Why Junk Silver Coins Are a Smart Investment Choice

When you want to buy junk silver coins, you're looking at one of the most practical ways to own physical silver. Don't let the misleading name fool you; junk silver holds genuine value for savvy investors.

Quick Guide to Buying Junk Silver Coins:

- What it is: Pre-1965 U.S. coins (dimes, quarters, half-dollars) containing 90% silver.

- Why buy: Lower premiums than modern silver coins, government-backed authenticity, and easy divisibility.

- Best types: Washington quarters, Roosevelt dimes, and Franklin half-dollars (all pre-1965).

- Where to buy: Reputable online dealers and local coin shops, often in bulk bags by face value.

- Key tip: Focus on silver content, not coin condition, as wear doesn't affect melt value.

The term "junk" simply means their value comes from silver content, not collectibility. These coins were a cornerstone of American commerce for nearly 175 years before the 1965 Coinage Act removed silver from most U.S. coinage.

This distinction is key: a worn 1964 Washington quarter has the same 0.1808 troy ounces of silver as a pristine one. You get silver's intrinsic value without paying extra for collector premiums.

I'm Eric Roach. After a decade as an investment banking advisor in New York, I now help individual investors use junk silver as part of a disciplined approach to portfolio diversification and wealth preservation.

What is Junk Silver and Why Is It Called That?

The term junk silver might sound unflattering, but it's one of the smartest ways to buy junk silver coins for investment.

Junk silver refers to pre-1965 U.S. dimes, quarters, and half-dollars with 90% silver content. The "junk" label signifies they have no numismatic value; their worth comes from silver, not rarity or condition. A worn 1964 quarter has the same silver as a pristine one. You pay for the silver melt value, not for a coin's appearance.

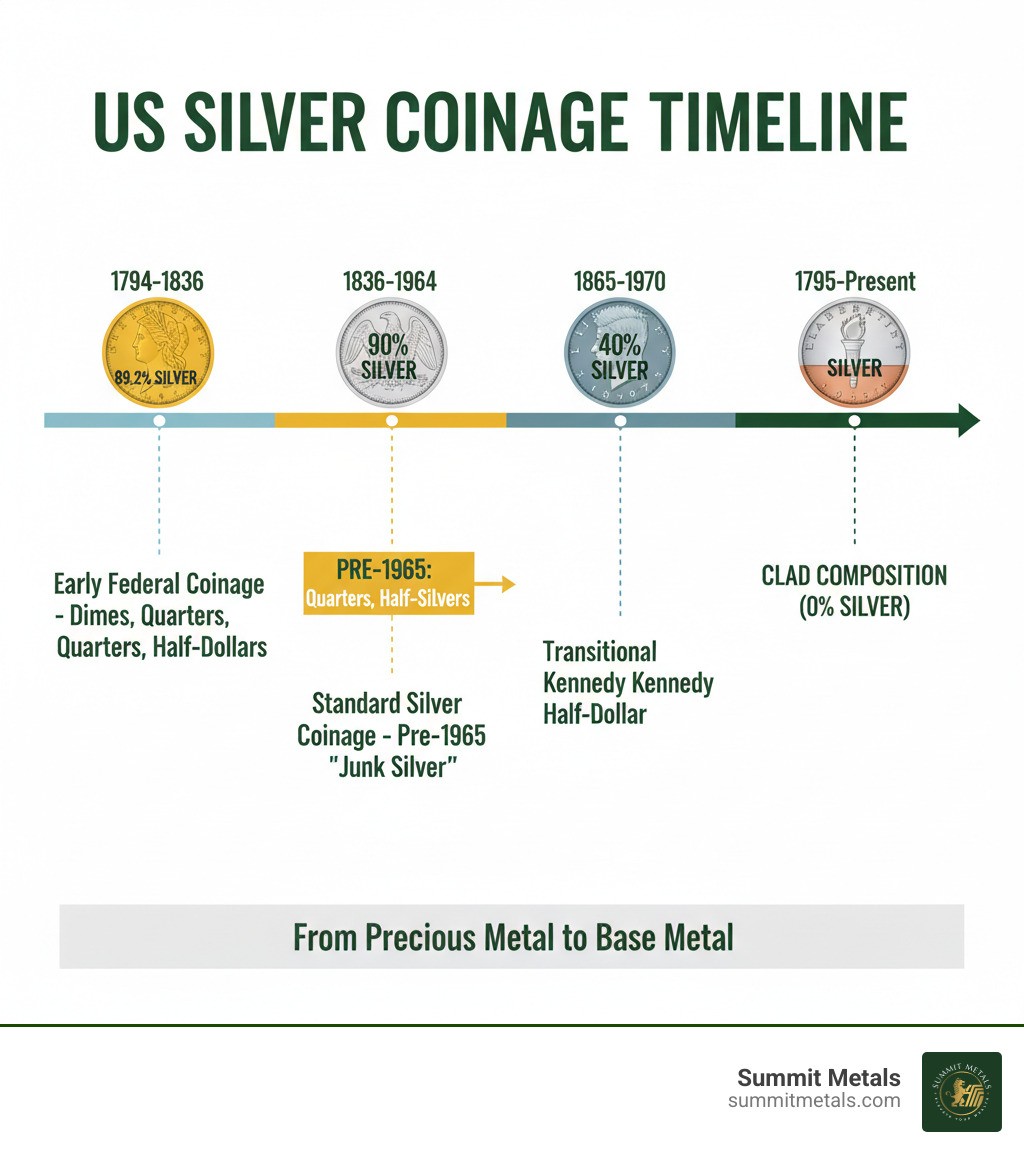

Historically, U.S. coins contained about 89.2% silver until 1836, when the Mint standardized the alloy to 90% silver. This standard lasted until the 1965 Coinage Act.

As silver prices rose, the metal value of coins exceeded their face value. The government responded by switching dimes and quarters to a silver-free copper-nickel clad composition. Half-dollars were briefly reduced to 40% silver before also becoming clad. Pre-1965 coins became valuable for their silver content alone, and dealers dubbed them "junk" to separate them from pricier numismatic coins.

Junk silver is different from scrap silver, though both are valued for their metal content:

| Feature | Junk Silver | Scrap Silver |

|---|---|---|

| Form | Government-issued coins with known silver content | Old jewelry, industrial waste, broken silver items |

| Value Basis | Standardized silver content (90% for pre-1965 coins) | Variable silver content requiring testing |

| Liquidity | High – dealers recognize them instantly | Lower – often needs assaying or refining |

A key advantage is government-backed authenticity. When you buy junk silver coins, you're getting a product verified by the U.S. Mint. A 1963 Roosevelt dime's silver content of 0.0723 troy ounces is guaranteed.

This makes junk silver highly liquid and divisible. You can easily transact in small or large amounts, using dimes, quarters, or half-dollars as pre-measured units of silver.

For a deeper understanding of how these historical coins maintain their value today, check out our comprehensive guide: An Essential Guide to Valuing Constitutional Silver.

The "junk" name perfectly captures what makes these coins special: pure, practical silver ownership without the collector markup.

The Different Types of Junk Silver Coins

When you buy junk silver coins, it's crucial to know the different types and their silver content to make smart purchases.

90% Silver Coins: The Standard for Stacking

Pre-1965 U.S. dimes, quarters, and half-dollars are the standard for junk silver. They contain a reliable 90% silver and 10% copper composition, making them ideal for stacking.

Dimes (Barber, Mercury, and pre-1965 Roosevelt) each contain 0.0723 troy ounces of silver. They are perfect for small transactions due to their high divisibility.

Quarters (Barber, Standing Liberty, and pre-1965 Washington Quarters) each contain 0.1808 troy ounces of silver. Washington quarters are especially common and a great starting point for new stackers.

Half-Dollars (Walking Liberty, Franklin, and 1964 Kennedy) each contain 0.3617 troy ounces of silver, making them excellent for larger purchases.

Silver Dollars (Morgan and Peace) contain 0.7734 troy ounces of silver. They often carry higher, semi-numismatic premiums but are a valuable addition for their substantial silver content. Our guide on Silver Freedom: Top Deals on Liberty Silver Dollars explores these coins in greater detail.

Pre-1966 Canadian dimes, quarters, and half-dollars contain 80% silver, offering another option for diversifying your holdings.

40% and 35% Silver Coins

Lower-purity coins also offer value when you buy junk silver coins.

40% Silver Coins: These include Kennedy Half-Dollars (1965-1970) and special collector-issue Bicentennial Kennedy Half-Dollars (1976). Eisenhower Dollars (1971-1974) also came in 40% silver versions for collectors, typically bearing an "S" mint mark. Our guide Coining a Legacy: Understanding the Ike Silver Dollar can help you steer these unique coins.

35% Silver "War Nickels": Minted from mid-1942 to 1945, these nickels contain 35% silver, 56% copper, and 9% manganese. This unique composition was a result of conserving nickel for the WWII effort. They are easily identified by the large mint mark (P, D, or S) above Monticello on the reverse.

These lower-purity coins provide an affordable entry point for building a silver portfolio, especially for those using dollar-cost averaging strategies.

Your Strategy to Buy Junk Silver Coins

To successfully buy junk silver coins, focus on three areas: finding reliable sources, understanding pricing, and verifying authenticity.

Where to Reliably Purchase Junk Silver Coins

Reputable online bullion dealers are the most convenient and competitive option. At Summit Metals, we offer authenticated precious metals with transparent, real-time pricing. Our Wyoming base and bulk purchasing power mean competitive rates for you. You can shop with us online or visit our Salt Lake City, Utah location.

Local coin shops offer a hands-on experience, which is great for new investors. While prices may be higher due to overhead, the direct interaction and ability to inspect coins can be valuable.

Coin shows and auctions can yield great deals for experienced buyers who can evaluate lots and bid strategically.

Junk silver is often sold by face value in bags or rolls. A $100 face value bag holds about 71.5 troy ounces of silver, while a $1,000 bag has 715 ounces. Coin rolls are a great starting point.

This approach is perfect for dollar-cost averaging. Our Autoinvest plan lets you buy a set amount monthly, similar to a 401(k) contribution. This disciplined strategy smooths out price volatility and builds your silver stack over time.

Before any purchase, review our guides on Identifying Reputable Bullion Dealers: Avoiding Counterfeits and How to Buy Gold and Silver Online Safely.

Key Factors to Consider When You Buy Junk Silver Coins

Smart purchasing isn't just about the lowest price. Understand the relationship between spot price and premiums to find true value.

The spot price is the market value for one troy ounce of silver. You'll pay a premium over spot, which covers dealer costs like authentication, handling, and profit.

Calculating melt value is simple: $1.00 face value of 90% silver coins contains about 0.715 troy ounces of silver. If silver is $25/oz, a $10 roll of quarters has a melt value of roughly $178.75 ($25 x 7.15 oz).

Junk silver has lower premiums than new bullion, making it affordable. However, premiums can fluctuate with market demand and supply.

Condition is secondary. These are circulated coins, so expect wear. A worn coin has the same silver content as a pristine one, so condition rarely affects its melt value. Our article on Spot Price vs. Premium: How Precious Metals Pricing Works explains this in more detail.

How to Identify Genuine Junk Silver and Avoid Fakes

While counterfeiting is a concern, junk silver's government-minted origin is a major advantage. Simple verification techniques can protect your investment:

- Date Check: Look for 1964 or earlier for 90% silver dimes, quarters, and half-dollars. Kennedy halves from 1965-1970 are 40% silver. War Nickels (1942-1945) have a large mint mark over Monticello.

- Ring Test: Tap the coin. Genuine silver produces a high-pitched "ping," unlike the dull thud of base metals.

- Edge Inspection: A 90% silver coin has a solid silver edge. Modern clad coins have a visible copper stripe.

- Magnetic Test: Silver is not magnetic. If a coin sticks to a magnet, it's fake.

- Weight Verification: Use a precise scale. A 90% silver Washington quarter weighs 6.25 grams. Significant deviations suggest a counterfeit.

At Summit Metals, we rigorously verify all products. If buying elsewhere, consult an expert if you have doubts. Protecting your investment is paramount.

Junk Silver as an Investment: Pros, Cons, and Portfolio Role

When you buy junk silver coins, you're making a strategic move. Here's a look at the pros, cons, and role of junk silver in your portfolio.

Advantages of Investing in Junk Silver

- Accessibility: You can start investing with just a few dollars, making it perfect for new investors.

- Lower Premiums: Junk silver trades closer to its melt value than modern bullion like American Silver Eagles. More of your money buys silver, not minting costs.

- Divisibility: Small denominations (dimes, quarters) are practical for small transactions or bartering, offering flexibility that large bars lack.

- Authenticity & Recognition: As former U.S. currency, these coins are instantly recognizable and trusted, making them highly liquid. This government backing provides a layer of security over generic silver rounds.

- Inflation Hedge: Like other precious metals, junk silver is a tangible asset that historically maintains its value when currency loses purchasing power.

| Feature | Junk Silver Coins | Silver Bars | American Silver Eagles |

|---|---|---|---|

| Divisibility | High (dimes, quarters) | Low (larger units) | Moderate (1 oz units) |

| Premiums | Lowest | Low | High |

| Authenticity | Government-minted, easily recognized | Varies by refiner, requires trust | Government-guaranteed, highly trusted |

| Storage | Bulky per ounce | Most space-efficient | Moderately efficient |

| Liquidity | Very High | High | Very High |

| Barter Use | Excellent for small transactions | Impractical for small transactions | Good for larger transactions |

Potential Risks and Downsides

- Variable Condition: These are circulated coins with wear and tear. They lack the pristine look of new bullion.

- Minor Silver Loss: Heavily worn coins ('slicks') may have slightly less silver. This is usually negligible when buying in bulk.

- Storage Space: Coins are bulkier per ounce than bars, requiring more storage space for large quantities.

- Fluctuating Premiums: While typically low, premiums can spike during periods of high demand.

The Role of Junk Silver in a Diversified Portfolio

Junk silver is a foundational tangible asset in a diversified portfolio, complementing paper assets like stocks and bonds, especially during market uncertainty.

Dollar-cost averaging is a disciplined strategy for investing in junk silver. Consistently buying a set amount over time helps average out your purchase price, reducing the risk of market timing.

Our Autoinvest program automates this process. Set up recurring purchases, like a 401(k) contribution, to build your silver holdings steadily and without emotion. This is a powerful way to accumulate tangible wealth. Learn more about this strategy in The Power of Dollar Cost Averaging in Gold and Silver Investments.

For retirement planning, a Precious Metals IRA allows you to hold physical assets like junk silver with tax advantages. Explore this option with our guide: Maximizing Retirement Security: Using a Precious Metals IRA to Invest in Gold and Silver with Summitmetals.com.

Storing, Selling, and Tax Considerations

After you buy junk silver coins, proper storage, selling strategies, and tax awareness are crucial for protecting your investment.

How to Properly Store and Preserve Your Coins

Proper storage is important. While condition isn't key to its value, good storage prevents damage and simplifies selling.

- Coin tubes are ideal for organizing rolls of dimes, quarters, or half-dollars.

- Canvas bags are standard for bulk purchases (e.g., $1,000 face value bags).

- A fire-resistant home safe is essential for securing your holdings, especially if you're building a large position with a program like our Autoinvest plan.

- Store your silver in a cool, dry place to avoid temperature extremes and humidity.

- Crucially, avoid PVC-based storage materials, as they can damage coins over time. Use archival-quality products.

Our guide, Top Storage for Silver: Best Practices for Safekeeping Your Investment, covers more advanced strategies.

Best Strategies for Selling Junk Silver

Junk silver is highly liquid, making it easy to sell. Selling to dealers like Summit Metals is often the smoothest option. We offer competitive buy-back prices and professional service online or at our Salt Lake City, Utah, and Wyoming locations. Understand that dealers buy for slightly under spot price to cover costs; reputable dealers keep this spread narrow.

Online marketplaces may offer higher prices but require more effort. Private sales can also yield higher prices but require caution to avoid scams. For a full comparison, see our guide: Online vs. Local: Where to Sell Silver.

Understanding Tax Implications

Understanding tax rules is essential. Capital gains tax applies to profits from selling silver. Long-term gains (held over a year) are taxed at a lower rate.

Good news: junk silver is not typically taxed as a 'collectible' (which has a higher tax rate of up to 28%). Its value is based on metal content, so it's subject to standard capital gains rates.

Reporting requirements apply to certain large transactions. Dealers may issue a Form 1099-B, and you must report your gains or losses. Keep meticulous records of all transactions for tax purposes.

Always consult a qualified tax professional for advice custom to your situation.

Frequently Asked Questions about Buying Junk Silver

Here are answers to the most common questions about buying junk silver coins.

Is junk silver a good investment?

Yes. Junk silver is a smart way to own physical silver due to its intrinsic value, low premiums, and high divisibility. You pay for silver content, not for minting or marketing costs like with new bullion coins. Its recognizability ensures high liquidity.

We recommend junk silver as a portfolio foundation and an inflation hedge. Our Autoinvest program simplifies stacking through automated monthly purchases, allowing you to build tangible wealth steadily. For more on silver's role, read our guide: Is Silver a Good Investment?.

How much is a bag of junk silver worth?

The value is tied to the silver spot price. A $1,000 face value bag of 90% silver contains about 715 troy ounces of silver. To calculate its value, multiply 715 by the current silver spot price. For example, if silver is $25/oz, the melt value is $17,875 ($25 x 715), plus a small dealer premium.

A $100 bag has 71.5 ounces, and a $500 bag has 357.5 ounces. This simple math makes it ideal for dollar-cost averaging. Our platform's real-time pricing ensures you always get a transparent and fair deal.

Can I use junk silver as money?

While they are legal tender at face value, spending them would be a major financial mistake. A 1964 silver quarter is legally worth 25 cents, but its silver melt value is many times higher.

Their true "money" potential is for bartering in a crisis. In such a scenario, their value would be based on silver content, not face value, preserving your purchasing power.

Think of junk silver as wealth insurance. Using our Autoinvest program to buy junk silver coins helps you build a financial safety net that holds its value independent of fiat currency.

Conclusion

Don't let the name fool you. As we've explored, "junk silver" is one of the smartest ways to build wealth. These pre-1965 coins offer affordability, divisibility, and universal recognition, making them a top choice for investors.

Unlike paper assets, junk silver is a tangible investment you can hold. It's a real asset that has preserved value for millennia, independent of financial markets or governments. The beauty of junk silver is its simplicity: its value is in its silver content, not its condition. Every purchase strengthens your hedge against inflation and economic uncertainty.

At Summit Metals, we make investing in precious metals simple and trustworthy. With transparent, real-time pricing and competitive rates from our bulk purchasing, we ensure you get maximum value and silver for your dollar.

Ready to build your silver foundation? Our Autoinvest program makes it easy to buy junk silver coins through consistent, automatic monthly purchases. It's a disciplined way to dollar-cost average and build real, tangible wealth over time.

Secure your financial future with the stability of physical precious metals. Explore our selection of Constitutional Silver / Junk Silver today and start building a portfolio that lasts. We're here to guide you every step of the way.