Your Guide to a Reputable Gold Dealer

Investing in gold is a smart move, and finding a reputable gold dealer is your first, crucial step to protect your money and ensure you get authentic products. A trustworthy dealer is defined by:

- Strong Reputation: Consistent positive reviews on platforms like BBB, BCA, and Trustpilot.

- Transparency: Clear pricing, fees, and policies.

- Accreditation: Legitimate industry affiliations and proper licensing.

- Quality Assurance: Products sourced directly from mints and strictly inspected.

- Excellent Customer Service: Responsive, helpful, and knowledgeable support.

- Clear Policies: Fair shipping, return, and buyback programs.

I'm Eric Roach, and with years of experience in finance and precious metals, my goal is to help investors like you steer the market. This guide will help you find a reputable gold dealer to protect and grow your wealth.

Reputable gold dealer further reading:

- Bulk gold purchasing

- Gold investment strategy

- IRA gold investment

What Defines a Reputable Gold Dealer?

Finding a reputable gold dealer is about building trust and gaining peace of mind. A trustworthy dealer doesn't just sell precious metals; they offer a secure way to protect your wealth. The best dealers stand out through transparency, strong accreditation, excellent customer service, and a solid proven track record.

Many top dealers proudly display high ratings from the Better Business Bureau (BBB) and the Business Consumer Alliance (BCA), showing their commitment to ethical standards. They also source products directly from original mints and official distributors, ensuring you receive genuine, high-quality gold. A long history in the business also speaks volumes about their reliability.

Good customer service is crucial. The best dealers focus on education, with knowledgeable staff ready to answer your questions without pressure. That secure feeling comes from knowing you're dealing with a reputable gold dealer who stands by their products and services.

Key Hallmarks of a Reputable Gold Dealer

When you're ready to invest, knowing what to look for is key to ensuring your investment is safe.

First is transparent pricing. A reputable dealer will clearly display the spot price of gold (the current market price) and their premium. They should provide real-time pricing data so you know exactly what you're paying. At Summit Metals, we offer transparent, real-time pricing and competitive rates, so you always know the value you're getting.

A reputable gold dealer also provides educational resources like articles and guides to help you invest with confidence. To learn more, our guide on Identifying Reputable Bullion Dealers: Avoiding Counterfeits is a great resource.

Verifying Dealer Credentials and Reputation

Before buying, always check a dealer's credentials. This is a vital step for your protection.

- BBB and BCA Ratings: A top rating from the BBB or BCA shows a company's commitment to customer satisfaction and ethical business practices.

- Trustpilot Scores: Websites like Trustpilot offer customer reviews. A consistently high rating from thousands of reviews is a strong positive signal.

- Industry Affiliations: Membership in well-known industry groups shows a commitment to best practices.

- Licensing and Regulations: While federal oversight is limited, some states have specific licensing requirements. A good dealer will be transparent about their compliance.

When speaking with a potential dealer, ask direct questions:

- "What are your BBB and BCA ratings?"

- "Are you a member of any industry organizations?"

- "How do you guarantee your products are authentic?"

- "What are your policies for shipping, returns, and buybacks?"

A reputable gold dealer will answer these questions clearly and confidently.

How to Identify and Avoid Common Gold Scams

Knowing how to spot a scam is essential for safe gold investing. The allure of gold can attract dishonest sellers, and at Summit Metals, we want to empower you with the knowledge to make secure purchases.

One of the biggest red flags is high-pressure sales tactics. If you feel rushed to "buy now or miss out," it's a sign to step back. Another common trick is unrealistic promises. If a dealer guarantees massive, quick profits, they are likely being dishonest. Gold is a long-term investment, and its price fluctuates.

Also, watch for bait-and-switch tactics, vague pricing, and hidden fees. A reputable gold dealer is always transparent about costs. Counterfeit products are a serious concern, which is why buying from a trusted source is critical. Finally, avoid buying gold on unregulated platforms like social media marketplaces, which are often rife with scams.

To learn more, check out our guide on How to Avoid Common Precious Metals Scams.

Red Flags to Watch For

Be aware of these specific warning signs:

- Cold calls or unsolicited contact that feels pushy or aggressive.

- "Too good to be true" deals with prices significantly below the market spot price.

- A lack of a physical address or complete, verifiable contact information.

- Pressure to act immediately, a tactic used to prevent you from doing research.

- Guaranteed profits, which are impossible for any investment, including gold.

- Refusal to provide clear pricing or detailed information about products and fees.

- Poor website quality with typos or broken links can indicate a less-than-professional operation.

Due Diligence: Your Best Defense

Your best protection against scams is doing your homework. This is your due diligence.

First, compare prices from various dealers. Remember to factor in shipping and payment method discounts. A bank wire transfer can often save you money over a credit card.

Next, read customer reviews on independent sites like the BBB, Trustpilot, and forums like Reddit's r/Silverbugs. Look for patterns in feedback.

Also, verify accreditations. Don't just take a dealer's word for their A+ BBB rating; check it yourself on the official BBB website. This simple step provides significant peace of mind.

Before buying, understand all fees. Ask for a complete breakdown of costs, including the dealer's premium, shipping, insurance, and any payment processing fees. A reputable gold dealer will be transparent.

Finally, ask about authentication guarantees. A trustworthy dealer will stand behind their products' authenticity and have a clear process for sourcing and inspection.

For more tips, see our guide: How to Buy Gold and Silver Online Safely.

Comparing Your Options: Online vs. Local Dealers

When buying gold, you'll face a choice: purchase from an online retailer or a local dealer? Both have unique advantages. At Summit Metals, we've perfected the online experience, but we believe in providing the full picture so you can choose what's best for you.

The table above gives a quick snapshot, but let's explore what each option offers.

Licensed Online Retailers

Online dealers have made precious metals more accessible than ever. The biggest advantages include:

- Convenience: You can browse and buy 24/7 from anywhere.

- Lower Premiums: Online retailers typically have lower overhead costs, which can translate into more competitive prices. At Summit Metals, our bulk purchasing power allows us to offer some of the best rates available.

- Wider Selection: Online stores aren't limited by physical space and can offer a massive inventory of coins and bars.

- Shipping Security: A reputable gold dealer ships your metals directly to you or a secure depository with full insurance, ensuring your investment arrives safely.

For more on this topic, our article, Don't Get Bent Out of Shape: How to Buy Metal Online, is a great resource.

Local Precious Metal Retailers

Local coin shops offer a different experience that many investors prefer. The main benefits are:

- In-Person Inspection: You can hold and examine the gold before you buy, providing peace of mind.

- Immediate Possession: Once you pay, the gold is yours to take home immediately.

- Building Relationships: A trusted local contact can be valuable for regular buyers and sellers.

However, local dealers often have higher premiums due to greater operating costs. Their inventory is also more limited compared to the vast selection online. Dedicated precious metal dealers—online or local—are typically the most reliable choice for serious investors. The key is finding a reputable gold dealer that fits your needs.

Understanding Policies, Fees, and Extra Services

Understanding the fine print—policies, fees, and extra services—is a key part of investing with a reputable gold dealer. These details can significantly impact your overall cost and experience.

Typical Costs and Fees

Beyond the spot price of gold, be aware of these potential costs:

- Dealer Premium (Spread): This is the markup a dealer charges over the spot price. A reputable gold dealer like Summit Metals will always be transparent about this cost.

- Shipping and Insurance: Many dealers offer free shipping on larger orders, but smaller purchases may have a fee. Always ensure your shipment is fully insured.

- Payment Method Fees: Some dealers offer discounts for paying with a bank wire, while credit card payments might incur a small processing fee.

- Storage Fees: If you use a professional depository, expect an annual fee to keep your metals secure.

- Cancellation/Restocking Fees: If you cancel an order or make a return, some dealers may charge a fee. Always check the policy.

Shipping, Return, and Buyback Policies

These policies are your safety net. Insured shipping is non-negotiable; your investment should be protected until it's in your hands, and it should arrive in discreet packaging.

Most dealers offer a limited return window. Be aware of market loss policies, which mean if gold's price drops after you buy, your refund for a return might be reduced. There may also be a cancellation fee.

A reputable gold dealer should have a clear buyback program, giving you an exit strategy. They will buy back metals at a discount to the current spot price. For more on certified dealers, explore our resource on Strike Gold with These Certified Gold Coin Dealers.

Secure Storage and Gold IRAs

Once you own gold, you need to store it safely. For large amounts, third-party depositories are a secure, insured option. You'll choose between segregated storage (your specific items are kept separate) or unsegregated storage (your metal is pooled with others). Annual storage fees are usually a small percentage of your holdings' value.

For retirement, you can hold physical gold in a self-directed Precious Metals IRA. The IRS has strict purity standards for IRA-approved gold. A reputable gold dealer will identify eligible products and can help you set up a Gold IRA, often connecting you with trusted custodians. To learn more about the broader market, visit the World Gold Council.

Frequently Asked Questions about Finding a Reputable Gold Dealer

It's normal to have questions as you begin your gold investment journey. Here are answers to some of the most common ones.

How much gold can I legally buy?

In the United States, there are no federal laws limiting the amount of physical gold you can buy or own. However, dealers may have minimum purchase or buyback amounts. For Gold IRAs, annual contribution limits are set by the IRS. A reputable gold dealer will also be transparent about any IRS reporting requirements for certain large cash transactions (over $10,000).

How is the price of gold determined?

The price of gold is based on its "spot price," the current market value. This price constantly shifts due to several key factors:

- Supply and Demand: The fundamental economic principle of availability versus desire.

- Geopolitical Events: Gold is a "safe-haven asset." Economic or political instability often increases demand and drives up the price.

- Market Speculation and Currency Values: Investor sentiment and the strength of the U.S. dollar influence gold's price. A weaker dollar often makes gold more attractive.

- Central Bank Activity: Decisions by central banks worldwide to buy or sell large quantities of gold can significantly impact the market.

Many reputable gold dealer websites, including Summit Metals, provide real-time price trackers to help you monitor the market.

How can I be sure the gold I receive is authentic?

This is a critical question. A reputable gold dealer ensures authenticity through several measures.

First, they use reputable sourcing, acquiring products directly from sovereign mints and respected private refiners. Second, they provide authentication guarantees. Many gold bars come with an assay card or certificate, which verifies the bar's weight, purity, and unique serial number.

For extra assurance, you can use a third-party professional testing service. For a quick preliminary check, you can try simple DIY tests: gold is not magnetic and has a distinct "ping" sound. However, these are not definitive.

Your best defense against counterfeits is always purchasing from a highly reputable gold dealer with a proven track record and strong guarantees.

Conclusion

We've covered the essentials of finding a reputable gold dealer, from identifying the hallmarks of a trustworthy company to avoiding common scams. By now, you should feel more confident in navigating your investment journey.

Remember the key takeaways: look for transparency, a stellar reputation, and excellent customer service. Understand the differences between online and local dealers, and be clear on all fees and policies before you buy. Your due diligence is the most important tool for protecting your investment.

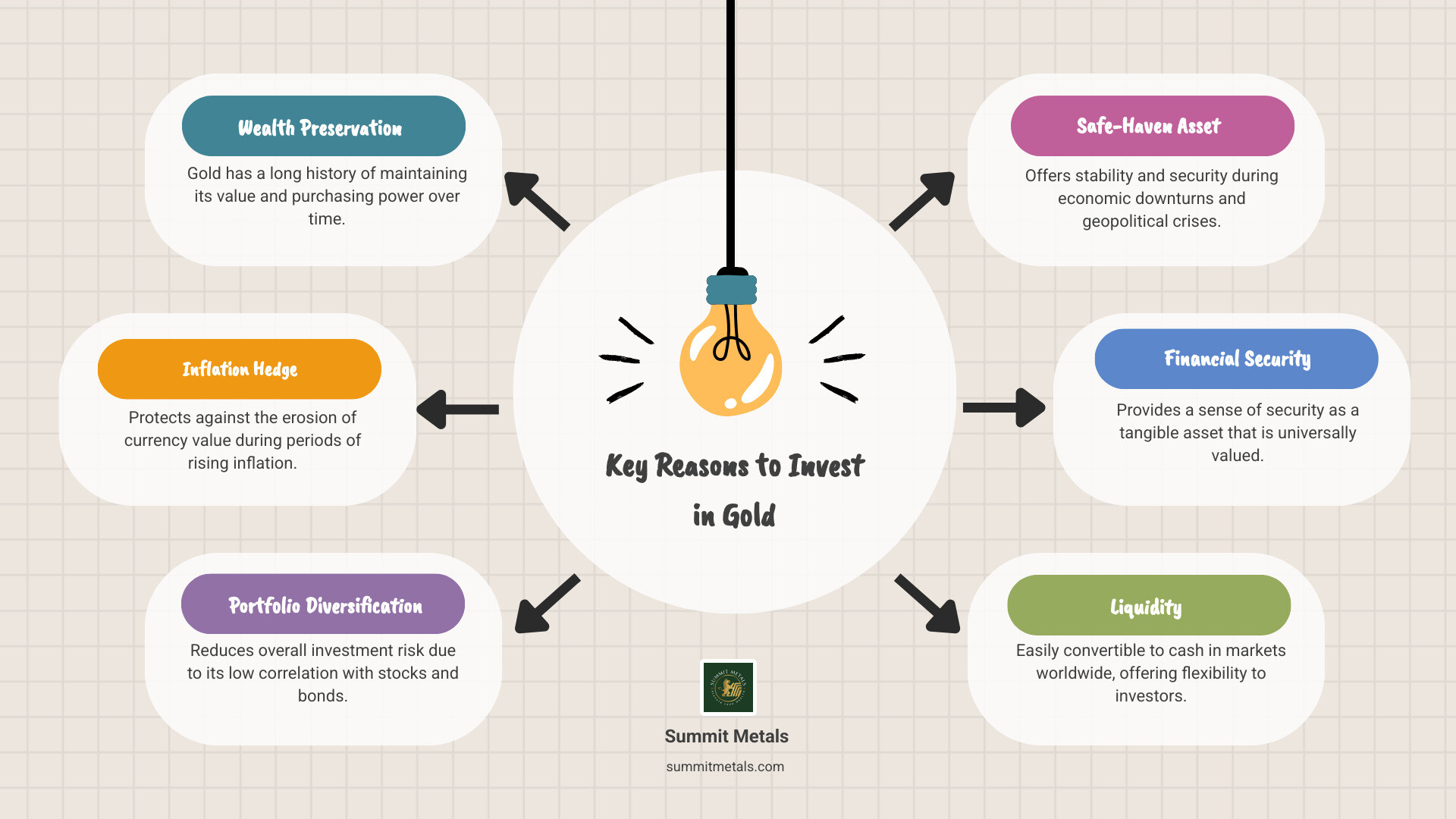

Gold is a timeless asset for wealth preservation, financial security, and portfolio diversification. It's a smart move, especially in uncertain economic times.

Here at Summit Metals, we make your gold investment journey clear and secure. Our bulk purchasing power allows us to offer transparent, real-time pricing and competitive rates. We are dedicated to providing authenticated gold and silver precious metals, ensuring you receive both trust and value.

Take the next confident step toward securing your financial future.

Check today's gold prices and start your investment journey with confidence.