Introduction: Uncovering the Worth of 1879 Gold Coinage

Understanding 1879 gold coin value requires examining several factors including denomination, mint mark, condition, and rarity. Here are the typical value ranges you can expect:

| Denomination | Circulated Value Range | Uncirculated Value Range | Rare Varieties |

|---|---|---|---|

| $1 Gold Dollar | $600 - $1,040 | $2,300 - $8,500+ | Proof: $5,750 - $41,000 |

| $2.50 Quarter Eagle | $365 - $400 | $375 - $550 | High-grade proof specimens |

| $5 Half Eagle | $1,200 - $1,500 | $1,400 - $2,000 | Proof: $13,000 - $137,000 |

| $10 Eagle | $1,329 - $15,000+ | $2,000 - $83,000+ | 1879-CC: $15,000 / 1879-O: $10,000 |

| $20 Double Eagle | $1,500 - $18,500 | $1,575 - $37,500+ | 1879-O: Most valuable |

| $4 Stella (Pattern) | Not circulated | N/A | Six-figure valuations |

Prices shown are at the time of this publication and represent estimates based on recent auction records.

The year 1879 holds special significance in American numismatic history. Following the Resumption of Specie Payments Act, the United States officially returned to the gold standard on January 1, 1879. This allowed Americans to once again exchange paper currency for gold coins, ending nearly two decades of greenback-only circulation.

This historic transition made 1879 a busy year at U.S. Mints. Four facilities—Philadelphia, San Francisco, Carson City, and New Orleans—struck gold coins in five different denominations, creating a diverse array of coins with varying rarity and collector appeal.

Coins from the Carson City (CC) and New Orleans (O) mints are particularly scarce. For example, only 1,762 of the 1879-CC $10 Eagles were minted, compared to 224,000 from San Francisco. That scarcity translates directly to value—an 1879-CC $10 Eagle commands around $15,000 even in circulated condition, while a common Philadelphia or San Francisco example might sell for $1,329.

Beyond regular-issue coins, 1879 also saw the production of the ultra-rare $4 Stella pattern coin, an experimental piece that now sells for six figures at auction.

I'm Eric Roach, and my background on Wall Street taught me how to analyze market cycles and structure defensive strategies. I now apply those skills to help investors understand 1879 gold coin value and build wealth through precious metals. My expertise helps clients see these historic coins not just as collectibles, but as tangible assets that can hedge against volatility.

This guide will walk you through every denomination of 1879 gold coinage, explain what makes certain pieces rare, and show you how to estimate what your coin might be worth.

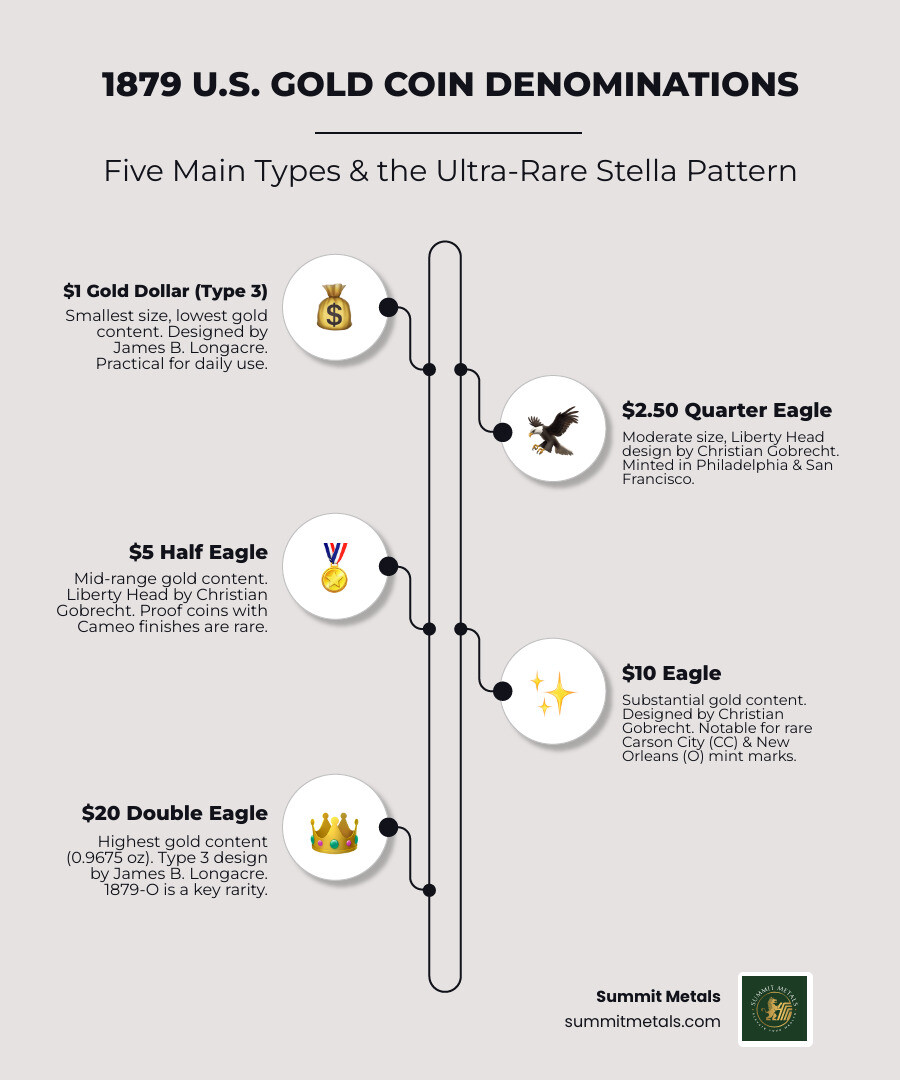

The Spectrum of 1879 Gold Coins: Denominations and Designs

The year 1879 produced a remarkable collection of U.S. gold pieces. From the tiny gold dollar to the grand double eagle, each coin tells a unique part of America's monetary story. Let's explore the different 1879 gold coins.

The $1 Gold Dollar (Type 3)

The $1 Gold Dollar was the smallest U.S. gold coin, featuring the Type 3 design of a Native American princess by Chief Engraver James B. Longacre. In 1879, only about 3,000 were made, many as special "proof" versions for collectors.

The **1879 gold coin value** for these treasures varies greatly with condition. A regular circulated coin might be worth around $1,040, while a high-grade uncirculated piece (MS66) could fetch $2,160 or more. Proof versions with special "Cameo" (PR CAM) or "Deep Cameo" (PR DCAM) finishes are even more valuable, ranging from $5,750 to over $41,000. For detailed pricing, see 1879 Gold Dollar Prices | Ungraded, NGC, PCGS Values. Prices shown are at the time of this publication.

The $2.50 Quarter Eagle (Liberty Head)

This coin features the classic Liberty Head design by Christian Gobrecht. In 1879, over 130,000 were struck at the Philadelphia (no mint mark) and San Francisco ("S" mint mark) Mints. A circulated 1879 Quarter Eagle from either mint is worth about $365. However, in uncirculated condition, the Philadelphia coin climbs to $375, while the San Francisco version jumps to $550, showing the premium collectors place on the "S" mint mark. These smaller coins are popular for those who want to own gold in affordable sizes, a concept explored in The Case for Fractional Gold.

The $5 Half Eagle (Liberty Head)

Also designed by Christian Gobrecht, the $5 Half Eagle features the same Liberty Head. While circulated coins were made in Philadelphia and San Francisco, the 1879 proof versions are exceptionally valuable. A standard proof can be worth $13,000 to $108,000. The true stars are those with "Cameo" and "Deep Cameo" (DCAM) finishes, which have frosty designs against mirror-like backgrounds. These can command prices from $51,000 to an astonishing $137,000. You can explore these values at 1879 $5 Liberty Gold, Proof Values & Prices By Issue | Greysheet. Prices shown are at the time of this publication.

The $10 Eagle (Liberty Head)

The $10 Eagle, another Gobrecht masterpiece, was struck at four mints in 1879: Philadelphia (no mint mark), San Francisco (S), Carson City (CC), and New Orleans (O). This variety is a huge factor in the **1879 gold coin value**.

Mintage numbers directly affect rarity and value:

- Philadelphia (P): 384,770 minted. A circulated (VF20) coin is worth around $1,329.

- San Francisco (S): 224,000 minted. Similar value of $1,329 in VF20, but can jump to over $7,700 in uncirculated condition.

- Carson City (CC): Only 1,762 minted. A VF20 example is valued at an impressive $15,000.

- New Orleans (O): Even rarer with only 1,500 minted. A VF20 coin is valued at $10,000.

An 1879/78 overdate variety, where the '9' was struck over an '8', adds a slight premium. The extreme scarcity of CC and O mint coins makes them true collector standouts.

The $20 Double Eagle (Liberty Head)

The largest U.S. gold coin, the $20 Double Eagle was designed by James B. Longacre. The 1879 version is a Type 3, identified by "TWENTY DOLLARS" spelled out on the reverse. Containing nearly a full ounce of gold (0.9675 troy oz), their melt value is substantial, but collector value often exceeds it.

Mint marks are critical for the **1879 gold coin value**:

- Philadelphia (P) & San Francisco (S): Valued around $1,500 in circulated (EF) condition and $1,575 in uncirculated (UNC).

- Carson City (CC): Much scarcer, valued at $5,000 (EF) and up to $12,000 (UNC).

- New Orleans (O): The rarest circulating Double Eagle of 1879. Valued at $18,500 (EF) and a remarkable $37,500 (UNC).

These large coins were the backbone of international trade, and their size, gold content, and rarity make them highly desirable. Find more about key dates in our guide, Is Your Liberty Head Gold Coin a Hidden Fortune?.

The Ultra-Rare $4 Stella

Beyond circulating coins, 1879 produced one of America's most fascinating rarities: the $4 Stella. This was a "pattern coin," an experimental piece intended to align with European currency systems. It comes in two designs, Flowing Hair and Coiled Hair, and was never meant for spending. Due to their extreme rarity and rich history, Stellas are valued in the six figures, representing the peak of **1879 gold coin value**.

Key Factors That Determine a Coin's Worth

Understanding the 1879 gold coin value is like solving a puzzle where the coin's physical traits, history, and market demand fit together. At Summit Metals, we believe in transparency to help you make informed decisions. Let's break down what matters.

Understanding the Base 1879 Gold Coin Value: Melt vs. Numismatic

Every gold coin has two distinct values. The melt value is what the gold itself is worth, calculated by multiplying the coin's gold content by the current spot price of gold. For example, an 1879 $10 Gold Eagle contains 0.48375 troy ounces of gold. This value represents the absolute floor for what your coin is worth. You can track live prices with our Gold Prices Today chart.

The numismatic value is what the coin is worth as a collectible. This premium above melt value is driven by rarity, condition, and collector demand. For most 1879 gold coins—especially those with rare mint marks or in exceptional condition—the numismatic value far exceeds the melt value. The 1933 gold recall, which led to the melting of millions of U.S. gold coins, made surviving pieces significantly scarcer, boosting their numismatic value substantially.

The Crucial Role of Condition and Grading

If mint marks tell you which coin you have, condition tells you what it's worth. The difference between a worn coin and a pristine one can mean thousands of dollars.

The numismatic world uses the Sheldon Scale (1-70) to standardize grading. Here’s a quick overview:

- Good (G) to Fine (F): Heavy to obvious wear from circulation. Major design elements are visible but details are faint.

- Extremely Fine (EF or XF): Light circulation with sharp details and some original luster remaining. Values start climbing here.

- Uncirculated (UNC or MS): No wear from circulation. Graded from MS-60 (with marks from the minting process) to the theoretically perfect MS-70.

Professional grading services like PCGS (Professional Coin Grading Service) and NGC (Numismatic Guaranty Company) are vital. They authenticate coins, assign precise grades, and seal them in secure holders, giving buyers confidence and establishing a consistent market value. Learn more in our guide on Graded Silver Eagles Explained.

How Rarity and Mint Marks Affect the 1879 Gold Coin Value

Rarity is simple economics: low supply plus high demand equals high prices. For 1879 gold coins, tiny mint marks tell you everything about rarity.

The Philadelphia Mint struck 384,770 $10 Eagles in 1879, while San Francisco produced 224,000. In contrast, Carson City (CC) struck just 1,762, and New Orleans (O) only 1,500. This dramatic difference is why an 1879-CC $10 Eagle in Very Fine condition is worth around $15,000, while a Philadelphia version in the same grade is worth $1,329. That small "CC" multiplies the value more than tenfold.

Here's a look at the mintage numbers for 1879:

| Denomination | Philadelphia (P) | San Francisco (S) | Carson City (CC) | New Orleans (O) |

|---|---|---|---|---|

| $1 Gold Dollar | 3,000 (Proof) | N/A | N/A | N/A |

| $2.50 Quarter Eagle | ~130,000 (combined P & S) | ~130,000 (combined P & S) | N/A | N/A |

| $10 Eagle | 384,770 | 224,000 | 1,762 | 1,500 |

| $20 Double Eagle | ~1.4M (includes P) | 1,223,800 | Low mintage | Low mintage |

Prices shown are at the time of this publication.

Beyond mint marks, Proof coins add another layer of rarity. These special strikes, made for collectors, can have Cameo or Deep Cameo (DCAM) finishes with frosted designs against mirror-like fields, often resulting in five or six-figure valuations.

1879 Gold Coin Value Charts and Price Ranges

So, what are these coins actually worth? The 1879 gold coin value varies dramatically based on condition and mint mark. Use these charts as a starting point, but remember the coin market is dynamic.

A word of caution: These are estimates based on recent auction records and dealer pricing at the time of this publication. Your specific coin's value will depend on factors like eye appeal, strike quality, and overall collector demand.

Price Guide for Circulated 1879 Gold Coins

Circulated coins show wear from use, but even worn examples of rare 1879 gold coins command impressive premiums.

- $1 Gold Dollar (P): Ranges from $600 (Fine) to $1,040 (light wear).

- $2.50 Quarter Eagle (P, S): Both mints hover around $365 in Extremely Fine condition, making them accessible entry points.

- $10 Eagle: The mint mark is everything. Philadelphia and San Francisco examples are valued at $1,329 in Very Fine condition. However, the rare Carson City (CC) version jumps to $15,000, and the New Orleans (O) mint mark commands $10,000 in the same grade.

- $20 Double Eagle: Philadelphia and San Francisco pieces are valued around $1,500 in Extremely Fine condition. The Carson City (CC) example leaps to $5,000, while the ultra-rare New Orleans (O) mint mark reaches a stunning $18,500.

Price Guide for Uncirculated and Proof Coins

Here's where values get exciting. Uncirculated (Mint State or MS) coins show no wear, and every grade point matters.

- $1 Gold Dollar: An uncirculated MS-62 is around $909, while proofs start at $5,750. A top-tier Deep Cameo (DCAM) proof can reach $41,000.

- $2.50 Quarter Eagle: Uncirculated Philadelphia examples are valued at $375, but the San Francisco mint mark jumps to $550.

- $5 Half Eagle: Proofs are for serious collectors. Standard proofs range from $13,000 to $108,000, while Cameo or DCAM examples can fetch $51,000 to $137,000.

- $10 Eagle: Uncirculated Philadelphia and San Francisco coins start around $2,000. A proof 1879 Eagle can command $83,000.

- $20 Double Eagle: Uncirculated Philadelphia or San Francisco coins are valued at $1,575. The rare mint marks tell a different story: Carson City examples jump to $12,000, and New Orleans pieces reach $37,500. For detailed pricing, you can reference the 1879 S $20 Liberty Gold Pricing Guide | The Greysheet.

What about those legendary $4 Stellas? These pattern coins exist only in proof-like condition and sell for six-figure sums, often exceeding $200,000 at auction.

The takeaway? Condition and mint mark are the difference between a coin worth its weight in gold and one worth a small fortune. If you have a high-grade or rare-mint 1879 gold coin, professional grading is the first step to open uping its true value.

Investing in and Collecting 1879 Gold Coins

Acquiring an 1879 gold coin is more than a purchase—it's a strategic addition to a diversified investment portfolio. These coins appeal to both the heart and the head, offering a tangible connection to America's past and a solid store of value.

Why Gold Coins Can Be a Smart Investment

When deciding between gold bars and gold coins, historic pieces like the 1879 series offer unique advantages. While gold bars provide pure bullion value, coins bring something extra to the table.

| Feature | Gold Coins (e.g., 1879 Eagle) | Gold Bars |

|---|---|---|

| Value Basis | Melt Value + Numismatic Premium | Melt Value Only |

| Authenticity | Government-guaranteed legal tender | Private mint branding |

| Fraud Protection | Intricate, hard-to-counterfeit designs | Simpler designs, more prone to fakes |

| Appreciation | Grows with gold price AND collector demand | Grows with gold price only |

Gold coins carry legal tender status, a government guarantee of weight and purity that private mint bars lack. The intricate designs by master engravers are also incredibly difficult to counterfeit, offering superior fraud protection. Finally, a rare 1879-CC Eagle has numismatic appreciation potential; its value can grow from both rising gold prices and increasing collector demand, giving you two potential growth engines. For a deeper comparison, see How to Compare Gold Bars vs. Gold Coins.

Building Your Collection with Dollar-Cost Averaging

A consistent investment strategy is key. Dollar-Cost Averaging (DCA) simplifies the process by letting you invest a fixed amount at regular intervals, regardless of market fluctuations. By investing consistently, you automatically buy more when prices are low and less when they are high, lowering your average purchase price over time.

Think of it like your 401k: you contribute every paycheck, steadily building wealth. The same principle works for precious metals. Instead of trying to time the market, you commit to a regular schedule and let the strategy work for you.

At Summit Metals, we've made this effortless with our Autoinvest program. You can set up automated monthly purchases and put your gold accumulation on autopilot—no stress, just steady growth. Learn more about this powerful approach in The Power of Dollar-Cost Averaging and set up your automated gold investment plan.

Where to Find Reliable Valuations and Coins

When dealing with 1879 gold coin value, accuracy is essential. Always work with trusted sources.

- Reputable Dealers: Look for businesses with established track records and transparent pricing. At Summit Metals, we built our reputation on real-time pricing and competitive rates.

- Auction Houses: Sites like Stack's Bowers provide invaluable market data through their realized auction prices.

- Professional Grading Services: PCGS and NGC authenticate coins and provide population reports, bringing confidence to both buyers and sellers.

For significant purchases or sales, get multiple opinions and work with professionals who treat your investment with the seriousness it deserves. Let us be Your Golden Compass: Navigating to a Reputable Gold Dealer.

Frequently Asked Questions about 1879 Gold Coins

What is the most valuable 1879 gold coin?

For pure dollar value, the $4 Stella pattern coin is the undisputed champion, regularly selling for six figures at auction. Among coins made for circulation, the 1879-O $20 Double Eagle is a top contender, reaching $37,500 in Uncirculated condition. Other key rarities include the 1879-CC $10 Eagle (around $15,000 in circulated condition) and high-grade proof coins, like an 1879 $5 Half Eagle in Deep Cameo that can command over $137,000.

How do I know if my 1879 gold coin is real?

The most reliable method is professional authentication by PCGS (Professional Coin Grading Service) or NGC (Numismatic Guaranty Company). These experts can spot even sophisticated counterfeits. At home, you can perform basic checks:

- Weight and Diameter: Check if the coin's measurements match official specifications. An 1879 $10 Eagle should weigh 0.48375 troy ounces.

- Design Details: Compare your coin to high-resolution images of authenticated examples. Look for crisp lettering and sharp details.

- Sound Test: A genuine gold coin produces a distinct, resonant ring when tapped gently.

For more detailed guidance, consult our guide on How to Tell If Gold Is Real.

What makes 1879 a significant year for U.S. coinage?

The year 1879 was pivotal for the U.S. economy. On January 1, the Resumption of Specie Payments officially returned the nation to the gold standard. For the first time since the Civil War, Americans could exchange paper money for physical gold coins. This event spurred massive production at all four active mints (Philadelphia, San Francisco, Carson City, and New Orleans), creating the rich variety of coins collectors seek today. The year is also famous for the experimental $4 Stella pattern and the resumption of coining operations at the New Orleans Mint, making it a cornerstone year for numismatists.

Conclusion: Is Your 1879 Gold Coin a Hidden Treasure?

Uncovering the true 1879 gold coin value is a journey through history, market dynamics, and numismatic detail. As we've seen, a coin's worth is a blend of its gold content and its unique story, determined by factors like denomination, the all-important mint mark ("CC" or "O"), and its condition.

The value range is astounding, from a substantial base melt value to six-figure sums for ultra-rare specimens like the $4 Stella or high-grade proofs. If you hold an 1879 gold coin, you now have the foundational knowledge to begin assessing its potential.

First, identify your coin's denomination and mint mark, then assess its general condition. For any piece that appears rare or is in exceptional condition, we strongly recommend professional authentication and grading. An expert opinion from PCGS or NGC confirms authenticity and open ups the coin's full market potential.

At Summit Metals, we empower our clients with knowledge to steer precious metals with confidence. Open uping the potential of your 1879 gold coin can be a rewarding journey, connecting you to a tangible piece of America's past.

Have a coin to sell? Get a quote from us today! [Have a coin to sell? Get a quote from us today!](https://summitmetals.com/pages/sell-to-us)