Why the Precious Metal Prices Chart 2026 Matters Now

Precious metal prices chart 2026 forecasts point to continued gains after gold's historic 2025 rally. Major financial institutions predict gold prices between $3,600 and $5,000 per ounce, representing what many analysts call a structural shift rather than a temporary rally. Silver is also expected to follow, driven by industrial demand and its role as an inflation hedge.

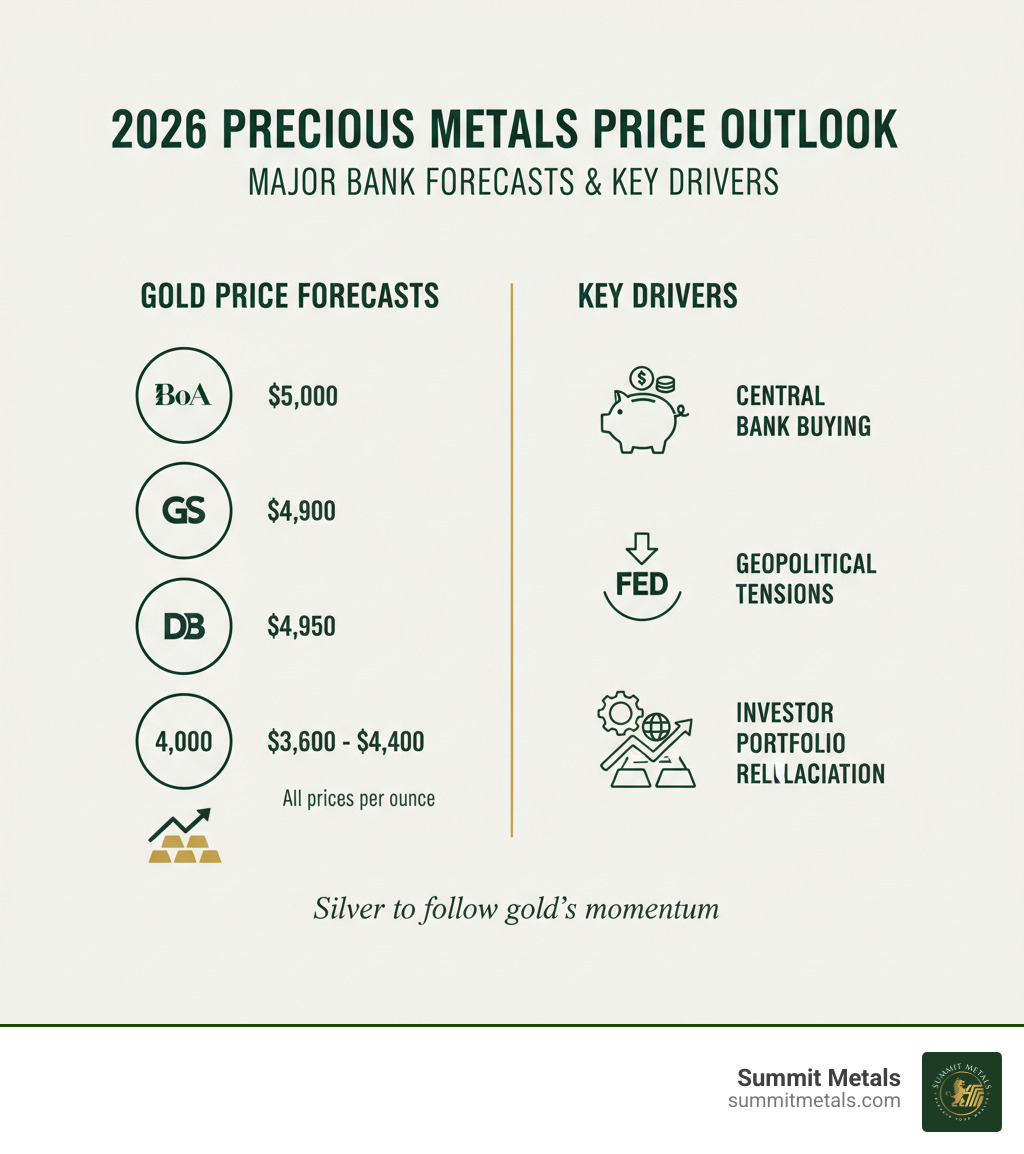

Key 2026 Price Forecasts:

| Institution | Gold Target | Expected Increase |

|---|---|---|

| Bank of America | $5,000/oz | +19% |

| Goldman Sachs | $4,900/oz | +17% |

| Deutsche Bank | $4,950/oz | +18% |

| J.P. Morgan | $4,000/oz | +14% |

| HSBC | $3,600-$4,400/oz | +5% to +8% |

Primary Drivers:

- Central bank gold purchases doubling since 2022

- Expected Fed rate cuts of ~75 basis points

- Ongoing geopolitical tensions and policy uncertainty

- Rising institutional portfolio allocations to precious metals

This matters for your wealth because today's surge reflects fundamental institutional changes. Morgan Stanley's CIO now endorses a 20% portfolio allocation to gold, and central banks are buying at multi-decade highs to diversify away from traditional reserve assets. The precious metal prices chart 2026 is a roadmap showing where smart money is heading as governments grapple with inflation and debt.

I'm Eric Roach. After a Wall Street career guiding Fortune 500 clients, I now help investors use these same institutional strategies to position their portfolios for long-term stability.

Decoding the Precious Metal Prices Chart 2026: Expert Forecasts

Leading financial institutions and analysts forecast continued strength for gold and silver on the precious metal prices chart 2026. This optimism is grounded in economic signals, global shifts, and new investment approaches. The World Bank's Commodity Markets Outlook projects a solid 5% rise for precious metals in 2026, following a historic investment-fueled jump of over 40% in 2025. Strong tailwinds from central bank buying and anticipated Fed rate cuts are setting the stage for a compelling year. For more on this, see this article on why gold prices could soar.

Gold Price Predictions on the 2026 Chart

The consensus among major institutions for 2026 gold prices is overwhelmingly positive. Our research at Summit Metals suggests a potential surge of up to 20%, building on 2025's impressive performance.

Forecasts from top analysts reflect this bullish sentiment:

- Bank of America (BofA): $5,000/oz

- Goldman Sachs: $4,900/oz

- Deutsche Bank: $4,950/oz

- J.P. Morgan Research: $4,000/oz

- HSBC: $3,600-$4,400/oz

Our own analysis, aligning with InvestingHaven, points to a target near $4,200 in 2026, with a longer-term prediction of $5,155 by 2030. These forecasts are informed by current market conditions and gold's historical performance during times of economic uncertainty and inflation. You can revisit our earlier insights on Price of Gold Predictions for the End of 2024: Expert Insights and AI Forecasts.

Silver's Trajectory on the Precious Metal Prices Chart 2026

While gold gets much of the attention, silver's potential on the precious metal prices chart 2026 is significant. Silver has a dual role as both a monetary metal and a vital industrial commodity, giving it a distinct market edge.

A primary driver is soaring industrial demand, especially from the renewable energy (solar panels) and electronics sectors. This built-in demand creates a strong price floor. Another key indicator is the gold-to-silver ratio, which suggests silver may be undervalued compared to gold and ready for a catch-up rally. To learn more, explore The Gold and Silver Ratio: A Timeless Measure for Precious Metals Investors.

Robust investment demand is also expected to continue, as silver serves as a safe-haven asset and an inflation hedge. At Summit Metals, we see a compelling bullish case for silver. The outlook for 2026 provides a persuasive answer to the question, Is Silver a Good Investment?.

Outlook Beyond 2026: Is a Correction Coming?

While the precious metal prices chart 2026 looks optimistic, it's wise to consider the long-term view, including potential market corrections. The World Bank predicts the current rally might moderate or consolidate around 2027 after hitting new highs. This would be a natural breather, not a crash.

At Summit Metals, we advocate a long-term strategy. Our price targets project gold approaching $5,155 by 2030, accounting for temporary pullbacks. The broader trend for the next decade remains positive. Historical corrections are a normal part of any market cycle, and a diversified portfolio is key to weathering fluctuations. The Historical Price of Silver Graph offers valuable context on past cycles and recoveries.

Key Factors Driving the 2026 Precious Metals Rally

Understanding why the precious metal prices chart 2026 looks so promising is key to making smart investment choices. At Summit Metals, we see a powerful combination of global events and strategic financial shifts driving gold and silver prices higher.

Knowing these underlying drivers is crucial. As we’ve highlighted in Key Factors Influencing Gold & Silver Prices: Supply, Demand, Geopolitics, these elements are creating a compelling environment for precious metals as assets for preserving and growing your wealth.

Central Bank Buying and a Declining Dollar

One of the biggest forces shaping the precious metal prices chart 2026 is central bank activity. Nations are buying gold at a record pace, with purchases more than doubling since 2022. This trend accelerated after Russia's foreign reserves were frozen, highlighting the risks of over-reliance on the U.S. dollar.

This has fueled a global move toward de-dollarization, as countries seek assets outside the control of any single government. Gold fits that role perfectly. You can learn more in our article, Why Central Banks Buy Gold (and Why You Should Too): A Look Into the Power of Physical Gold. A weakening U.S. dollar also makes gold cheaper for foreign buyers, boosting demand. Concerns about the dollar's long-term health further add to gold's appeal, a relationship we explore in The Declining Power of the US Dollar and Its Global Implications: What It Means for Precious Metals Investors.

Inflation, Interest Rates, and Investor Demand

Inflation and interest rates are also critical factors. Gold and silver have historically served as safe havens against inflation, protecting purchasing power when paper money's value declines.

Furthermore, the Federal Reserve is expected to cut interest rates. Lower rates decrease the appeal of interest-bearing assets, making non-yielding assets like gold and silver more attractive. This situation fuels the "debasement trade," where investors flock to gold to protect their wealth from devaluing currencies. This has led to a significant portfolio allocation shift, with major institutions like Morgan Stanley's Chief Investment Officer now recommending a 20% gold allocation. Our guide, The Interplay of Interest Rates, the Dollar, and Gold Prices, breaks down this connection.

Geopolitical Tensions and Market Uncertainty

Finally, geopolitical tensions and market uncertainty play a huge role in the precious metal prices chart 2026. Ongoing conflicts, trade disputes, and policy unpredictability drive investors toward the safety of gold and silver.

The freezing of Russia's reserves demonstrated the vulnerability of traditional financial systems during global strife, making tangible assets like physical gold and silver more appealing. While there are always downside risks—such as a sudden de-escalation of conflicts or a stronger-than-expected dollar—the current global uncertainty strongly supports a strategic investment in precious metals. For more on navigating these times, check out Maximizing Your Investment in a Chaotic Global Economy: Why Gold and Silver Are Essential for Portfolio Diversification in 2024.

Strategic Investing for 2026: How to Position Your Portfolio

Given the compelling outlook for the precious metal prices chart 2026, the question becomes: "How do I position my portfolio?" The answer lies in treating precious metals as a strategic, long-term foundation for wealth preservation, not a short-term trade.

This means committing to portfolio diversification for risk-adjusted returns. Physical gold and silver act as a hedge against economic instability and currency devaluation, making them essential components of a resilient portfolio. As we discuss in The Strategic Role of Gold in Long-Term Portfolio Management, a consistent approach is key.

Dollar-Cost Averaging with Autoinvest

Many investors get stuck waiting for the "perfect" moment to buy, watching the precious metal prices chart 2026 climb while they remain on the sidelines. Dollar-cost averaging solves this by removing emotion from the equation. You invest a fixed amount at regular intervals, buying more when prices are low and less when they are high. This averages out your purchase price and mitigates volatility.

At Summit Metals, we've simplified this with our Autoinvest program. It offers a 401k-style investing approach you're already familiar with. You set a monthly investment amount for gold or silver, and our automated investing system handles the rest. This consistent purchasing method builds your holdings of real assets methodically, allowing you to focus on your life, not on daily price swings. You can learn More info about Autopays services on our website.

Gold Coins vs. Gold Bars: Making the Right Choice

Once you decide to invest, you'll choose between coins and bars. Both are excellent options for holding physical metal, but they serve slightly different needs.

| Feature | Gold Coins (e.g., American Gold Eagle) | Gold Bars (e.g., 1 oz Gold Bar) |

|---|---|---|

| Premiums | Generally higher due to design, minting costs, and collectible value. | Generally lower, priced closer to the spot value of the metal. |

| Liquidity | Highly liquid and globally recognizable, especially government-minted coins. | Highly liquid, though some smaller or less common bars may be less recognized than major coins. |

| Security Features | Often include advanced anti-counterfeiting measures. Government backing provides a face value. | Typically have serial numbers and mint stamps for verification. |

| Fraud Protection | The legal tender status and face value offer superior fraud protection. Counterfeiting a government coin is a serious federal crime, which deters criminals. | Relies on the refiner's reputation and assay certificate. |

| IRA Eligibility | Many popular government coins (like American Gold Eagles) are IRA-eligible. | Many pure gold bars from approved refiners are IRA-eligible. |

| Storage | Easy to store in smaller quantities. | More space-efficient for very large holdings. |

| Divisibility | Available in fractional sizes (1/10 oz, 1/4 oz, etc.), making them easy to buy or sell in smaller amounts. | Must be sold as a whole unit; breaking a bar diminishes its value. |

For most investors, gold coins offer a distinct advantage in security. The government-backed face value provides an extra layer of fraud protection that bars lack. Attempting to pass a counterfeit American Gold Eagle is not just fraud; it's counterfeiting legal tender, a federal crime. This makes authentic, government-issued coins one of the safest ways to own physical metal. Coins also offer superior liquidity and divisibility.

Gold bars, however, are often more cost-effective for those making large purchases, as their lower premiums mean you get more gold for your dollar. Both are IRA-eligible and play a key role in The Role of Physical Gold Purchase in Diversifying Portfolio. Our team at Summit Metals can help you decide which option best fits your goals.

Frequently Asked Questions about 2026 Precious Metal Prices

It's natural to have questions about the precious metal prices chart 2026. Here are straightforward answers to some of the most common ones.

Why are analysts so bullish on gold and silver for 2026?

Analysts are optimistic due to a combination of powerful economic forces:

- Expected U.S. monetary easing: Anticipated interest rate cuts from the Federal Reserve make non-yielding assets like gold and silver more attractive.

- Persistent geopolitical uncertainty: Global conflicts and trade disputes improve the appeal of gold and silver as reliable safe-haven assets.

- Strong central bank demand: Nations are buying gold at record rates to diversify reserves away from the U.S. dollar, providing strong price support.

- Inflation and currency debasement: Precious metals serve as a time-tested hedge against the declining purchasing power of paper money.

What are the biggest risks to the 2026 precious metal price forecast?

While the outlook is bright, potential risks include:

- Less aggressive Fed rate cuts: If interest rates remain higher for longer, it could dampen demand for precious metals.

- De-escalation of global conflicts: A more stable geopolitical landscape could reduce demand for safe-haven assets.

- A stronger-than-expected U.S. dollar: This would make gold more expensive for international buyers.

- A slowdown in central bank buying: Though unlikely, a shift in this trend could remove a key pillar of support.

- A major market correction: A severe crash could cause a temporary sell-off of all assets, including gold, as investors scramble for cash.

Is 2026 a good time to start buying precious metals?

Yes, 2026 appears to be a strategic entry point. The convergence of long-term demand drivers and an institutional shift toward holding physical assets suggests it is a pivotal year.

While timing the market is difficult, the current environment is highly favorable for accumulating precious metals as part of a long-term strategy. Our Autoinvest program simplifies this process, allowing you to build a position consistently through dollar-cost averaging, much like a 401k. This disciplined approach helps you take control of your wealth as the precious metal prices chart 2026 unfolds.

Conclusion: Securing Your Wealth for 2026 and Beyond

The message from the precious metal prices chart 2026 is clear: the outlook for gold and silver is exceptionally bright. A powerful alignment of forces—including aggressive central bank buying, anticipated Fed rate cuts, and persistent geopolitical uncertainty—points to continued strength for these timeless assets. For investors in Utah, Wyoming, and across the nation, this presents a key opportunity to fortify your portfolio.

At Summit Metals, we champion a long-term strategy for preserving and growing wealth. We provide transparent, real-time pricing and competitive rates to ensure you receive the best value with every investment.

To simplify your journey, our Autoinvest program allows you to use dollar-cost averaging to build your position over time, just like a 401k. This disciplined, automated approach removes the stress of market timing and empowers you to take control of your financial future.

Ready to take the next step? Explore the resources at Summit Metals and begin securing your wealth. You can View Live Gold Price Charts & Historical Data on our website. The future for precious metals is promising, and we are here to help you be part of it.