Why Your Choice of Gold IRA Storage Matters

When you invest in a gold ira approved depository, you're not just checking a compliance box—you're choosing where your retirement wealth will live. The IRS requires that all precious metals held in an IRA be stored by a qualified trustee or custodian. You cannot keep them at home. Period.

Here's what you need to know right away:

Quick Answer: What is a Gold IRA Approved Depository?

- What it is: A secure, IRS-compliant vault facility operated by a qualified trustee or nonbank custodian that stores precious metals for retirement accounts

- Why it's required: IRS custody rules prohibit you from personally holding IRA metals—doing so triggers immediate taxation and a 10% penalty

- Where to find them: Common options include Delaware Depository, Brink's Global Services, IDS Group, and state-backed facilities like Texas Bullion Depository

- What it costs: Typically 0.30% to 1.5% annually, with minimums ranging from $100 to $200 per year

- Storage types: Segregated (your metals stay separate) or commingled (pooled with others but ownership tracked)

The stakes are high. Home storage IRAs have been repeatedly struck down by the IRS, resulting in full account taxation plus penalties. Most homeowner insurance caps precious metal coverage at just $1,000 to $2,500—nowhere near enough for a serious IRA holding.

Your depository choice affects three critical areas: security (physical and insurance protection), cost (annual fees that compound over decades), and peace of mind (knowing exactly where your wealth sits and how to access it).

I'm Eric Roach. With over a decade of experience in institutional risk management and advising on defensive portfolios, I help retirees select the right gold ira approved depository for their self-directed IRAs, blending Wall Street discipline with physical-asset resilience.

Quick gold ira approved depository terms:

Understanding the Rules: Why an IRS-Approved Depository is Non-Negotiable

When investing in a Gold IRA, the conversation inevitably turns to storage. This isn't a preference but a strict IRS requirement. A gold ira approved depository is not just a vault; it's a critical component for maintaining your account's tax-advantaged status.

Taking physical possession of your IRA precious metals is considered a distribution by the IRS. This can disqualify your entire IRA, triggering immediate taxation on its full value and a 10% penalty if you're under 59½. This costly mistake is confirmed by numerous tax court cases on IRA owner possession of gold coins. The risks of not using an IRS-approved depository for gold IRA assets are severe, including full taxation and penalties, as confirmed in this Tax Court case on IRA owner possession of gold coins.

Think of it this way: your gold IRA is an investment vehicle, and like any investment, it needs to be managed and held by a disinterested third party to ensure compliance and prevent abuse. This is where the depository comes in.

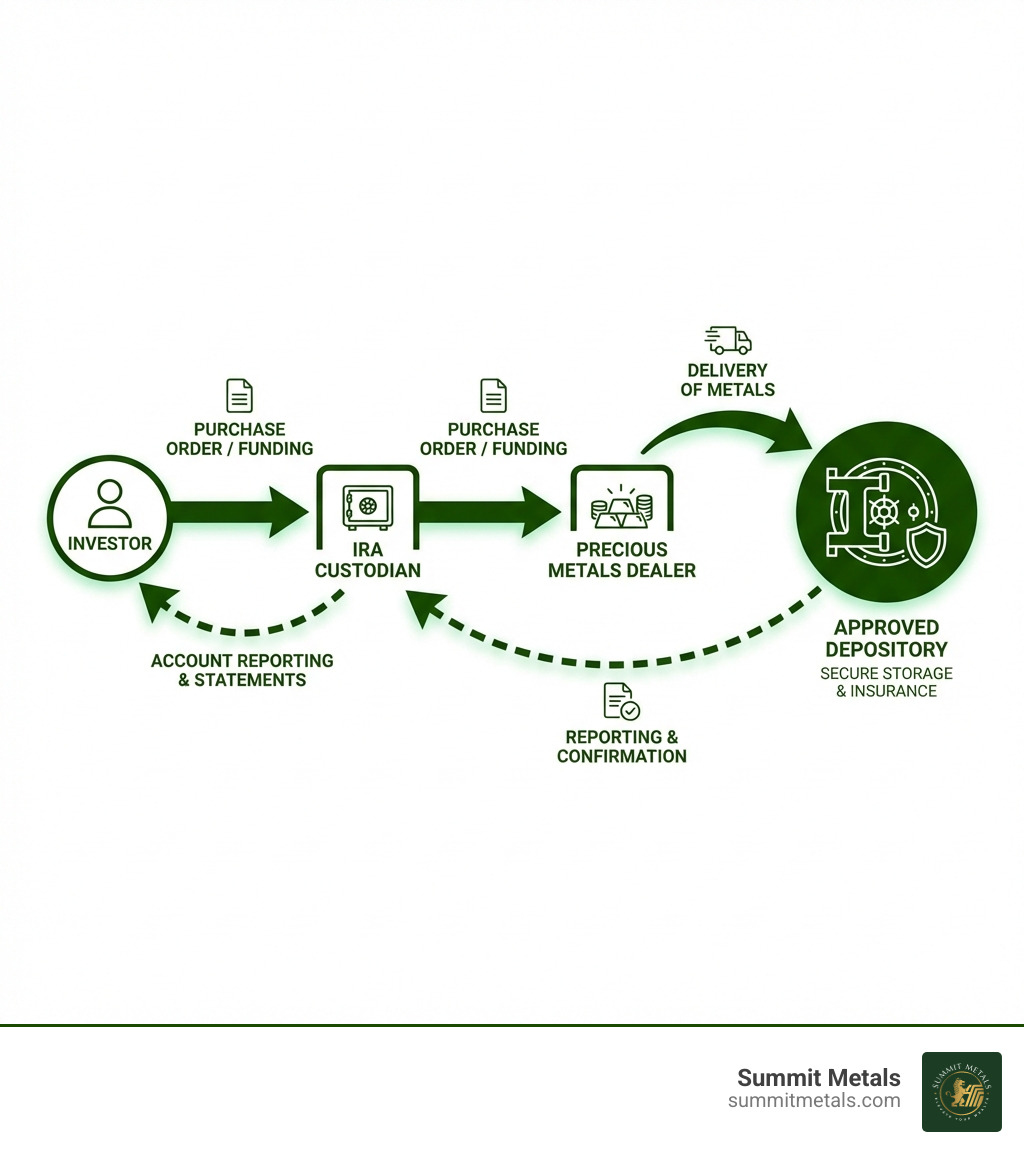

The Key Players in Your Gold IRA

Navigating a Gold IRA involves a few distinct entities, each with a crucial role:

- IRA Custodian: This is the financial institution (often a bank, federally insured credit union, or an IRS-approved nonbank trustee) that holds your IRA account and manages all the administrative paperwork. They are responsible for IRS reporting, administering withdrawals and transactions, and handling the paperwork related to your depository storage. They don't typically store the physical metals themselves but partner with depositories. Their fiduciary responsibility is to ensure your IRA remains compliant with IRS regulations.

- Precious Metals Dealer: Companies like Summit Metals act as the dealer. We facilitate your purchase of IRS-approved precious metals. We offer transparent, real-time pricing and competitive rates due to our bulk purchasing power. Once you purchase, we ensure the metals are securely transported to your chosen gold ira approved depository.

- Depository: This is the secure vault facility where your physical precious metals are actually stored. The depository's role is purely storage and security. They don't manage your IRA account or buy/sell metals; they simply keep them safe.

It's important to understand these distinctions. While a dealer helps you acquire the metals, and a custodian manages your IRA account, the depository is the physical home for your investment. For a deeper dive into these roles, check out our guide on Storing your shine- A guide to IRS approved precious metals depositories.

The IRS Custody Rule Explained

The core of why a gold ira approved depository is non-negotiable lies in the IRS's "custody rule." The IRS requires that IRA bullion be in the physical possession of a bank or an IRS-approved nonbank trustee. This means you, the IRA owner, cannot personally hold the metals, store them in a home safe, or even a safe deposit box that you directly control.

Why the strict rule? The IRS considers most metals to be "collectibles," and generally, IRAs cannot invest in collectibles. However, there's a specific exception for certain bullion (gold, silver, platinum, palladium) that meets strict purity standards and is held by an IRS-approved trustee. If the metals are not held by an approved trustee, they are treated as a collectible investment, triggering the same penalties as a prohibited transaction.

This is why "home storage IRAs," which often involve setting up an LLC to technically own the metals while the individual maintains physical control, have been repeatedly disallowed. The IRS views this as an attempt to circumvent the custody rule, and the consequences can be severe. To avoid such pitfalls, it's crucial to understand these regulations. The IRS bullion rules for IRAs explicitly lay out these requirements. Don't fall victim to misleading schemes; finding the right service is key to Don't get custody napped- Finding the right gold IRA service.

Segregated vs. Commingled: Choosing Your Storage Style

After understanding the need for a gold ira approved depository, the next decision is how your metals will be stored: segregated or commingled. This choice impacts cost, peace of mind, and how your assets are handled.

| Feature | Segregated Storage | Commingled Storage |

|---|---|---|

| Cost | Higher | Lower |

| Peace of Mind | Your exact items returned | Like-kind items returned |

| Asset Fungibility | Low (specific serial numbers) | High (any eligible bar/coin of same type) |

| Withdrawal Process | Your specific items retrieved | Any equivalent items retrieved |

| Identification | Individually tagged and tracked | Pooled with others, ownership recorded by weight/type |

For a comprehensive look at storage options, explore The ins and outs of precious metals storage options.

Segregated Storage: Your Metals, Your Vault Space

Segregated storage means your precious metals are stored separately from those of other clients. Your specific bars or coins, identifiable by their unique serial numbers, are kept in their own designated vault space or container.

Pros of Segregated Storage:

- Specific Asset Return: When it's time for a distribution, you receive the exact items you deposited. This can be important for collectors or those who have a sentimental attachment to specific pieces.

- Improved Peace of Mind: Many investors prefer knowing their specific assets are physically separated from others, offering an additional layer of assurance.

- Clarity in Audits: Auditing your specific holdings is straightforward as they are individually identified.

Cons of Segregated Storage:

- Higher Fees: Because it requires more administrative effort and dedicated space, segregated storage typically costs more than commingled storage. For example, Delaware Depository charges 1.5% of value annually for segregated storage, with a minimum semiannual charge of $50, compared to 0.50% for non-segregated.

- Less Flexibility: While you get your specific items back, the process can sometimes be slightly more involved due to the need to locate and retrieve those exact pieces.

Commingled Storage: The Cost-Effective Option

Commingled (sometimes called "allocated" or "non-segregated") storage means your precious metals are pooled with those of other investors. While your ownership is carefully recorded (e.g., you own 10 ounces of gold, but not which specific 10-ounce bar), the physical items are not individually separated. When you request a distribution, you receive equivalent items of the same type and fineness, not necessarily the exact ones you deposited.

Pros of Commingled Storage:

- Lower Fees: This is often the most significant advantage. Commingled storage is less expensive because it's more efficient for the depository to manage. Brink's Global Services, for example, offers commingled storage at $1.20 per $1,000 account value, with a minimum of $125 per year, which is generally more economical than their segregated option.

- Efficiency: The process of depositing and withdrawing can be quicker as there's no need to track specific serial numbers.

- Standard for Many: For most investors, particularly those focused purely on the metal's value rather than specific pieces, commingled storage is perfectly adequate and secure.

Cons of Commingled Storage:

- No Specific Asset Return: You won't receive the exact items you put in. For most, this isn't an issue, but some investors prefer the exactness of segregated storage.

- Perceived Lack of Control: While your ownership is legally secure and insured, some investors feel less connected to their investment when it's not physically distinct.

The choice between segregated and commingled storage depends on your personal preference and budget. Both are secure and IRS-compliant options within a gold ira approved depository.

How to Choose the Best Gold IRA Approved Depository for Your Needs

Choosing the right gold ira approved depository is critical for the security and success of your precious metals IRA. While your custodian may have preferred partners, you should understand the key factors that define a reputable facility to ensure your investment is in the best hands.

The depository choice affects more than security; it impacts the accessibility of your gold IRA investments. A good depository offers transparency, reliable reporting, and a smooth distribution process, ensuring your wealth is safe and manageable. For a broader perspective, consult The ultimate guide to gold and other precious metals storage.

Key Factors for Selecting a Gold IRA Approved Depository

When evaluating a gold ira approved depository, we recommend considering the following:

- Security Measures: This is paramount. Look for depositories with multi-layered security, including 24/7 surveillance, armed guards, biometric access controls, reinforced vaults (e.g., Class III vaults), and disaster-hardened facilities. Ask about their protocols for access, transportation, and internal handling of metals.

- Insurance Coverage: Your metals must be fully insured against theft, damage, and loss. Verify the underwriter (e.g., Lloyd's of London, AXA) and the coverage amount. Ensure it covers the full market value of your holdings. Delaware Depository, for instance, boasts $1 Billion in all-risk insurance through London underwriters.

- Audit Frequency and Independence: Reputable depositories conduct regular, independent audits of their holdings to confirm that what's recorded matches what's physically stored. Ask how often these audits occur and by whom. Transparency here is key.

- Fee Structures: Understand all costs involved – annual storage fees, minimum charges, potential transaction fees, and shipping costs for distributions. Compare segregated vs. commingled fees. BlueVault, for example, charges an annual fee of 0.84% of market value for segregated storage, including full insurance. While their physical locations are not in our service area, this provides a benchmark for comparison.

- Location and Accessibility: While the IRS doesn't permit personal possession, some investors prefer a depository in a politically stable or geographically convenient region. For Summit Metals clients, we partner with depositories that serve our Salt Lake City, Utah, clients efficiently. While you can't just drop by, some depositories allow supervised visits by appointment.

- Reporting and Transparency: Your custodian will receive statements from the depository, but it's good to know the depository's own reporting capabilities. Clear, concise, and regular statements help you track your investment.

A Look at Reputable Gold IRA Approved Depositories

While the IRS doesn't publish an "official list" of approved depositories, they focus on the custody rule, meaning any facility meeting their strict requirements (often partnered with an IRS-approved custodian) can serve. Here are some of the most commonly used and reputable options:

- Delaware Depository (DDSC): Widely respected, DDSC is an exchange-approved depository for major exchanges like CME and ICE. They are qualified to store IRA assets and offer high-level security. Their fee structure for non-segregated storage is 0.50% of value (minimum semiannual $25), and for segregated, it's 1.5% (minimum semiannual $50).

- Brink's Global Services: A global leader in secure logistics, Brink's offers secure storage for precious metals. Their long history of excellence and robust security protocols make them a trusted choice. They offer commingled storage at $1.20 per $1,000 account value (minimum $125/year) and segregated at $2.00 per $1,000 (minimum $200/year). Our clients in Salt Lake City, Utah, can benefit from Brink's presence there, ensuring local logistical support.

- IDS Group (International Depository Services): With locations in Delaware, Dallas, and Toronto, IDS Group is another popular choice. They offer comprehensive storage solutions with annual fees ranging from 0.65% to 0.30% of account value, with a minimum semiannual charge of $100.

- Utah Gold & Silver Depository, LLC: As a local option for our clients, the Utah Gold & Silver Depository offers secure storage within the state. This can provide a sense of local accessibility and support for investors in the region.

- Alpine Gold Ogden: Another valuable local option in Utah, Alpine Gold Ogden provides storage services that can be integrated with your IRA custodian for compliant precious metals storage.

- A-Mark Precious Metals: Primarily a wholesale provider, A-Mark Global Logistics is heavily used by many Gold IRA specialists for storing billions in tax-advantaged precious metals investments.

- CNT Depository: Described by Bullion.Directory as a "highly respected bullion depository," CNT is another established name in the industry.

It's worth noting that some unique models exist, such as the Texas Bullion Depository is now offering gold IRAs. This state-administered facility provides another example of a secure, compliant storage option, even though its geographical location is not directly relevant to our service areas.

When we at Summit Metals help you set up your Gold IRA, we work with reputable custodians who partner with these top-tier depositories, ensuring your metals are stored securely and compliantly.

The Financials: Understanding Depository Costs and Investment Strategies

Investing in a Gold IRA involves costs beyond the metal's price, including fees from your IRA custodian and the gold ira approved depository. Understanding these is crucial for maximizing your retirement savings.

These costs are part of holding physical assets in a retirement account, but understanding them allows for informed decisions. Integrating precious metals into your retirement plan is a powerful strategy for Maximizing retirement security- Using a precious metals IRA to invest in gold and silver with summitmetals.com.

A Breakdown of Typical Depository Fees

Depository fees are generally calculated as a percentage of your account's value, with minimum annual charges. These fees cover the security, insurance, and administrative overhead of storing your valuable assets.

-

Annual Storage Fees: These are the most significant ongoing cost. As we've seen, they can range from 0.30% to 1.5% of the value of your precious metals.

- Delaware Depository: Non-segregated storage is 0.50% annually (min. $25 semiannually). Segregated storage is 1.5% annually (min. $50 semiannually).

- IDS Group: Ranges from 0.65% to 0.30% of account value (min. $100 semiannually).

- Brink's Global Services: Commingled storage is $1.20 per $1,000 account value (min. $125/year). Segregated storage is $2.00 per $1,000 (min. $200/year). (Prices shown are at the time of this publication.)

- Minimum Charges: Many depositories have minimum fees, which can be a larger percentage of your holdings if your investment is smaller. For example, if you have $10,000 in metals and the fee is 1% with a $125 minimum, you'll pay the $125 minimum, not $100.

-

Custodian Fees: Don't forget your IRA custodian also charges fees. These can include:

- Account setup fees: Typically $50 to $100.

- Annual maintenance fees: Often $75 to $300 per year.

- Transaction fees: Around $40 per transaction for buying or selling metals within your IRA.

- Shipping Costs: When you purchase metals, there will be a cost to ship them from the dealer to the depository. Similarly, if you take an in-kind distribution, there will be shipping costs from the depository to your location.

We always advise our clients to get a clear, itemized breakdown of all fees from their chosen custodian and depository. Transparency in these costs is paramount for long-term financial planning.

Smart Investing: Coins, Bars, and Autoinvest

When it comes to actually acquiring precious metals for your IRA, you'll generally choose between coins and bars. Both have their merits, but understanding the differences can help you make an informed decision.

| Feature | Gold Coins (e.g., American Gold Eagle, Canadian Gold Maple Leaf) | Gold Bars (e.g., 1 oz, 10 oz, 100 oz bars) |

|---|---|---|

| IRA Eligibility | Yes (must meet purity, e.g., .995 fine, American Gold Eagle is .9167) | Yes (must be .995 fine or higher) |

| Premium over Spot | Generally higher (due to minting, recognition, potential collectibility) | Generally lower (closer to spot price) |

| Fraud Protection | Improved by legal tender status and government backing. Face value provides a baseline. | Relies on refiner's reputation and assay certificate |

| Liquidity | Often more liquid in smaller denominations | Good liquidity, especially for larger sizes |

| Divisibility | Good for smaller, incremental sales | Less divisible for partial sales |

Gold coins often carry a slightly higher premium over the spot price of gold due to their intricate design, government backing, and recognition. However, this same government backing and legal tender status can offer a unique layer of fraud protection. For instance, the American Gold Eagle, despite its .9167 fineness, is an exception to the .995 purity rule for IRA-approved gold because it's a U.S. government-issued coin.

Gold bars, on the other hand, typically have a lower premium over spot, meaning you get more gold for your dollar. They are a straightforward way to hold bullion. Both coins and bars must meet specific fineness requirements to be IRA-eligible (e.g., .995 fine for gold, .999 for silver).

At Summit Metals, we pride ourselves on offering a wide selection of IRA-approved gold and silver, all with transparent, real-time pricing. Our competitive rates, stemming from bulk purchasing, ensure you get the most value for your investment.

We also highly recommend our "Autoinvest" strategy for building your precious metals holdings. Just like investing in a 401k, Autoinvest allows you to dollar-cost average by making regular, consistent purchases every month. This approach helps mitigate market volatility and steadily builds your precious metals portfolio over time, a smart move for long-term retirement planning. This strategy aligns perfectly with the principles outlined in Golden rules- The ultimate guide to storing your precious gold.

Frequently Asked Questions about Gold IRA Depositories

We often receive questions from clients about the practicalities of storing their precious metals in a gold ira approved depository. Here are some of the most common ones:

Can I visit my precious metals in the depository?

In most cases, yes, you can visit your precious metals. However, it's not like dropping by a bank safe deposit box. Depositories are high-security facilities, and visits typically require advance scheduling and adherence to strict security protocols. You'll usually need to coordinate with your IRA custodian to arrange a supervised visit. Some depositories, like BlueVault (though not in our service area), even emphasize local access as a unique selling point, allowing clients to schedule visits to "eyeball their holdings." While our clients in Salt Lake City, Utah, may not have a Summit Metals-branded vault to visit, we partner with depositories that facilitate such arrangements.

How are distributions from a Gold IRA handled by the depository?

When you're ready to take distributions from your Gold IRA, the process generally involves your IRA custodian coordinating with the gold ira approved depository. You have two primary options:

- In-Kind Distributions: This means you receive the physical precious metals directly. The depository will arrange for insured and discreet delivery of your metals to your home or another designated location. This can be a strategic way to fulfill Required Minimum Distributions (RMDs) without having to sell your assets, allowing you to retain physical possession of your gold.

- Cash Distributions: Alternatively, you can choose to liquidate your precious metals. Your custodian will work with the depository to sell your holdings, and the cash proceeds will then be distributed to you.

In both scenarios, your IRA custodian acts as the intermediary, ensuring all transactions comply with IRS rules and that the depository releases or sells the metals as instructed.

Does the IRS publish an official list of approved depositories?

No, the IRS does not publish a neat, official list of gold ira approved depository facilities that you must use. Instead, the IRS focuses on the "custody rule." What they care about is that your IRA bullion is in the physical possession of a qualified trustee or custodian. This could be a bank, a federally insured credit union, a savings and loan association, or an IRS-approved nonbank trustee. These entities, in turn, partner with secure vault facilities (the depositories) that meet the IRS's stringent requirements for size, management, recordkeeping, and security.

Therefore, while there's no single government list, any depository that an IRS-approved custodian uses for precious metals storage is, by extension, considered compliant. It's the custodian's responsibility to ensure their chosen depository meets all federal guidelines.

Conclusion: Securing Your Retirement with the Right Partners

Navigating Gold IRAs and gold ira approved depository options can seem complex, but with the right knowledge and partners, it becomes a straightforward path to securing your financial future. We've seen that the IRS mandates strict rules for precious metals storage in IRAs, making an approved depository a non-negotiable requirement to maintain your account's tax-advantaged status. Understanding the differences between segregated and commingled storage, and diligently evaluating depositories based on security, insurance, audits, and fees, empowers you to make informed choices.

At Summit Metals, we believe in empowering our clients with transparent information and competitive rates. Our commitment to offering real-time pricing and leveraging bulk purchasing power means you get exceptional value when acquiring your IRA-eligible gold and silver. We partner with reputable custodians and their associated depositories to ensure your precious metals are stored securely and compliantly, whether you're in Salt Lake City, Utah, or beyond.

Choosing the right partners, from a transparent dealer like Summit Metals with its competitive, real-time pricing to a secure depository, is the cornerstone of a successful precious metals IRA. Ready to take the next step in securing your future? Explore our IRA gold investment- A comprehensive guide to securing your future to get started.