Why Canadian Coins Captivate Collectors Worldwide

Canada coins offer a compelling blend of rich history and world-class investment potential, making them a cornerstone of modern numismatics. From the iconic Maple Leaf bullion series to rare colonial tokens, Canadian coinage has something for every budget and collecting goal.

Today's circulation coins include the 5¢ (beaver), 10¢ (Bluenose schooner), 25¢ (caribou), $1 "Loonie" (loon), and $2 "Toonie" (polar bear). For investors, the most popular options are the Gold and Silver Maple Leaf bullion coins, alongside rare historical dates like the 1921 50-cent piece.

The Royal Canadian Mint is renowned for producing both circulation currency and some of the world's most respected bullion. This gives Canadian coins a dual appeal: collectors cherish the historical stories, like the WWII "Victory Nickel," while investors prize the government-backed purity and global liquidity of the precious metals series.

As Eric Roach, I've guided clients through multi-billion-dollar transactions on Wall Street and now help everyday investors build wealth through precious metals. Canadian coins, particularly the Maple Leaf series, consistently rank among my top recommendations for clients seeking authenticated precious metals with strong resale value.

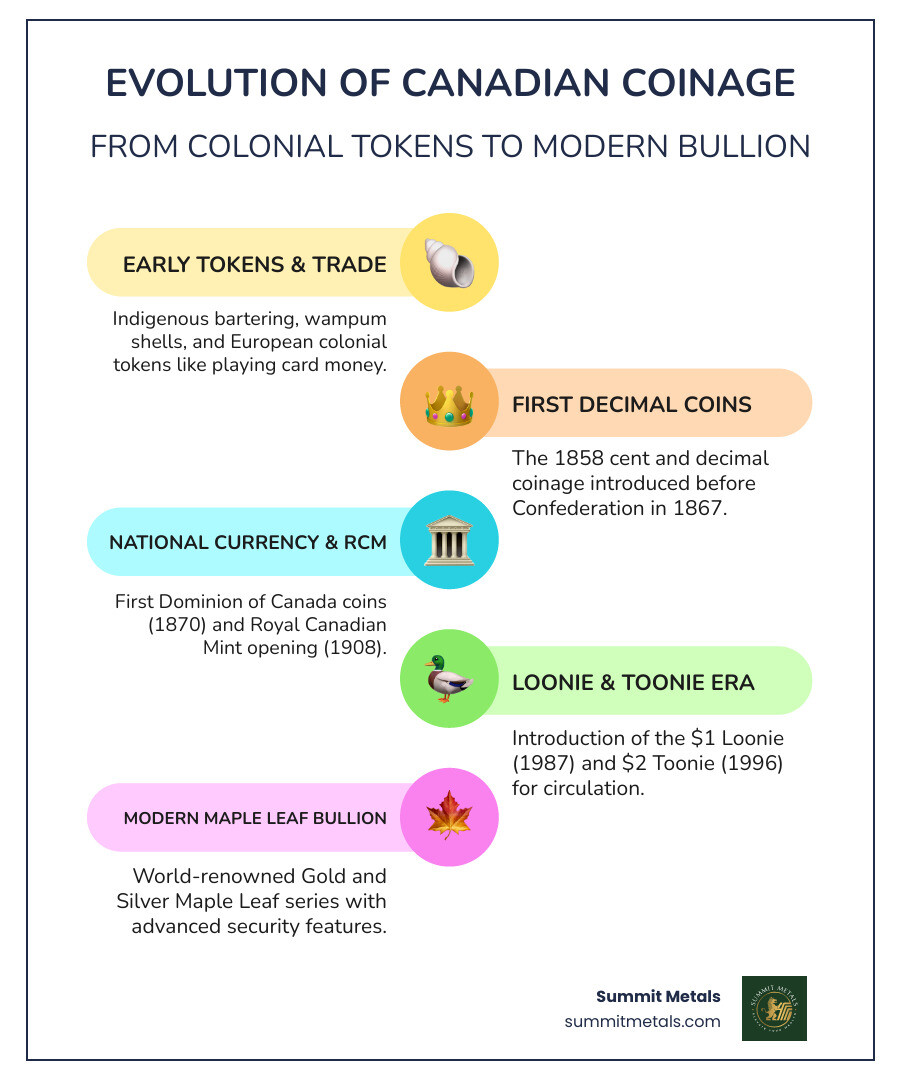

A Journey Through Canadian Coin History

This section explores the fascinating evolution of coinage in Canada, from Indigenous trade systems to the establishment of a national currency.

Early Trade and Colonial Coinage

Before European coins arrived, Indigenous peoples used sophisticated bartering systems, with items like furs and decorative wampum shells serving as currency. When French explorers established New France, they faced a chronic coin shortage. In a stroke of genius, colonial authorities issued playing card money in 1685, one of the first forms of paper money in the Western world.

After Britain took control in 1763, the coin shortage continued. Spanish silver dollars were popular, but colonies found creative ways to stretch their supply. Prince Edward Island famously created the "holey dollar" by punching the center out of Spanish coins, creating two coins from one.

The Road to a National Currency

As the need for a standardized currency grew, colonial banks like the Bank of Montreal began issuing tokens in the 1820s. A major step came in 1858 with Canada's first official decimal coinage, featuring Queen Victoria's effigy and proudly stamped with "CANADA." After Confederation in 1867, the first Dominion of Canada coins were issued in 1870, paving the way for true monetary independence with the opening of the Ottawa branch of the Royal Mint in 1908. You can explore more about this fascinating journey at the History of the Royal Canadian Mint.

20th Century Milestones

The Royal Canadian Mint's opening in 1908 ushered in an era of innovation. Canada briefly produced its own gold coins from 1912-1914, though most were melted to finance the WWI effort. Economic pressures led to a silver content reduction in 1920.

WWII brought even more dramatic material changes. With nickel needed for the war, cents were made from a brass alloy (tombac). The era's most famous coin is the "Victory Nickel" (1943-1945). It featured a large 'V' for victory and a hidden patriotic message in Morse code along the rim: "We Win When We Work Willingly." These innovations proved that Canada coins could adapt to any challenge, a tradition that continues today.

A Guide to Modern Canada Coins for Collectors and Investors

This section details the coins you'll encounter today, from pocket change to world-class bullion, helping you decide where to start.

Understanding Today's Circulation Coins

Today's Canada coins are a collection of iconic designs, each with an affectionate nickname. The 5-cent "nickel" features the beaver, the 10-cent "dime" showcases the Bluenose schooner, and the 25-cent "quarter" displays the caribou. The rarely seen 50-cent "half-dollar" bears the Canadian coat of arms.

The most famous are the larger denominations: the $1 "Loonie," named for the common loon on its reverse, and the bi-metallic $2 "Toonie," featuring a polar bear. These modern coins are made with a durable multi-ply plated steel composition. Notably absent is the penny, which Canada wisely discontinued in 2012 as its production cost exceeded its face value. You can read the official information on eliminating the penny.

Bullion vs. Numismatic: Choosing Your Canada Coins

Understanding the difference between bullion and numismatic coins is crucial. Bullion coins, like the Silver and Gold Maple Leaf, are valued by their precious metal content and are ideal for wealth preservation. Numismatic coins, like the rare 1921 50-cent piece, derive their value from rarity, history, and condition, appealing to collectors.

| Feature | Bullion Coins | Numismatic Coins |

|---|---|---|

| Primary Goal | Wealth Preservation | Hobby/Rarity |

| Value Basis | Melt Value + Premium | Rarity/Condition |

| Liquidity | High | Varies |

| Example | Silver Maple Leaf | 1921 50-Cent |

For investors, bullion coins also hold key advantages over generic bars. A government-minted coin like the Maple Leaf offers:

- Face Value Protection: A 1-ounce Gold Maple Leaf has a $50 CAD face value. This legal tender status provides a value floor and an extra layer of security that bars lack.

- Improved Security: This status makes counterfeiting a more serious crime, deterring fraud.

- Guaranteed Authenticity: Each coin is backed by the Canadian government for its weight and purity.

The World-Renowned Canadian Maple Leaf Series

When precious metals investors think of quality, the Canadian Maple Leaf series comes to mind. Launched in 1979 (Gold) and 1988 (Silver), these coins set the standard for purity. Both are struck in .9999 fine precious metal, with special editions reaching an incredible .99999 purity—among the purest on Earth.

The Royal Canadian Mint has also revolutionized security with advanced security features. These include precision-machined radial lines that create a unique light-diffracting pattern and a micro-engraved privy mark containing the production year, visible only under magnification. These innovations, combined with the government guarantee of weight and purity, give Canadian Maple Leafs global recognition as one of the most trusted and liquid bullion products available.

For a deeper dive into this iconic silver coin, check out our guide: Beyond the Leaf: Your Guide to the Canadian Silver Maple Coin.

How to Start and Grow Your Collection

Practical strategies for acquiring Canadian coins, whether you're a hobbyist on a budget or a serious precious metals investor.

Collecting on a Budget: Finding Value

You don't need deep pockets to start collecting Canada coins. The most rewarding finds can come from your own spare change. Pocket change hunting is a great way to find commemorative quarters, like the 2004 Poppy quarter—the world's first colored circulation coin. The provincial and territorial quarter series is another fun challenge, allowing you to collect a beautiful snapshot of Canadian heritage for face value.

For those willing to look closer, learning to spot common errors and varieties can turn ordinary coins into valuable finds. While major errors are rare, smaller varieties appear more often than you'd think. Another budget-friendly entry point is modern uncirculated sets from the Royal Canadian Mint, which offer pristine examples of contemporary coins.

Investing in Precious Metals with Canadian Coins

For serious precious metals investing, Canadian bullion coins like the Gold and Silver Maple Leaf are in a league of their own. The Royal Canadian Mint's global reputation for quality makes these coins a smart choice for building wealth.

What sets them apart is the government guarantee of weight and purity behind every coin. Furthermore, bullion coins have distinct advantages over bars. Every Maple Leaf has a face value ($50 for a 1oz Gold, $5 for a 1oz Silver), which provides legal protection and makes counterfeiting a federal crime—a safeguard generic bars lack. The advanced security features like radial lines and micro-engraved privy marks offer investors additional peace of mind, making these coins among the most trusted in the world.

For those ready to add silver to their portfolio, check out our current selection: Leaf It to Silver: Top Deals on 2025 Silver Maple Leaf Coins.

Smart Investing with Autopay

Stop trying to time the market. The smartest investors build wealth through consistency, not guesswork. This strategy is called dollar-cost averaging, and our Autoinvest program makes it effortless.

Think of it as a 401k for physical precious metals. You set a recurring monthly purchase amount, and we automatically secure authenticated Canadian gold and silver for you. When prices dip, your fixed investment buys more ounces. When prices rise, you buy fewer, but your existing holdings increase in value. Over time, this strategy smooths out market volatility and lowers your average cost per ounce.

Autoinvest removes emotion from your decisions and puts your wealth-building on autopilot. It's a disciplined, simple way to systematically build a real, physical asset position.

Ready to let consistency work for you? Set up your recurring precious metals purchase and start building your future today.

Notable and Rare Canadian Coins

A look at some of the most famous, valuable, and sought-after coins in Canadian numismatics that capture the imagination of collectors worldwide.

The Holy Grails of Canadian Numismatics

Every collecting field has its legends, and Canada coins are no exception. These treasures were born from a perfect storm of history, minting errors, and extreme scarcity.

The 1921 50-Cent Piece: Nicknamed "The King of Canadian Coins." The Mint struck over 200,000, but with low post-WWI demand, nearly all were melted down. Fewer than 100 are believed to exist, with values from $30,000 to over $350,000.

The 1936 "Dot" Cent: A story of royal drama. When King Edward VIII abdicated, the Mint wasn't ready with dies for the new king. To produce coins in early 1937, they reused 1936 dies, adding a tiny dot below the date. Only three are known to exist, with one selling for $312,000 in 2019.

The 1911 Pattern Silver Dollar: Canada didn't issue a dollar coin until 1935, but it experimented with a pattern in 1911. Only two silver and one lead example survived. One sold for $552,000 in 2019, with current estimates approaching $1.25 million. Dive into the story behind the 1911 Silver Dollar at the Bank of Canada Museum.

The 1948 Silver Dollar: A more accessible grail. A low mintage of just 18,780 occurred due to delays in receiving new dies after India's independence required a change in the king's title. Circulated examples start around $750.

Commemoratives That Tell a Story

Not every valuable coin is a million-dollar rarity. Some of the most beloved Canada coins are commemoratives that celebrate the nation's heritage.

The 1967 Centennial "flying goose" dollar was created for Canada's 100th birthday, featuring a Canada goose in flight—a powerful symbol of freedom. The groundbreaking 2004 Poppy Quarter made history as the world's first colored circulation coin, honoring veterans with a vibrant red poppy.

And of course, there are the Loonie and Toonie. The $1 "Loonie" (1987) and $2 "Toonie" (1996) quickly became national icons, replacing paper bills and showcasing Canada's wildlife heritage with the loon and polar bear designs. These coins prove that value can come from capturing a moment in history that resonates with millions.

Frequently Asked Questions about Canadian Coins

What are the most popular Canadian coins for US investors?

For American investors looking at Canada coins, the Gold and Silver Maple Leaf bullion series are the undisputed leaders. I consistently recommend them to clients for several key reasons.

First is their incredible purity—guaranteed at .9999 fine, with some gold editions reaching .99999 purity. Second, the Royal Canadian Mint's advanced security features, like micro-engraved marks and radial lines, make them extremely difficult to counterfeit.

Most importantly for US investors, they offer global recognition and liquidity. Dealers from New York to Singapore instantly recognize and trade Maple Leafs. Their IRA eligibility is another major advantage, as they meet the strict purity requirements for precious metals IRAs, making them ideal for tax-advantaged retirement planning and wealth preservation.

How are Canadian coins different from US coins?

Beyond the currency, there are a few key differences. Canada coins feature the reigning British monarch, while US coins show American presidents. Their composition also differs, with Canada using durable multi-ply plated steel for circulation coins.

A fascinating distinction is the orientation. Canadian coins use "medallic orientation," meaning both sides are upright when flipped horizontally. US coins use "coin orientation," where the reverse is upside down relative to the obverse—a quirky detail that sets them apart.

Is the Canadian 50-cent piece still made?

Yes, the Royal Canadian Mint still produces the 50-cent piece, but not for general circulation. Due to a lack of public demand in daily commerce, it has become a "collector's coin." The Mint produces them in small quantities each year, primarily for sale to collectors in special coin sets and rolls. While still legal tender, you're unlikely to find one in your change, making them a unique collecting opportunity that bridges the gap between circulation and numismatic coins.

Conclusion: Your Next Step in Canadian Coin Collecting

Whether you're captivated by the fascinating history of colonial tokens, the innovative security of modern Maple Leafs, or the legendary stories behind rare finds like the 1936 "Dot" Cent, Canada coins offer something special. They are tangible pieces of history you can hold, appreciate, and pass down.

The beauty of this field is its accessibility. You can start by searching pocket change for commemorative quarters, graduate to uncirculated sets, or take the leap into precious metals investing with the globally recognized Maple Leaf series.

For those focused on wealth preservation, Canadian bullion coins are a premier choice. Their government-backed purity, advanced anti-counterfeiting features, and global liquidity provide the peace of mind every investor deserves. Using a strategy like dollar-cost averaging through our Autoinvest program takes the guesswork out of investing, allowing you to build your position steadily over time.

At Summit Metals, we believe trust is paramount. We provide transparent, real-time pricing and leverage our bulk purchasing power to ensure you get competitive rates on authenticated Canadian gold and silver. We're not just selling coins—we're helping you build a more secure financial future.

Ready to see why collectors and investors worldwide choose Canadian coins? Start your precious metals journey with our comprehensive guide to buying gold and find how these remarkable coins fit into your strategy.

1 comment

Roberto

All the pictures are AI and this website is garbage written with AI