- Home

- 1 oz South African Gold Krugerrand BU (Random Year)

1 oz South African Gold Krugerrand BU (Random Year)

Why Choose Us?

Collapsible content

Product Description

Product Description

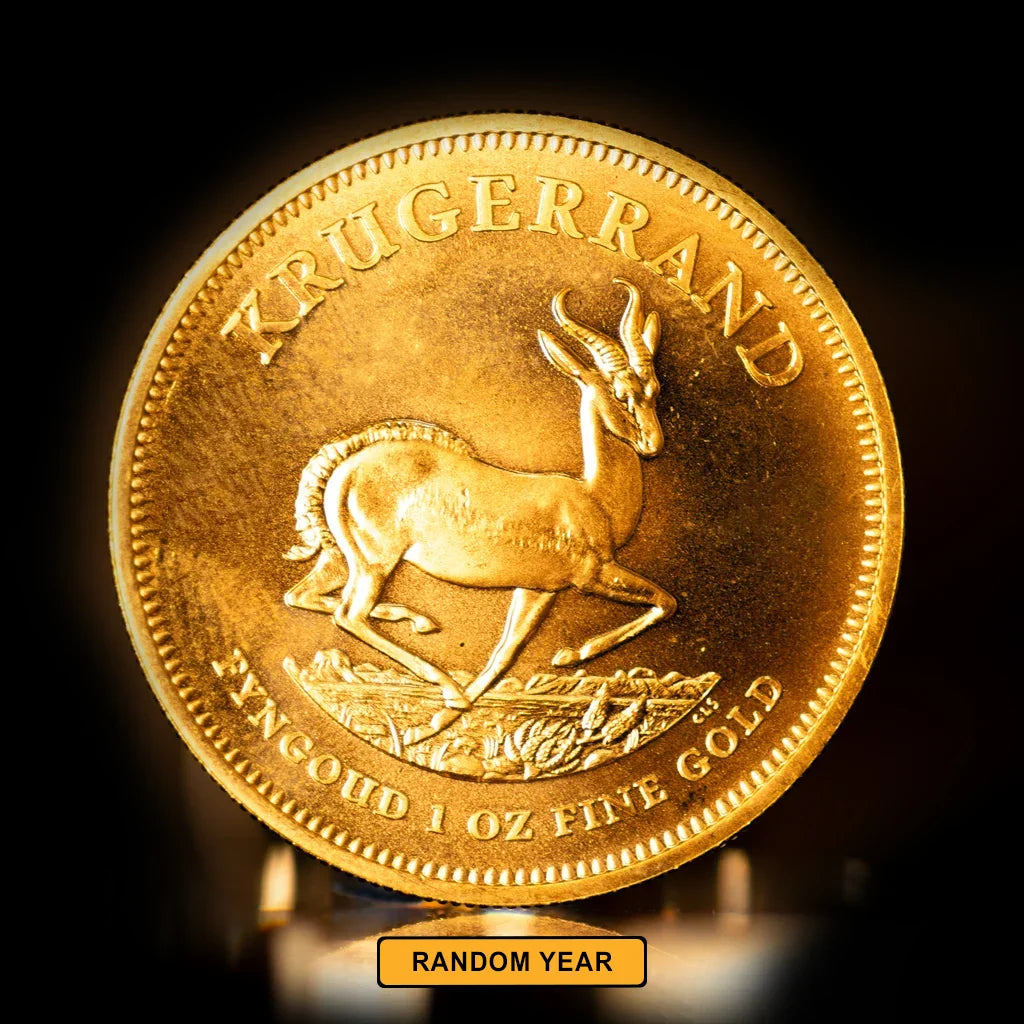

1 oz South African Gold Krugerrand Coin (Random Year, BU)

Iconic Sovereign Bullion | .9167 Fine (22 Karat) | LBMA Good Delivery

Quick Facts:

-

Metal Content: 1 troy oz pure gold (.9167 Fine)

-

Total Weight: 1.0909 troy oz (33.931 g)

-

Year: Random (1967–present; varies by stock)

-

Mint: South African Mint – Pretoria

-

Face Value: None (legal tender value based on gold content)

-

Condition: Brilliant Uncirculated (BU)

-

Packaging: Individual coins ship in protective flips

-

IRA Eligible: Yes (22K gold exception)

Why Choose Summit Metals?

-

Guaranteed Authentic & LBMA-Accredited

-

Secure, Fully Insured, Discreet Shipping

-

Trusted Buyback Guarantee

-

Satisfaction Guaranteed

Summit Metals sources Krugerrands directly from the South African Mint and authorized distributors, ensuring genuine sovereign bullion with pristine BU condition.

Legendary Krugerrand Design

-

Obverse: Profile of Paul Kruger, former President of the South African Republic, encircled by “SUID-AFRIKA” and “SOUTH AFRICA.”

-

Reverse: Iconic springbok antelope springing across the plains, with inscriptions “KRUGERRAND,”, minting year, and “FYNGOUD 1 OZ FINE GOLD.”

The durable 22-karat alloy of gold and copper ensures both beauty and resilience.

Investment & Collector Appeal

-

Sovereign flagship: First modern bullion coin, globally recognized

-

Balanced purity: 22K gold for durability and full 1 oz content

-

Fractional comfort: Ideal for investors seeking a mid-size sovereign option

-

Continuous minting: Random-year offerings include both early and recent issues

Packaging & Delivery

Your Krugerrand ships in a protective flips. Summit Metals packages every order discreetly, fully insured, and trackable—from our vault to your door.

Secure Your Gold Krugerrand Today

Add a piece of South African bullion history to your portfolio. Click “Add to Cart” to purchase a Random-Year 1 oz Gold Krugerrand (BU) and invest confidently with Summit Metals!