Why Smart Investors Are Adding Gold to Their Portfolios

A gold investment strategy is your financial compass in uncertain times, offering pathways to protect and grow your wealth. Here's what you need to know:

Core Gold Investment Strategies:

- Physical Gold: Direct ownership through coins and bars for maximum control

- Gold ETFs: Low-cost exposure with high liquidity (average expense ratio ~0.61%)

- Mining Stocks: Leveraged play on gold prices with higher risk/reward potential

- Portfolio Allocation: Most experts recommend 5-15% gold allocation for diversification

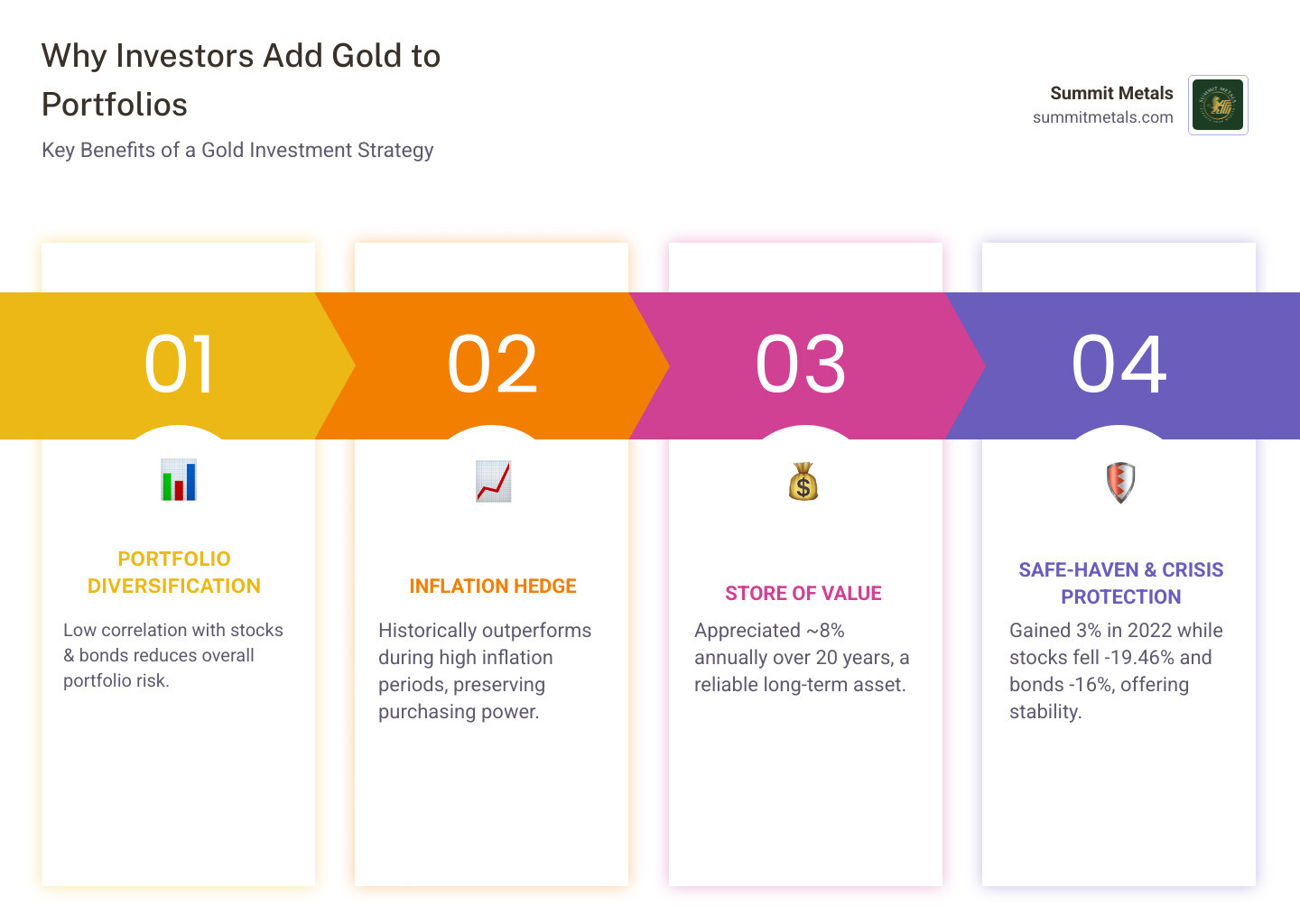

Key Benefits:

- Store of Value: Gold has appreciated ~8% annually over the past 20 years

- Inflation Hedge: Historically outperformed during high inflation periods

- Portfolio Diversification: Low correlation with stocks and bonds

- Crisis Protection: Gained 3% in 2022 while stocks fell -19.46% and bonds dropped -16%

The precious metals market has reached new heights, with gold breaking record highs over $2,180/oz in March 2024. Many investors wonder if gold deserves a place in their portfolio. Central banks worldwide are answering that question decisively, increasing their gold holdings to 1,057 million troy ounces in 2023 after record purchases in 2022. Whether you're seeking protection against economic uncertainty, diversification, or long-term wealth preservation, understanding gold's role is crucial for modern investors.

I'm Eric Roach. With over a decade as an investment banking advisor, I've guided clients through complex market volatility. Today, I help individuals apply institutional-level risk management principles to precious metals investing, translating Wall Street expertise into actionable guidance for building resilient portfolios.

Why Gold Shines: The Strategic Role of the Yellow Metal in Your Portfolio

Gold isn't just a shiny metal; it's a strategic asset that has protected wealth for thousands of years. What makes gold special as a long-term investment? Unlike stocks or bonds, it carries no credit risk and is nobody's liability. It's also highly liquid and can be sold almost anywhere. Gold's scarcity is fundamental; while central banks can print money, they can't print gold. This, combined with steady demand, helps explain its enduring value. The 2022 market turbulence illustrates this: while global stocks tumbled -19.46% and bonds fell -16%, gold gained 3%. This resilience is key to any gold investment strategy.

For a deeper understanding of how gold fits into your overall financial plan, check out The Strategic Role of Gold in Long-Term Portfolio Management.

Gold as a Diversifier and Safe Haven

Gold has historically shown low correlation with stocks and bonds, meaning when your other investments struggle, gold often stays calm or moves in the opposite direction. During market volatility, economic uncertainty, or geopolitical tensions, investors instinctively turn to gold. It's been happening for centuries, which is why gold is known as the ultimate safe-haven asset. This isn't just theory; investors consistently choose gold when the world feels unstable because it's tangible and universally valued. Adding gold can reduce overall portfolio risk while maintaining return potential, the magic of portfolio diversification.

Want to dive deeper into why gold and silver serve as such reliable safe havens? Read Why Gold and Silver: Understanding Their Value as Safe Haven Assets.

The Enduring Value and Historical Performance of Gold

Over the past 20 years, gold has delivered approximately 8% annual appreciation. While it can be volatile in the short term (from 2011 to 2015, it dropped about 40%), gold has consistently served as a store of value and an effective hedge against inflation over longer periods. When currencies lose purchasing power due to money printing, gold typically maintains its value. Unlike paper money, gold's supply is naturally limited. This fundamental scarcity helps it maintain purchasing power when currency debasement threatens traditional investments. From ancient civilizations to modern central banks, gold has been the go-to store of value.

Curious about gold's investment potential? Take a look at Is Gold a Good Investment? for a comprehensive analysis of gold's track record and future prospects.

Decoding the Market: Key Factors That Drive Gold Prices

An effective gold investment strategy requires understanding its price drivers. Beyond simple supply and demand, gold's value is shaped by macroeconomic factors, market sentiment, and geopolitics. Key drivers include the U.S. Dollar, real yields (inflation-adjusted interest rates), and central bank activity. While jewelry (50%) and industrial use (10%) form a demand base, investment demand often causes the most significant price movements.

To gain a deeper understanding of these influences, explore Key Factors Influencing Gold & Silver Prices: Supply, Demand, Geopolitics.

The Influence of Monetary Policy and the U.S. Dollar

One of the most significant factors influencing gold prices is the U.S. Dollar, which often has an inverse relationship with the metal. A stronger dollar can make gold more expensive for international buyers, potentially dampening demand. Monetary policy, particularly interest rates and real yields, also plays a pivotal role. While rising real yields have historically been a headwind for gold, the metal has shown remarkable resilience to rate hikes since 2022. This shift is largely attributed to robust central bank demand. Lower interest rates typically benefit non-interest-bearing assets like gold, making them more appealing compared to bonds.

To learn why central banks are such keen gold buyers, check out Why Central Banks Buy Gold and Why You Should Too: A Look Into the Power of Physical Gold.

Global Supply and Demand Dynamics

Physical supply and demand also have a profound impact. Central banks have become dominant players, with net purchases reaching a record 1,082 tonnes in 2022 and remaining high at 1,037 tonnes in 2023. This institutional buying provides a strong demand floor. While jewelry (50%) and industrial uses (10%) offer consistent demand, investment demand from sources like gold ETFs often creates the most significant price fluctuations. Gold ETF holdings, for example, grew from under 1 million oz t in 2003 to more than 82 million oz t 20 years later, indicating a growing investor appetite.

For more fascinating facts about gold, visit 24 Facts About Gold.

Crafting Your Gold Investment Strategy: From Physical Bullion to Digital Assets

Once you understand gold's strategic importance, the next step is choosing how to invest. Your gold investment strategy can take several forms, each with its own trade-offs. Some investors prefer the tangible security of physical gold, while others value the convenience of digital exposure. Many use a combination approach, balancing the benefits of different methods.

Here's how the main investment methods stack up:

| Investment Method | Ownership Form | Liquidity | Typical Costs | Key Advantages | Key Disadvantages |

|---|---|---|---|---|---|

| Physical Gold | Direct (bars, coins) | Moderate | Premiums (1-5%), Storage, Insurance | Tangible, No counterparty risk, Privacy | Storage costs, Less liquid, Higher premiums |

| Gold ETFs/Mutual Funds | Indirect (shares) | High | Expense ratios (~0.61%), Trading fees | Easy to trade, Low minimum, Diversified | No physical ownership, Counterparty risk, Taxed as collectibles |

| Gold Mining Stocks | Indirect (shares) | High | Trading fees | Leveraged upside, Potential dividends | Company-specific risk, Volatility, Not pure gold exposure |

| Gold Futures | Indirect (contracts) | Very High | Commissions, Margin interest | High leverage, Efficient pricing | High risk, Margin calls, Requires expertise |

Physical Gold: Coins and Bars

When you own physical gold through coins and bars, you have direct ownership of a tangible asset with no counterparty risk. This approach offers peace of mind, as your gold remains unaffected by financial system disruptions. It's private, liquid globally, and carries no credit risk. However, owning physical gold comes with practical considerations. You'll need secure storage (a home safe, bank box, or professional vault) and insurance. You'll also pay premiums above spot price, typically 1% to 5%, though they are lower for larger bars. When shopping, focus on purity standards like .999 or .9999 fine gold from reputable sources.

For guidance on making this decision, check out our comparison of Gold Bars vs. Coins. And always ensure you're working with trustworthy dealers by reading Identifying Reputable Bullion Dealers: Avoiding Counterfeits.

Gold-Backed Securities: ETFs and Mutual Funds

Gold ETFs and mutual funds offer gold exposure without storage headaches. They trade like stocks, making them convenient to buy and sell. With expense ratios averaging around 0.61%, they provide cost-effective exposure to gold's price movements. Key benefits are high liquidity and low barriers to entry. The trade-off is that you don't actually own physical gold; you own shares in a fund. This introduces counterparty risk and potential collectibles tax treatment on gains (up to 28%). For many investors, ETFs strike a good balance between convenience and exposure.

To better understand how ETFs compare to physical ownership, explore What's the Difference Between Physical Gold, Silver, and ETFs?.

Indirect Exposure: Mining Stocks and Futures

For more aggressive exposure, mining stocks offer a leveraged play on gold prices. Rising gold prices can dramatically increase a miner's profits, leading to outsized gains and potential dividend income. However, this leverage works both ways; mining stocks have higher volatility and carry company-specific risks like management and operational challenges. Gold futures contracts are the most sophisticated and risky approach. They offer high leverage through margin requirements and efficient pricing, but this also amplifies losses. The risk of margin calls makes futures unsuitable for most individual investors.

If you're considering futures, understand the mechanics thoroughly. Learn more about futures margin requirements before taking this advanced step.

Charting Your Course: Essential Tips for Gold Investors

Navigating gold investment requires a thoughtful approach to strategy, risk, and personal financial goals. A well-defined gold investment strategy is your most valuable asset. Successful gold investors approach precious metals with clear objectives and a long-term perspective. They understand that gold isn't a get-rich-quick scheme, but a tool for wealth preservation and portfolio protection.

For a comprehensive starting point, consult The Ultimate Beginner's Guide to Investing in Precious Metals.

Developing a Beginner's Gold Investment Strategy

If you're new to gold, start with the fundamentals: setting clear goals and understanding your risk tolerance. Ask yourself why you want gold—wealth preservation, inflation hedge, or diversification? Your answer guides your approach. If you prefer tangible assets, physical gold might be best. If you value liquidity, consider ETFs. For beginners, we often recommend starting small with fractional coins or small bars to get a feel for physical ownership. Many investors gradually build their position over time using a "stacking" approach.

This steady accumulation approach is called "stacking." To learn how to build your precious metals holdings systematically, read The Basics of Gold and Silver Stacking. And when you're ready to make your first purchase, How to Buy Gold and Silver Online Safely will help you steer the process securely.

Long-Term vs. Tactical Gold Investment Strategy

Gold can be a strategic long-term holding or a tactical short-term play. Most investors treat gold as a strategic, "buy and hold" allocation, leveraging its history of preserving wealth (~8% annual appreciation over 20 years). Tactically, some investors increase gold exposure during economic uncertainty and reduce it when conditions stabilize. This requires active management and market timing, which is notoriously difficult. For this reason, we believe in dollar-cost averaging—making regular purchases regardless of price to smooth out your entry points over time.

Learn more about this powerful technique in The Power of Dollar-Cost Averaging in Gold and Silver Investments.

How Much Gold Should You Own?

There's no universal answer, but a common rule of thumb suggests allocating 5-15% of your portfolio to gold. This range typically provides diversification benefits without over-concentrating. Some conservative advisors suggest 2%, while others like Ray Dalio suggest "more than 10%." Consider your financial goals. If you're nearing retirement, you might lean toward the higher end. Your risk profile also matters; a larger allocation can provide peace of mind if you're wary of volatility. Gold should complement your existing investments, not replace them.

For deeper insights into optimal allocation strategies, explore Understanding the Role and Gold Price in Asset Allocation.

Frequently Asked Questions about Gold Investing

We understand that investing in gold can raise many questions. Here, we address some of the most common inquiries to help you move forward with confidence.

What is the best way for a beginner to invest in gold?

For beginners, keeping it simple is key. Gold ETFs and mutual funds are often the smartest starting point. They offer low minimum investments, easy trading through a brokerage account, and exposure to gold prices without the complexities of storage or insurance. The main trade-offs are that you don't physically own the gold, there's counterparty risk, and potential collectibles tax treatment. If you prefer tangible assets, starting with small physical quantities like coins or bars is a great option. This provides direct ownership and no counterparty risk, but requires secure storage and involves paying premiums of 1-5% over spot price. A common approach is to start with ETFs to understand gold's price movements, then add physical gold later.

Is gold a good investment during a recession?

Gold has earned its reputation as a safe-haven asset during economic storms. In 2022, while stocks fell -19.46% and bonds lost -16%, gold gained 3%. This demonstrates its inverse correlation to traditional assets during stress. During recessions, safe-haven demand increases, and falling bond yields make non-yielding gold more attractive. However, gold is not a magic bullet and can be volatile. It's best viewed as part of a long-term gold investment strategy, not a short-term recession play.

Is it better to own physical gold or a gold ETF?

Physical gold is ideal if you prioritize direct ownership and protection against systemic risks. You have complete control and zero counterparty risk, but you must manage storage and insurance. Gold ETFs excel for investors who want pure gold price exposure with convenience and liquidity. You can trade instantly, and costs are low, but you own shares in a fund, not the metal itself, which introduces counterparty risk. A balanced approach often works best: hold some physical gold for foundational security and use ETFs for flexibility.

Conclusion: Securing Your Financial Future with Gold

Gold is more than a metal; it's a gold investment strategy that can transform your financial resilience. When stocks and bonds fell sharply in 2022, gold gained 3%, proving the power of diversification. Its ability to move independently makes it an invaluable safe-haven asset. Success in gold investing comes from a long-term perspective. Using dollar-cost averaging and maintaining a 5-15% portfolio allocation are principles that have served investors well. Central banks are buying record amounts of gold, signaling confidence in its enduring value.

At Summit Metals, we make gold investing simple with transparent, real-time pricing and competitive rates. Based in Wyoming, USA, we are a trusted partner for investors worldwide seeking authentic, investment-grade precious metals. Your financial future deserves the stability that gold provides. It's about giving your portfolio the foundation it needs to weather any storm.

Explore our selection of investment-grade gold bullion and start building your golden compass today.