Understanding the Copper Bullion Market

What is copper bullion? It's refined copper produced in standardized investment forms like bars, rounds, and cubes, typically .999 fine (99.9% pure). Unlike scrap or industrial copper, copper bullion is specifically manufactured for collectors and investors who want to own physical copper as a tangible asset.

Quick Answer:

- Physical Form: Bars, rounds, cubes, and novelty shapes

- Purity: Usually .999 fine copper (99.9% pure)

- Purpose: Investment and collecting (not industrial use)

- Value: Based on weight, purity, and collector demand

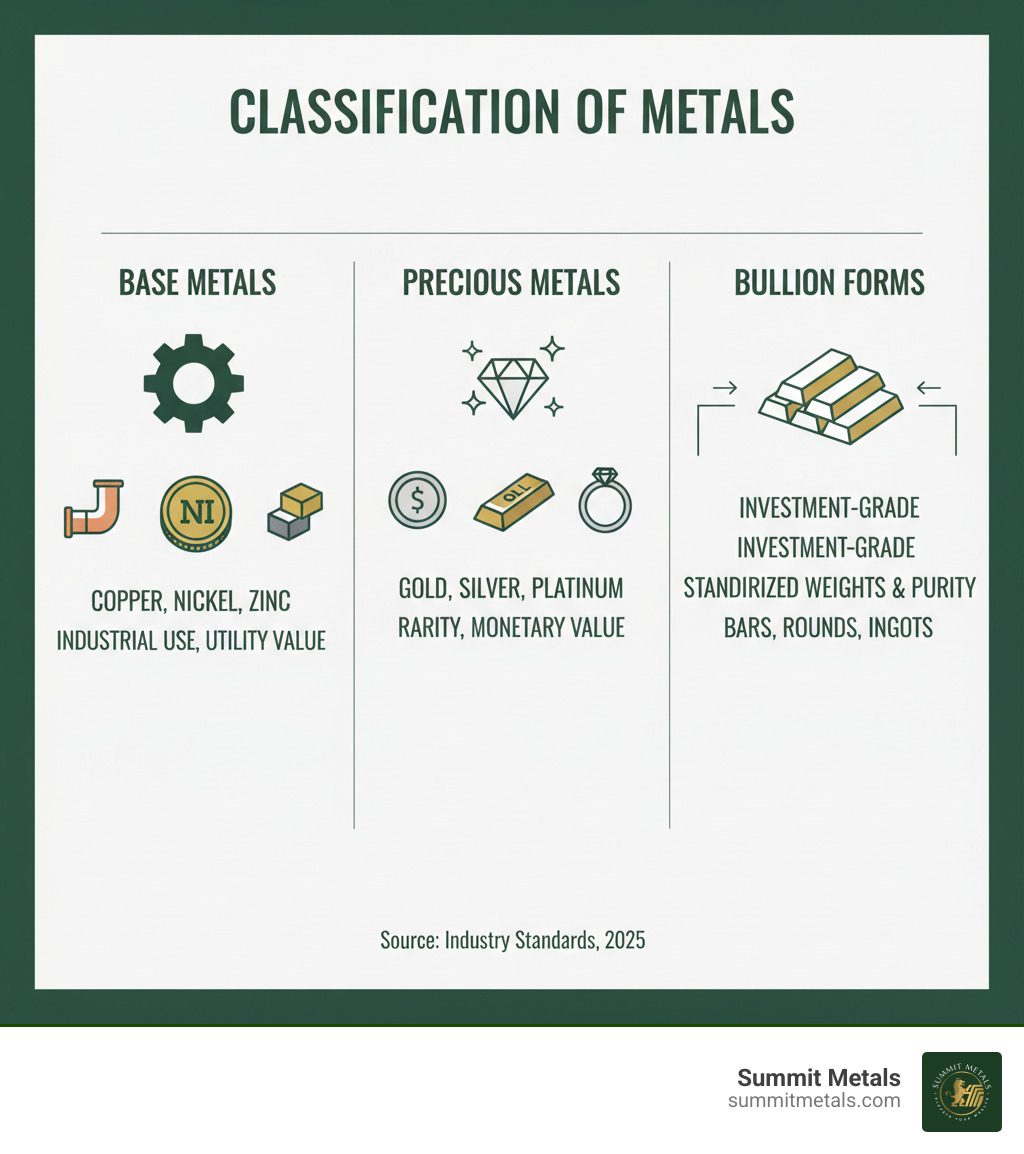

- Classification: Base metal, not precious metal like gold or silver

Copper might not shine like gold or silver, but this ancient metal has been essential to human civilization for over 10,000 years. Today, it's the third most-used metal globally, powering everything from your smartphone to electric vehicles.

While copper is classified as a base metal rather than a precious metal, its bullion forms have gained attention from investors seeking affordable tangible assets. At around $1 per ounce compared to gold's $2,000+ per ounce, copper bullion offers a low-cost entry point into physical metals ownership.

However, copper bullion comes with unique challenges. High premiums over spot price, storage requirements due to low value density, and limited resale markets make it more of a niche collectible than a core investment asset.

I'm Eric Roach. My decade on Wall Street guiding Fortune-500 clients taught me that understanding what is copper bullion means weighing its industrial importance against its investment limitations. While copper bullion has its place, my experience shows most investors benefit more from established monetary metals like gold and silver.

What is Copper Bullion? A Deeper Dive

Think of copper bullion as copper's refined, investment-grade version. Unlike the copper in your home's wiring, copper bullion is polished and crafted for investors and collectors who want to own this essential metal in its purest form.

What is copper bullion exactly? It's physical copper refined to exceptional purity—typically .999 fine copper (99.9% pure). This isn't scrap from old pipes or recycled electronics. The minting process involves melting refined copper and casting or striking it into standardized shapes. Each piece is stamped with its weight, purity, and often a mint mark, guaranteeing its quality and separating it from everyday copper.

Copper bullion is valued primarily by its weight and purity, not its artistic craftsmanship. This makes it fundamentally different from copper jewelry, where you're paying for the artisan's skill as much as the metal itself.

The difference between copper bullion and scrap copper is like comparing a freshly minted coin to pocket change. Scrap copper needs refining and often contains impurities, reducing its value. Bullion is ready to own right out of the box. If you're curious about how physical metals compare to other investment options, our guide on Physical Bullion vs. Gold/Silver ETFs: Pros and Cons breaks down the key differences.

The Different Types of Copper Bullion

Walking into the copper bullion world is like visiting a specialized candy shop—there's more variety than you'd expect.

Copper bars are the workhorses of the copper bullion world, ranging from tiny 1-ounce bars to hefty 10-pound bars. Many feature designs borrowed from classic American coinage, giving these affordable pieces a touch of historical elegance.

Copper rounds look like coins but lack legal tender status. They make up for it with artistic appeal, often featuring intricate designs—historical figures, wildlife, or commemorative themes—that turn functional metal into miniature art.

Copper cubes, like the 10 oz Copper Cube by Liberty Copper, solve the problem of stacking round objects. Their geometric precision is satisfying, and as this architectural article about reflective copper cubes shows, good design can lift copper from utilitarian to stunning.

Novelty shapes like bullets and artistic forms command slightly higher prices but are great conversation starters.

The stackability factor matters more than you might think with a metal that requires more storage space per dollar invested. The collectibility aspect adds another layer, as some pieces appreciate based on design rarity, not just metal content.

Understanding Copper's Value: Spot Price vs. Premiums

Here's where copper bullion gets tricky and separates casual interest from serious investment.

The spot price is copper's raw value on commodity markets like the London Metals Exchange. This price changes constantly based on global supply and demand.

But here's the reality check: premiums on copper bullion are substantial, often several hundred percent above spot price. For perspective, while raw copper might trade at $3.50-$4.50 per pound, a 1-pound copper bar could cost $30-$32. This means you're paying seven to eight times the raw metal value. This premium covers minting, distribution, and dealer costs, but it's a significant hurdle for investors.

This high premium is copper bullion's biggest challenge. For your investment to break even, the spot price of copper would need to rise dramatically just to cover what you paid above metal value. It's why many experienced investors view copper bullion more as a collectible. Understanding these dynamics is crucial, which is why we created our guide on Spot Price vs. Premium: How Precious Metals Pricing Works.

The bottom line? Copper bullion requires a different mindset. You're buying it for reasons beyond just the metal value—whether for its collecting appeal or the satisfaction of owning a piece of an essential industrial metal.

The Investment Case: Why Buy Copper Bullion?

Despite high premiums, there's a solid case for why people are drawn to what is copper bullion. This industrial workhorse offers massive real-world demand combined with an entry price that won't break the bank.

Industrial Demand

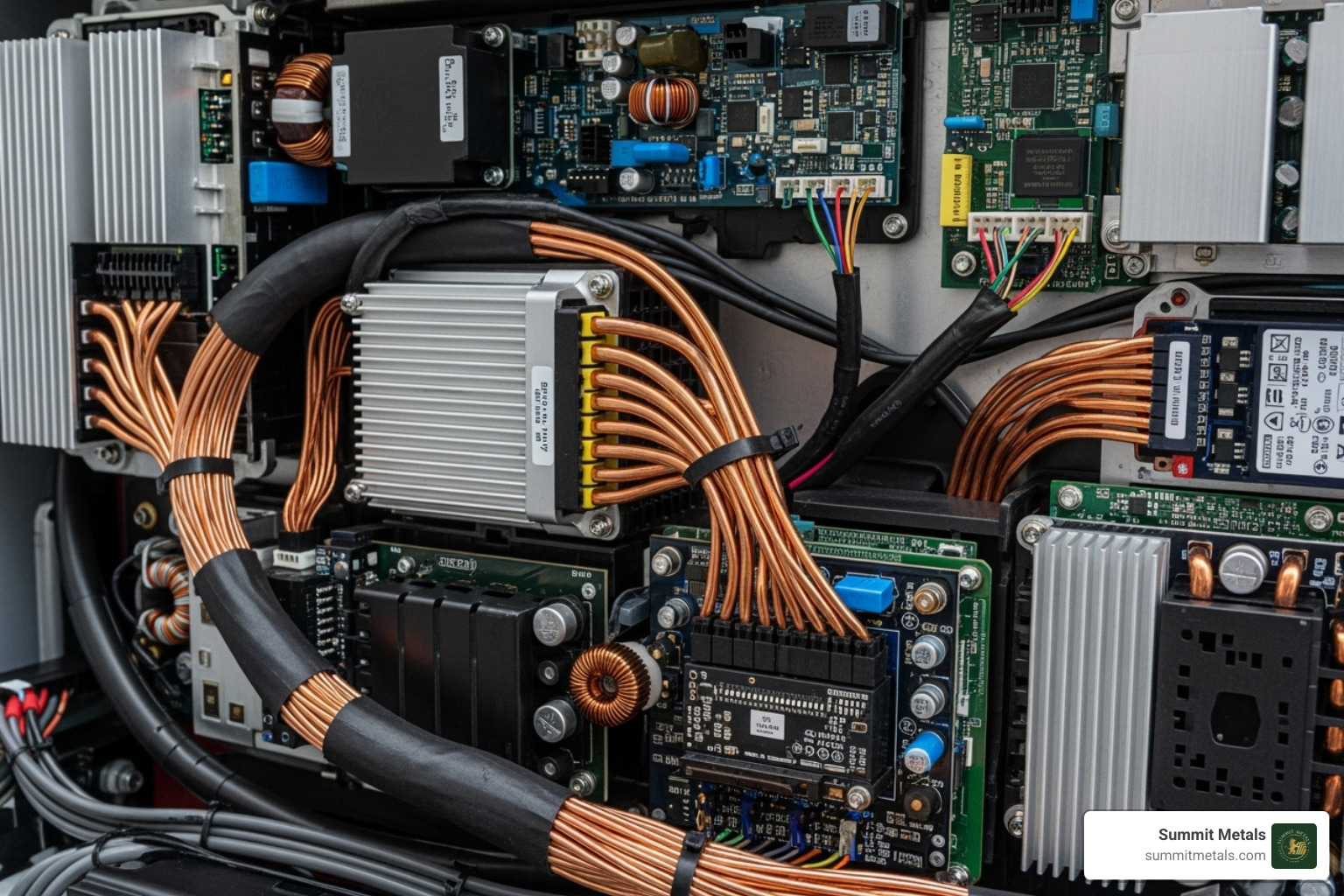

Copper is absolutely essential to modern life. As the third most-used metal globally, it powers our world in countless ways.

The metal's role in the green energy revolution is particularly exciting. Electric vehicles need about four times more copper than traditional cars. Solar panels, wind turbines, and charging stations all depend heavily on copper's excellent conductivity. This fundamental shift could drive demand for decades.

Copper's nickname "Dr. Copper" comes from its reputation as an economic indicator. When the global economy is healthy, copper demand soars. When things slow down, copper often signals the downturn first. Its unique properties—conductivity, corrosion resistance, and malleability—make it nearly irreplaceable in many applications, creating steady, underlying demand.

Affordability and Tangible Asset Ownership

Copper bullion's biggest advantage is affordability. At around $1 per ounce (at the time of this publication), it offers a dramatically lower entry point than silver at $25-$30 per ounce or gold at over $2,000 per ounce.

This makes copper bullion attractive for new investors who want to experience physical metal ownership without a huge financial commitment. There's something satisfying about holding a tangible asset that doesn't depend on a company's performance or a government's promises.

For those concerned about inflation, copper bullion provides exposure to a hard asset with industrial value. While it lacks gold's safe-haven reputation, its industrial necessity offers a different kind of security.

What is copper bullion's role in a diversified portfolio?

In a diversified metals portfolio, copper bullion serves as the industrial complement to gold and silver's monetary roles. While gold provides wealth preservation, copper gives you direct participation in global economic growth and technological advancement.

The diversification benefits come from copper's different price drivers. While gold might rise during economic uncertainty, copper often performs well during periods of economic expansion. This can create a natural balance in your metals holdings.

Dollar-cost averaging works particularly well with affordable metals. At Summit Metals, our Autoinvest feature lets you set up monthly purchases of copper, silver, or gold—just like contributing to a 401k. This approach helps smooth out price volatility by spreading your purchases over time. To learn more about this powerful strategy, explore our guide on The Power of Dollar-Cost Averaging in Gold and Silver Investments.

The key is viewing copper bullion as part of a broader metals strategy. Combined with gold and silver, copper rounds out a portfolio with exposure to industrial growth.

Copper vs. Gold and Silver: An Investor's Comparison

When exploring what is copper bullion means for your strategy, it's crucial to see how it stacks up against gold and silver. If gold is the luxury sedan and silver is the reliable SUV, then copper is the affordable compact car. Each serves a purpose, but their capabilities differ.

The most striking difference is value density. At the time of publication, copper is around $1/oz, silver $25-30/oz, and gold $2000+/oz. Storing $5,000 worth of copper requires far more space than the same value in silver, and dramatically more than gold.

Liquidity tells another important story. Gold and silver enjoy deep, established markets with dealers worldwide eager to buy and sell. The resale market for copper bullion is much smaller, and you might find yourself turning to slower, less predictable private sales.

The premium structure is a major challenge. Gold and silver have premiums of 5-15%, but copper bullion's can exceed 300%. This means the spot price must rise dramatically just for you to break even.

From an industrial perspective, copper is nearly 100% industrial, while silver is roughly 50-60% industrial, and gold is primarily a monetary asset with only 10-15% industrial use. This focus means copper prices move more with economic cycles than monetary concerns.

Monetary history provides another lens. Gold and silver have served as money for thousands of years and are recognized as safe-haven assets. Copper, despite ancient use in some currencies, never achieved the same monetary status. When markets get nervous, investors flee to gold and silver, not copper.

The relationship between gold and silver themselves offers insights. The Gold and Silver Ratio: A Timeless Measure shows how these metals interact, while understanding How Much Gold Has Been Found in the World? helps explain gold's enduring scarcity value.

Gold Coin vs. Gold Bar Comparison Chart

Benefits of owning a gold coin include their legal tender status, which provides built-in fraud protection since they're backed by sovereign governments. This face value, while minimal compared to their metal content, offers added security and makes verification easier. Coins like American Gold Eagles are widely recognized by dealers worldwide, ensuring strong liquidity.

Benefits of owning a gold bar center on efficiency and cost. Bars typically carry lower premiums per ounce than coins, making them ideal for larger investments. They're designed for easy stacking and storage, and when you're accumulating significant quantities, every percentage point in premium savings matters.

This comparison highlights why many view copper bullion as more of a collectible than a core portfolio holding. While copper has its place, gold and silver remain the workhorses of precious metals investing.

At Summit Metals, we've seen how dollar-cost averaging through our Autoinvest feature helps investors build positions in gold and silver over time, just like contributing to a 401k. This systematic approach works particularly well with precious metals that have established, liquid markets.

The Risks and Realities of Copper Bullion Investing

Let's be honest about what is copper bullion as an investment. While the industrial story is compelling, investing in copper bullion comes with serious challenges.

Low Liquidity

The biggest shock for most copper bullion investors comes when they try to sell. Unlike gold and silver, copper bullion exists in a much smaller, less liquid market.

Most precious metals dealers don't offer buyback programs for copper bullion, and those that do offer disappointing prices. This forces sellers into private sales on platforms like eBay, which involves shipping costs and uncertain pricing. Finding a buyer at a reasonable price can be nearly impossible.

Storage and Security

Here's where copper's low value density hits home. A $5,000 investment in copper will take up dramatically more space than the same value in gold or silver—the difference between a small safe and an entire closet.

The weight alone becomes an issue. The costs and security concerns of storing a heavy, bulky metal work against copper as a practical investment vehicle.

Price Volatility

Copper's price swings are tied directly to industrial cycles. When construction or manufacturing slows, copper prices can drop significantly. Unlike gold, which often rises during uncertainty, copper typically falls along with economic troubles.

This makes copper bullion more of a speculative bet on industrial growth rather than a stable store of value. It lacks the safe-haven status that draws people to precious metals in the first place.

Not a "Precious" Metal

This distinction matters. Copper is abundant—it's the third most-used metal because there's a lot of it. Gold and silver are precious partly because they're rare. This abundance keeps copper's intrinsic value relatively low and means it doesn't offer the same inflation protection or crisis hedge that true precious metals provide. Understanding this difference helps protect you from common misconceptions. For more guidance, check out our guide on How to Avoid Common Precious Metals Scams.

What is copper bullion's biggest risk for investors?

Without question, the high premiums are copper bullion's fatal flaw as an investment. Paying 300% to 500% over the spot price means the metal's value must triple or quadruple just for you to break even. This is an enormous hurdle that makes profitable investing extremely difficult.

Compare this to silver bullion, where premiums typically range from 15% to 50% over spot—still significant, but far more reasonable. This massive premium gap is why experienced investors often view copper bullion as a novelty item rather than a serious investment.

Frequently Asked Questions about Copper Bullion

When people start exploring what is copper bullion, they naturally have practical questions about buying, storing, and investing in this unique metal. Let's address the most common concerns.

Where can I buy copper bullion?

Finding quality copper bullion requires knowing where to look. Reputable online dealers are often your best bet for selection and convenience. Many established precious metals dealers carry copper products alongside their gold and silver offerings.

Local coin shops can be great for hands-on inspection, especially if you're interested in collectible rounds. Precious metals shows offer another avenue for finding unusual or limited-edition pieces.

No matter where you shop, always verify the dealer's reputation. Counterfeit products exist in the copper market. Our guide on Identifying Reputable Bullion Dealers can help you spot red flags and choose trustworthy sources.

At Summit Metals, we believe in transparent pricing and authentic products, which is why we encourage thorough research before any metals purchase.

How should I store my copper bullion safely?

Proper storage protects your copper's condition. Unlike gold, copper reacts with air and moisture, developing a patina over time.

Create a cool, dry environment away from humidity. Airtight containers and protective sleeves are your first line of defense against tarnishing. Individual capsules work well for rounds, while sealed bags can protect bars.

Silica gel packets are great for absorbing moisture. Toss a few into your storage containers and replace them periodically.

For security, consider a home safe or a bank safety deposit box. Given copper's low value density, you'll need more storage space than you might expect. Our comprehensive guide on Top Tips for Precious Metals Storage covers principles that apply to all physical metals.

Is copper bullion a good investment for beginners?

This question deserves a nuanced answer. The low cost of entry makes copper seem beginner-friendly. However, the high premiums are a major hurdle; you need the spot price to rise dramatically just to break even.

The low liquidity is also problematic for beginners. Unlike gold or silver, selling copper bullion can be slow and frustrating, often requiring private sales.

Honestly, copper bullion functions more as a niche collectible than a serious investment. If you're drawn to owning physical metal at a lower price point, consider fractional gold or silver coins instead. While these carry premiums, they are typically much lower, and the resale markets are far more liquid.

For beginners serious about building a metals portfolio, our Autoinvest feature lets you dollar-cost average into gold or silver with monthly purchases, just like contributing to a 401k. This approach helps smooth out price volatility while building your position over time.

Conclusion: Is Copper Bullion Right for You?

After exploring what is copper bullion, let's bring it all together. Copper bullion is an interesting corner of the physical metals world, backed by genuine industrial demand as the third most-used metal globally. Its affordability offers a low-cost entry point into tangible asset ownership that gold and silver can't match.

For collectors, copper bullion can be enjoyable. The craftsmanship is often impressive, and there's satisfaction in holding a piece of the metal that powers our world. If you view it as a niche collectible with potential long-term upside, it might fit your interests.

However, the investment realities are stark. High premiums (often 300%+) create a steep hill to profitability. Low liquidity makes selling difficult, and the storage requirements for this low-density metal make it impractical for building significant wealth compared to precious metals.

These factors position copper bullion as a speculative asset or collectible, not a core monetary holding. Unlike gold and silver, copper lacks the safe-haven status and deep, liquid markets that serious investors seek for wealth preservation and inflation hedging.

At Summit Metals, we focus on what we know best: authenticated gold and silver with transparent pricing and competitive rates. Our expertise lies in helping investors build wealth through established monetary metals with proven track records.

Ready to build a metals portfolio the smart way? Consider our Autoinvest program, where you can dollar-cost average your precious metals purchases monthly, just like contributing to a 401k. This approach helps smooth out market volatility while building your holdings consistently.

Whether you're just starting or expanding your holdings, we're here to help you steer the market with confidence. Check out our guide on Don't Get Bent Out of Shape: How to Buy Metal Online to learn more about making smart purchasing decisions.