Why Gold Demands Your Attention in 2025

Is gold good investment for your portfolio right now? Here's what you need to know:

Quick Answer:

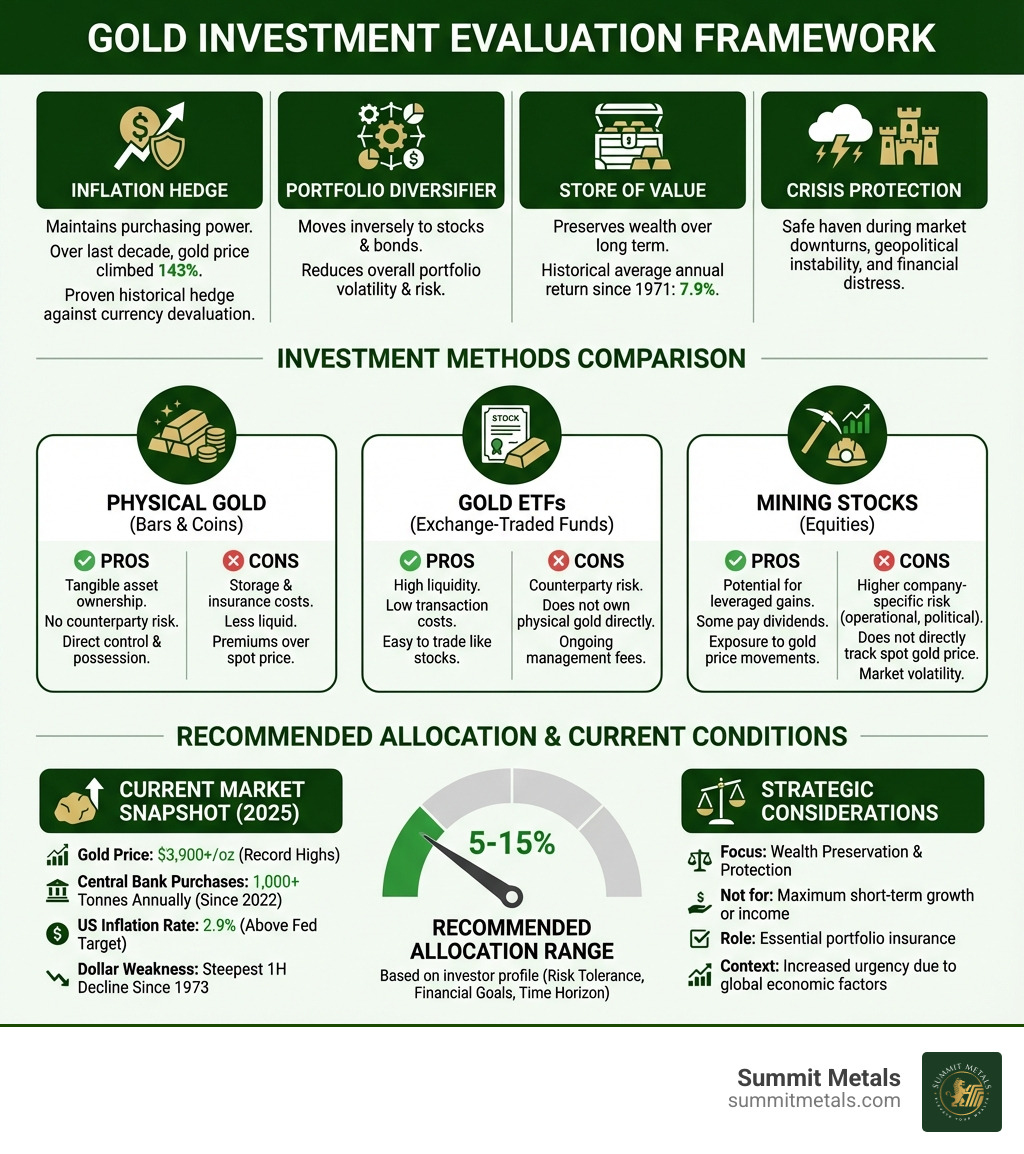

- Yes, for wealth preservation - Gold has climbed 143% over the past decade and provides a proven hedge against inflation and currency devaluation

- Yes, for portfolio diversification - Gold typically moves inversely to stocks and bonds, reducing overall portfolio risk

- Yes, for current conditions - With gold hitting $3,900+ per ounce in 2025, central banks buying record amounts (1,000+ tonnes annually since 2022), and inflation at 2.9%, the fundamentals remain strong

- Not ideal for income - Gold generates no dividends or interest, making it unsuitable for investors seeking regular cash flow

- Best allocation: 5-15% - Most financial advisors recommend limiting gold exposure to this range

The question is gold good investment has echoed through trading floors and kitchen tables for decades, but 2025 has brought unprecedented urgency to the answer. Gold prices have shattered records throughout the year, surging past $3,900 per ounce—a 40% increase in just twelve months. Yet even as the S&P 500 has climbed 35.7% over the same period, investors are pouring billions into the yellow metal at a pace not seen since the 2008 financial crisis.

This isn't speculation or hype. Global central banks have collectively purchased more than 1,000 tonnes of gold each year since 2022, up from an average of 481 tonnes annually between 2010 and 2021. When the world's most sophisticated financial institutions dramatically increase their gold holdings, individual investors need to pay attention.

But here's what most investors miss: Gold isn't competing with stocks for the highest returns. It's playing a different game entirely—one of preservation, protection, and portfolio insurance. While stocks have historically delivered 10.7% annual returns since 1971 compared to gold's 7.9%, that calculation ignores gold's real value: its ability to maintain purchasing power when paper currencies falter, markets crash, and geopolitical tensions flare.

The current economic landscape makes this distinction critical. US inflation sits at 2.9%, well above the Federal Reserve's 2% target. The dollar has experienced its steepest first-half decline since 1973. Political gridlock, trade tensions, and mounting government debt have created an environment where traditional safe havens—bonds and cash—are losing their appeal.

For someone evaluating is gold good investment for their situation, the answer isn't binary. It depends on your financial goals, time horizon, and risk tolerance. If you're chasing maximum growth over the next year, gold probably isn't your answer. But if you're building a resilient portfolio that can weather economic storms while preserving purchasing power over decades, gold deserves serious consideration.

I'm Eric Roach, and I've spent more than a decade structuring risk-management strategies for Fortune 500 companies before founding Summit Metals to bring that same institutional discipline to individual investors evaluating is gold good investment for their portfolios. My experience guiding clients through market volatility has shown me that the investors who thrive aren't chasing the highest returns—they're building balanced portfolios that can survive any market condition.

Is gold good investment terms explained:

The Case for Gold: A Modern Safe Haven

Gold has been a cornerstone of wealth for centuries, and for good reason. It offers unique benefits that other assets simply can't match, particularly in today's dynamic economic environment. Let's explore why gold has consistently demanded attention.

Store of Value: Gold's enduring appeal stems from its tangibility and intrinsic value. Unlike paper money, it cannot be printed into oblivion, nor does it rely on the promise of a government or corporation. This makes it a powerful hedge against currency debasement and a reliable store of wealth across generations. Its role as currency and a store of value has a long and fascinating history.

Hedge Against Inflation & Devaluation: When inflation rears its head, your purchasing power erodes. Gold, however, tends to maintain its value, acting as a shield against rising prices. The latest annual inflation rate for the United States was 2.9% in August 2025, up slightly from 2.7% in July. In such an environment, gold's ability to protect purchasing power becomes crucial. Moreover, as the U.S. dollar has experienced its steepest first-half decline since 1973, many investors are looking for alternatives to protect their wealth from the declining power of the U.S. dollar.

Performance During Volatility: Gold truly shines when markets are turbulent. During times of economic uncertainty, geopolitical instability, or even outright market crashes, gold often serves as a safe haven. Research from the Federal Reserve Bank of Chicago indicates that investors view gold as protective during "bad economic times." When everything else seems to be falling apart, gold often holds its ground or even gains value, offering a sense of security.

Portfolio Diversification: One of gold's most compelling attributes is its non-correlated nature. It tends to move independently of traditional asset classes like stocks and bonds, which means when those assets are struggling, gold might be performing well. This characteristic helps to reduce overall portfolio risk and smooth out returns. For a deeper dive into this, explore the role of physical gold purchase in diversifying your portfolio.

Surging Central Bank Demand: It's not just individual investors who recognize gold's value. Global central banks have been on a significant gold-buying spree, collectively purchasing more than 1,000 tonnes of gold each year since 2022. This is a substantial increase from the average of 481 tonnes a year between 2010 and 2021. This institutional demand underscores gold's perceived stability and importance in a volatile global economy. Understanding why central banks buy gold (and why you should too) can provide valuable insights.

How to Invest in Gold: A Practical Guide for 2025

Once you've decided that gold might be a valuable addition to your portfolio, the next step is to understand the various ways to invest. From holding the physical metal in your hand to investing in gold-related stocks, there's an option for almost every investor.

Investing in Physical Gold: Coins, Bars, and More

For many, the idea of owning gold conjures images of shiny coins or hefty bars. Physical possession offers ultimate control and eliminates counterparty risk, making it a popular choice for long-term investors.

Tangible Ownership: Owning physical gold means you have direct control over your asset. There's no third party holding it for you (unless you choose secure storage), which eliminates counterparty risk—the risk that the entity holding your asset might default. This tangible aspect is what draws many to demystifying physical precious metals.

Making the Choice: When it comes to physical gold, you'll primarily choose between bars and coins. Each has its own advantages, depending on your investment goals. You can also consider jewelry, though its value is often inflated by craftsmanship and aesthetic appeal rather than pure gold content, and scrap gold, which is typically sold at melt value.

| Feature | Gold Bars | Gold Coins |

|---|---|---|

| Premium Over Spot | Lower, especially for larger bars, as they are simpler to produce | Higher, due to intricate minting costs, collectible value, and legal tender status |

| Liquidity | High, but very large bars might be less divisible for smaller transactions | Very high, especially for globally recognized 1oz coins, making them easy to sell |

| Fraud Protection | Relies on brand reputation (e.g., PAMP Suisse) and assay certificates to guarantee purity and weight | Often backed by governments as legal tender, adding a layer of security and trust that helps protect against counterfeiting |

| Recognizability | Varies by refiner, though major brands are well-known | Universally recognized (e.g., American Eagles, Canadian Maples, Krugerrands), simplifying transactions globally |

For a full breakdown, check out our guide on bars or coins: your ultimate gold investment showdown.

Paper Gold: ETFs and Mutual Funds

If the idea of securing and insuring physical gold isn't for you, "paper gold" offers an alternative way to gain exposure to gold prices without the logistical challenges.

Gold ETFs: Exchange-Traded Funds (ETFs) are popular for their convenience. They track the price of gold, allowing you to buy shares that represent ownership in a trust that holds physical gold. Examples include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU). They offer low transaction costs and are easily traded on stock exchanges. However, you don't own the physical gold directly. For a detailed comparison, see physical bullion vs. gold/silver ETFs: pros and cons.

Gold Mutual Funds: These funds invest in a portfolio of gold-related assets, which can include physical gold, gold mining stocks, and other derivatives. They offer diversification within the gold sector but often come with higher management fees compared to ETFs.

Gold-Related Equities: Mining and Royalty Stocks

Another indirect way to invest in gold is by buying shares in companies involved in its production. This approach offers a different risk-reward profile.

Gold Mining Stocks: Investing in gold mining companies can offer leveraged returns. If the price of gold rises, the profits of a mining company can increase disproportionately. However, these stocks are subject to operational risks (e.g., mining accidents, labor disputes, regulatory changes) and market volatility that go beyond just the price of gold.

Royalty & Streaming Companies: These companies provide financing to gold miners in exchange for a percentage of future production or revenue. This hybrid model offers exposure to gold prices with less operational risk than direct mining, as they don't incur the high capital and operating costs of running a mine.

Is Gold a Good Investment? Weighing the Pros and Cons

Now that we've covered the "how," let's tackle the "is it good?" question directly. Gold, like any investment, has its strengths and weaknesses. A balanced evaluation is key to determining if it aligns with your financial objectives.

The Golden Upside: Why is gold a good investment for wealth protection?

Gold's primary appeal lies in its ability to preserve wealth and act as a financial shield, especially when other asset classes falter.

Key Advantages: Gold is a proven inflation hedge, meaning it tends to hold its value when the cost of living rises. It's often considered the ultimate safe haven asset during times of crisis. Furthermore, its low correlation with other assets makes it a powerful portfolio diversifier, enhancing stability. Finally, it's a tangible and highly liquid asset, easily bought and sold globally.

Historical Performance: While the stock market has delivered a higher average annual return of 10.7% from 1971 to 2024, gold has also provided a respectable 7.9% average annual return over the same period. This shows that while it might not always outperform, gold is far from a stagnant asset. According to research highlighted by Forbes, this long-term performance underscores its value.

The Tarnished Truth: Potential Downsides and Risks

Despite its undeniable shine, gold is not without its drawbacks. It's important to understand these before making any investment decisions.

No Yield: One of gold's most significant "shortcomings," as legendary investor Warren Buffett observed, is that it does not produce income. Gold sits there, "lifeless," as he put it. Unlike stocks that pay dividends or bonds that pay interest, gold doesn't generate cash flow until you sell it. Buffett famously cautioned investors in a 2011 letter about this very point.

Opportunity Cost: Because gold doesn't generate income, investing in it means you might be missing out on potential higher returns from other assets. For instance, stocks have historically averaged 10.7% annually, significantly higher than gold's 7.9%. If your primary goal is maximizing growth, tying up capital in a non-yielding asset might be an opportunity cost you're unwilling to bear.

Additional Costs: Owning physical gold comes with its own set of expenses. You'll need secure storage, whether that's a home safe or a professional depository in Salt Lake City, Utah. You'll also need insurance to protect against theft or loss. These ongoing costs can eat into your returns, especially over the long term. Understanding these factors is part of the ultimate guide to gold and other precious metals storage.

Price Volatility: While gold is considered a safe haven, its price can still be volatile. The price of gold has surged to numerous all-time highs throughout 2025, currently sitting just under $3,900 per ounce. While exciting, buying at all-time highs carries the risk of a market correction, as seen in previous gold rallies.

The Verdict: When is gold a good investment for your portfolio?

So, is gold good investment for you? The answer depends entirely on your financial goals, risk tolerance, and overall investment strategy.

Best For: Gold is an excellent choice for long-term wealth preservation, acting as a form of portfolio insurance against economic downturns, inflation, and geopolitical turmoil. It's for those who value stability and protection over aggressive growth.

Not Ideal For: If your primary objective is generating regular income or seeking short-term, speculative gains, gold is generally not the ideal investment. Its lack of yield and potential for volatility make it less suitable for these purposes.

Crafting Your Golden Strategy: Allocation, Timing, and Long-Term Goals

A successful gold investment isn't about reacting to market hype; it's about having a clear, disciplined strategy.

How Much Gold Should You Own?

This is a common question without a one-size-fits-all answer.

Portfolio Allocation: Most financial experts recommend a modest allocation to gold, typically ranging from 5% to 15% of your total portfolio. This allows you to benefit from gold's diversifying and protective qualities without over-exposing yourself to its unique risks.

Personalized Approach: Your ideal allocation will depend on factors like your age, how much risk you're comfortable with, and your specific financial goals. Younger investors with a higher risk tolerance might opt for a lower percentage, while those nearing retirement or with a more conservative outlook might lean towards the higher end. For more insights, consider understanding the role of gold in asset allocation.

When is the Best Time to Buy Gold?

Trying to perfectly time the market—buying at the absolute bottom and selling at the absolute top—is a fool's errand that even seasoned professionals struggle with. A disciplined approach is far more effective.

Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of the current price. For example, you might decide to buy $100 worth of gold every month. When prices are high, you buy less gold; when prices are low, you buy more. Over time, this averages out your purchase price, mitigates volatility, and removes emotion from your buying decisions. Learn more about the power of dollar-cost averaging in gold investments.

Automated Investing: To make dollar-cost averaging even easier, consider setting up an "Autoinvest" plan. This allows you to make consistent monthly purchases automatically, much like contributing to a 401(k). It builds your gold position steadily over time, leveraging the benefits of DCA without you having to manually place orders. At Summit Metals, we make it simple to set up your automated gold investment plan.

Choosing a Reputable Dealer

Your investment is only as secure as the dealer you buy from. Especially when dealing with physical precious metals, trust and transparency are paramount.

Due Diligence: Always look for dealers with transparent pricing, clear buy-back policies, and a strong track record of positive customer reviews. This ensures you know exactly what you're paying and that you'll have an easy time selling when you're ready.

Avoid Scams: The precious metals market, like any other, can attract unscrupulous actors. Work with established dealers to ensure you are buying authentic, investment-grade metal and avoiding counterfeits. Our guide on identifying reputable bullion dealers and avoiding counterfeits can help you steer this. As a Wyoming-based company with locations in Salt Lake City, Utah, we pride ourselves on transparent, real-time pricing and competitive rates, ensuring you receive authentic products and exceptional value.

Frequently Asked Questions About Investing in Gold

How has gold performed historically compared to stocks?

Over the long term (since 1971), the stock market has delivered average annual returns of 10.7%, while gold has delivered 7.9%. So, stocks have generally provided higher total returns. However, this isn't the full picture. Gold often outperforms stocks during periods of high inflation, recession, and geopolitical instability, acting as a crucial tool for portfolio stabilization when stocks struggle. For more depth, read why gold's return is higher than you think.

Can I hold physical gold in my IRA?

Yes, you can hold certain IRS-approved gold coins and bars in a self-directed Individual Retirement Account (IRA). However, you cannot store it at home. The metal must be stored in an approved, third-party depository. This setup allows you to enjoy the tax benefits of an IRA while diversifying your retirement savings with physical precious metals. Learn more about maximizing retirement security with a precious metals IRA.

Is silver a better investment than gold right now?

It depends on your investment strategy and risk tolerance. Silver has greater industrial use than gold, which can make its price more volatile and tied to economic cycles. With the gold-to-silver ratio at historical highs, some investors believe silver is currently undervalued compared to gold and thus has more room for price growth. Others prefer gold for its greater stability and role as a monetary metal. For a comprehensive look, explore is silver a good investment?.

The Final Verdict: Securing Your Financial Future with Gold

Gold is not a get-rich-quick scheme. It is a strategic asset for long-term wealth preservation, a hedge against uncertainty, and a vital component of a diversified investment portfolio. While it may not always glitter the brightest, its enduring value provides a foundation of stability that can help your portfolio weather any storm. By taking a disciplined, long-term approach, you can harness the power of gold to build a true financial fortress.

As a Wyoming-based dealer with locations in Salt Lake City, Utah, Summit Metals provides authenticated, investment-grade gold and silver with transparent, real-time pricing, helping you invest with confidence. Our commitment to competitive rates, often achieved through bulk purchasing, ensures you get the best value for your investment.

Ready to add a layer of security to your portfolio? Start building your precious metals holdings today with our automated investment plan.