An Investor's Introduction to the World of Copper

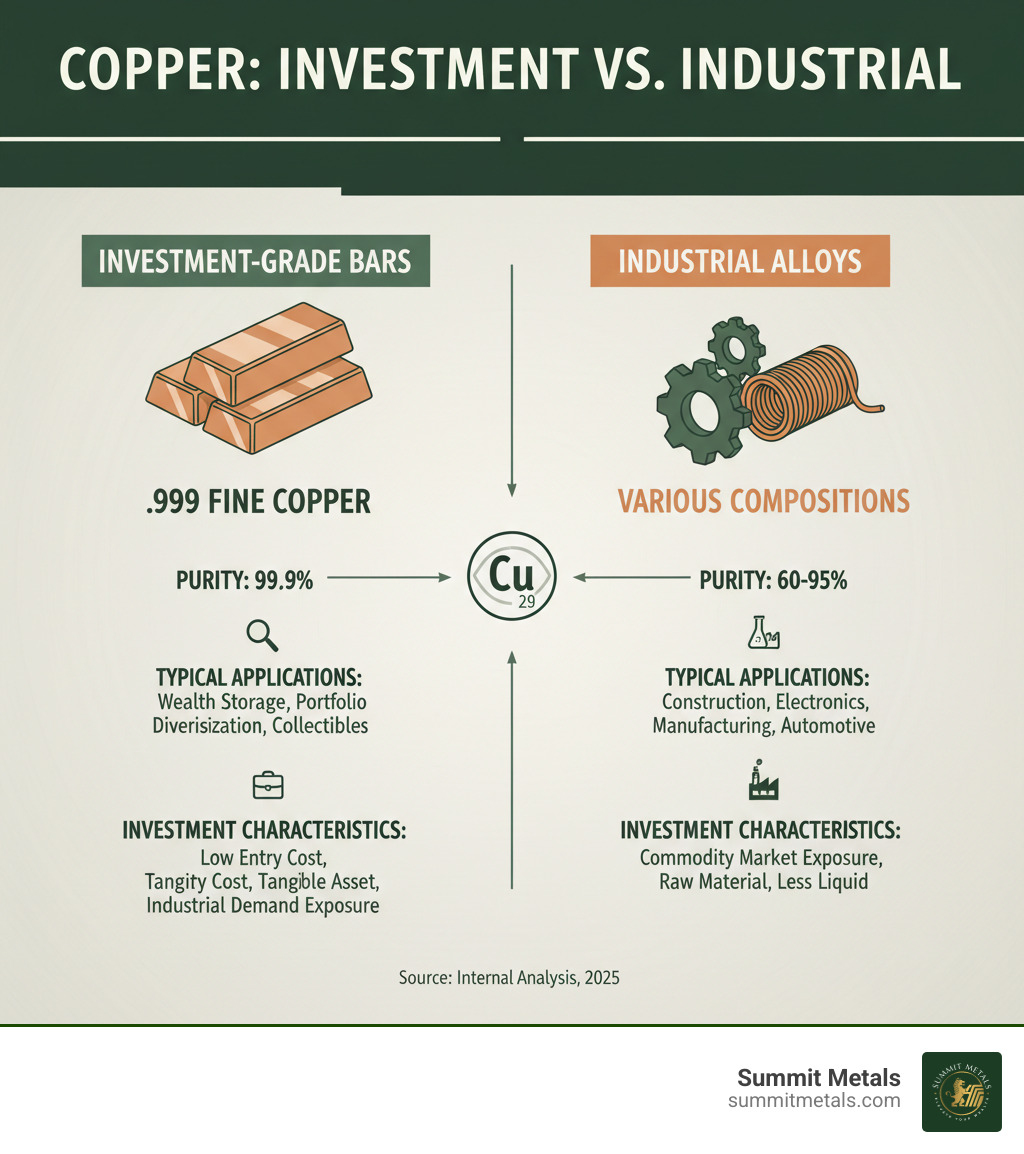

Copper bars are investment-grade bullion products made from .999 fine copper (99.9% pure). They are available in various sizes, from 1 oz to 10 lbs, for investors seeking portfolio diversification and exposure to industrial metals.

While gold and silver often dominate precious metals discussions, copper offers a unique opportunity for investors looking to diversify with tangible assets. This "red metal" has been a part of human history since 9000 B.C., eventually leading to the Bronze Age.

Today's copper bars are backed by massive industrial demand. Each electric vehicle requires approximately 180 pounds of copper, and wind turbines contain up to 4 tons. Unlike commercial-grade copper, investment copper bars feature .999 fine purity and come in standardized weights perfect for stacking and storage. Popular designs include historical banknote replicas and classic American symbols like the Buffalo.

I'm Eric Roach, and during my decade as an investment banking advisor, I guided Fortune-500 clients through hedging programs that included industrial metals like copper. My experience has shown me how copper bars can serve as an accessible entry point for retail investors seeking the same defensive strategies used by major corporations.

From Ancient Treasure to Modern Asset: The Enduring Legacy of Copper

Nearly 11,000 years ago, the findy of copper in the Middle East marked humanity's first step out of the Stone Age. As the first metal humans learned to work with, this malleable red material could be hammered, heated, and molded into tools that were far superior to their stone predecessors.

The real breakthrough occurred when ancient metallurgists mixed copper with tin to create bronze, an innovation so significant it launched the Bronze Age. This new alloy enabled civilizations to create stronger tools, more effective weapons, and intricate art.

The Romans later incorporated copper into their currency system, recognizing its intrinsic and lasting value. From Egyptian tools and weapons to Mesopotamian construction, copper was a cornerstone of ancient progress. You can a look at historical copper production methods to see how these early techniques laid the groundwork for today's industry.

Copper's story is one of enduring value. Its excellent electrical conductivity, corrosion resistance, and malleability made it indispensable throughout history. Today's copper bars represent the evolution of this ancient treasure into a modern investment asset. The same metal that helped build empires now powers electric vehicles and renewable energy, giving it a rich historical foundation and a compelling future.

This unique story means you're not just buying a commodity; you're investing in a metal that has proven its worth across every major civilization and technological revolution.

A Guide to the Different Types of Copper Bars

When investing in copper bars, you're acquiring pristine .999 fine copper (99.9% pure), the standard for investment-grade bullion. This purity ensures its value is directly tied to copper's market price. Beyond their metal content, many bars feature stunning designs, making them an investment that is both practical and beautiful.

Cast vs. Minted: Understanding Production and Finish

Cast bars are created by pouring molten copper into molds. This process gives each bar a rustic appearance with unique striations and markings. They have an old-world charm that many investors appreciate.

Minted bars begin as copper sheets cut into precise blanks, which are then stamped with detailed dies. This results in bars with a polished finish, sharp edges, and intricate designs. This precision often comes with slightly higher premiums due to the extra manufacturing steps.

Both types deliver the same .999 fine copper purity, so the choice is a matter of aesthetic preference.

Popular Sizes and Weights of Investment-Grade Copper Bars

Copper's affordability is a major advantage. While an ounce of gold can cost over $2,000, you can start with copper bars for just a few dollars. This makes strategies like dollar-cost averaging highly effective.

- 1 oz bars: The perfect entry point, often priced under $2. Great for gifting or starting a collection.

- 10 oz bars: A popular size for regular accumulation, balancing substance and affordability.

- 1 lb ingots (16 oz): A hefty and impressive workhorse for any copper stack.

- 1 kilo bars (35.27 oz): For more serious investors, these offer a better price-per-ounce.

- 10 lb bars (160 oz): The best value for dedicated stackers, offering the lowest premiums but requiring more storage space.

Collectible Designs on Modern Copper Bars

Modern copper bars often feature artistic designs that celebrate history, science, and nature.

- Buffalo designs: Echoing the iconic American Buffalo Nickel, these are a perennial favorite.

- Banknote replicas: These bars recreate vintage currency designs, appealing to history and art lovers.

- Elemental designs: Featuring copper's atomic symbol (Cu) and number (29), these have a sleek, scientific appeal.

- Patriotic symbols: Designs with Lady Liberty or the bald eagle are also common, adding a commemorative feel.

While these designs may add a small premium, many investors find the collector value and aesthetic appeal to be well worth it.

Why Invest in Copper? The "Red Metal's" Role in a Modern Portfolio

While gold and silver are seen as safe havens, copper bars represent a direct stake in global economic growth and our electric future. The green energy transition is creating an unprecedented hunger for copper, making it a compelling industrial metal for any diversified portfolio.

The Future is Electric: How Green Technology Drives Copper's Value

The numbers tell an incredible story. The global shift toward electrification is creating structural demand for copper that didn't exist a generation ago.

- Electric Vehicles (EVs): A typical EV requires 180 pounds of copper, three times more than a traditional car. As major automakers go all-electric, this demand will surge.

- Renewable Energy: A single wind turbine contains up to 4 tons of copper, while solar panels also rely on it for wiring and components. Offshore wind farms require even more for underwater power transmission.

- Global Construction: With spending projected to hit $15 trillion by 2030, copper remains the backbone of electrical and plumbing systems in all new infrastructure.

This isn't speculative demand—it's a structural change. The world is rewiring itself, and copper is the essential material making it possible. For investors, copper bars offer a way to benefit from this historic industrial transition. If you're building a tangible asset strategy, our guide on Maximizing Your Investment in a Chaotic Global Economy explains how industrial metals can complement precious metals.

Copper vs. Gold and Silver: An Investor's Comparison

Understanding how copper compares to precious metals is key to building a balanced portfolio. Each metal serves a different purpose.

| Feature | Copper | Silver | Gold |

|---|---|---|---|

| Price Point | Very Low ($1.79 for 1 oz) | Moderate ($20-30/oz) | Very High ($2,000+/oz) |

| Volatility | High (industrial demand cycles) | Moderate-High (dual role) | Moderate (safe haven) |

| Industrial Use | Very High (electrical, construction, EVs) | High (electronics, solar) | Low (jewelry, electronics) |

| Storage Density | Low (bulky per dollar value) | Moderate | High (compact, valuable) |

| Primary Investment Role | Industrial Growth Play | Hybrid Industrial/Monetary | Wealth Preservation |

The key takeaway is that copper is not a replacement for gold or silver but an excellent complement. Its value is tied to economic activity and technological progress, offering a different type of exposure than traditional safe-haven assets. For more on metal comparisons, see our analysis of Gold or Platinum: Making Your Bullion Investment Choice.

Smart Strategies for Buying and Storing Your Copper Bars

Investing in physical copper bars requires a smart approach to purchasing, storage, and management. The key is to ensure authenticity, protect your assets, and steer the market's inherent volatility.

How to Safely Purchase High-Purity Bullion

Authenticity is paramount. Always buy from reputable dealers who guarantee .999 fine copper. Look for established sellers with transparent pricing and positive customer reviews. At Summit Metals, we offer authenticated metals with real-time pricing reflecting our bulk purchasing advantages.

Legitimate copper bars are clearly marked with their weight and purity. While you can't verify this at home, these markings, backed by a dealer's guarantee, are your first line of defense. Local coin shows are another good source, but always remember: if a deal seems too good to be true, it probably is.

Secure Storage and Handling Best Practices

Proper storage is crucial for preserving your investment's condition and value.

- Home Safes: A high-quality, anchored fireproof and waterproof safe is a good option for smaller collections.

- Bank Safe Deposit Boxes: These offer professional-grade security but limit your access to banking hours.

- Third-Party Vaults: The premium choice for larger holdings, providing top-tier security and insurance.

Always wear clean cotton gloves when handling your bars, especially minted ones, to prevent tarnishing from skin oils. Keep a detailed inventory of your holdings for insurance and performance tracking.

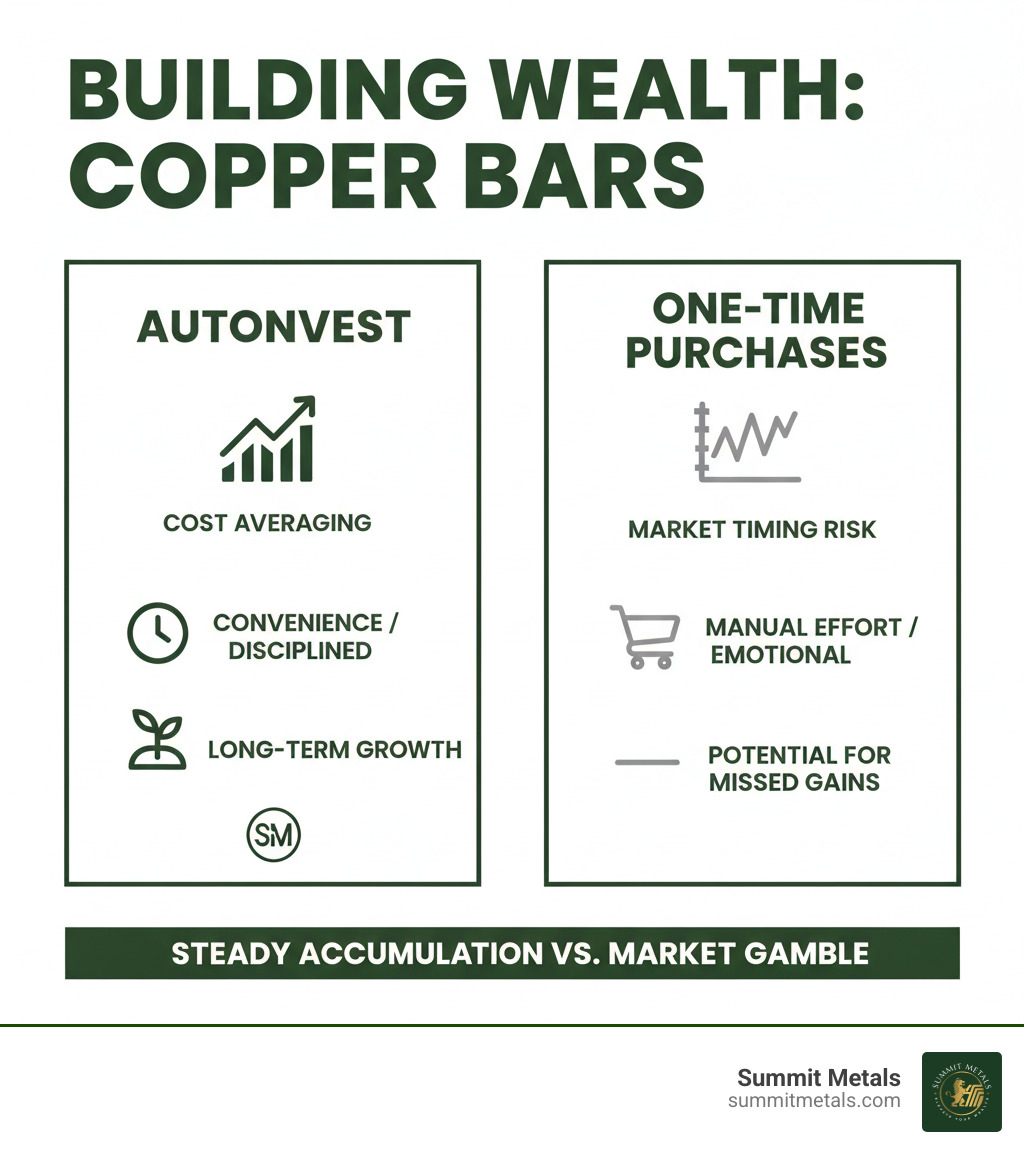

Dollar-Cost Averaging with Copper: The Autoinvest Strategy

Dollar-cost averaging is a powerful strategy for navigating copper's price volatility. It involves investing a fixed amount at regular intervals, which smooths out your average purchase price over time—you buy more when prices are low and less when they are high.

Summit Metals makes this easy with our Autoinvest program. You can set up recurring monthly purchases of metals, including copper, similar to contributing to a 401k. This disciplined, automated approach removes emotion from investing and ensures you consistently build your tangible asset portfolio.

The simplicity and consistency of Autoinvest help mitigate volatility while building long-term wealth. Ready to start? You can set up your Autoinvest plan with Summit Metals today. This 401k-style approach to metals is exclusive to Summit Metals customers and designed to make your investment journey as smooth as possible.

Comparison Charts: Making the Right Choice for Your Portfolio

Choosing the right metals for your portfolio is easier when you understand the key differences. These charts break down popular options to help you make informed decisions.

First, let's compare copper bars and copper rounds. Both offer .999 fine purity, but their form factor suits different goals.

| Feature | Copper Bar | Copper Round |

|---|---|---|

| Storage Efficiency | High; rectangular shape stacks neatly. | Lower; requires capsules and doesn't stack as well. |

| Design Appeal | Simple or intricate; large surface for art. | Coin-like and detailed; high collector appeal. |

| Premiums | Generally lower over spot price. | Can be slightly higher due to complex minting. |

| Liquidity | High; valued for metal content. | High; valued for metal and design. |

Bars are ideal for efficient, bulk stacking, while rounds appeal to collectors who enjoy numismatic designs.

Next, the classic debate: gold coins versus gold bars. This choice has significant implications for your strategy.

| Feature | Gold Coin | Gold Bar |

|---|---|---|

| Face Value | Yes, legal tender backed by a government. | No, valued purely by metal content. |

| Fraud Protection | High; security features make counterfeiting difficult. | Lower for small bars; large bars have assays. |

| Storage | Easy to store in tubes; less prone to scratching. | Highly stackable and efficient for bulk storage. |

| Premiums | Can be higher, but low for bullion coins. | Generally lower, especially for large sizes. |

| Liquidity | Highly liquid and globally recognized. | Highly liquid and globally recognized. |

| Legal Tender | Yes, provides a minimum value floor. | No. |

Gold coins offer a unique layer of security with their legal tender status and government backing, which provides a guaranteed value floor and improved fraud protection. This makes them a reassuring choice for many investors.

Whether you choose copper bars or gold coins, consistent investing is key. Summit Metals' Autoinvest program makes dollar-cost averaging effortless. Like a 401k, it lets you automatically build your portfolio over time, turning market volatility into an advantage.

Frequently Asked Questions about Copper Bars

Here are concise answers to the most common questions about investing in copper bars.

Are copper bars a good investment?

Yes, they can be an excellent diversification tool. Copper's value is tied to industrial growth and technology trends like green energy.

- Pros: Low entry price, direct exposure to economic growth, and high demand from the electrification trend.

- Cons: More volatile than gold, and its lower value density means storage requires more space.

They are best used to complement a portfolio of precious metals like gold and silver, not replace them.

How much is a 1 lb copper bar worth?

The value is the current spot price of copper multiplied by 16 (since a pound has 16 ounces), plus a small premium. The premium covers manufacturing and dealer costs. For example, at the time of publication, 1 lb copper bars were trading around $34.45. This price fluctuates daily with the market. Because you are buying a standardized product, the pricing is very transparent.

Is it better to buy copper bars or rounds?

This depends on your goals. Both are made from .999 fine copper.

- Choose bars if: Your priority is accumulating the most copper for your money in the most space-efficient way. Bars are easier to stack and typically have lower premiums.

- Choose rounds if: You enjoy collecting and appreciate artistry. Rounds often feature beautiful, coin-like designs but may carry slightly higher premiums and are less efficient to store.

Many investors choose a mix of both: bars for bulk accumulation and rounds for their collector appeal.

Conclusion: Is Copper the Right Addition to Your Portfolio?

Copper bars offer a compelling opportunity to invest in a tangible asset with a rich history and a future tied to global innovation. As a tangible asset, copper provides a satisfying physical holding that digital investments cannot replicate.

Its low entry cost makes it accessible to all investors, while its critical role in the green energy transition provides strong industrial demand. Every EV, wind turbine, and solar panel increases the need for this essential metal. However, investors should be aware of the risks: copper's price is more volatile than gold's, and its lower value density requires more storage space.

At Summit Metals, we specialize in authenticated gold and silver, providing transparent, real-time pricing. We recognize that industrial metals like copper can be a smart addition to a diversified tangible asset strategy. For many, the practical considerations of owning copper are a small price to pay for a stake in the green revolution.

Ready to expand your knowledge of tangible asset investing? Learn how to safely buy metals online with our complete guide and find how physical metals can strengthen your portfolio.