Why Gold Eagle Coins Are America's Most Trusted Gold Investment

American Gold Eagles are the official gold bullion coins of the United States and the world's bestselling gold coins. They combine investor-friendly features with a design that reflects American heritage.

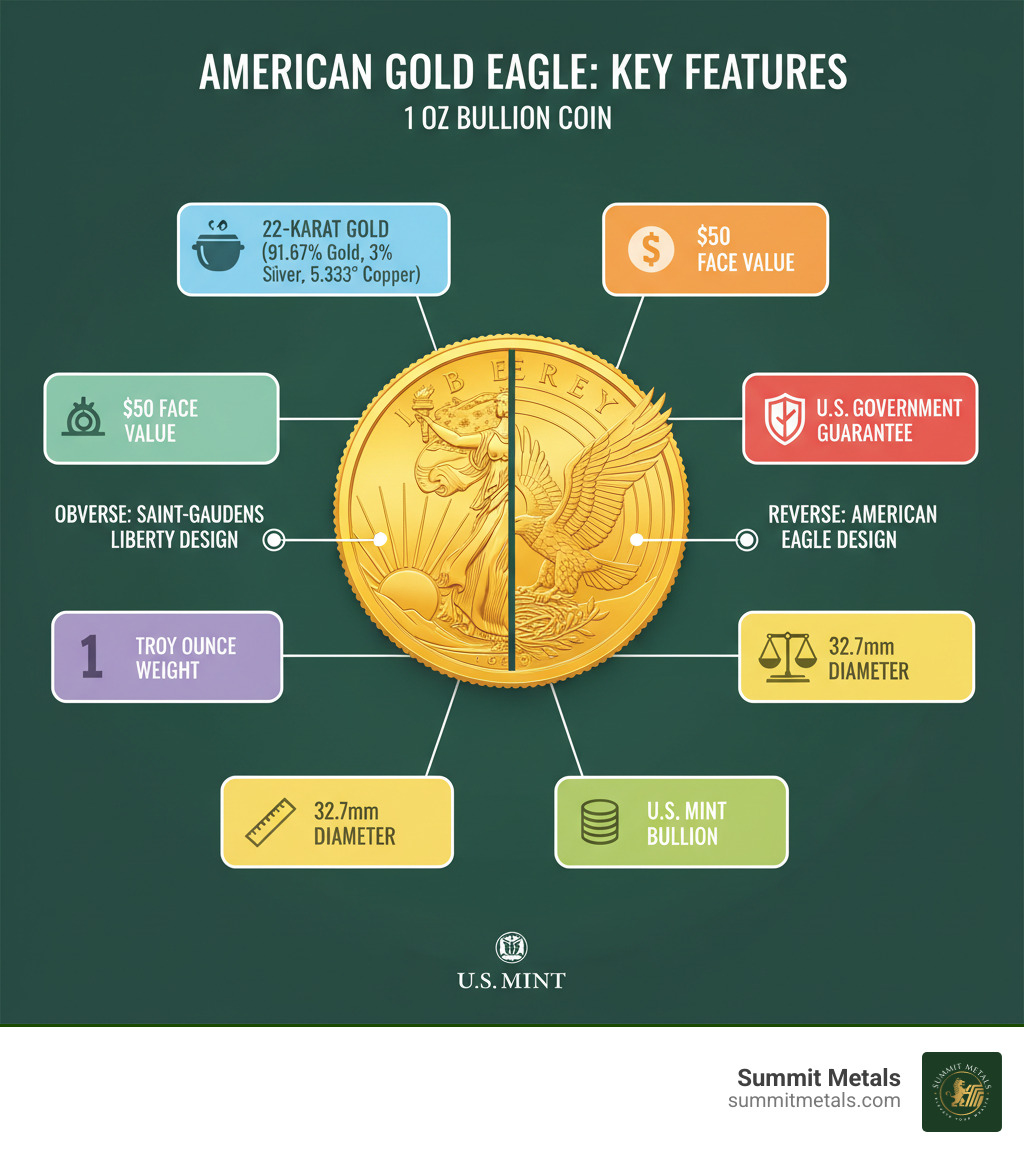

Key Features:

- Government Guaranteed: Weight, content, and purity backed by the U.S. government

- 22-Karat Gold: 91.67% pure gold with silver and copper for durability

- Four Sizes Available: 1 oz ($50), 1/2 oz ($25), 1/4 oz ($10), and 1/10 oz ($5)

- Legal Tender: Recognized face value provides fraud protection

- High Liquidity: Easy to buy and sell worldwide

- IRA Eligible: Can be held in precious metals retirement accounts

Since 1986, these coins have paired the iconography of Augustus Saint-Gaudens' Lady Liberty on the obverse with an American eagle reverse.

Whether you're diversifying, hedging inflation, or collecting a tangible asset, Gold Eagle coins offer a government-backed way to own physical gold.

I'm Eric Roach. After a decade advising on Wall Street, I now help individual investors apply institutional-grade precious metals strategies to protect and grow wealth.

The Anatomy of an American Gold Eagle Coin

When you hold an American Gold Eagle, you're holding a U.S. government–guaranteed asset with a century-plus design legacy. Here's what stands out about these remarkable coins that have captivated both investors and collectors since their introduction.

Iconic Design and Symbolism

The obverse features Augustus Saint-Gaudens' Liberty (adapted from the 1907–1933 $20 Double Eagle), carrying a torch and olive branch. This timeless design represents enlightenment and peace, embodying American ideals. In 2021, the U.S. Mint refined the design using original assets for sharper detail, enhancing the coin's visual appeal while maintaining its historic integrity.

The reverse has evolved through two distinct eras:

- 1986–mid-2021: Miley Busiek's "Family of Eagles" design, depicting a male eagle carrying an olive branch to a nest containing a female eagle and hatchlings

- 2021–present: Jennie Norris' close-up "Eagle Head" design, showcasing the strength and majesty of America's national bird

Collector note: 1986–1991 coins use Roman numerals for the date; from 1992 onward they use Arabic numerals. This subtle change marks an important transition in the coin's production history and can affect collectible value.

Specifications and Denominations

Composition: 22-karat crown gold (91.67% gold, 3% silver, 5.33% copper) for improved durability. This specific alloy, known as crown gold, has been used for centuries in coinage because it resists scratching and wear better than pure gold. Each coin's weight, content, and purity are guaranteed by Public Law 99-185, with gold sourced from within the United States. These coins are legal tender, though their intrinsic gold value far exceeds the face value—a feature that provides additional fraud protection since counterfeiting legal tender is a federal crime.

| Denomination | Gold Content (Troy Oz) | Diameter (mm) | Face Value (USD) | Typical Weight (grams) |

|---|---|---|---|---|

| 1 oz | 1.000 | 32.70 | $50 | 33.93 |

| 1/2 oz | 0.500 | 27.00 | $25 | 16.97 |

| 1/4 oz | 0.250 | 22.00 | $10 | 8.48 |

| 1/10 oz | 0.100 | 16.50 | $5 | 3.39 |

The 1/10 oz size is particularly popular as a cost-effective entry point and well-suited to dollar-cost averaging strategies, including Summit Metals' Autoinvest program. This smaller denomination allows investors to build their gold holdings gradually, making regular monthly purchases just like contributing to a 401(k), without the need for large upfront capital.

For official specifications and current production information, visit the Official U.S. Mint information on Gold Eagles.

Investing in Gold Eagle Coins: A Strategic Approach

Here is how to select among coin types and understand pricing so your purchases align with your goals.

Bullion vs. Proof vs. Uncirculated

- Bullion coins: Best for investors seeking gold exposure at the lowest premium over spot. No mint mark. Value tracks gold price closely.

- Proof coins: Collector finish (polished dies, multiple strikes). "W" mint mark. Limited mintages; higher premiums.

- Uncirculated (burnished) coins: Collector matte finish, also from West Point. Lower mintage than bullion; premiums between bullion and proofs.

Quick comparison:

| Type | Finish | Typical Premium | Mint Mark | Primary Use |

|---|---|---|---|---|

| Bullion | Brilliant | Lowest | None | Investment exposure |

| Uncirculated (Burnished) | Matte | Medium | W | Collectible + investment |

| Proof | Mirror-like | Highest | W | Collectible/display |

Note: In 2009, the Mint prioritized bullion production due to demand, pausing proof and uncirculated releases—an example of how investor demand can redirect mint capacity.

Factors Influencing the Price of Gold Eagles

Your price = gold spot price + premium. Premiums reflect:

- Minting and distribution costs

- Dealer fees and logistics

- Denomination (fractionals have higher percentage premiums)

- Coin condition, mintage, and collector demand

- Market conditions (e.g., inflation concerns often lift premiums)

Many investors use Gold Eagles as an inflation hedge and to diversify portfolios. For smaller, steady purchases, see: The Case for Fractional Gold.

Gold Eagle Coins vs. Gold Bars

Gold Eagles and bars both deliver physical gold exposure. Coins add government guarantees and legal tender status that improve liquidity and fraud protection.

| Feature | Gold Eagle Coins | Gold Bars |

|---|---|---|

| Government Guarantee | Yes (weight, content, purity) | No (depends on refiner/assayer) |

| Legal Tender Face Value | Yes ($5–$50) | No |

| Fraud Protection | High (counterfeiting legal tender is a federal crime) | Varies by brand; may require assay |

| Liquidity | Highest; globally recognized | Good; brand recognition matters |

| Divisibility | 1, 1/2, 1/4, 1/10 oz options | Limited; selling part of a bar is difficult |

| Premiums | Higher than large bars | Lower on larger bars |

Bottom line: If you value recognition, built-in fraud deterrence, and flexibility in buying/selling amounts, coins are compelling. If minimizing premium on very large purchases is the priority, large bars can help. Summit Metals publishes transparent, real-time pricing for both, so you can compare in seconds.

How to Buy and Build Your Gold Eagle Collection

You can keep purchases simple and consistent with a clear plan and reputable sourcing.

Where to Purchase Your Gold Eagles

The U.S. Mint sells bullion Gold Eagles only to authorized purchasers, who then supply dealers. Work with dealers that guarantee authenticity and show transparent, real-time pricing.

At Summit Metals (Wyoming-based), we source from mints and distributors via bulk purchasing to keep pricing competitive. Expect:

- Documented authenticity and clear product descriptions

- High-resolution photos and, when requested, certified coins (e.g., NGC)

- Straightforward, transparent pricing without hidden fees

For general buying tips that also apply to gold, see: Where to Buy Certified American Silver Eagles Without Ruffling Feathers.

Smart Investing with Dollar-Cost Averaging

Avoid timing the market. Instead, allocate a fixed amount on a schedule to smooth price volatility.

- Dollar-cost averaging (DCA) buys more when prices are low and fewer when prices are high, targeting a lower average cost over time.

- Multiple denominations (down to 1/10 oz) make DCA easy.

- Summit Metals Autoinvest lets you buy Gold Eagle coins automatically every month—just like contributing to a 401(k)—at our competitive bulk pricing.

Quick start with Autoinvest: 1) Choose denomination(s): start with 1/10 oz or mix with 1/4 oz and 1 oz. 2) Set a monthly budget aligned to your plan. 3) Automate purchases; monitor progress in your account.

For fractional strategies, see: Buy 1/10 oz Gold Eagle Coins: Best Prices.

Frequently Asked Questions about Gold Eagle Coins

Are Gold Eagle coins a good investment?

They can be a strong component of a diversified portfolio. Benefits include:

- Diversification: Often moves differently than stocks and bonds

- Inflation hedge: Gold has historically preserved purchasing power

- Liquidity: Among the most recognized and tradable gold coins globally

- Direct exposure: Value reflects the gold spot price plus a transparent premium

Can I put Gold Eagles in an IRA?

Yes. American Gold Eagles are specifically allowed in precious metals IRAs (traditional or Roth). They meet IRS rules for purity and authenticity. See: IRS rules on collectibles in IRAs.

Tip: Many investors pair an IRA holding with monthly Autoinvest purchases in a taxable account to DCA over time.

What is the difference between a Gold Eagle and a Gold Buffalo?

- Gold Eagle: 22-karat (91.67% gold, 3% silver, 5.33% copper) for added durability; widely recognized; government guaranteed.

- Gold Buffalo: 24-karat (99.99% gold); also government guaranteed, but softer due to higher purity.

Both are IRA-eligible and liquid; the choice often comes down to durability preference versus pure-gold appeal.

Conclusion: Start Your Gold Eagle Journey Today

The American Gold Eagle pairs U.S. government guarantees with outstanding liquidity and an iconic design. With four sizes, you can start small or buy full ounces, and choose bullion for investment or proofs/uncirculated for collecting.

To build steadily and reduce timing risk, set up Summit Metals Autoinvest and buy every month—just like a 401(k). You get transparent, real-time pricing and competitive rates from bulk purchasing.

Ready to go deeper? Explore: Everything You Need to Know About American Eagle Coins.