Why Your 1880 $10 Liberty Eagle Gold Coin Could Be Worth More Than You Think

The 1880 $10 liberty eagle gold coin represents one of America's most accessible entry points into historic gold ownership, with values ranging from its melt value of approximately $1,476 to over $4,750 for higher grades. Here's what determines your coin's worth:

Quick Value Assessment:

- Melt Value: $1,476 (based on 0.48375 oz of gold)

- Circulated Condition: $1,702 - $1,986

- Uncirculated (MS-60 to MS-63): $2,414 - $2,830

- High Grade (MS-64): $4,300+

- Mint Mark Impact: 1880-S commands premium over 1880-P

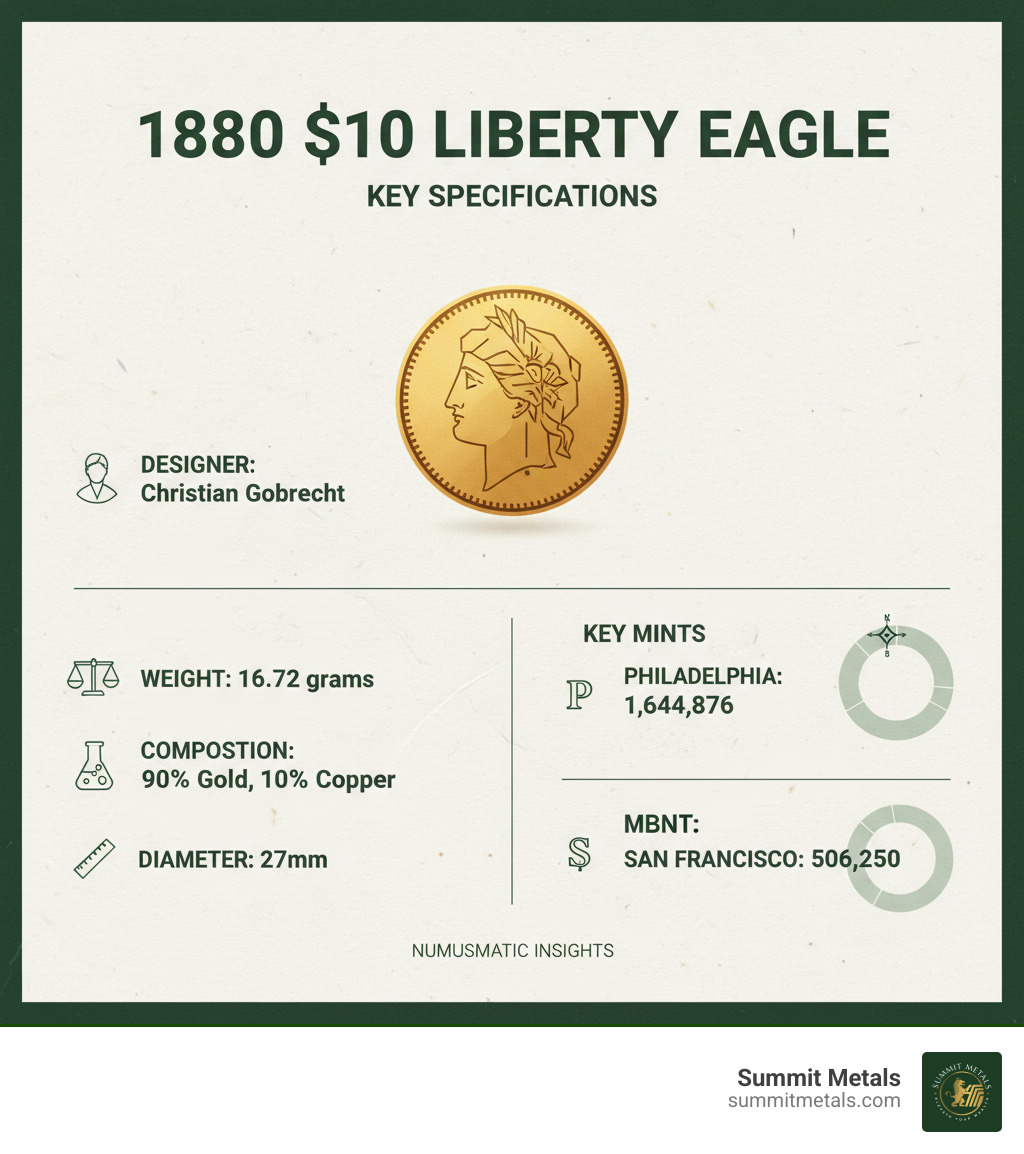

Key Specifications:

- Weight: 16.72 grams

- Composition: 90% gold, 10% copper

- Designer: Christian Gobrecht

- Mintage: 1,644,876 (Philadelphia), 506,250 (San Francisco)

The 1880 issue sits in a sweet spot for collectors and investors. While it's considered a "common date" in the Liberty Head series, scarcity increases dramatically in higher grades - with survival estimates showing zero coins grading MS-65 or better.

What makes this coin particularly interesting is its dual value proposition. Beyond the intrinsic gold content that provides a floor price, these coins carry numismatic premiums that can multiply their worth based on condition, mint mark, and market demand.

I'm Eric Roach, and during my decade on Wall Street helping Fortune-500 companies structure defensive strategies, I've seen how physical assets like the 1880 $10 liberty eagle gold coin serve as portfolio hedges against volatility. My experience guiding multi-billion-dollar transactions has shown me that the same disciplined approach blue-chip companies use to safeguard their balance sheets applies perfectly to individual precious metals investing.

The Anatomy of a Classic: Liberty Head $10 Eagle Design & History

Picture this: you're holding a piece of American history that once jingled in the pockets of cowboys, railroad barons, and frontier merchants. The 1880 $10 liberty eagle gold coin wasn't just money back then – it was a golden ambassador of American values, traveling from coast to coast during one of our nation's most dynamic periods.

The story begins with the Coinage Act of 1792, which officially established the "Eagle" as America's $10 gold piece. But like any good design, it took time to perfect. The Liberty Head series we know and love today ran from 1838 to 1907, evolving through three distinct types before reaching its final, most recognizable form.

Your 1880 $10 liberty eagle gold coin belongs to what collectors call the Type 3 "With Motto" design, minted from 1866 to 1907. This version added something special that earlier coins lacked: the phrase "IN GOD WE TRUST" on the reverse. It's a touching reminder of how the Civil War shaped not just our nation's politics, but even the messages we carried in our pockets.

Obverse and Reverse Design Elements

Behind every beautiful coin stands a talented artist, and the 1880 $10 liberty eagle gold coin owes its timeless appeal to Christian Gobrecht, one of the U.S. Mint's most celebrated engravers. Gobrecht had a gift for creating designs that felt both classical and distinctly American – no easy feat.

The obverse features a left-facing Liberty wearing her signature coronet inscribed with "LIBERTY." She's surrounded by 13 stars representing the original colonies, with the date positioned below her bust. There's something almost regal about Liberty's profile – confident but approachable, much like America itself was becoming by 1880.

The reverse showcases a magnificent heraldic eagle with shield, wings spread wide in a display of strength. The eagle clutches an olive branch and arrows, symbolizing our nation's preference for peace but readiness for defense. Above the eagle, a ribbon bears the "IN GOD WE TRUST" motto, while "UNITED STATES OF AMERICA" curves along the top and "TEN D." marks the denomination below.

These aren't just pretty pictures stamped on gold – they're symbols that told the world what America stood for. If you're curious about how coin designs evolved to reflect national identity, you might enjoy reading more about American coin design traditions.

Where the 1880 Issue Fits In

By 1880, this design had been America's workhorse for over a decade. Unlike the earlier "No Motto" types, your coin represents post-Civil War era coinage – a time when the country was healing, expanding westward, and experiencing unprecedented economic growth.

Think about it: in 1880, these coins were funding railroad construction, gold rush ventures, and cross-country trade. The design had become so trusted and familiar that people barely glanced at it – they just knew it represented real, solid value.

This established design would continue unchanged for another 27 years, making it one of the longest-running coin designs in American history. That consistency speaks volumes about both the artistic merit of Gobrecht's work and the stability it represented during a period of rapid change.

When you hold an 1880 $10 liberty eagle gold coin today, you're not just holding gold – you're holding a piece of the economic backbone that helped build modern America.

Unpacking the 1880 $10 Liberty Eagle Gold Coin: A Common Date with Uncommon Value

Here's what makes the 1880 $10 liberty eagle gold coin fascinating from a collector's perspective: it's both accessible and surprising. While you can find examples in lower grades without breaking the bank, the story gets much more interesting as condition improves.

Let's start with the basics. Each coin contains 90% gold and 10% copper, giving it that distinctive warm color and the durability needed for everyday commerce back in 1880. At 16.72 grams total weight and 27 millimeters in diameter, these coins have a substantial feel that immediately tells you they're something special. Most importantly for investors, each coin contains 0.48375 troy ounces of pure gold – that's your value floor right there.

The year 1880 saw production at two mints: Philadelphia (no mint mark) and San Francisco (marked with a small "S" below the eagle's tail feathers). This little detail makes a bigger difference than you might expect.

Mintage and Rarity of the 1880 $10 Liberty Eagle Gold Coin

Now here's where the numbers tell a compelling story. The Philadelphia Mint cranked out 1,644,876 coins in 1880, while San Francisco produced 506,250. These hefty production numbers earned the 1880 issue its reputation as a "common date" in the Liberty Head series.

But "common" in coin collecting is like "affordable" in real estate – it's all about context. You can find circulated examples without too much trouble. The real story emerges when we look at survival rates and condition.

Here's what the experts estimate survived to today: approximately 3,250 Philadelphia coins and 2,500 San Francisco coins in all grades combined. That might sound like plenty, but remember – we're talking about coins that are over 140 years old.

The plot thickens dramatically when we focus on high-grade examples. For uncirculated condition (MS-60 or better), we're down to roughly 1,050 Philadelphia coins and 800 San Francisco coins. The rarity scale rates these as R-4.9 and R-5.4 respectively, meaning scarce to rare.

But here's the kicker that makes collectors' hearts race: in gem uncirculated condition (MS-65 or better), the Philadelphia mint has an estimated zero survivors. That's right – zero. The San Francisco mint fares slightly better with approximately two coins known to exist in this condition. For more detailed information on the San Francisco variety, check out the PCGS CoinFacts for the 1880-S.

This creates an interesting dynamic where your "common date" 1880 $10 liberty eagle gold coin could actually be quite rare depending on its condition.

What's Your Coin Worth? A Valuation Guide for the 1880 $10 Liberty Eagle Gold Coin

Determining your coin's value starts with understanding two components: melt value and numismatic premium. The melt value is your safety net – based on current gold prices, that's approximately $1,476 regardless of condition. Everything above that reflects the coin's collectible appeal.

Condition is king in coin collecting. A heavily worn example might trade close to melt value, while an exceptional uncirculated piece can command several times that amount. The mint mark also matters – San Francisco coins often carry slight premiums due to their lower mintage and association with the Old West.

Here's how values typically break down across different conditions. Prices shown are at the time of this publication:

| Grade Category | 1880-P (Philadelphia) Estimated Value | 1880-S (San Francisco) Estimated Value |

|---|---|---|

| Good (G-4) | $1,886 | $1,702 |

| Very Fine (VF-20) | $1,909 | $1,725 |

| About Uncirculated (AU-50) | $1,986 | $1,801 |

| Uncirculated (MS-62) | $2,414 | $2,830 |

| Choice Uncirculated (MS-64) | $4,299+ | $4,750+ |

Notice the dramatic jump at MS-64 level – that's where scarcity really kicks in. The few proof examples that exist can reach $27,350 or more, though these are museum-quality rarities.

What's particularly interesting about the 1880 $10 liberty eagle gold coin is how it bridges the gap between bullion investing and numismatic collecting. Even in average circulated condition, you're getting nearly pure gold content plus a modest collector premium. In higher grades, that premium can multiply significantly.

The coin's dual value proposition makes it attractive for different investment strategies. Whether you're dollar-cost averaging into precious metals or building a collection piece by piece, the 1880 Eagle offers both intrinsic value and upside potential based on condition and market demand.

From Pocket Change to Portfolio Asset: Investing in Historic Gold

There's something magical about holding an 1880 $10 liberty eagle gold coin in your palm. It's not just the weight of the precious metal or the intricate artistry – it's the realization that you're holding a piece of American history that has retained and grown its value for over 140 years.

Unlike modern investments that exist only as digital entries on a screen, historic gold coins offer something beautifully tangible. The 1880 $10 liberty eagle gold coin represents what we call "dual-layer value" – the intrinsic worth of its gold content combined with the numismatic premium that comes from its rarity, condition, and historical significance.

What makes pre-1933 gold coins particularly compelling as investments? First, there's the intrinsic gold value – that reliable floor price based on 0.48375 troy ounces of pure gold that protects your downside. But then there's the numismatic premium, which can grow independently of gold prices based on collector demand and scarcity.

The collectibility factor is where things get interesting. While gold bars are purely about metal content, coins like the 1880 Eagle carry stories. They've witnessed economic booms, financial panics, and the change of America from an agricultural society to an industrial powerhouse. That historical narrative adds value that no modern bullion piece can match.

There's also the legal tender status to consider. Your 1880 $10 liberty eagle gold coin has a government-backed face value of $10, which provides additional fraud protection. The intricate designs created by master engraver Christian Gobrecht are incredibly difficult to counterfeit compared to simpler bullion products.

When you're ready to explore adding historic gold to your portfolio, choosing the right partner is crucial. Our comprehensive guide, Your Golden Compass: Navigating to a Reputable Gold Dealer, walks you through exactly what to look for in a precious metals dealer.

Gold Coins vs. Gold Bars: Which is Right for You?

This question comes up constantly, and honestly, there's no wrong answer – just different paths to the same destination of precious metals ownership. But understanding the differences can help you make the choice that aligns with your goals.

Gold coins, particularly historic pieces like the 1880 $10 liberty eagle gold coin, offer benefits that extend far beyond their metal content. The numismatic potential means your investment isn't solely tied to fluctuating gold prices. A rare coin in exceptional condition can appreciate dramatically even when gold prices remain flat.

The government-backed face value provides an extra layer of security. While your coin contains gold worth over $1,400 at current prices, it also carries legal tender status of $10. This dual recognition makes coins harder to counterfeit than bars, as replicating the intricate designs and government authentication is exponentially more challenging.

There's also the historical significance factor. Every time you look at your 1880 Eagle, you're connected to the era of westward expansion, the California Gold Rush aftermath, and America's emergence as an economic powerhouse.

Gold bars, on the other hand, shine when you're focused purely on accumulating the maximum amount of gold for your dollar. They typically carry lower premiums over spot price and are easier to store in large quantities. For investors building substantial positions quickly, bars offer efficiency.

The storage consideration varies by your situation. Coins often require individual protection and more careful handling, while bars stack efficiently for bulk storage. If you're planning to accumulate significant quantities, bars might make more practical sense.

For most of our clients interested in pieces like the 1880 $10 liberty eagle gold coin, the coin advantages typically outweigh the slightly higher premiums. The combination of gold value, collectibility, and historical connection creates a more engaging investment experience. You can dive deeper into this comparison in our detailed analysis: Gold Bars vs Coins.

Building Your Collection with Autoinvest

Here's where smart investing meets practical reality. Building a meaningful precious metals portfolio doesn't require timing the market perfectly or making large lump-sum purchases. Our Autoinvest program applies the same dollar-cost averaging strategy that makes 401k investing so effective to physical gold and silver.

Think about how you invest in your retirement account – you contribute consistently every month, regardless of whether the stock market is up or down. Over time, this approach smooths out volatility and typically results in a lower average purchase price. Autoinvest brings this same discipline to precious metals.

Here's the beauty of the system: when gold prices dip, your fixed monthly investment buys more ounces. When prices rise, you acquire fewer ounces but benefit from the appreciation of your existing holdings. This consistent investing approach removes the stress of trying to time market movements.

For someone interested in historic coins like the 1880 $10 liberty eagle gold coin, Autoinvest helps you build your position systematically. Rather than waiting for the "perfect moment" to make a large purchase, you're consistently adding to your tangible asset portfolio just like you would with traditional investments.

The mitigated volatility aspect is particularly valuable in precious metals, where prices can swing based on economic news, geopolitical events, or currency fluctuations. By spreading your purchases across time, you're naturally hedging against these short-term movements while building long-term wealth.

This approach also instills financial discipline. Instead of sporadic purchases based on emotions or market headlines, you're following a systematic plan that treats precious metals as a serious component of your overall financial strategy.

Whether you're accumulating modern bullion or building a collection that includes historic treasures, Autoinvest provides the framework for steady, strategic growth. Learn more about the mathematical advantages of this approach in our article: The Power of Dollar Cost Averaging in Gold and Silver Investments.

Frequently Asked Questions about the 1880 $10 Liberty Eagle

Over the years, we've helped countless collectors and investors understand the nuances of historic gold coins. Here are the questions that come up most often when people find they might own an 1880 $10 liberty eagle gold coin:

How can I tell if my 1880 $10 Liberty Eagle is from Philadelphia or San Francisco?

This is actually one of the easier mysteries to solve in numismatics! Grab your 1880 $10 liberty eagle gold coin and flip it over to the reverse side. Now, look carefully below the eagle's tail feathers.

If you spot a small "S" mint mark in that location, congratulations – your coin was minted in San Francisco, likely using gold from the California mines. If there's no mint mark visible, your coin came from the Philadelphia Mint, which was the primary U.S. Mint facility and didn't use mint marks during this period.

It's that simple! The presence or absence of that tiny letter makes a significant difference in both the coin's story and its value.

Is the 1880 $10 Liberty Eagle a rare coin?

Here's where things get interesting – and it's a perfect example of why condition is everything in coin collecting. The answer to this question changes dramatically based on what grade we're talking about.

In circulated conditions like Good, Very Fine, or About Uncirculated, the 1880 $10 liberty eagle gold coin is considered a common date. With over 1.6 million coins minted in Philadelphia and more than 500,000 in San Francisco, finding one in average condition shouldn't be too challenging.

But climb up to MS-64 condition, and suddenly we're in scarce territory. These higher-grade examples become significantly harder to locate and command substantial premiums over their common-grade cousins.

Now here's where it gets really exciting: in MS-65 or better condition, your 1880 $10 liberty eagle gold coin transforms into numismatic gold. Our research shows zero known survivors from Philadelphia in MS-65 or higher, while San Francisco has maybe two examples in existence at this grade level. That's not just rare – that's "needle in a haystack" territory.

So while you might easily find a well-worn example at your local coin shop, finding one in pristine condition could be like finding buried treasure in your attic.

What is the minimum value of an 1880 $10 Liberty Eagle?

Every genuine 1880 $10 liberty eagle gold coin has a built-in safety net – its melt value. This represents the absolute floor price for your coin, regardless of its condition or numismatic appeal.

Each coin contains exactly 0.48375 troy ounces of pure gold. To find the current melt value, you simply multiply this gold content by today's spot price of gold. For example, if gold is trading at $2,000 per ounce, your coin's melt value would be approximately $967.50.

Of course, gold prices fluctuate daily, so this baseline value moves with the market. The good news? Almost every authentic 1880 $10 liberty eagle gold coin trades for a premium above its melt value, even in heavily circulated condition. The historical significance, artistic design, and collector interest ensure that you're getting more than just the gold content when you buy or sell.

To stay current with gold prices and understand how they affect your coin's value, you can check the live gold price anytime. Prices shown are at the time of this publication and can vary based on current market conditions.

Conclusion: Is Your 1880 Gold Eagle a Treasure?

After exploring every facet of the 1880 $10 liberty eagle gold coin, one thing becomes crystal clear: you're not just holding a piece of gold – you're holding a piece of American history that offers remarkable investment potential.

Your 1880 $10 liberty eagle gold coin embodies a fascinating dual value proposition that sets it apart from modern bullion. First, there's the intrinsic gold value – that solid foundation of 0.48375 troy ounces of pure gold that provides a reliable floor price, regardless of market conditions. This alone makes it a tangible hedge against economic uncertainty.

But here's where it gets exciting: the numismatic potential can multiply your coin's worth far beyond its melt value. We've seen how condition and mint mark dramatically impact value, with high-grade examples commanding premiums of 200-300% above gold content. Even in circulated condition, these coins consistently trade above their melt value due to their historical significance.

The importance of condition and mint mark cannot be overstated. While your coin might be considered "common" in lower grades, scarcity increases exponentially as condition improves. An MS-64 example becomes genuinely scarce, and MS-65 or better? We're talking about coins so rare they're practically nonexistent for the Philadelphia mint.

What makes the 1880 $10 liberty eagle gold coin particularly appealing is its role as an accessible entry point into historic gold. Unlike some rarities that require five-figure investments, you can own a piece of 1880s America for a reasonable premium over gold's spot price. It's history you can hold, with the added benefit of precious metals diversification.

At Summit Metals, we've helped countless investors find the unique satisfaction of building a tangible asset portfolio with authenticated historic gold. Whether you're drawn to the artistic beauty of Christian Gobrecht's design, the economic story these coins tell about America's golden age, or simply want portfolio insurance that doesn't depend on Wall Street's whims, these coins deliver.

For those looking to build their precious metals holdings systematically, consider our Autoinvest program. Just like contributing to your 401k every month, you can dollar-cost average into physical gold and silver, taking advantage of price fluctuations while building wealth in assets you can actually touch.

Your 1880 $10 liberty eagle gold coin represents more than just an investment – it's a bridge between America's economic past and your financial future. Whether it becomes a cornerstone of your collection or part of a broader precious metals strategy, you're holding genuine treasure.

Ready to explore more about American gold coins and their place in modern portfolios? Check out our comprehensive guide: Everything You Need to Know About American Eagle Coins.