The World's First Modern Gold Bullion Coin

The South African Krugerrand is one of the most recognizable and traded gold coins in the world. First minted in 1967, it revolutionized precious metals investing by making gold ownership accessible to the average person. Before the Krugerrand, gold was primarily held in large, expensive bars. South Africa changed this by creating the world's first one-ounce gold bullion coin for investment.

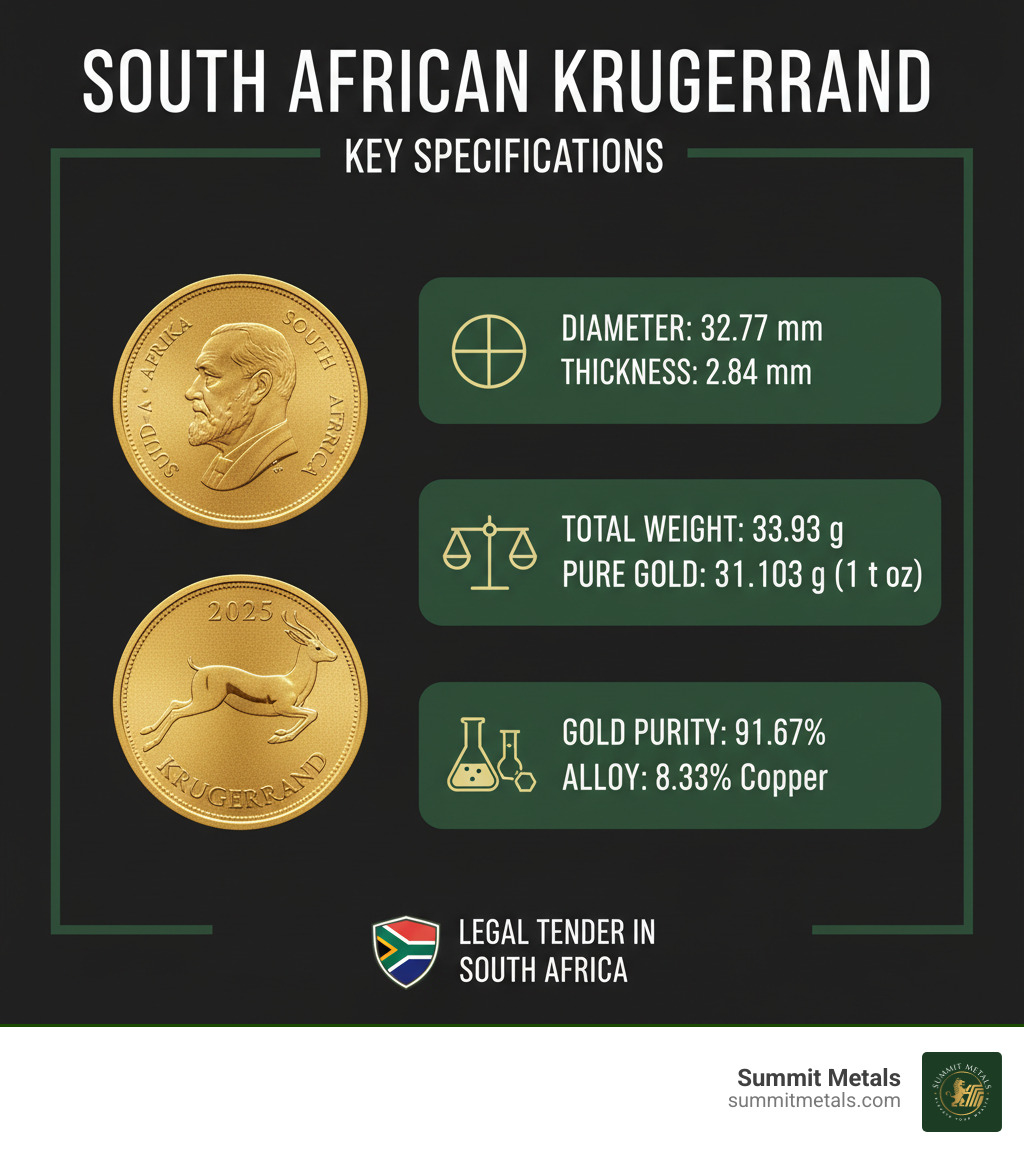

Key Features of the South African Krugerrand:

- First minted: July 3, 1967

- Composition: 91.67% gold (22-karat), 8.33% copper

- Weight: 1 troy ounce of pure gold (33.93 grams total)

- Design: Paul Kruger (obverse) and Springbok antelope (reverse)

- Legal tender: In South Africa with no face value

- Market dominance: Accounted for 90% of the global gold coin market in 1980

This innovation democratized gold ownership. By 1980, Krugerrands dominated 90% of the worldwide gold coin market. The coin's durability comes from its 22-karat gold and copper alloy, which gives it a distinctive reddish hue and makes it resistant to scratches.

As precious metals experts, we've seen how investors use gold as a defensive strategy. The South African Krugerrand remains one of the most liquid and trusted vehicles for this purpose. We help individual investors apply sound principles to build resilient portfolios through precious metals.

The Genesis of a Gold Giant: History and Significance

The South African Krugerrand was born from a brilliant idea to change gold investing. In 1967, South Africa, holding the world's largest gold reserves, decided to create a coin that would let everyday people own a piece of this precious metal. On July 3, 1967, the South African Mint struck the first Krugerrand coins, allowing investors to buy exactly one ounce of gold in a durable, beautiful coin. For a concise historical overview, see The History of the Krugerrand.

The South African Mint, with roots dating to 1890, partnered with the Rand Refinery to produce the bullion Krugerrands, while it focused on crafting the collectible Proof versions.

The impact was spectacular. Before the Krugerrand, gold investment meant buying expensive, heavy bars. The coin made physical gold accessible, and by 1980, the South African Krugerrand dominated an incredible 90% of the global gold coin market. Since its inception, over 50 million ounces of gold Krugerrands have been sold worldwide. This success democratized gold investment and became the template for other nations' bullion coins.

A Coin Forged in Controversy: The Apartheid Era

The Krugerrand's success in the 1970s was overshadowed by South Africa's apartheid system. As a response, Western nations imposed economic sanctions, making the coin a political symbol.

The most significant blow came on October 2, 1985, when the U.S. banned imports of the South African Krugerrand. Other countries followed, and the coin's market share collapsed. This created a vacuum that competitors rushed to fill. Canada introduced the Gold Maple Leaf in 1979, and the United States launched the American Gold Eagle in 1986, both designed to capture the market the Krugerrand had lost.

The ban was lifted in July 1991 as apartheid ended, and President George H.W. Bush re-established economic ties with South Africa. While the Krugerrand never reclaimed its 90% dominance, it had secured its place in history. Today, it remains one of the most respected and liquid bullion coins in the world.

Anatomy of an Icon: Design, Composition, and Variations

The South African Krugerrand carries the story of a nation in its design. The obverse features a portrait of Paul Kruger, a four-time president of the Zuid-Afrikaansche Republiek, with the country's name in "Suid-Afrika" and "South Africa."

The reverse, designed by sculptor Coert Steynberg, displays South Africa's national animal, the springbok antelope, in mid-leap. The year of mintage and the name "Krugerrand" complete the design.

What makes the Krugerrand special is its composition. It's crafted from 22-karat gold (91.67% pure) alloyed with 8.33% copper. This "crown gold" alloy gives the coin its signature reddish-orange hue and, more importantly, makes it incredibly durable and resistant to scratches, unlike softer 24-karat coins. This durability is ideal for investors who are building a physical stack of gold over time, perhaps using a program like Summit Metals' Autoinvest to make regular monthly purchases.

The standard 1 oz South African Krugerrand weighs 33.93 grams, contains exactly one troy ounce (31.103 grams) of pure gold, and measures 32.77 mm in diameter.

Bullion vs. Proof: What's the Difference?

When buying Krugerrands, you'll find two types: bullion and proof.

- Bullion Krugerrands are mass-produced for investors. They are priced closer to the gold spot price and are the ideal choice for stacking gold for wealth preservation.

- Proof Krugerrands are limited-edition collector's items. They feature a mirror-like finish with frosted designs, come with a certificate of authenticity, and command higher premiums.

A simple way to tell them apart is by the edge: bullion coins have 160 serrations, while proofs have 220 finer ones. For most investors, bullion coins offer better value.

A Family of Coins: Sizes and Metal Types

The Krugerrand family has expanded beyond the original 1 oz gold coin. In 1980, fractional sizes were introduced: the 1/2 oz, 1/4 oz, and 1/10 oz, making gold accessible to more investors. For its 50th anniversary in 2017, the South African Mint launched the first-ever Silver Krugerrand and a limited-mintage Platinum Krugerrand, further diversifying the options for collectors and investors.

Investing in the South African Krugerrand: Value and Strategy

The South African Krugerrand offers a straightforward path to building wealth with precious metals. For over five decades, these coins have helped investors preserve and grow their wealth, making them a cornerstone of any smart portfolio.

The value of a Krugerrand moves directly with the gold spot price, but unlike paper assets, you hold the real thing. This tangible ownership provides best peace of mind. What truly sets Krugerrands apart is their exceptional liquidity. They are recognized and accepted by dealers worldwide, ensuring you can easily convert your gold to cash. Their legal tender status in South Africa adds a layer of legitimacy that generic gold rounds lack. For more foundational knowledge, see our guide: Gold Investment 101: Turning Your Savings into Solid Gold.

How Much is a South African Krugerrand Worth?

A Krugerrand's value starts with its melt value—the worth of its one troy ounce of pure gold based on the current spot price. You will pay a small premium over spot when buying, which covers minting and distribution costs.

Some Krugerrands also carry numismatic premiums based on collector demand. Factors influencing this include:

- Rarity: Coins from years with low mintages are more desirable.

- Condition: Professionally graded coins in pristine condition fetch higher prices.

- Special Editions: Anniversary issues and proof versions attract collectors.

For a detailed breakdown, see our guide: Krugerrand Pricing 101: How Much Is Your Gold Worth?.

Building Your Stack: Dollar-Cost Averaging with Krugerrands

Trying to time the gold market is nearly impossible. A smarter approach is dollar-cost averaging (DCA), and the South African Krugerrand is perfect for it. With DCA, you invest a fixed amount of money at regular intervals, such as monthly or quarterly. This strategy smooths out market volatility, as you buy more gold when prices are low and less when they are high, lowering your average cost over time.

This disciplined, emotion-free approach is key to long-term wealth building. Gold has been a reliable store of value for millennia, and consistent accumulation helps you harness that stability. Learn more in The Midas Touch: Exploring the Benefits of Gold Investment.

At Summit Metals, we make this easy with our Autoinvest program. It lets you set up automatic monthly purchases of South African Krugerrands or other precious metals, just like contributing to a 401k. You choose the amount, and we handle the rest, growing your gold stack steadily in the background.

Krugerrands vs. Other Bullion: A Comparative Look

How does the South African Krugerrand stack up against other popular gold bullion options? The choice often comes down to purity vs. durability, government backing, and global recognition.

Here’s a comparison of the Krugerrand against its main competitors:

| Feature | South African Krugerrand | American Gold Eagle | Canadian Gold Maple Leaf | 1 oz Gold Bar |

|---|---|---|---|---|

| Purity | 22-karat (91.67% gold) | 22-karat (91.67% gold) | 24-karat (99.99% gold) | Varies (typically 99.99%) |

| Durability (Alloy) | High (8.33% copper) | High (copper & silver alloy) | Lower (pure gold is soft) | Lower (pure gold is soft) |

| Legal Tender Status | Yes (in South Africa) | Yes (in USA) | Yes (in Canada) | No |

| Fraud Protection | High (Gov't backed coin) | High (Gov't backed coin) | High (Gov't backed coin) | Lower (requires assay) |

| Design | Paul Kruger / Springbok | Lady Liberty / Eagle | Monarch / Maple Leaf | Mint mark & purity |

| Historical Significance | World's first bullion coin (1967) | Created after Krugerrand ban (1986) | High-purity pioneer (1979) | Basic unit of storage |

The "purity vs. durability" debate is crucial. While 24-karat coins like the Canadian Gold Maple Leaf are 99.99% pure, they are soft and easily scratched. The South African Krugerrand and American Gold Eagle use a 22-karat alloy for superior durability, making them ideal for handling and storage.

More importantly, coins shine over bars due to their legal tender status. A Krugerrand is backed by a sovereign government, providing strong protection against counterfeiting. When selling a generic gold bar, you may face costly assay tests to verify its authenticity. With a globally recognized coin like the Krugerrand, its government backing and familiar design provide instant credibility and liquidity.

Gold Coins vs. Gold Bars: Quick Decision Guide

| Factor | Government-Backed Gold Coins (e.g., Krugerrand) | 1 oz Gold Bars |

|---|---|---|

| Face Value / Legal Tender | Yes (adds gov't-backed trust) | No |

| Recognition & Liquidity | Very high worldwide | High, but varies by mint/refiner |

| Counterfeit Risk Handling | Visual ID, weight/dimensions, dealer familiarity | Often requires assay/XRF on resale |

| Durability for Handling | Higher with 22k alloy (Krugerrand, Eagle) | Lower (24k is softer) |

| Typical Premium Over Spot | Slightly higher than lowest-premium bars | Often lowest premium |

| Resale Friction | Low—fast transactions | Potential delays for testing |

| Best Use Case | Dollar-cost averaging, frequent buying/selling | Long-term deep storage |

If you’re dollar-cost averaging, coins usually win. Their liquidity and easy authentication make monthly accumulation smoother. That’s why Krugerrands pair perfectly with Summit Metals’ Autoinvest—buy every month, just like contributing to a 401k, and build a position that’s easy to sell when you need it.

For investors who value durability, fraud protection, and global recognition, the South African Krugerrand offers a superior combination of practical benefits. This is why we often recommend them for clients using our Autoinvest program, as their consistency and universal acceptance are perfect for dollar-cost averaging.

Frequently Asked Questions about the Krugerrand

Here are answers to the most common questions we hear at Summit Metals about the South African Krugerrand.

Is the Krugerrand a good investment?

Yes, the Krugerrand is widely considered a solid investment. Its value is tied directly to gold, which has a long history of preserving wealth. Key benefits include:

- Hedge against inflation: Gold tends to perform well when the cost of living rises.

- Portfolio diversification: Gold often moves independently of stocks and bonds, which can reduce overall portfolio volatility.

- High liquidity: Krugerrands are recognized and easily sold to dealers worldwide, providing quick access to cash.

- Tangible asset: You own a physical store of value, which provides security that paper assets cannot.

How can you verify a real Krugerrand?

Authenticity is critical. While counterfeit coins exist, genuine South African Krugerrands have distinct features for verification.

- Buy from reputable dealers: Your best defense is to purchase from a trusted source like Summit Metals, where every coin is guaranteed authentic.

- Check weight and dimensions: A 1 oz Krugerrand weighs exactly 33.93 grams, is 32.77 mm in diameter, and 2.84 mm thick. Any deviation is a red flag.

- Examine the edge serrations: Bullion coins have 160 serrations, while proof versions have 220.

- Use professional verification: Dealers use specialized equipment to confirm metal content. Grading services like NGC or PCGS also provide authentication.

Are Krugerrands legal to own in the US?

Yes, South African Krugerrands are completely legal to own, buy, and sell in the United States. An import ban was in place from 1985 to 1991 due to apartheid-era sanctions, but those restrictions were lifted over three decades ago. Today, Krugerrands are freely traded and are one of the world's premier gold investment coins.

Start Your Golden Journey: Acquiring and Securing Your Krugerrands

Beginning your gold investment journey with South African Krugerrands starts with choosing the right dealer. A reputable dealer is your guarantee of authenticity and fair pricing.

At Summit Metals, we've built our reputation on transparent pricing and guaranteed authenticity. Our bulk purchasing allows us to offer competitive rates, ensuring you get the best value. For a complete overview, read our guide: Going for Gold: Your Ultimate Guide to the Precious Metal.

Once you acquire your Krugerrands, secure storage is the next step. Whether you choose a home safe or professional vaulting, having a plan is key.

For a disciplined and effortless approach, consider our Autoinvest program. You can set up automatic monthly purchases of South African Krugerrands, building your gold stack over time without trying to time the market. It’s as simple as contributing to a 401k. The Krugerrand's exceptional liquidity makes it a perfect choice for this strategy, as explained in What is the Best Silver & Gold to Buy and Why Liquidity Matters.

Investing in Krugerrands is more than just owning gold; it's holding a piece of monetary history that has proven its resilience for over 50 years. Ready to begin? Summit Metals is here to help you invest with confidence.