The Enduring Legacy of Walking Liberty Silver

Walking liberty one ounce silver products represent one of the most beloved and recognizable designs in American numismatics. Here are the key options available to investors and collectors:

Top Walking Liberty One Ounce Silver Products:

- American Silver Eagle - Official U.S. Mint bullion coin with $1 face value

- Private Mint Silver Rounds - .999 fine silver rounds from Highland Mint, Sunshine Minting, and Golden State Mint

- Vintage Walking Liberty Half Dollars - Historical 90% silver coins (1916-1947) containing 0.36 troy ounces

- Special Edition Rounds - Limited releases with antique finishes or unique packaging

The iconic Walking Liberty design, created by sculptor Adolph A. Weinman in 1916, depicts Lady Liberty striding toward the rising sun while draped in the American flag. This powerful image has graced American coinage for over a century, symbolizing hope, freedom, and America's march toward a brighter future.

Modern one-ounce silver rounds with this design offer a cost-effective way to own precious metals. Their .999 fine silver purity and lower premiums than government coins provide excellent value for investors.

Whether drawn to the history of the original Walking Liberty Half Dollar or the investment potential of modern silver rounds, these products offer tangible wealth preservation. The design's enduring popularity makes Walking Liberty silver one of the most liquid and recognizable forms of precious metals ownership.

I'm Eric Roach. In my decade-plus career advising Fortune-500 clients, I've guided many investors toward walking liberty one ounce silver as a cornerstone of their portfolios. My Wall Street experience has shown me how physical silver serves as a hedge against inflation and a liquid store of value.

An American Icon: The Origin and Symbolism of the Walking Liberty Design

The Walking Liberty design captures the heart of American ideals. When sculptor Adolph A. Weinman created this masterpiece in 1916, he crafted a symbol that would resonate for generations.

The design first graced the 1916 Half Dollar, and it's easy to see why it became an instant classic. Lady Liberty strides boldly toward the rising sun, her figure draped in the flowing American flag. She wears the distinctive Phrygian cap, a symbol that dates back to ancient Rome where freed slaves wore it as a badge of their liberty.

What makes this design truly special is the rich symbolism woven throughout. Liberty carries oak and laurel branches—the oak representing America's civil achievements and the laurel honoring our military glory. The rising sun she approaches isn't just decorative; it represents hope and America's bright future, embodying the symbolism of hope and generosity that defines our nation.

Weinman himself described his vision as Liberty "striding towards a new day," and that sense of forward momentum is palpable in every detail. Her outstretched hand seems to offer the gift of freedom to all who encounter her.

Art historians have praised this as one of the most beautiful coin designs ever created worldwide. The intricate details and flowing lines make it easy to see why.

The reverse side is equally impressive, featuring an American bald eagle perched majestically on a rocky crag with wings spread wide. A young mountain pine emerges from the rocks below, symbolizing America's growth and resilience. The eagle holds both arrows and an olive branch, perfectly capturing our nation's philosophy of peaceful strength.

This timeless design has found new life in modern walking liberty one ounce silver rounds, allowing today's investors to own a piece of this artistic legacy. The enduring appeal of Weinman's creation continues to make these silver products among the most sought-after in the precious metals market.

For those interested in diving deeper into the historical context, you can explore A History of the Walking Liberty Half Dollar and learn more about constitutional silver in our An Essential Guide to Valuing Constitutional Silver.

The Walking Liberty One Ounce Silver Round: A Modern Classic

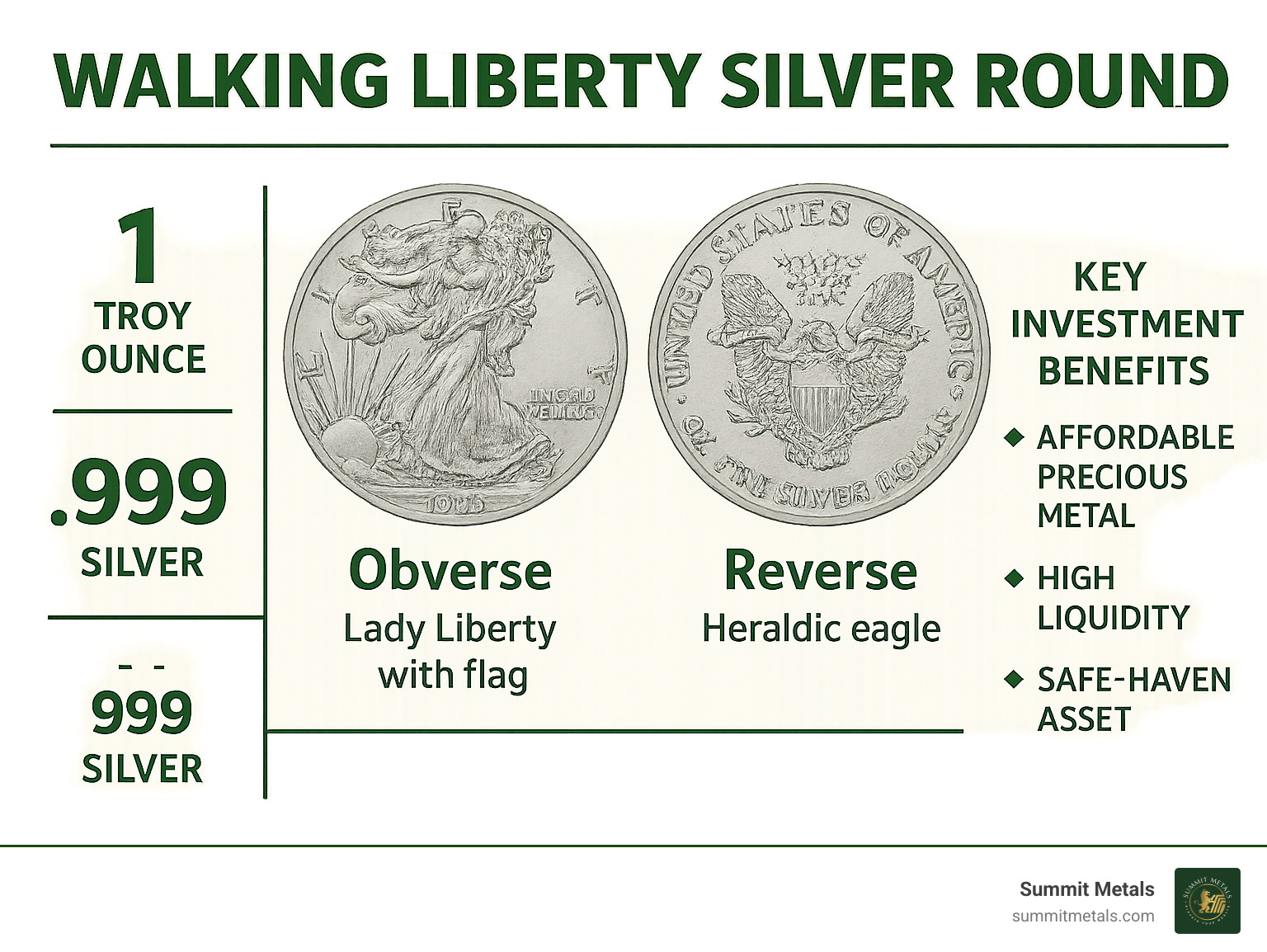

Today's walking liberty one ounce silver rounds bring Weinman's timeless artistry into the modern investment world. These beautifully crafted pieces offer something the original half dollars couldn't—a full troy ounce of .999 fine silver in each round.

These rounds are appealing for their practical approach to investing. Unlike government coins with hefty premiums, silver rounds focus on pure silver content at competitive prices. As they are not legal tender, their value comes from their silver content plus a modest minting premium.

At Summit Metals, we've watched these rounds become increasingly popular among both new and seasoned investors. The reason is simple—you get the iconic Walking Liberty design without paying the premium that comes with government backing. It's like getting a classic car's beautiful design in a modern, efficient package.

The beauty of this approach becomes clear when you consider the investment fundamentals. You're accumulating precious metals for wealth preservation, not collecting coins for their numismatic value. For deeper insights into silver's investment potential, our guide Is Silver a Good Investment? explores the metal's role in modern portfolios.

Specifications and Purity

Every Walking Liberty silver round maintains precise specifications that serious investors appreciate. Each round contains exactly 31.103 grams of silver—that's one troy ounce of .999 fine silver, the highest standard for investment-grade precious metals.

The 99.9% purity level means you're getting virtually pure silver with only trace amounts of other metals for structural integrity. This consistency is crucial for stacking and storage, as each round has nearly identical dimensions and weight.

Most rounds measure approximately 39mm in diameter and 2.8mm thick, though these measurements can vary slightly between different mints. The edges are either reeded or smooth, depending on the manufacturer's design preferences.

This standardization makes these rounds incredibly stackable and storage-friendly. Whether you're buying a few rounds or several tubes, they'll fit together perfectly and store efficiently in your safe or safety deposit box.

For those just starting their precious metals journey, our comprehensive guide on The Basics of Gold and Silver Stacking provides essential knowledge for building a solid foundation.

Distribution, Availability, and Special Editions

Walking Liberty silver rounds are widely available through reputable precious metals dealers. They typically come in protective tubes of 20 rounds or boxes of 500 rounds, making them convenient whether you're making your first purchase or adding to a substantial collection.

The rounds are available in different finishes to suit various preferences. Standard bullion strikes offer the best value for pure investment purposes, while proof-like finishes showcase the design's intricate details with mirror-like surfaces.

Historical demand offers fascinating insights. During the 2008 recession, American Silver Eagle sales skyrocketed. The 2020 pandemic created similar surges, requiring emergency production to meet investor needs.

Some mints create special editions that go beyond standard bullion rounds. These might include antique finishes that give rounds a vintage appearance, limited mintage runs for collectors, or special packaging in presentation boxes. While these versions carry higher premiums, they can offer additional collectible value beyond their silver content.

The key is understanding your investment goals. If you're focused purely on silver accumulation, standard bullion rounds offer the best value. If you appreciate the artistry and don't mind paying a bit more, special editions can add variety to your collection.

Security and Authenticity

Reputable mints take counterfeiting seriously, incorporating various security features into their Walking Liberty rounds. The precise edge design—whether reeded or smooth—follows consistent patterns that are difficult to replicate accurately.

High-quality striking ensures sharp, well-defined details throughout the design. Authentic rounds display crisp images of Lady Liberty and the eagle, with no signs of poor striking or blurred features that might indicate counterfeit production.

Proper weight and dimensions are perhaps the most reliable authentication methods. Genuine rounds weigh exactly one troy ounce and have consistent dimensions. A simple scale can verify weight, while calipers can confirm diameter and thickness.

The magnetic test provides another quick verification method. Silver is not magnetic, so genuine rounds won't stick to magnets. If a round is attracted to a magnet, it's definitely not pure silver.

Authentic rounds also produce a distinctive clear, sustained tone when dropped. This "ring test" reveals a bell-like sound that counterfeits typically cannot replicate.

For comprehensive guidance on protecting yourself from counterfeits and choosing reliable dealers, our detailed article on Identifying Reputable Bullion Dealers & Avoiding Counterfeits provides essential knowledge for safe precious metals investing.

Walking Liberty Silver Rounds: Expanding the Collection

When I help clients build their precious metals portfolios, walking liberty one ounce silver rounds from private mints consistently emerge as one of the smartest choices. These rounds offer the same beloved design as government coins but at a fraction of the cost—and that difference can be dramatic.

Here's what makes them so appealing: while American Silver Eagles might carry premiums of $4-6 over spot silver prices, private mint rounds typically trade at just $1-3 over spot. When you're building a substantial silver position, those savings add up quickly. It's like getting extra silver for free, simply by choosing rounds over government coins.

The beauty of these rounds lies in their simplicity. Since they're not legal tender, their value comes purely from their silver content and market demand. This makes them incredibly efficient for investors who want to maximize their precious metals holdings without paying unnecessary premiums for government backing they may not need.

Understanding how precious metals pricing works is crucial for making smart buying decisions. Our comprehensive guide on Spot Price vs. Premium: How Precious Metals Pricing Works breaks down these concepts in plain English.

Characteristics of Walking Liberty One Ounce Silver Rounds

What sets walking liberty one ounce silver rounds apart from other silver investments? Let me walk you through the key features that make them so attractive to both new and experienced investors.

The design inspiration stays true to Weinman's original masterpiece. Modern minting technology actually allows for even sharper detail than the original half dollars, so you get that stunning artistic beauty in crisp, clear relief. Every fold in Liberty's flowing robes, every feather on the eagle's wings—it's all there in remarkable detail.

The silver purity at .999 fine silver means you're getting virtually pure silver in every round. This isn't just about meeting industry standards—it's about ensuring your investment maintains its value and liquidity over time. When you're ready to sell, buyers know exactly what they're getting.

Cost-effectiveness is where these rounds really shine. Lower premiums mean more silver for your investment dollar, which is especially important if you're using a dollar-cost averaging strategy. Over time, those premium savings can represent a significant amount of additional silver in your portfolio.

The stackability might seem like a minor detail, but it's actually quite important. Consistent dimensions and weight make these rounds easy to store efficiently, whether you're keeping them in a home safe or professional storage facility. They stack neatly, count easily, and take up minimal space.

Liquidity is perhaps the most crucial characteristic. The Walking Liberty design is instantly recognizable to dealers and collectors worldwide. When you're ready to sell, you won't have to explain what you have or convince someone of its value—the design speaks for itself.

For deeper insights into why liquidity matters so much in precious metals investing, check out our analysis on What is the Best Silver & Gold to Buy and Why Liquidity Matters.

Exploring Walking Liberty Silver Round Formats

The one-ounce format has become the gold standard—or should I say silver standard—for precious metals investing. It offers the perfect sweet spot between affordability and substantial silver content. You can buy one or one hundred without breaking the bank, yet each round contains a meaningful amount of precious metal.

The round format itself is practical in ways that might not be immediately obvious. Rounds are easier to handle than bars, simpler to authenticate than irregular shapes, and stack more efficiently than coins with varying thicknesses. They're designed with the investor in mind, not the collector.

Several private mints produce exceptional Walking Liberty rounds, each bringing their own quality standards and slight variations to the design. The key is that all reputable mints maintain the essential elements that make the Walking Liberty image so compelling while ensuring consistent quality and specifications.

The investment focus of these rounds cannot be overstated. They're purpose-built for precious metals investors who want maximum silver content at minimal premium. This makes them particularly suitable for systematic investing strategies, where you might be purchasing silver regularly over months or years.

Proper storage protects your investment and maintains its value. Our comprehensive guide on Top Storage for Silver: Best Practices for Safekeeping Your Investment covers everything from home storage solutions to professional vault services.

Why Investors and Collectors Cherish These Silver Pieces

There's something truly special about holding a piece of American history in your hands. Walking liberty one ounce silver products capture that feeling perfectly, combining the artistic beauty of Weinman's timeless design with the practical benefits of precious metals investing.

The enduring appeal of these silver pieces goes far beyond their metal content. They represent a tangible connection to America's artistic heritage while serving as a reliable store of value in an uncertain economic landscape. When you own Walking Liberty silver, you're not just investing in precious metals—you're preserving a piece of American craftsmanship that has inspired generations.

Silver's role as a hedge against inflation has been proven time and again throughout history. During periods of economic turmoil, precious metals often shine brightest when traditional investments falter. The 2008 financial crisis demonstrated this clearly, with silver demand surging as investors sought tangible assets they could hold in their hands rather than paper promises.

Portfolio diversification becomes more meaningful when you add physical silver to the mix. Unlike stocks or bonds, silver doesn't depend on corporate earnings or government promises. It's a real asset with intrinsic value that has been recognized for thousands of years. This makes Walking Liberty silver rounds particularly attractive for investors looking to balance their portfolios with something solid and dependable.

The aesthetic appeal of the Walking Liberty design adds another dimension that generic silver bars simply can't match. There's genuine satisfaction in owning beautiful silver pieces that showcase American artistry. The detailed craftsmanship and symbolic meaning make these rounds a pleasure to own and display, whether you're a serious collector or a practical investor.

For those considering the broader question of physical versus paper precious metals exposure, our analysis of Physical Bullion vs. Gold & Silver ETFs: Pros and Cons provides valuable insights into the benefits of owning physical silver.

Investing in Walking Liberty One Ounce Silver: What Drives Value?

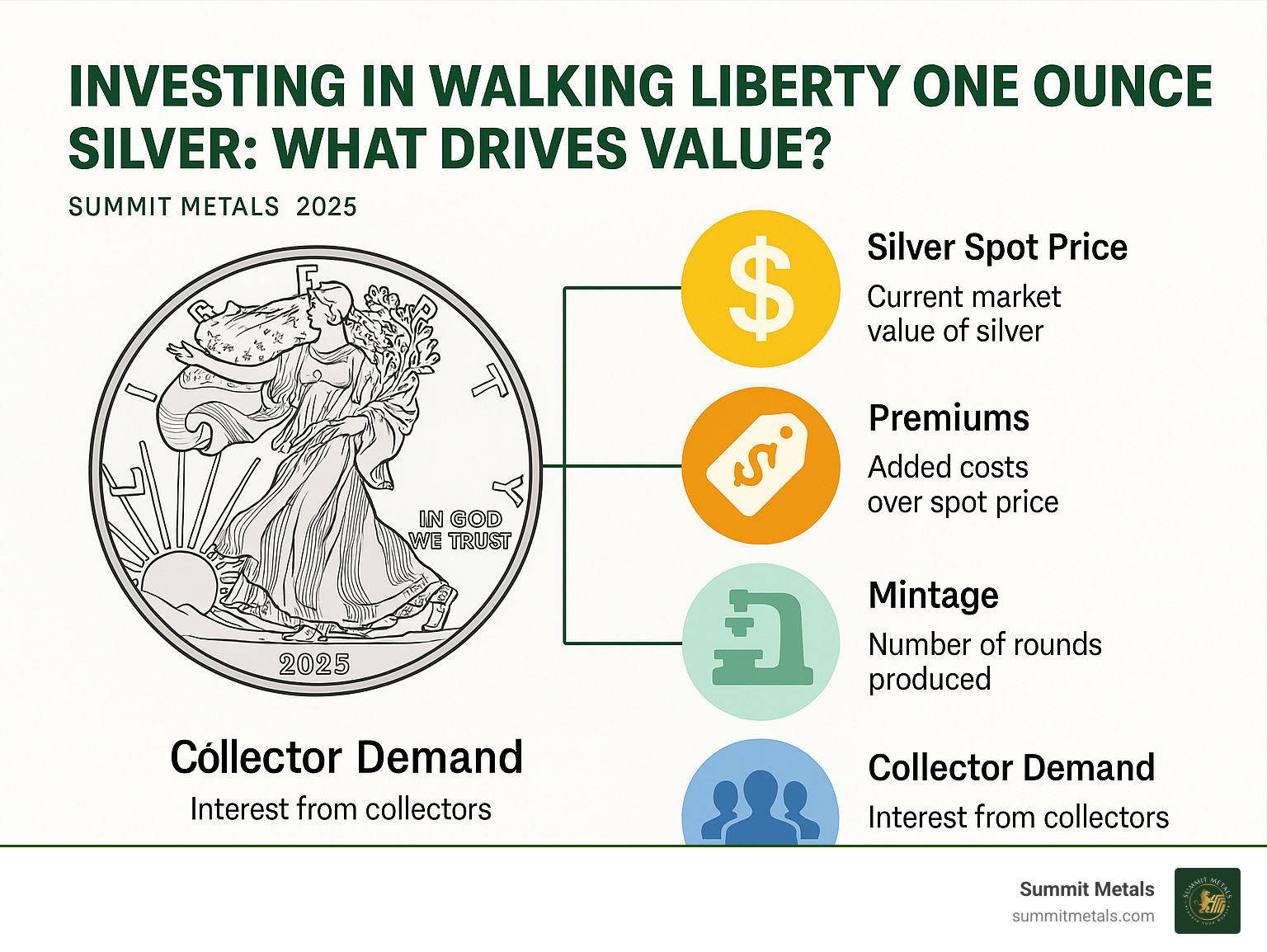

Understanding what drives the value of walking liberty one ounce silver helps you make smarter investment decisions. The good news is that these factors are straightforward and logical once you understand the basics.

The silver spot price forms the foundation of all silver values. This is the current market price for raw silver, traded on global commodity exchanges around the clock. Think of it as the wholesale price that fluctuates based on supply and demand, industrial usage, and broader economic conditions. When spot prices rise, your silver becomes more valuable instantly.

Premiums over spot price represent the additional cost above the raw silver value. These premiums cover minting costs, dealer margins, and market demand. Private mint Walking Liberty rounds typically carry much lower premiums than government coins, which means more of your investment dollar goes toward actual silver content. This efficiency is particularly important when building substantial silver positions over time.

Mintage numbers can affect value, especially for special editions or limited runs. However, standard bullion rounds are produced in large quantities to meet investment demand, keeping premiums reasonable. The focus remains on silver content rather than artificial scarcity.

Condition and grade matter for maintaining value. Modern rounds are typically produced in brilliant uncirculated condition, but proper storage and handling preserve this quality. Any damage or wear can reduce resale value, so treating your silver with care pays dividends later.

Collector demand for the Walking Liberty design creates additional value beyond pure silver content. This beloved design has maintained its popularity for over a century, ensuring steady demand from both investors and collectors. This dual appeal provides a potential premium above melt value when it's time to sell.

Market liquidity might be the most important factor of all. The widespread recognition of the Walking Liberty design ensures ready markets for buying and selling. You won't struggle to find buyers when you need to convert your silver to cash, and dealers worldwide recognize and value these rounds immediately.

Understanding these value drivers helps you time your purchases and sales more effectively. Our guide on The Gold and Silver Ratio: A Timeless Measure for Precious Metals Investors provides additional context for making strategic precious metals decisions.

Prices shown are at the time of this publication, and silver markets move constantly. This dynamic nature is part of what makes precious metals investing both exciting and rewarding for those who understand the fundamentals.

Frequently Asked Questions about Walking Liberty Silver

When it comes to walking liberty one ounce silver products, we hear the same questions from investors time and time again. Let me clear up the most common confusion points based on my years of experience helping clients steer the precious metals market.

Is a Walking Liberty silver round the same as a government-issued silver coin?

This is the most important distinction to understand, and it directly affects your wallet. Privately minted Walking Liberty silver rounds are not the same as government-issued coins, though they may look nearly identical.

The key difference: private mint rounds have no face value and are not legal tender. Their worth comes from their silver content plus a market premium. Think of them as beautiful pieces of investment-grade silver featuring America's most beloved coin design.

Government-issued coins like the American Silver Eagle are different. While they showcase the same stunning Walking Liberty design, they carry a $1 face value and legal tender status. The U.S. government backs their weight and purity, but this comes at a price. These government coins typically carry premiums of $4-6 over spot price, while private rounds often trade at just $1-3 over spot.

For investors focused on accumulating silver, private mint rounds offer significantly better value. You're getting the same beautiful design and one troy ounce of .999 fine silver, but at a fraction of the premium.

What does "one troy ounce" mean?

The troy ounce system can be confusing for newcomers. A troy ounce equals 31.1035 grams, which is heavier than the standard (avoirdupois) ounce of 28.35 grams. When you buy walking liberty one ounce silver, you're getting about 10% more weight than a standard ounce.

This system dates to medieval times and is the global standard for precious metals trading. It allows dealers in New York, London, and Hong Kong to trade silver seamlessly. This standardization makes it easy to compare products and calculate your holdings, knowing every "one ounce" product contains the same amount of precious metal.

Are Walking Liberty silver products a good investment?

Walking Liberty silver products represent one of the most liquid and recognizable ways to own physical silver. Their value moves directly with silver spot prices, giving you pure exposure to precious metals price movements.

The investment advantages are compelling. High liquidity is key—dealers worldwide instantly recognize the Walking Liberty design, making these products easy to sell. The design's century-long popularity gives you confidence in future marketability.

Cost-effectiveness is another major benefit. Private mint Walking Liberty rounds let you accumulate silver at minimal premiums over spot price. This efficiency is crucial when building substantial positions or using dollar-cost averaging strategies.

Silver is a historical inflation hedge, maintaining purchasing power when currencies weaken. During the 2008 and 2020 crises, silver demand surged as investors sought tangible assets. Physical silver provides portfolio diversification and the comfort of tangible ownership.

However, there are risks. Silver prices can be volatile, and there are storage costs. Silver doesn't generate income; your returns come purely from price appreciation.

I always recommend that clients treat precious metals as portfolio insurance rather than speculation. A 5-10% allocation to physical silver can provide meaningful protection during economic uncertainty.

Precious metals investing requires patience and a long-term perspective. Silver's value isn't just in its price movements—it's in the peace of mind that comes from owning a tangible asset with thousands of years of monetary history.

Secure Your Ounce of Freedom Today

The Walking Liberty design carries something special—it's more than just beautiful artwork on silver. It represents the American spirit of freedom and progress that has inspired people for over a century. When you hold a Walking Liberty silver round, you're touching a piece of history that connects you to America's greatest artistic achievements.

Whether you're just starting your precious metals journey or you're a seasoned collector, walking liberty one ounce silver rounds offer the perfect combination of beauty, value, and investment potential. The iconic image of Lady Liberty striding toward the rising sun speaks to something deep in the American spirit—the belief that tomorrow will be brighter than today.

At Summit Metals, we've built our reputation on trust, transparency, and competitive pricing. Our Wyoming-based operations give us the advantage of bulk purchasing power, which means better prices for our clients. We believe precious metals investing shouldn't be complicated or expensive—it should be straightforward and accessible to everyone.

These silver rounds represent an ideal entry point for new investors while remaining attractive to experienced collectors. The combination of low premiums, high liquidity, and that timeless design makes them a natural choice for any silver portfolio. You're not just buying silver—you're investing in a piece of American cultural heritage.

In today's uncertain economic climate, physical silver provides tangible protection that paper investments simply cannot match. While stocks and bonds exist only on computer screens, your Walking Liberty silver rounds sit securely in your hands. They're real, they're beautiful, and they're yours.

The timeless appeal of this design continues to resonate with investors who want both security and beauty in their precious metals holdings. As inflation concerns persist and economic uncertainty continues, more people are finding the peace of mind that comes with owning physical silver.

Your precious metals journey starts with a single ounce. Each Walking Liberty silver round you acquire represents not just an investment in silver, but a tangible asset that will endure for generations. It's collector's pride and investment security rolled into one magnificent piece.

Ready to add these beautiful pieces to your portfolio? Explore our curated collection of high-quality silver products and find why thousands of investors trust Summit Metals for their precious metals needs.

Prices shown are at the time of this publication and subject to change based on market conditions.