Why a 1 Gram Platinum Bar Belongs in Every Smart Portfolio

From Gram to Glam: Where to Buy 1g Platinum Bars for Investment

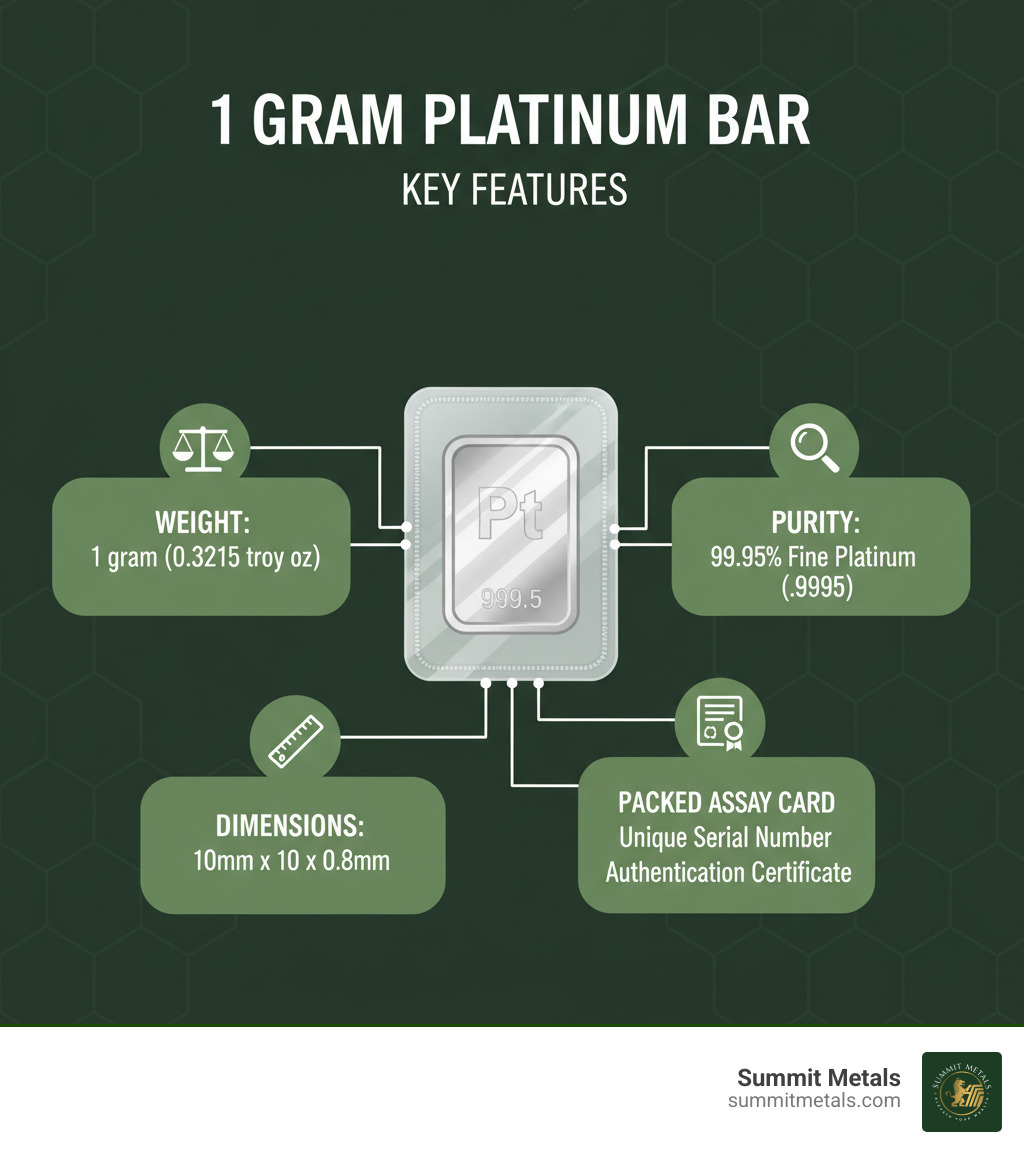

A 1 gram platinum bar is the smallest practical denomination of platinum bullion you can buy. Containing 0.03215 troy ounces of .9995 pure platinum, it's an accessible entry point for investors who want exposure to one of Earth's rarest precious metals without a large upfront investment.

Quick Guide to 1 Gram Platinum Bars:

- Weight: 1 gram (0.03215 troy oz)

- Purity: .9995 fine platinum (99.95% pure)

- Typical Dimensions: 10mm x 10mm x 0.6–0.8mm

- Price Range: $53–$72 per bar (prices vary by dealer)

- Key Manufacturers: Valcambi, PAMP Suisse, Argor Heraeus

- Packaging: Sealed assay card with serial number and authentication

- IRA Eligible: Yes, when purchased from approved dealers

- Best Use Cases: Portfolio diversification, dollar-cost averaging, gifting

Platinum is 30 times rarer than gold, yet often trades at a lower price per ounce, making it an intriguing opportunity for savvy investors. Industrial demand from automotive catalytic converters keeps this metal in constant circulation. A 1 gram bar gives you tangible exposure to this dynamic market without the premium shock of larger bars.

These tiny ingots, roughly the size of a pinky fingernail, pack serious investment potential. Each bar arrives in tamper-evident packaging with an assay card that guarantees its weight and purity. Unlike paper assets, you can hold this wealth in your hand—a physical hedge against economic uncertainty. Physical precious metals can be a resilient, liquid complement to traditional portfolios, and fractional platinum is one of the most underrated tools in that strategy.

If you're ready to dive deeper into this fascinating metal, we invite you to explore The World of Platinum Bullion: A Beginner's Introduction.

Why Invest in a 1 Gram Platinum Bar?

When first exploring precious metals, the thought of a large investment can be overwhelming. That's where the 1 gram platinum bar shines—it's your financial toe-dip into one of Earth's rarest metals without the sticker shock. A 1 gram bar gives you real exposure to platinum's market dynamics while keeping your initial commitment manageable, often costing between $53 and $72. If you're looking for more ways to invest without breaking the bank, see our guide on Platinum Bullion on a Budget: Your Guide to Affordable Options.

The divisibility factor is where fractional platinum proves its worth. If you need quick access to cash, owning a large bar forces an all-or-nothing sale. With 1 gram bars, you can sell exactly what you need and keep the rest working for you. This liquidity advantage means you maintain control over your holdings, converting small portions to cash without disrupting your entire strategy.

Beyond affordability, platinum offers unique portfolio diversification. While gold moves with currency fears, platinum has its own drivers. About 80% of the global supply comes from South Africa, and the metal is critical for automotive catalytic converters. This means platinum prices respond to automotive trends, emissions regulations, and the shift toward green technology like hydrogen fuel cells. This industrial utility, combined with extreme scarcity, has earned it the nickname "Rich Man's Gold," yet it often trades at a discount to gold—an opportunity savvy investors recognize. Learn more in Beyond Gold: Exploring the World of Precious Metal Investments.

The gifting potential is also significant. A 1 gram platinum bar makes a sophisticated, memorable gift that holds intrinsic value. It's perfect for graduations, milestone birthdays, or introducing a young adult to wealth-building concepts.

Perhaps the most powerful use of 1 gram bars is for dollar-cost averaging. At Summit Metals, our Autoinvest program lets you buy every month—just like contributing to a 401(k), but with physical platinum. By purchasing fractional amounts consistently, you smooth out price volatility and build wealth steadily without trying to time the market. A small monthly commitment is manageable for most budgets, yet over time those bars accumulate into a meaningful position.

If you're weighing platinum against other precious metals, Gold or Platinum: Making Your Bullion Investment Choice will help you understand how these two metals complement each other.

The bottom line? A 1 gram platinum bar removes barriers to entry. It's affordable enough to start today, liquid enough for flexibility, and strategic enough to improve your portfolio's resilience.

Top Manufacturers and How to Verify Authenticity

When you're holding a 1 gram platinum bar, you want to be certain it's the real deal. Reputable platinum refiners have perfected their authentication systems, with Swiss refiners leading the way. Valcambi Suisse, PAMP Suisse, and Argor-Heraeus are trusted names whose products carry weight in the investment community. At Summit Metals, we source only from these established manufacturers, ensuring every bar meets the highest standards.

Every legitimate 1 gram bar comes sealed in an assay card—a protective birth certificate for your platinum. This tamper-evident card lists the bar's weight, purity, and a certified assayer's signature. It's your proof of authenticity, so keep the bar sealed in its card to preserve its resale value.

Key authentication features include:

- Unique Serial Number: Stamped on the bar and printed on the assay card, this number makes your bar traceable and verifiable.

- Tamper-Evident Packaging: The assay card is designed to show obvious signs of tampering, such as tears or broken seals.

- Purity Mark: Look for .9995 fine platinum (99.95% pure). This is the globally recognized benchmark for investment-grade platinum and is required for IRA eligibility.

Our 1 gram platinum bar offerings carry all these features. You'll find clear markings on both sides of the bar showing weight, purity, and the refiner's logo—all matching the details on the assay card. Every bar comes in protective packaging to keep it in pristine condition, providing layers of security that give you confidence in your purchase.

The same principles of authentication apply across precious metals. You can learn more by reading about security features on other fractional products, like in The Golden Gram: Unearthing the Best Deals on 1g PAMP Suisse Gold Bars.

Ready to add authenticated platinum to your portfolio? Explore our current selection at 1g Platinum Bar - Summit Metals, where transparent pricing meets uncompromising quality.

Understanding the Price: Spot Price vs. Premium

Understanding the price of a 1 gram platinum bar involves two key components: the spot price and the premium.

Spot Price Explained

The spot price is the live market rate for one troy ounce of raw platinum ready for immediate delivery. This price fluctuates constantly based on global supply and demand, industrial use, and currency movements. It's the baseline value of the metal before it's fabricated into a bar. For a deeper dive, see Platinum Bullion and Spot Price: What You Need to Know.

Premiums Explained

The premium is the amount you pay above the spot price. This covers the real costs of producing and delivering a physical bar, including:

- Fabrication: The energy, machinery, and labor to mint raw platinum into a precise bar.

- Packaging and Assay: The tamper-evident card and certification process that guarantees authenticity.

- Dealer Markup: The costs of running a reputable business, including secure storage, insurance, shipping, and customer service.

Fractional bars like the 1 gram platinum bar typically carry a higher percentage premium than larger bars. This is because the fixed costs of fabrication and assaying don't scale down proportionally. For example, if the spot value of 1 gram of platinum is $32.15, the bar might sell for $53 to $72. That difference is the premium. While higher, this premium is the trade-off for the affordability and divisibility that make fractional bars so accessible. Learn more about navigating these dynamics in Mastering Platinum Bullion Trading.

Finding the Best Price on a 1 gram platinum bar

Smart shopping can help you save. Here’s how to find the best value:

- Compare Dealers: Look for transparent pricing that clearly shows the total cost. At Summit Metals, we provide real-time pricing that reflects current market conditions.

- Check Total Cost: Always factor in shipping, insurance, and any payment processing fees.

- Look for Volume Discounts: Many dealers, including Summit Metals, offer tiered pricing. Buying multiple bars at once can lower the per-bar cost. This is ideal for an Autoinvest strategy, where regular monthly purchases help you build wealth steadily.

- Use Payment Method Discounts: Payments via bank wire or check often have lower processing fees than credit cards, and dealers pass these savings on to you, sometimes reducing the price by up to 4%.

These principles apply to other fractional metals as well. Learn more in Fractional Gold Bars: An Affordable Entry Point for Gold Investors.

Where and How to Buy Your Platinum Investment

Once you've decided a 1 gram platinum bar fits your goals, the next step is buying one. Working with a trusted dealer makes the process simple and secure.

Finding the Right Place to Buy

Reputable online dealers like Summit Metals are the most convenient way to purchase. Online shopping gives you access to competitive pricing, real-time inventory, and the ability to compare products easily. Because we buy in bulk, we can pass those savings on to you. While we operate from Wyoming with a physical presence in Salt Lake City, Utah, our online store serves investors nationwide. Local coin shops may offer immediate access but often have limited selection and higher premiums.

Payment, Shipping, and Insurance

At Summit Metals, we offer flexible payment options. Bank wire transfers typically provide the best pricing due to lower processing fees. Credit cards offer convenience but carry higher fees. We also accept cryptocurrency and checks. Our pricing is transparent, so you can choose the method that works best for you.

When you order a 1 gram platinum bar, we treat it with care. Every shipment is sent in discreet, unmarked packaging and is fully insured from our vault to your doorstep. You'll receive tracking information to follow your investment's journey, giving you complete peace of mind.

Building Wealth Steadily with Autoinvest

One of the smartest ways to invest in precious metals is through dollar-cost averaging—investing a consistent amount at regular intervals. This strategy smooths out price volatility and removes the emotion from investing.

Our Autoinvest program makes this effortless. You can set up a recurring monthly purchase of 1 gram platinum bars, and we'll automatically process your order. It's like contributing to a 401k, but you're building a portfolio of tangible assets you can hold. The low entry price of 1 gram bars makes consistent monthly purchases realistic for almost any budget.

Explore our subscription options at https://summitmetals.com/pages/subscriptions or learn more about automated payments at https://summitmetals.com/pages/autopays. For a complete overview, read The Ultimate Beginner's Guide to Investing in Precious Metals.

Why Summit Metals?

We built Summit Metals on the principle that precious metals investing should be straightforward and transparent. We offer real-time pricing, authenticated products, and no hidden fees. Our bulk purchasing power means you get competitive rates that smaller dealers can't match. We're not just selling metal—we're helping you build financial security.

Comparison Charts: Making the Right Choice

Understanding your options is key to building a strong precious metals portfolio. Let's compare a 1 gram platinum bar with some common alternatives to help you make the right choice for your goals.

Platinum vs. Gold: The 1 Gram Decision

Both platinum and gold offer an accessible entry point at the 1-gram size, but they serve different roles in a portfolio. Platinum's price is heavily influenced by industrial demand, while gold is primarily a monetary and safe-haven asset.

| Feature | 1g Platinum Bar | 1g Gold Bar |

|---|---|---|

| Primary Driver | Industrial Demand (Automotive, Green Tech) | Monetary Demand (Safe Haven) |

| Rarity | 30x rarer than gold | Globally recognized monetary metal |

| Upfront Cost | Often lower due to lower spot price | Often higher due to higher spot price |

| Premium | Typically higher percentage over spot | Typically lower percentage over spot |

| Diversification | Hedges against different risks than gold | Traditional hedge against inflation |

Size Matters: 1 Gram vs. 1 Ounce Platinum

Here we see the classic trade-off between affordability and efficiency. Smaller bars offer flexibility, while larger bars provide better value on a per-gram basis.

| Feature | 1 Gram Platinum Bar | 1 Ounce Platinum Bar |

|---|---|---|

| Premium Over Spot | Higher (due to fabrication costs) | Lower (more efficient production) |

| Total Cost | Lower entry price | Higher initial investment |

| Liquidity | Excellent (easy to sell small units) | Good (standard investment size) |

| Divisibility | Very High | Low (all-or-nothing sale) |

| Dollar-Cost Averaging | Ideal (easy to buy regularly with Autoinvest) | Less ideal (requires larger purchases) |

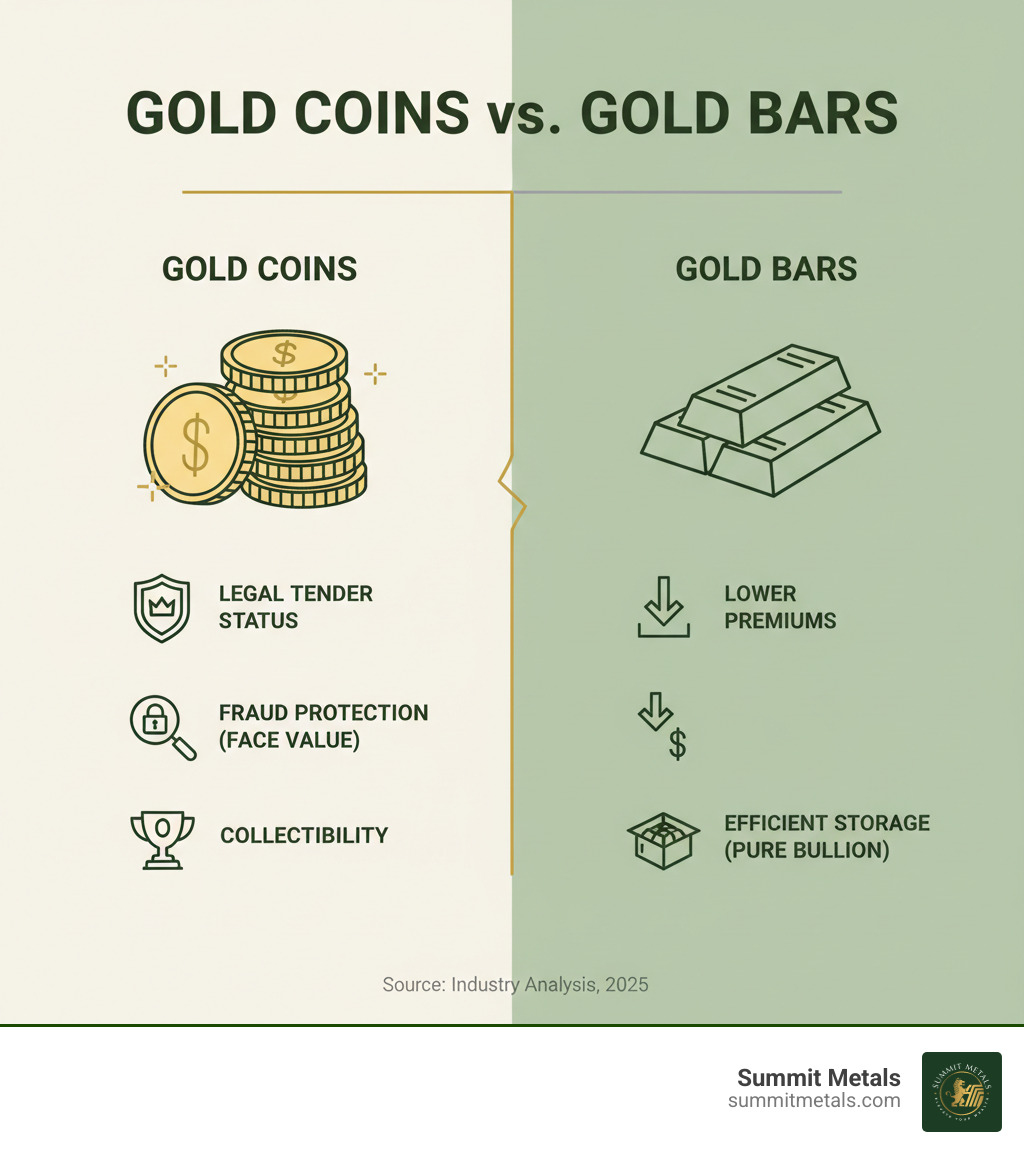

The Coin Conversation: A Quick Word on Gold

While we're focused on platinum bars, it's worth understanding why some investors prefer government-minted coins, especially when buying gold.

Coins like the 1 Gram Canadian Gold Maple Leaf Coins carry legal tender status. This face value, though symbolic, provides an extra layer of anti-counterfeiting protection, as faking legal tender is a more serious crime. Coins may also carry numismatic value for collectors.

Bars, on the other hand, are all about efficiency. They typically have lower premiums and deliver pure bullion value without the collectibility factor. The choice comes down to your personal strategy, and at Summit Metals, we provide quality options across the spectrum.

Frequently Asked Questions about 1g Platinum Bars

Here are answers to the most common questions we hear from investors about 1 gram platinum bars.

How should I store my 1 gram platinum bars?

Your bar's compact size makes storage simple. The golden rule is to keep it in its original assay card. This packaging is your proof of authenticity and is crucial for maintaining resale value.

Good storage options include:

- A home safe: Offers immediate access. Ensure it's fireproof, waterproof, and discreetly located.

- A bank deposit box: Provides institutional-level security, though access is limited to bank hours.

- A professional depository: Ideal for larger holdings, offering advanced security and insurance for complete peace of mind.

Are 1 gram platinum bars eligible for an IRA?

Yes. A 1 gram platinum bar is an excellent choice for a self-directed IRA, especially for dollar-cost averaging. To be eligible, the platinum must meet the .9995 purity standard and come from a recognized refiner like those sold by Summit Metals. You will need to work with a self-directed IRA custodian, and the metals must be stored in an approved depository, not at home. The fractional size of a 1 gram bar is perfect for making regular, budget-friendly contributions to your retirement account.

How do I convert the weight of a 1 gram platinum bar?

The precious metals industry uses troy ounces, while most of the world uses grams. The conversion is simple:

- 1 gram = 0.03215 troy ounces

- 1 troy ounce = 31.1035 grams

Knowing this helps you calculate the underlying metal value of your bar. When the platinum spot price is quoted per troy ounce, you can multiply it by 0.03215 to find the approximate spot value of your 1 gram platinum bar. The difference between that value and your purchase price is the premium.

For a deeper understanding of platinum's unique position in the precious metals market, explore The World of Platinum Bullion: A Beginner's Introduction.

Conclusion: Start Your Platinum Journey One Gram at a Time

We've covered how a 1 gram platinum bar is a smart, strategic tool for building real wealth. It offers an affordable entry point, excellent divisibility for liquidity, and unique diversification benefits that go beyond traditional assets.

The beauty of starting with a 1 gram bar is that it removes the intimidation factor. You don't need to be a Wall Street veteran to begin. You can learn the market and build confidence without overextending yourself. Whether you're buying a single bar or using our Autoinvest program to build your holdings steadily each month, you're taking a tangible step toward financial resilience.

Starting small isn't just smart—it's strategic. Ready to hold your first 1 gram platinum bar? Our team at Summit Metals is committed to transparent pricing and authenticated products to support you at every step. Explore the differences between bullion bars and coins to further your investment knowledge.

Your platinum journey starts with a single gram. Visit us at https://summitmetals.com/ to explore our full selection of authenticated precious metals.