Why Understanding Gold IRA Rules Is Your First Step to Retirement Security

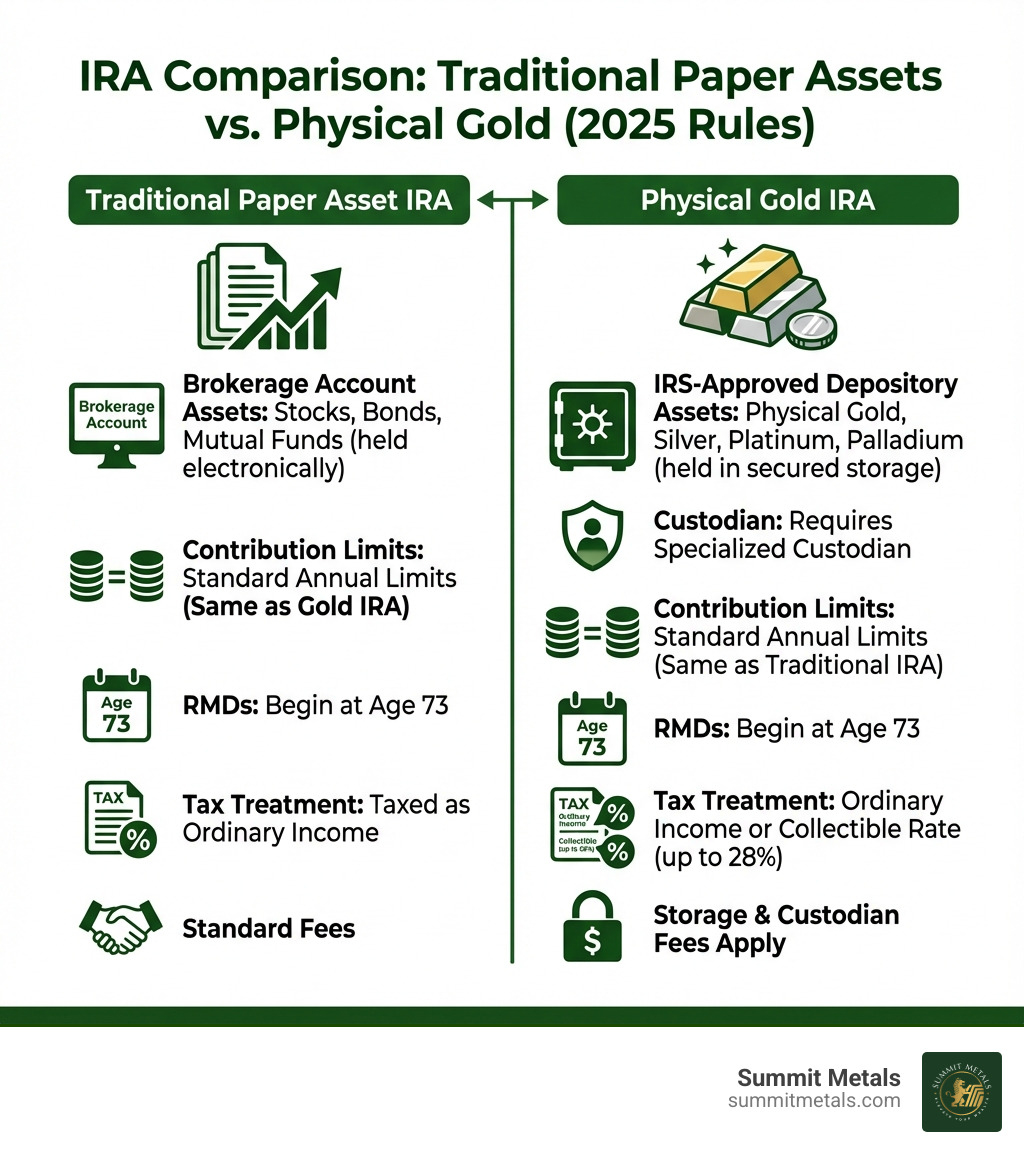

Gold IRA rules are the federal regulations governing how you can hold physical precious metals in a retirement account. If you're looking to diversify your retirement savings with gold, understanding these rules is non-negotiable.

Essential Gold IRA Rules at a Glance:

- Purity Standards: Gold must be 99.5% pure (except American Gold Eagles at 91.67%), silver 99.9% pure, and platinum/palladium 99.95% pure.

- Storage Requirement: All metals must be held in an IRS-approved depository. Home storage is prohibited and triggers severe penalties.

- Contribution Limits: For 2024, the limit is $7,000 annually ($8,000 if age 50+), the same as traditional IRAs.

- Custodian Mandate: You must use an IRS-approved custodian; you cannot manage the account yourself.

- Distribution Rules: Required Minimum Distributions (RMDs) begin at age 73. Early withdrawals before 59½ incur a 10% penalty.

- Prohibited Actions: You cannot contribute gold you already own, use it as collateral, or take temporary possession.

A Gold IRA is a self-directed Individual Retirement Arrangement that lets you hold physical precious metals—gold, silver, platinum, and palladium—instead of paper assets like stocks and bonds. Unlike a standard IRA, a Gold IRA requires a specialized custodian and an IRS-approved depository to store your physical metals.

The appeal is clear: gold has historically served as a hedge against inflation and economic uncertainty, often maintaining its purchasing power when paper assets decline. For many, allocating a portion of their retirement portfolio to physical metals can provide stability and improve returns.

But here's the catch: one wrong move can disqualify your entire account. The IRS has increased its scrutiny of self-directed IRAs. Violations like storing gold at home can trigger steep taxes, penalties, and a complete loss of your account's tax-sheltered status.

This guide cuts through the confusion. We'll break down every rule you must follow, from purity standards to prohibited transactions, so you can avoid costly mistakes. Whether you're rolling over a 401(k) or opening a new account, you'll learn exactly what the IRS requires to stay compliant.

I'm Eric Roach, and after a decade in investment banking, I now help everyday investors steer Gold IRA rules. My goal is to help you protect your wealth with the same disciplined approach used by large institutions, but without the jargon or pitfalls.

Basic Gold IRA rules glossary:

Understanding the Foundation: What is a Gold IRA?

A Gold IRA is a type of self-directed Individual Retirement Arrangement (SDIRA) that allows you to hold physical precious metals as an investment. Unlike traditional IRAs, which are limited to "paper assets" like stocks and bonds, a Gold IRA lets you own tangible assets. This is a key strategy for investors seeking diversification and a hedge against economic uncertainty.

Many investors turn to gold as a long-term store of value and a safe haven during market volatility. As former U.S. Mint Director Edmund C. Moy noted, "Because gold prices generally move in the opposite direction of paper assets, adding a gold IRA to a retirement portfolio provides an insurance policy against inflation." This approach can help balance risk over the long term.

For a deeper dive, explore our guide: Retirement Riches: How Gold IRAs Can Fortify Your Financial Future.

How a Gold IRA Works

Setting up a Gold IRA involves a few key players mandated by the IRS. The process is straightforward:

- Open a Self-Directed IRA: You'll open an SDIRA account with a custodian specializing in precious metals.

- Fund Your Account: Fund the account via direct contributions, rollovers (e.g., from a 401(k)), or transfers from other IRAs.

- Purchase Eligible Metals: Your custodian facilitates the purchase of IRS-approved metals from a dealer like Summit Metals. The transaction is handled through your IRA funds.

- Secure Storage: The metals are shipped directly to an IRS-approved depository for secure storage. You never take personal possession until taking a qualified distribution.

- Enjoy Tax Advantages: Your investments grow tax-deferred or tax-free, depending on whether you choose a Traditional or Roth Gold IRA.

To make ongoing investing simple, many Summit Metals customers use an Autoinvest approach: they schedule regular monthly purchases of IRA-eligible metals, much like contributing to a 401(k) every paycheck. This dollar-cost-averaging style strategy can help smooth out price volatility over time.

Types of Gold IRAs: Traditional, Roth, and SEP

Gold IRAs come in the same varieties as standard IRAs, each with unique tax implications. Choosing the right one is crucial for your retirement strategy.

Here's a quick comparison:

| Feature | Traditional Gold IRA | Roth Gold IRA | SEP Gold IRA |

|---|---|---|---|

| Contributions | Pre-tax; may be tax-deductible | After-tax; not tax-deductible | Employer contributions; tax-deductible for employer |

| Growth | Tax-deferred | Tax-free | Tax-deferred |

| Withdrawals | Taxable in retirement | Tax-free in retirement (if qualified) | Taxable in retirement |

| RMDs | Apply starting at age 73 | No RMDs for original owner | Apply starting at age 73 |

| Eligibility | Earned income; no income limits | Earned income; income limits apply | Self-employed/small business owners |

| Contribution Limits (2024) | $7,000 ($8,000 if 50+) | $7,000 ($8,000 if 50+) | Up to 25% of compensation or $69,000 |

SEP Gold IRAs are designed for employers and self-employed individuals. As Investopedia notes, they function like a Traditional IRA but with much higher contribution limits, making them a powerful tool for small business owners.

To decide which type fits you best, consider this at-a-glance comparison:

| If you want... | Consider This Gold IRA Type | Why it may fit |

|---|---|---|

| Lower taxes today and expect to be in a lower bracket in retirement | Traditional Gold IRA | Contributions may be deductible now; you pay tax later when you withdraw. |

| Potentially tax-free withdrawals in retirement and expect higher future tax rates | Roth Gold IRA | You pay tax now on contributions; qualified withdrawals of metals or cash are tax-free. |

| To make large, flexible contributions as a business owner | SEP Gold IRA | Much higher limits tied to your income; contributions are made by the employer. |

The Core Gold IRA Rules You Must Follow

When it comes to Gold IRA rules, the IRS is strict. These accounts are governed by Internal Revenue Code Section 408, and the inclusion of physical metals adds specific regulations. With the IRS increasing its focus on self-directed IRAs, compliance is more critical than ever. As we detail in our guide, The Ultimate Rulebook for Precious Metals IRA Investors, understanding these guidelines is your best defense against penalties.

IRS Requirements for Precious Metals

Not all precious metals are eligible for your Gold IRA. The IRS has strict purity and manufacturing standards.

Here are the fineness standards for approved metals:

- Gold: Must be 99.5% pure (.995 fineness). The American Gold Eagle coin is a notable exception, permitted at 91.67% purity.

- Silver: Must be 99.9% pure (.999 fineness).

- Platinum: Must be 99.95% pure (.9995 fineness).

- Palladium: Must be 99.95% pure (.9995 fineness).

As Forbes Advisor confirms, these purity standards are a firm requirement for most IRA-eligible metals.

Prohibited Collectibles: Numismatic Coins vs. Bullion

A common pitfall is confusing investment-grade bullion with "collectibles." The IRS prohibits holding collectibles in an IRA, which includes most rare or numismatic coins. The value of an IRA-approved metal must derive from its intrinsic metal content, not its rarity or collector appeal.

To illustrate, let's compare IRA-eligible gold coins and bars:

| Feature | IRA-Eligible Gold Coins | IRA-Eligible Gold Bars |

|---|---|---|

| Purity | .995+ (e.g., Maple Leaf); .9167 (American Gold Eagle) | .995+ |

| Issuance | Sovereign government mints | Accredited refiners/assayers |

| Liquidity | Generally higher due to smaller, recognizable units | Can be less liquid in larger sizes |

| Cost (Premiums) | Typically higher premium per ounce | Typically lower premium per ounce |

| Face Value | Yes (legal tender value backed by issuing government) | No face value |

| Fraud Protection | Government-issued, legal-tender status and recognizable designs help protect against counterfeiting | Relies on refiner's reputation, hallmark, and assay |

| Storage Efficiency | Slightly less dense by value (more pieces per ounce) | Very efficient for storing larger values in compact form |

| Examples | American Gold Eagle, Canadian Maple Leaf, American Gold Buffalo, Austrian Philharmonic | 1 oz, 10 oz, 1 kg bars from PAMP, Credit Suisse, and other accredited refiners |

Both coins and bars can be excellent for a Gold IRA. However, many investors prefer coins for part of their holdings because their legal-tender face value and widely recognized designs add an extra layer of fraud protection and potential ease of resale, while using bars for larger, lower-premium allocations.

The Golden Rules for Storage

This is a critical rule: your IRA-held precious metals cannot be stored at home. The IRS is clear on this point. As The Wall Street Journal reported, taxpayers should be wary of anyone claiming home storage is permissible for IRA metals.

Taking physical possession of your IRA metals—even temporarily or in a personal safe deposit box—is considered a taxable distribution. Your metals must be held by an IRS-approved third-party depository. At Summit Metals, we partner with leading depositories to ensure your assets are safeguarded according to federal guidelines. Learn more about IRA Storage.

You can typically choose between two storage types:

- Commingled (Allocated) Storage: Your metals are stored with other investors' identical metals.

- Segregated Storage: Your specific coins and bars are stored separately. This often costs more but provides peace of mind.

Prohibited Transactions and Penalties

The IRS strictly forbids "self-dealing" under IRC Section 4975. Common prohibited transactions include:

- Personal Use or Possession: Storing IRA metals at home.

- Using Metal as Collateral: Pledging your IRA gold for a loan.

- Transactions with "Disqualified Persons": Buying from or selling to yourself, your spouse, or other close relatives.

- Contributing Existing Gold: You cannot buy gold personally and then contribute it to your IRA. The purchase must be made with IRA funds.

The penalties are severe, starting with a 15% excise tax and potentially rising to 100% if not corrected. In the worst case, the entire IRA can be disqualified, making the full balance immediately taxable. As the IRS Retirement Plan Investments FAQs clarify, understanding these rules is crucial.

Managing Your Gold IRA: Contributions, Distributions, and Taxes

Understanding how to contribute, withdraw, and handle taxes is key to managing your Gold IRA. Recent laws like the SECURE Act 2.0 have also introduced new dynamics you need to know.

For a comprehensive approach, see our insights on Maximizing Retirement Security Using a Precious Metals IRA to Invest in Gold and Silver with SummitMetals.com.

Contribution Limits and Funding Your Account

Gold IRA rules for contributions mirror those of traditional IRAs.

- Annual Contribution Limit (2024): Up to $7,000.

- Catch-Up Contribution (Age 50+): An additional $1,000, for a total of $8,000.

You can fund your Gold IRA in several ways:

- Direct Contributions: Deposit cash directly, subject to annual limits.

-

Rollovers vs. Transfers:

- Rollover: You receive funds from an old retirement account and have 60 days to deposit them into your new Gold IRA. Missing the deadline triggers taxes and penalties.

- Transfer: Your current custodian sends funds directly to your new Gold IRA custodian. This "trustee-to-trustee" method is safer, simpler, and avoids the 60-day rule.

For a detailed guide, see Unlocking Your Retirement's Potential: A Guide to Gold IRA Transfers.

Dollar-Cost Averaging with Autoinvest

Just like contributing to a 401(k) with every paycheck, you can apply dollar-cost averaging to your Gold IRA. With Summit Metals' Autoinvest approach, you can set up a consistent schedule of purchases—such as buying eligible gold or silver every month using your IRA, as funds become available through contributions or transfers.

This strategy involves investing a fixed dollar amount in metals at set intervals. When prices are low, you buy more metal; when prices are high, you buy less. Over time, this averages out your purchase price, helps reduce the impact of market volatility, and steadily builds your portfolio.

To decide whether a lump-sum purchase or an Autoinvest-style strategy fits you better, consider the following:

| Approach | How It Works | Potential Benefits | Potential Drawbacks |

|---|---|---|---|

| Lump-Sum Purchase | Invest a large amount at once | Immediate full exposure to metals; can benefit if prices rise soon after purchase | Higher timing risk if you buy just before a price drop; may feel less flexible |

| Autoinvest / Dollar-Cost Averaging | Invest smaller, regular amounts (e.g., monthly) | Helps smooth out price swings; easier to budget like a 401(k) contribution; builds discipline | You may miss some gains if prices rise sharply right after you start |

The Rules for Taking Distributions

When it's time to access your funds, you must follow specific distribution rules to avoid penalties.

- Required Minimum Distributions (RMDs): For Traditional or SEP Gold IRAs, you must start taking RMDs at age 73 (this will increase to 75 in 2033). RMDs are not required for Roth IRA owners.

-

In-Kind vs. Cash Distributions: You have two options:

- Cash Distribution: Your custodian sells the metals, and you receive the cash.

- In-Kind Distribution: You receive the physical metals directly. Once you take possession, the assets are no longer in your IRA and are subject to immediate taxation.

- Early Withdrawal Penalties: Withdrawing before age 59½ typically incurs a 10% tax penalty on top of ordinary income tax.

- Exceptions to the Penalty: The IRS allows penalty-free withdrawals for certain situations, such as disability, high medical expenses, or a first-time home purchase (up to $10,000). For a full list, see IRS Publication 590-B.

Your custodian will generally report distributions on Form 1099-R, and contributions and rollovers on Form 5498, which are important for accurate tax filing.

Setting Up Your Account: Custodians, Fees, and Best Practices

Establishing a Gold IRA requires careful due diligence. Choosing the right partners is key to a smooth and compliant process.

To ensure you make the best choice, use our Ultimate Checklist for Gold IRA Services Comparison.

Key Players: Custodians and Depositories

Your Gold IRA requires two non-negotiable partners:

- The Custodian: An IRS-approved financial institution that holds your IRA account. They handle all paperwork, facilitate transactions, and ensure compliance with Gold IRA rules.

- The Depository: A highly secure, IRS-approved facility where your physical metals are stored. These facilities offer robust security, full insurance, and regular audits. Common examples include Delaware Depository and Brink's Global Services. You can verify financial professionals through government resources like investor.gov.

Summit Metals works alongside your chosen custodian and depository to source and ship IRA-eligible metals at transparent, real-time prices, so each party focuses on what they do best.

Understanding the Costs

Gold IRAs have a unique fee structure due to the physical assets involved. At Summit Metals, we believe in full transparency. Common fees include:

- Setup Fee: A one-time charge to open the account (e.g., $50-$150).

- Annual Administration Fee: For account management by the custodian (e.g., $200-$300).

- Storage Fee: For secure storage at the depository, often a flat fee or a percentage of asset value (e.g., $100-$250 annually).

- Transaction Fees: For buying or selling metals within the IRA.

- Liquidation Fees: When you sell your metals for a cash distribution.

As one custodian example notes, "There is often a set-up fee and annual fee to hold a precious metals IRA" and "The fee is $275 annually" for certain accounts (see Vantage IRAs for more detail). Actual fees will vary by provider, so always confirm the exact schedule with your chosen custodian and depository.

To quickly compare fee structures when you are shopping providers, use a simple framework like this:

| Fee Type | What to Ask | Why It Matters |

|---|---|---|

| Setup Fee | One-time or waived with minimum balance? | Affects your cost to get started. |

| Annual Admin Fee | Flat fee or based on account value? | Impacts long-term holding costs as your account grows. |

| Storage Fee | Flat per year or percentage of metals value? | Determines the cost of keeping metals in an approved facility. |

| Transaction / Trading Fees | Per trade, per ounce, or spread built into price? | Helps you compare true buy/sell costs between dealers. |

| Hidden or Misc. Fees | Ask for all fees in writing upfront. | Prevents surprises that eat into returns. |

Best Practices for Compliance

Staying compliant is an ongoing commitment. Follow these best practices:

- Meticulous Record-Keeping: Keep detailed records of all transactions, statements, and communications.

- Digital Backups: Store digital copies of your records securely.

- Annual Account Review: Review your statements annually to verify assets and check for unauthorized activity.

- Stay Informed: Regulations can change. Follow IRS guidance and reliable industry news, like our blog on Precious Metals SIRA Regulations 101.

- Consult Professionals: Work with your custodian, a tax advisor, or a financial planner for complex questions.

- Use Structured Buying Plans: Consider setting up an Autoinvest-style plan with Summit Metals—regular, scheduled purchases can keep your strategy disciplined and aligned with your long-term goals while keeping every transaction documented and compliant with Gold IRA rules.

Frequently Asked Questions about Gold IRA Rules

Here are answers to the most common inquiries we receive about Gold IRA rules.

Can I store the gold from my IRA at home?

No. This is one of the most critical Gold IRA rules. The IRS explicitly prohibits storing IRA-held metals at home or in a personal safe deposit box. Taking physical possession is a prohibited transaction that disqualifies the account, making the entire value taxable and subject to penalties. Your metals must be held in a secure, IRS-approved third-party depository.

What specific types of gold can I hold in my IRA?

The IRS requires gold to be at least 99.5% pure (.995 fineness). The American Gold Eagle coin (91.67% pure) is a specific exception.

Common IRA-eligible gold coins include:

- American Gold Eagle

- American Gold Buffalo

- Canadian Gold Maple Leaf

- Austrian Gold Philharmonic

Eligible gold bars must also meet the .995 fineness standard and come from an accredited refiner like PAMP Suisse or Credit Suisse. Collectible or numismatic coins are generally not permitted.

What happens if I take my gold out before age 59 ½?

A withdrawal before age 59 ½ is considered an early distribution. It is typically subject to your ordinary income tax rate plus an additional 10% tax penalty. For example, a $10,000 early withdrawal would result in a $1,000 penalty on top of income taxes.

The IRS allows exceptions to the 10% penalty for certain situations, including:

- Total and permanent disability

- Unreimbursed medical expenses (exceeding 7.5% of AGI)

- Qualified higher education expenses

- First-time home purchase (up to a $10,000 lifetime limit)

- Certain emergency or domestic abuse victim distributions (new rules apply after 2023)

Always consult a tax professional to see if you qualify for an exception.

Conclusion: Securing Your Golden Years with Confidence

Navigating the intricate landscape of Gold IRA rules might seem daunting, but with a clear understanding and the right partners, it becomes a powerful strategy for retirement security. We've covered the essentials, from IRS purity standards and strict storage requirements to prohibited transactions, contribution limits, and distribution rules. Compliance isn't just about avoiding penalties; it's about preserving the tax-advantaged status of your hard-earned savings.

Gold, silver, platinum, and palladium offer unique benefits as long-term assets, providing diversification and a hedge against economic volatility. By adhering to these golden rules, you can confidently integrate physical precious metals into your retirement portfolio.

At Summit Metals, based in Wyoming with locations in Utah, we are committed to helping you understand and steer these rules with ease. Our transparent, real-time pricing and competitive rates, secured through bulk purchasing, ensure you get trusted value for your investment. We believe in empowering investors with knowledge and providing a seamless, compliant path to securing their future.

Ready to take the next step in securing your golden years? Explore our comprehensive guide to IRA Gold Investment: A Comprehensive Guide to Securing Your Future and let us help you build a resilient retirement portfolio.