Why Graded American Silver Eagles Matter to Collectors and Investors

Graded American Silver Eagles are the certified versions of America's official silver bullion coin, evaluated by third-party services like NGC and PCGS on a 70-point scale. This grading process guarantees a coin's authenticity and condition, improves its liquidity in the collector market, and protects it from damage in a sealed slab. For collectors and investors, this certification can open up premium value and investment potential beyond the silver content alone.

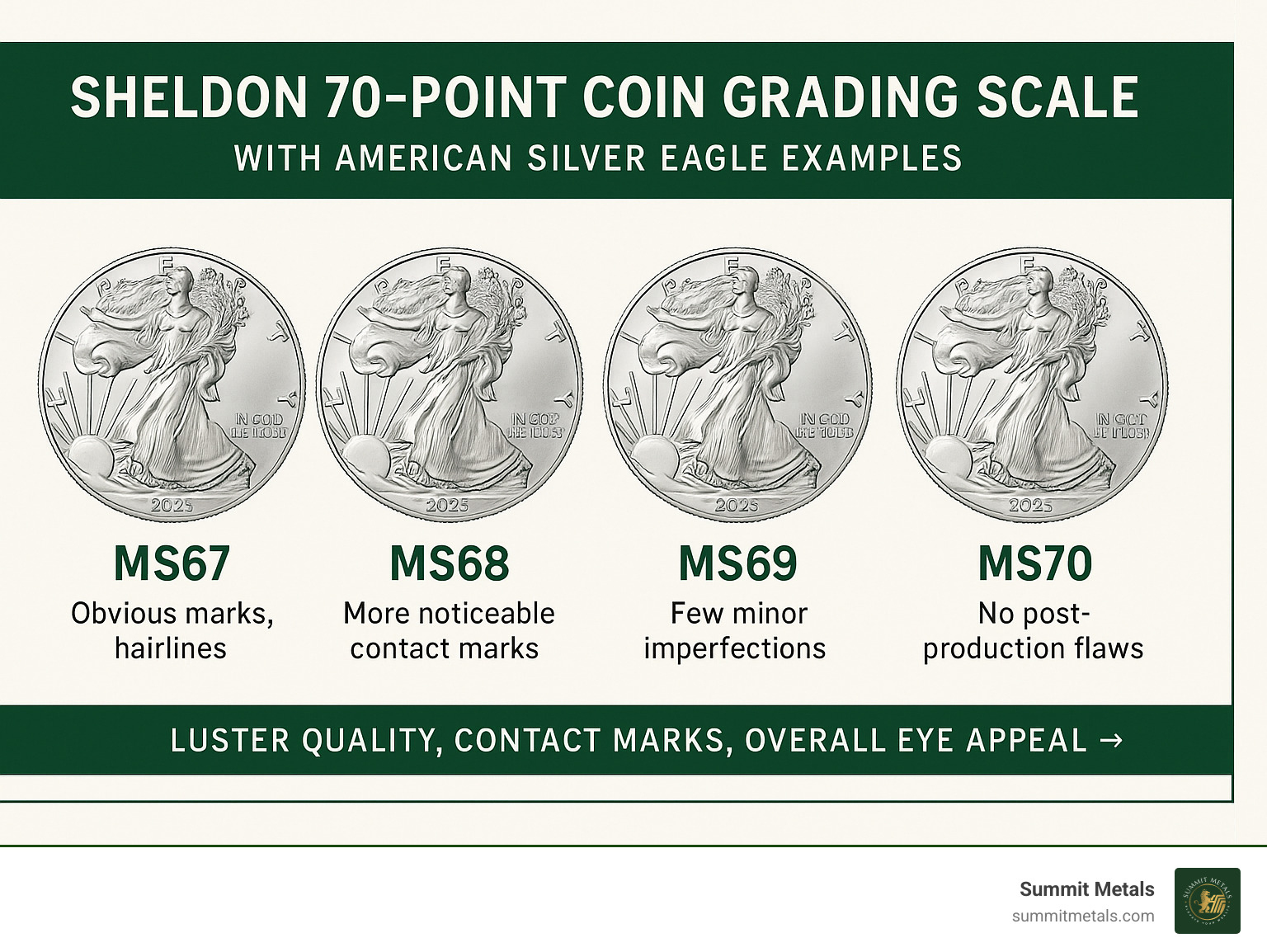

The choice between graded and raw Silver Eagles depends on your goals. If you're stacking silver for its metal content, ungraded coins offer better value. If you're interested in the numismatic aspect or building a collection, graded coins provide authentication and potential premium appreciation. Most modern Silver Eagles grade between MS67 (a coin with obvious issues like hairlines) and MS70 (a perfect coin), making perfect specimens particularly valuable, especially for older dates.

What Are American Silver Eagles?

The American Silver Eagle is the official silver bullion coin of the United States, first released in 1986. Each coin is guaranteed by the U.S. Mint to contain one troy ounce of 99.9% pure silver. While it has a nominal face value of one dollar, its true value is tied to the spot price of silver, making it a cornerstone for investors worldwide.

The coin's obverse features Adolph A. Weinman's iconic "Walking Liberty" design. The reverse originally showcased John Mercanti's heraldic eagle, which was updated in 2021 to a new "Type 2" design by Emily Damstra. This blend of trusted silver content and celebrated artistry makes the Silver Eagle a globally recognized asset for both collectors and investors. For a deeper dive into its origins, check out our guide: Beyond the Bullion: Exploring American Silver Eagles.

Why Grade a Silver Eagle?

Paying extra to have a Silver Eagle graded and sealed in a plastic slab comes down to three key benefits: authenticity, preservation, and value. Professional grading services like PCGS and NGC act as impartial arbiters, verifying that your coin is genuine. The protective slab then shields the coin from environmental damage and handling, preserving its condition.

This certified condition and authenticity improve liquidity, making the coin easier to sell. Most importantly for many, grading open ups numismatic value. A perfectly graded coin from a key date can command a significant premium over its silver content, turning a simple bullion coin into a collectible investment. For more on the fundamentals of this popular coin, see our article: Silver Eagle Bullion Coin Explained: Everything You Need to Know.

The Grading Gauntlet: From Mint to Slab

Turning a new Silver Eagle into a graded American Silver Eagle is a meticulous process. Collectors and dealers submit coins to third-party services like PCGS or NGC, where impartial experts, who are contractually prohibited from commercially trading coins, perform a rigorous examination.

Using magnification, numismatists assess luster, contact marks, strike quality, and overall eye appeal. Based on this assessment, the coin is assigned a grade on the 70-point Sheldon Scale. Finally, it's sonically sealed in a tamper-evident plastic holder, or "slab," with a label detailing its grade, year, and other key information. This encapsulation protects the coin and serves as a permanent certificate of its authenticity and condition.

The Crucial Difference: MS70 vs. MS69

For graded American Silver Eagles, the price difference between an MS70 and an MS69 can be thousands of dollars for key-date coins. The distinction is subtle but critical:

- MS70 is a perfect coin with no post-production imperfections visible at 5x magnification. It has flawless luster, strike, and eye appeal.

- MS69 is a near-perfect coin with tiny, almost imperceptible flaws, such as microscopic contact marks or minuscule hairlines.

The dramatic price gap exists because perfection is rare. For a key-date coin like the 1996 Silver Eagle, an MS70 specimen is far scarcer and more valuable than an MS69. This rarity of perfection is why that single point on the grading scale is so important to collectors. You can learn more about these grading standards at How NGC Grades American Silver Eagles.

Understanding Other Grades: MS68 and Below

Not every coin achieves a top grade. Understanding the lower Mint State grades helps in making smart purchases.

- An MS68 grade indicates a coin with strong luster but more noticeable flaws, like minor contact marks or small milk spots.

- An MS67 grade coin has more obvious issues, such as prominent hairlines or larger spots, that are readily visible.

While issues like milk spots (milky white blemishes) and hairlines (fine scratches) don't affect the silver content, they significantly impact a coin's grade and collectible value. An MS67 from a common year may trade for a small premium over its silver value, while an MS70 of the same coin commands a much higher price. This makes lower-grade coins a potential value play for those focused on silver content, while top-tier grades appeal to collectors seeking perfection. For more insights on how these grade differences affect value, check out our detailed guide: Eagle Eye on Value: Decoding the American Silver Eagle .999 Fine Silver.

Slabbed vs. Raw: The Great Silver Eagle Debate

Choosing between graded American Silver Eagles and ungraded (raw) coins comes down to a fundamental question: are you building a collection of numismatic treasures, or are you stacking silver ounces for their metal content? The decision impacts your cost, storage, and resale strategy.

| Feature | Graded American Silver Eagles | Ungraded (Raw) American Silver Eagles |

|---|---|---|

| Cost | Higher premium due to grading fees, encapsulation, and numismatic value. | Lower premium, closer to the spot price of silver. |

| Investment Focus | Numismatic value, collectibility, rarity, condition. | Intrinsic silver content, hedging against inflation/currency devaluation. |

| Liquidity | Generally higher liquidity in collector markets due to certified condition. | High liquidity for silver content, but less for numismatic value. |

| Storage | Protected in hard plastic slabs, stackable, easy to display. | Can be stored in tubes, bags, or boxes, more compact for bulk. |

| Collector Appeal | High, especially for perfect grades, rare dates, or special labels. | Low to moderate, primarily for those seeking pure bullion weight. |

| Authenticity | Authenticity and condition guaranteed by third-party graders. | Authenticity relies on a reputable dealer; condition is subjective. |

Whether you're dollar-cost averaging into precious metals monthly through a program like Summit Metals' Autoinvest, or making a bulk purchase, your strategy will influence which type of Silver Eagle makes the most sense.

The Case for Graded Silver Eagles

When you buy a graded American Silver Eagle, you're acquiring an authenticated piece of American history. The primary advantage is peace of mind; a grade from NGC or PCGS guarantees the coin's authenticity and condition. This certification often leads to stronger resale value, especially for perfect MS70 grades or coins from key dates like 1996, which can command premiums far exceeding their silver content.

The protective slab also ensures your investment is safe from fingerprints, environmental damage, and accidental drops, preserving its condition for decades. For serious collectors building long-term holdings, this protection is invaluable. If you're ready to explore certified options, check out our guide: Where to Buy Certified American Silver Eagles Without Ruffling Feathers.

The Case for Ungraded (Raw) Silver Eagles

Raw Silver Eagles appeal to the pragmatic investor. If your goal is to acquire as much silver as possible, ungraded coins are the way to go. The math is simple: lower premiums mean more ounces for your dollar. While a graded MS70 might cost $50-$100+ over the spot price, a raw Silver Eagle carries a much smaller premium.

This approach is ideal for those stacking silver as a hedge against economic uncertainty. Raw coins are easy to buy in bulk via mint tubes, simple to store efficiently, and straightforward to sell based on current silver prices. If your goal is accumulating precious metal weight, raw coins deliver maximum value. To learn more about maximizing your silver investment, explore our comprehensive resource: American Eagle Silver Bullion Coins for Sale: Your Ultimate Buying Guide.

Decoding the Premium on Graded American Silver Eagles

Understanding why graded American Silver Eagles cost more than raw coins means cracking the code of numismatic premiums. This premium is the amount you pay above a coin's silver value, and it's driven by rarity, condition, and market demand. A single grade point difference, from MS69 to MS70, can double or triple a coin's value for older dates.

How Rarity and Mintage Affect Value

Fewer coins minted generally means higher premiums. The 1996 Silver Eagle, with its low mintage, commands serious premiums in top grades. In contrast, a high-mintage year like 2015 (with 47.3 million coins produced) is far more common, and its premiums are lower. It's also important to distinguish between coin types—mass-produced bullion coins, collector-focused proof coins, and specially prepared burnished coins—as each has its own mintage figures that affect rarity. You can dive deep into these mintage figures at Silver Eagles (1986-Date) | Coin Explorer.

The Impact of Special Labels on Graded American Silver Eagles

Special labels can significantly boost a coin's desirability and price by creating perceived rarity.

- First Strike® and Early Releases: Given to coins submitted within the first 30 days of release.

- First Day of Issue: An even more exclusive label for coins submitted on day one.

- Signed labels: Featuring signatures from designers like John Mercanti or Emily Damstra.

- Emergency Production / Special Privy Marks: Commemorate unique production circumstances or events.

These designations create niches that dedicated collectors pursue, often driving premiums higher than those for coins with standard labels.

Why Condition is King for Graded American Silver Eagles

Condition is paramount. While mintage tells you how many coins were made, condition tells you how many survived in pristine shape. Population reports from services like NGC provide a census of how many coins have been certified at each grade. For older Silver Eagles, finding an MS70 is exceptionally rare, which is why they command such high premiums.

Modern coins are different. Thanks to better handling, 99% of recent Silver Eagles grade between MS67-MS70. This makes MS69 relatively common and MS70 less rare than for older coins. The key takeaway is that a grade's value is relative to its scarcity. For more insights into how these factors play out in real-world values, check out our comprehensive guide: Soaring High: Everything About American Eagle Dollars.

An Investor's Guide to Buying Graded Silver Eagles

Success in the graded American Silver Eagles market begins with a clear strategy. These coins offer both the security of physical silver and the potential upside of numismatic appreciation, but realizing that potential requires knowledge and a defined purpose.

Define Your "Why": Collecting vs. Investing

Your approach should align with your goals. Are you a collector or an investor?

Collectors often aim to complete sets, hunt for key dates, or acquire special labels. The joy is in the pursuit, and the goal is often to build a comprehensive series. Speculating on rare dates and their potential for appreciation is part of the journey. For those building a collection, consider starting with pieces that have historical significance: Eagle-Eyed Collectors Rejoice: 1 oz Proof Silver American Eagles Await.

Investors typically use graded coins to hedge with physical assets and diversify their portfolios. The focus is on long-term value, understanding that the numismatic premium can fluctuate independently of silver prices. The extra cost of the grade must be justified by its potential performance.

Smart Strategies for Acquiring Graded Coins

Smart acquisition is key to success. The graded coin market rewards patience and research.

- Buy from reputable dealers. A trusted dealer like Summit Metals ensures you receive authentic, fairly priced coins backed by transparent, real-time pricing.

- Understand market trends. Use resources like the NGC Census and price guides to research a coin's population and historical performance before buying.

- Use dollar-cost averaging. Instead of trying to time the market, make regular, consistent purchases. Summit Metals' Autoinvest program makes this easy, allowing you to buy precious metals monthly, just like contributing to a 401(k).

- Focus on quality over quantity. One high-grade, key-date coin will likely hold its value better than several lower-grade, common-date coins.

For those looking to start their journey, consider the newest additions to the series: 2025 American Silver Eagle Coins: Collect a Piece of History Today.

Frequently Asked Questions about Graded Silver Eagles

Are graded Silver Eagles a good investment?

They can be. Graded American Silver Eagles offer a dual value: a floor value from their silver content and upside potential from their numismatic premium. If your goal is to maximize silver ounces, raw bullion is more cost-effective. However, if you appreciate the collecting aspect and want a tangible asset with potential for numismatic appreciation, a graded coin can be an excellent long-term investment, especially for key dates in high grades.

Can I get my own Silver Eagles graded?

Yes, you can submit coins to services like NGC and PCGS after becoming a member. However, it's often not cost-effective for modern bullion coins. With fees for grading, shipping, and membership, the cost can easily exceed the value added by an MS69 grade. Submission makes the most sense for coins that are likely to achieve a perfect MS70 grade or are rare varieties. For most people, buying already-graded coins from a reputable dealer is more economical.

Do special labels like "First Strike" really add value?

Yes, labels like First Strike, Early Releases, and First Day of Issue add market value and are popular with collectors. They create perceived rarity and can improve a coin's liquidity. However, many numismatists debate their long-term value, especially for high-mintage modern coins. The premium is most likely to hold its value when combined with a truly scarce coin or a perfect MS70 grade.

Conclusion: Finding the Perfect Eagle for Your Nest

Whether you choose the certified perfection of a graded American Silver Eagle or the straightforward value of a raw coin, the right choice depends on your personal goals. Graded coins are ideal for collectors and those seeking numismatic potential, offering authenticated history in a protective slab. Raw coins are the clear winner for investors focused on accumulating the most silver for their dollar.

At Summit Metals, our Wyoming-based team understands that every investor's path is unique. We offer a comprehensive selection of both raw and graded American Silver Eagles with transparent, real-time pricing to ensure you get the best value.

To build your portfolio with discipline, consider our Autoinvest program. It allows you to make regular monthly purchases, dollar-cost averaging into Silver Eagles just as you would with a 401(k). This strategy removes the stress of timing the market and helps your nest egg grow steadily.

American Silver Eagles, in any form, are a cornerstone of precious metals investing—backed by the U.S. government and recognized worldwide. Whatever path you choose, you're investing in a piece of American heritage.