Why Precious Metals Investment Matters for Your Financial Future

Precious Metals Investment means owning rare, finite metals—most notably gold and silver—that have preserved purchasing power for millennia. In an era of rising inflation and market volatility, a modest allocation to physical bullion can act as financial insurance.

Key Benefits

- Portfolio diversification with low correlation to stocks and bonds

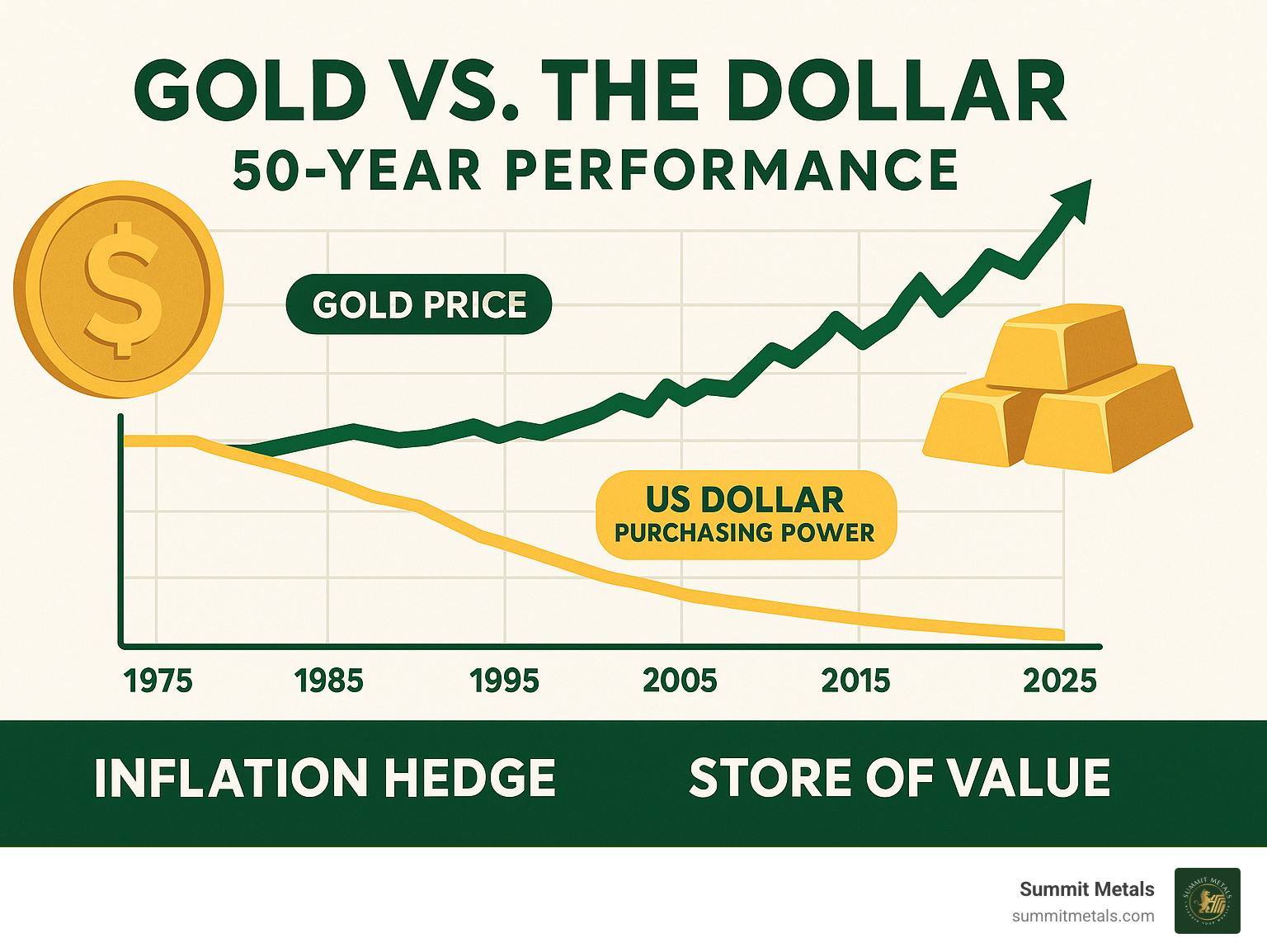

- Time-tested hedge against inflation and currency debasement

- Tangible, private assets that eliminate digital counter-party risk

- Universal liquidity—buy or sell almost anywhere on the globe

How Summit Metals Clients Invest

- Physical bullion (gold and silver bars or coins) shipped to you or a secure depository

Suggested Allocation: Independent planners often recommend 5–10 % of a well-balanced portfolio in physical metals. This range offers meaningful protection without sacrificing growth potential in other asset classes.

With supply limited and demand accelerating, many families are adding gold and silver as their “sleep-well” assets. Because bullion carries no promise from any government or corporation, it tends to gain favor whenever confidence in paper assets falters.

I’m Eric Roach. After a decade advising Fortune-500 firms on Wall Street, I now guide everyday investors in applying institutional risk-management principles through straightforward ownership of physical gold and silver.

What Are Precious Metals and Why Invest in Them?

Precious metals are nature’s limited-supply assets formed deep within the Earth. Unlike paper money, gold and silver cannot be printed, and their scarcity—combined with industrial usefulness—creates enduring economic value.

Because bullion is tangible, it offers peace of mind during financial upheaval. Gold’s corrosion resistance makes it invaluable in electronics and aerospace, while silver’s antibacterial properties give it wide medical and industrial demand. These real-world uses place a natural floor under prices.

For added context on why nations continue to hoard bullion, see Why Central Banks Buy Gold and Why You Should Too.

The Main Investment Metals

Most private investors concentrate on gold and silver because they combine deep liquidity with established global markets. Other precious metals such as platinum and palladium exist, but their smaller markets and higher volatility make them better suited for specialists.

- Gold – universally recognized store of value and the most liquid precious metal on Earth.

- Silver – lower entry cost, essential for solar, batteries and electronics, and historically more volatile (and sometimes more rewarding) than gold.

Core Benefits of Owning Bullion

- Diversification: physical metals often move independently of equities and bonds.

- Inflation protection: gold and silver have retained purchasing power through every major currency collapse.

- Safe-haven demand: during geopolitical or economic stress, investors flock to bullion.

For a deeper strategic view, read The Strategic Role of Gold in Long-Term Portfolio Management.

Navigating Your First Precious Metals Investment: A Step-by-Step Guide

Taking your first steps into Precious Metals Investment can feel overwhelming, but with the right approach, you'll build confidence quickly. Think of it like learning to drive - once you understand the basics, the process becomes second nature.

Start with clear goals. Before you buy anything, ask yourself why you want precious metals. Are you worried about inflation eating away at your savings? Looking to diversify beyond stocks and bonds? Want something tangible you can actually hold? Your reasons will shape every decision that follows.

Set your allocation strategy. Financial experts consistently recommend putting 5-10% of your portfolio into precious metals. This gives you meaningful protection without putting all your eggs in one basket. If you're just starting out, begin with the lower end of this range and increase over time as you get comfortable.

Do your homework on dealers. This step is absolutely crucial. You want a company that's been around for years, has transparent pricing, and doesn't pressure you into buying overpriced collectible coins. Look for dealers who publish their prices online and have strong customer reviews.

The beauty of precious metals is that you don't need to be an expert to start. You just need to understand the basics and work with trustworthy people. For a comprehensive foundation, check out The Ultimate Beginner's Guide to Investing in Precious Metals.

Consider dollar cost averaging if you're nervous about timing the market. Instead of making one large purchase, spread your investments over several months. This approach helps smooth out price swings and reduces the stress of trying to time the perfect entry point. Learn more about The Power of Dollar Cost Averaging in Gold and Silver Investments.

Different Ways to Invest

When it comes to Precious Metals Investment, you have several paths to choose from. Each has its own advantages, and the best choice depends on your goals and comfort level.

Physical bullion remains the most popular option for good reason. When you own bars, coins, or rounds, you truly own the metal. There's no counterparty risk, no management fees eating into your returns, and no worry about whether some distant company will honor its promises.

| Investment Type | Cost | Ownership | Risk Level | Liquidity |

|---|---|---|---|---|

| Gold/Silver Bars | Low premiums (1-3%) | Direct physical ownership | Storage/theft risk | High |

| Gold/Silver Coins | Moderate premiums (3-8%) | Direct physical ownership | Storage/theft risk | Very High |

| Silver Rounds | Low premiums (1-4%) | Direct physical ownership | Storage/theft risk | Moderate |

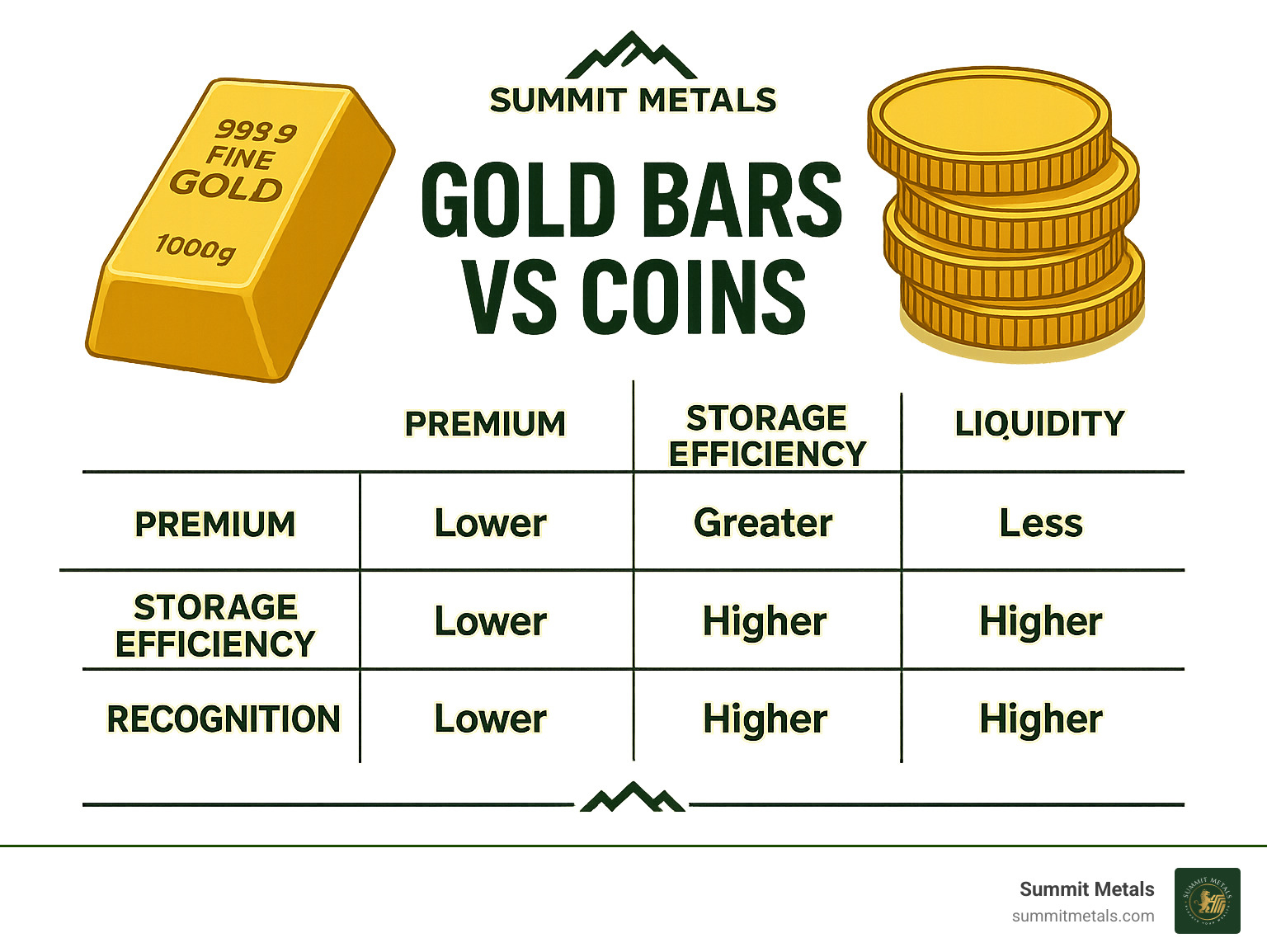

Gold and silver bars offer the most metal for your money. They typically carry the lowest premiums over spot price, making them ideal if you're buying larger amounts. The trade-off is that bars are less divisible - you can't easily sell just part of a 10-ounce bar.

Government-minted coins like American Eagles or Canadian Maple Leafs cost a bit more but offer excellent liquidity. Everyone recognizes them, and they're easy to buy and sell. They're also more divisible than bars, which is handy if you need to sell smaller amounts.

Silver rounds split the difference. They're privately minted, so they cost less than government coins but more than bars. They're a good middle ground for many investors.

The key is understanding what you're getting for the premium you pay. For a detailed breakdown of the pros and cons, read What's the Difference Between Gold Bars and Coins?.

Understanding Costs and Fees

Here's where many new investors get surprised - precious metals aren't just about the metal price you see on financial websites. There are several costs to factor in, and understanding them upfront will help you make better decisions.

Dealer spreads are the difference between what you pay to buy and what you'll get when you sell. This typically ranges from 1-10% depending on what you're buying and who you're buying from. Bullion generally has much lower spreads than collectible coins.

Purchase premiums are what you pay above the spot price of the metal. Based on current market conditions, expect to pay premiums ranging from 2.90% for smaller purchases down to 0.99% for amounts over $100,000. Larger purchases get better pricing because dealers can spread their fixed costs over more metal.

Selling fees work similarly in reverse. When you're ready to sell, fees typically range from 2.00% for smaller amounts to 0.75% for transactions over $250,000. Again, larger transactions get better treatment.

Watch out for numismatic markups - this is where some dealers make their real money. Collectible coins can carry markups of 30% or more above their metal value. Semi-numismatic coins may have markups of 25-100% of melt value. Unless you're specifically collecting coins, stick to bullion.

Storage and insurance costs add up over time if you don't keep your metals at home. Professional storage typically runs 0.5-2% annually, depending on the service level you choose.

Most dealers also have minimum purchase requirements, often around $2,500 for physical metals. This helps them manage their costs and ensures serious buyers.

Understanding these costs isn't meant to scare you away - it's about making informed decisions. When you know what to expect, you can budget properly and avoid unpleasant surprises. For a deeper dive into how precious metals pricing works, check out Spot Price vs Premium: How Precious Metals Pricing Works.

These costs are the price of owning real, physical assets. When you factor in the peace of mind and long-term wealth protection precious metals provide, many investors find the costs quite reasonable.

Key Risks and How to Mitigate Them

While physical bullion is a powerful wealth-preservation tool, it is not risk-free. Understanding the following points will help you protect your holdings:

Price Volatility: Gold fell from an inflation-adjusted peak of about $2,200 in 1980 to below $400 in 2001. Have a long-term horizon so you are not forced to sell during temporary downturns.

No Ongoing Income: bullion’s return comes solely from price appreciation, so plan other sources of cash flow in your portfolio.

Storage & Security: Whether you keep metals at home or in a professional vault, include the cost of safes, insurance, and possible storage fees in your calculations.

Counter-party Exposure in Paper Proxies: Physical metal has zero counter-party risk. Paper substitutes, however, rely on the financial health of the issuing institution.

Liquidity Differences: Popular one-ounce coins sell quickly at transparent prices, whereas large bars or rare collectibles may take longer to move.

For more protection tips, review Top Gold Investing Mistakes and How to Avoid Them.

Factors That Move Prices

Supply constraints, geopolitical shocks, real interest rates, and U.S. dollar strength all influence daily bullion pricing. Staying informed on these drivers allows you to buy with confidence and avoid emotionally driven trades.

Important Considerations for New Investors

Starting your Precious Metals Investment journey successfully comes down to making smart choices from day one. The decisions you make early on will shape your entire investment experience, so let's walk through the key considerations that separate successful investors from those who struggle.

Finding reputable dealers should be your first priority. Look for companies with transparent pricing, secure shipping methods, and genuine customer reviews. Be wary of dealers who use high-pressure sales tactics or try to push expensive numismatic coins with sky-high markups. A trustworthy dealer will educate you about your options rather than rushing you into a purchase.

Product authenticity is non-negotiable in this market. Counterfeit precious metals are unfortunately common, especially when buying from unknown sources or unverified online sellers. Stick with established dealers who provide certificates of authenticity and have systems in place to verify the purity and weight of their products.

Your long-term perspective will largely determine your success. Precious Metals Investment works best when you think in years, not months. The costs associated with buying and selling mean that frequent trading can eat into your returns. Instead, focus on building your position steadily over time through a disciplined approach.

Education remains your best defense against poor decisions and scams. Understanding purity levels, premium structures, and liquidity differences between products helps you make informed choices. The more you know about what you're buying, the better equipped you'll be to spot red flags and avoid costly mistakes.

Don't underestimate the importance of proper documentation. Keep detailed records of every purchase, including receipts, certificates of authenticity, and storage documentation. This paperwork becomes crucial for insurance claims, tax calculations, and proving ownership if questions arise later.

For comprehensive guidance on safe purchasing practices, check out How to Buy Gold and Silver Online Safely. Our guide on Identifying Reputable Bullion Dealers: Avoiding Counterfeits provides additional protection strategies.

How Your Precious Metals Investment is Taxed

The tax treatment of Precious Metals Investment often surprises new investors, so understanding these rules upfront helps you plan more effectively.

The IRS classifies physical precious metals as collectibles, which means they're subject to a 28% long-term capital gains tax rate when held for more than one year. This rate is significantly higher than the standard 15% capital gains rate that applies to most stocks and bonds. If you sell your metals within one year of purchase, any gains are taxed as ordinary income, which could push your tax rate even higher depending on your bracket.

This higher tax rate makes precious metals more suitable for long-term holding strategies rather than frequent trading. The tax implications favor investors who buy and hold for years rather than those who try to time the market with frequent transactions.

Accurate record keeping becomes essential for tax purposes. You'll need to track your purchase prices, dates of acquisition, and selling prices to calculate your gains or losses correctly. Without proper documentation, you might end up paying more taxes than necessary or facing complications during an audit.

The complexity of precious metals taxation makes professional tax advice worthwhile for most investors. A qualified tax advisor can help you understand strategies for minimizing your tax burden and ensure you're complying with all applicable regulations. For more detailed information about collectibles taxation, review How Collectibles are Taxed.

Choosing Your Storage Solution

Protecting your Precious Metals Investment through proper storage requires balancing security, accessibility, and cost considerations.

Home storage offers the ultimate control and immediate access to your metals. You can check on your investment anytime and don't pay ongoing storage fees. However, this convenience comes with responsibility. You'll need a high-quality safe, a reliable home security system, and adequate insurance coverage. Many homeowner's insurance policies don't fully cover precious metals, so additional coverage might be necessary.

Bank safety deposit boxes provide professional security at a reasonable cost. Your metals are protected in a secure facility, and you don't have to worry about home security. The downside is limited access hours and the fact that most banks don't insure precious metals stored in safety deposit boxes. You'll need to verify your bank's specific policies before choosing this option.

Third-party depositories offer the highest level of professional storage services. These facilities specialize in precious metals storage and typically provide comprehensive insurance coverage. Some offer segregated storage where your specific metals are identified and kept separate from other investors' holdings.

Understanding allocated versus unallocated storage is important when considering professional storage. Allocated storage means specific metals are set aside with your name on them, while unallocated storage gives you a claim on a pool of metals. Allocated storage offers better protection if the storage company faces financial difficulties, but it typically costs more.

Insurance coverage should be a priority regardless of which storage method you choose. Make sure your metals are adequately protected against theft, damage, and loss. The cost of insurance should be factored into your overall investment returns.

For comprehensive storage guidance, explore Top Tips for Precious Metals Storage: Secure Your Investments. If you're considering retirement planning, Maximizing Retirement Security: Using a Precious Metals IRA to Invest in Gold and Silver provides valuable insights into tax-advantaged storage options.

Frequently Asked Questions about Precious Metals Investing

How much of my portfolio should go into metals?

Most planners suggest 5–10 %. Treat bullion like insurance—enough to matter, not enough to dominate.

Which metal is best for beginners?

Start with gold for maximum liquidity and lower volatility. Add silver later if you want more upside potential at a lower dollar-per-ounce cost. Learn the basics in The Basics of Gold and Silver Stacking.

Should I buy bars or coins?

Bars carry the lowest premiums; coins offer better divisibility and instant global recognition. Many investors hold a mix. See the detailed breakdown in Gold Bars vs Coins.

Conclusion

Precious Metals Investment has proven itself as a reliable cornerstone for smart investors who understand the value of true diversification. Throughout this guide, we've explored how gold, silver, platinum, and palladium can serve as your financial insurance policy against economic uncertainty, inflation, and market volatility.

The beauty of precious metals lies in their simplicity and permanence. While stock markets fluctuate wildly and currencies lose purchasing power over time, precious metals have maintained their intrinsic value for thousands of years. They offer something that digital assets and paper investments simply cannot: tangible ownership of real, physical wealth that you can hold in your hands.

Your journey into precious metals investing doesn't need to be overwhelming. Start with the 5-10% portfolio allocation that experts recommend, focusing on gold for stability and silver for affordability. This is a long-term wealth preservation strategy, not a get-rich-quick scheme. The investors who benefit most from precious metals are those who understand patience and consistency.

Due diligence remains your best friend in this market. Choose reputable dealers who offer transparent pricing, understand the costs involved, and plan for proper storage and insurance. The upfront effort you put into education and preparation will pay dividends in peace of mind and financial security.

At Summit Metals, we've built our reputation on the principle that precious metals investing should be straightforward and trustworthy. As a Wyoming-based company, we combine the values of honesty and hard work with competitive bulk purchasing power to bring you transparent, real-time pricing on authenticated gold and silver. We believe your investment decisions should be based on facts, not high-pressure sales tactics.

The current economic landscape makes precious metals particularly relevant. With inflation concerns, banking instability, and unprecedented monetary policy creating uncertainty, having a portion of your wealth in physical assets provides stability that traditional investments may lack during turbulent times.

Precious Metals Investment works best when integrated thoughtfully into a diversified portfolio. These metals aren't meant to replace your other investments but rather to complement them, providing the defensive stability that allows you to take appropriate risks elsewhere.

Your financial future deserves the protection that only physical precious metals can provide. Whether you're concerned about inflation, seeking portfolio diversification, or simply want the peace of mind that comes with owning tangible assets, precious metals offer a time-tested solution.

Start building your precious metals portfolio today with Summit Metals' commitment to transparency and value. We're here to guide you through every step, from your first purchase to building a comprehensive precious metals strategy that protects and preserves your wealth for years to come.

Prices shown are at the time of this publication.