What Makes Circulated American Silver Eagles Unique

Circulated silver eagles are American Silver Eagle coins that have been handled, traded, or stored in ways that show visible signs of wear, distinguishing them from their brilliant uncirculated counterparts. Here's what defines circulated Silver Eagles:

- Visible wear patterns on high points like Liberty's breast, leg, and the eagle's feathers

- Loss of original mint luster resulting in a duller, matte appearance

- Contact marks, scratches, or dings from handling and storage

- Lower premiums over silver spot price compared to uncirculated coins

- Same silver content - still contains 1 troy ounce of .999 fine silver

- Maintained liquidity and recognition in the precious metals market

The American Silver Eagle remains one of the most recognizable silver coins globally, whether in circulated or uncirculated condition. As noted in the research, "There is no single silver bullion specimen in the world more popular than the American Silver Eagle." These coins have been struck continuously since 1986, with mintages ranging from the lowest at 3.6 million coins in 1996 to record highs of over 47 million in 2015.

Understanding the difference between circulated and uncirculated Silver Eagles is key for investors. While circulated coins show wear, they retain their full silver content and government backing, making them an accessible entry point for collectors and stackers.

I'm Eric Roach. With over a decade in investment banking, I've seen how circulated silver eagles serve as an affordable, liquid hedge within diversified portfolios. They offer the same intrinsic silver value as pristine specimens but at lower premiums.

Simple guide to circulated silver eagles terms:

- certified american silver eagles

- american eagle silver bullion coins for sale

- silver eagle 1 ounce

The Anatomy of an American Silver Eagle

When you hold an American Silver Eagle in your hands, you're touching a piece of legislation that became numismatic history. Born from the Liberty Coin Act of 1985 and first minted on November 24, 1986, this isn't just another coin – it's the official silver bullion product of the United States.

Every American Silver Eagle, whether it's a pristine example or one of the more affordable circulated silver eagles, carries the same impressive credentials. The U.S. government guarantees that each coin contains one troy ounce of .999 fine silver, giving it substantial intrinsic value despite its symbolic $1 face value.

The U.S. Mint produces these beautiful coins primarily at the West Point facility, though San Francisco and Philadelphia have also contributed to the series over the years. This government backing and consistent quality make Silver Eagles incredibly liquid and trusted worldwide.

For a deeper dive into what makes these coins so special, check out our comprehensive guide: More info about American Silver Eagles.

The Iconic "Walking Liberty" Obverse

The front of every American Silver Eagle showcases one of America's most beloved coin designs: Adolph A. Weinman's "Walking Liberty." This isn't a new creation – Weinman originally designed it for the Walking Liberty Half Dollar, which graced American pockets from 1916 to 1947.

Lady Liberty strides confidently toward the rising sun, draped in the flowing American flag, carrying oak and laurel branches that symbolize strength and glory. The inscriptions "LIBERTY," "IN GOD WE TRUST," and the year of issue complete this inspiring scene.

There's something truly moving about this design – it captures hope, freedom, and progress in a way that speaks to collectors and investors alike. Here's a fun detail that surprises many people: those designer's initials "AW" on the coin aren't a mint mark for West Point, but actually Weinman's signature on his masterpiece!

The Reverse Designs: Type 1 vs. Type 2

While Lady Liberty has remained constant on the front, the back of the American Silver Eagle tells a tale of tradition and innovation.

For over three decades, the Type 1 reverse designed by John Mercanti defined what we expected to see on a Silver Eagle. This classic design features a heraldic eagle behind a shield, grasping an olive branch (peace) in one talon and arrows (preparedness) in the other. Above the eagle, 13 stars represent the original colonies, while "E Pluribus Unum" reminds us of our unity.

Then came 2021 and a celebration of the 35th anniversary of the Silver Eagle program. Emily Damstra created the stunning Type 2 reverse that shows an eagle landing with an oak branch in its talons, as if preparing to build a nest. This fresh, naturalistic approach breathes new life into America's national bird.

But the Type 2 isn't just about looks – it includes improved security features that make counterfeiting much more difficult. These subtle improvements protect both collectors and investors, whether they're buying pristine coins or more budget-friendly circulated silver eagles.

Both designs carry the same silver content and government guarantee, making them equally valuable as precious metal investments while offering collectors the choice between classic and contemporary American artistry.

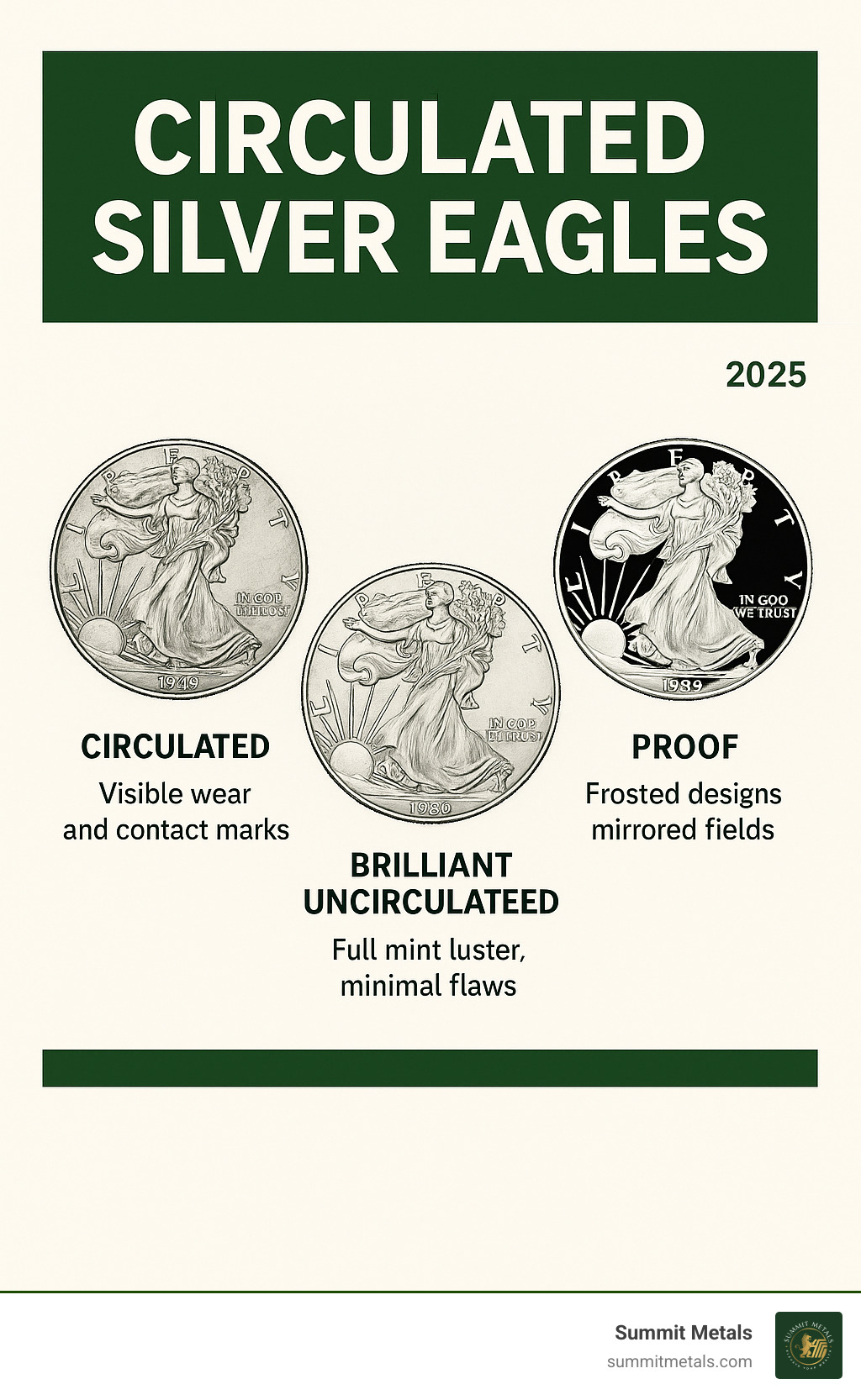

Circulated vs. Uncirculated: What's the Difference?

Understanding the difference between circulated and uncirculated coins is key for any investor. Both types contain the same silver, but their condition reflects their history.

A Brilliant Uncirculated (BU) coin comes directly from the U.S. Mint in "mint state," retaining its original mint luster—a brilliant, reflective sheen. It has not been subjected to public circulation.

BU coins are not always flawless. They might have minor contact marks from bumping into other coins during the minting process or while being transported in mint bags.

Circulated silver eagles, on the other hand, have been handled, traded, or stored in ways that result in visible wear and tear. This real-world experience is what distinguishes them from their uncirculated counterparts.

The beauty of both types is that they contain the same one troy ounce of .999 fine silver. A coin's history doesn't change its fundamental value as a precious metal investment. For deeper insights into how condition affects value across different silver coins, check out our guide An Essential Guide to Valuing Constitutional Silver.

How to Identify Circulated Silver Eagles

Spotting circulated silver eagles is a matter of knowing what visual cues to look for. The most obvious clue is the loss of luster. Uncirculated coins have this amazing "cartwheel" effect when you tilt them under light – they seem to shimmer and dance. Circulated coins? Not so much. They've lost that magic and appear duller, more matte.

Next, look for flattening of high points. These are the areas that stick out most from the coin's surface, making them the first casualties of handling. On Lady Liberty, check her breast, knee, and the folds of her gown. On the eagle side, examine the feathers and the highest points of the head and wings. If these details look worn down or less sharp, you're looking at a circulated coin.

Scratches and dings are the battle scars of circulation. While even uncirculated coins might have tiny "bag marks" from their time in mint storage, excessive scratches or prominent dings tell the story of a coin that's seen some action.

Here's where it gets interesting: toning vs. damage. Toning is actually beautiful – it's when silver naturally reacts with air to create gorgeous color patterns. Many collectors love this natural patina. But if you see uneven, splotchy discoloration, that might indicate cleaning damage or poor storage, which can hurt the coin's value.

The Value of Circulated Silver Eagles vs. Uncirculated

Here's the thing about American Silver Eagles – they're democratic when it comes to intrinsic value. Every single one contains exactly one troy ounce of .999 fine silver, which means their base value moves with the silver spot price. A circulated eagle has the same silver content as a perfect MS-70 graded coin.

The difference comes in numismatic value – that's collector speak for "how much extra people will pay because it's pretty or rare." Uncirculated coins, especially those with high grading scores from services like PCGS or NGC, command higher premiums because collectors love perfection.

Circulated silver eagles trade closer to their silver content value, with lower premiums over spot price. This actually makes them incredibly attractive to investors who want to own physical silver without paying extra for pristine condition. Think of it as getting the same engine in a car that might have a few more miles on it – you're still getting where you need to go.

| Feature | Circulated Silver Eagle | Uncirculated Silver Eagle |

|---|---|---|

| Luster | Dull, matte appearance lacking original mint sheen | Full, vibrant mint luster with "cartwheel" effect |

| Detail | High points may show flattening or wear | Sharp, crisp details throughout the design |

| Wear | Visible handling marks, scratches, and dings | No circulation wear, possible minor bag marks |

| Premium over Spot | Lower premiums, closer to silver melt value | Higher premiums, especially for top grades |

The beautiful truth is that even a well-worn circulated silver eagle is still backed by the U.S. government and contains a full ounce of pure silver. For investors building their precious metals portfolio through consistent purchasing – like our Autoinvest feature that lets you dollar-cost average into silver monthly – circulated eagles can be an excellent way to accumulate more ounces for your investment dollar.

A Guide to Collecting and Investing in Circulated Silver Eagles

For new and seasoned stackers alike, circulated silver eagles offer a fantastic way to build wealth while owning a piece of American history. Despite any signs of wear, they still carry a full ounce of .999 fine silver, making them valuable assets.

The story of American Silver Eagle mintages is fascinating and directly impacts what you'll find in the market today. When these coins debuted in 1986, the U.S. Mint struck 5.393 million of them – not bad for a first year! But by 1987, demand exploded to 11.442 million coins as investors and collectors caught on to their appeal.

Here's where it gets interesting for collectors: 1996 stands out as the holy grail year with just over 3.6 million coins produced – the lowest mintage in the entire series. Even circulated silver eagles from this year can command a slight premium because of their scarcity. On the flip side, 2015 saw record-breaking demand with 47 million coins minted, making these more common but still valuable for their silver content.

This dance between supply and demand is what makes collecting these coins so engaging. Some years are easier to find, while others require patience and a bit of hunting. For those looking to build a comprehensive precious metals portfolio, our guide on The Basics of Gold and Silver Stacking covers strategies that work whether you're buying pristine coins or well-loved examples.

Bullion, Proof, and Burnished Versions

Not all Silver Eagles are created equal, and understanding the different types helps explain why some circulated silver eagles might look different from others you encounter.

Bullion coins are the bread and butter of the Silver Eagle world. These investment-grade coins come straight from the mint with that brilliant, lustrous finish we associate with new coins. They're produced in massive quantities specifically for investors who want to own physical silver. Most circulated silver eagles you'll encounter started life as bullion coins – no mint marks, just pure American silver at its finest.

Proof coins are the show-offs of the family. Struck multiple times with specially polished dies, they feature stunning mirror-like fields with frosted design elements that create an almost three-dimensional effect. These collector favorites typically carry mint marks like "W" for West Point or "S" for San Francisco. While less common in circulated condition, when you do find circulated proof coins, they've lost much of their original proof character but retain their silver value.

Burnished coins (sometimes confusingly called "Uncirculated" collector versions) have a unique matte finish that's neither brilliant like bullion nor mirrored like proofs. They're struck on specially prepared blanks that give them a distinctive appearance. Like proofs, they usually bear a "W" mint mark and are produced in limited quantities for collectors.

Factors Affecting the Value of Circulated Silver Eagles

While silver spot price drives the base value of all circulated silver eagles, several factors can nudge their worth up or down in the marketplace.

Condition matters, even among circulated coins. A Silver Eagle with light wear and good eye appeal will always outperform one that looks like it went through a washing machine with gravel. Professional grading services like PCGS and NGC primarily focus on uncirculated coins, but understanding wear patterns helps you make smart buying decisions.

Rarity plays a role too. 1996 low-mintage year we mentioned? Even circulated examples can carry a small premium simply because fewer exist. Collectors working on date sets might pay a bit extra for harder-to-find years, regardless of condition.

Certification isn't common for everyday circulated silver eagles, but occasionally you'll find problem-free examples that have been professionally authenticated and graded. This third-party validation can boost both value and buyer confidence.

Special editions like gilded or colorized coins add another dimension. While these aren't official U.S. Mint products (they're improved by third-party companies), they can appeal to collectors who enjoy unique variations. Just remember that circulation can affect these special finishes.

A Smart Strategy: Dollar-Cost Averaging

Here's where investing in circulated silver eagles gets really exciting. Instead of trying to time the perfect moment to buy (spoiler alert: nobody consistently gets this right), consider building your stack through consistent, regular purchases.

Dollar-cost averaging means investing the same amount of money at regular intervals – say $200 every month – regardless of whether silver prices are up or down. When prices dip, your money buys more ounces. When prices rise, you get fewer ounces but your existing stack gains value. Over time, this strategy smooths out the bumps and helps you build wealth steadily.

Think of it like contributing to your 401k, but instead of buying stocks and bonds, you're accumulating real, tangible silver that you can hold in your hands. It's a powerful way to build financial security without the stress of constantly watching price charts.

We're thrilled to announce that Summit Metals will soon be launching our Autoinvest feature, making dollar-cost averaging easier than ever. Set it up once, and we'll automatically purchase your chosen amount of precious metals each month. Whether you prefer circulated silver eagles for their affordability or want to mix in some pristine examples, Autoinvest helps you build your stack consistently while you focus on living your life.

For a deeper dive into how this strategy can transform your precious metals investing, check out The Power of Dollar Cost Averaging in Gold and Silver Investments. It's one of the smartest approaches we've seen for building long-term wealth through physical precious metals.

Practical Considerations for Buyers

When you're ready to add circulated silver eagles to your collection or investment portfolio, smart buying habits can make all the difference between a great experience and a frustrating one. Think of it like buying a used car – you want to know what you're getting and who you're buying from.

The most important step is choosing a reputable dealer who stands behind their products. At Summit Metals, we've built our reputation on transparency and trust, offering authenticated precious metals with real-time pricing that reflects our bulk purchasing power. We believe you shouldn't have to guess what you're paying or wonder if your coins are genuine. For a deeper dive into safe purchasing practices, check out our guide on How to Buy Gold and Silver Online Safely.

Look for dealers who provide clear product descriptions that honestly represent the condition of their circulated silver eagles. Avoid anyone who seems evasive about pricing or condition – transparency should be the norm, not the exception. A good dealer will also offer responsive customer service and stand behind their authenticity guarantees.

Are American Silver Eagles IRA-Eligible?

Here's some exciting news for retirement planners: American Silver Eagles are absolutely IRA-eligible! This means you can hold these beautiful coins within a tax-advantaged Precious Metals IRA, whether they're pristine or circulated silver eagles.

The IRS requires silver coins in retirement accounts to meet a purity standard of .999 or higher, and American Silver Eagles exceed this requirement with their .999 fine silver content. However, there's an important catch – you can't store them in your home safe and call it an IRA investment.

IRA-held silver must be stored with an authorized custodian in an approved depository facility. This ensures compliance with IRS regulations and protects the tax-advantaged status of your investment. Think of it as having a professional security service for your retirement silver – they handle the storage headaches while you enjoy the potential benefits.

For complete details on IRS requirements and contribution limits, the official IRS Publication 590-A on IRA contributions is your best resource.

Packaging, Security, and Storage

Even circulated silver eagles that already show some character deserve proper protection from further damage. After all, every scratch avoided helps preserve their value and your investment.

Individual coins benefit from protective plastic flips or direct-fit capsules that shield them from environmental damage and handling. For larger quantities, mint tubes holding 20 coins each provide excellent bulk storage, while "Monster Boxes" containing 500 coins (typically 25 tubes) are perfect for serious stackers.

The American Silver Eagle incorporates several security features that help ensure authenticity. The reeded edge – those distinctive ridges around the coin's perimeter – is a time-tested anti-counterfeiting measure that prevents "clipping" or shaving metal from the edges. Since 2021, Type 2 Silver Eagles also include subtle edge variations that change with each mintage year, adding another layer of authentication.

Proper storage protects your investment for the long haul. Keep your silver in a cool, dry environment away from direct sunlight, temperature swings, and harsh chemicals. A quality home safe works well for moderate holdings, while professional depositories offer superior security for larger collections.

For comprehensive storage guidance that covers everything from humidity control to security considerations, our detailed guide Top Storage for Silver: Best Practices for Safekeeping Your Investment provides invaluable insights for protecting your precious metals investment.

Frequently Asked Questions about American Silver Eagles

We love connecting with both seasoned stackers and folks just starting their precious metals journey. Over the years, we've noticed the same thoughtful questions come up again and again about American Silver Eagles, especially when it comes to their condition and investment potential. Let me share some insights from our experience at Summit Metals.

Are circulated Silver Eagles still a good investment?

Absolutely! Here's the beautiful thing about circulated silver eagles – they contain the exact same one troy ounce of .999 fine silver as their pristine cousins. The silver doesn't know whether it's been handled or not, and neither does the market when it comes to intrinsic value.

While circulated silver eagles won't command the higher numismatic premiums that collectors pay for perfect specimens, they offer something equally valuable: accessibility. They're often available at lower premiums over spot price, making them an excellent choice for investors who want to accumulate physical silver without paying extra for cosmetic perfection.

Think of it this way – you're getting the same government backing, the same liquidity, and the same hedge against inflation, just with a coin that has a little more character. For many of our clients who focus on building their silver stack through consistent purchases (like our upcoming Autoinvest feature), circulated silver eagles represent outstanding value.

What is the rarest American Silver Eagle?

The crown jewel of rarity in the American Silver Eagle series is the 1996 bullion issue. With just over 3.6 million coins produced, it has the distinction of being the lowest mintage year in the entire program. This scarcity makes it highly sought after by collectors, even in circulated condition.

But here's where things get really interesting for serious numismatists: the 1995-W Proof Silver Eagle takes rarity to another level entirely. This coin was only available as part of a special 10-coin set, with a tiny mintage of just over 30,000 units. Finding one of these beauties is like finding a needle in a haystack!

It's worth noting that even common-date American Silver Eagles from high-mintage years can become collectible over time, especially key dates or those with interesting die varieties. The silver market has a funny way of creating value where you least expect it.

Can you get Silver Eagles from a bank?

This is one of our most frequently asked questions, and I totally understand the confusion! Unfortunately, you won't find American Silver Eagles sitting next to the quarters and half-dollars at your local bank branch.

The U.S. Mint operates through a specialized network of authorized purchasers – essentially wholesale dealers who buy directly from the mint in large quantities. These authorized purchasers then distribute the coins to smaller dealers like us here at Summit Metals, and eventually to individual investors and collectors.

While some larger banks might offer precious metals products through specialized divisions or partnerships, American Silver Eagles aren't dispensed as regular currency. They're investment products, not spending money (despite their $1 face value!).

Your best bet for authentic, competitively priced American Silver Eagles is always working with a reputable precious metals dealer who can provide transparent pricing and proper authentication. That's exactly what we do at Summit Metals – we source directly through authorized channels and pass along our bulk purchasing advantages to our clients.

Conclusion

After exploring circulated silver eagles, one thing becomes crystal clear: these coins are far more than just "worn" versions of their pristine cousins. They're accessible gateways to precious metals investing that don't compromise on what matters most - that full troy ounce of .999 fine silver backed by the U.S. government.

The beauty of circulated silver eagles lies in their practicality. While they may show the gentle patina of time and handling, their intrinsic silver value remains unchanged. They track the silver spot price just like their uncirculated siblings, but at lower premiums, making them perfect for investors who prioritize silver accumulation over numismatic perfection.

Whether you're just starting your precious metals journey or you're a seasoned stacker looking to maximize your ounces per dollar, these coins offer remarkable collector appeal combined with investment-grade substance. They're highly liquid assets that precious metals dealers worldwide recognize and value.

At Summit Metals, we've built our reputation on transparent pricing and helping investors make informed decisions. Our Wyoming-based team understands that every investor's needs are different - some want museum-quality specimens, while others prefer to focus purely on silver content at competitive rates.

For those ready to build their silver stack methodically, consider our upcoming Autoinvest feature. Just like contributing to a 401k, you can set up automatic monthly purchases, using dollar-cost averaging to smooth out market volatility while consistently growing your precious metals holdings.

Ready to find how circulated silver eagles can strengthen your investment portfolio? We invite you to explore our carefully curated selection, where every coin is authenticated and fairly priced.