Why Precious Metal Investment is Essential for Modern Portfolios

Precious metal investment offers a proven way to protect wealth, hedge against inflation, and diversify portfolios beyond traditional stocks and bonds. Here's what you need to know:

Key Precious Metals for Investment:

- Gold - The ultimate store of value and portfolio hedge

- Silver - Affordable entry point with industrial demand

- Platinum - Rare metal with automotive industry ties

- Palladium - Critical for catalytic converters

Main Investment Benefits:

- Hedge against inflation and currency devaluation

- Portfolio diversification with low correlation to stocks

- Tangible assets you can hold

- Protection during economic uncertainty

Investment Methods:

- Physical bullion (coins and bars)

- Dollar-cost averaging through monthly purchases

- Direct ownership vs. paper alternatives

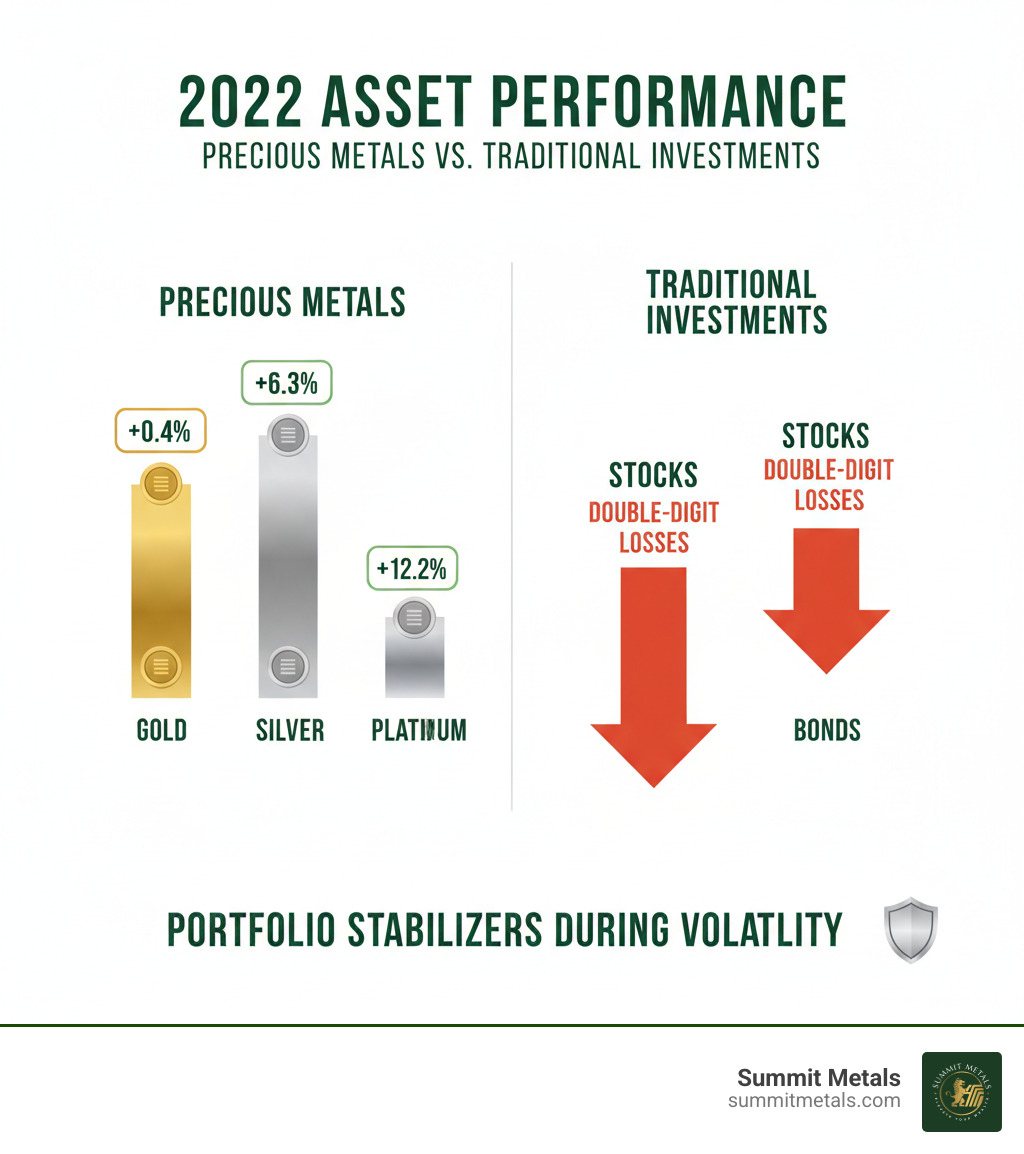

Ancient civilizations coveted gold and silver as stores of wealth, and this wisdom remains relevant today. In 2022, when stocks and bonds widely recorded double-digit losses, gold climbed 0.4%, silver rose 6.3%, and platinum jumped 12.2%. This demonstrates precious metals' ability to preserve value during market turmoil.

The purchasing power of gold has remained remarkably stable over time. In 1935, you could buy a basic car for about $500, equivalent to 14 ounces of gold at $35 per ounce. Today, those same 14 ounces worth roughly $28,000 would still buy a basic vehicle.

I'm Eric Roach. With over a decade as an investment banking advisor in New York, I helped Fortune-500 clients with defensive strategies before focusing on precious metal investment guidance for individual investors. My experience confirms that physical gold and silver are resilient hedges that protect and grow wealth, using the same disciplined approach blue-chip companies employ to safeguard their balance sheets.

Basic precious metal investment glossary:

What Are Precious Metals and Why Invest in Them?

Precious metals are nature's rarest treasures – metallic elements that have captivated humanity for thousands of years. Think of them as the VIPs of the periodic table: gold, silver, platinum, and palladium. These metals earned their "precious" status not just because they're scarce, but because they possess unique properties that make them incredibly valuable for both industrial uses and wealth preservation.

The appeal of precious metal investment lies in its scarcity. Unlike fiat currency, which central banks can print at will, precious metals cannot be created. This gives them an intrinsic value that has endured for millennia, from ancient pharaohs to modern investors.

When you invest in precious metals, you're buying a hedge against inflation, adding portfolio diversification, securing a reliable store of value, and creating your own personal safe haven asset. It's like having a financial security blanket that doesn't lose its warmth when economic storms hit.

The Case for Diversification

Precious metals shine in an investment strategy because they have a low correlation to equities, meaning they don't typically move in the same direction as stocks. While your stocks might fall, your precious metal investment could hold steady or even climb.

This characteristic makes them powerful risk management tools. During market volatility, they often act as a stabilizing force in your portfolio. Remember the 2008 financial crisis? While many investors watched their portfolios crumble, those with precious metals exposure had some protection against the carnage.

The numbers are impressive: precious metals historically capture only 14.4% of downside movements when stocks fall. This offers superior downside protection compared to other commodities, which typically capture about 61.7% of the downside.

For a deeper dive into building a resilient portfolio, check out our comprehensive guide on maximizing your investment in a chaotic global economy.

Hedging Against Economic Uncertainty

When economic storm clouds gather, precious metals often become the lighthouse guiding investors to safety. They serve as an inflation hedge, protecting your purchasing power when paper money loses its strength. As currency devaluation erodes the value of dollars, euros, or any fiat currency, gold and silver tend to maintain their worth.

Geopolitical instability and interest rate fluctuations can send traditional investments on a roller coaster ride, but precious metals often provide stability during these turbulent times. Think about it: with the U.S. national debt approaching $37 trillion (at the time of this publication), many investors are questioning the long-term stability of paper currencies.

Even central banks understand this dynamic – they're some of the world's largest gold buyers! When the institutions that create money choose to hold precious metals as reserves, that tells you something important about their enduring value.

The relationship between these economic factors is complex but fascinating. To understand how interest rates, the dollar, and gold prices interact, explore The Interplay of Interest Rates, the Dollar, and Gold Prices. You can also find Why Central Banks Buy Gold (And Why You Should Too) for deeper insights into institutional precious metal strategies.

A Closer Look at the Top 4 Precious Metals

When people think about precious metal investment, gold usually comes to mind first. But there's a whole family of precious metals worth understanding, each with its own personality and market behavior. Let's explore the unique characteristics and investment potential of gold, silver, platinum, and palladium.

Gold: The Timeless Standard

Gold is the timeless grandfather of precious metals, used to store wealth for millennia because it doesn't rust or tarnish. As a "monetary metal," it has served as money throughout history and remains the ultimate global store of value.

With over $130 billion traded daily, gold is more liquid than most stocks. This incredible liquidity means you can easily buy or sell gold anywhere in the world, making it a highly accessible investment.

Central banks aren't just casual gold fans – they're serious collectors. The United States holds a whopping 8,133.5 tons of gold in reserves, and there's a good reason for that institutional confidence. Gold serves as the ultimate financial insurance policy, maintaining its purchasing power even when currencies struggle.

Beyond investment appeal, gold has practical uses in dentistry and electronics thanks to its excellent conductivity and resistance to corrosion. But unlike silver or platinum, gold's price isn't heavily influenced by industrial demand – it's primarily driven by investor sentiment, economic stability, and the strength of the US dollar.

Want to see how countries stack up in their gold holdings? View the latest data on Gold Reserves by Country. For deeper insights into gold's role in your portfolio, check out The Strategic Role of Gold in Long-Term Portfolio Management.

Silver: The Dual-Purpose Metal

If gold is the steady sibling, silver is the energetic one—more volatile, affordable, and with vast industrial applications. This dual personality makes silver fascinating, as its price is driven by both investment demand (like gold) and industrial demand (like copper).

Silver's accessibility comes from its affordability. At a significantly lower price per ounce than gold, it's perfect for new investors. You can build a meaningful position without a large initial investment, which is why many use Summit Metals' Autoinvest program to dollar-cost average into silver monthly, similar to a 401k contribution.

Silver's industrial uses are absolutely everywhere – from solar panels and medical equipment to batteries and electronics. The rise of green technology has been a game-changer for silver demand. In fact, industrial consumption is expected to grow by 23 million ounces annually by 2030. That's a lot of silver!

This industrial demand creates more price volatility than gold, but it also means silver can potentially outperform during economic growth periods when industrial activity picks up.

Thinking about adding silver to your portfolio? Our comprehensive guide Is Silver a Good Investment? covers everything you need to know. The relationship between gold and silver prices is also worth understanding – dive into Understanding the Gold-Silver Ratio. For official statistics and data, check out the USGS Mineral Commodity Summary for Silver.

Platinum & Palladium: The Industrial Powerhouses

Platinum and palladium, the rare earth royalty, are significantly scarcer than gold and critical to modern industry. As platinum-group metals (PGMs), their investment case is closely tied to industrial demand, especially from the automotive sector.

Here's a jaw-dropping statistic: about 80% of global palladium supply goes into catalytic converters, those devices that clean up vehicle emissions. Platinum plays a similar role, plus it's used in jewelry, petroleum refining, and computer manufacturing. When you start your car in the morning, you're literally using these precious metals!

The supply situation creates some interesting investment dynamics. Most platinum and palladium come from just two countries – South Africa and Russia. South Africa leads in platinum production, while Russia dominates palladium. This concentration means geopolitical events or mining disruptions in these regions can send prices soaring.

Platinum often trades at a premium to gold during stable periods, but its smaller market size means prices can be more volatile. This volatility can work both ways – creating opportunities for gains but also requiring a stronger stomach for price swings.

The automotive industry's shift toward electric vehicles adds another layer of complexity to these metals' future demand, making them particularly interesting for investors who like to think about long-term industrial trends.

Trying to decide between precious metals options? Gold or Platinum? Making Your Bullion Investment Choice can help guide your decision. If you're new to platinum investing, The World of Platinum Bullion: A Beginner's Introduction provides an excellent foundation.

Your Guide to a Smart Precious Metal Investment Strategy

Building a successful precious metal investment strategy doesn't have to feel overwhelming. Think of it like learning to cook - once you understand the basic ingredients and techniques, you can create something truly valuable. At Summit Metals, we've simplified this process by focusing on what matters most: authenticated physical metals with transparent pricing and reliable service.

The beauty of precious metals lies in their simplicity. Unlike stocks that can disappear overnight or bonds tied to government promises, physical gold and silver are tangible assets you can hold. They've preserved wealth for thousands of years, and they're not going anywhere anytime soon.

Choosing Your Investment Vehicle

When you're ready to dive into physical precious metals, you'll face a classic choice: coins or bars? Both give you direct ownership of real metal, but each has distinct advantages that might make one perfect for your situation.

Gold coins, like the popular American Gold Eagle, come with some pretty neat benefits. They're legal tender with a face value backed by the U.S. government, which adds an extra layer of fraud protection. If someone tries to pass off a fake coin, they're not just cheating you - they're counterfeiting government currency, which carries serious penalties. This government backing makes coins highly trusted and easier to sell, especially in smaller amounts.

Gold bars, on the other hand, are the efficiency champions. They typically carry lower premiums over spot price, meaning you get more metal for your money. If you're looking to make a substantial investment and want maximum gold content per dollar spent, bars are often your best bet.

The choice really comes down to your priorities. Want maximum fraud protection and easy resale flexibility? Coins might be your answer. Focused on getting the most metal for your investment dollar? Bars could be the way to go. There's no wrong choice here - just different paths to the same destination of owning real, physical precious metals.

For a deeper dive into this decision, check out our comprehensive guide: Bars or Coins? Your Ultimate Gold Investment Showdown.

Building Your Position with Autoinvest

Here's where many investors stumble: they wait for the "perfect" time to buy. The truth? There's no crystal ball for precious metals prices, just like there isn't one for the stock market. That's why smart investors use a strategy called Dollar-Cost Averaging (DCA).

DCA is beautifully simple. Instead of trying to time the market, you invest the same amount every month regardless of price. When prices are high, you buy less metal. When prices are low, you buy more. Over time, this smooths out the bumps and helps you build a solid position without the stress of market timing.

Our Summit Metals Autoinvest program makes this effortless. Think of it as a 401k for precious metals - you set up automatic monthly purchases, and we handle the rest. No more watching price charts or second-guessing yourself. Just steady, disciplined accumulation of authenticated gold and silver.

The program takes the emotion out of investing, which is often the biggest hurdle. When gold prices spike, you might hesitate to buy. When they drop, you might panic and avoid investing altogether. Autoinvest removes these emotional roadblocks by making your purchases automatic and consistent.

This approach has helped countless investors build substantial precious metals positions over time. It's not flashy or exciting, but it works. Sometimes the best investment strategies are the boring ones that quietly build wealth in the background.

Learn more about The Power of Dollar Cost Averaging in Gold and Silver Investments and explore More info about our Autopay services to see how easy it is to get started.

Understanding the Risks and Tax Implications

While the benefits of precious metal investment are significant, it's crucial to approach it with a clear understanding of the associated risks and tax implications. Like any investment, there are factors to consider that can impact your returns and overall experience.

Key Risks in precious metal investment

No investment is without risk, and precious metals are no exception. Understanding these risks upfront helps you make informed decisions and avoid common pitfalls.

Price volatility is perhaps the most obvious risk. Precious metals, particularly silver, platinum, and palladium, can experience significant price swings. While gold tends to be more stable, all precious metals dance to the rhythm of market forces, economic changes, geopolitical tensions, and supply-demand dynamics. These movements can happen quickly, and you could see your investment value fluctuate dramatically in short periods. The key is maintaining a long-term perspective and not panicking during temporary downturns. Learn more about Why Gold and Silver Prices Fluctuate.

Security and storage present another challenge that many new investors underestimate. When you own physical precious metals, you become responsible for keeping them safe. Storing them at home carries obvious theft risks - imagine explaining to your insurance company that someone walked away with your life savings in gold coins! Professional storage solutions offer better security but come with ongoing fees. At Summit Metals, we understand this concern and offer guidance on secure storage options. Explore The Ins and Outs of Precious Metals Storage Options to find the right solution for your situation.

The counterfeit risk is unfortunately real in today's market. Fake precious metals have become increasingly sophisticated, making it harder for untrained eyes to spot fakes. This is exactly why buying from reputable dealers matters so much. At Summit Metals, we authenticate all our products and provide transparent, real-time pricing with competitive rates. We've heard too many heartbreaking stories of investors who thought they got a "great deal" only to find they'd purchased worthless metal. Our guide on Identifying Reputable Bullion Dealers: Avoiding Counterfeits can help you avoid these costly mistakes.

Finally, physical precious metals provide no cash flow. Unlike dividend-paying stocks or rental properties that generate regular income, your gold and silver just sit there looking pretty. Your return comes entirely from price appreciation when you eventually sell. This makes precious metals better suited for long-term wealth preservation rather than income generation.

U.S. Tax Considerations for your precious metal investment

From a tax perspective, the IRS has specific rules for precious metal investment that might surprise you.

The government classifies physical precious metals as "collectibles" for tax purposes. This seemingly innocent classification carries a significant financial impact. When you sell your precious metals after holding them for more than one year, any profits get taxed at the collectibles rate of 28%—not the more favorable long-term capital gains rates that apply to most other investments.

For perspective, long-term capital gains on stocks are typically taxed at 15% or 20%. The 28% collectibles rate on precious metals is substantially higher and can eat into returns. For example, a $10,000 profit on gold would incur $2,800 in taxes, compared to $1,500 on a similar stock gain.

This doesn't mean precious metals are a bad investment - they still offer valuable portfolio diversification and inflation protection. But it does mean you should factor this tax treatment into your overall strategy and perhaps consider holding periods and timing of sales more carefully.

For detailed information about these tax rules, Learn more about how collectibles are taxed. If you're thinking about incorporating precious metals into your retirement planning, our comprehensive guide Precious Metals IRA Regulations 101 explains how IRAs can potentially help with some of these tax considerations.

As always, consult with a qualified tax professional who understands your specific situation. Tax laws can be complex and change over time, so professional guidance ensures you're making the most tax-efficient decisions for your circumstances.

Frequently Asked Questions about Precious Metal Investing

Starting your precious metal investment journey often comes with questions—and that's perfectly normal! Over the years, I've heard the same concerns from countless investors, whether they're complete beginners or seasoned portfolio managers looking to add some shine to their holdings. Let me address the most common questions that come up.

What percentage of my portfolio should be in precious metals?

This question keeps me busy! The truth is, there's no one-size-fits-all answer because your ideal allocation depends on your unique financial situation, risk tolerance, and investment goals. However, most financial experts suggest starting with 5% to 10% of your total portfolio in precious metals.

Think of precious metals as your portfolio's insurance policy rather than your ticket to overnight riches. They're designed to preserve wealth and provide stability during those stomach-churning market downturns we all love to hate. Some investors feel comfortable with as little as 5%, while others who are more concerned about inflation or economic uncertainty might lean toward 10% or even slightly higher.

The key is finding what helps you sleep well at night. If you're constantly worried about market volatility or inflation eating away at your savings, a higher allocation might make sense. If you're more focused on growth and comfortable with market fluctuations, a smaller percentage could be perfect. For a deeper dive into finding your sweet spot, check out How Much of My Net Worth Should Be in Gold & Silver?.

Which precious metal is best for a beginner?

For newcomers to precious metal investment, gold is typically the best starting point. It's like the reliable friend who's always there for you—stable, widely recognized, and incredibly liquid. Gold's price movements are generally less dramatic than other precious metals because they're primarily driven by investor sentiment and macroeconomic factors rather than industrial demand.

That said, silver deserves serious consideration, especially if you're working with a smaller budget. Silver's lower price per ounce means you can actually hold more physical metal in your hands for the same investment amount. Many investors I know started by "stacking" silver coins and bars before gradually adding gold to their collection.

Silver does come with a bit more excitement (read: volatility) due to its dual nature as both an investment asset and an industrial commodity. This can create more dramatic price swings, but it also means there are multiple factors supporting long-term demand.

If you're ready to make your first purchase, our guide New to Gold? Here's How to Make Your First Investment Shine will walk you through the process step by step.

How liquid are precious metals?

Liquidity—how quickly you can convert your investment back to cash without significantly affecting its price—is one of precious metals' strongest advantages. Gold is exceptionally liquid, ranking among the most liquid assets in the world. We're talking about over $130 billion worth of gold changing hands daily, which means you can typically buy or sell gold bullion quickly and efficiently.

Silver also boasts excellent liquidity, though its market is somewhat smaller than gold's. You'll still find plenty of buyers and sellers, making it easy to enter or exit positions when needed.

Platinum and palladium are a bit different. While they're valuable and tradeable, their markets are smaller and more specialized due to their heavy reliance on industrial demand. This doesn't mean they're illiquid, but finding buyers for larger quantities might take a bit more time or involve slightly wider pricing spreads.

The key to maximizing liquidity is choosing widely recognized forms of precious metals. That's why at Summit Metals, we focus on authenticated, standardized products that dealers and collectors worldwide recognize and trust. Understanding this concept is crucial for any investor, so I recommend reading What Is the Best Silver & Gold to Buy and Why Liquidity Matters.

Building a precious metal investment position doesn't have to happen all at once. Many successful investors use our Autoinvest program to dollar-cost average their way into precious metals, buying a set amount each month just like they would with a 401k. This approach takes the guesswork out of timing and helps smooth out those price fluctuations over time.

Conclusion: Starting Your Precious Metal Journey

Your exploration into precious metal investment has taken you through centuries of financial wisdom, from ancient civilizations who recognized gold's enduring value to modern investors who use these tangible assets as shields against economic uncertainty. You've finded how gold offers best stability and liquidity, how silver provides an affordable entry point with dual investment and industrial appeal, and how platinum and palladium serve as rare industrial powerhouses.

The evidence is compelling: when traditional markets stumbled in 2022 with double-digit losses, precious metals stood firm. Gold gained 0.4%, silver rose 6.3%, and platinum jumped 12.2%. This isn't just about numbers on a screen—it's about real wealth preservation when it matters most.

Your precious metal investment strategy should focus on the fundamentals we've covered. Diversification remains the golden rule, with most experts suggesting 5-10% of your portfolio in precious metals. Inflation protection becomes increasingly important as national debt soars and currencies face pressure. The beauty lies in owning something tangible—assets you can hold, store, and pass down to future generations.

Starting your journey doesn't require massive capital or complex strategies. At Summit Metals, we've built our entire approach around making precious metal investment accessible and straightforward. Our authenticated physical metals come with transparent, real-time pricing and competitive rates thanks to our bulk purchasing power. You're not just buying metal—you're buying peace of mind.

The Autoinvest program transforms precious metals investing into something as simple as your 401k contributions. Set up automatic monthly purchases, let dollar-cost averaging smooth out market volatility, and watch your position grow consistently over time. It's the disciplined approach that builds real wealth, removing the emotional guesswork that trips up so many investors.

Whether you choose the government-backed security of coins or the lower-premium efficiency of bars, whether you start with gold's stability or silver's affordability, the important step is starting. Every month you delay is another month without this crucial portfolio protection.

Your financial future deserves the same time-tested approach that has preserved wealth for millennia. Begin your precious metal investment journey with Summit Metals today and join the ranks of investors who understand that true wealth isn't just about growth—it's about preservation, protection, and peace of mind.