks down those stubborn lode deposits upstream. The heavy gold settles in riverbeds and streams, creating the classic nuggets that sparked gold rushes around the world. This is where the romantic image of gold panning comes from - prospectors swirling sediment in pans, watching for that telltale glint.

Gold rarely occurs in pure form in nature. It's commonly found as electrum, a natural alloy mixing gold with 20-50% silver. Most gold is finded nestled in quartz veins or mixed with sulfide minerals that require sophisticated separation techniques.

Nature has some surprising helpers in concentrating gold deposits. Certain bacteria can actually precipitate gold from solution, helping create richer deposits. Even earthquakes play a role - the rapid pressure changes during seismic activity can cause gold to crystallize from hot underground fluids in fault zones.

A Golden Legacy: Gold's Journey Through Human History

Ancient Civilizations and the Dawn of Value

Gold artifacts from the Varna Necropolis in Bulgaria (4,600 BC) mark humanity’s earliest craftsmanship in the metal. Egyptians called gold “the flesh of the gods,” tapping Nubian mines to finance pyramids and crafting wonders like Tutankhamun’s 21-pound mask. Greeks wove gold into myth, while Romans turned it into economic muscle with the aureus coin and massive engineering feats at Las Médulas. Across the Atlantic, Incas and Aztecs produced intricate pieces that were both sacred and status-laden.

From Currency to Empire

The kingdom of Lydia introduced the first gold coins around 650 BC, revolutionizing trade with a uniform medium of exchange. Rome’s aureus and Byzantium’s solidus later anchored commerce for centuries. In 1324, Mansa Musa’s gold-laden pilgrimage briefly depressed Cairo’s prices, proving how one ruler could sway global markets. The Age of Exploration then releaseed a flood of New World gold into Europe, accelerating the transition to early capitalism.

The Gold Standard and Modern Monetary Systems

Sir Isaac Newton pegged gold at £3 17s 10d per ounce in 1717, a value that endured until World War I. The 19th-century Classical Gold Standard brought unprecedented monetary stability, but wartime spending and the Great Depression forced nations off convertibility. Bretton Woods (1944-1971) tied the U.S. dollar to gold at $35/oz until President Nixon closed the “gold window.” Even without formal backing, central banks still hold roughly 35,000 tonnes, underscoring gold’s enduring monetary relevance.

Gold in the Modern Era: Investment, Industry, and Culture

Primary Uses and Applications of Gold Today

Half of all newly mined gold becomes jewelry, especially in India and China where ornaments double as savings. About 40 % is held for investment—physical bullion, ETFs, futures, and vast central-bank reserves that hedge currency risk. The remaining 10 % powers technology: gold’s conductivity and corrosion resistance make it indispensable for electronics, aerospace connectors and visor coatings, dental alloys, and cutting-edge medical nanotech.

Historical Price Fluctuations and Market Value

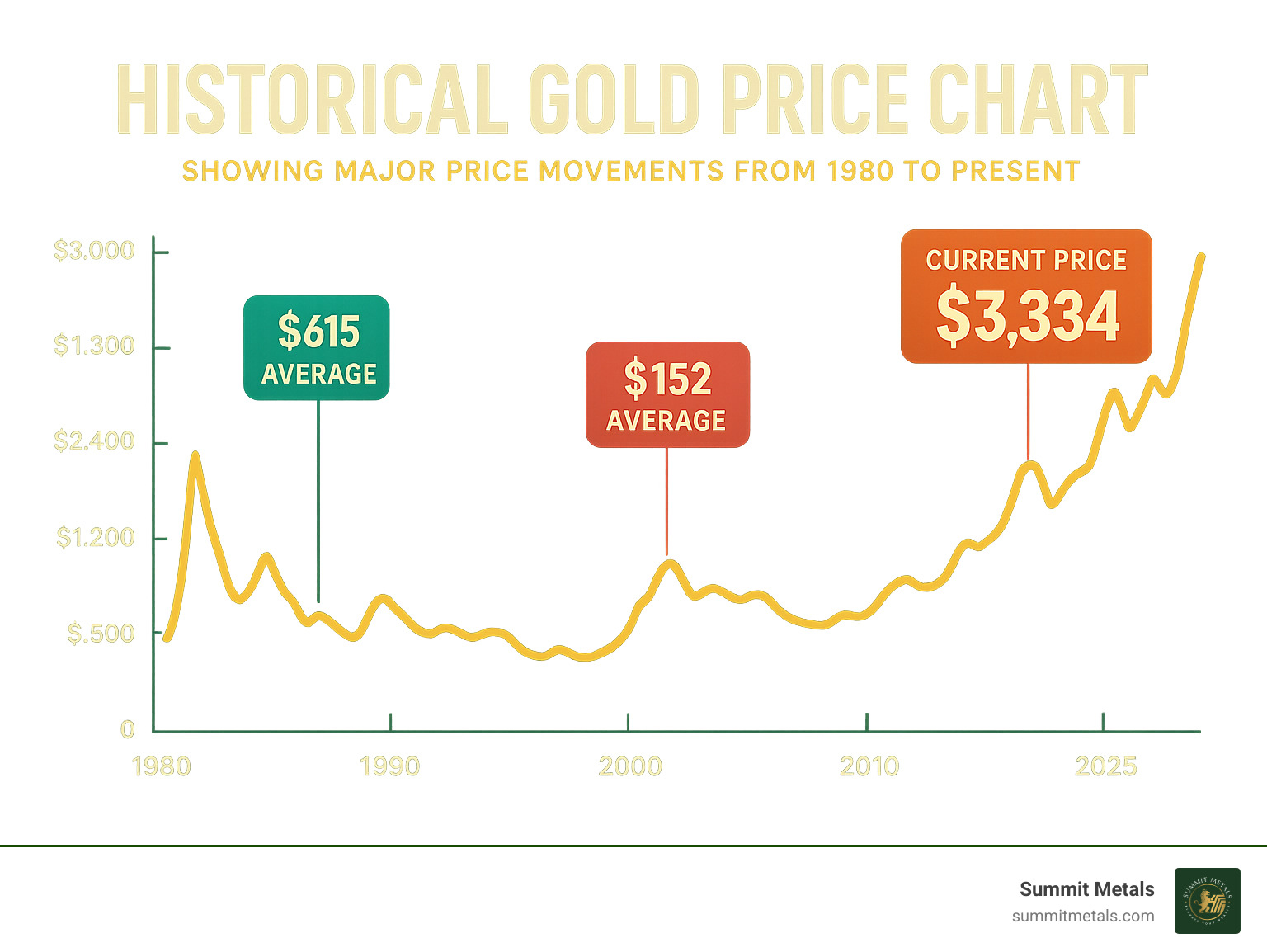

Gold’s price mirrors global confidence. It averaged $615/oz in 1980 amid stagflation, $1,571/oz in 2011 after the financial crisis, and about $3,334/oz today. Key drivers include:

- Inflation that erodes fiat purchasing power

- Geopolitical stress that sparks safe-haven demand

- Negative real interest rates that favor non-yielding assets

- Market turmoil—from 2008 to COVID-19—that prompts flight to quality

From 1971-2022 gold delivered roughly 7.8 % average annual returns, though short-term volatility remains part of the ride.

The Enduring Cultural and Economic Significance

Wedding rings, Diwali gifts, and Lunar New Year bars showcase gold’s symbolism of permanence and prosperity. For investors, those same traits translate into diversification, liquidity, and insurance against currency debasement or systemic shocks—benefits no digital entry on a screen can match.

Frequently Asked Questions about Gold

How is the purity of gold measured?

Purity is expressed in karats (24 K = 99.9 % pure) or fineness (999.9). Common jewelry grades are 22 K (916) and 18 K (750). Copper, silver, palladium and other metals are added for color or durability. Summit Metals supplies only investment-grade 999.9 bullion.

Why is gold so non-reactive?

Gold’s electron configuration—and relativistic effects on those fast-moving electrons—make it chemically “noble,” so it resists bonding with oxygen or moisture. That’s why ancient artifacts still shine; only aggressive agents like aqua regia or cyanide can dissolve the metal.

Can gold be created artificially?

Yes, via nuclear transmutation in particle accelerators, but the process costs far more than the gold produced. Practical supply therefore remains limited to what nature forged in supernovae and deposited on Earth.

Conclusion: Securing Your Future with a Timeless Asset

From violent stellar collisions to the coins in your hand, gold’s scarcity is locked in by physics. For 6,000 years it has funded empires, stabilized currencies, and protected investors during every crisis. Central banks still hold tens of thousands of tonnes because gold simply works.

Summit Metals makes ownership easy with authenticated bullion, real-time transparent pricing, and volume-based savings. In an uncertain world, adding tangible gold to your portfolio is a small step that can make an outsized difference.

Ready to get started? Invest in authenticated gold and silver with transparent, real-time pricing.