Why Understanding Gold and Silver Transactions Protects Your Wealth

How to buy and sell gold and silver is simpler than most investors realize, yet many lose money through hidden fees, poor timing, or scams. This guide provides the essential knowledge you need.

Quick Answer: The Essential Steps

-

Buying Gold and Silver

- Research the current spot price before any purchase.

- Choose reputable dealers (online or local).

- Decide between coins, bars, or rounds.

- Verify authenticity via hallmarks or certificates.

- Understand premiums and all costs, including shipping.

-

Selling Gold and Silver

- Know the current spot price as your baseline.

- Get multiple quotes from dealers.

- Expect to receive around 95% of the spot price for standard bullion.

- Ship with full insurance and tracking.

- Keep records for tax purposes.

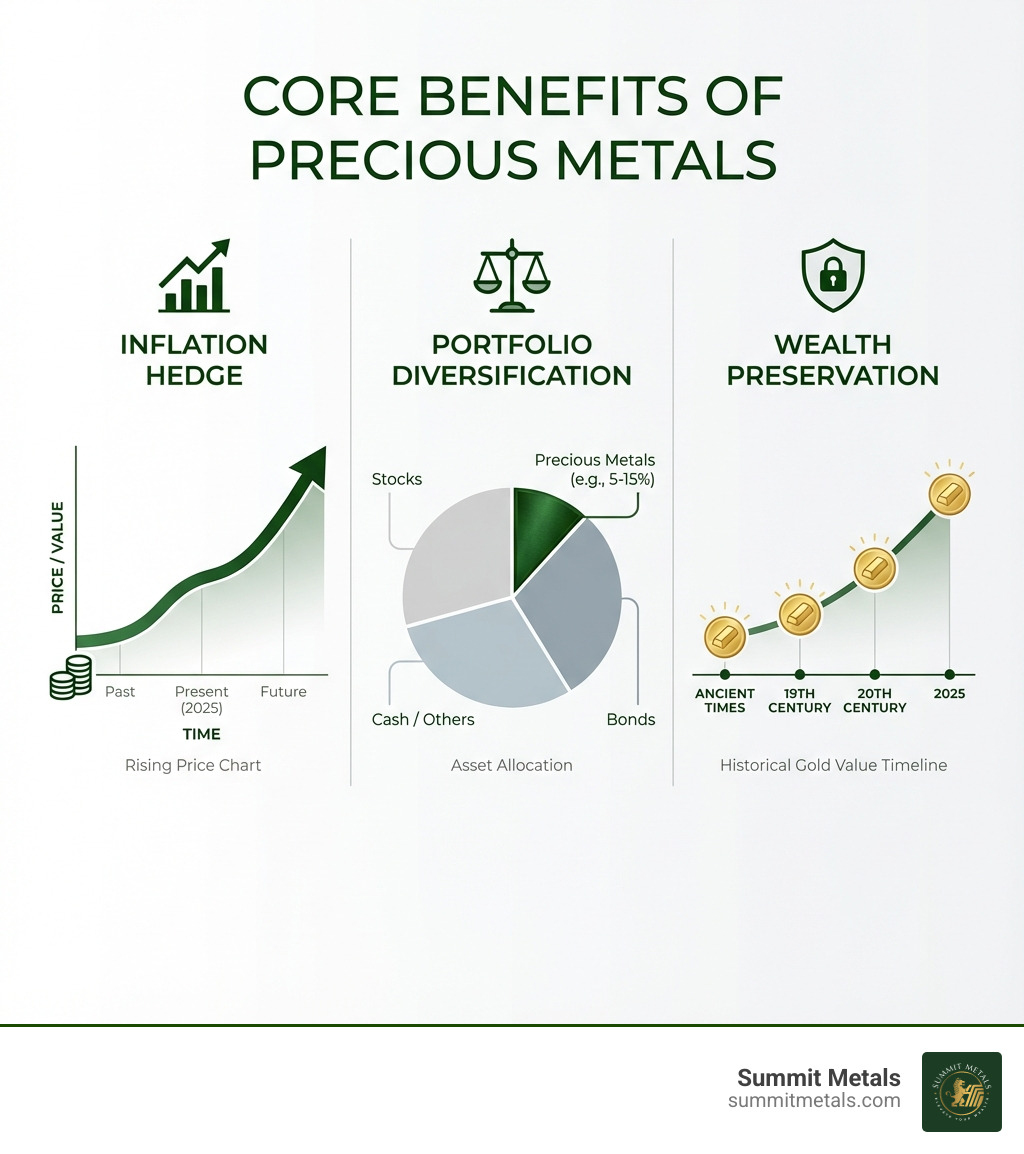

Gold and silver have preserved wealth for centuries as paper currencies have failed. However, the precious metals market can feel intimidating, especially when protecting savings from inflation and market volatility. In recent years, gold has hit all-time highs, rewarding investors who understood how to steer the market without getting overcharged.

The main challenge is that retail precious metals dealers are not federally regulated. This can lead to massive spreads, hidden commissions, and even outright fraud.

This guide cuts through the complexity. You'll learn how to buy physical gold and silver at fair prices, sell for maximum value, and avoid the red flags that cost uninformed investors thousands. Whether you're seeking portfolio insurance, building generational wealth, or want the security of a tangible asset, understanding these transactions is your first step toward confident investing.

Why Invest in Gold and Silver?

Investing in gold and silver is a time-tested strategy for wealth protection. These precious metals serve as effective hedges against inflation, provide portfolio diversification, and act as a tangible store of value when traditional markets falter. Their performance often has a low correlation with stocks and bonds, helping to balance your overall portfolio during economic uncertainty.

For a deeper dive, explore How to Invest in Precious Metals: A Safe Haven in Uncertain Times and Why Gold and Silver: Understanding Their Value as Safe Haven Assets.

Gold vs. Silver: Key Differences for Investors

While both are valuable, gold and silver have unique traits. Understanding them is crucial to buy and sell gold and silver effectively.

- Gold: Often seen as the more conservative choice, gold is a quintessential safe-haven asset with lower price volatility. Its value is driven by investment demand and macroeconomic factors. Because of its high value per ounce, significant investments require less storage space.

- Silver: Silver has a dual role as an investment and an industrial metal. Its extensive use in industry can lead to higher price volatility but also offers greater potential for appreciation. Its lower price point makes it more accessible, though larger investments require more storage.

The gold-to-silver ratio, which tracks how many ounces of silver it takes to buy one ounce of gold, is a key metric for gauging their relative value.

Gold vs. Silver: Investment Benefits

| Feature | Gold | Silver |

|---|---|---|

| Price Stability | Higher (less volatile) | Lower (more volatile) |

| Liquidity | Very high | High |

| Storage Needs | Lower (higher value density) | Higher (lower value density) |

| Minimum Investment | Higher | Lower (more accessible) |

| Primary Driver | Investment demand, safe haven | Industrial demand, investment |

| Inflation Hedge | Excellent | Excellent |

| Portfolio Diversification | Excellent | Excellent |

| Industrial Use | Limited | Extensive |

| Potential for Capital Appreciation | Steady, long-term | Higher, more speculative |

Physical Metals: The Smart Choice for Investors

While ETFs and mutual funds offer exposure to precious metals, owning physical gold and silver is the smart choice for many investors. Physical metals provide tangible ownership, which eliminates counterparty risk—you aren't relying on a third party's financial stability. Unlike paper assets, physical metals are not registered securities and are not covered by the Securities Investor Protection Corporation (SIPC). If an ETF provider fails, your investment could be at risk. With physical metals, you hold your wealth in your hands.

For a detailed breakdown, see Physical Bullion vs. Gold/Silver ETFs: Pros and Cons. However, ownership requires secure storage and vigilance against scams. Always research before you buy and be wary of offers that seem too good to be true.

The Ultimate Guide on How to Buy and Sell Gold and Silver

Navigating the market to buy and sell gold and silver is straightforward with the right knowledge. This guide empowers you to make informed decisions, whether you're starting a collection or liquidating holdings.

Best Practices for How to Buy Gold and Silver

Precious metals are available in several forms:

- Coins: Government-minted bullion coins (e.g., American Eagles) are popular, liquid, and ideal for investment.

- Bars: Preferred for larger purchases, bars often have lower premiums per ounce.

- Rounds: Privately minted and similar to coins but without face value, offering competitive prices.

- Jewelry & Scrap: Generally not recommended for investment due to high markups (jewelry) or low resale value (scrap).

Our essential steps for buying:

- Research Prices: Always know the current spot price of gold and silver. Market data sites provide real-time prices.

- Choose Reputable Dealers: This is critical. Look for dealers with a proven track record and positive reviews. The U.S. Mint maintains a searchable database of sellers. At Summit Metals, we pride ourselves on transparency and competitive pricing. Learn more about How to Buy Gold and Silver Online Safely.

- Compare Premiums: Dealers add a premium over the spot price. Premiums are lower on generic bars than government coins, and volume discounts are common. Compare offers from several dealers.

- Verify Authenticity: Reputable dealers provide certificates or hallmarks.

- Use Dollar-Cost Averaging: Instead of trying to time the market, invest a fixed amount regularly. This strategy mitigates risk by averaging your purchase price over time.

- Factor in All Costs: Account for shipping, insurance, and any applicable taxes.

Autoinvest with Summit Metals

Consistency is key to building wealth. Our Autoinvest program helps you dollar-cost average your purchases effortlessly. Just like a 401k, you can set up monthly purchases with Summit Metals to build your portfolio automatically. It's a hands-off approach to smart investing. Find out How to Buy Gold and Silver Automatically.

Gold Coins vs. Gold Bars

| Feature | Gold Coins (e.g., American Eagles) | Gold Bars (e.g., 1 oz, 10 oz) |

|---|---|---|

| Face Value | Yes (legal tender, government-backed) | No |

| Recognizability | High (globally known) | Varies by refiner |

| Divisibility | Excellent (many fractional sizes) | Good (various weights) |

| Premium Costs | Generally higher | Generally lower per ounce |

| Fraud Protection | Strong (government anti-counterfeit features) | Good (assays and serial numbers) |

| Ideal For | Security, divisibility, ease of trade | Maximizing metal per dollar |

Highlight: Government-issued gold coins have a legal tender face value, providing an extra layer of security and recognizability. This government backing offers strong protection against fraud, making them a trusted choice for many investors.

Smart Strategies for How to Sell Gold and Silver

Knowing how to sell is as important as knowing how to buy.

- Know the Spot Price: This is your baseline for any buyback offer. Most dealers offer about 95% of spot for standard bullion.

- Get Multiple Quotes: Buyback offers vary based on a dealer's inventory and market demand. Get quotes from at least three sources.

- Online vs. Local Dealers: Online dealers like Summit Metals often offer competitive prices due to lower overhead and provide a clear selling process with insured shipping. Local coin shops (like those in Salt Lake City, Utah) offer immediate payment but may have slightly lower offers. For more insights, read Where Can I Sell My Gold Coins for Best Price?.

- Understand Dealer Needs: Dealers pay more for popular, in-demand items (like American Eagles) that they can resell quickly.

- Pack and Ship Securely: When selling online, follow the dealer's instructions for secure packaging and use their insured shipping labels.

- Avoid Common Mistakes: Don't make impulse sales, always research your items' value, and be wary of high-pressure tactics. See our guide on Beginner Gold and Silver Selling Mistakes and How to Avoid Them.

Maximizing Value: Understanding Price Determinants

To master how to buy and sell gold and silver, you must understand what drives their value beyond the metal itself. This includes spot price, premiums, and dealer margins.

Factors That Determine Buyback Prices

When selling, the offer you receive depends on several factors:

- Spot Price: The current market price of the metal is the foundation for all buyback offers.

- Dealer Inventory: A dealer with a surplus of an item may offer less, while one with low stock may offer more. This is why getting multiple quotes is vital.

- Market Demand & Product Popularity: Popular and liquid items like American Eagle coins typically fetch better buyback prices because they are easier for dealers to resell.

- Dealer Margins: A dealer's offer must cover their business costs and allow for a profit. Learn more about How Precious Metals Pricing Works.

Bullion vs. Numismatic: What's Your Metal Worth?

Understanding the difference between bullion and numismatic (collector) coins is critical for maximizing your return.

| Feature | Bullion (Coins/Bars) | Numismatic Coins |

|---|---|---|

| Value Basis | Primarily metal content (spot price) | Rarity, condition, historical significance |

| Premium | Low to moderate over spot | High, often far above melt value |

| Liquidity | Very high | Varies (niche market) |

| Target Buyer | Investors | Collectors, historians |

| IRA Eligibility | Generally eligible | Generally not eligible |

- Purity (Fineness): Higher purity (.999 or .9999 fine) means more value.

- Mint of Origin: Products from reputable mints (e.g., U.S. Mint, Royal Canadian Mint) are more trusted and liquid.

- Condition: For numismatic coins, condition is paramount. For bullion, significant damage can slightly reduce its value. Learn about The Value of Perfection: Graded Silver Eagles Explained.

Mitigating Risks and Managing Your Investment

Like any investment, precious metals carry risks. Understanding price volatility, storage, and the threat of scams is key to protecting your assets.

Safe Storage and Avoiding Scams

Physical ownership requires secure storage.

- Home Storage: Offers immediate access but carries risks of theft or loss. A high-quality, bolted-down safe is recommended.

- Third-Party Depositories: These specialized, insured facilities offer high-level security and are preferred for larger holdings. See our Guide to Storing All Types of Silver.

Avoiding Scams: The precious metals market attracts fraudsters. Protect yourself with these tips:

- Be Skeptical: Ignore unsolicited offers and high-pressure sales tactics.

- Verify Dealers: Check a dealer's reputation with the Better Business Bureau.

- Get It in Writing: Demand a written agreement detailing all fees and prices before committing.

- Watch for Red Flags: Beware of dealers pushing "semi-numismatic" coins at inflated prices or pressuring you into a Precious Metals IRA, a common target for fraud. The CFTC offers a Precious Metals Fraud Advisory.

For a complete guide, read How to Avoid Common Precious Metals Scams.

Understanding the Tax Implications of Selling

When you buy and sell gold and silver, you must consider taxes. The IRS classifies precious metals as "collectibles."

- Capital Gains Tax: Profits from selling metals held for more than a year are taxed at a maximum rate of 28%. Assets held for a year or less are taxed at your ordinary income rate.

- Reporting: Dealers may be required to issue a Form 1099-B for certain transactions.

- Consult a Professional: Tax laws are complex. We always recommend consulting a qualified tax professional for personalized advice, especially regarding state-specific laws (e.g., in Utah).

For more strategies, read A Practical Guide to Sell Gold & Silver Tax-Free.

Frequently Asked Questions about Gold and Silver Transactions

Here are quick answers to common questions about how to buy and sell gold and silver.

What's the difference between spot price and the price I pay?

The spot price is the raw market value of the metal. The price you pay is the spot price plus a premium, which covers the dealer's costs for minting, shipping, and business operations. This is explained in detail in Spot Price vs. Premium: How Precious Metals Pricing Works.

Is it better to buy coins or bars?

It depends on your goals.

- Coins: Offer high liquidity, recognizability, and added security from their legal tender status. They are great for divisibility.

- Bars: Generally have lower premiums per ounce, making them ideal for acquiring the most metal for your money.

For a deeper dive, see Bars or Coins: Your Ultimate Gold Investment Showdown.

How are gold and silver sales taxed in the US?

The IRS treats precious metals as collectibles.

- Long-Term Capital Gains (held >1 year) are taxed at a maximum of 28%.

- Short-Term Capital Gains (held <1 year) are taxed at your ordinary income rate.

Dealers may be required to report certain sales to the IRS. Due to the complexity, we strongly advise consulting a tax professional. Explore general strategies in A Practical Guide to Sell Gold & Silver Tax-Free.

Conclusion: Your Path to Confident Precious Metals Investing

Mastering how to buy and sell gold and silver means making informed decisions to protect and grow your wealth. By understanding the market, choosing reputable dealers, and managing risks, you can confidently use precious metals as a long-term hedge against uncertainty.

The key takeaways are to perform due diligence, compare offers, understand premiums, and prioritize secure storage. Knowledge is your most valuable asset.

As a trusted dealer, Summit Metals offers transparent pricing, competitive rates, and educational resources. Our Autoinvest program provides a convenient way to build your holdings consistently. We are committed to ensuring you feel secure in every transaction.

Ready to take control of your financial future? Explore our selling process or browse our selection of authenticated gold and silver to start your investment journey.