Why the Platinum vs Gold Bullion Debate Matters for Your Portfolio

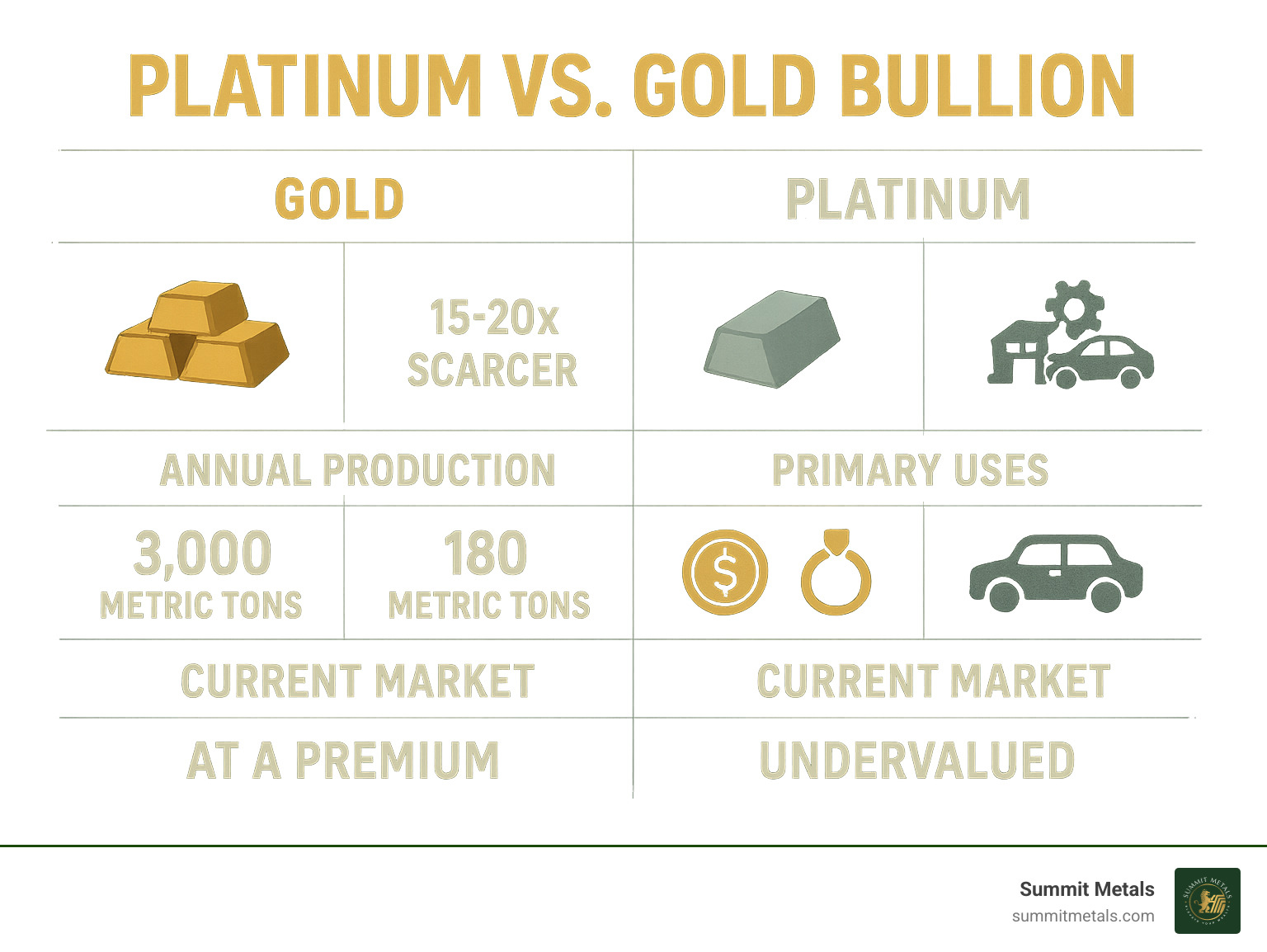

The platinum vs gold bullion debate is a crucial one for any precious metals investor. Each metal offers unique benefits for portfolio diversification. Here's a quick comparison:

Gold Bullion:

- A safe-haven asset with high liquidity and an established market.

- A historical store of value held by central banks.

- Exhibits lower volatility compared to platinum.

- Currently trades at a premium to platinum.

Platinum Bullion:

- 15-20 times rarer than gold, with significant scarcity.

- Has higher growth potential but is more volatile.

- Features strong industrial demand, especially from the automotive sector.

- Currently appears undervalued relative to historical norms.

Gold provides stability and an inflation hedge during economic uncertainty. Platinum offers higher upside potential due to its scarcity and industrial applications, including emerging hydrogen fuel cell technology. The right choice depends on your risk tolerance and investment goals. Gold suits those seeking wealth preservation, while platinum appeals to investors comfortable with higher volatility for potentially greater returns.

The Fundamental Differences: Rarity, Purity, and Industrial Demand

When we look closely at precious metals, it's clear that while both gold and platinum are amazing, they have very different traits. These differences really shape how they work as investments. Understanding everything from how rare they are to what industries use them is key to making a smart choice for your portfolio. If you're just starting your journey into precious metals, you might find our guide, The Ultimate Guide to Investing in Precious Metals, a helpful resource.

Platinum is about 15 to 20 times scarcer than gold. In 2023, the world mined roughly 3,000 metric tons of gold but only about 180 metric tons of platinum. This vast production difference highlights platinum's rarity. Furthermore, extracting platinum is more difficult and costly.

Their purity standards also differ slightly. Investment-grade gold is typically refined to .9999 fine (99.99% pure), while platinum bullion is .9995 fine. This small difference is due to the higher cost of purifying platinum to the final degree; both are considered excellent for investment bullion. By nature, Platinum is a white metal, contributing to its popularity in jewelry.

Finally, their primary industrial uses differ significantly, which plays a massive role in their price movements.

Gold: The Monetary Metal

For millennia, gold has been a symbol of wealth and power, establishing it as the classic monetary metal and a global store of value. This is why central banks hold vast gold reserves to diversify and stabilize their finances. Gold's appeal comes from its unique physical properties, including its density, durability, and conductivity. It is also the most malleable metal, making it ideal for jewelry.

As an investment, gold shines as a safe-haven asset, especially during economic instability, global unrest, or high inflation. Its value tends to rise when traditional financial markets struggle, offering protection against currency devaluation. This steady investor demand, combined with its cultural importance, helps keep gold's price relatively stable. For more on this topic, we recommend checking out our guide: Why Gold and Silver Prices Fluctuat.

Platinum: The Industrial Metal

While gold has a monetary history, platinum is an industrial workhorse. Its price is heavily influenced by its many critical industrial applications. The largest demand comes from the automotive industry, where it is a vital component in catalytic converters that reduce harmful emissions.

Beyond cars, platinum's industrial usefulness extends to medical and dental equipment, such as pacemakers, and the electronics industry for components in hard drives and LCD screens. Looking forward, platinum is ready to play a key role in green technologies, particularly hydrogen fuel cells, which could significantly impact its future price.

Unlike gold, platinum's price is more sensitive to economic growth and industrial output, making it more volatile during economic slowdowns.

Investment Fundamentals: The Platinum vs Gold Bullion Showdown

Deciding between platinum vs gold bullion for your investment portfolio comes down to understanding how each metal behaves in the market. They have distinct personalities regarding liquidity, volatility, and their role as a safe haven.

Here's a quick overview of their investment characteristics:

| Feature | Gold | Platinum |

|---|---|---|

| Liquidity | Very High (Global, established market) | Moderate (Niche market, lower trading volume) |

| Volatility | Lower (More stable, less industrial-driven) | Higher (More sensitive to industrial demand) |

| Safe-Haven Status | High (Traditional, during uncertainty) | Moderate (Less recognized, industrial ties) |

| Industrial Demand Link | Low (Primarily jewelry/investment) | High (Automotive, medical, electronics) |

| Historical Performance | Generally stable, strong long-term growth | More volatile, historically traded at premium to gold until 2015, currently undervalued |

Historical Price Performance and the Platinum/Gold Ratio

For most of the 20th century until 2015, platinum was typically more expensive than gold, at one point in 2008 soaring to over double the price of gold. This was driven by strong industrial demand and supply issues.

After the 2008 financial crisis, the dynamic shifted. Gold's price climbed while platinum's fell, hurt by an economic slowdown that impacted industrial demand. Since 2015, gold has consistently traded at a premium to platinum.

This brings us to the platinum/gold ratio (the price of platinum divided by the price of gold). When the ratio is low, platinum is historically inexpensive compared to gold. Currently, the ratio is at levels not seen in over a century, indicating a historical "undervaluation" that has captured the interest of many investors. Understanding this ratio can help time purchases, and we monitor market movements on exchanges like COMEX to spot these opportunities.

Volatility and Liquidity: A Tale of Two Markets

When we compare platinum vs gold bullion, their differences in volatility and liquidity are stark.

Gold is known for its relative stability. Its price is driven more by investor sentiment and its safe-haven role than by industrial cycles. Gold is also incredibly liquid, traded in massive volumes globally. This means it can be bought and sold quickly with minimal bid-ask spreads, making it ideal for those who value easy access to cash. Our guide, The Strategic Role of Gold in Long-Term Portfolio Management, explores this further.

Platinum, conversely, is more volatile. Its smaller market and lower trading volume can lead to more dramatic price swings. Since its demand is heavily tied to industrial use, its price reacts sharply to economic changes. This higher volatility presents both greater risk and potential for higher returns. Liquidity is also lower than gold's, which can mean wider bid-ask spreads and a slightly longer time to sell.

Analyzing the Pros and Cons of Investing in Bullion

Making an informed choice between platinum vs gold bullion requires a clear understanding of the advantages and disadvantages each metal brings to an investment portfolio. Your personal investment strategy, risk tolerance, and long-term goals will ultimately guide your decision.

Advantages and Disadvantages of Gold Bullion

Gold has earned its reputation as the bedrock of precious metals investing.

Advantages:

- Safe-Haven Asset: Investors flock to gold during economic instability, making it an excellent hedge against inflation and currency devaluation.

- High Liquidity: Gold is easily bought and sold worldwide, much like a globally accepted form of cash.

- Historical Stability: Its long track record and use as a reserve asset by central banks provide peace of mind for wealth preservation.

Disadvantages:

- Higher Premiums: Due to high demand, gold often carries higher premiums over its spot price compared to platinum. Prices shown are at the time of this publication.

- Slower Growth Potential: Gold is designed for wealth preservation, not aggressive growth.

Advantages and Disadvantages of Platinum Bullion

Platinum offers more aggressive growth potential but comes with higher risk.

Advantages:

- High Growth Potential: Currently trading at a historical discount to gold, platinum presents a unique "buy low" opportunity for value investors. Prices shown are at the time of this publication.

- Strong Industrial Demand: Its price is supported by real-world use in catalytic converters, medical devices, and emerging hydrogen fuel cell technology.

- Rarity: Being 15-20 times scarcer than gold provides an intrinsic value that can drive prices up as demand grows.

Disadvantages:

- High Volatility: Price swings can be sharp, as industrial demand falls during economic downturns.

- Lower Liquidity: The smaller market can mean wider bid-ask spreads and potentially slower sales.

Many investors solve this dilemma by diversifying, holding both metals to balance gold's stability with platinum's growth potential.

How to Build Your Precious Metals Portfolio

Once you've weighed the pros and cons of platinum vs gold bullion, the next step is to build your position. This involves choosing the right products, managing costs, and developing a consistent investment approach.

Choosing Your Bullion: Bars, Coins, and Premiums

When it comes to physical precious metals, you have two main choices: bars and coins.

Bars typically offer the most metal for your money. Because their value is tied almost entirely to their metal content, they carry lower premiums over the spot price, making them ideal for accumulating weight.

Coins, like the American Gold Eagle or Canadian Platinum Maple Leaf, offer instant recognition and trust. While their premiums may be slightly higher, their liquidity is excellent, as buyers worldwide know their quality.

Premiums are the cost above a metal's spot price, covering manufacturing, distribution, and dealer costs. Smaller products and those from renowned mints usually have higher premiums. Currently, platinum products often carry lower premiums than their gold counterparts, making them attractive from a cost-efficiency standpoint. Prices shown are at the time of this publication. For more strategies, see The Basics of Gold and Silver Stacking.

Diversifying and Dollar-Cost Averaging with Autoinvest

Smart investing means diversifying. Combining both gold and platinum creates a more balanced portfolio. A common strategy is allocating 5-10% of your overall portfolio to gold for stability and 1-5% to platinum for growth potential.

The key to building this position without stress is dollar-cost averaging: investing a fixed amount regularly, regardless of price fluctuations. This strategy removes emotion and market-timing guesswork from your decisions.

This is where Summit Metals' Autoinvest program is a game-changer. It allows you to automate your precious metals purchases, just like contributing to a 401k. You can set up recurring monthly buys of both gold and platinum, building your platinum vs gold bullion holdings consistently over time. Autoinvest makes disciplined investing easy, ensuring you build wealth steadily without having to constantly watch the market. It's the simplest way to implement a sophisticated, long-term strategy. For more on safe purchasing, explore How to Buy Gold and Silver Online Safely.

Frequently Asked Questions about Platinum vs Gold Bullion

We understand that investing in precious metals can bring up a lot of questions. Here are the most common inquiries we receive about platinum vs gold bullion, answered with the straightforward information you need to make informed decisions.

Which is a better investment, gold or platinum?

There is no single "better" choice; it depends on your goals.

- Choose Gold for stability and wealth preservation. It's the classic safe-haven asset for protecting against economic uncertainty.

- Choose Platinum for growth potential. Its current undervaluation and industrial demand offer higher potential returns but come with more volatility.

The best strategy for many is diversification. Holding both allows you to benefit from gold's safety and platinum's upside.

Is platinum rarer than gold?

Absolutely, and the numbers are pretty striking. Platinum is roughly 15-20 times scarcer than gold in the Earth's crust. Annual mine production reflects this: in 2023, roughly 3,000 metric tons of gold were mined versus only 180 metric tons of platinum. However, rarity doesn't always dictate price, as market size and demand drivers also play a huge role. This disconnect is why some investors see platinum as a major opportunity.

Why is gold considered a better safe-haven asset?

Gold's reputation as the ultimate financial safe haven is built on several key factors that platinum, despite its rarity, simply can't match:

- History: Gold has been used as money and a store of value for thousands of years across all cultures.

- Central Bank Holdings: Major world governments hold substantial gold reserves, providing a stable floor for demand.

- Lower Industrial Link: Gold is less tied to industrial cycles, insulating it from economic downturns that affect platinum.

- Superior Liquidity: The gold market is massive and highly liquid, allowing for quick and easy transactions anywhere in the world.

- Investor Psychology: In times of crisis, investors instinctively turn to the tangible, trusted security of gold.

While platinum can certainly perform well under the right economic conditions, its stronger industrial ties and smaller market make it less of a pure safe-haven play. For a deeper understanding of safe-haven assets, check out our comprehensive guide: Gold vs. Silver: Understanding the Differences and Investment Potential.

Final Verdict: Aligning Your Choice with Your Strategy

The great debate of platinum vs gold bullion isn't about finding a single "winner." Instead, it's about understanding how each of these amazing metals can uniquely fit into your financial plans.

Gold is the anchor of a precious metals portfolio. Its history, liquidity, and safe-haven status make it the ultimate tool for long-term wealth preservation and protection against inflation.

Platinum is the growth-oriented component. Its extreme rarity, vital industrial role, and current pricing relative to gold present a compelling opportunity for investors seeking higher potential gains, albeit with more volatility.

Your final decision should match your personal risk tolerance. If stability is your priority, lean towards gold. If you are comfortable with more risk for potentially greater returns, platinum is an exciting option. Many savvy investors own both, balancing stability with growth.

At Summit Metals, we are dedicated to helping you invest wisely. We offer authenticated gold and silver precious metals with transparent, real-time pricing. Our goal is to provide the knowledge and tools you need to make the best decision for your financial journey, whether you're in our home state of Wyoming or across the country in Salt Lake City, Utah. To learn more, explore our guide on Bullion Investing 101: How to Safely Stack Your Wealth.