Why Understanding Krugerrand Market Price Is Essential for Gold Investors

The Krugerrand market price is simply today’s gold spot price plus a small premium. Get these two numbers right and you instantly know what a 1 oz coin should cost.

Quick Snapshot (1 oz Krugerrand)

- Market Price: $3,336.74 USD (latest quote)

- 52-Week Range: $2,376.63 – $3,510.33

- Usual Premium: 3 – 5 % above spot

Main drivers you need to track:

- Gold spot price (≈ 90 % of the coin’s value)

- Dealer premium (covers minting, shipping, and a modest markup)

- Supply-demand surges (premium can spike when physical gold is scarce)

Launched in 1967, the Krugerrand was the first modern bullion coin and remains one of the most liquid ways to hold physical gold. Because each coin contains exactly one troy ounce of gold—while its durability-boosting copper alloy keeps it scratch-resistant—investors worldwide treat Krugerrands as the benchmark for 1 oz gold pricing.

At Summit Metals we leverage bulk purchasing to keep those premiums competitive and publish real-time prices so you can verify that what you pay lines up with the global market.

Understanding the Gold Krugerrand: Composition, History, and Value

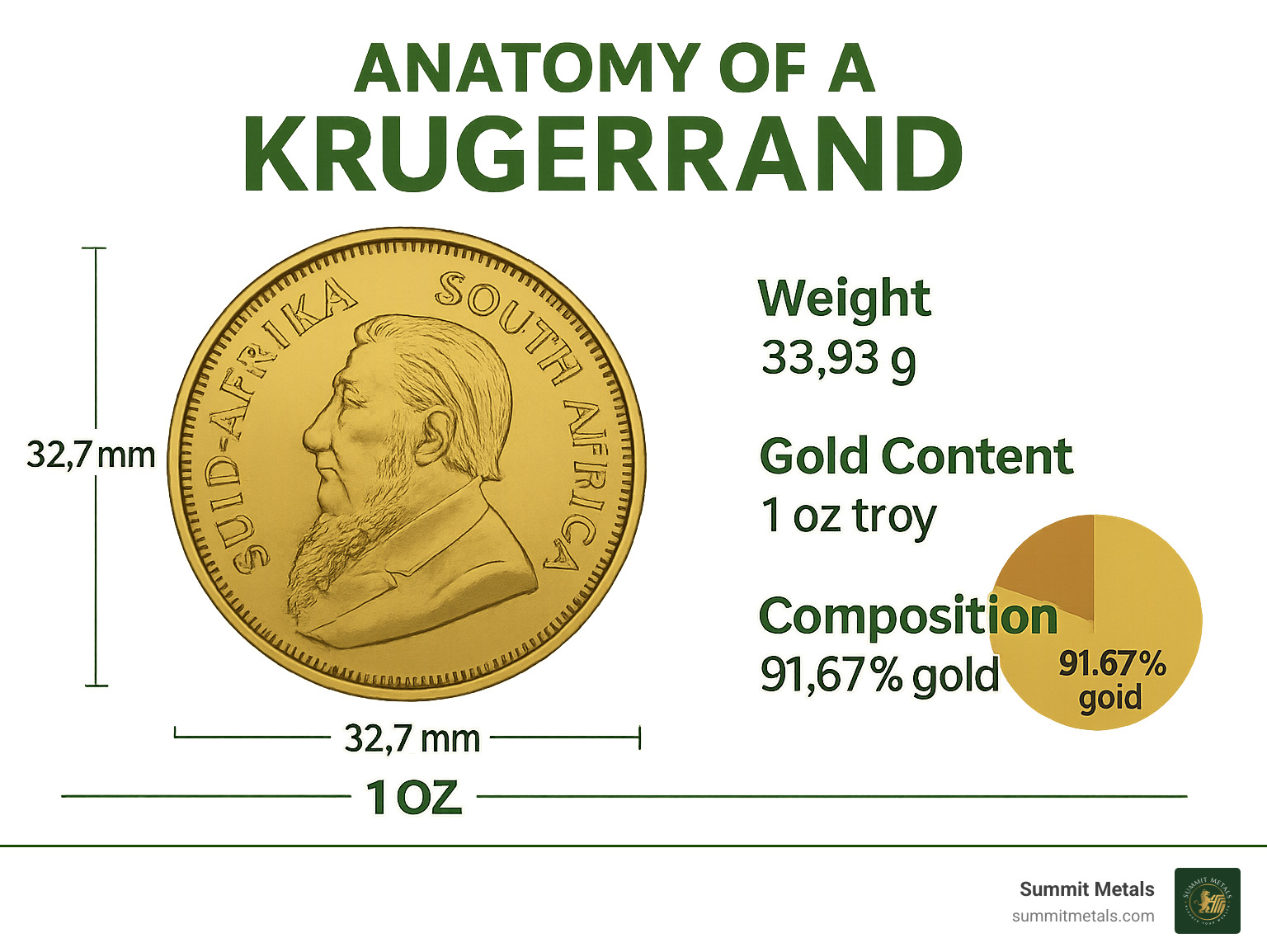

When you pick up a Krugerrand you’ll notice its signature reddish-gold hue. That colour comes from the 8.33 % copper blended with 91.67 % gold (22 karat). The alloy makes the coin harder and far more resistant to everyday handling than 24 karat pieces.

Vital specs at a glance:

- Total weight: 33.93 g

- Pure gold content: 31.103 g (1 troy oz)

- Diameter: 32.77 mm

The obverse shows Paul Kruger, South Africa’s former president, while the reverse features the Springbok antelope. Crucially, the coin carries no face value—its worth is set entirely by the live Krugerrand market price.

Introduced on 3 July 1967, the coin created an entirely new category—modern gold bullion—and by 1980 held 90 % of world market share. Sanctions in the 1980s temporarily reduced exports but also inspired other nations to mint their own bullion coins.

Today the South African Mint strikes four sizes (1 oz, ½ oz, ¼ oz, ¹⁄₁₀ oz). Fractionals let small investors join the market, though they carry higher per-ounce premiums.

For a concise historical overview see Krugerrand on Wikipedia. That external summary pairs well with our in-house guide on Understanding Karats and Purity in Gold.

Krugerrand Market Price: How Is It Determined?

Think of a Krugerrand’s cost as two simple layers:

- Gold spot price – the worldwide, continuously updated quotation for one troy ounce of gold.

- Premium – covers minting, shipping, insurance, and the dealer’s modest margin.

During calm markets premiums hover at 3 – 5 %. Supply squeezes or sudden safe-haven demand (e.g., 2020 lockdowns) can double that number until inventories catch up.

Key forces that tug the spot price—and therefore your coin’s value—include:

- Inflation expectations and real interest rates

- US dollar strength or weakness

- Geopolitical shocks

- Central-bank buying or large ETF inflows/outflows

What Moves the Premium?

- Production costs: relatively fixed; matter more when gold itself is cheap.

- Order size: tubes and monster boxes shave 1 – 2 % off the retail premium.

- Coin condition/year: proofs and first-year 1967 issues cost more; most investors stick to random-date bullion.

- Dealer competition: Summit Metals posts live prices, so comparison shopping keeps margins fair.

For deeper detail see Spot Price vs Premium: How Precious Metals Pricing Works.

Historical Trends and Investment Performance of Krugerrands

From $35 in 1967 to $3,336+ today, Krugerrands have appreciated more than 9,000 % and handily outpaced inflation. The coin’s track record during crises—1970s stagflation, the 2008 credit crunch, and the 2020 pandemic—shows why investors treat it as a core wealth-preservation tool.

Milestone Moments

- 1971–1980: End of the Bretton Woods system ignites a gold bull run above $800.

- 1980s sanctions: Import bans push other nations to launch competing bullion coins.

- 2008–2011: Financial crisis doubles gold prices; Krugerrands rally in lock-step.

- 2020–Present: Record-low rates and stimulus drive gold to fresh highs.

Track the day-to-day action with our Krugerrand 1 oz Spot Price Chart. For forward-looking views, see our piece on Price of Gold Predictions for the End of 2024.

Strategies for Buying and Selling Krugerrands at the Best Price

- Buy random years. Asking for a specific date adds 1 – 2 % for zero extra gold.

- Go bigger when you can. A tube of 20 often saves 1 – 1.5 % versus single-coin purchases; monster boxes cut premiums even further.

- Skip proofs unless you’re a collector. Standard BU coins deliver the same metal for a fraction of the premium.

- Shop premiums, not headlines. Gold may be $20 cheaper on Dealer A, but if their premium is 2 % higher you still pay more.

- Authenticate. Weight (33.93 g), diameter (32.77 mm), and non-magnetic properties are easy checks—but the safest route is using a reputable dealer that guarantees every coin.

Know the Bid/Ask Spread

In normal times Krugerrands trade with a 2–4 % spread; during panics it can widen to 6 %+. Get multiple bids before you sell, and consider off-loading a portion when spreads are tight.

Need step-by-step safety tips? Read How to Buy Gold and Silver Online Safely.

Taxes & Storage (US-centric quick notes)

- Long-term gains on bullion are taxed up to 28 %.

- Many states waive sales tax on large gold purchases—check local rules.

- Home safes offer instant access but require insurance; professional, allocated storage adds a small fee but full coverage.

For a deeper dive into exit strategies and tax optimisation, see Selling Your Costco Gold Bar and Silver for Maximum Value.

Frequently Asked Questions about Krugerrand Market Price

When you're considering Krugerrand investments, certain questions come up again and again. Let me address the most common concerns I hear from investors, drawing from my years of experience helping clients steer precious metals markets.

How closely does the Krugerrand market price track the gold spot price?

The Krugerrand market price follows gold spot prices like a shadow - remarkably closely, but not perfectly. In normal market conditions, when gold spot prices move up or down by $100, your Krugerrand value moves by essentially the same amount.

The key is understanding that Krugerrands trade at a premium above spot price, typically 3.3% to 5.5% over the current gold price. This premium usually stays fairly stable during regular market conditions, which means the price movements you see in gold directly translate to your Krugerrand value.

Here's where it gets interesting: during market stress, this relationship can change. I witnessed this during the 2020 pandemic when physical gold became harder to find. While gold spot prices stayed relatively calm, Krugerrand market price premiums expanded significantly as investors scrambled for physical gold.

Think of it this way - the spot price is like the base rent for gold, while the premium is like the service fee. The rent changes constantly, but the service fee usually stays steady unless there's high demand or supply problems.

Do Krugerrands have numismatic value or are they strictly bullion?

This is a great question that often confuses new investors. Krugerrands are primarily bullion coins, which means their value comes from their gold content, not from being rare or collectible.

For 99% of Krugerrands out there, you're looking at straight bullion value. They're valued for their one troy ounce of gold, period. This is actually good news for investors because it means simpler, more predictable pricing.

However, a few exceptions exist. First-year 1967 Krugerrands carry some collectible appeal since they were the inaugural coins. Some years with particularly low mintage numbers might command small premiums from collectors. Proof versions definitely carry higher premiums due to their special minting process and limited production.

But here's my advice: unless you're specifically collecting coins, treat Krugerrands as bullion investments. Their real strength lies in providing direct exposure to gold price movements, not in hoping for collectible appreciation. The beauty of Krugerrands is their simplicity - no need to worry about grades, rarity, or condition issues that affect numismatic coins.

What is the typical premium over spot for a 1 oz Gold Krugerrand?

Current premiums for 1 oz Gold Krugerrands typically range from 3.3% to 5.5% over the gold spot price, though this varies based on how many you're buying and what's happening in the market.

When you're buying individual coins during normal market conditions, expect to pay around 4-6% premium. If you're purchasing a tube of 20 coins or more, that premium usually drops to 3-5% because dealers can process larger orders more efficiently.

Market conditions can shift these numbers significantly. During high-demand periods - like economic uncertainty or supply disruptions - premiums can jump to 6-8% for individual coins. In extreme market stress situations, I've seen premiums spike above 10%, though this is unusual.

The good news is that Krugerrand premiums are competitive with other major gold bullion coins. Their excellent liquidity and global recognition mean you're not paying extra for the Krugerrand name - you're getting fair market pricing for one of the world's most tradeable gold coins.

At Summit Metals, our bulk purchasing relationships help us keep premiums as low as possible while maintaining the transparent, real-time pricing that gives you confidence in your investment decisions. We believe you should know exactly what you're paying and why - no hidden fees or surprise markups.

Conclusion: Maximizing Value with Transparent Krugerrand Pricing

Mastering Krugerrand market price dynamics puts you in control of one of the world's most liquid gold investments. After five decades of proven performance, these South African coins continue to offer investors an unbeatable combination of gold exposure, global recognition, and market liquidity.

The path to maximizing your Krugerrand investment value starts with understanding the fundamentals we've covered. The price structure is straightforward - gold spot price plus premium equals your total cost. But the real skill lies in minimizing those premiums while ensuring you're working with trusted dealers who guarantee authenticity.

Smart timing can make a meaningful difference in your returns. While nobody can predict short-term price movements perfectly, understanding when premiums typically expand or contract helps you make better buying and selling decisions. Premiums often spike during market stress when everyone wants physical gold, but they compress during quieter periods when dealers compete for business.

The liquidity advantage of Krugerrands cannot be overstated. Unlike many investments that might take days or weeks to sell, Krugerrands can typically be converted to cash quickly at fair market prices. This flexibility makes them ideal for investors who want gold exposure without sacrificing accessibility to their wealth.

Long-term perspective matters most with Krugerrand investments. The price appreciation from $35 in 1967 to over $3,300 today demonstrates gold's power as an inflation hedge and wealth preserver. Short-term volatility is normal and expected - it's the decades-long trend that creates real value for patient investors.

At Summit Metals, we've built our Wyoming-based business around providing transparent, real-time Krugerrand market price information that you can trust. Our bulk purchasing relationships allow us to offer competitive premiums while maintaining the authentication standards and reliable service you deserve. No hidden fees, no surprise markups - just honest pricing on genuine coins.

Whether you're taking your first steps into precious metals or expanding an existing portfolio, these pricing fundamentals will serve you well. The combination of gold's intrinsic value, the Krugerrand's proven track record, and transparent pricing creates compelling opportunities for wealth preservation and growth.

For comprehensive guidance on integrating precious metals into your investment strategy, our The Ultimate Beginner's Guide to Investing in Precious Metals provides the complete roadmap you need.

The Krugerrand market price will continue reflecting global gold market dynamics, but the coin's fundamental strengths remain unchanged. Authenticity, liquidity, and universal recognition ensure Krugerrands will remain relevant in precious metals portfolios for generations to come. By understanding these pricing mechanisms and partnering with dealers who provide transparent pricing, you're building a solid foundation for long-term wealth preservation that has worked for millions of investors worldwide.