Why Your First Silver Purchase Matters More Than You Think

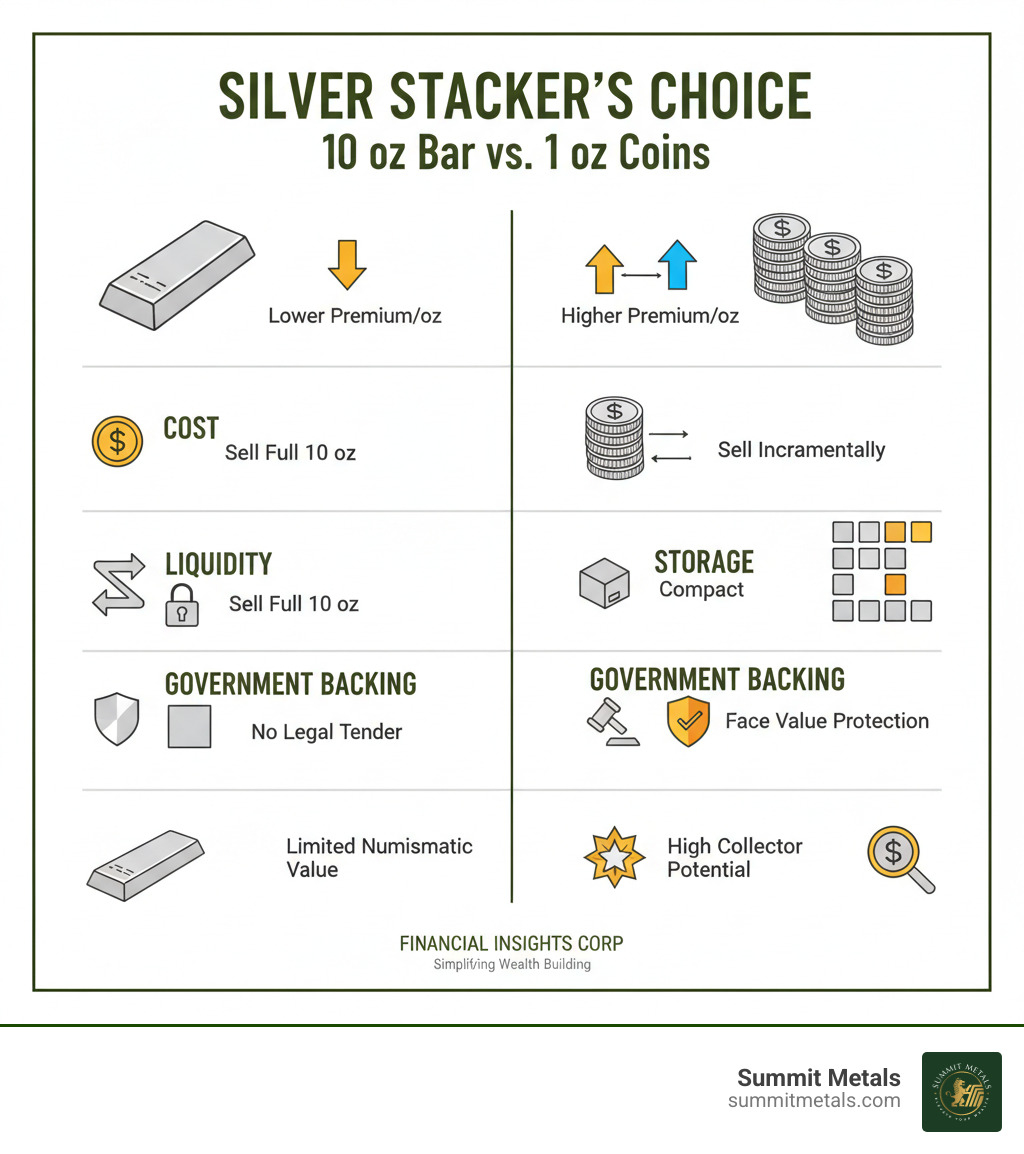

A 10 oz silver bar is a popular entry point for precious metals investors, but is it a better choice than ten 1 oz silver coins? The answer depends on your investment goals.

Quick Answer: 10 oz Silver Bar vs. 1 oz Coins

| Factor | 10 oz Silver Bar | 1 oz Silver Coins |

|---|---|---|

| Cost per Ounce | Lower premium over spot | Higher premium over spot |

| Liquidity | Must sell entire 10 oz | Sell any quantity you need |

| Storage | Compact (3.5" x 2" x 0.25") | 10 pieces take more space |

| Government Backing | No legal tender status | Legal tender with face value |

| Collectibility | Limited (except rare mints) | High potential for numismatic value |

| Security & Fraud Protection | Relies on mint security features, assays, and serials; no legal tender protections | Sovereign legal tender with advanced anti-counterfeit features and legal protections |

Purchasing a 10 oz silver bar is more economical per ounce, making it ideal for investors focused on accumulating the maximum amount of silver. These bars, containing 311 grams of .999+ fine silver, are produced by reputable mints like the Royal Canadian Mint and Asahi Refining.

However, 1 oz silver coins offer superior divisibility for partial sales, government backing as legal tender, and built-in counterfeit protection. This flexibility is crucial for those who prioritize liquidity or may use silver for bartering.

Tip: If you prefer a set-it-and-forget-it approach, use Summit Metals' Autoinvest to dollar-cost average into silver every month—just like a 401k for your stack.

This guide will help you understand the trade-offs between 10 oz silver bars and 1 oz coins, enabling you to build a diversified silver stack that aligns with your financial goals and risk tolerance.

Important 10 oz silver bar terms:

- buy silver bars

- premium over spot

- precious metals storage

The Case for the 10 oz Silver Bar: Bulk Value and Efficiency

For investors aiming to build silver wealth efficiently, the 10 oz silver bar is a top choice. Its primary advantage is a lower premium over the spot price compared to smaller denominations. Because mints produce one item instead of ten, the savings are passed to the buyer, allowing you to acquire more silver for your money.

Beyond cost, storage efficiency is a major benefit. A 10 oz silver bar is compact—roughly the size of a deck of cards—making it easy to stack and store securely. This simplifies inventory management and minimizes the space required for your holdings. For those building a substantial foundation in precious metals, the 10 oz silver bar offers an ideal balance of affordability and substance. To learn more about safely building your wealth with bullion, check out our guide on Bullion Investing 101: How to Safely Stack Your Wealth.

Understanding the 10 oz Silver Bar

Before buying, it's important to know the key characteristics of a 10 oz silver bar:

- Weight: 10 troy ounces (approximately 311 grams).

- Purity: Typically .999 (99.9%) or .9999 (99.99%) fine silver.

- Dimensions: Roughly 3.5" x 2" x 0.25", making them highly stackable.

- Types: Cast bars are poured into molds for a rustic look, while minted bars are precision-stamped for a uniform, polished finish with sharper details.

Your choice between cast and minted bars is a matter of aesthetic preference, as both offer the same intrinsic value.

Popular Mints for Your 10 oz Silver Bar Collection

Investing with confidence means choosing reputable mints. Here are some of the most trusted names:

- Royal Canadian Mint (RCM): A government mint known for .9999 fine purity and advanced security features.

- Asahi Refining: An LBMA-certified refiner with a 200-year history, offering popular 10 oz silver bars.

- American Mints: SilverTowne is known for patriotic designs, while Sunshine Minting incorporates its innovative MintMark SI™ anti-counterfeiting feature.

- PAMP Suisse: A Swiss refiner famous for its beautifully designed minted bars, like the Lady Fortuna.

- Vintage & Artistic Bars: Bars from discontinued producers like Engelhard and Johnson Matthey carry a collectible premium. Mints like Argentia Precious Metals offer unique, ultra-high relief designs that blur the line between bullion and art.

Sticking with well-known mints ensures you receive verified weight and purity, the cornerstone of any sound precious metals investment.

The Allure of the 1 oz Silver Coin: Liquidity and Recognition

While 10 oz silver bars excel in value, 1 oz silver coins offer advantages that many investors prioritize: flexibility and recognition. The most significant benefit is high liquidity. The divisibility of coins allows you to sell small amounts as needed, unlike a 10 oz silver bar which must be sold as a single unit. This makes coins ideal for covering unexpected expenses or for potential bartering.

Another key feature is government backing. Coins like the American Silver Eagle and Canadian Silver Maple Leaf are legal tender issued by sovereign governments. This provides an extra layer of trust and authenticity, often including advanced counterfeit protection features. Finally, coins have numismatic potential, meaning their value can increase beyond their silver content due to rarity, design, or collector demand—an upside that most bars lack.

Why Choose 1 oz Silver Coins?

Investors choose 1 oz coins for their flexibility in selling and global recognition. Selling a few coins is simple, whereas finding a buyer for a larger bar can be more difficult if you only need a small amount of cash. Globally recognized coins include:

- American Silver Eagle: The world's most popular silver coin, trusted for its .999 purity and iconic design.

- Canadian Silver Maple Leaf: Known for its high .9999 purity and advanced security features.

- Other Popular Coins: The British Britannia, Austrian Philharmonic, and Australian Kangaroo are also highly regarded for their design appeal and collectibility. For a deeper understanding of how certification adds value, see our guide on Bar None: The Best Understanding Certified Silver Bars.

The Cost of Convenience: Premiums on 1 oz Coins

The flexibility of 1 oz coins comes at a cost: higher premiums per ounce. Producing and securing individual coins is more expensive than making a single bar, and this cost is passed to the buyer. For example, the total premium on ten 1 oz coins is often significantly higher than the premium on one 10 oz silver bar. (Premiums fluctuate with market conditions).

There is also a storage consideration. Ten individual coins take up more space and require more organization (tubes or capsules) than one compact 10 oz silver bar. This is a trade-off between cost-efficiency and flexibility. For more on building your stack, read The Basics of Gold and Silver Stacking.

Making Your Decision: A Head-to-Head Comparison

The choice between a 10 oz silver bar and ten 1 oz coins depends on your investment strategy. This side-by-side comparison highlights the key differences.

| Metric | 10 oz Silver Bar | 1 oz Silver Coin (x10) |

|---|---|---|

| Cost per Ounce | Lower premium; more silver for your money. | Higher premium; cost of flexibility. |

| Liquidity | Must sell the entire 10 oz unit. | Highly divisible; sell any number of coins. |

| Storage | Compact and space-efficient. | Requires more space and organization. |

| Collectibility | Limited, except for rare vintage bars. | Strong potential for numismatic value. |

| Government Backing | None; valued as private bullion. | Legal tender with anti-counterfeit features. |

| Security & Fraud Protection | Relies on private-mint security features, assays, and serial numbers; no legal tender protections. | Sovereign legal tender with advanced security and legal protections against counterfeiting. |

If your goal is to accumulate the most silver at the lowest cost, the 10 oz silver bar is the clear winner. If you prioritize flexibility, government backing, and the ability to sell in small increments, 1 oz coins are the better fit.

Building Your Strategy: Dollar-Cost Averaging with Autoinvest

A disciplined investment strategy is key. Dollar-Cost Averaging (DCA) involves investing a fixed amount of money at regular intervals, which smooths out your purchase price over time and removes the stress of trying to time the market. It's the same principle used in 401k contributions.

Summit Metals' Autoinvest program makes this easy—set it and forget it. Buy every month just like a 401k to grow your holdings consistently. We recommend a blended portfolio: use Autoinvest to buy 10 oz silver bars for low-cost bulk accumulation and 1 oz coins for liquidity. This gives you the best of both worlds. Learn more about The Strategic Approaches to Investing in Gold and Silver: Dollar Cost Averaging and Value Averaging.

Smart Buying and Secure Storage

Protecting your investment involves smart buying and secure storage.

Where to Buy: Always use a reputable dealer. Look for:

- Transparent Pricing: Real-time spot prices and premiums clearly displayed.

- Strong Reputation: Check reviews and ratings from sources like the Better Business Bureau.

- Secure Shipping: Your order should be discreet, tracked, and fully insured.

Check dealer ratings on the Better Business Bureau

Storage Options:

- Home Safe: Good for smaller holdings, but ensure it's fire-resistant and bolted down.

- Bank Deposit Box: Higher security for larger stacks, but access is limited to banking hours.

- Third-Party Depository: The highest level of security, with insurance and audits, ideal for substantial holdings.

Always check your insurance coverage for precious metals and practice discretion about your holdings. For more on security, read our Silver Surfers Guide: How to Secure Your Precious Metals Online.

Frequently Asked Questions about 10 oz Silver Bars

Here are straightforward answers to common questions about investing in a 10 oz silver bar.

What factors influence the price of a 10 oz silver bar?

The final price of a 10 oz silver bar is determined by several factors:

- Silver Spot Price: The real-time market price for raw silver.

- Mint Premium: Covers the cost of production, which varies by mint and complexity.

- Dealer Premium: The seller's markup to cover operational costs and profit.

- Condition & Collectibility: New bars cost more than secondary market bars, unless the bar is from a rare or discontinued mint like Engelhard or Johnson Matthey, which can carry a collectible premium.

Are 10 oz silver bars a good investment?

Yes, 10 oz silver bars are an excellent component of a diversified portfolio. They offer several key benefits:

- Portfolio Diversification: Silver often moves independently of stocks and bonds, helping to balance risk.

- Hedge Against Inflation: As a tangible asset, silver tends to hold its value when the purchasing power of currency declines.

- Tangible Asset: Unlike digital assets, a 10 oz silver bar is physical wealth you can hold.

- Cost-Efficiency: They offer a lower premium per ounce, maximizing the amount of silver you acquire.

For more on precious metals investing, see The Midas Touch: Exploring the Benefits of Gold Investment.

How can I verify the authenticity of my silver bar?

Verifying your 10 oz silver bar is genuine is crucial. The most important step is to buy from a reputable dealer like Summit Metals, which sources products from legitimate mints. Additionally, you can:

- Check Markings: Familiarize yourself with the mint's logo, purity, and weight stamps.

- Verify Security Features: Many modern bars include serial numbers, assay cards, or unique anti-counterfeiting marks like Sunshine Minting's MintMark SI™.

- Confirm Dimensions and Weight: A genuine bar will match the official specifications (10 troy ounces, or 311 grams).

- Use Professional Testing: A local dealer can perform a specific gravity or XRF scan to confirm the bar's composition.

Conclusion: Making the Right Choice for Your Stack

The choice between a 10 oz silver bar and 1 oz silver coins is a personal one based on your investment goals. There is no single "right" answer.

- The 10 oz silver bar is the workhorse for bulk accumulation. It offers the lowest cost per ounce, making it the most efficient way to build a large position in physical silver.

- The 1 oz silver coin provides best flexibility and liquidity. Its divisibility, government backing, and numismatic potential make it a versatile tool for any investor.

Most successful investors use a blended strategy, using 10 oz silver bars as the foundation of their stack and adding 1 oz coins for liquidity. This approach combines cost-efficiency with adaptability.

A consistent strategy is the most effective. Our Autoinvest program allows you to use dollar-cost averaging to build your stack over time, making regular monthly purchases automatically, much like a 401k. This removes the stress of market timing and ensures steady growth.

At Summit Metals, a Wyoming, USA-based company, we provide authenticated precious metals with transparent pricing. Whether you choose bars, coins, or a mix of both, we are here to help you build your stack with confidence. To learn more, explore what to buy and why liquidity matters.