Understanding How Much Junk Silver Equals an Ounce

How much junk silver equals an ounce depends on the coin denomination, but here's your quick answer:

| Coin Type | Quantity Needed for ~1 Troy Ounce | Face Value |

|---|---|---|

| Pre-1965 Dimes | 14 dimes | $1.40 |

| Pre-1965 Quarters | 6 quarters (5.5 to round up) | $1.50 |

| Pre-1965 Half Dollars | 3 half dollars | $1.50 |

| Quick Rule | $1.40 face value (any mix) | $1.40 |

If you've inherited a jar of old silver coins or stumbled across pre-1965 dimes and quarters in circulation, you're holding more than pocket change. These coins contain 90% silver and are valued primarily for their metal content, not their numismatic rarity. Understanding how to calculate their true worth empowers you to make smart decisions whether you're selling, insuring, or building a hedge against inflation.

The term "junk silver" is misleading. These coins represent the last era when U.S. currency was directly backed by precious metal. Before 1965, the U.S. Mint stamped dimes, quarters, and half dollars with a 90% silver alloy. Today, they offer an affordable, recognizable way to own fractional silver—perfect for diversifying your portfolio or even bartering if economic instability strikes. For a bit of background on silver as money, see the history of the United States dollar.

The math is straightforward once you understand that one troy ounce (the standard for precious metals) weighs 31.1 grams, and $1.00 face value of 90% silver coins contains approximately 0.715 troy ounces of pure silver after accounting for circulation wear. Multiply that by the current silver spot price, and you've got your melt value.

I'm Eric Roach, and during my decade advising Fortune 500 clients on IPOs and hedging programs in New York, I saw how institutional players use precious metals to protect balance sheets—strategies I now bring to everyday investors like you. My experience guiding clients through market volatility has taught me that understanding how much junk silver equals an ounce is the first step toward building a resilient, tangible asset that no government can print away. At Summit Metals, we help you dollar-cost average into physical silver through our Autoinvest program, making it as simple as contributing to your 401(k)—just set your monthly budget, and we'll ship authenticated silver directly to your door every month so you build your stack automatically.

Quick look at how much junk silver equals an ounce:

How Much Junk Silver Equals an Ounce? The Simple Answer

For anyone looking to quickly gauge the silver content in their pre-1965 U.S. coins, the simplest answer to how much junk silver equals an ounce is often expressed in terms of face value. A common rule of thumb among precious metals investors is that roughly $1.40 face value of 90% U.S. silver coinage contains approximately one troy ounce of pure silver.

This "rule of thumb" simplifies what can otherwise seem like a complex calculation. It's an average that accounts for the slight variations in individual coin weights and the minor loss of metal from circulation wear. Our goal at Summit Metals is to make understanding your precious metals investments as straightforward as possible.

When we talk about an "ounce" in the context of precious metals like silver, we're specifically referring to a troy ounce. This is different from the more common avoirdupois ounce used for everyday goods. One troy ounce weighs 31.103 grams, while an avoirdupois ounce is slightly lighter at 28.35 grams. This distinction is crucial for accurate valuation.

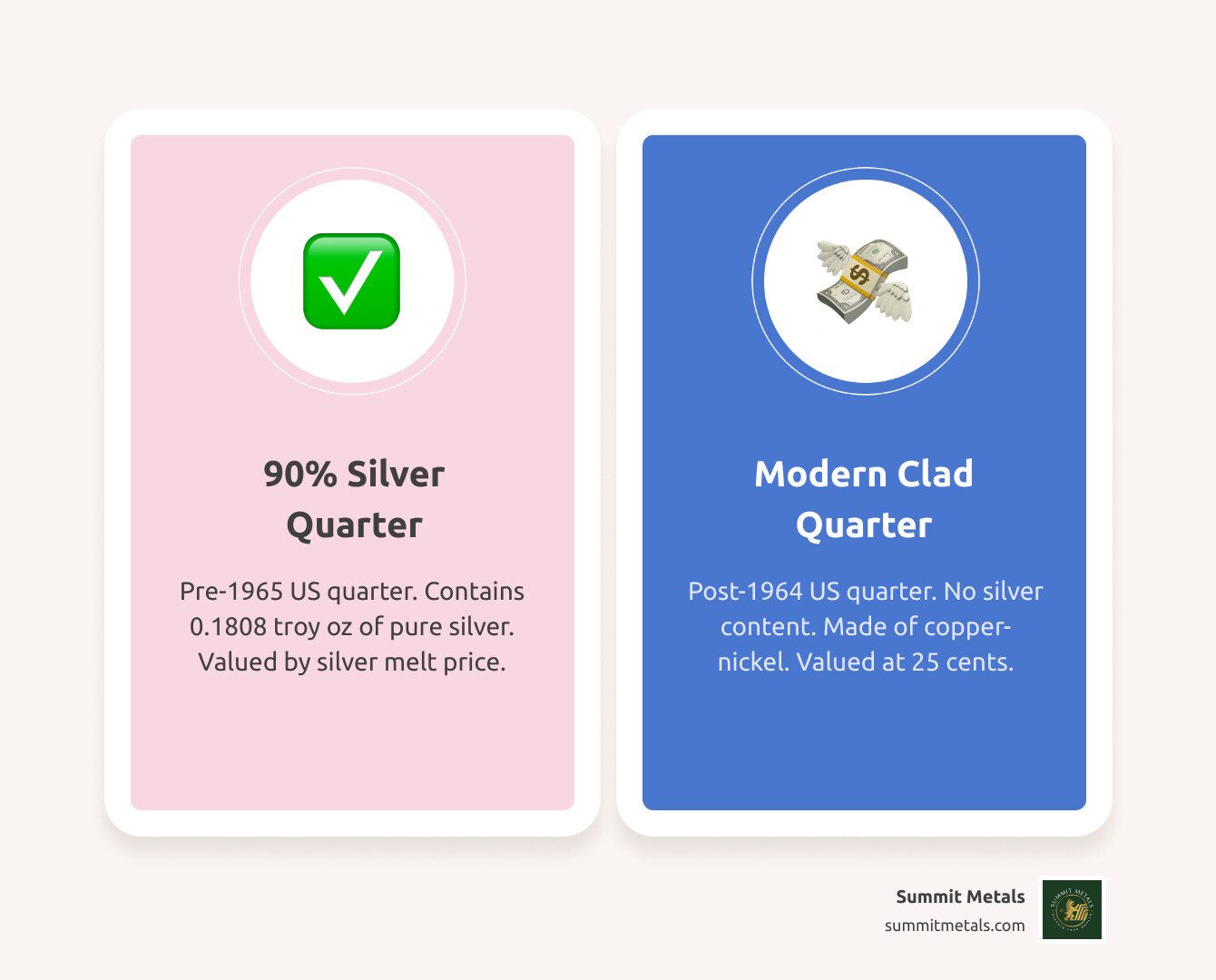

The pre-1965 90% silver coins are primarily U.S. dimes, quarters, and half dollars. These coins were minted with an alloy of 90% silver and 10% copper. This composition made them durable enough for circulation while still retaining significant intrinsic value. Let's break down the approximate quantities for each denomination:

To dig deeper into the specifics of valuing these coins, you might find our guide, An Essential Guide to Valuing Constitutional Silver, very helpful.

How many pre-1965 dimes equal one troy ounce of silver?

To accumulate one troy ounce of pure silver using pre-1965 dimes, you would need approximately 14 dimes. Each pre-1965 dime, whether it's a Roosevelt, Mercury, or Barber dime, contains about 0.0723 troy ounces of pure silver.

To illustrate, 14 dimes would have a total face value of $1.40. Multiplying 14 dimes by their individual silver content (14 * 0.0723 troy oz) gives you approximately 1.0122 troy ounces of silver, which is slightly more than one troy ounce. This makes the $1.40 face value a very convenient benchmark.

How many pre-1965 quarters equal one troy ounce of silver?

For pre-1965 quarters, you'll find that it takes about 5.5 quarters to reach one troy ounce of pure silver. However, since you can't have half a quarter, you'd typically need 6 quarters to ensure you have at least one troy ounce. Each pre-1965 quarter, including Washington, Standing Liberty, and Barber quarters, contains approximately 0.1808 troy ounces of pure silver.

So, if you collect 6 quarters, you'd have a total face value of $1.50, and their combined silver content would be roughly 1.0848 troy ounces (6 * 0.1808 troy oz). It's worth noting that wear and tear can slightly reduce the exact silver content of heavily circulated coins, but the 0.715 factor (which we'll discuss shortly) helps account for this average loss.

How many pre-1965 half dollars equal one troy ounce of silver?

When it comes to pre-1965 half dollars, such as the iconic 1964 Kennedy half dollars, Franklin half dollars, or Walking Liberty half dollars, you'll need approximately 3 half dollars to equal one troy ounce of pure silver. Each of these coins contains about 0.3617 troy ounces of pure silver.

Three half dollars would give you a total face value of $1.50, and their collective silver content would be around 1.0851 troy ounces (3 * 0.3617 troy oz). This makes half dollars a popular choice for those looking to accumulate silver in slightly larger, yet still fractional, increments.

A Deeper Dive: Calculating the Precise Value of Your Silver Coins

Understanding the simple rules of thumb for how much junk silver equals an ounce is a great starting point, but for precise valuation, we need to dig a little deeper into the numbers. The world of precious metals uses specific measurements, and knowing them empowers you to truly understand your investment.

As we mentioned, the standard unit of weight for precious metals is the troy ounce, not the more common avoirdupois ounce. A troy ounce is roughly 1.097 times heavier than an avoirdupois ounce. This distinction is critical because all silver spot prices are quoted in dollars per troy ounce. So, when calculating the value of your silver, always ensure you're using troy ounces. You can read more about this weight system in the entry on the troy ounce.

The pre-1965 U.S. dimes, quarters, and half dollars are made from a 90% silver and 10% copper alloy. This means that for every 100 parts of the coin's metal, 90 parts are silver and 10 parts are copper. While a freshly minted coin would have a slightly higher pure silver weight, the reality of decades in circulation means a small amount of metal is lost due to friction and wear.

This brings us to the famous 0.715 factor. While two silver half dollars (which make $1 face value) originally contained about 0.723 troy ounces of 99.9% pure silver when they left the mint, dealers and investors commonly use a slightly adjusted figure of 0.715 troy ounces of pure silver per $1.00 face value for 90% junk silver. This wear and tear adjustment accounts for the average loss of metal over years of circulation, providing a more realistic estimate of the actual silver content in typical "junk" coins.

So, the melt value formula for your 90% junk silver coins is:

Melt Value = (Total Face Value of 90% Silver Coins) x 0.715 x (Current Silver Spot Price)

For example, if you have $100 face value of 90% junk silver and the current silver spot price is $25.00 per troy ounce (prices shown are at the time of this publication), your calculation would be:

$100 (FV) x 0.715 x $25.00/oz = $1,787.50

This simple formula allows you to quickly assess the intrinsic value of your 90% silver holdings. You can always check the live silver spot price to get the most up-to-date pricing. For more insights on acquiring these valuable assets, refer to our guide, Junk Silver Coins: Your Go-To Guide for Smart Purchases.

Calculating Value for Other Silver Coins

While 90% silver dimes, quarters, and half dollars are the most common forms of "junk silver," the U.S. Mint has produced other coins with significant silver content. It's important to recognize these distinct categories because their silver content and, therefore, their melt value, will differ.

Here's a list of other U.S. silver coins you might encounter and how their silver content compares:

- 40% Silver Kennedy Half Dollars (1965-1970): After 1964, the U.S. Mint reduced the silver content in half dollars to 40% (60% copper). These coins contain approximately 0.15 troy ounces of pure silver per coin. So, you'd need about 7 of these to get one troy ounce of silver. Some Eisenhower dollars from 1971-1974 and 1976 also contained 40% silver, with approximately 0.3161 troy ounces per coin.

- 35% Silver "War Nickels" (1942-1945): During World War II, nickel was a strategic metal, so the U.S. Mint temporarily changed the composition of nickels. These "War Nickels" contain 35% silver, 56% copper, and 9% manganese. Each War Nickel holds about 0.057 troy ounces of pure silver. You would need approximately 18 of these to reach one troy ounce of silver.

- Morgan and Peace Silver Dollars: These larger, iconic silver dollars (Morgan: 1878-1921, Peace: 1921-1935) also contain 90% silver, but their larger size means they have a significantly higher silver content per coin. Each Morgan or Peace dollar contains approximately 0.7734 troy ounces of pure silver. This means you'd need roughly 1.3 of these to equal a troy ounce. However, it's crucial to note that many Morgan and Peace dollars often carry a numismatic premium above their melt value, especially in higher grades or for specific dates and mint marks. Always check their collector value before considering them purely as "junk silver."

For those interested in the history and where to find silver dollars, our article Coining History: Where to Find Eisenhower Silver Dollars provides more context.

Melt Value vs. Numismatic Value: Is It Really "Junk"?

The term "junk silver" can be a bit misleading because it suggests these coins have no value beyond their silver content. While for most circulated pre-1965 dimes, quarters, and half dollars this is true, understand the distinction between melt value and numismatic value.

Melt value is simply the intrinsic worth of the precious metal contained within the coin, calculated by multiplying its pure silver weight by the current spot price of silver. This is the value we've been focusing on when discussing how much junk silver equals an ounce. For the vast majority of heavily circulated "junk silver," the melt value is its primary worth.

Numismatic value, on the other hand, refers to the value a coin holds for collectors due to its rarity, historical significance, condition, specific mint marks, or special varieties. Factors that contribute to numismatic value include:

- Rarity: How many of that particular coin were minted?

- Condition: Is the coin well-preserved, or is it heavily worn? Uncirculated coins or those with minimal wear fetch higher premiums.

- Key Dates: Certain years or mint marks are significantly rarer and more sought after by collectors.

- Mint Marks: The small letter on a coin indicating where it was minted (e.g., "D" for Denver, "S" for San Francisco) can drastically affect its value.

While most "junk silver" coins are too common or too worn to command significant numismatic premiums, it's always a good practice to quickly check your coins for any potential collector value before selling them for melt. For instance, some Barber dimes or Standing Liberty quarters, even if circulated, might have specific dates or mint marks that make them valuable to a collector. You can easily check coin melt values and compare them against typical numismatic guides to ensure you're getting the most out of your silver.

To systematically build a position in both bullion and potential numismatic pieces without trying to time the market, many investors use Summit Metals' Autoinvest program. By committing a fixed monthly amountmuch like contributing to a 401(k)you can dollar-cost average into authenticated silver delivered to your door, smoothing out price swings over time.

Why Invest in Junk Silver? Practical Benefits for Today's Investor

Beyond the fascinating historical aspect of holding "real money" in your hand, investing in junk silver offers several compelling practical benefits for today's investor, especially in an uncertain economic landscape. At Summit Metals, we believe in tangible assets, and junk silver fits perfectly into a diversified portfolio.

- Affordability and Accessibility: Junk silver provides an accessible entry point into precious metals ownership. You don't need to buy expensive bullion bars to start. Even a few dimes add up, making it easy to accumulate silver on any budget.

- Fractional Silver Investment: Unlike large silver bars, junk silver coins are inherently fractional. This divisibility makes them incredibly practical for smaller transactions or for liquidating only a portion of your holdings if needed. It's like having silver in small, recognizable denominations.

- Recognizability for Barter: In a worst-case scenario or during periods of extreme economic instability, junk silver's history as circulating currency makes it highly recognizable and potentially useful for bartering. Its intrinsic value is understood, unlike unmarked bullion.

- Hedge Against Inflation: Historically, silver has served as a reliable hedge against inflation and economic uncertainty. When traditional currencies lose purchasing power, precious metals often retain or increase their value. Holding physical silver, especially in a recognizable form like U.S. coinage, offers a sense of security.

We at Summit Metals are committed to helping you build your financial resilience. That's why we champion strategies like dollar-cost averaging through our Autoinvest program. This approach involves investing a fixed amount of money into silver at regular intervals, regardless of the market price. Over time, this strategy can reduce the impact of market volatility and allow you to accumulate more silver when prices are low. With Autoinvest, you simply set your monthly budgetjust like a recurring 401(k) contributionand we'll ship authenticated silver directly to your door, making consistent investment automatic whether you're in Wyoming or Salt Lake City, Utah. For more on bulk purchases, check out Bagging a Bargain: Navigating Bulk Junk Silver Purchases.

Junk Silver Coins vs. Silver Bars: A Comparison

When deciding how to acquire physical silver, investors often weigh the pros and cons of junk silver coins versus silver bars. Both have their place in a balanced portfolio, but their practical benefits differ:

| Junk Silver Coins | Silver Bars | |

|---|---|---|

| Primary Advantage | Historically recognized money | Lower premiums in larger sizes |

| Denominations | Small, fractional face values (dimes, quarters, halves) | Larger, fixed weights (1 oz, 10 oz, 100 oz, etc.) |

| Premium Over Spot | Often moderate, reflects coinage and demand | Typically lower per ounce in bigger bar sizes |

| Use in Barter | Highly practical; easy to make small trades | Better for large-value transactions or long-term storage |

| Government Backing | U.S. government-issued with a legal-tender face value | Mint or refiner guarantees purity, but no face value |

| Counterfeit Risk | Lower; familiar designs, sizes, and ring test help | Modern bars have security features, but less familiar to public |

| Storage & Handling | Easy to divide into small bags or rolls | Very efficient for stacking and storing in safes or depositories |

While silver bars often offer a lower premium per ounce, especially in larger sizes, junk silver coins have a unique appeal due to their history, divisibility, and government-backed face value. This face value, even if symbolic relative to the melt value, offers a layer of protection against fraud and improves their liquidity in certain scenarios. It's a bit like buying a gold coin versus a gold barthe coin has that extra layer of government guarantee and recognizability.

Gold Coins vs. Gold Bars: How the Same Logic Applies

The same trade-offs appear when you look at gold coins versus gold bars:

| Gold Coins | Gold Bars | |

|---|---|---|

| Face Value | Have a legal-tender face value backed by a sovereign mint | No face value; value rests solely on metal content |

| Fraud Protection | Government designs, security features, and known specs help deter counterfeiting | Reputable refiners add security features, but brand recognition matters |

| Recognizability | Widely recognized globally (e.g., American Eagle, Maple Leaf) | Recognition depends on refiner (e.g., PAMP, Valcambi) |

| Divisibility | Issued in fractional sizes (1 oz, 1/2 oz, 1/4 oz, 1/10 oz) | Often larger format; best for consolidating wealth |

| Premiums | Usually higher than bars due to minting and collectibility | Typically lower per ounce, especially for larger bars |

Investors who value flexibility, recognizability, and a government-backed face value often lean toward coins, while those focused purely on the lowest cost per ounce may prefer bars. Summit Metals can help you blend both approaches and, through Autoinvest, spread your purchases over time so you're accumulating the mix of coins and bars that best fits your long-term plan.

Frequently Asked Questions about Junk Silver

We often hear common questions about junk silver from both new and experienced investors. Here are some of the most frequent inquiries and our expert answers.

What's the easiest way to calculate the value of a mixed bag of 90% junk silver?

The easiest and most common method for calculating the value of a mixed bag of 90% junk silver is to use the "face value" method combined with the adjusted silver content factor.

Here's how it works:

- Count the total face value: Add up the face value of all your 90% silver dimes, quarters, and half dollars. For example, if you have 10 dimes ($1.00 FV), 4 quarters ($1.00 FV), and 2 half dollars ($1.00 FV), your total face value is $3.00.

- Apply the 0.715 factor: $1.00 face value of 90% silver coins contains approximately 0.715 troy ounces of pure silver. This factor already accounts for average circulation wear.

- Use the formula: Multiply your total face value by 0.715 and then by the current silver spot price.

Formula: Total Face Value x 0.715 x Current Silver Spot Price = Melt Value

So, if you had $3.00 face value and the silver spot price was $25.00/oz (prices shown are at the time of this publication): $3.00 (FV) x 0.715 x $25.00/oz = $53.625

This method is quick, reliable, and widely accepted by dealers.

Should I clean my junk silver coins?

A resounding NO! We cannot emphasize this enough. While it might be tempting to make your old silver coins shiny and new, cleaning junk silver coins is almost always a mistake. Here's why:

- Removes the natural patina: The dark, aged surface that develops on silver coins over time is called patina. It's a natural protective layer and is highly valued by collectors. Removing it diminishes the coin's historical integrity.

- Can cause microscopic scratches: Even gentle cleaning methods can cause tiny scratches on the coin's surface, which are visible under magnification. These "hairlines" significantly reduce a coin's appeal.

- Drastically reduces or destroys any potential numismatic value: If a coin happens to have any numismatic value beyond its melt value, cleaning it will almost certainly destroy that premium. Collectors prefer original, uncleaned coins, even if they're toned or dirty.

Your "junk silver" is beautiful in its worn, circulated state. Accept the history it carries, and leave the cleaning to the professionals (or, better yet, don't clean them at all!).

How does wear and tear affect my coins' silver content?

It's a valid concern! After decades of changing hands, being dropped, and rubbing against other coins, it's natural to assume some silver has worn away. And you're right, it has. However, the impact on the overall silver content for melt purposes is relatively small and accounted for.

As we discussed, the U.S. Mint's original specification for pre-1965 90% silver coins meant that $1.00 face value contained approximately 0.723 troy ounces of pure silver. However, due to average circulation wear, most dealers and calculators use the slightly lower figure of 0.715 troy ounces of pure silver per $1.00 face value. This 0.008 troy ounce difference per dollar accounts for the typical metal loss.

So, while heavily circulated coins do lose a tiny bit of silver, the 0.715 oz per dollar face value rule for 90% silver is designed to give you an accurate average for what you'll find in a typical bag of junk silver. For extremely worn or "cull" coins (those with significant damage or very little detail), the actual silver content might be marginally less, but for most coins, this factor provides a reliable estimate.

Conclusion: Turning Your Pocket Change into a Precious Asset

We've covered a lot of ground today, from defining what exactly "junk silver" is to precisely calculating its value. The core takeaway is clear: understanding how much junk silver equals an ounce is a crucial step for any investor looking to diversify their portfolio with tangible assets.

To recap, you now know that:

- Roughly $1.40 face value of pre-1965 90% U.S. coinage equals approximately one troy ounce of pure silver. This translates to about 14 dimes, 6 quarters, or 3 half dollars.

- The value of these coins is primarily tied to the live spot price of silver, not their numismatic rarity.

- A useful shortcut for 90% silver is that $1.00 face value contains approximately 0.715 troy ounces of pure silver, factoring in average circulation wear.

- Other U.S. coins, like 40% silver Kennedy half dollars, 35% silver War Nickels, and Morgan/Peace dollars, have different silver contents that require separate calculations.

- You should never clean your junk silver coins, as this can destroy their value.

Junk silver offers an accessible and tangible investment, providing a hedge against inflation and a practical form of fractional silver. At Summit Metals, based in Wyoming and serving investors in Salt Lake City, Utah, we pride ourselves on providing authenticated precious metals with transparent, real-time pricing and competitive rates. We believe in making precious metals ownership easy and reliable.

Whether you're starting small or looking to significantly expand your holdings, consider our Autoinvest program. By committing to a fixed monthly purchasejust like a 401(k) contributionyou can dollar-cost average into a diversified stack of authenticated silver and gold, shipped directly to your door on a schedule you control. Over time, this hands-off, rules-based approach helps smooth out price volatility and keeps you consistently building your wealth with a trusted partner.