The Rising Interest in Copper as an Investment Asset

A copper bar 1kg has become an increasingly popular topic among investors looking to diversify beyond traditional precious metals, but the reality of copper bullion investment is more complex than it appears. Here's what you need to know:

Key Facts About 1kg Copper Bars:

- Weight: 1 kilogram (35.274 troy ounces)

- Purity: Typically .999 fine copper

- Purchase Price: $39-$54 from dealers

- Scrap Value: Approximately $9 (based on copper spot price)

- Premium: 300-500% over spot price

- Primary Use: Novelty items and collector pieces rather than investments

The copper market has seen dramatic changes since the early 2000s, with prices surging from under $1 per pound to around $4.50 per pound within a decade. This price appreciation has caught the attention of retail investors, leading many to consider copper bars as a potential investment vehicle.

However, copper is a base metal, not a precious metal like gold or silver. While copper has essential industrial applications in infrastructure, electronics, and electric vehicles, the investment case for physical copper bullion faces significant challenges due to extremely high premiums over spot price.

As one Reddit investor finded after purchasing a 1kg copper bar for $39.30: "The actual value of the bar is about $9... Copper bullion is a novelty item with prohibitively high premiums." This stark difference between purchase price and intrinsic value highlights the primary obstacle facing copper bullion investors.

I'm Eric Roach, and during my decade as an investment banking advisor on Wall Street, I've guided clients through complex hedging strategies and alternative asset allocations, including physical metals portfolios. While I've helped clients successfully diversify with gold and silver, the economics of a copper bar 1kg investment present unique challenges that every potential buyer should understand.

What Is a 1kg Copper Bar?

A copper bar 1kg is exactly what it sounds like—a solid block of copper weighing one kilogram (about 2.2 pounds). To put this in perspective, that's roughly 35.274 standard ounces, though copper isn't typically measured in troy ounces like precious metals.

These bars pack some serious weight and have that distinctive reddish-brown copper color that makes them instantly recognizable. Most copper bars 1kg are made from .999 fine copper, meaning they're 99.9% pure. Some premium manufacturers like Geiger even produce bars with .9999 fine purity—that's 99.99% pure copper.

The physical dimensions can vary by manufacturer, but a typical copper bar 1kg might measure around 142mm long, 80mm wide, and 10mm thick. That gives it a substantial, almost loaf-like appearance that feels satisfying to hold—if you enjoy the tactile experience of physical metals.

What are the different types of copper bars?

Just like their precious metal cousins, copper bars come in different styles based on how they're made. Each manufacturing method creates a distinct look and feel.

Cast bars are created by melting copper and pouring it into molds. This gives them a more rustic, handcrafted appearance with slightly rough textures and sometimes visible pour lines. Many larger copper bars, including copper bars 1kg, use this casting method. The "Elemental Cast Copper Bar" is a popular example, often featuring copper's periodic table information pressed into the surface.

Poured bars take the casting concept further, celebrating the natural flow of molten metal. These bars often have irregular edges and unique character marks that make each one slightly different. Geiger Edelmetalle produces beautiful poured copper bars that come sealed and serialized, combining traditional craftsmanship with modern security features.

Minted bars are pressed under high pressure, similar to how coins are made. This creates smooth, uniform surfaces perfect for intricate designs and sharp edges. While less common for large copper bars 1kg due to the high cost of minting such substantial pieces, this method produces stunning smaller copper rounds and art bars.

Beyond manufacturing methods, design variations are endless. Some copper bars feature artistic designs, historical motifs, or even replicas of old currency. These artistic elements make them particularly appealing to collectors who appreciate both the metal content and the craftsmanship.

For those who appreciate unique artistry, an artistic copper bar design shows how beautiful these pieces can be.

How does copper bullion compare to other forms of copper investment?

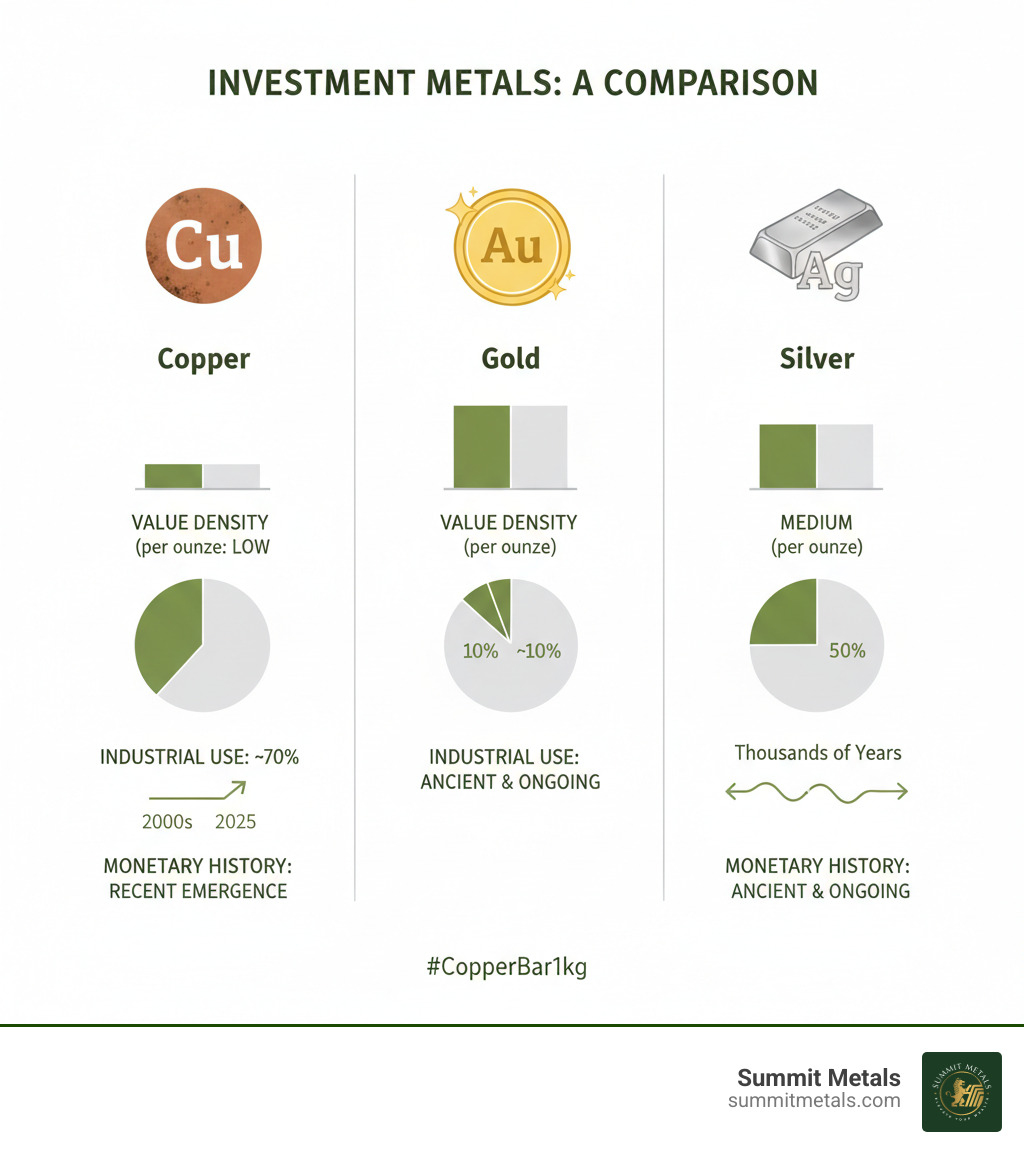

When considering copper as an investment, a physical copper bar 1kg is just one option. Understanding how it compares to other metals helps put copper bullion in perspective.

The biggest difference between copper and precious metals like gold and silver is their fundamental nature. Gold and silver are monetary metals with thousands of years of history as stores of value. Copper is an industrial metal, meaning its value comes primarily from manufacturing demand rather than investment demand.

| Investment Metric | 1kg Copper Bar | 1oz Gold Coin | 1kg Silver Bar |

|---|---|---|---|

| Premium over Spot | 300-500%+ | 3-8% | 5-15% |

| Value Density | Very Low | Very High | Moderate |

| Storage Requirements | High space needed | Minimal space | Moderate space |

| Liquidity | Poor | Excellent | Good |

| Face Value Protection | None | Yes (legal tender) | None |

The comparison reveals why copper bars 1kg face challenges as investments. While a gold coin offers legal tender protection and easy storage, copper requires significant space for relatively little value. For investors seeking long-term wealth preservation through physical metals, the extreme premiums and storage challenges of copper bars 1kg make gold and silver more practical choices.

At Summit Metals, we've seen clients achieve better results building precious metals portfolios through our Autoinvest program—dollar-cost averaging into gold and silver monthly, just like contributing to a 401(k).

The Price vs. Value Dilemma of Copper Bullion

Understanding copper's investment potential starts with recognizing why it's nicknamed "Dr. Copper" - its price often serves as a reliable thermometer for global economic health. When economies thrive, copper demand surges. When they struggle, copper prices typically follow suit downward.

This economic sensitivity stems from copper's absolutely critical role in modern infrastructure. Home construction represents copper's largest market, with every new house requiring extensive copper wiring and plumbing. Beyond residential use, copper forms the nervous system of our electrical grids, telecommunications networks, and virtually every electronic device you touch daily.

The electric vehicle revolution is creating unprecedented copper demand. A typical EV uses about four times more copper than a traditional gas-powered car - from the motor windings to the charging infrastructure. Similarly, renewable energy projects like solar farms and wind turbines are copper-intensive, requiring miles of copper cabling and components.

Healthcare applications add another demand layer, with copper's natural antimicrobial properties making it valuable for medical devices and hospital surfaces. When you combine infrastructure, electronics, transportation electrification, and medical applications, you understand why copper prices move with economic cycles.

What is the true price of a 1kg copper bar?

Here's where the investment dream meets harsh reality. The "true price" of a copper bar 1kg involves understanding the massive gap between what you pay and what the copper is actually worth.

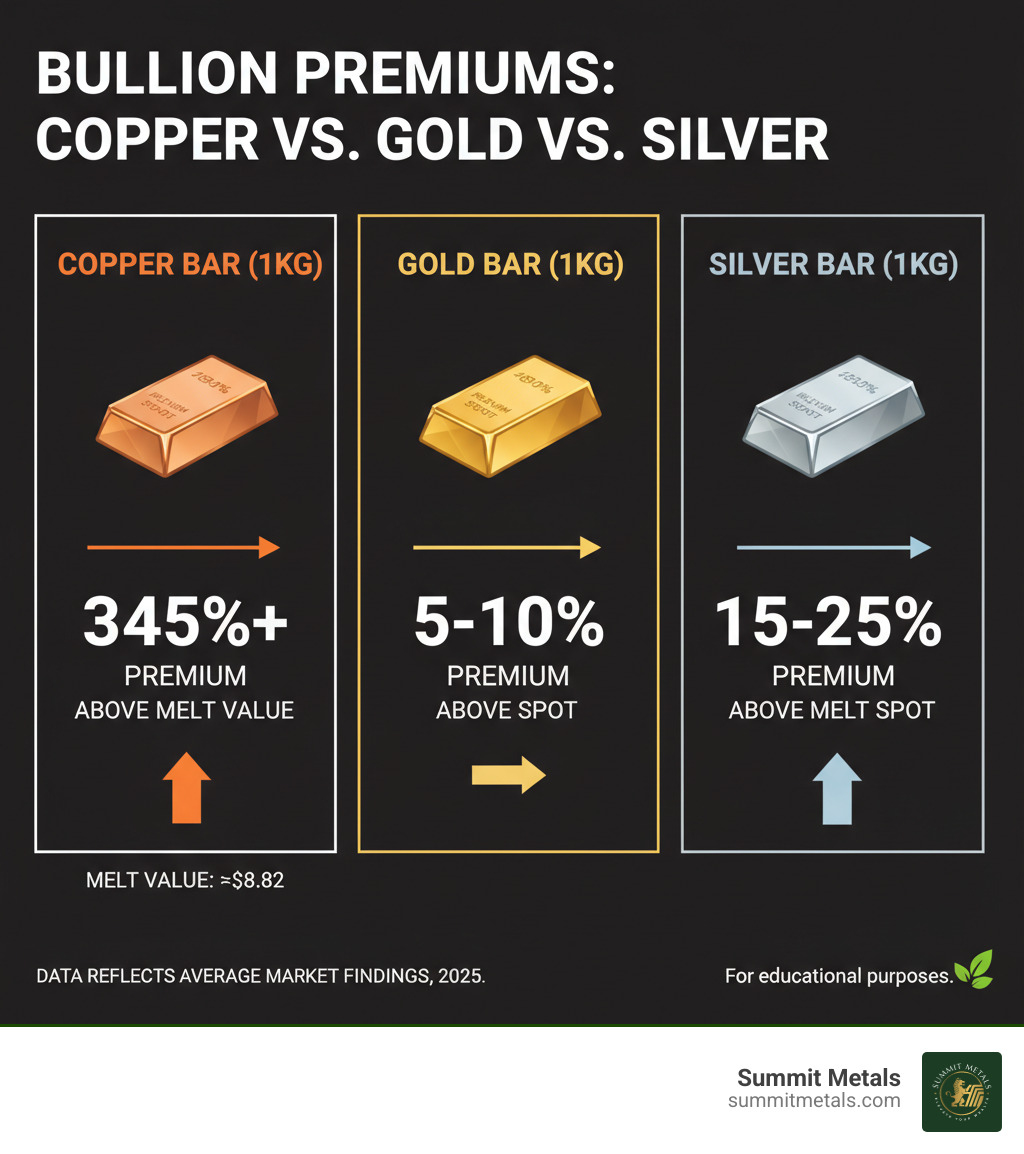

Let's break down the real numbers. Recent market research shows copper bar 1kg purchases ranging from $39 to $54 from various dealers. Meanwhile, copper's spot price - the raw commodity value - tells a very different story.

With copper trading around $4.00 per pound (prices shown are at the time of this publication), a 1kg bar contains about 2.2 pounds of copper. Simple math reveals the melt value: approximately $8.82 worth of actual copper metal.

This creates a staggering reality. If you pay $39 for your copper bar 1kg, you're paying a 345% premium over the metal's intrinsic value. Pay $54, and that premium jumps to over 500%. These aren't typos - they're the standard markup for copper bullion.

The scrap value situation is even more sobering. Scrap yards need to cover processing costs, so they'll pay less than melt value - typically around $9 for a 1kg copper bar. This means your $39-$54 investment immediately becomes worth about $9 if you need to liquidate quickly.

Compare this to precious metals, where premiums typically range from 3-15% over spot price. Gold and silver dealers can offer competitive premiums because the underlying metals hold substantial value per ounce, making reasonable markups economically viable.

What are the risks of investing in copper bullion?

The premium problem creates a cascade of investment challenges that make copper bullion particularly risky for wealth building.

Storage becomes a nightmare as your investment grows. Imagine storing $10,000 worth of copper versus $10,000 worth of gold. The copper would fill a small room and weigh hundreds of pounds, while the gold fits comfortably in a small safe. This low value-to-weight ratio makes secure storage expensive and impractical for meaningful investment amounts.

Market volatility hits copper harder than precious metals because of its industrial nature. Economic downturns, supply chain disruptions, or shifts in manufacturing can cause rapid price swings. Unlike gold, which maintains value during economic uncertainty, copper prices often fall when investors need stability most.

The fundamental difference between copper and precious metals cannot be overstated. Gold and silver have served as monetary metals for thousands of years, providing wealth preservation during currency debasements and economic crises. Copper lacks this monetary history entirely - it's purely an industrial commodity.

Profitability becomes nearly impossible when you combine 300-500% premiums with storage costs and market volatility. For copper prices to generate profit, spot copper would need to increase several hundred percent just to break even on your initial premium, let alone provide meaningful returns.

This reality explains why experienced investors often view physical copper bullion as novelty items rather than serious investments. The math simply doesn't support copper bars as wealth-building tools, despite copper's important industrial role and long-term demand growth.

For investors seeking metal exposure with reasonable premiums and proven wealth preservation history, gold and silver remain the practical choices. At Summit Metals, we focus on these precious metals because they offer the transparency, value retention, and storage efficiency that make physical metal ownership viable for long-term wealth protection.

The Investment Case for a Copper Bar 1kg: A Comparison

Despite the sobering realities we've discussed, there's still something undeniably appealing about owning a copper bar 1kg. I get it – there's a certain charm to holding a solid piece of metal that represents humanity's oldest industrial materials. Let's be honest about both the appeal and the investment reality.

The draw is real and understandable. For many people, a copper bar 1kg offers genuine affordability as an entry point into physical metals ownership. While a single ounce of gold might cost over $2,000, you can own a kilogram of copper for under $60. There's something satisfying about that tangible asset experience – the weight in your hands, the knowledge that you own something physical rather than just numbers on a screen.

The aesthetic appeal shouldn't be dismissed either. Many copper bars are genuinely beautiful, with rich reddish-brown tones and often intricate designs that showcase the metal's natural beauty. They make excellent conversation pieces, and as one reviewer mentioned, they're "perfect fathers day pressies" or unique gifts that combine beauty with substance.

For collectors, copper bars occupy an interesting niche. They're collector's items that bridge the gap between industrial commodity and artistic expression. Some feature periodic table details, others showcase beautiful casting work, and many celebrate copper's essential role in our modern world.

But let's step back and look at the investment metrics objectively. When we compare a copper bar 1kg against established precious metals investments, the differences are striking:

| Investment Metric | 1kg Copper Bar | 1oz Gold Coin (e.g., AGE) | 1kg Silver Bar (e.g., 32.15 oz) |

|---|---|---|---|

| Premium over Spot | Very High (300-500%+) | Low-Moderate (3-8%) | Moderate (5-15%) |

| Value Density/Storage | Very Low (Bulky, costly to store for value) | Very High (Compact, efficient storage) | Medium (More compact than copper, less than gold) |

| Liquidity | Low (Niche market, difficult to sell profitably) | Very High (Globally recognized, easy to sell) | High (Widely accepted, good resale market) |

| Monetary History | Limited (Industrial commodity) | Extensive (Thousands of years as money/wealth) | Extensive (Thousands of years as money/wealth) |

| Industrial Demand | Very High (Primary value driver) | Moderate (Jewelry, electronics, dentistry) | Moderate (Industrial, electronics, jewelry) |

| Face Value (for coins) | N/A | Yes (Legal tender status, fraud protection) | N/A |

Is copper a better long-term investment than gold or silver?

Here's where I need to be completely straightforward with you: for long-term wealth preservation and investment, physical copper bullion like a copper bar 1kg simply doesn't measure up to gold or silver. This isn't about dismissing copper's importance – it's about understanding what makes a sound investment.

Gold and silver function as monetary metals with thousands of years of history backing their role as stores of value. They've survived currency collapses, economic upheavals, and political revolutions while maintaining their purchasing power. Their value isn't solely tied to industrial demand but also to their scarcity, universal acceptance, and historical role as wealth preservation tools.

Copper operates as an industrial metal first and foremost. While demand projections look strong – especially with the green energy transition and electric vehicle adoption – investing in physical copper bars means you're speculating on industrial growth while fighting those massive premiums we discussed. Even if copper prices doubled, you'd still struggle to break even on most copper bar 1kg purchases due to those initial premiums.

The profitability challenge is real. As multiple investors have finded, "copper bullion is a novelty item with prohibitively high premiums." This fundamental reality makes it incredibly difficult to realize profits compared to gold and silver, where premiums typically range from 3-15% rather than 300-500%.

When considering gold investments, even within that category, coins often offer advantages over bars. Gold coins provide face value protection – they're legal tender with a government-backed minimum value, making them harder to counterfeit and easier to authenticate. This fraud protection gives coins a security edge that's particularly valuable in uncertain times.

| Feature | Gold Coin (e.g., American Eagle) | Gold Bar |

|---|---|---|

| Legal Tender | Yes, has a face value | No |

| Fraud Protection | Government backing and design make it harder to counterfeit | Relies on manufacturer's brand and assay |

| Authenticity | Easier for individuals to verify | Often requires expert verification |

| Liquidity | Highly liquid and recognized globally | Very liquid, but may be less preferred by small investors |

At Summit Metals, we focus on authenticated gold and silver precisely because they offer the most efficient path to wealth preservation. Our Autoinvest program lets you dollar-cost average into precious metals by making regular monthly purchases, just like contributing to a 401k. This systematic approach helps smooth out price volatility while building a meaningful precious metals position over time.

What are the historical and future price trends for copper?

Copper's price journey through the 21st century tells a compelling story of industrial growth and economic cycles. Starting at under $1 per pound in 2000, copper experienced a dramatic surge to around $4.50 per pound within the first decade – a remarkable 350%+ increase that caught many investors' attention.

This 21st-century price surge wasn't just random market movement. It reflected rapid industrialization in emerging markets, massive infrastructure projects, and the beginning of our digital change. Copper became the backbone of economic growth, earning its nickname "Dr. Copper" for its ability to diagnose global economic health.

Since then, we've seen typical market volatility as copper prices react to global economic cycles. Recessions bring decreased construction and manufacturing, while economic recoveries drive renewed demand for the red metal. This cyclical nature makes copper prices inherently more volatile than precious metals.

Looking ahead, future predictions are genuinely optimistic for copper demand. The increased demand forecast is driven by several unstoppable trends: the electrification of transportation, renewable energy infrastructure expansion, and continued technological advancement. Electric vehicles alone use significantly more copper than traditional cars, and as EV adoption accelerates, this demand will only intensify.

However, here's the crucial distinction: strong demand for copper as a commodity doesn't automatically translate to profitable investment in physical copper bar 1kg purchases. Those prohibitive premiums remain the primary obstacle. For those focused on wealth preservation and portfolio protection, gold and silver remain the time-tested choices that have served investors well for millennia.

How to Steer the Copper Bullion Market

If you're still drawn to acquiring a copper bar 1kg—whether for its aesthetic appeal, as a conversation piece, or simply to satisfy your curiosity—knowing where to shop and what to look for can save you both money and disappointment.

The online marketplace offers the widest selection of copper bars. Major online bullion dealers carry various copper products, including 1kg bars from different mints. Large online marketplaces have also become surprisingly popular for copper bullion, with many individual sellers offering competitive prices and a decent selection. Local coin shops might carry smaller copper rounds or art bars, but finding a full copper bar 1kg locally can be hit-or-miss.

When evaluating any dealer, reputation should be your first checkpoint. Look for strong customer reviews, Better Business Bureau ratings, and established track records. On large marketplace platforms, seller ratings and feedback become especially important since you're dealing with individual sellers rather than established companies.

Pricing transparency separates good dealers from questionable ones. Reputable sellers clearly display their prices, update them regularly to reflect market changes, and are upfront about shipping costs. Nobody likes surprise fees at checkout, especially when you're already paying substantial premiums over spot price.

Shipping policies matter more than you might think. Quality dealers offer insured shipping, discreet packaging, and reasonable delivery timeframes. Since you're paying hundreds of percent over melt value, the last thing you want is a damaged or lost package with minimal recourse.

However, here's where I need to be completely honest with you. While we acknowledge the curiosity around copper bars, Summit Metals focuses exclusively on what actually builds wealth: authenticated gold and silver precious metals. We've built our reputation on transparent, real-time pricing and competitive rates through bulk purchasing. When you're ready to make serious moves toward wealth preservation, we're here to guide you.

For investors who understand the power of consistency, we offer something special: dollar-cost averaging through our Autoinvest program. Instead of trying to time the market or making large lump-sum purchases, you can set up monthly purchases of gold and silver—just like contributing to your 401k. This disciplined approach helps smooth out market volatility while steadily building your precious metals position over time. It's the difference between speculation and systematic wealth building.

What are the advantages of holding physical bullion?

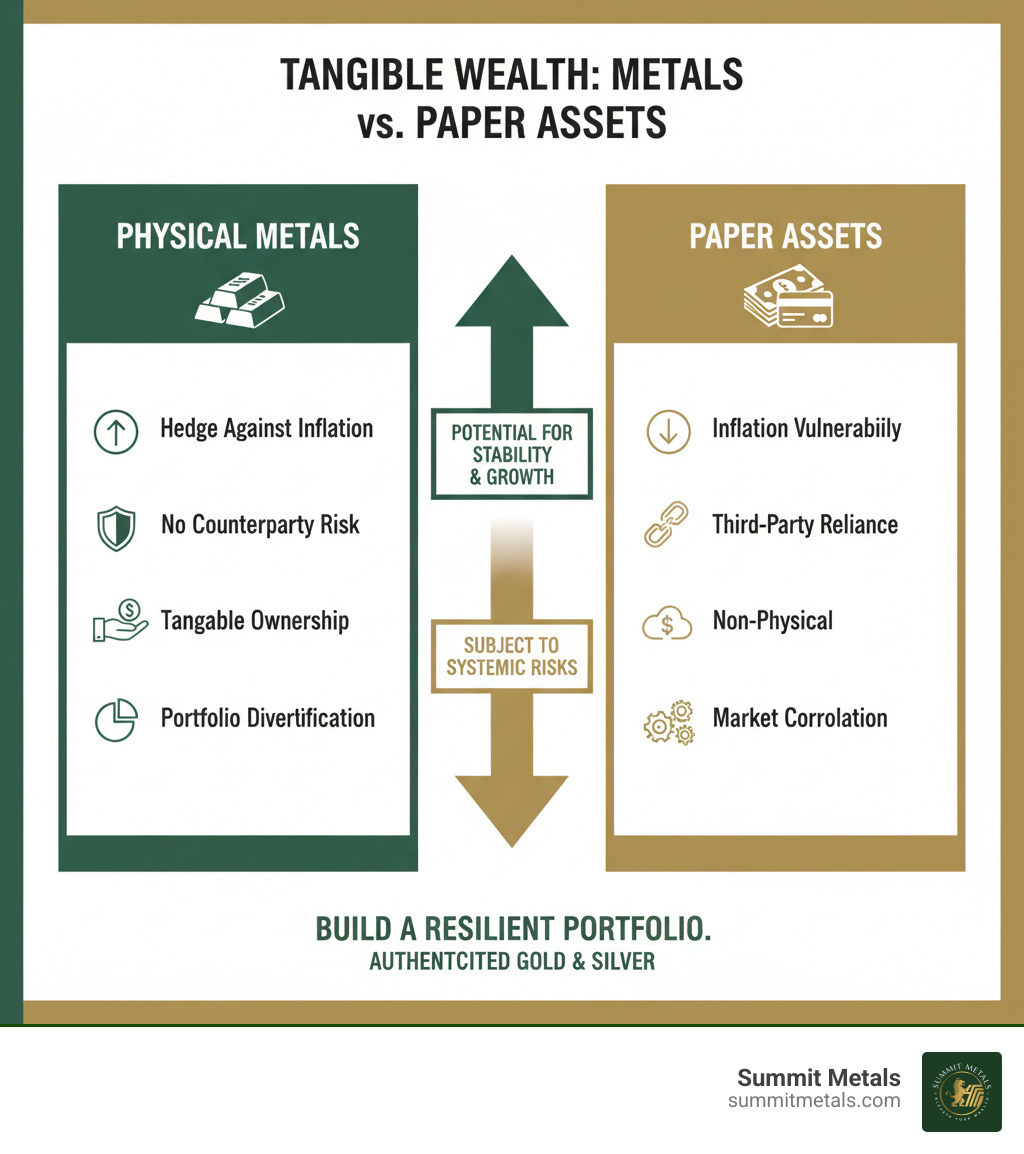

Despite the specific challenges we've outlined with copper bars, the fundamental advantages of holding physical precious metals remain compelling—when you choose the right metals.

Physical gold and silver serve as a hedge against inflation in ways that few other assets can match. While your dollar's purchasing power erodes over time, precious metals have maintained their value for thousands of years. When grocery prices double, your gold and silver holdings help preserve your wealth's real purchasing power.

Counterparty risk disappears when you hold physical metals. Unlike stocks, bonds, or even bank deposits, you don't depend on someone else's promise to pay. There's no corporate bankruptcy, bank failure, or government default that can make your physical metals worthless. You own it outright—no middleman required.

The tangible ownership aspect resonates deeply with many investors, especially those who've watched digital portfolios vanish during market crashes. There's profound peace of mind in holding real wealth that exists independent of computer systems, financial institutions, or government policies.

Portfolio diversification through precious metals isn't just theory—it's proven strategy. Gold and silver often move independently of traditional investments, providing stability when stock markets stumble. During the 2008 financial crisis, while many portfolios lost 30-50% of their value, gold actually gained ground.

At Summit Metals, we've made these advantages accessible through authenticated gold and silver that you can trust. While a copper bar 1kg might satisfy curiosity, precious metals satisfy the deeper need for true wealth preservation and financial security.

Conclusion: Is Copper the Right Metal for Your Portfolio?

After walking through all the numbers, market realities, and investment fundamentals, I have to be honest with you: a copper bar 1kg makes for a fascinating conversation piece, but it's not going to build your wealth.

The math is simply unforgiving. When you're paying $39 to $54 for something worth about $9 in actual copper, you're not investing – you're buying an expensive paperweight. That 300-500% premium over spot price means copper would need to triple or quadruple in value just for you to break even. That's not a realistic investment strategy.

The novelty factor versus investment reality is where many people get tripped up. There's something satisfying about holding a hefty chunk of metal, and copper bars can be beautifully crafted. But satisfying and profitable are two very different things.

Here's what we've learned: copper is absolutely essential for our modern world. Electric vehicles, renewable energy, infrastructure – they all need copper. But high industrial demand doesn't automatically equal good bullion investment. The retail copper bullion market is structured in a way that makes it nearly impossible for individual investors to profit.

Superior alternatives exist for anyone serious about wealth preservation and portfolio diversification. Gold and silver have served as stores of value for thousands of years, not decades. Their premiums are reasonable, their liquidity is excellent, and their track record for protecting wealth during economic uncertainty is proven.

At Summit Metals, we've seen too many investors get distracted by shiny objects that promise easy profits. The truth is, wealth building requires patience and smart choices. That's why we focus exclusively on authenticated gold and silver – metals with real monetary history and reasonable premiums.

If you're serious about building lasting wealth through physical metals, consider our Autoinvest program. You can set up monthly purchases of gold and silver, just like contributing to a 401k. This dollar-cost averaging approach helps smooth out market volatility while steadily building your precious metals portfolio over time.

Don't let the allure of a copper bar 1kg derail your long-term financial goals. Understanding the difference between a collectible and a sound investment is crucial for your financial future. For true wealth preservation and growth, stick with the metals that have stood the test of time.

Ready to start building a real precious metals portfolio? Learn how to safely buy precious metals online and find why thousands of investors trust Summit Metals for their gold and silver investments.