Why Certified Silver Offers Superior Investment Security

Buy Certified Silver to lock-in authenticity, preserve condition and maximize resale value. Unlike raw bullion, certified coins arrive in tamper-evident slabs with third-party verification, turning ordinary silver into a documented asset.

Top Places to Buy Certified Silver

- Trusted online bullion dealers (Summit Metals and other well-reviewed vendors)

- Accredited local coin shops

- Direct submissions through leading grading service membership programs

Key Benefits

- Guaranteed authenticity backed by industry insurers

- Improved liquidity when markets heat up

- Physical protection from fingerprints and scratches

- Higher collector appeal and premiums

Major grading services have graded tens of millions of coins, using the 70-point Sheldon Scale. A perfect MS-70 or PF-70 coin shows zero post-production flaws under 5x magnification, while MS-69 or PF-69 allows at most two tiny marks.

During recent silver rallies, certified American Silver Eagles traded at premiums far above melt value precisely because buyers trusted the slabs. With over a decade on Wall Street guiding both Fortune-500 hedging programs and individual stackers, I've seen how certified pieces can turn a metal allocation into a portable, verifiable asset.

What is Certified Silver and Why Does it Matter?

Think of certified silver as your precious metals' passport to authenticity. When you Buy Certified Silver, you're getting coins that have been thoroughly examined by independent experts who know their stuff. These third-party grading services don't just give your coins a quick once-over - they put them through rigorous testing before sealing them in protective cases that clearly show what you've got.

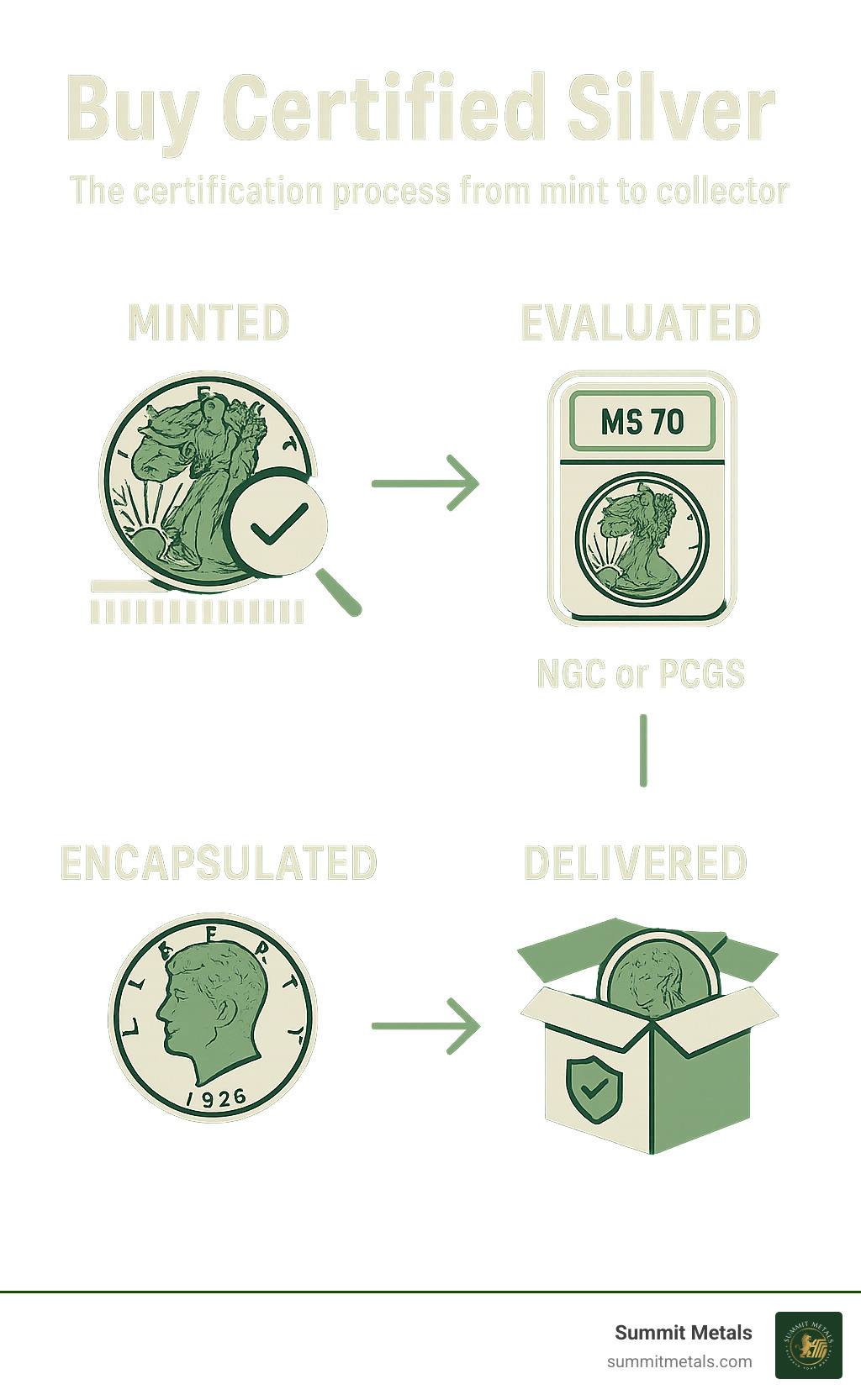

Here's how it works: Professional grading companies have been doing this for decades. The modern grading industry kicked off in the mid-1980s to solve trust issues in rare coin markets, and the top services have since become global leaders in coin certification.

The process itself is pretty thorough. Expert numismatists - that's fancy talk for coin specialists - examine each piece based on five key factors: strike quality, surface condition, preservation, luster, and overall eye appeal. At least two professionals look at every coin independently, so you're getting an unbiased assessment. Once they're done, your coin gets sealed in a sonically welded plastic holder (called a "slab") that protects it while showing off its grade and unique serial number.

The real difference between certified and regular silver comes down to value. A basic silver round might trade close to the current silver price, but a certified American Silver Eagle in perfect MS-70 condition? That can command serious premiums because collectors and investors know exactly what they're getting. You're getting both the numismatic value (collector appeal) and melt value (silver content) rolled into one.

For anyone putting real money into precious metals, certification takes the guesswork out of the equation. When you're investing thousands of dollars, having independent experts verify your coins' authenticity and condition just makes sense. It's like having a professional inspection before buying a house - you want to know what you're getting into. More info about silver as an investment

The Key Benefits of Buying Certified Silver

The perks of certified silver go way beyond just knowing your coins are real. Guaranteed authenticity tops the list - the top grading services back their assessments with their reputation and insurance. If they mess up (which rarely happens), they'll make it right.

Improved liquidity is another huge plus. Certified coins sell faster in secondary markets because buyers trust what they're getting. When precious metals markets get choppy and trading picks up, this liquidity advantage becomes even more valuable.

The higher resale potential often justifies paying extra for certification upfront. Certified coins, especially those perfect MS-70 or PF-70 specimens, can appreciate well beyond their silver content value. Perfect coins are rare, and collectors will pay premium prices for them.

Protection from damage might sound basic, but it's incredibly practical. Those protective slabs keep your coins safe from fingerprints, scratches, and environmental damage. Your investment stays in the same condition you bought it in, which preserves its value over time.

The collector appeal adds another layer to your investment strategy. Many collectors specifically hunt for certified coins, creating demand beyond just investors focused on silver content. This dual market often supports better prices and easier selling when you're ready to cash out.

At Summit Metals, we've seen certified silver consistently outperform regular silver during market upswings. The certification process essentially creates a premium product that appeals to both precious metals investors and coin collectors. A guide to silver stacking

The Cornerstones of Certification: Grading Explained

Grading is the precious-metals equivalent of a home inspection. When you Buy Certified Silver, independent numismatists determine authenticity and condition using the universally accepted Sheldon Scale.

How the Process Works

- Submission & authentication check.

- Two or more graders independently examine strike, surface, luster and eye appeal under magnification.

- Final grade is averaged, verified and the coin is sealed in a sonically-welded holder with a unique serial number.

Full-time graders at leading certification companies are barred from trading coins commercially, preserving impartiality. Their online databases let buyers confirm any slab's serial number in seconds.

Understanding the Grades: MS-1 to a Perfect 70

- Mint State (MS) coins never circulated; Proof (PF/PR) coins are struck for collectors.

- MS/PF-70 - flawless under 5x; the hobby's "perfect diamond."

- MS/PF-69 - near-perfect, allowing up to two tiny imperfections.

- Special labels like First Strike, Early Release or Ultra Cameo can add extra cachet.

Knowing these distinctions helps you target the sweet spot between price and quality when you Buy Certified Silver. The basics of bullion investing

Top Certified Silver Coins for Your Collection or Stack

When you Buy Certified Silver, certain coins consistently deliver liquidity and collector interest:

- American Silver Eagle – 1 troy oz of .999 silver, U.S. government guarantee, huge secondary-market demand.

- Canadian Silver Maple Leaf – .9999 purity plus advanced anti-counterfeit features.

- British Silver Britannia – classic Britannia motif, now .999 pure.

- Mexican Silver Libertad – limited mintages and striking design versatility.

- Chinese Silver Panda – annually changing designs drive global collectability.

- Historic U.S. Morgan & Peace Dollars – certified high-grade examples combine metal value with American history. More on Constitutional Silver

The common thread is government or historical backing plus well-documented mintage figures, making resale straightforward and premiums easier to justify.

Where and How to Buy Certified Silver

Buying slabs isn't complicated once you focus on three things: reputation, verification and cost.

Primary Channels

- Reputable online dealers - broad inventory and real-time pricing.

- Local coin shops - hands-on inspection and relationship building.

- Direct certification submissions - useful if you already own raw coins worth grading.

Cost Basics Premiums reflect grading fees, market demand and dealer overhead. A perfect MS-70 Eagle will cost more than a near-perfect MS-69, and both exceed the price of an uncertified round.

Due-Diligence Checklist

- Confirm dealer standing through the Better Business Bureau or Industry Council for Tangible Assets.

- Use the grading service's online look-up to match slab serial numbers.

- Compare prices across at least two dealers and factor in shipping & insurance.

- Read return policies before you click "buy."

How to buy gold and silver online safely

Following these steps lets you Buy Certified Silver with the same confidence you expect from any other financial asset.

Certified vs. Uncertified Silver: A Head-to-Head Comparison

Choosing between certified and uncertified silver often feels like picking between a luxury car and a reliable truck - both get you where you're going, but the experience differs significantly. Let's break down the real differences to help you decide which path makes sense for your investment goals.

Authenticity assurance represents the most striking difference between these options. When you Buy Certified Silver, you're getting third-party verification from established grading services. These companies stake their reputation on accuracy and back their certifications with financial guarantees. If they make a mistake, they'll make it right. Uncertified silver relies on the mint's or dealer's reputation, which can vary dramatically depending on your source.

Condition evaluation becomes much more straightforward with certified pieces. Professional graders use standardized criteria and the Sheldon Scale to assess each coin's condition precisely. You know exactly what you're getting - no surprises, no guesswork. Uncertified silver ranges from brilliant uncirculated pieces to heavily worn coins, making evaluation more subjective and potentially risky for newer investors.

The premium cost difference is where things get interesting. Certified silver commands higher premiums due to grading fees and increased desirability. These premiums can range from modest for common coins in average grades to substantial for perfect specimens. Uncertified silver typically trades much closer to spot price with lower premiums, making it attractive for pure metal accumulation.

Liquidity considerations favor both options, but certified coins often trade more smoothly. The standardized grading eliminates the need for buyers to conduct their own condition assessments, speeding up transactions. Both types offer excellent liquidity compared to many other investments, but certified pieces remove some friction from the selling process.

Storage requirements are similar for both types, though certified coins need extra care to protect their protective slabs. Damage to the certification holder can impact value, making proper storage even more critical. Both require secure physical storage and insurance considerations.

Insurance coverage tends to be more straightforward with certified silver. Insurance companies readily accept certified grades for coverage purposes, while uncertified pieces might require additional appraisal documentation. The clear documentation makes claims processes smoother.

Counterparty risk remains low for both options compared to paper silver investments. However, certified silver provides additional protection against counterfeit products through independent authentication. This extra layer of security becomes increasingly valuable as counterfeit techniques become more sophisticated.

Your choice ultimately depends on your investment objectives. Pure precious metals exposure with minimal premiums points toward uncertified silver. Authentication assurance, condition verification, and potential numismatic appreciation favor certified silver despite higher initial costs. At Summit Metals, we've found that many investors start with uncertified silver and gradually add certified pieces as their portfolios grow and their knowledge deepens.

Frequently Asked Questions about Buying Certified Silver

Is certified silver a better investment than silver bars?

This question comes up constantly, and honestly, there's no one-size-fits-all answer. It really depends on what you're trying to accomplish with your precious metals investment.

Silver bars are the straightforward choice for investors who want maximum silver content for their dollar. They trade much closer to spot price with lower premiums, making them incredibly efficient if you're focused purely on accumulating precious metals. Think of bars as the "meat and potatoes" of silver investing - they get the job done without any fancy extras.

Certified silver coins, on the other hand, offer something extra. When you Buy Certified Silver, you're getting precious metals value plus potential numismatic appreciation. That MS-70 American Silver Eagle isn't just an ounce of silver - it's a perfect specimen that collectors actively seek out. This dual appeal can lead to returns that exceed the underlying silver price movement.

The trade-off is pretty clear: you'll pay higher premiums upfront for certified coins, but you also get the potential for those premiums to expand over time. We've seen certified coins significantly outperform bars during bull markets when collector enthusiasm runs high.

At Summit Metals, we often suggest a balanced approach to our clients. Build your core position with cost-effective products like bars or uncertified coins, then add certified pieces for diversification and upside potential. This strategy gives you the best of both worlds without breaking the bank on premiums.

How can I verify a silver coin's certification?

Verifying certification is actually pretty simple, and it's one of the most important steps when you Buy Certified Silver. The leading grading services maintain comprehensive online databases that make verification quick and easy.

Here's how the process works: Find the unique serial number printed on your coin's certification slab. Head to the grading service's website and look for their certification verification section. Enter that serial number exactly as it appears, and within seconds you'll see the coin's complete certification details.

The database typically shows the coin's grade, certification date, and often includes actual photographs of your specific coin. This image matching provides an extra layer of security - you can compare the coin in your hands to the photo on file.

Modern convenience makes this even easier. The major grading services now offer mobile apps that can scan QR codes or barcodes directly from certification slabs. It's like having a verification tool right in your pocket.

Never skip this verification step, especially when buying from unfamiliar sources. Counterfeit slabs do exist, and a quick verification check protects you from costly mistakes. We always encourage our customers to verify their certifications - it takes two minutes and provides invaluable peace of mind.

What does a grade of MS-70 mean?

MS-70 is the holy grail of coin grading - it represents absolute perfection on the Sheldon Scale. When a coin receives this grade, it means professional numismatists examined it under 5x magnification and found zero post-production imperfections.

Perfect doesn't happen by accident. These coins must exhibit full, original mint luster and exceptional eye appeal. Every surface must be flawless, every detail must be sharp, and the overall appearance must be stunning. It's the kind of perfection that makes you stop and admire the coin's beauty.

The rarity of MS-70 specimens creates intense collector demand. For modern bullion coins like American Silver Eagles, achieving this perfect grade requires exceptional manufacturing quality and careful handling from the mint through certification. Even tiny imperfections invisible to the naked eye can prevent a coin from reaching MS-70 status.

This rarity translates directly to value. MS-70 coins command significant premiums over lower grades, sometimes many times their silver content value. The premium reflects both the coin's perfect condition and the strong collector demand for flawless specimens.

For investors, MS-70 coins offer the potential for appreciation well beyond precious metals prices. However, those high premiums require careful consideration of your investment goals and timeline. These coins work best for investors who appreciate the combination of precious metals value and numismatic potential that makes certified silver so compelling.

Conclusion

Making the decision to Buy Certified Silver is really about choosing peace of mind over uncertainty. When you're investing your hard-earned money in precious metals, you want to sleep well at night knowing exactly what you own.

Think about it this way: would you rather buy a car without knowing if it's been in an accident, or get one with a detailed inspection report? Certified silver gives you that inspection report. Third-party authentication removes the guesswork, while professional grading tells you exactly what condition your coins are in.

The protective slabs aren't just fancy packaging - they're your investment's bodyguard. They keep your coins safe from scratches, fingerprints, and that one family member who always wants to "feel how heavy it is." Meanwhile, the standardized grading means you can compare prices confidently, whether you're buying from us here in Wyoming or from a dealer across the country.

Yes, certified silver costs more upfront than raw silver. But here's the thing - authenticity guarantees and improved liquidity often make up for those premiums when it's time to sell. Plus, if you end up with a perfect MS-70 specimen, you might be pleasantly surprised by how much collectors are willing to pay.

The grading process might seem complicated at first, but it's really just a quality control system that benefits everyone. When a top grading service puts its reputation behind a coin, it's essentially saying "we've checked this thoroughly, and here's exactly what you're getting."

Whether you choose American Silver Eagles for their government backing, Canadian Maple Leafs for their exceptional purity, or historic Morgan Dollars for their numismatic appeal, certified silver offers something raw bullion simply can't match - documented value that's recognized worldwide.

At Summit Metals, we've seen how certified silver helps our customers build stronger portfolios. Our bulk purchasing power lets us offer competitive pricing on authenticated coins, while our Wyoming location keeps our overhead low. We believe precious metals investing should be straightforward, not stressful.

The beauty of certified silver lies in its dual nature. You get the intrinsic value of silver content plus the added security of professional authentication. It's like having both a savings account and an insurance policy rolled into one shiny package.

For investors seeking authenticated precious metals with transparent, competitive pricing, Summit Metals provides a trusted source for building your portfolio. We combine institutional-grade standards with the personal touch you'd expect from a Wyoming-based company. Explore our silver collection.

The certified silver market will keep evolving, but the core benefits remain constant: authenticity, security, and peace of mind. Whether you're just starting your precious metals journey or you're a seasoned stacker, certified silver deserves a place in your portfolio. After all, when it comes to protecting your wealth, why settle for anything less than the best?