Why Understanding Spot Price is Your Key to Smart Precious Metals Investing

It's the question every new precious metals investor asks: how to buy gold and silver at spot price? The allure of purchasing at the raw "spot price" feels like a secret path to maximum value. The truth is, buying physical bullion at the exact spot price is nearly impossible for retail investors. But that doesn't mean you can't get very close.

Quick Answer: Steps to Buy Gold and Silver at Spot Price (or Close to It):

- Understand spot price is a benchmark, not the final retail price.

- Look for promotional "at-spot" deals from reputable dealers for new customers.

- Choose lower-premium products like generic rounds and larger bars.

- Buy in larger quantities to reduce per-ounce premiums.

- Compare total costs, including shipping, insurance, and payment fees.

- Use dollar-cost averaging through programs like Summit Metals' Autoinvest.

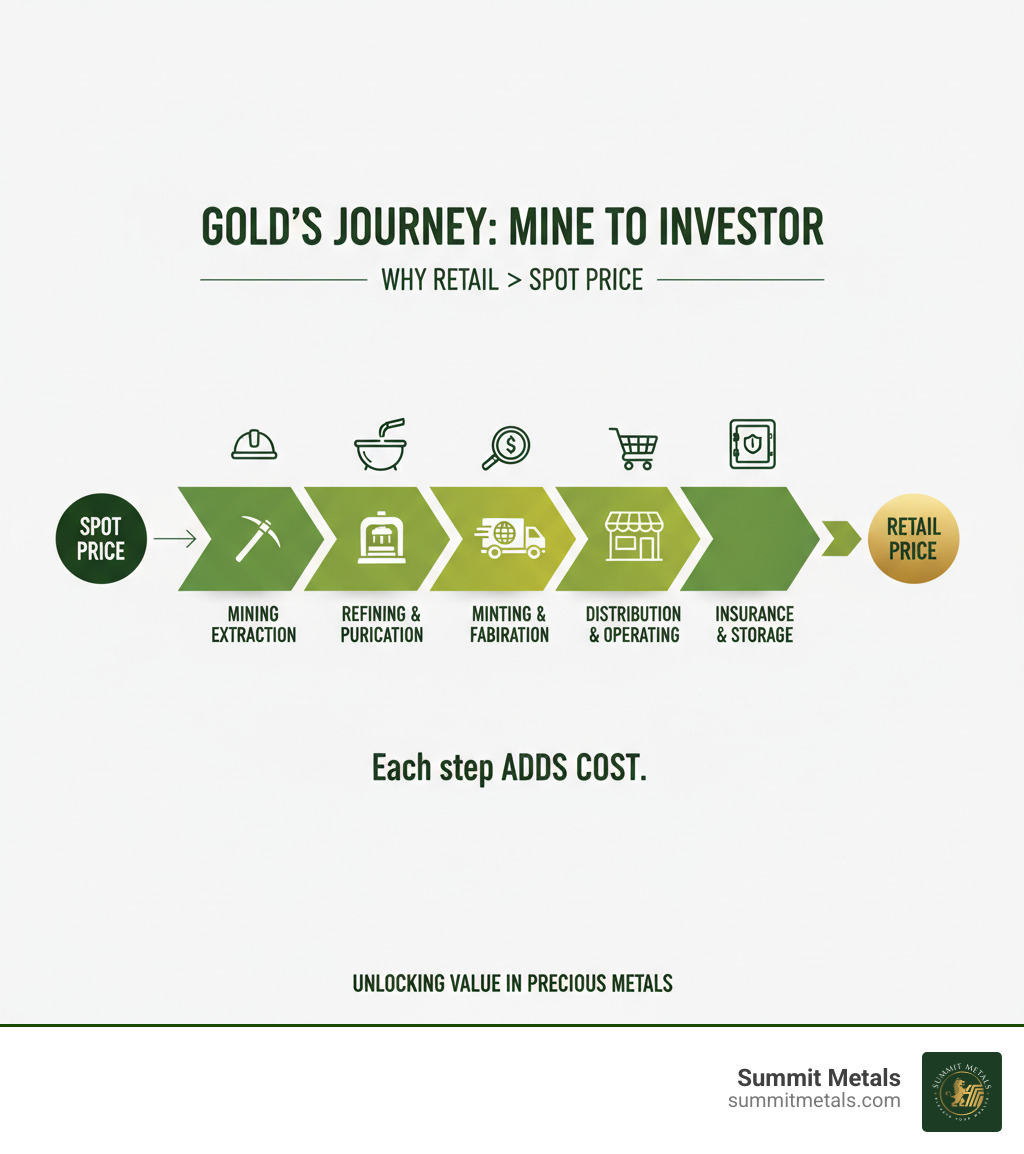

The spot price you see on financial news represents the price of raw metal traded in massive quantities between institutions. When you buy physical gold or silver, you're paying for the mining, refining, minting, and distribution that turns that raw material into a finished product. These costs create the "premium" over spot price.

As a former Wall Street investment banker, I'm Eric Roach. I've guided Fortune-500 clients through multi-billion-dollar transactions, and now I help everyday investors understand how to minimize premiums and build resilient precious metals portfolios at the lowest possible cost.

Decoding Spot Price vs. Retail Price

If you've ever wondered how to buy gold and silver at spot price, the first step is understanding what that "spot price" number actually represents. For a neutral primer, see spot price.

Think of spot price as the wholesale price for raw, unfinished metal traded in the paper market on exchanges like COMEX and the LBMA. This price is for massive quantities—thousands of ounces at a time—and doesn't include minting, shipping, or any services. It's the institutional benchmark.

The retail price is what you, the individual investor, actually pay for a finished product like an American Eagle coin. This price will always be higher than spot because it includes the cost of turning raw metal into an investment-grade, authenticated product delivered to you. The difference between the spot and retail price is called the premium.

At Summit Metals, we believe in complete transparency. Our website displays our real-time retail pricing right next to the live spot price, so you can see the exact premium you're paying.

What are Premiums and Why Do They Exist?

Premiums are not arbitrary fees; they are the real-world costs of creating and delivering physical bullion. Think of it as a "facilitation fee" that makes physical ownership possible. As we detail in our guide The Price of Shine: Understanding Your Bullion's Premium, these costs include:

- Mining and Extraction: Getting the metal out of the ground.

- Refining and Purification: Turning raw ore into .999 or .9999 fine metal.

- Minting and Fabrication: Shaping the metal into coins, bars, or rounds.

- Distribution and Logistics: Moving products from mints to dealers.

- Dealer Costs and Profit: Covering secure storage, staff, and business operations.

- Insurance and Shipping: Protecting your investment until it's in your hands.

Factors That Influence Bullion Premiums

Premiums fluctuate based on real market forces. Understanding these drivers is key to finding the best value.

- Supply and Demand: High demand or low mint production increases premiums. Ample inventory tends to lower them.

- Product Type: Government-minted coins (e.g., Canadian Maple Leafs) have higher premiums than generic rounds or bars due to their legal tender status, government backing, and security features.

- Mint of Origin: Products from renowned mints like the U.S. Mint command higher, more consistent premiums due to trust and quality.

- Product Size: Smaller items (like a 1-gram bar) have higher per-ounce premiums because fixed manufacturing costs are spread over less metal. Buying larger bars or in bulk reduces the per-ounce cost.

- Rarity and Collectibility: Limited-mintage or numismatic coins carry high premiums and are often a different class of investment than bullion.

- Market Climate: Economic uncertainty or geopolitical conflict often increases demand and, therefore, premiums. Our article on Silver's Strategic Edge explores this.

For a deeper dive, see our guide: Spot Price vs. Premium: How Precious Metals Pricing Works.

Actionable Strategies for How to Buy Gold and Silver at Spot Price

While buying physical bullion at the exact spot price is a myth for retail investors, the real goal is to get as close as possible by minimizing premiums. Think of it like car shopping: you know the sticker price, but your mission is to find the dealer who gets you closest to the invoice cost.

These strategies come from years of helping investors steer the market effectively.

Strategy 1: Choose the Right Product (Coins vs. Bars vs. Rounds)

Not all bullion is priced equally. Generic rounds and larger bars typically have the lowest premiums due to simpler manufacturing and economies of scale. A 10-ounce silver bar will almost always cost less per ounce than ten 1-ounce rounds. The secondary market (pre-owned bullion) can also offer great value.

However, sometimes a slightly higher premium is a smart investment. Government-minted coins offer security and liquidity that often justify the cost, especially for new investors. For reference, see the U.S. Mint’s American Eagle bullion program and the Royal Canadian Mint’s Maple Leaf bullion overview (Royal Canadian Mint) for examples of legal-tender backing and security features.

| Feature | Gold Coins | Gold Bars | Gold Rounds |

|---|---|---|---|

| Premium | Higher (government minting) | Lower (simpler production) | Lowest (private mint) |

| Liquidity | High (universally recognized) | Medium-High (brand dependent) | Medium (recognition varies) |

| Recognizability | Highest (government-backed) | High (reputable refiners) | Varies (private mint) |

| Counterfeit Protection | Highest (security features) | High (serial numbers, assays) | Varies (dealer reputation) |

| Face Value | Yes (legal tender status) | No | No |

| Fraud Protection | Government guarantee | Reputable refiner backing | Dealer reputation only |

As the chart shows, the face value on a government coin like an American Eagle provides legal protection against fraud, and its universal recognition makes it easier to sell later. This peace of mind is often worth the small extra premium. Our Silver Bullion Buying Guide explores these choices in more detail.

Strategy 2: Buy in Bulk and Automate Your Investment

Buying larger quantities lowers your per-ounce premium because fixed costs (processing, handling, shipping) are spread across more metal. Most dealers offer tiered pricing that rewards larger orders.

An even smarter approach is Dollar-Cost Averaging (DCA). Instead of trying to time the market, you invest a consistent amount regularly. This disciplined strategy removes emotion and averages your cost over time.

Our Summit Metals Autoinvest program automates this process, creating your own precious metals 401k. You set a monthly budget, and we do the rest, buying more ounces when prices are low and fewer when they are high.

| Approach | One-Time Purchase | Autoinvest (DCA) |

|---|---|---|

| Market Timing Risk | High (all-in on one price) | Low (spread across months) |

| Average Cost | Depends on luck | Smoothed out over time |

| Convenience | Manual effort each time | Set it and forget it |

| Budgeting | Requires lump sums | Predictable monthly amounts |

| Emotional Investing | High (prone to FOMO/panic) | Low (disciplined and automatic) |

Learn more about this systematic approach in The Basics of Gold and Silver Stacking.

Strategy 3: Look for Special "At-Spot" Deals

This is the closest you'll get to true spot pricing. These promotional offers are real but limited.

- New Customer Offers: Many dealers offer a specific item (like a 1oz silver round) at or near spot to first-time buyers to earn their business.

- Limited-Time Promotions: Dealers may use these to move specific overstocked inventory.

These deals are loss-leaders—items sold at little to no profit to attract customers. They are typically restricted to small quantities and specific products. While you shouldn't build your strategy around them, they are great opportunities when you find them. Our guide on How to Snag Silver Bullion at Spot Price explains how to take advantage of these rare deals.

Navigating the Market: Finding Reputable Dealers and Avoiding Pitfalls

When chasing low prices, it's crucial to only work with reputable dealers. Remember the golden rule: if a price seems too good to be true, it almost certainly is.

Protecting yourself starts with knowing what to look for in a trustworthy dealer. Here’s how to do your due diligence:

- Check Their Track Record: Look for companies that have been serving investors for years.

- Read Online Reviews: Use sites like Shopper Approved, Google Reviews, and the Better Business Bureau (BBB) to gauge customer satisfaction. Consistent, long-term feedback is a great sign.

- Verify Authenticity Guarantees: A reputable dealer will stand behind their products with an ironclad guarantee and work directly with major mints.

- Avoid Suspiciously Low Prices: Prices far below the market average from unknown sources are a major red flag for counterfeit products or scams.

- Look for Professional Affiliations: Being an authorized distributor for mints like the Royal Canadian Mint indicates trust within the industry.

Our guide, Your Golden Compass to a Reputable Gold Dealer, offers more tips on identifying trustworthy sources.

A Step-by-Step Guide on How to Buy Gold and Silver at Spot Price (or Close to It)

Follow this process to get the best possible price safely:

- Check the Live Spot Price: You need a baseline. Reputable dealer websites, including ours, feature live price feeds for your convenience.

- Compare Reputable Dealers: Check multiple trusted dealers for the products you want. Keep an eye out for new customer "at-spot" offers.

- Analyze the Total Cost: Don't just focus on the premium. Factor in shipping, insurance, and any payment processing fees to find the true lowest cost per ounce.

- Verify Dealer Reputation: Use the methods above. A slightly higher premium from a top-tier dealer is better than a risky deal from an unknown seller.

- Lock In Your Price: Precious metals prices fluctuate constantly. Once you commit to an order, most dealers lock your price, but you must complete payment promptly.

For more tips, see our guide on How to Buy Gold and Silver Online Safely.

Spotting Hidden Fees and Choosing the Right Payment Method

Even with a low premium, hidden fees can inflate your cost. Scrutinize the final invoice for:

- Shipping and Insurance: Some dealers offer free shipping over a certain threshold, while others charge flat or variable rates. Ensure your shipment is fully insured.

- Processing Fees: Question any vague "administrative" or "processing" fees that aren't clearly explained.

- Payment Method Costs: Credit card/PayPal payments often incur a 3-4% surcharge, which is passed on to you. Bank wires and checks typically offer the best pricing, especially for larger orders.

Choosing the right payment method can save you a significant amount. Our Foundational Precious Metals Knowledge section covers more of these financial details.

Frequently Asked Questions about Buying Precious Metals

As you learn how to buy gold and silver at spot price, questions are natural. Here are honest answers to the most common ones.

Can you actually buy physical gold or silver at the exact spot price?

In almost all cases, no. The spot price is a benchmark for raw, unfabricated metal traded in enormous volumes between institutions. When you buy a physical coin or bar, you are buying a finished product. The premium you pay above spot covers essential costs like refining, minting, security, and distribution.

Those "at-spot" deals you see are promotional tools—loss-leaders offered to new customers on a limited basis to introduce you to a dealer's service. They are the exception, not the rule.

What is the best form of gold or silver for a new investor?

For new investors, we often recommend government-minted coins like American Eagles or Canadian Maple Leafs. Although they have slightly higher premiums, they offer significant advantages:

- Instant Recognizability: They are trusted and easy to liquidate worldwide.

- Government Backing: Their weight and purity are guaranteed by a sovereign government.

- Security Features: Advanced anti-counterfeiting technology provides peace of mind.

- Legal Tender Status: A face value offers an additional layer of legal protection.

If your sole focus is the lowest possible premium, generic bars from reputable refiners are an excellent choice. The best option for you balances low cost with security and ease of resale.

How does buying in larger quantities lower the price?

This is due to economies of scale. Every order has fixed costs for a dealer, such as processing, secure packaging, and shipping. When you buy in larger quantities, these fixed costs are spread across more ounces, which lowers your per-ounce premium.

Dealers also get better pricing from mints on bulk orders and can pass those savings on to you. This is why you see tiered pricing on most dealer websites—the more you buy, the lower the premium per ounce.

This principle is why our Autoinvest program is so effective. It allows you to make consistent, automated monthly purchases. This not only helps you dollar-cost average but can also help you take advantage of better pricing over time, just like a bulk buyer.

Conclusion: Your Golden Opportunity

The secret to how to buy gold and silver at spot price isn't about finding a mythical deal; it's about becoming a savvy investor who consistently minimizes premiums. You now have the strategies to do just that.

You know that spot price is a benchmark, not a retail price. You understand how to choose the right products, balancing low premiums with the security of government-minted coins. You see the power of buying in larger quantities and using dollar-cost averaging with programs like Summit Metals' Autoinvest to build wealth systematically.

Most importantly, you are equipped to identify trustworthy dealers and avoid the pitfalls of hidden fees and questionable sellers. This knowledge is the key to building a foundation of tangible wealth that can protect your purchasing power for decades to come.

Investing in precious metals is a marathon, not a sprint. It's about preserving wealth and securing your financial future. Gold and silver have been a store of value for millennia, and that enduring legacy is what makes them a cornerstone of a resilient portfolio.

Ready to take the next step? Browse our authenticated precious metals today, or harness the power of consistent investing and start your journey with our Autopays subscription service. Welcome to smart precious metals investing.