Why Silver Eagle Prices Matter to Today's Investors

Silver eagles today are trading with premiums that reflect their silver content and status as America's official silver bullion coin. Here's what you need to know:

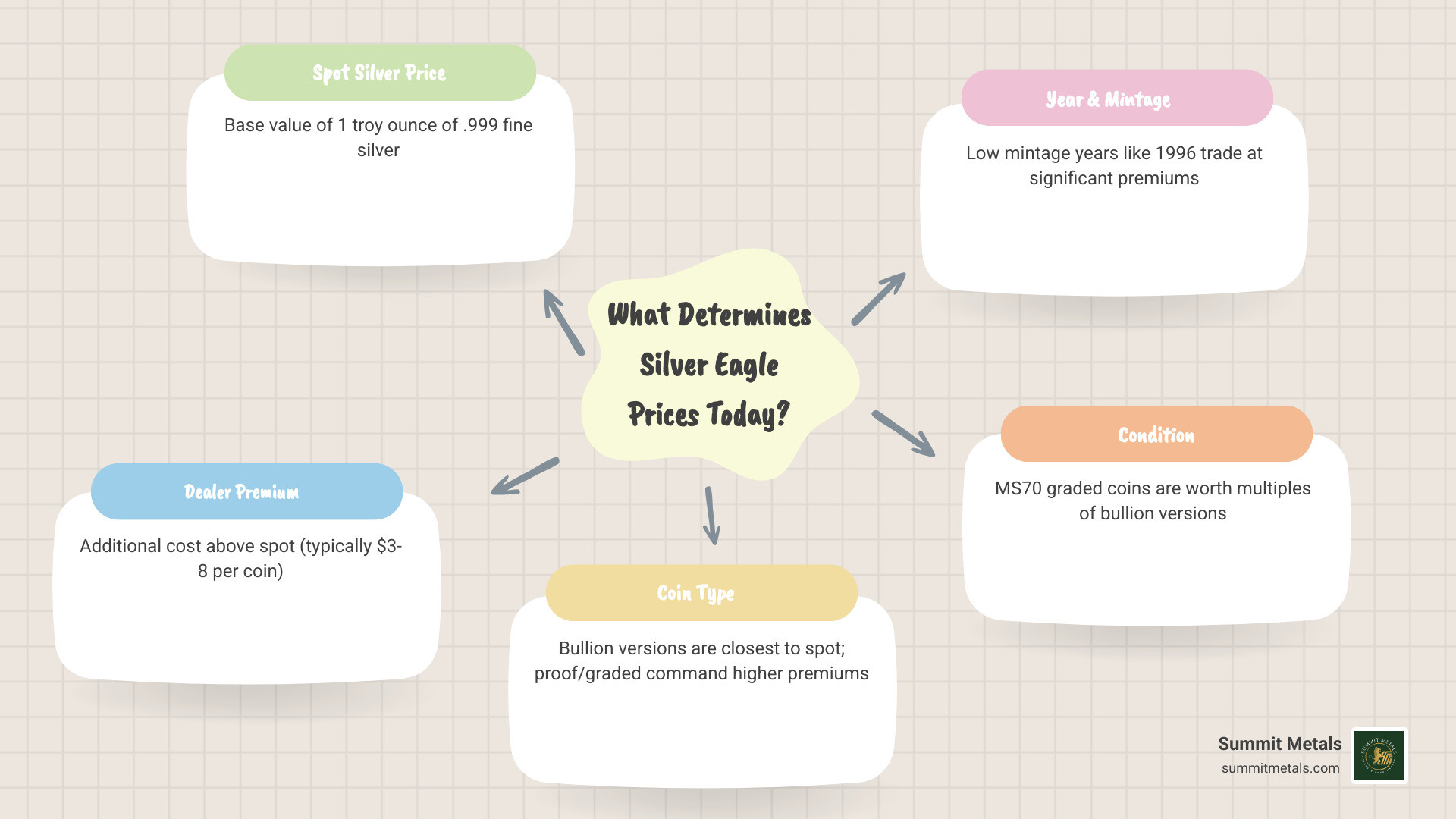

Current Silver Eagle Pricing Factors:

- Spot Silver Price: The base value of 1 troy ounce of .999 fine silver.

- Dealer Premium: Additional cost above spot (typically $3-8 per coin).

- Coin Type: Bullion versions are closest to spot, while proof/graded coins command higher premiums.

- Year & Mintage: Key dates like 1996 (lowest mintage) trade at significant premiums.

- Condition: MS70 graded coins are worth multiples of bullion versions.

Prices shown are at the time of this publication.

The American Silver Eagle is the world's most popular silver bullion coin, with over 500 million ounces purchased since 1986. Whether you're diversifying a portfolio or building a collection, understanding today's pricing is crucial.

From the iconic Walking Liberty design to the government's guarantee of weight and purity, these coins offer both intrinsic silver value and numismatic appeal. Premiums can swing dramatically based on supply, economic uncertainty, and collector demand.

Smart investors use dollar-cost averaging through programs like Summit Metals' Autoinvest to build their silver positions consistently, just like contributing to a 401k. This approach helps smooth out price volatility.

I'm Eric Roach. My decade as a Wall Street investment banking advisor provides institutional-level insight to help individual investors steer precious metals markets with confidence.

Easy silver eagles today glossary:

- Buy Certified Silver

- Precious Metals Investment

- walking liberty one ounce silver

Understanding the American Silver Eagle: A Primer

This section covers the essential background of the world's most popular silver coin, from its historic origins to its iconic design.

The History and Legacy of the Silver Eagle

In 1985, Congress passed the Liberty Coin Act to convert the U.S. government's silver stockpile into America's official silver bullion coin, creating the American Silver Eagle.

When the first Silver Eagles were minted in 1986, 5.4 million coins were produced. Demand surged, and production more than doubled to 11.4 million by 1987. A key feature is the U.S. Government guarantee backing each coin's weight and purity, with authenticity enforced by the Secret Service. This security has made silver eagles today the world's most popular silver bullion coin, with over 500 million ounces sold. For more insights, see Silver Eagle Silver Dollar Secrets Every Collector Should Know.

Anatomy of an Icon: Type 1 vs. Type 2 Designs

The coin's front features the iconic Walking Liberty design by Adolph A. Weinman, originally from the 1916-1947 half dollar. For over 30 years, the back featured John Mercanti's heraldic eagle design (Type 1). In 2021, the U.S. Mint introduced the Type 2 design by Emily Damstra, a dynamic landing eagle. The 2021 transition year is unique for collectors, as the Mint produced both Type 1 (13.1 million) and Type 2 (15.2 million) coins. Explore these designs in our guide Soaring High: Everything About American Eagle Dollars.

The U.S. Government Guarantee of Purity and Weight

Every Silver Eagle contains exactly 1 Troy ounce of .999 fine silver, guaranteed by the U.S. government. While they have a symbolic $1 USD face value making them official legal tender, their true value lies in their silver content and collectible status. This government backing ensures quality and authenticity, making them easily traded worldwide. Whether you're a new buyer or building a portfolio through dollar-cost averaging, this guarantee provides peace of mind. For full specifications, see the American Silver Eagle Bullion Coins information or our analysis: Eagle-Eyed on Value: Decoding the American Silver Eagle .999 Fine Silver.

What Determines the Price of Silver Eagles Today?

The value of a Silver Eagle is more than just its weight in silver. Here's a breakdown of the factors that influence its price on any given day.

Spot Price vs. Premium: The Two Halves of the Coin's Cost

The price of silver eagles today has two parts: the silver spot price and the dealer premium.

The spot price is the real-time market value of one troy ounce of silver. The premium covers costs like minting, design, security, transport, and dealer operations. Premiums are not fixed; they can rise with high market demand, as seen during the 2020 pandemic. At Summit Metals, we use our bulk purchasing power to offer competitive premiums. For example, buying in larger quantities lowers the per-coin price. Prices shown are at the time of this publication.

To smooth out these fluctuations, consider Summit Metals' Autoinvest program, which allows you to dollar-cost average into Silver Eagles monthly, like a 401k contribution. Learn more in our guide: Spot Price vs. Premium: How Precious Metals Pricing Works.

Bullion, Proof, and Burnished: How Finish Affects Value

The U.S. Mint produces Silver Eagles in three main finishes. Uncirculated (bullion) coins are the standard investment version, offering the most silver for your money with a brilliant mint luster. Proof coins are collector's items, struck multiple times to create a frosted finish on a mirror-like background. They are produced in smaller quantities, often with a W mint mark, and command higher premiums. Burnished coins have a unique matte finish and also carry the W mint mark, making them a collectible option that's often more affordable than proofs.

The finish dramatically affects value, so your choice depends on whether you are stacking for weight or collecting for numismatic value. Explore more in Beyond the Bullion: Exploring American Silver Eagles.

Key Dates, Mintage, and Rarity: The Numismatic Factor

While all Silver Eagles contain one ounce of silver, some are far rarer. Mintage numbers are key. The 1996 Silver Eagle is the rarest of the series, with only 3.6 million minted, compared to 47 million in a high mintage year like 2015. This scarcity creates high collector demand and significant premiums. Other low mintage years and rare error coins can also be worth thousands.

Graded coins, professionally evaluated on a 70-point scale, add another value layer. An MS70 grade signifies a perfect coin, which can be worth multiples of a standard version. The Greysheet price guide for collectors shows this wide value range, highlighting the importance of the numismatic factor for both collectors and investors.

Smart Strategies for Buying and Investing in Silver Eagles

Whether you're buying your first coin or your five-hundredth, these strategies will help you invest wisely and build your collection with confidence.

Where to Buy Authentic American Silver Eagles

Since the U.S. Mint doesn't sell bullion directly to the public, buying from reputable dealers is essential for authenticity. These dealers, like Summit Metals, source from the Mint's network of authorized purchasers. We pride ourselves on transparent, real-time pricing with no hidden fees. When buying, look for security features like the reeded edge and high-definition design details, which are difficult to counterfeit. Buying authentic, government-backed coins provides priceless peace of mind. For more tips, read our guide: Where to Buy Certified American Silver Eagles Without Ruffling Feathers.

Packaging Options: From Single Coins to Monster Boxes

Silver Eagles come in various packaging options designed for protection and value. Individual protective flips are ideal for single coins. For larger quantities, mint tubes of 20 coins are a convenient and trusted standard in the secondary market.

For serious investors, the sealed Green Monster Box holds 500 coins (25 tubes). Because they are sealed by the U.S. Mint, unopened Monster Boxes often command a premium, as the coins inside are guaranteed to be in pristine condition. Proper storage is key to protecting your investment. Learn more in our guide: From Eagles to Ingots: Your Guide to Storing All Types of Silver.

Prices shown are at the time of this publication.

Automate Your Investment with Dollar-Cost Averaging

Trying to time the precious metals market is stressful and often ineffective. A better strategy is dollar-cost averaging. Just as you contribute to a 401k, you invest a fixed amount regularly. When silver prices are high, you buy fewer ounces; when prices are low, you get more for your money. This disciplined approach removes emotion from investing and can lead to a lower average cost per ounce over time.

Summit Metals' Autoinvest program makes this easy. You can set up automatic monthly purchases of American Silver Eagles, putting your investment on autopilot. It's a powerful way to build wealth systematically. Learn more in our guide: The Power of Dollar Cost Averaging in Gold and Silver Investments.

Frequently Asked Questions about Silver Eagles Today

Get quick answers to the most common questions about buying and valuing American Silver Eagles.

How much is a Silver Eagle worth today?

The value of silver eagles today is its one-troy-ounce silver content (the spot price) plus a premium. This premium varies based on the coin's year, condition, type, and dealer pricing. A common 2024 bullion coin will be priced close to spot, while a rare 1996 coin or a perfectly graded MS70 specimen will command a much higher value. The coin's type—bullion, proof, or burnished—also significantly affects its final price. The $1 face value is symbolic; the coin's true worth is determined by its silver content and collectibility.

Prices shown are at the time of this publication.

Are American Silver Eagles a good investment?

Yes, American Silver Eagles are widely considered a strong investment. They offer the intrinsic value of .999 fine silver, are backed by the U.S. government, and are highly liquid worldwide. This makes them a tangible hedge against inflation and economic uncertainty. Silver Eagles are also IRA eligible, allowing you to hold physical silver in a tax-advantaged retirement account. Using a strategy like dollar-cost averaging through our Autoinvest program can make investing even more effective by smoothing out price volatility over time. For a deeper analysis, read our guide: Is Silver a Good Investment?

What is the difference between an uncirculated and a proof Silver Eagle?

The main difference is their purpose and production method. Uncirculated (BU) Silver Eagles are the standard investment-grade version, struck for mass distribution with a brilliant, uniform luster. They are valued primarily for their silver content. Proof Silver Eagles are special collector editions, struck multiple times with polished dies to create a frosted design on a mirror-like background. They have lower mintages, often feature a mint mark (e.g., "W" for West Point), and carry higher premiums due to their superior craftsmanship and rarity. Your choice depends on whether you are investing for silver weight or collecting for numismatic artistry.

Conclusion

The American Silver Eagle is a premier investment, blending the security of government-guaranteed .999 fine silver with the appeal of a numismatic collectible. Its value today is a dynamic mix of the silver spot price, collector demand, and its official backing, making it a unique asset for wealth preservation.

Understanding factors like mintage, condition, and finish is key to smart investing, whether you prefer affordable bullion or rare proof specimens. To build your holdings consistently and mitigate market volatility, consider a dollar-cost averaging strategy with Summit Metals' Autoinvest program, which functions like a 401k contribution for precious metals.

At Summit Metals, we provide transparent, real-time pricing to help you invest with confidence. The market for silver eagles today offers incredible opportunities for all investors. Start or grow your collection of American Silver Eagles today and find why it's the foundation of millions of investment portfolios.