Why Understanding Copper Ingot Pricing Matters for Your Portfolio

The price of copper ingots per pound currently ranges from approximately $4.65 to $5.40 per pound depending on form and purity. Here's a quick look:

- Spot Price Range: $4.65 - $5.39 per pound (market fluctuates daily)

- Copper #1 Scrap: $5.40 per lb

- Copper #2 Scrap: $5.20 per lb

- Bare Bright Copper: $5.50 per lb

- Retail Copper Ingots: Spot price + premium (typically $1-2 per ounce or more)

Note: Prices shown are at the time of this publication and change constantly based on global market conditions.

Copper has earned the nickname "Dr. Copper" among economists for its ability to diagnose the health of the global economy. Rising copper prices often signal growing construction and manufacturing, while falling prices can warn of economic slowdowns.

Unlike gold and silver—which primarily serve as stores of wealth—copper is an industrial workhorse. Electric vehicles, solar panels, wind turbines, and electrical grids all depend on this versatile metal. This widespread industrial demand makes copper both a commodity and an attractive investment.

However, copper pricing is more complex than a single spot price. The number quoted online is the raw market value. The price you pay for a physical copper ingot depends on purity, fabrication costs, dealer premiums, and form—whether it's bars, rounds, or scrap.

Understanding these pricing layers is essential for industrial buyers, collectors, and investors. The copper market moves fast, influenced by everything from labor strikes at Chilean mines to surging demand for electric vehicles in China.

With a decade of experience advising on multi-billion-dollar hedging programs, I've seen how industrial metals like copper fit into sophisticated risk-management strategies. Today, our team helps individual investors understand the price of copper ingots per pound and how physical metals can serve as a resilient hedge alongside traditional portfolios.

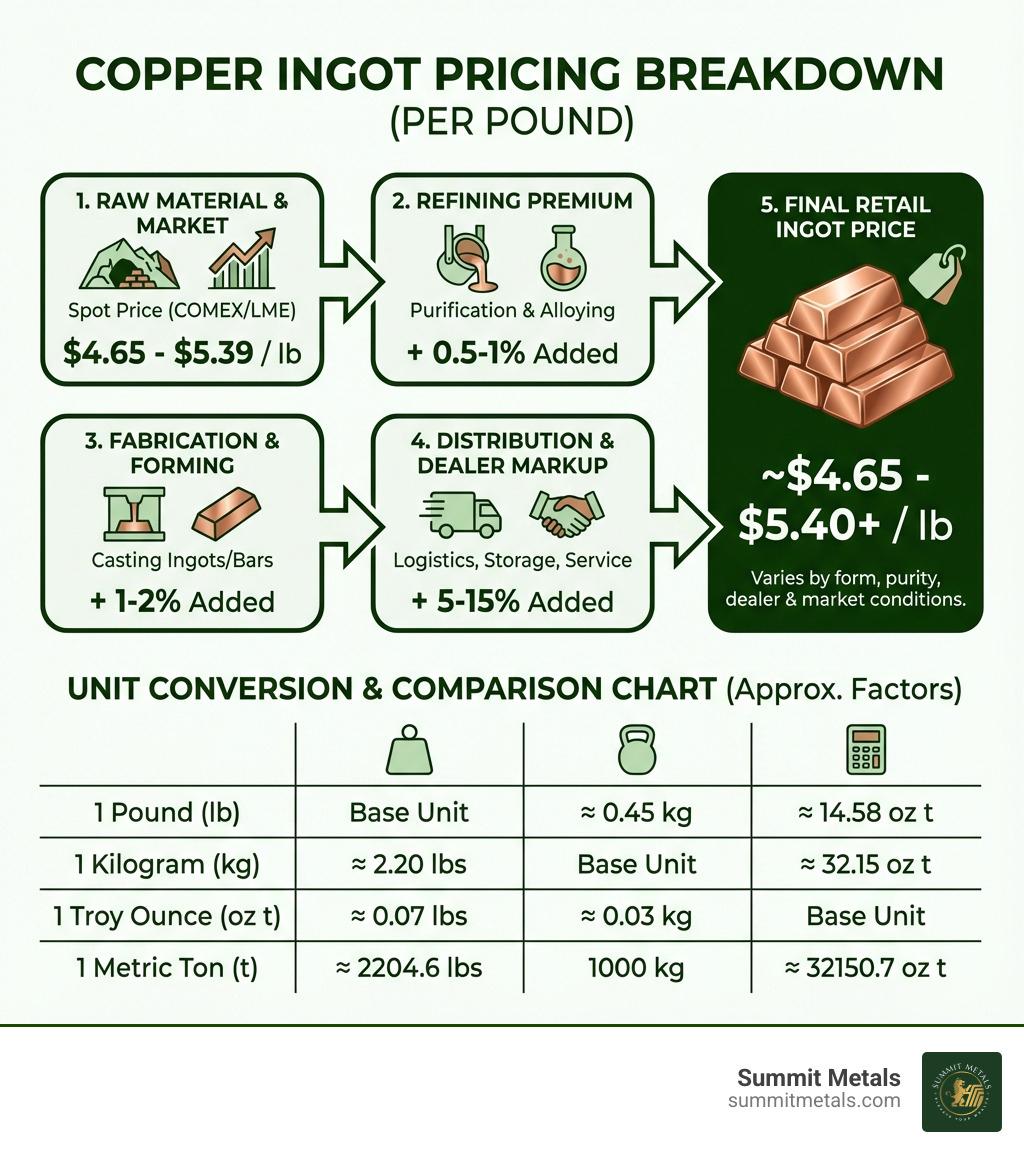

Infographic: The journey from copper mine to your copper ingot—showing spot price determination at commodity exchanges (COMEX, LME), plus added premiums for refining (0.5-1%), fabrication (1-2%), distribution costs, and dealer markup (5-15%), resulting in final retail price per pound. Includes conversion chart showing price per pound, per kilogram, per troy ounce, and per metric ton.

Must-know price of copper ingots per pound terms:

- What is copper bullion?

- copper bars

- selling copper bullion

Understanding the Current Price of Copper Ingots Per Pound

When discussing the price of copper ingots per pound, it's crucial to know there isn't one static number. The copper market is dynamic, constantly shifting with global supply and demand. The "current price" usually refers to the spot price – the price for immediate delivery of the raw commodity.

Currently, the live bid price for copper is around $5.3897 per pound, with an ask price of $5.3948 per pound. You might also see market prices around $4.65 per pound. These figures reflect real-time market value but are just the starting point. To stay informed, you can set up Google Alerts for "copper prices." For comprehensive data, the LME Copper page is an excellent resource.

What is the Spot Price vs. the Price You Pay?

The spot price of copper is a baseline for one pound of raw copper, determined by futures contracts on major exchanges like the LME. It's quoted in US dollars globally to prevent arbitrage.

However, the price you pay for a physical copper ingot will always be higher than the spot price. The journey from raw commodity to a tangible ingot involves several steps, each adding a cost known as a "premium." These premiums cover:

- Refining costs: Turning raw copper ore into pure, investment-grade copper (.999 fine).

- Fabrication costs: Shaping the refined copper into ingots, bars, or rounds.

- Distribution costs: Transporting the finished products from the refiner to the dealer.

- Dealer markup: The profit margin for the dealer, covering their operational expenses and services.

As a result, the final retail price is the spot price plus these accumulated premiums. While the live copper price might be around $5.3897 per pound, the markup for a retail copper ingot can add $1-2 per ounce or more, depending on the product. At Summit Metals, we pride ourselves on transparent, real-time pricing and competitive rates, achieved through bulk purchasing to ensure our customers get the best value.

How Copper is Weighed and Priced in Different Units

Copper is weighed and priced using various units. Understanding the difference is key to assessing value.

- Pounds (lb): A common unit in the US, equal to 453.592 grams.

- Kilograms (kg): Used in international markets, a kilogram is 1,000 grams.

- Metric Tons (Tonne): For large industrial quantities, a metric ton is 1,000 kg. The live price per tonne is approximately $11,882.20.

- Tons (US Ton): A US ton is 2,000 pounds, with a live price of around $12,072.88 per ton.

- Troy Ounce (t oz): Common for precious metals, a troy ounce (31.1035 grams) is slightly heavier than a standard ounce (about 28 grams). You may see smaller copper items priced this way. Each kilogram of copper contains about 32.151 troy ounces.

Understanding these conversions is vital for comparing prices across different sources. For instance, you can convert a price per kilogram to a price of copper ingots per pound for an apples-to-apples comparison.

Key Factors That Influence Copper Prices

The price of copper ingots per pound reflects the broader health of the global economy. Known as "Dr. Copper," it's a leading indicator for economic trends. Prices are influenced by a blend of demand drivers and supply-side pressures, with the LME Copper serving as a global benchmark.

Demand Drivers: From Construction to Clean Energy

Copper's diverse demand makes its price sensitive to shifts across multiple industries:

- Global Economic Health: Booming economies increase demand for copper in everything from coins to crude oil exploration.

- Emerging Markets: Fast-growing economies like China and India require enormous amounts of copper for infrastructure, urbanization, and industrialization.

- US Housing Market: The building construction industry uses nearly half of the US copper supply for electrical wiring, plumbing, and roofing. A strong housing market, including in our local area of Salt Lake City, Utah, directly fuels copper consumption.

- Electrical Wiring: Copper's superior conductivity makes it the top choice for electrical wiring in buildings and power grids.

-

Green Technologies: This is a rapidly growing demand sector for copper. The global transition to renewable energy relies on it:

- Electric Vehicles (EVs): Use significantly more copper than traditional cars.

- Solar Panels and Wind Turbines: These are essential components in renewable energy systems.

- Modern Infrastructure: Smart grids and charging stations are built on a backbone of copper.

These drivers create a strong, unwavering demand for copper, positioning it as the "metal of the future."

Supply-Side Pressures and Market Volatility

While demand pushes prices up, supply challenges can create bottlenecks and escalate the price of copper ingots per pound.

- Mining Output: Most of the world's copper comes from a few regions, particularly Chile and Peru. Disruptions there have a global impact.

- Labor Strikes: Miner strikes can halt production, leading to supply shortages and higher prices.

- Geopolitical Instability: Political unrest or policy changes in producing countries can affect mining and exports.

- Natural Disasters: Earthquakes or extreme weather can damage mining infrastructure and slow output.

- Supply Chain Disruptions: Global events can snarl shipping and logistics, making it more expensive to get copper to market.

- Substitution: As copper prices rise, industries may seek cheaper alternatives like aluminum for power cables or electrical equipment. This can cap price increases if copper becomes too expensive.

While copper is relatively abundant, its vast industrial use means that any supply hiccup can quickly impact prices.

Copper Ingots vs. Other Metals and Forms

When considering the price of copper ingots per pound, it's helpful to compare it to other metals and its various forms. While gold and silver are revered as precious metals, copper stands out as a vital industrial commodity.

Investment-grade copper ingots, like those offered at Summit Metals, are typically .999 fine (99.9% pure). This purity makes them suitable for industrial use and for investors seeking a tangible asset. Unlike gold and silver, copper's investment appeal is tied to its industrial demand and role as an economic indicator. You can learn more in our article, The Shiny Truth: Unpacking What Copper Bullion Really Is.

Understanding Different Forms of Copper

Copper comes in various forms, each with its own pricing and purpose:

- Ingots and Bars: High-purity (.999 fine) copper cast into rectangular shapes, favored by industrial users and investors. Their price includes premiums for refining and fabrication.

- Rounds: Coin-shaped but without legal tender status, often featuring artistic designs. Their value includes the metal content plus a potential premium for aesthetics.

-

Scrap Copper: Recycled copper with varying purities. Prices are lower than for ingots due to processing costs. Grades include:

- Bare Bright: The highest grade of uncoated, unalloyed wire, commanding the highest scrap price (around $5.50 per lb).

- Copper #1 Scrap: Clean, unalloyed copper pipe or wire (around $5.40 per lb).

- Copper #2 Scrap: May have impurities or coatings, priced lower (around $5.20 per lb).

Scrap is for industrial recycling, not investment. Learn more about different bar types in our guide, Copper Bar Types 101.

Copper Ingots vs. Copper Scrap vs. Gold Bars vs. Gold Coins

This comparison highlights the unique investment propositions of copper and gold.

| Feature | Copper Ingots (e.g., 1kg bar) | Copper Scrap (#1, #2) | Gold Bars (e.g., 1oz bar) | Gold Coins (e.g., 1oz American Eagle) |

|---|---|---|---|---|

| Investment Purpose | Industrial demand, economic indicator, tangible asset, diversification | Recycling, industrial reuse, short-term commodity speculation | Store of wealth, inflation hedge, long-term value | Store of wealth, legal tender, fraud protection, collectibility |

| Pricing Basis | Spot price + refining, fabrication, dealer premium | Spot price (lower purity) - processing costs | Spot price + fabrication, assay, dealer premium | Spot price + numismatic premium, legal tender value, dealer premium |

| Liquidity | Good, but less liquid than gold/silver | Varies by grade and market | Very high | Very high |

| Storage Considerations | Heavier, takes up more space per dollar value | Bulky, often requires industrial storage | Compact, high value density | Compact, high value density |

| IRA Eligibility | No, generally not eligible | No | Yes, for specific purities (.999+) | Yes, for specific purities (.999+) |

Benefits of Gold Coins: Gold coins issued by sovereign governments, like the American Gold Eagle, offer unique advantages. They carry a face value and legal tender status, which provides a layer of protection against fraud. Their intricate designs and limited mintages can also add numismatic (collectible) value beyond their base metal content.

Benefits of Gold Bars: Gold bars are often preferred by investors seeking the lowest possible premium over the spot price. Their simple form means lower fabrication costs than coins, and they are highly efficient for storage, packing significant value into a small, dense package ideal for secure vaults.

Benefits of Copper Ingots: Copper ingots provide an affordable entry point into tangible metal assets. They are a direct investment in industrial demand and global economic growth, offering diversification away from traditional precious metals.

Benefits of Copper Scrap: The primary benefit of copper scrap is its recycling value for industrial reuse. However, its variable purity and quality mean it is not considered an investment-grade asset like bullion ingots or bars.

Investing in Copper: A Practical Guide

Investing in physical copper ingots can be a great way to diversify your portfolio and tap into industrial and technological growth. However, it requires careful consideration.

Strategies for Building a Metals Portfolio

Building a robust metals portfolio involves strategic planning based on your goals.

- Dollar-Cost Averaging with Summit Metals Autoinvest: A smart strategy for any commodity is dollar-cost averaging—investing a fixed amount at regular intervals. This smooths out price volatility and can lower your average purchase price. At Summit Metals, our Autoinvest program makes this easy. It allows you to buy copper (and other metals like gold and silver) every month, similar to investing in a 401k, providing a disciplined approach to building wealth.

- Diversification Across Different Metals: A well-rounded portfolio should also include gold and silver. They provide a hedge against inflation and economic uncertainty, complementing copper's industrial appeal and balancing risk.

- Long-Term vs. Short-Term Goals: Consider your investment horizon. Copper's industrial drivers suggest strong long-term potential. Short-term trading is possible but carries higher risk due to volatility. Our article, Is a 1kg Copper Bar Your Next Long-Term Investment?, explores this further.

Risks of Investing in Copper:

- Market Volatility: Prices can fluctuate significantly due to economic shifts and supply disruptions.

- Storage: Physical copper is bulky and requires secure storage.

- Liquidity: Selling large quantities may take more time than selling gold or stocks.

- Not IRA Eligible: Copper cannot be held in a Precious Metals IRA for tax advantages.

The Process of Buying and Selling Copper Bullion

The process of buying and selling copper should be straightforward.

- Finding Reputable Dealers: Your top priority is finding a dealer with a strong reputation for authenticity and transparent pricing. Summit Metals is a trusted source for authenticated metals, offering competitive rates due to our bulk purchasing power.

- The Buying Process: When you decide to buy, a reputable dealer will let you "lock in" the price. They typically accept various payment methods, with bank wires or checks sometimes offering a discount over credit cards. Ensure your purchase is fully insured during transit. We guarantee secure and discreet shipping.

- The Selling Process: When selling, you'll get a quote (the bid price), lock it in, and ship your metals to the dealer. They will verify authenticity and purity before issuing payment. For a detailed guide, see From Bar to Bank: Your Guide to Selling Copper Bullion.

Frequently Asked Questions about the Price of Copper Ingots per Pound

Here are answers to some common questions about the price of copper ingots per pound.

Why do different dealers have different prices for copper ingots?

While the spot price of copper is universal, retail prices vary between dealers. This is due to differences in the "premium" added to the spot price. Factors influencing the premium include:

- Dealer Overhead: Larger dealers with higher sales volumes, like Summit Metals, can often charge smaller premiums as their costs are spread across more sales.

- Bulk Purchasing Power: Dealers who buy in bulk from refiners get better wholesale prices, which can be passed on to customers.

- Operating Costs: Refining, fabrication, shipping, and insurance costs can differ between suppliers.

- Purity and Brand: Specific brands or highly recognized refiners might command a slightly higher premium.

The difference between a dealer's buying price (bid) and selling price (ask) is the "spread," which also varies.

Is investing in physical copper better than other forms of copper investment?

Physical ownership of copper ingots offers distinct advantages over financial instruments like ETFs or futures contracts:

- Tangible Asset: You have direct control over your investment.

- No Counterparty Risk: Owning the physical metal eliminates the risk that the other party in a financial contract (like an ETF issuer) might default. You own the asset outright.

- Simplicity: The value is tied directly to the market price of the metal. ETFs and futures can be more complex, with management fees and tracking errors.

- Security: While physical metal requires secure storage, this is a trade-off for the peace of mind that comes with owning a real asset.

For most long-term investors, physical copper ingots are often the preferred choice.

Are there taxes on buying or selling copper ingots?

Yes, buying and selling copper can have tax implications.

- Sales Tax: When you purchase copper, your transaction may be subject to state and local sales taxes. These regulations vary significantly by location. Some states offer exemptions for bullion purchases, so it's crucial to understand the rules in your specific area, such as Utah.

- Capital Gains Tax: If you sell your copper for a profit, you may owe capital gains tax. The rate depends on how long you held the asset (short-term vs. long-term) and your income.

- Consult a Tax Professional: Tax laws are complex and change. We always advise clients to consult with a qualified tax professional to understand their specific obligations when buying or selling any metal. This ensures compliance with all federal, state, and local regulations.

Conclusion

The price of copper ingots per pound is far more than just a number on a screen; it's a window into the global economy and a reflection of industrial progress. We've explored how the spot price forms the foundation, but premiums for refining, fabrication, and dealer services ultimately determine the retail cost. We've also seen how powerful forces like emerging market growth, the US housing market, and the accelerating demand for green technologies are driving copper's value, while supply disruptions can cause significant price volatility.

Understanding these dynamics empowers you to make informed decisions about your investments. While copper offers a compelling opportunity as an industrial workhorse and economic bellwether, we also recognize the enduring appeal and stability of investment-grade precious metals like gold and silver. These metals serve as time-tested stores of wealth, offering a crucial hedge against inflation and economic uncertainty.

At Summit Metals, we are committed to providing transparent, real-time pricing and competitive rates for authenticated gold and silver, enabling you to build a resilient and diversified metals portfolio. Whether you're interested in the industrial might of copper or the steadfast value of gold and silver, we're here to guide you. Learn how to safely and confidently buy metals online with us.