Why Finding the Cheapest Silver Prices Online Matters for Your Wealth

Cheapest silver prices online can vary by $5 or more per ounce depending on where you shop. For a 100-ounce bar, that's a $500 difference—the difference between paying $3,300 or $3,800. Here's what drives those prices:

| Factor | What It Means | Typical Range |

|---|---|---|

| Spot Price | Current market value of raw silver | Changes every few seconds during trading hours |

| Premium | Cost above spot for fabrication, shipping, dealer profit | 2% to 15%+ depending on product type |

| Product Type | Bars typically cheaper than coins per ounce | Bars: lowest premium; Coins: higher premium but government-backed |

| Payment Method | Bank wire/check often cheaper than credit card | Save 3-4% by avoiding credit card fees |

| Bulk Purchases | Larger quantities mean lower per-ounce cost | 100 oz bars offer best value per ounce |

The bottom line: The "cheapest" silver isn't always the best value. You need to balance low premiums with dealer reputation, product authenticity, and liquidity.

Right now, silver is trading around $28-$30 per ounce at spot price. But you'll never actually pay spot—dealers add premiums to cover refining, minting, shipping, and profit margins. Understanding this difference is the first step to avoiding overpaying.

Silver's dual role as both an industrial metal and a wealth-preservation asset makes it unique. Demand from solar panels and electric vehicles is pushing consumption higher while supply growth remains constrained. Meanwhile, investors turn to silver during periods of inflation and currency devaluation—exactly the conditions we're seeing today.

The challenge? Online silver dealers range from highly reputable to outright fraudulent. Some advertise "below spot" prices that are always scams. Others hide fees in shipping, insurance, or payment processing. And counterfeit products are a real risk when authenticity isn't properly verified.

This guide cuts through the confusion. You'll learn how to compare dealers, identify red flags, choose the right products, and use strategies like dollar-cost averaging to build your silver holdings without overpaying.

At Summit Metals, our team brings decades of experience from the financial and precious metals industries. We've seen how institutional investors use precious metals to hedge risk, and we apply those same principles to help individual investors find the cheapest silver prices online without sacrificing quality or security. Our goal is to translate complex market tactics into clear, actionable steps so you can protect your wealth with confidence.

Glossary for cheapest silver prices online:

- buying silver online

- best online silver coin dealers

- silver for sale online

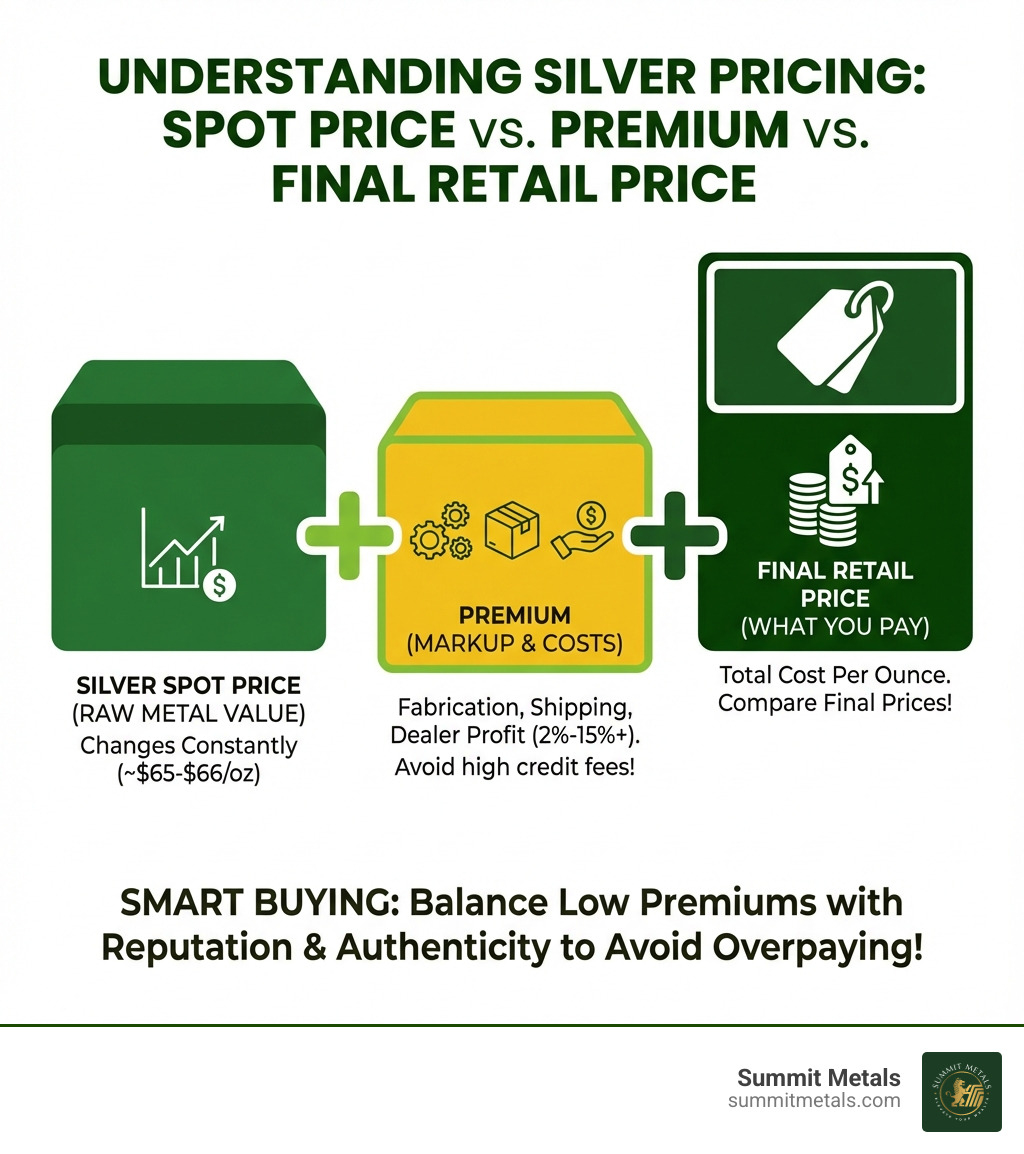

Understanding Silver Pricing: Spot vs. Retail

When we talk about cheapest silver prices online, it's crucial to first understand how silver is priced. The market for silver is dynamic, influenced by a myriad of factors that can cause its value to fluctuate by the second. The cornerstone of silver pricing is the "spot price."

What is the Difference Between Spot Price and Retail Price?

The spot price of silver is essentially the current market price for immediate delivery of raw, un-fabricated silver. This price is determined by global commodity futures exchanges, primarily the COMEX in New York, and also influenced by major players like the LBMA. It represents the value of silver as a raw material, traded in bulk on global markets. For example, the live bid price for silver can be seen fluctuating throughout the day. You can track these movements in real-time on major financial news websites.

However, you cannot actually purchase physical silver at this spot price. This is where the concept of a "premium" comes into play, leading to the retail price. The retail price is what you, the buyer, ultimately pay. It includes the spot price plus a premium that covers all the additional costs involved in getting that raw silver from the mine to your hands. These premiums typically range from 2% to 15% or more above the spot price, depending on the product type, dealer, and market conditions.

Here's what makes up that premium:

- Fabrication Costs: The expense of refining raw silver into usable forms like coins, bars, or rounds, and then minting or casting them.

- Dealer Markup: This is the dealer's profit margin, covering their operational costs, overhead, and ensuring they can stay in business to serve you.

- Bid vs. Ask Price: Dealers buy silver at the "bid" price (what they're willing to pay) and sell at the "ask" price (what they charge customers). The difference between these two is known as the "spread," which reflects the dealer's profit and market liquidity. A wider spread means less liquidity or higher dealer costs.

Understanding this distinction is vital. When we search for the cheapest silver prices online, we're looking for the lowest retail price, which means finding dealers with the smallest premiums over the current spot price.

Are There Hidden Costs When Buying Silver Online?

Unfortunately, the quest for the cheapest silver prices online can sometimes be derailed by unexpected fees. While reputable dealers are transparent, it's always wise to be aware of potential hidden costs:

- Shipping Costs: Physical silver needs to be shipped securely. These costs can vary significantly based on the weight of your order, the distance, and the shipping method. Always check a dealer's shipping policy before finalizing your purchase.

- Insurance: During transit, your precious metals should be insured against loss or damage. This is a non-negotiable cost for peace of mind, and it's usually factored into the shipping fee or added separately.

- Payment Processing Fees: How you pay can impact your final price. Credit card payments often incur a 3-4% processing fee, which many dealers pass on to the customer. We often offer discounts for payments made via bank wire, ACH, or personal check, as these methods have lower processing costs for us, allowing us to pass those savings on to you.

- State and Local Taxes: Depending on where you live and the amount of your purchase, you may be subject to sales tax. Tax laws vary by state, so it's important to understand your local regulations. For comprehensive information on tax regulations, we recommend checking your state's official revenue or taxation department website or consulting a tax professional. In Utah, like many other states, sales tax exemptions for precious metals purchases can depend on the total transaction amount, so it's always best to verify.

Always review the final checkout page carefully to see the total cost, including all fees, before committing to a purchase.

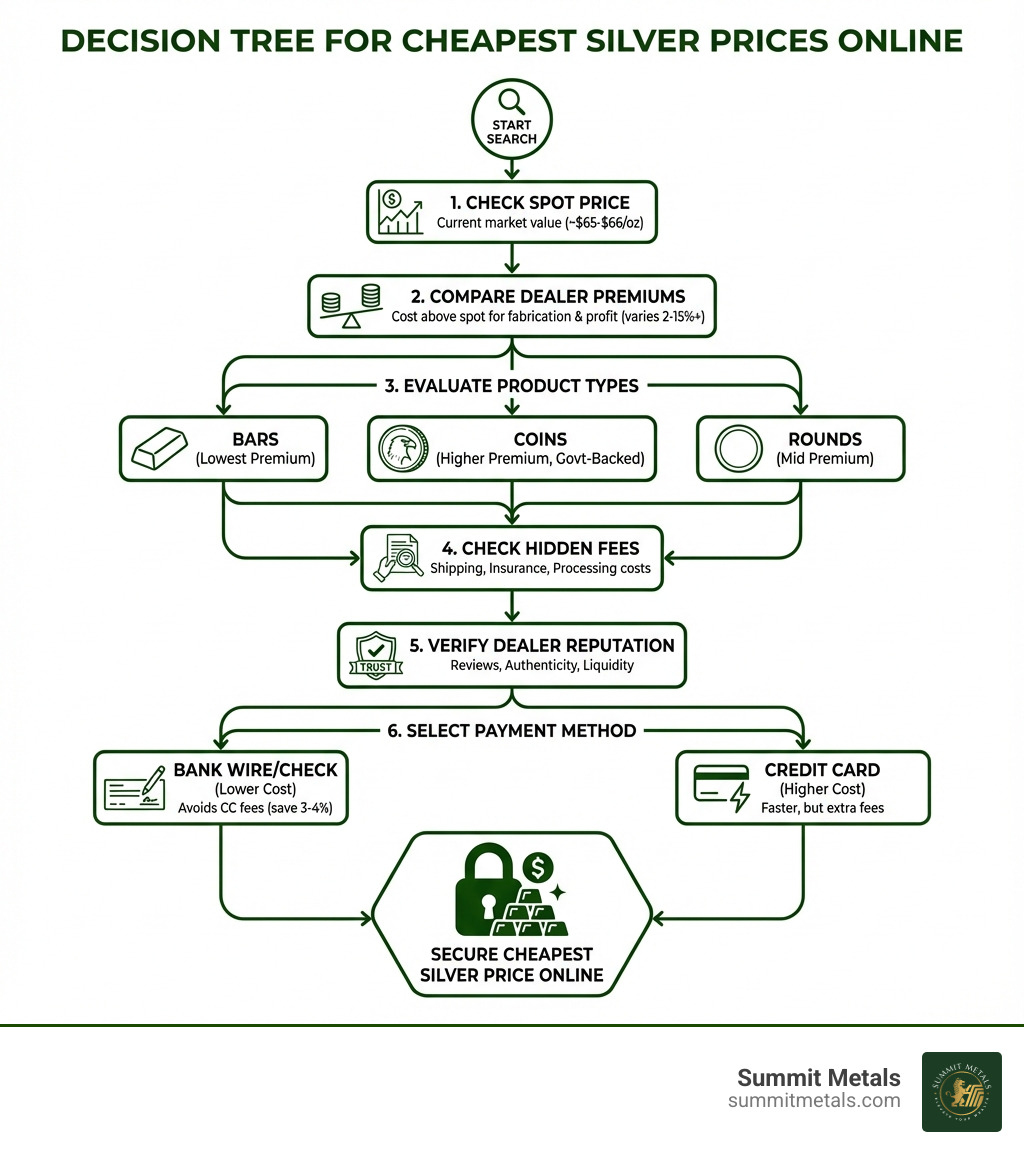

A Step-by-Step Guide to Finding the Cheapest Silver Prices Online

Finding the cheapest silver prices online isn't just about spotting the lowest number; it's about a strategic approach that balances price with reliability and value.

Comparing Dealers for the Cheapest Silver Prices Online

The first rule of thumb when buying silver online is to prioritize reputation over price. A deal that seems too good to be true often is. We always advise you to:

- Check Customer Reviews: Look for consistent positive feedback regarding product authenticity, shipping speed, and customer service.

- Verify Business Standing: Check for a good rating with organizations like the Better Business Bureau (BBB).

- Understand Shipping and Insurance Policies: Ensure the dealer offers secure, insured shipping. We prioritize getting your investment to you safely.

- Review Price-Locking Policies: Reputable dealers will lock in your price at the time of purchase, protecting you from market fluctuations between order and payment. We lock in your price to give you certainty.

While we strive to offer highly competitive rates due to our bulk purchasing power, we encourage you to compare us with other reputable dealers. Look for transparent pricing with no hidden fees.

Choosing the Right Silver Product for the Best Value

The form of silver you buy significantly impacts its premium and, therefore, its overall cost per ounce. When seeking the cheapest silver prices online, you'll generally find that:

- Larger bars tend to have lower premiums per ounce than smaller bars, rounds, or coins.

- Generic silver rounds (privately minted, non-sovereign designs) often have lower premiums than government-minted coins.

Here's a comparison to help you decide:

| Feature | Silver Coins (e.g., American Eagle) | Silver Bars (10 oz, 100 oz) | Silver Rounds (Generic) |

|---|---|---|---|

| Premium | Higher (due to government backing, collectible appeal, minting costs) | Lowest (especially larger sizes like 100 oz) | Low (privately minted, less collectible appeal) |

| Liquidity | Excellent (globally recognized, easy to sell) | Very Good (standard sizes, widely accepted) | Good (recognized for metal content, less for design) |

| Government Backing | Yes (face value, purity guaranteed by sovereign mint) | No (purity guaranteed by refiner/manufacturer) | No (purity guaranteed by private mint) |

| Counterfeit Risk | Lower (advanced security features, well-known designs) | Moderate (easier to fake than coins, but still checked) | Higher (more variation, less standardized security) |

| Best For | Collectors, those seeking highest recognition and security | Investors focused on maximizing silver weight per dollar | Budget-conscious investors, stackers |

For maximizing your silver weight for the lowest cost, our research and experience show that 100 oz silver bars often present the cheapest silver prices online on a per-ounce basis. For example, if the spot price of silver is $29/oz, a 1 oz Recognized Silver Bar might be priced at $32.50/oz. In contrast, a 100 oz Recognized Silver Bar could be $3,100/bar, which averages out to just $31.00/oz (prices are illustrative and change with the market). This demonstrates the cost-effectiveness of buying in bulk.

When choosing between forms, consider your goals. If you prioritize the lowest possible cost per ounce, large bars or generic rounds are often the way to go. If you value government backing, global recognition, and potential numismatic value, sovereign coins like the Silver American Eagle or Silver Maple Leaf are excellent choices, though they come with slightly higher premiums.

Key Factors That Influence Silver Prices

Silver's price is a complex dance between supply, demand, and global events. Understanding these factors is key to knowing when you're getting the cheapest silver prices online and when the market might be ready for a move.

The Role of Industrial and Investment Demand

Silver is unique among precious metals because of its dual nature: it's both a monetary metal (a store of wealth) and a critical industrial commodity.

-

Industrial Demand: This is a huge driver for silver. Silver is an indispensable component in a vast array of high-tech and industrial applications due to its unparalleled electrical and thermal conductivity.

- Green Technology: The "Green Revolution" is a massive catalyst. Silver is crucial for solar panels (photovoltaics), with consumption for solar increasing by 63.8% in 2023 alone. Electric vehicles (EVs) also use about twice as much silver as internal combustion engine vehicles, and with 20% of new vehicles sold in 2024 being EVs, this demand is only growing. Full electrification could consume an additional 100 million ounces by 2030.

- Electronics: From smartphones to medical devices, silver's conductivity makes it essential.

- Other Uses: It's also used in healthcare, automotive components, and even water purification. This continuous and growing industrial demand means that even if investment demand wanes, there's a strong fundamental floor for silver prices. If industrial demand continues to rise, as we expect, silver prices could potentially rise along with it.

-

Investment Demand: Like gold, silver is seen as a safe-haven asset, especially during times of economic uncertainty, geopolitical instability, or inflation.

- Inflation Hedge: Investors turn to silver to protect their purchasing power when fiat currencies are devalued.

- Currency Devaluation: A weaker U.S. dollar, in which silver is primarily traded, can make silver more attractive to international buyers, pushing prices up.

- Geopolitical Events: Wars, trade disputes, and other global tensions can send investors flocking to precious metals. For example, dovish comments from the Fed can lead to significant price increases, as seen with a 4.21% jump in silver prices on November 28th, 2023.

The interplay between these two powerful demand forces means silver prices can be volatile but also offer significant upside potential. With silver supply decreasing by 2.0% in 2023 and forecasted demand potentially outstripping supply in 2025 (1.2 billion ounces demanded vs. 1.05 billion ounces supplied), the fundamentals look strong for silver.

How the Gold-to-Silver Ratio Impacts Your Purchase

The gold-to-silver ratio is a powerful tool for investors. It tells us how many ounces of silver it takes to buy one ounce of gold, calculated by simply dividing the price of gold by the price of silver. This ratio helps us assess the relative value of silver and determine if it's currently undervalued compared to gold.

- Historical Perspective: Historically, the ratio has fluctuated widely. A high ratio (meaning it takes a lot of silver to buy gold) can suggest that silver is undervalued relative to gold, potentially signaling a good opportunity to buy silver. Conversely, a low ratio might suggest silver is overvalued, or gold is undervalued.

- Investment Tool: Savvy investors use this ratio to strategically shift between gold and silver. For example, if the ratio is high, we might consider buying silver, anticipating that it will eventually narrow, leading to potential gains. When the ratio falls, we might consider converting some silver back into gold. One example from our research showed an investor potentially yielding over 133% returns by trading the ratio between 2019 and 2020. This strategy allows us to potentially increase our overall precious metal holdings without injecting new capital.

Keeping an eye on the gold-to-silver ratio can help us make more informed decisions about when to buy, helping us secure the cheapest silver prices online relative to its precious metal counterpart.

Smart Buying & Investing Strategies

Navigating the online silver market effectively requires more than just finding a low price. It demands smart strategies for buying, investing, and ensuring the authenticity and security of your assets.

Tips for Securing the Cheapest Silver Prices Online

To consistently find the cheapest silver prices online without compromising quality, we recommend these strategies:

- Buy in Bulk: As we discussed, larger silver bars (e.g., 10 oz, 100 oz, or even 1kg bars) typically carry lower premiums per ounce than smaller items. For instance, if a 1 oz silver coin costs $33, a 10 oz Recognized Silver Bar might be available for $315, bringing your per-ounce cost down to $31.50 (prices are illustrative). This is often the most cost-effective way to acquire significant amounts of silver.

- Pay with Bank Wire or Check: Many dealers, including us at Summit Metals, offer discounts for payments made via bank wire, ACH, or personal check. This is because these methods incur lower processing fees for us compared to credit cards, and we pass those savings directly to you. This can shave 3-4% off your total purchase.

- Sign Up for Dealer Newsletters: Stay informed about flash sales, special promotions, and pre-sale items. Dealers often announce their best deals to their subscribers first.

- Consider Pre-Sale Items: Sometimes, buying newly released products during a pre-sale period can offer slight discounts or locked-in prices before potential market shifts.

- Focus on Low-Premium Products: If your goal is purely to accumulate silver weight, prioritize generic silver rounds or larger bars over highly collectible government-minted coins, which typically command higher premiums. The cheapest silver prices online are almost always found in these high-volume, low-premium products.

Automate Your Investment with "Autoinvest"

One of the smartest long-term strategies for acquiring silver is dollar-cost averaging, and our "Autoinvest" program is designed to make this effortless. Just like you might contribute to a 401k every month, Autoinvest allows you to make consistent, recurring purchases of silver.

- Dollar-Cost Averaging: By investing a fixed amount of money at regular intervals (e.g., monthly), you buy more silver when prices are low and less when prices are high. Over time, this strategy helps to mitigate market volatility and can result in a lower average cost per ounce.

- Consistent Monthly Purchases: Our Autoinvest program enables you to set up automated silver purchases, building your stack steadily without having to constantly monitor market fluctuations. It takes the emotion out of investing and ensures discipline.

- Building a Stack Over Time: This "set it and forget it" approach is perfect for long-term investors in Utah and beyond who want to accumulate physical silver as a hedge against inflation and economic uncertainty. It’s a powerful way to build wealth, similar to how many successful retirement plans grow over decades.

We encourage you to Learn about our Autopay options and see how easy it is to automate your silver investing journey with Summit Metals.

Risks, Verification, and Long-Term Storage

The digital age offers unparalleled access to cheapest silver prices online, but it also brings risks.

- Counterfeit Risks: The biggest danger is inadvertently purchasing counterfeit silver. This is why we emphatically state: never attempt to buy silver below spot price. Offers that are "too good to be true" are almost always scams selling fake products. The spot price represents silver's actual value, and premiums are necessary to cover legitimate costs.

- Importance of Reputable Dealers: Always buy from highly-rated, established dealers with a proven track record. At Summit Metals, we pride ourselves on transparent, real-time pricing and authenticated products. Our Wyoming, USA, base means we adhere to strict business practices, ensuring trust and value for investors like you in Utah.

- Verifying Authenticity: Ensure the silver you purchase is at least .999 (99.9%) fine silver. Reputable dealers will clearly state the purity. When you receive your silver, you can perform basic tests like the magnet test (silver is not magnetic) or the ping test (for coins) to further confirm authenticity. For serious investors, consider professional assaying for larger purchases.

-

Secure Storage Options: Once you own physical silver, securing it is paramount.

- Home Storage: For smaller amounts, a high-quality home safe or lockbox can suffice. Ensure it's fire-resistant and discreetly placed.

- Dedicated Facility Storage: For larger holdings, consider a professional, insured, third-party storage facility. This offers improved protection against theft and environmental damage.

- Selling Your Silver: When the time comes to sell, dealing with a reputable buyer is just as important as buying from one. We offer competitive pricing based on live market rates for gold, silver, and platinum. If you're Thinking about selling your silver?, we make the process transparent and fair.

Frequently Asked Questions about Buying Silver

We understand you might have more questions about securing the cheapest silver prices online. Here are some common inquiries:

What is the cheapest form of silver to buy?

Generally, the cheapest silver prices online per ounce are found in larger silver bars, such as 10 oz, 100 oz, or even 1 kg bars. Generic silver rounds (privately minted, non-sovereign designs) also typically have lower premiums over the spot price compared to government-minted coins. If your primary goal is to acquire the most silver weight for your dollar, these options offer the best value. For example, a 100 oz Recognized Silver Bar often has a significantly lower per-ounce premium than a single 1 oz Silver American Eagle Coin.

How can I be sure the silver I buy online is real?

The best way to ensure the silver you buy online is real is to purchase exclusively from highly-rated, established dealers with a strong reputation for authenticity and transparency. Avoid any offers that seem "too good to be true," especially those advertising prices below the current spot price, as these are almost invariably scams involving counterfeit products. A reputable dealer, like Summit Metals, will have clear return policies, transparent pricing, and will guarantee the authenticity and purity (typically .999 fine) of their products. Always check customer reviews and business ratings (e.g., with the BBB) before making a purchase.

What are the tax implications of buying and selling silver?

The tax implications of buying and selling silver can vary. When you buy silver online, your purchase may be subject to state and local sales taxes depending on your specific location (e.g., in Utah) and the total amount of the order. Many states offer sales tax exemptions for larger precious metals purchases. When you sell silver for a profit, that profit is generally subject to capital gains tax. The specific rates and rules can depend on how long you held the silver (short-term vs. long-term capital gains) and your overall income. We always recommend consulting a qualified tax professional to understand the specific tax implications for your situation, as we are not tax advisors.

Conclusion

Finding the cheapest silver prices online is a journey that combines market knowledge, strategic purchasing, and diligent verification. We've explored how understanding the difference between spot and retail prices, recognizing hidden costs, and choosing the right product form can significantly impact your investment. We also digd into the powerful forces of industrial and investment demand driving silver's value, and how the gold-to-silver ratio can inform your buying decisions.

The "cheapest" doesn't always mean the best. Prioritizing reputable dealers, verifying authenticity, and planning for secure storage are just as crucial as finding low premiums. For those committed to building their wealth in precious metals, strategies like dollar-cost averaging through our "Autoinvest" program offer a disciplined approach to mitigating market volatility and accumulating silver over time.

At Summit Metals, we are committed to providing you with transparent, real-time pricing and competitive rates, backed by our bulk purchasing advantage, so you can invest with trust and confidence. Whether you're in Utah or anywhere else, we believe in empowering you with the knowledge and tools to make smart investment decisions.

Ready to secure your financial future with silver? Start building your silver portfolio safely today with Summit Metals.