Why Understanding Bulk Silver Coin Prices Matters for Serious Investors

Bulk silver coin prices offer savvy investors a path to acquire tangible wealth at competitive rates. Navigating this market, however, requires understanding the key factors that drive pricing and value.

Key pricing factors include:

- Product Type: "Junk" silver bags often have lower premiums (1-3% over melt) than modern bullion.

- Volume: Discounts are common for tubes (20+ coins) and monster boxes (500+ coins).

- Payment Method: eCheck/wire transfers can be 3-5% cheaper than credit cards.

- Spot Price: All prices fluctuate with the live silver spot price.

The silver market has seen dramatic shifts, with prices recently rallying over $30 per ounce. Whether you're buying Constitutional "junk" silver (pre-1965 90% silver US coins) or modern bullion, understanding the premium structure and volume discounts is crucial to avoid overpaying. A $100 face value bag of junk silver contains about 71.5 troy ounces of silver, with its price based on melt value plus a small premium. Modern coins have standardized purity but often carry higher premiums.

I'm Eric Roach. After a decade on Wall Street advising on complex hedging programs, I've seen how bulk purchasing can significantly reduce per-ounce costs. My experience in precious metals strategies shows that understanding market mechanics is key to building meaningful wealth protection.

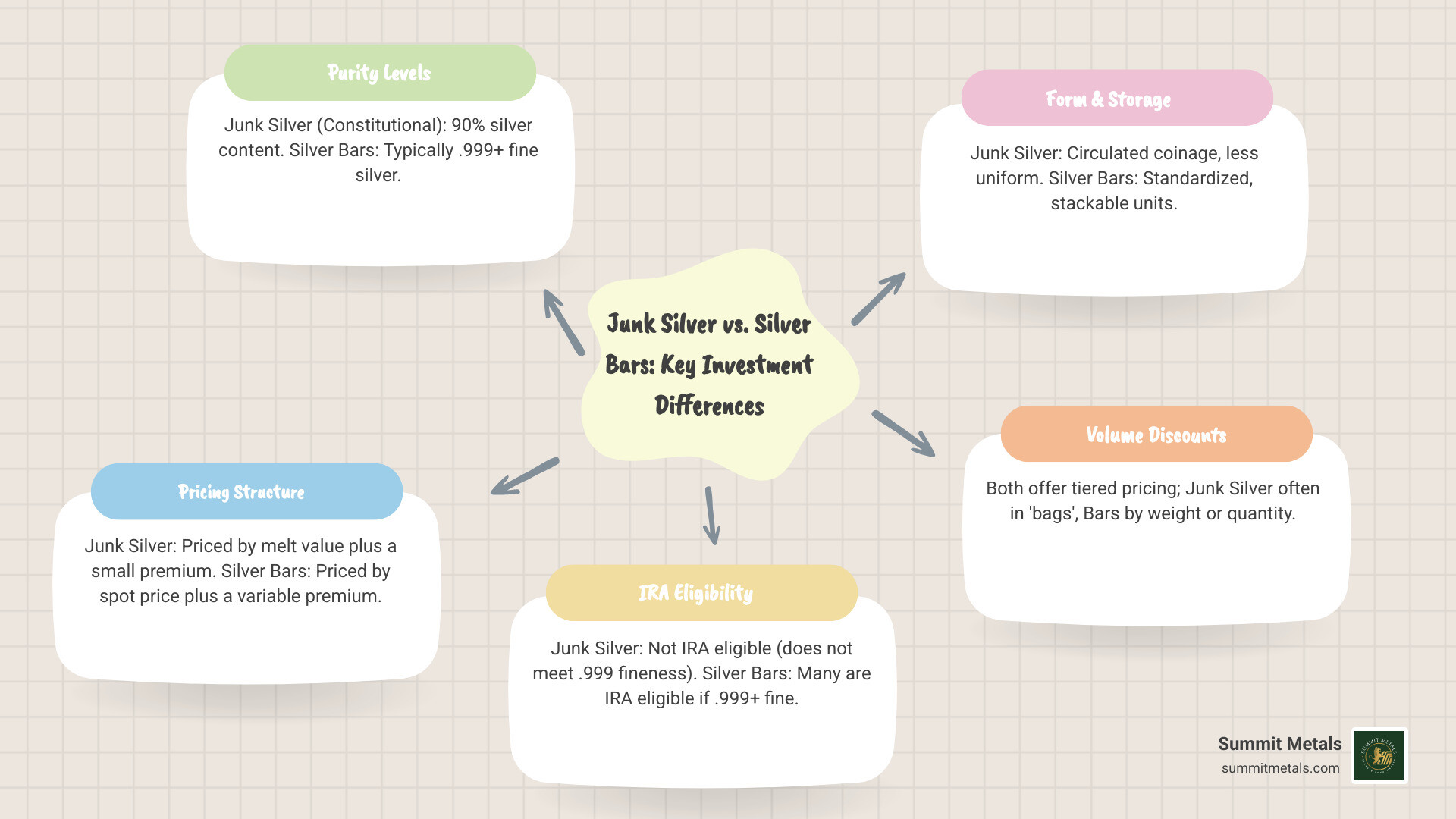

Understanding Junk Silver vs. Silver Bars

When exploring bulk silver coin prices, you'll encounter two main options: "junk" silver and silver bars. Understanding their differences is key to your investment strategy. At Summit Metals, we help investors choose the right silver for their goals, potentially saving them thousands.

What Exactly is "Junk" Silver?

"Junk" silver, or Constitutional silver, refers to pre-1965 U.S. dimes, quarters, and half-dollars containing 90% silver. The "junk" label simply means they lack numismatic (collector) value; their worth comes from their silver melt value.

These coins are priced by face value bags (e.g., a $100 face value bag holds about 71.5 troy ounces of silver). They offer excellent divisibility for smaller transactions and are easily recognizable, which can be an advantage in times of economic uncertainty.

Silver Bars: Purity and Premiums

Silver bars are purpose-built for investment, offering .999 fine silver (99.9% pure) or higher. Their price is tied directly to the silver spot price plus a premium for manufacturing.

While small bars may have higher premiums than junk silver, larger bars often provide a lower cost-per-ounce. They are designed for easy, efficient stacking and storage. A key advantage is their IRA eligibility; their .999 purity meets IRS requirements, unlike 90% junk silver.

Here is a comparison of the two investment types:

| Feature | Junk Silver (Constitutional) | Silver Bars |

|---|---|---|

| Purity | 90% Silver | .999+ Fine Silver |

| Pricing Basis | Melt value + small premium | Spot price + premium |

| IRA Eligibility | No | Yes |

| Key Advantages | Divisibility, recognizability, low premiums | High purity, stackability, IRA-eligible |

For a detailed breakdown, check out our guide: Silver Bar vs. Junk Silver: Which Is Right for You?

Gold Coin vs. Gold Bar Comparison

The coin vs. bar decision also applies to gold. Understanding these differences can help you build a diversified precious metals portfolio.

| Feature | Gold Coins (e.g., American Eagle) | Gold Bars |

|---|---|---|

| Government Backing | Yes (Legal tender, face value) | No |

| Security | Face value provides fraud protection and guarantees weight/purity | Relies on manufacturer's reputation |

| Premiums | Generally higher than bars | Generally lower, especially for larger sizes |

| Stackability | Good, but less uniform than bars | Excellent, designed for efficient storage |

The choice between coins and bars—in silver or gold—depends on your priorities: maximizing metal for your money (bars) or gaining the security and divisibility of government-backed coins.

Decoding Bulk Silver Coin Prices and Finding Value

Understanding what drives bulk silver coin prices helps you spot value opportunities that others miss.

The Anatomy of Bulk Silver Coin Prices

Every silver price starts with the silver spot price, the wholesale price for raw silver on global markets. However, you never pay just the spot price for physical metal. There is always a premium added to cover costs like minting, shipping, and dealer overhead. This premium can range from 2% to 15% over spot, depending on the product and quantity.

Bulk purchasing is the key to lowering your per-ounce cost. Buying a tube of 20 coins or a monster box of 500 significantly reduces the premium per coin compared to buying a single one. For junk silver, the math is simple: the price is the silver content (e.g., 71.5 oz in a $100 face value bag) multiplied by the spot price, plus a small premium of 1-3%. Smart buyers focus on minimizing this premium.

Key Factors That Drive the Market

Silver prices respond to several real-world factors:

- Economic Uncertainty: Inflation and shaky economic data often drive investors to precious metals as a hedge, and silver's affordability makes it a popular choice.

- Geopolitical Tensions: "Flight to safety" during global instability boosts demand for tangible assets like silver.

- Industrial Demand: Silver is essential for solar panels, EVs, and electronics. This growing industrial use provides strong underlying support for its price.

- Supply Constraints: Mining disruptions and regulations can limit the supply of new silver, further impacting prices.

The gold-to-silver ratio is another useful indicator. A high ratio suggests silver may be undervalued compared to gold, signaling a potential buying opportunity for savvy investors. Historical trends show silver's volatility and potential, with prices having moved from under $4 to nearly $50. Our analysis in Silver Price: The Bullish Case for Silver with a Potential 20% Upside explores current market dynamics.

The Advantages of Buying in Bulk

Buying silver in bulk is a serious investment strategy that offers more than just a lower cost-per-ounce. Spreading fixed costs over more ounces means more of your money buys actual silver.

Committing to tubes, bags, or monster boxes shifts your mindset from collecting to wealth building, a core principle of The Basics of Gold and Silver Stacking. Building a significant position requires discipline, which is where Summit Metals' Autoinvest program can help. It allows you to dollar-cost average by making automatic monthly purchases, removing the stress of trying to time the market. Bulk buying encourages a long-term perspective, helping you build a tangible asset base to protect your wealth.

The Smart Buyer's Guide: How to Purchase Bulk Silver Safely

Investing in bulk silver is a great strategy, but protecting your investment starts with smart buying practices. At Summit Metals, we empower our clients to steer the market safely and confidently.

Where to Find Reputable Dealers

Choosing the right dealer is crucial. Look for a partner with a strong reputation, transparent pricing, positive customer reviews, and authentication guarantees.

Why buy from Summit Metals? Based in Wyoming, we serve clients nationwide with a focus on security and value. We offer transparent, real-time pricing and competitive rates achieved through our own bulk purchasing power. We pass those savings directly to you, making your purchase straightforward and secure. For more guidance, read our article: Where to Buy Certified Silver Coins Without Getting Tarnished.

Verifying Authenticity and Quality

While buying from a trusted dealer is key, knowing basic authenticity checks provides extra confidence.

- Counterfeit Detection: Be wary of deals that seem too good to be true, like silver sold below its spot price.

- Basic Tests: Genuine silver is not magnetic (the magnet test), has a specific weight and dimensions, and emits a distinct chime when tapped (the ping test).

- Buy Authenticated Metals: The best protection is to buy from a dealer that guarantees authenticity. At Summit Metals, we sell only authenticated precious metals sourced from recognized mints, giving you complete peace of mind.

Bullion coins are typically "Brilliant Uncirculated," while circulated "junk silver" will show wear, which doesn't affect its value based on silver content.

Navigating Shipping, Insurance, and Taxes

Your total cost includes more than just the metal's price. Factor in shipping, insurance, and potential taxes.

- Shipping and Insurance: Reputable dealers offer free shipping above a certain order value and always ship fully insured in discreet packaging. Summit Metals ensures all shipments are protected until they reach your door.

- Taxes: Sales tax laws for precious metals vary significantly by state and order size, so it's important to understand the rules for your location. Profits from selling silver may also be subject to capital gains tax. Consulting a tax professional is always recommended.

Calculating your total cost per ounce—including all fees and taxes—is the best way to compare dealers accurately. For a complete overview, see Your Ultimate Guide to Buying Silver Coins Online.

Automating Your Investment: A Strategy for Consistent Growth

Imagine building your silver stack with the same steady, disciplined approach as a 401k. This is possible through dollar-cost averaging (DCA), a powerful strategy for precious metals investors.

Instead of trying to time the market, DCA involves investing a fixed amount at regular intervals. When bulk silver coin prices are low, your investment buys more silver; when prices are high, it buys less. Over time, this strategy smooths out volatility and can lead to a lower average cost per ounce. Market swings become an advantage, not a source of stress.

This disciplined approach removes emotion from investing. You no longer have to guess the right time to buy. At Summit Metals, we've made this easy with our Autoinvest plan. It works just like a 401k contribution:

- You choose a monthly investment amount.

- You select your preferred silver products.

- We handle the rest, automatically shipping your silver each month.

This hands-off method is perfect for building long-term wealth and is a key strategy covered in The Ultimate Beginner's Guide to Investing in Precious Metals. Automating your purchases ensures you consistently grow your tangible assets without the guesswork.

Ready to put your silver investing on autopilot? Setting up your Autoinvest plan takes just minutes and provides a systematic path to wealth building.

Frequently Asked Questions about Bulk Silver Coin Prices

Here are answers to common questions about investing in bulk silver coin prices.

Is it cheaper to buy junk silver or silver bars in bulk?

It depends on your goals. Junk silver typically has lower premiums over its melt value, making it a cost-effective way to accumulate silver weight. This is because the coins were minted decades ago, so there are no new fabrication costs.

Silver bars offer higher purity (.999+ fine), are easier to store, and are IRA-eligible. For very large quantities, the premiums on large bars can be competitive with junk silver. Many investors at Summit Metals hold a mix of both: junk silver for low cost and divisibility, and bars for purity and efficient storage.

How is the price of a "$100 face value" bag of junk silver calculated?

The price has nothing to do with the $100 face value. It's based entirely on the silver content. A standard $100 face value bag of 90% U.S. coins contains approximately 71.5 troy ounces of silver. The price is calculated as:

(71.5 oz) x (Current Silver Spot Price) + (Dealer Premium)

This ensures you pay for the actual precious metal content, not an outdated monetary value.

Can I include junk silver in a Precious Metals IRA?

No. Junk silver does not meet the IRS minimum fineness requirement of .999 for inclusion in a Precious Metals IRA. Its 90% purity falls short of the standard.

To add silver to an IRA, you must use IRA-eligible products like .999+ fine silver bars or sovereign coins like American Silver Eagles. Many of our clients at Summit Metals use their IRA for high-purity bullion while building a separate, personal stack of junk silver for flexibility. You can use our Autoinvest plan to consistently add IRA-eligible silver to your retirement account.

Conclusion: Secure Your Wealth with Tangible Assets

Understanding bulk silver coin prices is about more than saving money—it's about securing your financial future with a real, tangible asset. Precious metals provide a steady foundation when other markets feel uncertain.

Constitutional "junk" silver is a smart way to build wealth protection, offering low premiums, divisibility, and historical significance. Buying in bulk transforms you from a casual collector into a serious investor, lowering your per-ounce cost and helping you build a significant position in a timeless asset.

The market fundamentals are clear: Spot price + Premium = Your Cost. The drivers behind these prices—growing industrial demand, economic uncertainty, and supply constraints—point toward continued strength for silver.

Your success depends on a trustworthy partner. At Summit Metals, we provide transparent pricing, authenticated products, and competitive rates. We're here to help you build a strategy that fits your goals.

To build your stack consistently without market-timing stress, our Autoinvest program allows you to dollar-cost average with automatic monthly purchases.

This is about long-term wealth security. Whether hedging against inflation or diversifying your portfolio, silver offers peace of mind. Now that you have the knowledge, you can make smart decisions to build your silver foundation.