Why a Gold IRA Custodian is Your Most Important Decision

A Gold IRA custodian is an IRS-approved financial institution that holds and manages your precious metals retirement account, ensuring compliance with federal regulations while safeguarding your physical assets. Without one, you legally cannot own gold or silver in an IRA—and choosing the wrong partner can cost you thousands in hidden fees.

Quick Answer: What You Need to Know

- Required by Law: The IRS mandates that all physical precious metals in an IRA must be held by an approved custodian

- Key Responsibilities: Execute transactions, maintain records, report to the IRS, coordinate with secure depositories

- Typical Fees: Setup fees around $50, annual maintenance $80-$200, storage costs $100-$150

- Minimum Investments: Range from $2,000 to $50,000+ depending on the precious metals dealer

- Not All Equal: Custodians differ in fee structures, storage options, and customer service

Unlike paper assets, physical precious metals offer stability when economic uncertainty spikes. Gold is finite and can't be devalued by government printing presses. Learn more about gold's history as money in this overview of gold as an investment.

However, you can't just buy gold and store it at home for IRA tax benefits. IRS regulations require your precious metals sit in an approved depository, managed by a licensed custodian.

The problem? Some custodians charge flat annual fees, while others take a percentage of your account value. This guide breaks down everything you need to know—from what a custodian does to red flags that signal a bad choice. By the end, you'll know how to select a partner that fits your budget and pair that choice with Summit Metals' Autoinvest feature to dollar-cost average into gold and silver monthly, just like contributing to a 401(k).

What is a Gold IRA Custodian and Why Do You Need One?

A Gold IRA custodian is a specialized financial institution, approved by the IRS, that acts as trustee for your self-directed IRA containing precious metals. Their primary function is holding your physical gold, silver, platinum, or palladium in an IRS-approved depository. This isn't optional—it's an IRS mandate.

Beyond legal requirements, custodians provide essential security, expertise, and administrative support. They ensure all transactions comply with IRS regulations and safeguard your assets. Learn how a Gold IRA can secure your future: Retirement Riches: How Gold IRAs Can Fortify Your Financial Future.

The Role and Responsibilities of a Gold IRA Custodian

Key responsibilities of a Gold IRA custodian include:

- Safeguarding Assets: Ensuring precious metals are stored in secure, IRS-approved depositories

- Executing Transactions: Handling buy/sell orders with reputable dealers like Summit Metals

- Account Administration: Maintaining detailed records of all account activity

- IRS Reporting: Managing all necessary IRS reporting for tax compliance

- Maintaining Compliance: Guaranteeing your IRA adheres to all IRS rules

For more on regulations, see Precious Metals IRA Regulations 101.

How Custodians Ensure Security and Compliance

The IRS requires all physical IRA assets be stored in approved depositories—this is non-negotiable.

- IRS-Approved Entities: All custodians must be IRS-approved and licensed, often regulated as 'non-bank custodians'

- Working with Depositories: Custodians partner with specialized facilities featuring advanced security

-

Storage Options:

- Segregated: Your metals stored separately (exact coins/bars retrievable, higher cost)

- Unsegregated: Pooled with other investors' assets (slightly cheaper)

- Insurance: Reputable depositories carry comprehensive insurance against theft, damage, or loss

Details on storage: Storing Your Shine: A Guide to IRS-Approved Precious Metals Depositories.

Gold IRA vs. Traditional IRA Custodians

Core distinctions:

- Physical vs. Paper Assets: Traditional custodians handle stocks/bonds; Gold IRA custodians manage tangible metals

- Alternative Investments: Gold IRAs are self-directed IRAs allowing broader investment options

- Specialized Expertise: Gold IRA custodians need knowledge of precious metals markets and specific IRS regulations

- Storage Logistics: Must coordinate with depositories and manage physical inventory

The Financials: Understanding Custodian Fees and Investment Minimums

Investing in a Gold IRA involves understanding costs beyond gold prices. Fees vary significantly between custodians and impact overall returns.

When evaluating a Gold IRA custodian, scrutinize setup fees, annual maintenance, storage costs, and transaction fees. Compare these to ensure value. For perspective on fee structures, see this guide on comparing self-directed IRA custodian fees.

Pair a cost-effective custodian with Summit Metals' Autoinvest program—set monthly purchases like 401(k) contributions to dollar-cost average into metals.

A Breakdown of Typical Custodian Fees

- Account Setup Fee: One-time charge around $50

- Annual Maintenance Fee: $80-$200 per year for administrative services

-

Storage Fees:

- Unsegregated: ~$100/year

- Segregated: ~$150/year

- Transfer Fees: $50-$100 if moving between custodians

Total annual fees typically range $200-$500. Details: Precious Metals Storage Options and Fees: A Depository Deep Dive.

Quick Comparison: Flat Annual vs. Percentage-Based Fees

| Account Size | Flat Annual ($300/year) | Percentage-Based (0.75%) | Which Is Cheaper? |

|---|---|---|---|

| $10,000 | $300 | $75 | Percentage-based |

| $50,000 | $300 | $375 | Flat fee |

| $100,000 | $300 | $750 | Flat fee |

| $250,000 | $300 | $1,875 | Flat fee |

Larger balances benefit from flat fees; smaller accounts may prefer percentage-based costs.

Navigating Minimum Investment Requirements

Minimums vary widely:

- Low Minimums: $2,000-$10,000 for new investors

- Higher Minimums: $25,000-$50,000 for substantial investors

- Account Value Impact: Larger transfers may receive fee waivers

Summit Metals' Autoinvest lets you start small and add monthly, reaching target allocations over time without large upfront commitments.

Choosing the Right Gold IRA Custodian: A 2024 Roundup

Selecting the right Gold IRA custodian is a decision that requires careful thought, much like choosing a trusted advisor for any significant financial move. It's about finding a partner who aligns with your investment philosophy, offers transparent services, and provides excellent support.

We need to conduct thorough due diligence, looking beyond flashy advertisements to the substance of their services. This means delving into their reputation, understanding their fee structures, and assessing their customer support.

Key Factors for Evaluating a Gold IRA Custodian

When choosing a Gold IRA custodian, several factors come into play. Think of it as a checklist to ensure your retirement assets are in capable hands.

- Reputation and Track Record: Look for custodians with high ratings from reputable consumer organizations like the Better Business Bureau (BBB) and positive customer reviews on platforms like Trustpilot. Beware of companies that have lost accreditation or faced regulatory charges.

- Fee Structure and Transparency: We prefer custodians who are upfront and clear about all their charges—setup, annual maintenance, storage, and transfer fees. Look for detailed breakdowns, not vague promises.

- Customer Support and Education: A good custodian should offer responsive, knowledgeable customer service and provide educational resources to help you make informed decisions.

- Metal Selection and Purity: Ensure the custodian supports a wide range of IRA-approved precious metals (gold, silver, platinum, palladium) and adheres strictly to IRS purity requirements.

- Storage Options: The availability of both segregated and unsegregated storage, along with clear information about their partnered IRS-approved depositories, is important.

For a comprehensive guide to help you compare services, refer to our Ultimate Checklist for Gold IRA Services Comparison.

To complement a solid custodian choice, combine it with Summit Metals' Autoinvest program so you can steadily build your metals position each month, mimicking the discipline of a 401(k) contribution schedule.

Comparing Fee Structures: Flat-Rate vs. Asset-Based

When it comes to fees, the structure can significantly impact your long-term costs, especially as your account grows. Understanding the difference between flat-rate and asset-based fees is crucial.

- Flat-Rate Fees: Some custodians charge a fixed annual fee, regardless of your account's value. This structure is often beneficial for investors with larger account balances, as the fee doesn't increase as your assets grow.

- Tiered Fees: Other custodians use a tiered system, where the fee changes based on specific account value thresholds. This means your fees may increase as your account grows beyond certain points.

- Percentage of Account Value: While less common, some custodians might charge a small percentage of your total account value. This can become very expensive for high-value accounts, as the fee grows proportionally with your investment.

For investors planning substantial contributions or expecting significant growth, a flat-rate fee structure can lead to considerable savings over time. Always do the math for your projected account size to see which structure offers the best value.

Quick Custodian Comparison: Which Structure Fits You?

| Investor Type | Typical Account Size | Best-Suited Fee Structure | Why It Often Fits Best |

|---|---|---|---|

| New / Budget-Conscious | Under $25,000 | Lower percentage or tiered | Keeps early costs low while balance is smaller |

| Growing, Long-Term Investor | $25,000–$100,000 | Competitive flat or low-tier | Balances predictability with reasonable percentages |

| High-Net-Worth / Large IRA | $100,000+ | Flat-rate | Prevents fees from ballooning as the account grows |

Once you know where you fall on this spectrum, you can narrow your custodian shortlist to those whose fee models align with your long-term plans.

Top Custodian Features for Different Investor Needs

The "best" Gold IRA custodian isn't a one-size-fits-all answer; it depends on your individual needs. Here's a look at top features that cater to different types of investors:

- For New Investors (Low Minimums): If you're just starting out, look for dealers that partner with custodians to offer low minimum purchase requirements. This allows you to begin diversifying your retirement without a hefty upfront commitment.

- For Large Accounts (Transparent, Flat-Rate Fees): Investors with substantial retirement savings often prefer transparent, flat-rate fees. This provides cost predictability and makes long-term financial planning much simpler.

- For Beginners (Extensive Educational Resources): If you're new to precious metals, a dealer or custodian offering robust educational resources is invaluable for helping you make informed decisions.

- For Consistent Investors (Autoinvest Feature): For those who believe in dollar-cost averaging, look for partners that facilitate regular, automated investments. At Summit Metals, we champion our Autoinvest feature, allowing you to buy every month—just like investing in a 401(k)—to build your precious metals portfolio steadily over time. This systematic approach can mitigate market volatility and simplify your investment strategy while your custodian focuses on compliance and reporting.

The Nuts and Bolts: Setting Up and Managing Your Gold IRA

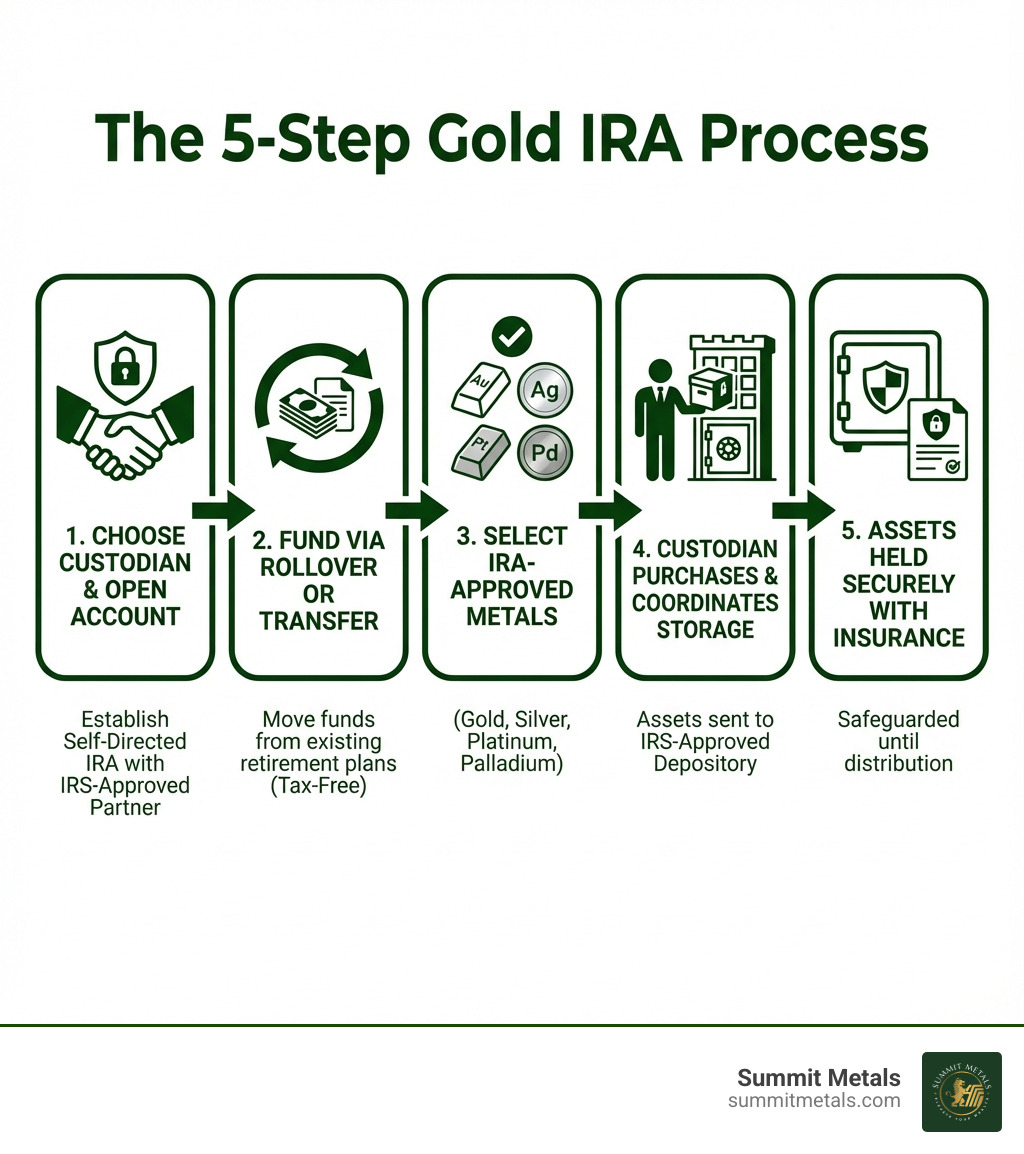

Once you've chosen a Gold IRA custodian and dealer like Summit Metals, setting up involves funding your IRA, selecting permissible metals, and arranging storage.

Layer in Summit Metals' Autoinvest program to buy monthly like 401(k) contributions for easier ongoing management.

The Process: Transferring Funds to Your New Custodian

Funding typically involves moving money from existing retirement accounts:

- Transfer: Easiest method—funds move directly between custodians, tax-free and not reportable

- Rollover: Moving from employer plans (401(k)/403(b)) to IRA. Direct rollovers recommended to avoid tax implications

Handled correctly, moving funds is tax-free. Your custodian facilitates this process. Learn more: Unlock Your Retirement's Potential: A Guide to Gold IRA Transfers.

Once funded, set up Autoinvest with Summit Metals for recurring purchases to smooth price volatility.

What Can You Hold? IRA-Approved Precious Metals

IRS has strict requirements:

| Precious Metal | Purity Requirement | Approved Forms | Unique Benefit of Coins |

|---|---|---|---|

| Gold | .995+ fine | Coins (American Eagle, Canadian Maple Leaf), Bars/Rounds | Face value offers fraud protection and liquidity |

| Silver | .999+ fine | Coins (American Silver Eagle), Bars/Rounds | Face value offers fraud protection and liquidity |

| Platinum | .9995+ fine | Coins (American Platinum Eagle), Bars/Rounds | Face value offers fraud protection and liquidity |

| Palladium | .9995+ fine | Bars/Rounds from approved refiners | --- |

Key Advantage of Coins: Legal tender status provides fraud protection (counterfeiting currency is a serious crime) and improves liquidity through wide recognition.

Gold Coins vs. Gold Bars: Which Fits Your IRA Strategy?

| Feature | Gold Coins (e.g., American Eagle) | Gold Bars (Approved Refiners) |

|---|---|---|

| Legal Tender/Face Value | Yes – government backed | No |

| Fraud Protection | Strong – counterfeiting is crime | Relies on refinery markings |

| Recognition & Liquidity | Widely recognized | Specialized recognition |

| Premium Over Spot | Higher | Lower per ounce |

| Ideal For | Security, recognition, flexibility | Maximizing metal per dollar |

Many investors hold both, using Autoinvest to regularly add their preferred type.

Understanding Storage, Insurance, and 'Checkbook Control'

- IRS-Approved Depositories: Mandatory—home storage prohibited

- Storage Options: Segregated (higher fee) or commingled (cost-effective)

- Insurance: Full market value coverage against theft/damage/loss

- 'Checkbook Control' LLCs: Complex structure with higher fees and compliance burden—most find direct custodian work safer

- Home Storage Risk: Strictly prohibited—triggers taxable distribution and penalties

More on storage: The Ins and Outs of Precious Metals Storage Options.

With storage arranged, focus on your allocation plan using Summit Metals' Autoinvest for disciplined monthly additions.

Frequently Asked Questions about Gold IRA Custodians

We often encounter common questions from investors navigating Gold IRAs. Let's address some of the most pressing ones to provide clarity.

Can I store my IRA-owned precious metals at home?

Absolutely not. This is one of the most critical rules of a Gold IRA. The IRS explicitly prohibits individuals from taking physical possession of their IRA-owned precious metals. According to IRC Section 408(m), all physical assets held within an IRA must be stored in a secure, IRS-approved depository.

Attempting to store your IRA metals at home is considered a taxable distribution by the IRS. This means you would owe immediate income taxes on the entire value of the metals, plus a 10% early withdrawal penalty if you are under age 59 1/2. Always use an approved depository.

What happens when I want to take a distribution from my Gold IRA?

When you reach retirement age (59 ½ or older), you have two main options for taking distributions:

- In-Kind Distributions: You can receive the physical precious metals themselves. Your Gold IRA custodian will arrange for the secure shipment of your metals to you. The fair market value at the time of distribution is taxable as ordinary income.

- Liquidating Assets: You can instruct your custodian to sell your precious metals. The cash proceeds are then sent to you, and this distribution is also taxable as ordinary income.

Once you reach age 73, the IRS mandates that you begin taking Required Minimum Distributions (RMDs) from your traditional Gold IRA. Your custodian will help you calculate and facilitate these distributions to ensure compliance.

Can a Gold IRA custodian offer 'checkbook control' for investments?

Yes, some Gold IRA custodians can facilitate a "checkbook control" structure, but it's a complex and risky strategy.

This involves setting up a Self-Directed IRA LLC, where your IRA funds are transferred to a new LLC that you manage. This gives you direct control over a bank account to make investments.

However, this approach has significant drawbacks:

- Increased Responsibility: You assume full responsibility for complying with complex IRS rules. A mistake can lead to severe penalties, including the disqualification of your entire IRA.

- Higher Fees and Complexity: Setting up an IRA LLC involves higher legal and administrative fees (often $1,000-$2,000 for setup) and ongoing costs.

- Compliance Risks: The IRS scrutinizes these structures closely. It's highly recommended to consult with a qualified tax advisor before pursuing this option.

Most investors find that working directly with a reputable Gold IRA custodian offers sufficient control without the added complexity and risk.

Conclusion: Securing Your Future with the Right Partner

Navigating Gold IRAs can seem daunting, but with the right knowledge and a trusted Gold IRA custodian, it becomes a powerful tool for diversifying your retirement portfolio. The key is due diligence: carefully evaluating a custodian's reputation, fee structure, and service.

Choosing wisely means avoiding hidden fees, ensuring IRS compliance, and gaining peace of mind that your hard-earned retirement savings are secure. For long-term security, consider how you'll consistently build your precious metals portfolio.

At Summit Metals, we believe in transparent, real-time pricing and competitive rates, ensuring trust and value. We also champion the power of consistent investing. Our Autoinvest feature allows you to dollar-cost average your way into precious metals, buying every month just as you would with a 401(k), steadily building your secure financial future while your custodian focuses on safekeeping and compliance.

By understanding the role of your Gold IRA custodian and precious metals dealer, you're taking a proactive step towards a more robust retirement. For a comprehensive guide to securing your future, explore IRA Gold Investment: A Comprehensive Guide to Securing Your Future.

If you want additional background on how gold is commonly used in investment portfolios beyond IRAs, you may also find this overview of gold as an investment helpful as you fine-tune your long-term strategy.