Why Platinum Deserves a Place in Your Portfolio

While gold and silver often steal the spotlight, platinum presents a unique and compelling investment opportunity. It's currently one of the most undervalued precious metals, trading at historically low prices compared to gold, despite being more than 20 times rarer than gold.

This rarity, combined with strong industrial demand—particularly from the automotive sector—provides a solid foundation for its value. Yet, investment demand remains surprisingly low, creating what many analysts see as a prime buying opportunity. With demand outstripping supply for the past five years, now is an excellent time to consider adding platinum to your portfolio.

Finding the cheapest platinum bullion is key to maximizing your investment. The most affordable options typically include:

- Platinum bars (lowest premiums)

- Secondary market coins

- Random year government-issued coins

- Fractional platinum for smaller budgets

- Bulk purchases for volume discounts

At Summit Metals, we specialize in helping investors find the best value and build resilient portfolios. Let's explore why platinum is a smart addition and how you can acquire it cost-effectively.

Why Consider Platinum for Your Investment Portfolio?

While gold and silver often take the spotlight, platinum offers a unique combination of rarity and industrial utility, making it a compelling addition to any investment portfolio. Unlike gold, which is primarily a monetary asset, platinum has significant industrial applications that create a strong, consistent demand floor.

The Dual Role of Platinum: Industrial Powerhouse and Precious Metal

Platinum's value is driven by two key factors: its scarcity and its industrial necessity.

- Extreme Rarity: Platinum is over 20 times rarer than gold. In fact, all the platinum ever mined could fit inside a typical garage. This inherent scarcity gives it long-term value.

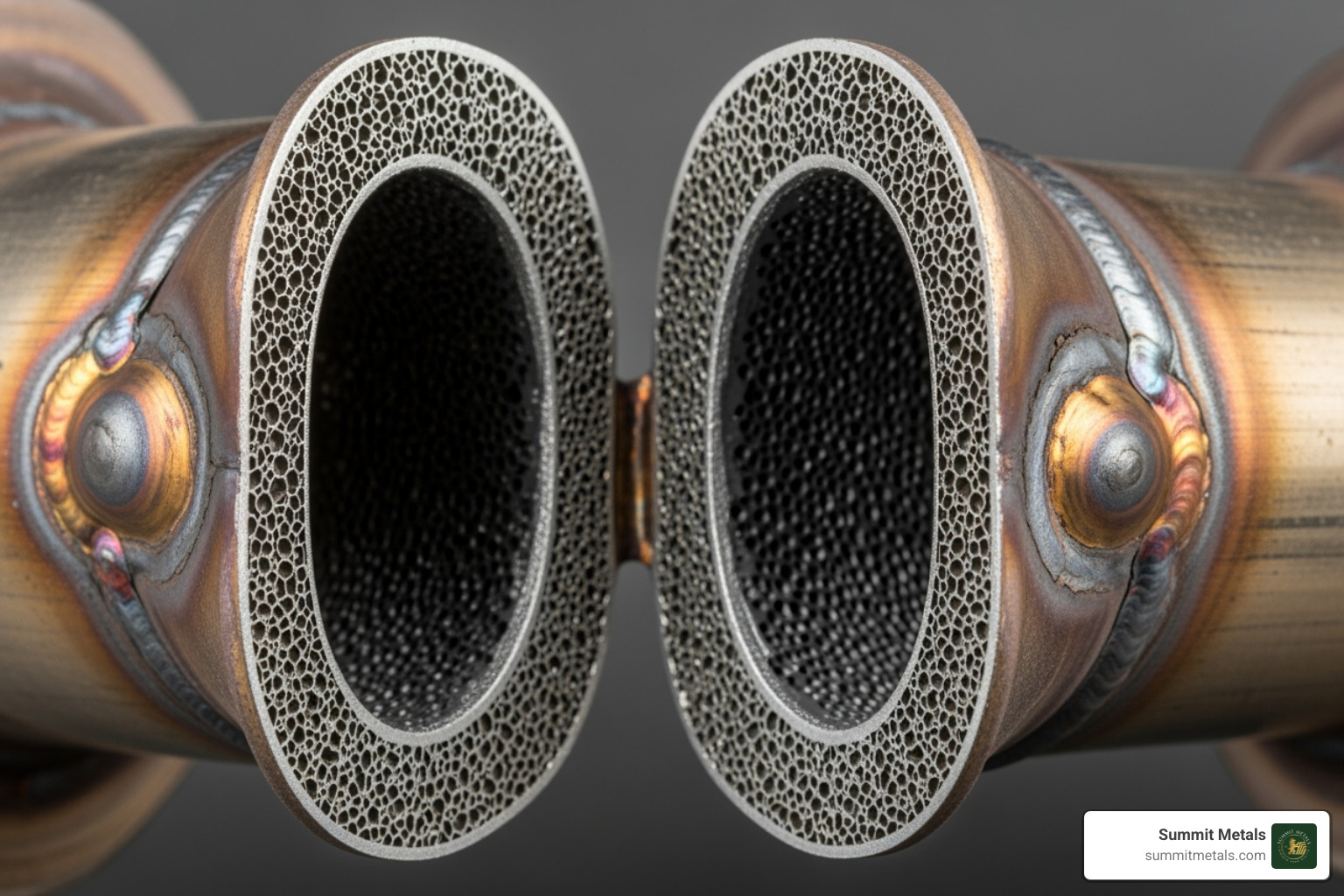

- Industrial Demand: Nearly half of all platinum is used in catalytic converters for vehicles to reduce harmful emissions. It's also essential in medicine for pacemakers, in the chemical industry for producing fertilizers and gasoline, and in emerging green technologies like hydrogen fuel cells. This industrial demand provides a stable price floor, as detailed by the Royal Society of Chemistry.

A Unique Opportunity for Diversification

Because its price is influenced by different economic factors than stocks or even other precious metals, platinum is an excellent tool for portfolio diversification. Its value can rise with industrial growth, stricter environmental regulations, or when investors seek alternatives to gold.

Historically, platinum has traded at a premium to gold. Today, it is priced at a significant discount, a rare occurrence that has only happened a few times in the last 40 years. With demand outstripping supply for five consecutive years, many analysts see this as a prime opportunity to invest. This makes platinum not just a hedge against inflation but also a potential growth asset. For more on diversification, see our guide on Maximizing Your Investment in a Chaotic Global Economy: Why Gold and Silver Are Essential for Portfolio Diversification in 2024.

For investors looking for the cheapest platinum bullion, this market presents a unique entry point. Understanding how to buy it efficiently is the next step.

Understanding Platinum Prices: Spot Price vs. Premiums

To find the cheapest platinum bullion, you need to understand its two-part pricing: the spot price and the premium. The spot price is the live market value for one troy ounce of platinum, while the premium is the additional cost to cover manufacturing, distribution, and dealer overhead.

What Drives the Spot Price?

The spot price fluctuates based on several key factors:

- Industrial Demand: As a critical component in catalytic converters, demand from the automotive industry heavily influences the price.

- Supply Constraints: Over 70% of the world's platinum comes from South Africa. Any supply disruptions there can significantly impact prices.

- Economic Conditions: Global economic health affects industrial output and, consequently, platinum demand.

- Investor Sentiment: While not as dominant as with gold, investor demand for platinum as a safe-haven asset or a portfolio diversifier also plays a role.

What Determines the Premium?

The premium is the cost above the spot price and is where savvy buyers can find savings. It covers:

- Manufacturing & Fabrication: The cost to refine, mint, or cast the platinum into bars or coins.

- Dealer Costs: Includes overhead, storage, insurance, and a profit margin.

- Product Type & Size: Simpler products like bars have lower premiums than intricate coins. Similarly, larger bars (e.g., 10 oz) typically have a lower premium per ounce than smaller 1-gram bars.

By understanding these components, you can make informed decisions to minimize your costs. While you can't control the spot price, you can choose products with lower premiums. For a deeper dive into these concepts, check out The Ultimate Beginner's Guide to Investing in Precious Metals.

How to Find the Cheapest Platinum Bullion

Finding the cheapest platinum bullion means minimizing the premium you pay over the spot price. This involves choosing the right product and buying it smartly.

| Type of Platinum Bullion | Typical Premium (over spot) | Pros | Cons - | Platinum Bars | 4-12% | Lowest premiums, simple manufacturing, wide size range, ideal for stacking | Less ornate, no legal tender status | | New Government Coins | 8-20% | Government backing, legal tender status, high recognition | Higher premiums, more expensive manufacturing | | Secondary Market Coins | 5-15% | Lower premiums than new coins, government minted quality | May show wear, limited selection |

Platinum Bars: The Most Cost-Effective Option

For investors focused on acquiring the most platinum for their money, platinum bars are the best choice. Their simple design means lower manufacturing costs and, therefore, lower premiums over the spot price. Bars are available in a wide range of sizes, from 1-gram fractional pieces to large kilogram bars, making them accessible for any budget and ideal for systematic stacking. All reputable bars are .9995 fine platinum, ensuring you get a high-purity investment. For more on this strategy, see our guide on Bullion Investing 101.

Finding the Cheapest Platinum Bullion Coins

While bars are typically cheaper, platinum coins like the American Platinum Eagle offer government backing and high recognizability. To get them at a lower cost, consider:

- Random Year Coins: These are often priced lower than coins from a specific, sought-after year.

- Secondary Market Coins: Pre-owned coins can have significantly lower premiums, especially if they show minor signs of wear. The platinum content remains the same, making them a great value.

For more tips on building your collection, explore The Basics of Gold and Silver Stacking.

Smart Buying Strategies

To secure the best prices, always compare dealer premiums. At Summit Metals, we offer transparent, real-time pricing. Also, consider these strategies:

- Dollar-Cost Averaging: Instead of trying to time the market, make regular, consistent purchases. Our Autoinvest program makes this easy, allowing you to build your holdings over time, much like a 401k.

- Buy in Bulk: Larger purchases often come with volume discounts, reducing the per-ounce cost.

- Payment & Shipping: Look for dealers who offer discounts for bank wire payments and have free shipping thresholds.

Finally, always buy from a reputable source. Learn how to protect yourself with our guide on How to Avoid Common Precious Metals Scams.

Key Considerations Before You Buy

Before investing in platinum, it's important to understand a few key factors, from storage and IRA eligibility to the inherent risks of the market.

Storage, Purity, and IRA Eligibility

- Secure Storage: Once you own physical platinum, you need to store it safely. Options include professional, insured vaulting services, which we can help you arrange, or a high-quality home safe. Bank safe deposit boxes are another choice, but be aware they are typically not insured by the FDIC.

- IRA Eligibility: You can hold physical platinum in a self-directed IRA for potential tax advantages. To be eligible, the platinum must meet a minimum purity of .9995 and be produced by a government mint or an approved refiner. The American Platinum Eagle is a popular IRA-eligible coin. Always consult with a financial advisor and a specialized IRA custodian to ensure compliance.

- Purity and Mints: Investment-grade platinum is .9995 fine. Stick to products from reputable mints and refineries like the U.S. Mint, Royal Canadian Mint, PAMP Suisse, or Valcambi. This ensures authenticity and makes your bullion easier to sell later.

Understanding Market Risks

Like any investment, platinum carries risks. Its price is influenced by industrial demand, making it more volatile than gold during economic shifts. While its current price is historically low compared to gold, and its use in emerging technologies like hydrogen fuel cells is promising, market fluctuations are a reality. Platinum is also less liquid than gold, meaning the spread between buy and sell prices can sometimes be wider. For more on managing investment risks, see our guide on The Strategic Role of Gold in Long-Term Portfolio Management.

By understanding these factors and working with a trusted dealer like Summit Metals, you can make informed decisions and build a robust portfolio. For a broader perspective on precious metals, our guide on Is Gold a Good Investment? is a great resource.

Frequently Asked Questions about Affordable Platinum

Here are answers to some common questions about finding the cheapest platinum bullion.

Is it better to buy platinum bars or coins for the lowest price?

For the lowest price per ounce, platinum bars are almost always the better choice. Bars have lower production costs than coins, which translates to lower premiums over the spot price. If your goal is to accumulate the most platinum for your money, bars are the most cost-effective option.

What is the minimum amount of platinum I can buy?

You can start investing in platinum with a very small amount. Fractional platinum bars, such as 1-gram bars, are widely available and provide an affordable entry point for new investors or those with a limited budget. This allows you to build your holdings gradually.

How does platinum's price compare to gold right now?

Historically, platinum has often been more expensive than gold due to its rarity. However, in recent years, it has been trading at a significant discount to gold. This is a rare market condition that many investors see as a potential buying opportunity, given that platinum is over 20 times rarer than gold and has strong industrial demand.

Conclusion

Finding the cheapest platinum bullion is about making a smart, strategic investment in a rare and valuable precious metal. By understanding the difference between spot price and premiums, you can maximize the amount of platinum you get for your money.

Remember these key takeaways:

- Platinum Bars are King for Low Premiums: Due to lower manufacturing costs, bars are typically the most cost-effective way to invest.

- Smart Buying Strategies: Look for deals on secondary market coins, consider random-year issues, and use dollar-cost averaging with a program like our Autoinvest to build your position over time.

- Know the Fundamentals: Pay attention to purity (.9995 fine), choose reputable mints, and have a secure storage plan, whether in a home safe, a vault, or an IRA.

Platinum's unique combination of industrial demand and rarity, especially at its current price relative to gold, presents a compelling opportunity. At Summit Metals, we're committed to providing transparent pricing and the resources you need to invest with confidence.

Ready to add platinum to your investment strategy? Start building your precious metals portfolio today with Bullion Investing 101 and find how this remarkable metal can strengthen your financial future.

Frequently Asked Questions about Affordable Platinum

It's natural to have questions when you're looking to add a powerful asset like platinum to your investment portfolio, especially when you're focused on getting the most value for your money. Here at Summit Metals, we often hear similar questions from investors aiming for the cheapest platinum bullion. Let's explore some of the most common ones!

Is it better to buy platinum bars or coins for the lowest price?

When your main goal is to acquire as much pure platinum as possible for your investment dollar, platinum bars are almost always your best bet. Why, you ask? It really comes down to what we call "premiums" – that extra cost above the metal's spot price.

Bars generally have lower premiums because they are simpler to make. Think about it: a bar is less ornate and requires far less intricate design work compared to a finely detailed coin. This means lower manufacturing costs, and those savings get passed on to you. They also tend to have lower distribution costs. So, if you're purely focused on stacking wealth, bars offer one of the most cost-effective ways to buy platinum. Plus, they're available in a wider variety of sizes, giving you more flexibility.

What is the minimum amount of platinum I can buy?

You absolutely don't need to start big to invest in platinum! Many investors begin their journey with fractional bullion. This means buying platinum in smaller increments, like 1-gram platinum bars. These offer a fantastic, lower entry point compared to full-ounce products.

Starting with these smaller pieces is a practical way to begin diversifying your portfolio without a huge initial outlay. They also often come with a lower premium per gram compared to small, fractional coins of similar size, making them a smart choice for budget-conscious buyers.

How does platinum's price compare to gold right now?

This is a fascinating question, and it highlights a truly unique opportunity for platinum right now! Historically, platinum has often traded at a higher price than gold. This makes a lot of sense when you consider just how rare platinum truly is. For every single ounce of platinum ever mined, roughly thirty ounces of gold have been extracted from the earth. That's incredible scarcity!

However, in recent years, we've seen an unusual market dynamic: platinum has been trading at a significant discount to gold. This isn't the norm. In fact, platinum has only been cheaper than gold four times in the last four decades, and the current period is the longest stretch ever for this to happen. Many seasoned investors and market analysts view this as a truly unique buying opportunity, suggesting that the current platinum spot price is positioned for some potentially significant upside. It's a moment that savvy investors are taking note of.

Conclusion

Finding the cheapest platinum bullion isn't just about saving money—it's about making a strategic investment in one of the world's most undervalued precious metals. Throughout this guide, we've seen how platinum's incredible rarity (remember, all platinum ever mined could fit in your garage!) combined with its essential industrial uses creates a compelling investment opportunity that many investors are just beginning to find.

The secret to affordable platinum lies in understanding how pricing works. While you can't control the spot price, you absolutely can minimize those premiums by choosing wisely. Platinum bars consistently offer the lowest premiums because they're simpler to manufacture than coins. Think of it like buying a plain wedding ring versus an ornate one—you're paying for the metal, not the fancy design work.

But don't overlook coins entirely. Random year government coins and secondary market options can offer excellent value, especially if you're not concerned about having the shiniest, newest pieces in your collection.

The smartest buyers use multiple strategies to get the best deals. Compare prices across dealers (we make this easy with our transparent, real-time pricing), watch for sales, and consider our Autoinvest program where you can buy every month just like investing in your 401k. This dollar-cost averaging approach takes the guesswork out of timing and helps you build your platinum position steadily over time.

Before you dive in, remember the practical considerations. Make sure you understand purity standards (.9995 fine is the investment grade), choose reputable mints and refineries, and have a solid storage plan. Whether that's secure vault storage or an IRA for tax advantages, protecting your investment is just as important as finding the best price.

Yes, platinum carries risks like any investment. Its price can be volatile, and its smaller investment market means it's not quite as liquid as gold or silver. But for many investors, these factors are outweighed by platinum's unique position—trading below gold despite being far rarer, with growing demand from emerging technologies like hydrogen fuel cells.

At Summit Metals, we've built our reputation on helping investors steer these decisions with confidence. Our bulk purchasing power means competitive rates for you, and our commitment to transparency means no surprises at checkout. We believe that informed investors make better decisions, and better decisions lead to stronger portfolios.

Ready to add platinum to your investment strategy? Start building your precious metals portfolio today with Bullion Investing 101 and find how this remarkable metal can strengthen your financial future.