Why Silver, Gold, and Silver Matter for Your Financial Future

Silver gold silver refers to the strategic balance between these two precious metals in your investment portfolio. Here's what you need to know:

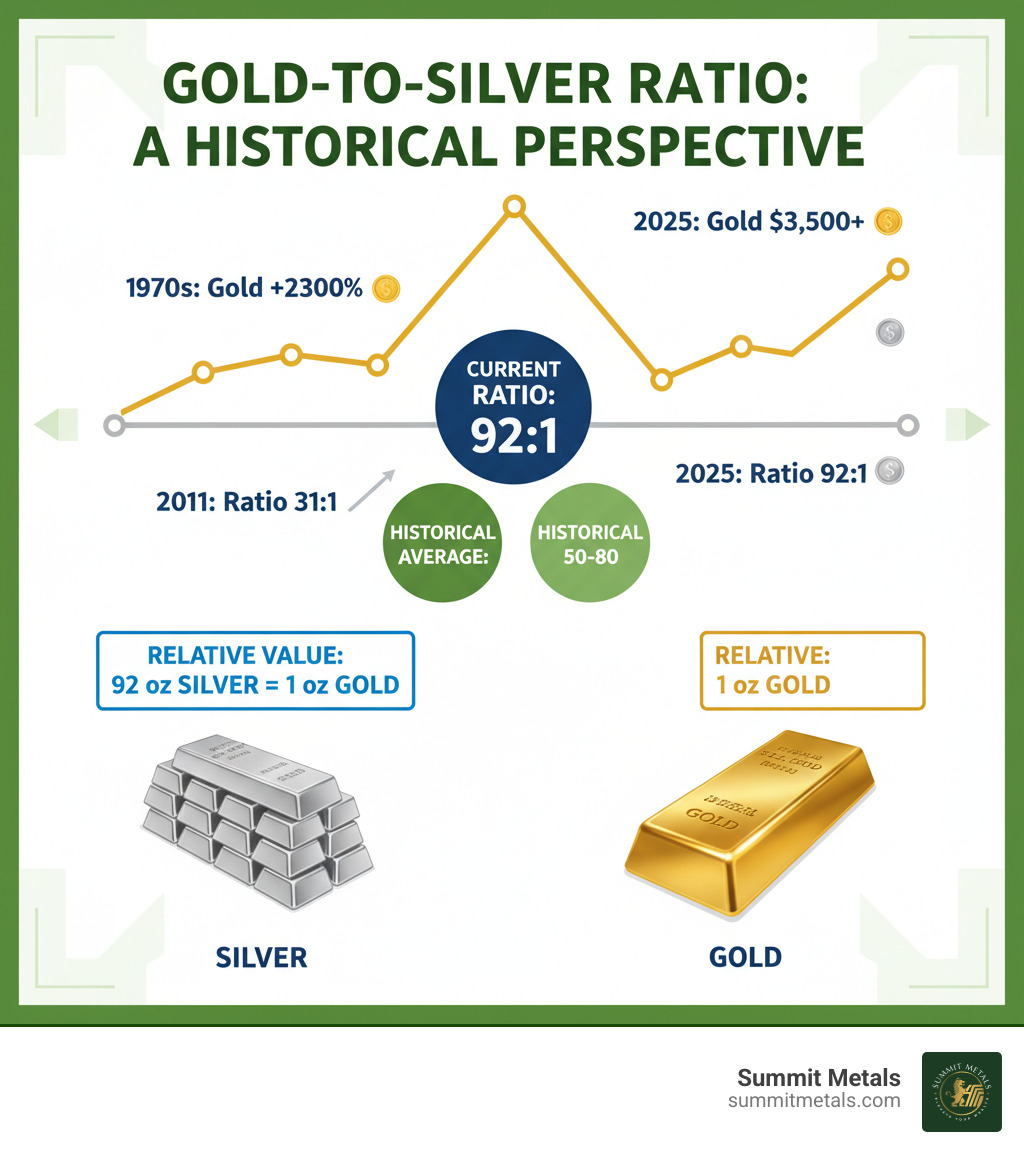

- The Gold-to-Silver Ratio measures how many ounces of silver equal one ounce of gold (currently around 92:1)

- Silver offers affordability and high growth potential, historically used as currency

- Gold provides stability and wealth preservation, with some analysts projecting significant price increases in the coming years

- Strategic investing means using the ratio to balance both metals for optimal returns

Many investors wonder whether to buy gold, silver, or both. The answer lies in understanding how these metals complement each other. During the 1970s, for example, gold surged over 2,300% amid economic turmoil. Silver followed similar patterns, proving both metals are reliable stores of value when traditional markets struggle.

The gold-to-silver ratio tells a powerful story. When the ratio is high—like today's 92:1—silver is relatively cheap compared to gold. Historically, the ratio has averaged between 50 and 80, suggesting silver has significant room to grow. In 2011, the ratio dropped to just 31, showing how quickly these dynamics can shift.

Physical ownership of both metals provides true diversification. Unlike stocks or bonds, you hold real assets that have preserved wealth for over 5,000 years. Whether you choose coins or bars, each serves a distinct purpose in your financial strategy.

I'm Eric Roach, and after a decade on Wall Street advising on multi-billion-dollar transactions, I learned how institutional investors use silver gold silver strategies to hedge risk. Now, I help everyday investors apply those same tactics. My experience taught me that transparency and education matter more than complex sales pitches, a principle we live by at Summit Metals.

Handy silver gold silver terms:

Understanding Gold and Silver Prices

Gold and silver prices are constantly in motion, reacting to global events and market sentiment. For a silver gold silver investor, understanding these movements is key to making smart decisions.

Think of prices as a global conversation. Economic uncertainty often drives investors to the safety of gold and silver, pushing prices up. Conversely, when confidence in traditional markets is high, demand may ease. This dynamic creates the daily price fluctuations you see.

Historically, precious metals have performed well during turmoil. In the 1970s, gold surged over 2,300%. More recently, both metals have seen significant price action, with some analysts projecting new highs as economic challenges persist. This creates opportunities for investors who understand the relationship between gold and silver.

Key Factors Influencing Gold & Silver Prices: Supply, Demand, Geopolitics

How Prices are Determined

The price you see quoted is the spot price—the market rate for one troy ounce of pure metal, set by futures trading on exchanges like COMEX. However, you can't buy physical metal at spot price.

When you buy physical coins or bars, you pay a premium over spot. This premium covers the costs of refining, minting, shipping, and the dealer's overhead.

- Bars typically have lower premiums as they are simpler to produce.

- Coins and rounds have slightly higher premiums due to design and minting costs.

- Jewelry carries the highest premiums, reflecting craftsmanship beyond the metal's value.

Another term you might hear is the London Fix, a benchmark price for large institutional contracts. For retail investors, the key figures are the real-time spot price and the dealer's premium.

Spot Price vs. Premium: How Precious Metals Pricing Works

Several forces influence prices. Inflation erodes currency value, making metals attractive. High interest rates can draw some investors to bonds, while geopolitical instability sends them rushing back to safe-haven assets like gold and silver. The US Dollar's strength also plays a role; a weaker dollar often means higher gold prices, as it becomes cheaper for foreign buyers.

The Interplay of Interest Rates, the Dollar, and Gold Prices

Historical Price Trends and Performance

The relationship between gold and silver stretches back millennia; the Roman Empire maintained a gold-to-silver ratio of about 12:1. Modern history also reveals opportunity. After bottoming out in the early 1970s, both metals delivered substantial long-term gains. Silver hit a modern peak near $29 per ounce in 2011, demonstrating its volatility and potential.

The gold-to-silver ratio has swung from a low of 31 in 2011 to highs over 100. These fluctuations help investors spot opportunities when one metal seems undervalued relative to the other. While past performance is no guarantee, the long history of precious metals as a store of wealth is compelling. Some analysts speculate that gold could reach five-figure prices in a future crisis, though such predictions are not certain.

Gold to Silver Ratio - 100 Year Historical Chart

Gold Prices Today: Live Gold Price Chart & Historical Data

The "Silver Gold Silver" Ratio: A Key Investment Tool

A single number can help you decide whether to buy gold or silver: the gold-to-silver ratio. Understanding this tool is central to a successful silver gold silver strategy. It's a real-time indicator of relative value, showing which metal may be a bargain. Smart investors use it to time purchases and strategically grow their holdings.

The Gold and Silver Ratio: A Timeless Measure for Precious Metals Investors

What is the Gold-to-Silver Ratio?

The ratio answers a simple question: How many ounces of silver does it take to buy one ounce of gold? To calculate it, divide the current price of gold by the price of silver. For example, if gold is $2,000/oz and silver is $20/oz, the ratio is 100:1.

This relationship has a long history. The Roman Empire fixed it at 12:1, showing how much its value can shift. In modern times, it has been as low as 31 (in 2011) and as high as 114 (in 2020). Currently, the ratio stands at 92.10. These swings reflect changes in investor sentiment and industrial demand, creating opportunities for savvy investors.

What Is the Gold/Silver Ratio?

What Is the Gold-to-Silver Ratio? Is It Important?

Using the "Silver Gold Silver" Ratio for Investment Decisions

The ratio is your compass for navigating the precious metals market.

- When the ratio is high (e.g., above 80), silver is considered undervalued compared to gold. This can be a good time to accumulate silver, as the ratio tends to revert to its historical average.

- When the ratio is low (e.g., below 50), gold may offer better value. Some investors use this as a signal to trade silver for gold, a strategy known as ratio trading.

Silver is more volatile than gold, which causes these wide swings in the ratio and creates more trading opportunities. To take advantage of this without emotion, consider using Summit Metals' Autoinvest feature. By setting up automated monthly purchases, you practice dollar-cost averaging—just like with a 401(k). This disciplined approach allows you to accumulate more metal when prices are low and less when they are high, smoothing out your average cost over time.

The ratio is more than just a number; it's an actionable tool. By understanding when each metal offers better relative value, you can make strategic decisions that build your wealth over the long term.

Investing in Gold and Silver: A Decision Guide for Savvy Investors

How to Invest: Physical Gold and Silver Options

In silver gold silver investing, physical ownership offers a unique sense of security. Holding a tangible asset eliminates counterparty risk—you aren't relying on a bank or institution. This direct ownership is a core reason many investors choose physical precious metals to diversify their portfolios and protect their wealth.

The Ultimate Beginner's Guide to Investing in Precious Metals

Choosing Your Metal: Bars vs. Coins

The first choice for many investors is between bars and coins.

Bullion bars are the most cost-effective way to buy metal. Their simple production means lower premiums, so you get more gold or silver for your dollar. They are ideal for investors focused on accumulating the maximum weight.

Bullion coins, minted by governments like the U.S. and Canada, offer different advantages. While their premiums are higher, they come with a government guarantee of weight and purity. This makes them highly recognizable and easy to trade worldwide, providing excellent liquidity and protection against counterfeiting.

Here's how they compare:

| Feature | Bullion Bars | Bullion Coins |

|---|---|---|

| Premiums | Lower premiums mean more metal per dollar spent. | Higher premiums but include government guarantee and collectible potential. |

| Liquidity | Excellent for larger holdings, though harder to sell small portions. | Highly liquid worldwide, especially government-minted coins—easier to sell in smaller amounts. |

| Storability | Compact and space-efficient for storing large quantities. | Take up more space per ounce due to individual packaging and coin shape. |

| Government Guarantee | No sovereign backing—value based purely on metal content. | Legal tender with face value and government guarantee of weight and purity. |

| Recognizability | May require verification from less-known refiners. | Instantly recognized and trusted globally, simplifying authentication. |

| Best For | Maximizing metal content, long-term storage, larger investments. | Flexibility, easy selling, smaller investments, added security against fraud. |

Many investors own both, using bars for bulk storage and coins for liquidity.

Gold Bars vs Coins Bars vs. Coins: Unpacking the Differences in Silver Investing

Other Forms and Purity Considerations

Other forms of physical metal include:

- Rounds: Privately minted, coin-shaped pieces that offer lower premiums than government coins.

- Constitutional Silver: Pre-1965 U.S. coins (dimes, quarters, half-dollars) containing 90% silver. They are valued for their silver content and are easily divisible.

- Jewelry: While beautiful, jewelry carries high premiums for craftsmanship and is generally not an optimal investment vehicle.

An Essential Guide to Valuing Constitutional Silver

Purity is also key. Gold purity is measured in karats (24K is pure), while silver is measured by fineness (.999 is investment-grade). Investment products like the American Gold Eagle (22K) or American Silver Eagle (.999 fine) are alloyed for durability but are still valued for their precious metal content. For investment purposes, focus on high-purity products.

Understanding Karats and Purity in Gold

At Summit Metals, we ensure every product is clearly marked, so you have complete transparency with every purchase.

Building Your Precious Metals Portfolio

Building a silver gold silver portfolio is about strategic allocation, not hoarding. Gold and silver act as financial insurance, hedging against inflation and market volatility. They provide an anchor of intrinsic value when traditional assets falter.

Smart Investment Strategies for "Silver Gold Silver"

The most effective strategy for most investors is Dollar-Cost Averaging (DCA). This involves investing a fixed amount at regular intervals (e.g., monthly), regardless of price fluctuations. It's the same principle that makes 401(k) plans successful over the long term.

DCA removes the stress of trying to time the market. Your fixed investment buys more metal when prices are low and less when they are high, lowering your average cost per ounce over time.

Summit Metals' Autoinvest feature makes this easy. You can set up automated monthly purchases to build your holdings consistently. It's a disciplined, hands-off approach to accumulating real assets and building wealth in gold and silver.

The Power of Dollar-Cost Averaging in Gold and Silver Investments

Never Miss a Beat: How to Buy Gold and Silver Automatically

Key Considerations Before You Buy

Before investing, consider these three critical factors:

- Find a Reputable Dealer: The wrong dealer can be costly. Look for transparent, real-time pricing, clear terms, and authentic customer reviews. Based in Wyoming and serving investors nationwide, including Salt Lake City, Utah, Summit Metals prides itself on transparency and competitive rates. We authenticate every item we sell.

- Avoid Scams: Be wary of high-pressure sales tactics and deals that seem too good to be true. Verify a dealer's credentials and insist on authenticated products.

- Plan for Storage: Protecting your investment is crucial. For smaller holdings, a quality, bolted-down home safe may suffice (check your insurance policy). For larger positions, professional third-party depository storage offers insured, audited security and peace of mind.

How to Buy Gold and Silver Online Safely

Top Tips for Precious Metals Storage: Secure Your Investments

Conclusion: Start Your Gold and Silver Journey

You now have the essential knowledge for silver gold silver investing. You understand the stability of gold, the growth potential of silver, and how to use the gold-to-silver ratio to your advantage. Building wealth with precious metals is about consistent, strategic accumulation, not gambling on price spikes.

Gold acts as an anchor in economic storms, while silver offers growth potential, especially when the ratio is high. Together, they form a balanced foundation for any portfolio. The beauty of physical metals is their simplicity and tangible nature—they are real assets with 5,000 years of proven value, free from the counterparty risks of paper investments.

Starting is easier than you think. With Dollar-Cost Averaging through our Autoinvest program, you can build your portfolio automatically, just like a 401(k). This disciplined approach removes emotion and market-timing stress, allowing for consistent wealth building over time.

At Summit Metals, we are built on transparency, education, and fair pricing. Our real-time prices reflect our bulk purchasing power, and every item is authenticated for your confidence. We're here to help you build lasting wealth on your terms.

Don't wait for the next crisis. Start building your foundation today.

Start building your precious metals portfolio with our Decision Guide for Savvy Investors

Ready to take the first step? Visit Summit Metals to explore our gold and silver products. If you're looking to sell, check out our Sell to Us program. To automate your investing, set up Autopays or explore our Subscriptions.

Your financial future deserves the security that only real, physical precious metals can provide. Let's build it together.