Securing Your Retirement Future with Precious Metals

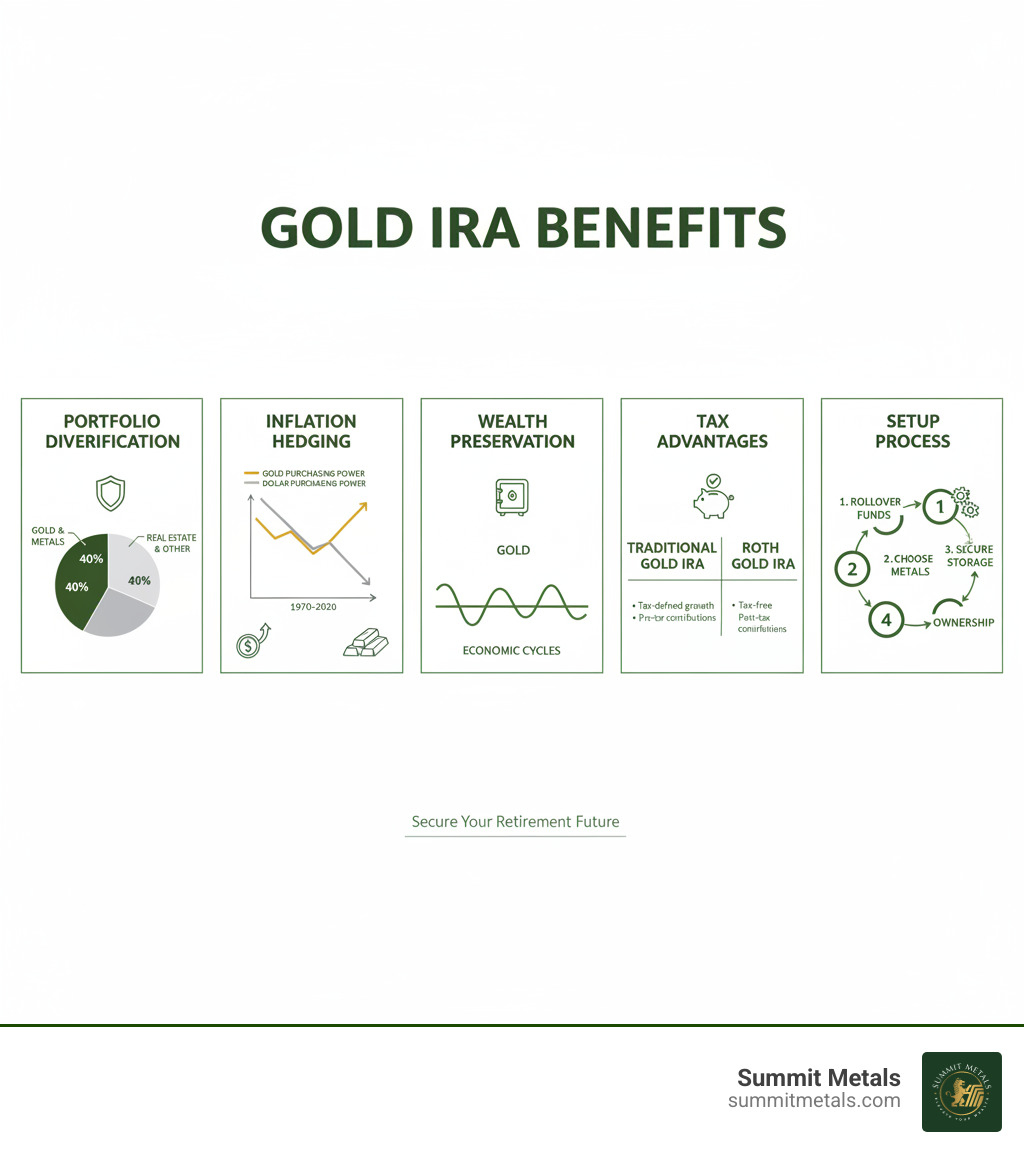

Gold IRA services allow you to hold physical gold, silver, platinum, and palladium in a retirement account, offering portfolio diversification and a hedge against economic uncertainty. These self-directed IRAs provide the same tax advantages as traditional accounts but with the security of tangible assets.

A full-service provider handles everything from IRA setup and metals purchasing to secure storage and liquidation. As investors seek alternatives to paper assets, Gold IRAs have become a popular way to build more resilient retirement portfolios.

However, quality and costs vary significantly. Annual fees typically range from $180 to $350, and minimum investments can be anywhere from $2,000 to $50,000. It's crucial to compare providers on their fee structures, storage options, and product selection.

As Eric Roach, I've spent a decade on Wall Street creating defensive portfolios for Fortune-500 clients. Now, I apply that institutional expertise to help individual investors steer gold IRA services and build durable retirement strategies with precious metals.

What is a Gold IRA? Understanding the Fundamentals

A Gold IRA, or precious metals IRA, is a type of Self-Directed IRA (SDIRA) that lets you hold physical gold, silver, platinum, and palladium in your retirement portfolio. It offers the same tax advantages as a standard IRA (tax-deferred or tax-free growth), but your investment consists of tangible metals that have been a store of value for centuries.

At Summit Metals, we provide authenticated investment-grade precious metals that meet strict IRS standards. Based in Wyoming, we believe owning physical assets provides peace of mind and a tangible hedge when market volatility strikes.

Image: A selection of IRA-approved precious metals, including American Eagle gold and silver coins, and PAMP Suisse gold bars.

Gold IRA vs. Traditional IRA

The primary difference between gold IRA services and traditional IRAs is the asset class, which affects everything from custodians to costs.

- Asset Types: Traditional IRAs hold paper assets like stocks, bonds, and ETFs. A Gold IRA holds physical precious metals that meet IRS purity requirements.

- Custodian Roles: Gold IRAs require specialized custodians who manage the compliance and storage of physical assets, unlike standard brokerage firms.

- Fee Structures: Gold IRA services have higher annual fees to cover secure storage, insurance, and administration for physical metals.

- Investor Control: A self-directed Gold IRA gives you more control, allowing you to select specific coins and bars for your account, rather than being limited to a fund's pre-selected options.

| Feature | Traditional IRA | Gold IRA |

|---|---|---|

| Assets Held | Stocks, bonds, mutual funds, ETFs | Physical gold, silver, platinum, palladium |

| Custodian Requirements | Standard financial institutions | Specialized precious metals custodians |

| Typical Fees | Lower annual fees, commission-based trading | Higher fees including storage and insurance |

| Investor Control | Limited to available investment options | Direct selection of specific metals and products |

Gold IRA vs. Other Retirement Assets

Compared to "paper gold" investments like ETFs or mining stocks, a Gold IRA offers distinct advantages.

- Physical Ownership: With a Gold IRA, you own specific, allocated coins or bars. With an ETF, you own shares in a fund that claims to hold gold.

- Counterparty Risk: Physical ownership minimizes counterparty risk. Your investment isn't dependent on a fund manager's or company's performance and solvency.

- Liquidity: While paper assets can be sold instantly during market hours, reputable gold IRA services offer streamlined buyback programs, making liquidation straightforward for long-term investors.

- Storage: Physical metals require secure, insured storage in an IRS-approved depository, which adds cost but guarantees institutional-grade protection.

| Feature | Gold IRA | Paper Assets (ETFs, Mining Stocks) |

|---|---|---|

| Physical Ownership | Direct ownership of actual metals | Indirect exposure through financial instruments |

| Counterparty Risk | Minimal once stored securely | Higher dependence on fund managers and companies |

| Liquidity | Moderate with buyback programs | High during market hours |

| Storage Requirements | Mandatory IRS-approved depository | Digital brokerage account records |

The Pros and Cons of Investing in a Gold IRA

Investing in a Gold IRA is a strategic move for long-term retirement planning, not a get-rich-quick scheme. It's about adding a stabilizing anchor to your portfolio. Like any investment, weigh the benefits against the drawbacks.

Image: A balanced portfolio scale, illustrating stocks and bonds on one side, and gold on the other, representing diversification.

Key Benefits: Why Investors Choose Gold IRAs

- Portfolio Diversification: Gold's price often moves independently of stocks and bonds, which can help cushion your portfolio during market downturns.

- Inflation Protection: Historically, gold has maintained its purchasing power over the long term, acting as a reliable hedge against inflation.

- Economic Uncertainty: During periods of market instability or geopolitical turmoil, investors have traditionally flocked to gold as a safe-haven asset.

- Tangible Asset Ownership: Owning a physical asset that exists outside the digital financial system provides a unique sense of security. It can't be devalued by printing more of it.

For more on why precious metals are considered safe-haven assets, see our guide on Why Gold and Silver: Understanding Their Value as Safe Haven Assets.

Risks and Drawbacks to Consider

- Higher Fees: Gold IRAs involve costs for setup, administration, secure storage, and insurance, which are higher than typical brokerage accounts.

- No Income Generation: Precious metals do not pay dividends or interest. Your return depends entirely on price appreciation.

- Price Volatility: While often seen as stable, gold prices can experience significant short-term swings based on market sentiment and economic data.

- Potential for Scams: The industry can attract fraudulent actors. The CFTC warns investors about Gold and Silver Schemes Designed to Drain Your Retirement Savings. Be wary of high-pressure tactics and promises of guaranteed returns.

Most advisors recommend allocating 5-15% of a portfolio to precious metals to gain diversification benefits without over-exposure.

Navigating IRS Rules and Regulations for Gold IRAs

When using gold IRA services, following IRS rules is non-negotiable. These regulations are designed to protect the integrity of your retirement savings. The most critical rule is that you cannot store your IRA gold at home. All precious metals must be held by a third-party custodian in an IRS-approved depository.

Attempting to take physical possession of your IRA metals is a prohibited transaction that the IRS treats as a full distribution, triggering taxes and potential penalties. Your custodian ensures all transactions and storage arrangements remain compliant. For a complete breakdown, see our Ultimate Rulebook for Precious Metals IRA Investors.

Eligible Precious Metals and Purity Standards

The IRS has strict purity requirements for metals held in an IRA:

- Gold: 99.5% pure (.995 fine)

- Silver: 99.9% pure (.999 fine)

- Platinum & Palladium: 99.95% pure (.9995 fine)

Commonly approved products include American Eagle coins, Canadian Maple Leafs, and bars from accredited refiners like PAMP Suisse. Most collectible or numismatic coins are not eligible. When choosing between coins and bars, consider the following:

| Feature | Gold Coins (e.g., American Eagles) | Gold Bars (e.g., PAMP Suisse) |

|---|---|---|

| Government Backing | Yes, guaranteed by a sovereign mint | No, guaranteed by a private refiner |

| Face Value | Yes, a legal tender value | No face value |

| Fraud Protection | High, with intricate and recognizable designs | Good, but relies on refiner reputation |

| Liquidity | Excellent, highly recognized and divisible | Good, but may be less divisible |

| Premium Over Spot | Higher due to minting costs and design | Lower, closer to the metal's spot price |

Many investors prefer government-minted coins like the American Eagle for their IRA due to their high recognizability, government guarantee, and built-in anti-counterfeiting features.

Contribution Limits, Taxes, and Distributions

A Gold IRA follows the same contribution and distribution rules as a standard IRA.

- Contribution Limits (2024): You can contribute up to $7,000 per year, plus an additional $1,000 catch-up contribution if you are age 50 or older. This limit applies across all your IRA accounts combined.

- Tax Treatment: With a Traditional Gold IRA, contributions may be tax-deductible, and withdrawals are taxed in retirement. With a Roth Gold IRA, you contribute with after-tax dollars, but qualified withdrawals are tax-free.

- Withdrawals: Taking distributions before age 59½ typically results in a 10% penalty plus income tax. Traditional IRAs have Required Minimum Distributions (RMDs) starting at age 73, while Roth IRAs do not for the original owner.

Always check the official IRS information on retirement plan contribution limits for the most current rules.

Your Checklist for Comparing Gold IRA Services

Choosing the right gold IRA services provider is the most critical decision you'll make. A trustworthy partner will safeguard your retirement assets for decades. Use this checklist to evaluate potential companies.

Image: A checklist on a clipboard, symbolizing the careful evaluation process for selecting Gold IRA services.

Key Evaluation Criteria

- Reputation and Ratings: Look for companies with A+ BBB and AAA BCA ratings, backed by positive customer reviews on sites like Trustpilot. Avoid providers who use high-pressure sales tactics.

-

Fee Transparency: A reputable company provides a clear, upfront breakdown of all costs. There should be no surprise fees. Key costs include:

- Setup Fee: A one-time charge, often $50-$100 (sometimes waived).

- Annual Admin Fee: $80-$160 for account management.

- Storage Fee: $100-$150 annually. Segregated storage (your metals held separately) costs more than commingled storage. Learn more in our Depository Deep Dive.

- Dealer Premium: The markup over the metal's spot price. Understanding how pricing works is crucial.

- Product Selection & Minimums: Ensure the provider offers a wide range of IRA-eligible metals and has a minimum investment that fits your budget (typically $2,000 to $50,000).

- Educational Resources: Companies committed to investor education demonstrate a long-term partnership mentality, not just a desire for a quick sale.

- Buyback Policies: A clear, fair, and guaranteed buyback policy is essential for future liquidity when you need to take distributions.

A Smarter Way to Invest: Automating Your Gold IRA Services

Instead of trying to time the market with one large purchase, smart investors use dollar-cost averaging to build their positions over time. This strategy involves investing a fixed amount regularly, which smooths out volatility by buying more metal when prices are low and less when they are high.

This is the same principle behind consistent 401(k) contributions. At Summit Metals, our Autoinvest program makes this easy. You can set up recurring monthly purchases of gold and silver for your IRA, automating your investment strategy. Our transparent, real-time pricing and bulk purchasing power ensure you get maximum value with every contribution.

This hands-off approach removes the stress of market timing and builds wealth steadily. Learn more about this powerful strategy in our article on The Power of Dollar-Cost Averaging in Gold and Silver Investments.

Frequently Asked Questions about Gold IRAs

As you consider gold IRA services, questions are natural. Here are answers to the most common ones we hear from investors.

Can I store my IRA gold at home?

No. IRS regulations are strict and clear: all precious metals held within an IRA must be stored in an IRS-approved depository. Storing them at home is a prohibited transaction that can trigger severe tax consequences and penalties, as the IRS would consider it a full distribution of your account's value.

Approved depositories offer institutional-grade security and insurance, ensuring your assets are far safer than they would be in a personal safe while keeping you fully compliant.

How do I fund a Gold IRA?

You have three primary options to fund your account, and your provider will help you with the process:

- Rollover: Move funds from a former employer's plan (like a 401(k), 403(b), or TSP) directly to your new Gold IRA custodian. This is the most common method and is a tax-free event.

- Transfer: Transfer funds from an existing IRA (Traditional, Roth, SEP, etc.) to your new Gold IRA. This is also a tax-free transaction.

- Direct Contribution: Contribute new money from your bank account, up to the annual IRA limit ($7,000 for 2024, or $8,000 if age 50+).

What's the difference between a Traditional and a Roth Gold IRA?

The choice between a Traditional and Roth Gold IRA comes down to when you want to pay taxes.

Traditional Gold IRA: You contribute with pre-tax dollars, potentially getting a tax deduction now. Your investments grow tax-deferred, and you pay income tax on withdrawals in retirement. Required Minimum Distributions (RMDs) start at age 73.

Roth Gold IRA: You contribute with after-tax dollars (no upfront deduction). Your investments grow tax-free, and qualified withdrawals in retirement are also tax-free. There are no RMDs for the original owner.

Your choice depends on whether you expect your tax rate to be higher now or in retirement. Many investors use a mix of both to create tax diversification for their future.

Conclusion: Making Your Final Decision

Choosing the right gold IRA services is a foundational step toward a secure retirement. By now, you understand what a Gold IRA is, its pros and cons, and the IRS rules that govern it. The path forward is about careful, informed decisions.

Remember these key takeaways:

- Diversification is crucial. Physical metals can provide a buffer against the volatility of paper assets.

- Follow IRS rules without exception. Use an approved custodian and depository to avoid costly penalties.

- Compare providers diligently. Focus on reputation, fee transparency, and customer service over flashy marketing.

Instead of trying to time the market, consider a smarter approach. Dollar-cost averaging through automated investing removes guesswork and builds wealth steadily. Our Autoinvest program makes it simple to contribute to your Gold IRA consistently, just like a 401(k).

At Summit Metals, we are committed to transparency and trust. Based in Wyoming, we provide authenticated gold and silver at competitive rates, thanks to our bulk purchasing power and real-time pricing. We make precious metals investing straightforward and accessible.

Your financial future deserves the stability that tangible assets can offer. To learn more, read our IRA Gold Investment: A Comprehensive Guide to Securing Your Future. We're here to help you build the resilient retirement you deserve.