Why American Silver Eagles Are America's Most Trusted Silver Investment

When you buy US silver eagles, you're investing in the official silver bullion coin of the United States - the only silver coin whose weight, content, and purity are guaranteed by the U.S. government. Here's what you need to know:

Top Places to Buy US Silver Eagles:

- Authorized precious metals dealers (like Summit Metals)

- Online bullion retailers with transparent pricing

- Coin shops and local dealers

- Direct from authorized purchasers of the U.S. Mint

Key Buying Considerations:

- Spot price + premium determines total cost

- Bulk purchases (tubes of 20, monster boxes of 500) offer better rates

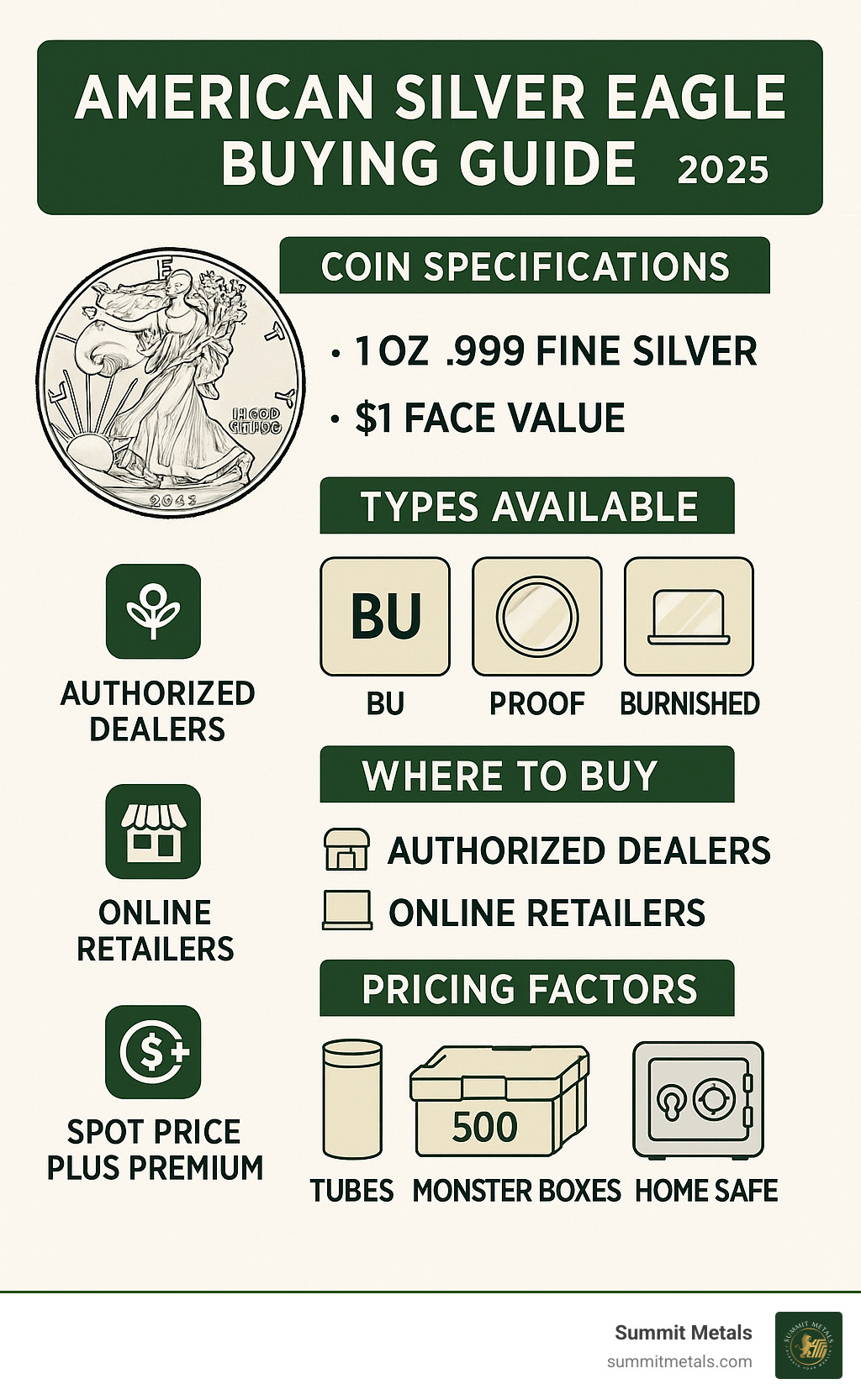

- BU, Proof, and Burnished versions available

- IRA-eligible for retirement accounts

The American Silver Eagle stands as the world's most popular silver bullion coin, with over 500 million coins sold since 1986. Its iconic Walking Liberty design and government backing make it a cornerstone investment for those seeking to diversify their portfolio with precious metals.

During my decade on Wall Street guiding Fortune-500 clients through complex hedging strategies, I've seen how institutional investors use precious metals to safeguard wealth - and the same principles apply when you buy US silver eagles for personal investment. I'm Eric Roach, and I help everyday investors apply institutional-grade strategies to protect and grow their wealth through physical precious metals.

Buy us silver eagles terms made easy:

- american eagle dollars

- american silver eagle 999

- silver eagle bullion coin

What is the American Silver Eagle?

The American Silver Eagle is the official silver bullion coin of the United States, prized by investors for its purity and government backing, and beloved by collectors for its iconic design. First minted in 1986, it represents a cornerstone of the global precious metals market. This guide will walk you through everything you need to know before you buy US silver eagles, from their rich history and specifications to their investment potential and various collectible forms.

History and Significance

Authorized by the Liberty Coin Act of 1985, the first American Silver Eagles were minted in 1986. They are the only silver bullion coin whose weight, purity, and content are guaranteed by the U.S. government. This unique backing has made them the world's most popular silver bullion coin, with over 500 million sold.

Each coin contains exactly 1 troy ounce of .999 fine silver, alloyed with a small amount of copper for durability. This consistency and reliability are why investors trust them as a cornerstone of their portfolios.

For investors looking to understand the fundamentals, our guide on Silver Eagle Bullion Coin Explained: Everything You Need to Know covers all the essential details.

Iconic Design and Specifications

The American Silver Eagle is renowned for its beautiful, historic artistry.

The obverse features Adolph A. Weinman's iconic Walking Liberty design, first introduced in 1916. This timeless image of Lady Liberty symbolizes freedom and hope.

The reverse has seen one major change. The original Type 1 design (1986-2021) by John Mercanti featured a classic heraldic eagle. In mid-2021, the Mint introduced the Type 2 reverse by Emily Damstra, which depicts a more naturalistic eagle landing with an oak branch. This newer design also incorporates improved security features, including a reeded edge variation to deter counterfeiting.

When you buy US silver eagles, you get precise, government-guaranteed specifications. Each coin weighs 1 troy ounce, measures 40.6mm in diameter, and is 2.98mm thick. While they carry a symbolic face value of $1, their true worth lies in their full ounce of .999 fine silver.

Want to dive deeper into what makes that .999 purity so special? Check out our detailed analysis: Eagle Eye on Value: Decoding the American Silver Eagle .999 Fine Silver.

Why Invest in American Silver Eagles?

American Silver Eagles are a strategic investment that has earned the trust of both seasoned investors and newcomers to precious metals. With over 500 million coins sold since 1986, they offer a unique combination of security, liquidity, and tangible value.

A Cornerstone for Your Portfolio

When you buy US silver eagles, you gain several key advantages:

- High Liquidity: Their global recognition ensures they can be easily converted to cash anywhere in the world.

- Government Backing: The U.S. government guarantees every coin's weight, content, and purity, offering best security.

- Tangible Asset: Unlike digital investments, you can physically hold your wealth, providing a unique sense of security.

- Hedge Against Inflation: Historically, precious metals like silver have held their value or appreciated as the purchasing power of paper currency declines.

- Portfolio Diversification: Silver often moves independently of stocks and bonds, providing crucial balance to your investment strategy.

For deeper insights into how Silver Eagles compare to other options, our Silver Showdown: Liberty 1 oz Fine Silver One Dollar Coins Reviewed breaks down the details you need to know.

IRA Eligibility

American Silver Eagles are IRA-eligible, meaning you can hold them in a Precious Metals IRA. The IRS requires precious metals in retirement accounts to have .999 purity or higher, a standard Silver Eagles easily meet. The coins must be held by an authorized custodian, not at home.

This allows you to gain the long-term wealth protection of physical silver within a tax-advantaged retirement structure, fortifying your self-directed IRA against inflation and market volatility.

Dollar-Cost Averaging with Autoinvest

One of the smartest strategies for building wealth with Silver Eagles is dollar-cost averaging. Instead of trying to time the market, you invest a fixed amount regularly. When prices are high, you buy fewer coins; when prices dip, you automatically buy more. Over time, this smooths out market volatility and can lead to a better average price per coin.

Our Autoinvest feature makes this strategy simple. Just like contributing to a 401k, you can set up automatic monthly purchases of American Silver Eagles. This disciplined approach takes the emotion out of investing and ensures you are steadily building your position over time, one ounce at a time.

A Collector's Guide to Silver Eagle Varieties

The world of American Silver Eagles extends beyond the standard bullion coin. Understanding the different varieties can help you make smarter decisions when you buy US silver eagles, whether for investment or collecting.

Bullion vs. Proof vs. Burnished Finishes

Brilliant Uncirculated (BU) coins are the standard investment-grade Silver Eagles. They are mass-produced for investors who prioritize silver content and are sold in tubes of 20 or Monster Boxes of 500. They may show minor imperfections from the minting process, which is normal and does not affect their silver value. For investors focused on accumulating silver, BU coins are the most cost-effective option.

Proof coins are the pinnacle of the series, struck multiple times to create a stunning contrast between deeply mirrored fields and frosted designs. Each comes in a presentation box with a Certificate of Authenticity. Due to their limited mintage, superior finish, and artistry, they command higher premiums and are highly sought after by collectors.

Burnished coins, introduced in 2006, have a unique matte-like finish and carry a 'W' mintmark from the West Point Mint. These limited-production coins are sold in presentation cases, appealing to collectors who want a special finish without the full premium of a proof coin.

For collectors seeking the finest examples, our guide on Eagle-Eyed Collectors Rejoice: 1 oz Proof Silver American Eagles Await provides deeper insights into these premium coins.

The Role of Certified and Graded Coins

For collectors, third-party grading can significantly increase a coin's value. Leading services like PCGS (Professional Coin Grading Service), NGC (Numismatic Guaranty Corporation), and CAC (Certified Acceptance Corporation) provide expert authentication and condition assessment.

They use the 70-point Sheldon Scale, where a grade of MS-70 (for bullion) or PF-70 (for proof) signifies a flawless coin, which commands the highest premiums. After grading, coins are sealed in protective, tamper-evident holders ("slabs") that display the grade and a unique certification number. This encapsulation guarantees authenticity and preserves the coin's condition.

Special designations like "First Strike" or "Early Release" indicate a coin was submitted for grading shortly after its release, adding further collectible appeal.

For those seeking certified coins, our resource on Where to Buy Certified American Silver Eagles Without Ruffling Feathers can guide you toward reputable sources. You can also explore grading standards directly at PCGS and NGC websites.

How to Buy US Silver Eagles and Understand Their Value

Navigating the market for American Silver Eagles is straightforward once you understand where to purchase them, what drives their value, and how to protect your investment.

Where to buy US Silver Eagles

The U.S. Mint does not sell bullion Silver Eagles directly to the public. Instead, it sells to a network of authorized purchasers (large distributors), who then supply dealers like Summit Metals. Buying from a reputable dealer guarantees authenticity and fair, transparent pricing.

For investors, Silver Eagles are available in several formats:

- Mint tubes of 20 coins for steady accumulation.

- Monster Boxes of 500 coins (25 tubes) for serious investors, offering lower premiums per coin.

Our Autoinvest feature makes building your position easy. You can set up consistent monthly purchases, similar to a 401k contribution, to take advantage of dollar-cost averaging without trying to time the market.

For a comprehensive guide on purchasing, you can read our American Eagle Silver Bullion Coins for Sale: Your Ultimate Buying Guide.

Factors Influencing Premiums and Price

The total price of a Silver Eagle consists of two parts: the spot price of silver and a premium. The spot price is the fluctuating market price for one troy ounce of raw silver.

The premium is the amount added on top of the spot price to cover minting costs, distribution, and the dealer's margin. Premiums are not fixed; they rise and fall with supply and demand. For example, during periods of high demand, premiums can increase significantly.

Mintage figures and collectibility also affect the price. Low-mintage coins like the 1996 Silver Eagle, as well as proof, burnished, and perfectly graded (MS-70/PF-70) coins, command much higher premiums than common-date bullion coins. Prices shown are at the time of this publication.

Storing and Protecting Your Investment

Proper storage is crucial to protect your investment's value and condition.

- Use Protective Packaging: Keep coins in their original U.S. Mint tubes, Monster Boxes, or individual coin capsules.

- Control the Environment: Store your silver in a cool, dry place to prevent tarnishing from air and humidity. Airtight containers offer extra protection.

- Secure Your Investment: A quality, fire-resistant home safe is suitable for smaller collections. For larger holdings, consider professional depository storage, which offers climate control, insurance, and high-level security. Summit Metals can help connect you with reputable storage partners.

Frequently Asked Questions about Buying Silver Eagles

When you're ready to buy US silver eagles, these are the questions that come up most often. Here are the answers you need.

What is the difference between a Type 1 and Type 2 Silver Eagle?

The main difference is the reverse design. The Type 1 (1986-mid-2021) features John Mercanti's classic heraldic eagle. The Type 2 (mid-2021-present) showcases Emily Damstra's more naturalistic landing eagle and includes an improved security feature in the reeded edge.

Are American Silver Eagles really worth only $1?

While they have a legal tender face value of one dollar, this is a legal technicality. The coin's actual market value is based on its intrinsic silver content—one troy ounce of .999 fine silver—plus any premium for its condition, rarity, and market demand. The $1 face value is symbolic; the real value lies in the precious metal.

What is the most valuable American Silver Eagle?

The 1996 American Silver Eagle is the most valuable regular-issue coin due to its low mintage. However, any Silver Eagle's value depends on a combination of factors: its year of minting, its finish type (bullion, proof, or burnished), and its condition and professional grade. A perfect MS-70 or PF-70 graded coin will always command the highest premiums.

How do American Silver Eagles compare to other silver coins like the Silver Buffalo?

American Silver Eagles carry the full backing of the U.S. government, guaranteeing their weight, content, and purity. This official status creates unparalleled trust and liquidity worldwide. While private mint coins like the Silver Buffalo also contain .999 fine silver, they lack this government guarantee, making Silver Eagles the benchmark for silver bullion investment.

What are the security features of American Silver Eagles?

Beyond the high-definition details that are difficult to replicate, the Type 2 Silver Eagle includes a reeded edge variation—a subtle, missing reed that acts as an anti-counterfeiting measure.

Are Silver Eagles 100% silver?

No, they are 99.9% pure silver (.999 fine). The remaining 0.1% is copper, which is added to increase the coin's durability. Pure silver is too soft for practical use in coins, so this small alloy is essential.

Can you get Silver Eagles at the bank?

It's uncommon. The U.S. Mint sells bullion Silver Eagles to a network of authorized purchasers (large distributors), not directly to the public or most banks. Dedicated precious metals dealers like Summit Metals are the primary source, offering specialized expertise and competitive pricing.

Why are ASE at such a high premium compared to other coins?

The premium on American Silver Eagles reflects their superior quality and status. You are paying for the U.S. government's guarantee, the U.S. Mint's reputation, exceptional global liquidity, and the iconic, universally recognized design. This premium often translates to easier resale and higher buyer confidence.

How often does the U.S. Mint release new American Silver Eagle designs?

Design changes are rare. The Walking Liberty obverse has never changed. The reverse saw its first and only update in 2021 after 35 years. This rarity makes design changes significant events for collectors.

Are there tracking devices in the Type 2 Silver Eagles?

No. This is a persistent myth. There are no tracking devices or microchips in any American Silver Eagle coins or Monster Boxes. The security features are entirely physical.

Prices shown are at the time of this publication.

Start Your Silver Eagle Collection Today

Congratulations! You've made it through our comprehensive guide on American Silver Eagles. Now comes the exciting part - taking action to secure your financial future with these remarkable coins.

When you buy US silver eagles, you're not just purchasing silver. You're investing in a piece of American history that's been trusted by millions of investors worldwide for nearly four decades. These coins represent the perfect marriage of investment security and collector's pride, making them a cornerstone asset that belongs in every well-diversified portfolio.

At Summit Metals, we've built our reputation on one simple principle: transparency. Based in Wyoming, we believe precious metals investing shouldn't be complicated or mysterious. That's why we offer real-time pricing with no hidden fees, competitive rates through our bulk purchasing power, and the kind of straightforward service you'd expect from your neighbors.

Your Next Steps to buy US Silver Eagles

Think of American Silver Eagles as your financial insurance policy - one that happens to be beautiful, historic, and government-guaranteed. Here's why savvy investors choose them:

IRA-eligible status means you can hold these physical coins in your retirement account, giving you tangible assets alongside your traditional investments. Government-backed authenticity provides peace of mind that's simply impossible to get with private mint products. The highly liquid nature of these coins means you can sell them anywhere in the world - try doing that with your local real estate! And that iconic Walking Liberty design? It's been turning heads since 1916 and never goes out of style.

Here's where our Autoinvest program really shines. Just like you automatically contribute to your 401k every month, you can set up consistent monthly purchases of Silver Eagles. This dollar-cost averaging approach takes the emotion and guesswork out of timing the market. Some months you'll buy when silver is up, other months when it's down - but over time, you'll build a substantial position at a balanced average price.

Prices shown are at the time of this publication.

The beauty of starting today is that you don't need to be a precious metals expert or have thousands of dollars ready to invest. You can begin with a single coin and grow your collection over time. Every Silver Eagle you add is another ounce of real, tangible wealth that no government can print away or corporation can dilute.

Ready to join the millions of Americans who've made Silver Eagles part of their wealth strategy? Explore our collection of American Silver Eagles and see how easy it is to get started. Your future self will thank you for taking this step toward financial security today.