Your Complete Guide to Turning Copper Ingots Into Cash

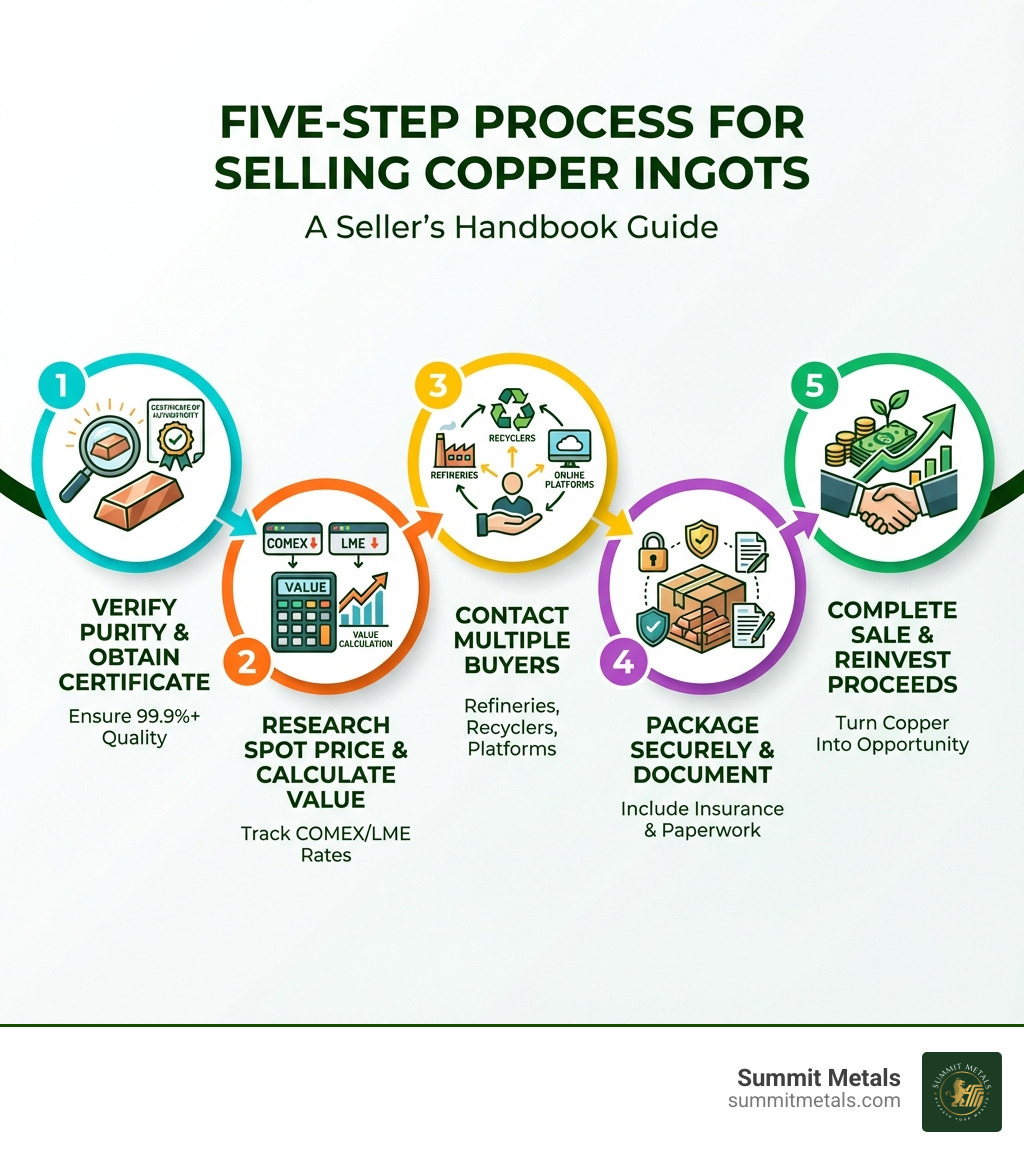

Selling copper ingots involves understanding purity standards, finding the right buyers, and navigating pricing based on the spot market. Here's what you need to know to get started:

- Verify Your Ingot Quality - Check purity (99.9% or 99.99%) and ensure you have a Certificate of Authenticity

- Understand Pricing - Your payout depends on the COMEX/LME spot price, purity grade, and weight

- Choose Your Buyer - Options include refineries, foundries, national recyclers, or online platforms

- Prepare for Sale - Gather documentation, take clear photos, and package securely

- Complete the Transaction - Arrange shipping with insurance and understand any international requirements

The global copper market reached $170.1 billion in 2022 and continues to grow at 4.1% annually. As demand surges from electric vehicles and renewable energy, copper ingots have become increasingly valuable—but getting the best price requires knowing how to steer the selling process.

Unlike raw copper scrap, ingots offer easier handling and storage. However, they also present unique challenges. Many scrap yards struggle to verify ingot composition and may reject them outright or offer lower-grade pricing. The key is understanding where and how to sell to maximize your return.

This guide walks you through everything from verifying your ingot's purity to choosing the right buyer and shipping securely. Whether you're a business liquidating inventory or an individual with investment-grade copper, you'll learn how to turn your metal into cash at fair market rates.

I'm Eric Roach, a former Wall Street M&A advisor who now helps everyday investors protect wealth through alternative assets. My experience guiding Fortune-500 companies through complex hedging programs translates directly into practical strategies for selling copper ingots at competitive prices.

Simple guide to selling copper ingots:

Understanding Your Copper Ingots: Types and Quality

Before you even think about selling copper ingots, it's crucial to understand what you have. Not all copper ingots are created equal, and their type and quality significantly impact their market value.

Copper ingots primarily come in different purity standards. The most common investment-grade ingots are 99.9% (often referred to as .999 fine) or even 99.99% (sometimes called 4N) and higher, reaching grades like 99.9999% (6N) for specialized applications. These higher purity levels are essential because industrial buyers and investors seek minimal impurities. For instance, the research shows that higher purity grades (e.g., 99.99%) command higher values.

Ingots can also be categorized by their manufacturing process, such as cast or extruded. Cast ingots are formed by pouring molten copper into molds, while extruded ingots are pushed through a die. For investors, the form factor of copper bullion can vary, including bars, rounds, and even "bullets." We've explored these variations in more detail in our guide on Copper Bar Types 101.

The importance of authenticity cannot be overstated. A genuine ingot, especially one with a Certificate of Authenticity (COA), provides peace of mind to buyers and helps ensure you receive a fair price. Without proper documentation, even high-quality copper can be difficult to sell at its true value. For some, copper ingots are also valued as decorative items, like elemental design paperweights, but for serious selling, purity and authenticity are key.

Why Purity is Paramount

Purity directly correlates with price. Imagine selling a diamond—a flawless one fetches a far higher price than one with inclusions. Copper is no different. Industrial applications, especially in electronics and specialized manufacturing, demand extremely high purity to ensure optimal conductivity and performance. If your copper ingots aren't certified to a high purity, they might be classified as lower-grade material, significantly reducing their value.

For example, our research indicates that the purity of copper ingots is a critical factor in determining their price, with higher purity grades commanding higher values. This is because industrial users need specific material properties, and impurities can compromise these.

The assay process is how purity is determined. This scientific analysis verifies the exact composition of the metal. Without a professional assay or a reliable COA, a potential buyer, especially a larger refinery or manufacturer, might be hesitant or discount their offer significantly to account for potential unknown contaminants. This leads us to our next point.

Verifying Authenticity and Quality

Ensuring the authenticity and quality of your copper ingots is fundamental to a successful sale. When we sell precious metals, trust and verification are paramount, and the same applies to copper.

One common method for verifying metal composition is using X-ray fluorescence (XRF) guns. These devices can quickly and non-destructively analyze the elemental composition of a metal. While helpful, XRF guns typically only analyze the surface, so a professional assay is often preferred for a thorough assessment.

Professional assay services involve taking a small sample of the ingot and chemically analyzing it to determine its precise purity. This process provides an independent, verifiable certification of your copper's quality.

When purchasing ingots, always look for a seller-provided Certificate of Authenticity (COA) from a reputable source. These certificates, along with clear stamped markings indicating weight and purity, are crucial for future sales. Buyers will also verify the weight of your ingots using calibrated scales. Any discrepancies, even slight ones, can impact the final payout.

Decoding Copper Ingot Pricing

Understanding how copper ingots are priced is like having a secret decoder ring in the metal market. The price isn't static; it's a dynamic interplay of global forces.

The benchmark for copper prices is typically set by major commodity exchanges like the London Metal Exchange (LME) and COMEX, which is part of the CME Group. These exchanges reflect the global supply and demand for copper. Our research shows that the price of copper ingots can fluctuate significantly based on global supply and demand, geopolitical events, and economic conditions.

For instance, the global copper market size was valued at USD 170.1 billion in 2022 and is projected to reach USD 235.5 billion by 2030. This growth is driven by its use in construction, electronics, automotive, and renewable energy. In 2024, the price of copper ingots has seen an upward trend due to increased demand from the electric vehicle sector. These market trends directly influence the value of your ingots.

Key Factors Influencing Your Payout

When you're ready to sell, several factors will determine your final payout:

- Spot Price of Copper: This is the current market price for immediate delivery, as dictated by the LME or COMEX. It's the baseline for your ingot's value.

- Purity Grade Premium: Higher purity copper (like 99.99% or 6N) commands a premium over standard commercial-grade copper. Buyers are willing to pay more for fewer impurities, as this reduces their processing costs.

- Ingot Weight and Quantity: Larger quantities or heavier ingots might sometimes receive a slightly better per-pound price due to economies of scale in handling and shipping. However, for most individual sellers, the weight is simply multiplied by the per-unit price.

- Buyer Type: The type of buyer you choose also impacts your payout. A direct-to-foundry sale might yield a better price than a local scrap yard, as the latter often includes more middlemen and processing fees.

For a deeper dive into how these factors play out, especially for investment-grade copper, you might find our article on Pure Copper, Pure Value: Navigating 1kg Ingot Prices particularly useful.

Ingots vs. Scrap: A Value Comparison

This is a critical distinction for sellers. While both ingots and loose copper scrap are raw materials, how they are perceived and priced by buyers can differ dramatically.

We've seen discussions among scrap metal enthusiasts about the viability of turning scrap copper into ingots. While some believe it can upgrade lower-grade scrap and simplify handling, others question the profitability due to labor and fuel costs.

The biggest challenge with selling homemade ingots to a typical scrap yard is verification. Scrap yards often classify copper as #1 or #2 grade, with #1 being more valuable. They might refuse ingots outright or offer a lower price because they can't easily verify the composition, fearing hidden impurities. Some are starting to use XRF guns, but it's not universal. Refineries or foundries are generally better equipped to assay and value metal ingots.

Here's a quick comparison:

| Feature | Selling Copper Ingots | Selling Copper Scrap (Loose) |

|---|---|---|

| Pros | Easier to store, handle, and weigh. Can command higher price if purity certified. Potential for direct sale to industrial users. | Generally accepted by most scrap yards. Less processing effort required by seller. |

| Cons | Verification challenges at typical scrap yards. Requires proof of purity (assay/COA). Melting process adds cost/labor if starting from scrap. | Lower price per pound. More difficult to store and transport efficiently. Often sold as lower grades. |

| Typical Buyer | Refineries, foundries, specialized metal dealers, online bullion platforms. | Local scrap yards, general recyclers. |

| Price Potential | Higher, especially for certified high-purity material. | Lower, often based on visual inspection and general grade. |

While making ingots from scrap can potentially upgrade lower-grade copper (#2) to a higher-priced category (#1), the cost of labor and fuel, plus the challenge of finding a buyer who values the ingot form, must be carefully considered. It's a trade-off between effort and potential increased return.

The Ultimate Guide to Selling Copper Ingots

Now that we understand the types and pricing, let's talk about where and how to actually sell your copper ingots. Finding the right buyer is paramount to maximizing your return. This involves exploring various avenues, from local options to national and online platforms. Our guide, From Bar to Bank: Your Guide to Selling Copper Bullion, offers a broader perspective on selling bullion.

| Selling Method | Pros | Cons | Best For |

|---|---|---|---|

| Local Scrap Yards | Immediate payment, convenient, no shipping required. | Lower prices, may not accept ingots, verification challenges. | Small quantities of uncertified copper, quick cash needs. |

| Online Dealers/Platforms | Potentially higher prices, wider market reach, established processes for certified metal. | Requires shipping, potential for fees, payment is not instant. | Certified, investment-grade ingots, larger quantities. |

| Direct to Foundry/Refinery | Highest potential price, direct access to industrial users. | Often requires very large quantities, more complex logistics. | Businesses or individuals with bulk industrial-grade copper. |

Selling Locally: Scrap Yards and Recyclers

For many, the first thought is often the local scrap yard. In our area, places like Wasatch Metal Recycling, Western Metals Recycling in Salt Lake City, UT, and Redwood Recycling are prominent options. These facilities are convenient, offering immediate cash or check payments.

However, there are pros and cons. While they're easy to access, their ingot acceptance policies can vary wildly. As discussed, many scrap yards are set up to handle mixed scrap and may not have the equipment or expertise to verify the purity of ingots. This often leads to them treating ingots as lower-grade scrap or rejecting them entirely.

When approaching a local recycler, always get a quote first. Be prepared for an on-site inspection, and if possible, bring any documentation (like a COA) you have. Their primary business is often volume-based processing of mixed metals, so specialized items like high-purity ingots might not fetch their best price here.

National recyclers like CMC operate a vast network and buy a wide range of scrap metals, including various grades of copper. While their specific locations might not be in Wyoming or Utah, their general practices reflect what you might expect from a large-scale operation. They emphasize accurate scale weights, efficient receiving, and timely payments, and can even offer custom scrap solutions for larger industrial sellers. They are more likely to have the means to properly assess and value ingots than smaller, local operations.

Selling Online: Reaching a Broader Market

Online platforms and specialized bullion dealers offer access to a much broader market, potentially yielding better prices for your ingots, especially if they are of high purity or investment grade.

Platforms like eBay allow you to set your own price and reach collectors or small-scale industrial buyers. However, you'll need to build a reputation, and the fees can eat into your profits. The key is clear listings and high-quality photos that accurately represent your product.

For more significant quantities or higher-purity ingots, consider specialized bullion dealer websites. These platforms often have established processes for buying back metals, offering price locks and insured shipping solutions. While many such dealers focus on gold and silver, some may deal in copper bullion. They typically have a step-by-step selling process: request a quote, lock in the price, ship securely, and receive payment. The minimum buy-back amount can vary, but generally starts around $1,000 USD.

When selling online, whether through a marketplace or a dealer, the importance of clear, honest representation cannot be overstated. We've seen how much buyers value authenticity and transparency.

Key Factors for Successfully selling copper ingots

To ensure a smooth and profitable sale, keep these factors in mind:

- High-Quality Photos: Clear, well-lit images from multiple angles build trust and help buyers assess the physical condition of your ingots.

- Accurate Descriptions: Detail the weight, dimensions, purity (if known), and any unique markings.

- Purity Documentation: A Certificate of Authenticity or a professional assay report is your best friend here. It provides undeniable proof of your ingot's quality.

- Transparent Pricing: Be realistic about your asking price, aligning it with current market rates and considering the buyer's processing needs.

- Secure Payment Methods: Always opt for secure payment methods to protect yourself from fraud.

Logistics and Legalities: Finalizing the Sale

Once you've found a buyer and agreed on a price, the next crucial steps involve getting your copper ingots safely to their destination and handling any necessary paperwork, especially for larger or international transactions.

Shipping and Handling Safely

Copper ingots are heavy, dense, and valuable. Proper packaging and shipping are non-negotiable to protect your investment.

- Secure Packaging Instructions: Always use a new, unmarked box. Avoid using old boxes with previous shipping labels or branding, as this can attract unwanted attention or confuse carriers. Wrap each ingot individually to prevent damage during transit. The goal is to make the package as nondescript and sturdy as possible. For valuable shipments, many reputable dealers provide step-by-step instructions for packaging to ensure safety and insurance coverage.

- Choosing a Reliable Carrier: For domestic shipments, reputable carriers like UPS or FedEx are common. For very large quantities, freight shipping might be necessary. Always choose a carrier known for reliability and secure handling.

- Insuring Your Shipment: This is critical. Insure your shipment for its full market value. In the unfortunate event of loss or damage, this insurance will protect your investment. Some dealers offer their own insured logistics solutions, which can simplify the process and potentially offer better coverage. Always obtain a tracking number and monitor your shipment's progress.

Navigating International Sales

Selling copper ingots internationally adds layers of complexity, but it can also open up new markets and potentially better prices. Major trading hubs for copper include London, New York, and Shanghai, and China was the largest producer of refined copper in 2023. This indicates a global demand that sellers can tap into, but it requires careful attention to detail.

- Commercial Invoice: This document details the transaction, including the seller and buyer, description of goods, quantity, price, and terms of sale.

- Bill of Lading: For sea freight, this is a contract between the shipper and the carrier, acting as a receipt of goods and a document of title.

- Certificate of Origin: This document certifies that your copper ingots originated in a specific country. This can be important for customs duties and trade agreements.

- Export Licenses: Depending on the quantity, value, and destination country, you may need specific export licenses. It's crucial to research the regulations of both your country (USA) and the destination country.

- Understanding Incoterms (e.g., CIF): Incoterms define the responsibilities of buyers and sellers for the delivery of goods under sales contracts. CIF (Cost, Insurance, and Freight) means the seller pays for the cost, insurance, and freight to bring the goods to the named port of destination. Understanding these terms is vital to avoid disputes and unexpected costs.

We always recommend consulting with a customs broker or international trade specialist when engaging in international sales to ensure full compliance with all regulations.

Frequently Asked Questions about Selling Copper Ingots

We often encounter common questions from individuals and businesses looking to sell their copper ingots. Here are some of the most frequent ones, along with our insights.

Will scrap yards buy my homemade copper ingots?

This is a tricky one, and the answer is: it depends, but often not at the best price. Scrap yard policies vary significantly. Many local scrap yards prefer raw scrap that they can easily identify and sort into their established grading systems (like #1 or #2 copper).

The main issue is verification. Unless a scrap yard has advanced equipment like XRF guns (which are becoming more common but not universal), they might be hesitant to buy ingots, fearing unknown impurities. If they do buy them, they might offer a lower price, classifying them as a lower grade to account for the risk. A user in our research noted that many scrap yards won't take ingots because they can't verify composition, and if they do, they'll offer a lower price.

For genuine ingots, especially those with certified purity, refineries or foundries are often better buyers because they have the necessary equipment and processes to accurately assay the metal and pay you based on its true content.

How is the price of copper ingots determined?

The price of selling copper ingots is primarily determined by the global spot price of copper, which is set by major commodity exchanges like the London Metal Exchange (LME) and COMEX. This spot price reflects real-time supply and demand.

Beyond the spot price, several factors influence your final payout:

- Purity Grade: Higher purity copper (e.g., 99.99%) commands a premium.

- Weight and Quantity: The total weight of your ingots is multiplied by the per-pound or per-ounce price. Larger quantities might sometimes get a slightly better rate.

- Buyer's Premium/Processing Fees: Different buyers will offer slightly different prices based on their own profit margins, processing costs, and how quickly they can turn your ingots into a usable product.

As we noted, prices can fluctuate significantly due to economic conditions, geopolitical events, and industrial demand (like from the electric vehicle sector).

What's the advantage of selling ingots over loose copper scrap?

There are several advantages to selling copper ingots compared to loose copper scrap, but also some trade-offs:

Advantages:

- Easier Handling and Storage: Ingots are uniform in size and density, making them much easier to stack, store, and transport than a pile of miscellaneous scrap.

- Simpler Weighing: Accurate weighing is straightforward with solid ingots, which helps in calculating value.

- Potential for Higher Price (with verification): If you can provide certified purity (via a COA or professional assay), ingots can command a higher price per pound than unverified scrap. This is especially true when selling to industrial buyers or specialized dealers who need specific purity levels.

- Market Appeal: For some buyers, especially collectors or smaller foundries, a well-formed ingot is more appealing than a random assortment of scrap.

Trade-offs/Challenges:

- Verification: As mentioned, scrap yards may struggle to verify ingot purity, potentially leading to lower offers or rejection.

- Initial Processing Cost: If you're starting with raw scrap and melting it into ingots, there are costs associated with the labor, fuel, and equipment for melting and casting. These costs need to be weighed against the potential price increase.

The advantage of ingots lies in their consolidated, standardized form, which is highly valued by buyers who require specific purity and consistency, provided you can prove that purity.

Conclusion: Maximizing Your Returns

Selling copper ingots successfully boils down to a few key principles: understanding your product, knowing the market, choosing the right buyer, and handling logistics with care. We've walked through the different types and purity standards, how market forces like the LME and COMEX dictate pricing, and the crucial steps for verifying authenticity and ensuring a smooth transaction.

The copper market is dynamic and growing, driven by industries like electric vehicles and renewable energy. This robust demand means your copper ingots hold significant value. By taking the time to understand their quality, seeking professional assays if needed, and researching potential buyers, you can maximize your returns.

The goal is not just to sell, but to sell smartly. While local scrap yards offer convenience, specialized metal dealers, refineries, or online platforms may provide better value for certified ingots. Always prioritize secure shipping with insurance, and for international sales, ensure all documentation is in order.

As your wealth grows from selling copper ingots, you might consider reinvesting your profits into other authenticated precious metals. Copper is a fantastic industrial metal, but gold and silver have historically served as premier stores of value and hedges against economic uncertainty. If you're looking to diversify or convert your gains, we at Summit Metals specialize in helping you acquire high-quality, authenticated gold and silver products with transparent, real-time pricing.

We believe in making wealth protection accessible. That's why we offer an Autoinvest program, allowing you to dollar-cost average your way into precious metals. Just like investing in a 401k, you can buy a set amount of gold or silver every month, building your portfolio consistently over time.

To learn more about smart investing and growing your wealth, check out our resources:

- Is a 1kg Copper Bar Your Next Long-Term Investment?

- Learn how to buy precious metals online safely and securely

- Visit Summit Metals for all your precious metal needs: https://summitmetals.com/

- Sell your metals to us: https://summitmetals.com/pages/sell-to-us

- Explore our Autopays program: https://summitmetals.com/pages/autopays

- Find our subscription options: https://summitmetals.com/pages/subscriptions

1 comment

EDWARD A DZIEDZIC

1 Geiger Feinkupfer 9999 10 oz

2 Cu 63.55 1 pound .999 fine copper USA

1 Cu 63.55 square 10 oz

1 white tube containing 20 “don’t thead on me” 1 oz

1 white tube containing 20 APMEX.COM 1 oz cannabis SKU#: 201929 / XC-3-40

11 “don’t thead on me” 1 oz

10 GOLDEN STATE MINT 1929 Indian head/back side has an Eagle on it – 2 oz

5 2 oz CONSTITUTIONAL RIGHT TO BEAR ARMS

5 1 oz PROTECT THE FUTURE/back side has guns and gold with 2 guns on it

4 1 oz home of the free because of the brave

3 1 oz abominable snowman

9 1 oz ahead of the curve – shows a map of the USA

18 1 oz shows 2 Aliens with the saying “WE’LL BE BACK.”

8 1 oz with a cannabis leaf on it

2 i oz plastic sealed with an Indian on it dated 1877

1 1 oz with the wings shield

1 1 oz with the wings shield back side has a buffalo

1 1 oz with the wings shield back side has an eagle

1 1 oz bar with a buffalo on it

10 1 oz bar with a man’s face and a 500 / back side has 500

149 oz of copper altogether