Why Smart Investors Choose Silver Bars for Wealth Preservation

Investing in silver bars offers one of the most direct paths to owning physical precious metals at the lowest cost per ounce. Here's what you need to know:

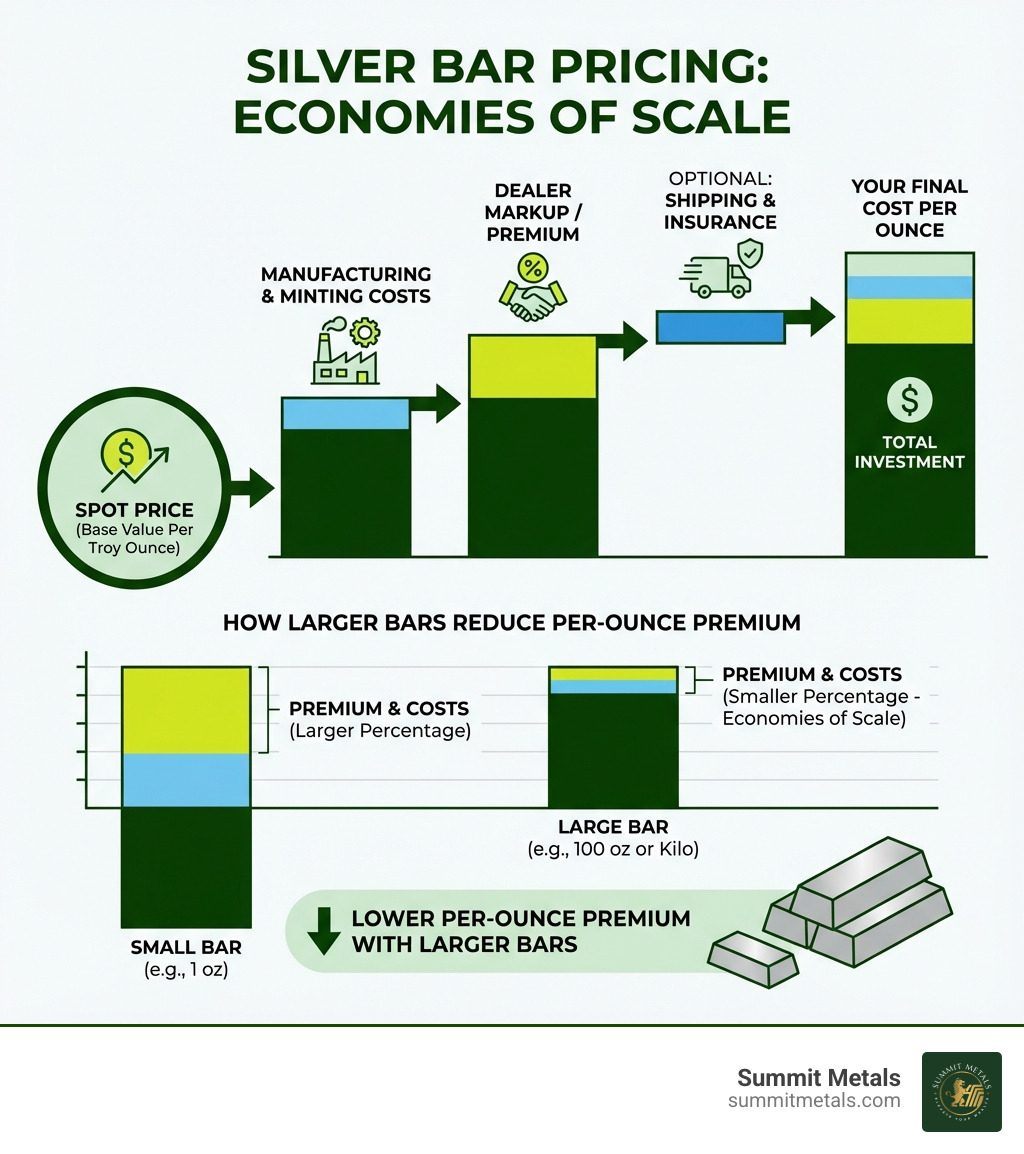

- Lower premiums than coins – Silver bars typically cost 3-8% over spot price, while coins can carry 15-30% premiums

- Bulk savings – Larger bars (10 oz, 100 oz, or kilo) cost significantly less per ounce than smaller denominations

- Pure silver content – Most investment-grade bars are .999 fine silver (99.9% pure)

- Straightforward pricing – Value is based almost entirely on weight and purity, not rarity or collectibility

- Efficient storage – More silver in less space compared to equivalent coin holdings

When the economy weakens or geopolitical tensions rise, tangible assets like silver have historically preserved wealth. While gold often steals the spotlight, silver offers an accessible entry point—currently trading at roughly 1/100th the price of gold—making it what many call "poor man's gold."

The choice between silver bars and coins comes down to your priorities. Bars maximize your metal for your money. Coins offer government backing and broader recognition. Both have a place in a diversified portfolio, but bars win on pure cost-efficiency.

I'm Eric Roach, and during my decade in New York investment banking—guiding Fortune 500 clients through multi-billion-dollar transactions—I learned how institutions protect their balance sheets during volatility. Now I help everyday investors apply those same defensive strategies through investing in silver bars and other physical precious metals to build resilient, long-term wealth outside the traditional financial system.

Silver Bar vs. Silver Coin: A Head-to-Head Comparison

When we talk about physical silver investments, two main forms come to mind: bars and coins. Both are considered "bullion," which refers to precious metals in bulk form, valued primarily for their metal content rather than their rarity or artistic merit. Investment-grade silver, whether in bar or coin form, is typically at least 99.9% pure (.999 fine silver). This high purity ensures that you're buying actual wealth, not just a pretty trinket.

The key difference often lies in their origin and perceived value beyond the metal itself. Silver coins are typically products of sovereign mints, like the U.S. Mint's American Silver Eagle or the Royal Canadian Mint's Silver Maple Leaf. These coins carry legal tender status in their respective countries, which provides a government guarantee of authenticity and a floor to their value, even if it's a nominal face value much lower than the silver content. This can offer a psychological comfort to some investors.

Silver bars, on the other hand, are much more likely to be the products of private mints. While reputable private mints like PAMP Suisse or Engelhard produce bars of exceptional quality and purity, their authenticity relies on the mint's reputation and any accompanying assay certificates.

For a deeper dive into the nuances, let's unpack the differences: Bars or Coins? Unpacking the Differences in Silver Investing.

Here's a quick comparison to help us decide which might be a better fit for your investment strategy:

| Feature | Silver Bars | Silver Coins |

|---|---|---|

| Premium Over Spot | Generally lower (3-8% above spot), especially for larger sizes. Ideal for maximizing silver ounces per dollar. | Generally higher (15-30% above spot), due to minting costs, intricate designs, and legal tender status. |

| Purity & Authenticity | Almost always minted as purely as possible (.999 fine). Authenticity relies on reputable mints, serial numbers, and assay certificates. More susceptible to counterfeiting for lesser-known brands. | Often 99.9% or 99.99% pure. Authenticity is guaranteed by sovereign mints and legal tender status. Designs are harder to counterfeit, providing an added layer of trust. |

| Liquidity | Can be less liquid than coins, especially generic or lesser-known bars, as they may require additional verification or may not sell as quickly. Larger bars can be harder to move. | Highly liquid and widely recognized. Easier to buy and sell, especially popular government-minted coins like American Silver Eagles. Their recognition and guaranteed purity offer added security for investors. |

| Storage & Portability | Come in a wide variety of sizes, from 1 oz to 1,000 oz. Bulk purchases can present storage challenges due to size and weight. Melting and reshaping is possible without catastrophic value loss. Much harder to move than coins. | Typically 1 oz. Easier to store in smaller quantities and transport. Condition is crucial for collector value, requiring careful handling. Melting would destroy numismatic value. |

| Ideal Investor Profile | Bulk buyers, cost-conscious stackers, long-term wealth preservationists, investors prioritizing weight over collectibility. Those looking for the most silver for their investment dollar. | Investors who value ease of transaction, broader market acceptance, potential numismatic value (though not for bullion-focused investors), and government backing. Suitable for smaller, more frequent purchases. |

The Case for Silver Bars: Maximizing Your Metal for Your Money

When our goal is to acquire as much physical silver as possible for our investment dollar, investing in silver bars truly shines. The primary advantage lies in their lower premiums over the spot price of silver. While silver coins, with their intricate designs and government backing, often command premiums of 15-30% (or even more for collectible editions), silver bars typically hover in the 3-8% range. This significant difference means that for the same amount of money, we can acquire a greater quantity of actual silver.

This cost-efficiency is magnified when we consider bulk purchasing. For example, buying a 1-kilo silver bar is far less expensive per ounce than purchasing 1,000 separate 1-ounce bars. We can magnify the lower premium and per-unit savings on our silver bars if we are willing to buy in bulk. This makes bars the most economical option for those looking to make substantial investments in silver. The larger the silver bar, the lower the premium per ounce over the spot price.

The valuation of silver bars is also refreshingly straightforward. Their price is based almost entirely on the current silver spot price and their weight and purity. Unlike coins, there's no numismatic value or collector's premium to consider, which can sometimes complicate pricing and resale. This clear, metal-centric valuation appeals to investors who want pure exposure to silver's price movements. You can always keep an eye on the latest market movements with our guide: Spot On: Your Live Silver Price Per Ounce Guide.

For us, building a robust and diversified portfolio is key to long-term financial security. Silver, like gold, acts as a hedge against inflation and economic uncertainty. It has been recognized for its value throughout mankind's history, offering a sense of stability that fiat currencies often lack. Silver's enduring allure lies not only in its historical significance but also in its contemporary relevance, with industrial demand surging in sectors like renewable energy, electronics, and medical supplies.

Investing in silver bars plays a vital role in portfolio diversification, especially for those who want a tangible asset to hold outside the traditional financial system. We believe it's essential for maximizing your investment in a chaotic global economy. Learn more about why gold and silver are essential for portfolio diversification in 2024: Maximizing Your Investment in a Chaotic Global Economy: Why Gold and Silver Are Essential for Portfolio Diversification in 2024.

This focus on maximizing ounces at the lowest possible premium makes silver bars particularly attractive to large-scale investors or "stackers" who are accumulating significant amounts of physical silver. They prioritize the sheer volume of metal over the aesthetic or collectible appeal of coins.

Navigating the Risks of Investing in Silver Bars

While investing in silver bars offers compelling advantages, it's not without its unique set of considerations and risks. As with any physical asset, storage and security are paramount. Silver bars, especially larger ones, can be quite heavy and bulky. Storing different sizes of silver bars can present a logistical challenge. We need a secure place to keep our investment safe from theft or damage. Options range from home safes to bank safety deposit boxes, and even professional vault services. Each comes with its own set of pros and cons regarding accessibility, cost, and insurance coverage. FDIC insurance does not cover items in a bank safety deposit box, only deposited funds! For comprehensive guidance on keeping your precious metals safe, explore our insights on: Top Storage for Silver: Best Practices for Safekeeping Your Investment.

Another potential challenge is liquidity. While silver in general is a relatively liquid asset, silver bars, particularly lesser-known or generic ones, may not sell as quickly as popular government-minted coins. They might also require additional verification, potentially delaying a sale. This isn't a deal-breaker for long-term investors, but it's something to be aware of if we anticipate needing to liquidate quickly.

Finally, market volatility is a constant companion in the precious metals world. Silver prices can fluctuate based on industrial demand, economic indicators, and geopolitical events. While we view silver as a long-term store of value, short-term price swings are a reality.

Key Risks in Investing in Silver Bars

One of the most concerning risks when investing in silver bars is the potential for counterfeits or silver-plated bars. It is much easier to produce counterfeit silver bars or silver-plated bars than coins, given their simpler designs. This underscores the critical importance of purchasing from reputable dealers. A trusted dealer will guarantee the authenticity and purity of the silver.

To mitigate this risk, we always look for investment-grade silver that is at least 99.9% pure. Reputable silver bars, especially those from well-known refineries like PAMP Suisse, Royal Canadian Mint, or Engelhard, often come with serial numbers and assay certificates. These certificates, sometimes embedded directly into the packaging, guarantee the bar's weight and purity, speeding up the verification process for future resale. Learn how to spot the good guys from the bad: Identifying Reputable Bullion Dealers: Avoiding Counterfeits.

Market Trends and Outlook

Silver's value is driven by a fascinating dual appeal: its historical role as money and its increasing importance as an industrial metal. Silver has been recognized for its value throughout a great deal of mankind's history, lending it a sense of stability. Yet, its unique properties, such as superior electrical conductivity and reflectivity, make it indispensable in modern industries. The renewable energy sector (think solar panels), electric vehicles, and advancements in electronics are driving significant industrial demand.

This industrial utility means silver prices are often reactive to various measures of manufacturing data. Currently, we're seeing a perfect storm of factors: major (and ongoing) supply deficits, surging industrial demand, and safe-haven buying amidst global economic uncertainty. This has fueled significant price rallies for silver.

While the silver market is prone to deep dives, providing buying opportunities, it also has the potential to offer higher returns than gold in bull markets. The gold/silver ratio, which compares the metals' prices, can sometimes indicate when silver might be undervalued relative to gold.

We believe that investing in silver bars should be approached with a long-term perspective. Experts recommend against trying to time the market, instead suggesting dollar-cost averaging to mitigate price fluctuations. Silver should not be considered a short-term investment, but rather a resilient asset for wealth preservation over the long haul. Dig into silver's rich history and its journey through time: Silver's role in mankind’s history.

How to Buy Silver Bars: Your 4-Step Action Plan

Ready to add the shine of silver bars to your portfolio? Here's our straightforward, four-step action plan to guide you.

Step 1: Choose a Reputable Dealer

This is arguably the most crucial step. A trustworthy dealer ensures the authenticity and quality of your silver, provides transparent pricing, and offers reliable service. We have options from local coin shops to established online retailers. For those of us in Salt Lake City, Utah, local options like Utah Gold Buyers or JM Bullion's local presence offer physical locations, though many prefer the competitive pricing and convenience of online brokers.

When evaluating dealers, we always conduct thorough research. We check customer reviews, ratings, and ensure they have transparent pricing, clearly showing the premium over the spot price. Their shipping and insurance policies are also vital—we want our precious metals to arrive safely and securely. For a comprehensive guide to finding the best places to buy, check out: The 7 Best Places to Buy Silver Bars Compared.

Step 2: Select Your Silver Bars

Silver bars come in a wide variety of sizes, catering to different investment budgets and goals. Common sizes include 1 oz, 5 oz, 10 oz, 1 kilo (32.15 oz), 100 oz, and even 1,000 oz. For personal investments, we typically recommend smaller to medium sizes (1 oz, 5 oz, 10 oz, or even 1 kilo and 100 oz) for their balance of lower premiums and easier liquidity. Larger bars like 1,000 oz are generally more suited for industrial use or very large institutional investors due to their weight and the logistics of moving them.

We also pay attention to the mints. Bars from reputable mints like PAMP Suisse, Engelhard, the Royal Canadian Mint, or Johnson Matthey are widely recognized and trusted. These "branded" bars tend to have better resale value and liquidity compared to generic, lesser-known bars. To help you decide on sizes, compare the options: Silver Stackers' Choice: Comparing 10 oz Bars and 1 oz Coins.

Step 3: A Smart Strategy for Investing in Silver Bars: Dollar-Cost Averaging

We understand that trying to "time the market" is a fool's errand. Instead, we advocate for a smart, disciplined strategy called dollar-cost averaging. This involves investing a fixed amount of money into silver bars at regular intervals, regardless of the current market price. This approach helps mitigate the impact of market volatility by averaging out our purchase price over time. When prices are high, we buy less silver; when prices are low, we buy more. It's a simple yet powerful way to build our silver stack consistently and reduce overall risk.

Think of it like investing in your 401k – consistent, automated contributions over the long term. We're big fans of this method because it takes the emotion out of investing and fosters good habits. To learn more about this effective strategy, read: The Power of Dollar-Cost Averaging in Gold and Silver Investments.

At Summit Metals, we make this strategy even easier with our Autoinvest program. It allows you to set up recurring silver purchases, so you can build your wealth automatically, just like your 401k. It's a hassle-free way to consistently grow your physical precious metals holdings.

Step 4: Arrange for Secure Storage

Once we've acquired our beautiful silver bars, the next critical step is ensuring their secure storage. Proper storage protects our investment from theft and damage and helps maintain its condition and resale value.

We have several options:

- Home Safes: These offer immediate access, which can be appealing. However, they require robust security measures, and we must check if our homeowners insurance covers precious metals stored on-premises. Many policies have limits, so additional riders might be necessary. Also, remember the first rule of keeping physical bullion in your own house: be discreet about your holdings!

- Bank Safety Deposit Boxes: These provide a good level of security for smaller holdings and offer peace of mind. However, access is limited to bank hours, and as mentioned, they are not FDIC insured.

- Professional Vault Services/Third-Party Depositories: For larger investments or those who prefer maximum security and insurance, professional vault services are an excellent choice. These facilities are specifically designed for precious metals, often offering segregated (your specific bars are stored separately) or allocated (you own a specific quantity of metal, but it's commingled with others') storage. They come with inspection, auditing, confirmation, and insurance for your benefit. This is often the most secure option.

Understanding your storage options is crucial for protecting your investment. Dive deeper into finding the right fit for your needs: What Is Metal Storage? Your Ultimate Guide to Durability and Design.

Frequently Asked Questions about Silver Bar Investments

Who is the ideal investor for silver bars?

The typical investor who chooses investing in silver bars over other silver investment options is often a "stacker" or a bulk buyer. These are individuals and entities primarily focused on accumulating the maximum amount of physical silver at the lowest possible cost per ounce. They are cost-conscious, prioritizing the intrinsic value of the metal over numismatic appeal or intricate designs.

Silver bars also appeal to long-term wealth preservationists who view silver as a hedge against inflation and economic instability, and who prefer the tangible ownership of a physical asset. They are less concerned with short-term liquidity and more focused on building a substantial reserve of wealth. If you're looking to get the most silver for your money and hold it for the long haul, silver bars are likely your ideal investment vehicle.

Are silver bars harder to sell than silver coins?

Generally, yes, silver bars can be somewhat harder to sell than popular government-minted silver coins. Silver coins like the American Silver Eagle or Canadian Silver Maple Leaf have universal recognition and guaranteed purity, making them instantly identifiable and highly liquid across most dealers.

Silver bars, particularly lesser-known or generic ones, might require additional verification from a buyer. While investment-grade silver bars from reputable mints (like PAMP Suisse or the Royal Canadian Mint) are still relatively easy to sell, they might not command the same immediate, unquestioning acceptance as a sovereign coin. Larger bars, while offering better premiums, can also be harder to liquidate quickly if you need to sell only a portion of your holdings. Smaller bars (1 oz, 5 oz, 10 oz) tend to be more liquid because they appeal to a broader range of buyers.

The ease of selling depends heavily on the bar's origin and size, and the dealer's buy-back policies. For a deeper dive into which silver investments are easiest to sell, explore: What are the easiest silver investments to sell right now?.

What are the tax implications of buying and selling silver bars?

The tax implications for investing in silver bars can vary, but there are some general rules we should be aware of.

- Capital Gains Tax: When we sell silver bars for a profit, those gains are subject to capital gains tax. For physical precious metals, this is often treated as a collectible, which can be taxed at a higher long-term capital gains rate (up to 28% in the U.S.) than other long-term investments like stocks. The holding period (short-term vs. long-term) also plays a role. It's crucial to keep accurate records of purchase dates and prices.

- Sales Tax: Sales tax on physical precious metals can vary significantly by state. In Utah, for example, there is generally an exemption for sales tax on precious metals if the transaction amount exceeds a certain threshold. However, if the invested amount is below that threshold (e.g., $2,000 in some states), sales tax may still apply. We always advise checking current state and local tax laws before making a purchase.

- Reporting Requirements: Dealers are typically required to report certain transactions to the IRS, particularly large sales. For example, sales of 1,000 oz silver bars might trigger reporting requirements. It's important for us to be aware of these rules and to consult with a tax professional for personalized advice.

Understanding these implications is a vital part of a comprehensive investment strategy. To learn more about precious metals investing and its financial considerations, refer to: Learn more about precious metals investing.

Conclusion: Are Silver Bars the Right Investment for You?

After weighing the pros and cons, we believe that investing in silver bars presents a compelling opportunity for many investors, particularly those focused on cost-efficiency and maximizing their physical silver holdings. Their lower premiums, especially when purchased in bulk, make them an economical choice for building a substantial silver stack. While storage and liquidity require careful consideration, these aspects are manageable with proper planning and reputable partnerships.

Silver bars offer a tangible asset that can serve as a powerful hedge against inflation and economic uncertainty, playing a crucial role in portfolio diversification. The straightforward valuation, based purely on weight and purity, appeals to investors seeking direct exposure to the silver market without the added complexities of numismatic value.

At Summit Metals, we are committed to providing transparent, real-time pricing and competitive rates on authenticated gold and silver precious metals. Our goal is to ensure trust and value for our investors, whether you're starting small or making a significant investment. We believe that incorporating physical silver into your financial strategy can provide a solid foundation for long-term wealth preservation.

Ready to start building your silver stack effortlessly? Explore our Autoinvest program and begin your journey today: Start building your silver stack effortlessly with our Autoinvest program.