Why Precious Metals are a Cornerstone of Modern Investing

Precious metals buying is a critical strategy for investors seeking to protect their wealth from economic uncertainty. In an era of currency devaluation and market volatility, precious metals offer something most investments can't: intrinsic value. Unlike paper assets, gold and silver have maintained their worth for thousands of years.

Here are the essential steps for getting started:

- Choose your metal: Gold (stability), Silver (affordability), or Platinum (rarity).

- Select the form: Physical coins/bars vs. ETFs/certificates.

- Find a reputable dealer: Check BBB ratings and customer reviews.

- Understand pricing: Spot price + dealer premium = your cost.

- Plan storage: Home safe, bank deposit box, or professional vault.

- Consider dollar-cost averaging: Regular purchases reduce price volatility.

Gold has outperformed the S&P 500 in 2024, yet 99.9% of US households own less than one ounce. This gap presents an opportunity for investors who recognize precious metals as both a hedge against inflation and a safe-haven asset during downturns.

Whether diversifying a retirement portfolio or building an emergency fund, success requires understanding your options and buying from trusted sources. It's about knowing pricing, verifying authenticity, and planning for storage.

I'm Eric Roach. After a decade on Wall Street guiding Fortune-500 clients through billion-dollar transactions, I now focus on precious metals buying strategies for individual investors. I've seen how the right strategy—like a 42% silver gain that funded an early retirement—can transform a financial future.

Understanding Your Options: Types and Forms of Precious Metals

When it comes to precious metals buying, understanding your options is the first step to building a wealth protection strategy. Each metal and form serves a different purpose in your investment toolkit. Deciding how you want to own these metals is just as important as deciding which metals to buy.

Gold, Silver, and Platinum: The Big Three

Gold is the classic safe-haven asset. It holds its value during market crashes and currency devaluation because it has intrinsic value—its worth isn't dependent on a government's promise or a company's performance. Its resistance to corrosion also ensures its physical permanence.

Silver is both an investment and an industrial metal. Its affordability makes it accessible, while its use in solar panels and electronics creates industrial demand. This dual role means its price can be driven by both economic growth and investor demand for a safe haven, leading to higher volatility and potential.

Platinum and its rarer cousin, palladium, are primarily industrial metals. Their value is heavily tied to the automotive industry, where they are used in catalytic converters. With supply concentrated in just a few countries, they are subject to price swings based on industrial demand and geopolitical factors, making them a more cyclical investment than gold.

Physical vs. Paper: Choosing the Right Form for You

After choosing a metal, you must decide on the form: physical bullion or paper assets. This choice defines your ownership experience and risk exposure.

Physical bullion means you own real metal you can touch. Bullion coins like the American Gold Eagle are backed by governments and carry face values. This face value provides legal protection against counterfeiting, a security feature bars do not have. Mints like the Royal Canadian Mint use advanced Bullion DNA™ technology with micro-engravings to make their coins nearly impossible to fake. Coins are easily recognized and traded worldwide.

Bullion bars focus purely on metal content, making them a cost-effective way to acquire more ounces. A 10-ounce silver bar will have a lower premium than ten 1-ounce coins. However, larger bars can be less liquid than smaller, more recognizable coins.

Paper assets like ETFs and E-certificates offer exposure to metal prices without the need for physical storage. They trade like stocks, offering instant liquidity. However, this convenience comes with counter-party risk: you are trusting a third party to hold the metal for you. If the managing institution fails, your investment could be at risk.

Here's how these options stack up:

| Feature | Bullion Coins | Bullion Bars | ETFs |

|---|---|---|---|

| Ownership | You hold the real thing | You hold the real thing | You own shares in a fund |

| Premiums | Higher due to minting costs | Lower, especially larger bars | Just management fees |

| Liquidity | Excellent – recognized everywhere | Good, but large bars harder to sell | Excellent – trades like stocks |

| Storage | Your responsibility | Your responsibility | Fund handles it |

| Counter-party Risk | Minimal | Minimal | Present |

Many investors use a hybrid approach: physical bullion for long-term security and paper assets for short-term trading. Combining this with dollar-cost averaging through a service like Summit Metals' Autoinvest program allows you to build a position gradually while managing both risk and convenience.

The Ultimate Guide to Precious Metals Buying

Breaking down precious metals buying into manageable steps transforms it from an overwhelming task into a confident strategy. Let's walk through the three essential steps to becoming a savvy precious metals investor.

Step 1: Decoding Precious Metal Pricing

Understanding precious metals pricing is key to getting a fair deal. The price you pay is a combination of several factors.

- Spot Price: This is the baseline price for one troy ounce of a metal for immediate delivery, set by global markets like the London Bullion Market Association (LBMA).

- Bid-Ask Spread: Dealers have two prices: the "bid" (what they pay to buy from you) and the "ask" (what you pay to buy from them). The spread is their operating margin.

- Premium: This is the amount you pay above the spot price. It covers manufacturing, transportation, insurance, and the dealer's markup. Premiums are typically higher on a per-ounce basis for smaller items like 1-ounce coins compared to larger items like 10-ounce bars.

Prices are influenced by economic uncertainty, as investors flock to metals during downturns, a pattern confirmed by gold's performance during economic instability. Other factors include currency fluctuations, interest rates, and industrial supply and demand.

Step 2: Choosing a Reputable Bullion Dealer

Your choice of dealer can make or break your investment experience. A trustworthy dealer is a partner in building your wealth.

- Reputation: Look for dealers with a long history and significant sales volume. Companies like APMEX and JM Bullion have built trust over many years and billions in transactions.

- Reviews: Check Trustpilot and the Better Business Bureau (BBB). Read reviews to understand how a company handles issues.

- Transparent Pricing: A reputable dealer displays real-time bid and ask prices clearly on their website. If you have to call for a price, it's a red flag. At Summit Metals, we pride ourselves on this transparency.

- Product Selection: A wide selection from recognized sources like the U.S. Mint and Royal Canadian Mint indicates established, legitimate supply chains.

- Buyback Policies: A clear and fair buyback policy shows the dealer is interested in a long-term relationship. We make our process straightforward because we want to earn your business for life. Learn more about selling your precious metals to us.

Online dealers like Summit Metals often offer better pricing and selection due to lower overhead, while local shops provide face-to-face service. Banks offer another option, though often at higher prices.

Step 3: Smart Strategies for Precious Metals Buying

With a plan, you can build your portfolio effectively. The best strategies focus on consistency over market timing.

Dollar-cost averaging is our preferred strategy for most investors. By investing a fixed amount regularly (e.g., $200 monthly), you buy more ounces when prices are low and fewer when they are high. This approach smooths out volatility and lowers your average cost over time, removing the impossible task of timing the market.

Our Autoinvest subscription service makes this effortless. Similar to a 401(k) contribution, our Autopay program automatically purchases metals for you on a set schedule. It's a disciplined way to build wealth without constantly watching the market. More info about our Autopay subscription service.

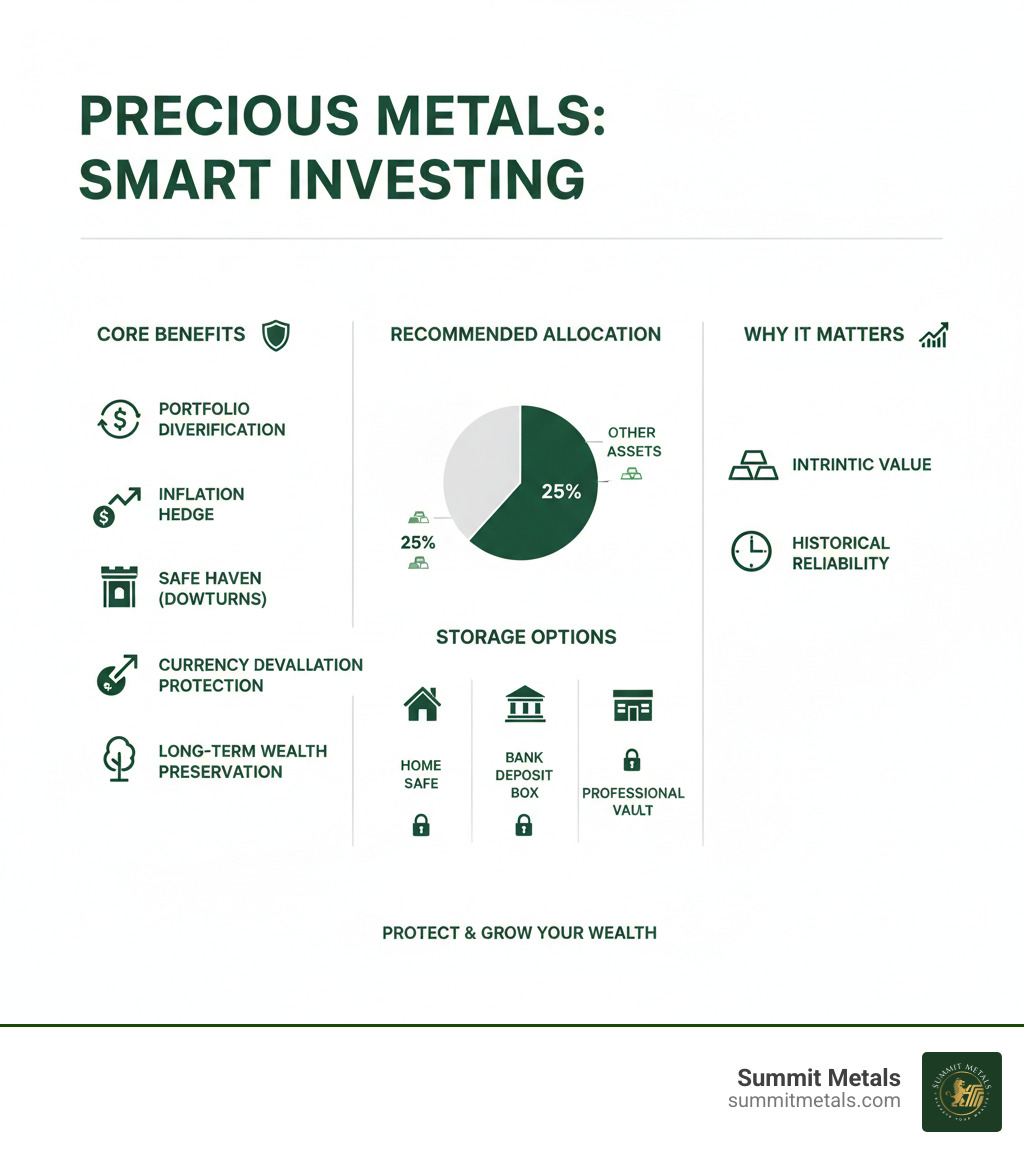

Other strategies include lump-sum investing, which is effective if you have significant capital and market conviction, and buying on dips, which requires patience and the discipline to act when prices fall. As for how much to buy, most experts suggest a 5-10% portfolio allocation to precious metals for meaningful diversification.

Securing Your Investment: Storage and Authenticity

Once your precious metals buying is complete, your responsibility shifts to verifying authenticity and ensuring secure storage. Physical possession offers control but requires vigilance to maintain long-term security and peace of mind.

Verifying Authenticity: How to Spot a Fake

Authentic bullion has several features that are difficult to replicate. Knowing what to look for is your first line of defense.

- Hallmarks and Purity Marks: Look for stamps indicating purity (e.g., "9999" for 99.99% pure) and weight. For gold, 24-karat also signifies 99.9% purity.

- Mint Marks and Serial Numbers: Coins from government mints (e.g., U.S. Mint, Royal Canadian Mint) carry official mint marks. Bars often have unique serial numbers for traceability.

- Security Features: Modern mints use sophisticated anti-counterfeiting technology. The Royal Canadian Mint’s Bullion DNA™ includes micro-engraved features that are nearly impossible to copy.

- Simple Tests: Real gold, silver, and platinum are not magnetic, so a strong magnet should have no effect. The ping test involves flicking a coin to listen for the distinct, sustained ring of authentic silver or gold.

For large investments or any doubt, professional assaying provides definitive purity analysis. The easiest way to avoid fakes is to buy from reputable sources like Summit Metals, where all products are authenticated.

Best Practices for Safe Storage

Choosing where to keep your metals depends on your holdings, need for access, and comfort with different security levels.

- Home Safe: A viable option for modest holdings. Choose a fire-resistant safe that is too heavy to be easily moved. Be aware that standard homeowner's insurance offers limited coverage for bullion; you will likely need a special rider.

- Bank Safety Deposit Box: This offers excellent security from theft and fire. However, access is limited to banking hours, and contents are not typically insured by the bank or FDIC.

- Third-Party Vaults: For substantial holdings, professional depositories offer military-grade security, climate control, and full insurance. You can choose between allocated storage, where your specific, segregated items are held in your name, and unallocated storage, where you own a share of a larger pool of metal. We strongly recommend allocated storage for true ownership and security.

Finding the right balance between security, accessibility, and cost is key to protecting your investment.

The Exit Strategy: Selling Your Precious Metals

While precious metals buying is for long-term preservation, a clear exit strategy is vital for realizing gains or accessing liquidity. With proper preparation, selling your assets can be a straightforward process.

Market timing is a factor, as metals often perform best during economic uncertainty, but trying to perfectly time a sale is nearly impossible. The buyback process is more predictable. Dealers will offer you the "bid" price, which is slightly below the current spot price, representing their operating margin.

One of the greatest advantages of precious metals is liquidity. Government-minted coins like Canadian Maple Leafs and American Eagles are recognized worldwide and can be converted to cash quickly.

Considerations for Selling Your Bullion

When you're ready to sell, a few key steps will ensure a smooth and profitable transaction.

- Find a Reputable Buyer: The same diligence you used to buy applies to selling. Online dealers often provide competitive rates, while local shops offer convenience. At Summit Metals, we pride ourselves on transparent and competitive buyback prices.

- Understand Buyback Prices: Get quotes from multiple buyers. The price will depend on the current spot price, the condition of your items, and the dealer's inventory needs.

- Provide Documentation: Purchase receipts, certificates of authenticity, and original packaging help verify provenance and can speed up the sale.

- Know the Tax Implications: Profits from selling precious metals are typically subject to capital gains tax. Metals held for over a year may qualify for a lower long-term rate. Consult a tax professional for advice specific to your situation.

- Secure the Transaction: For online sales, use the insured shipping labels provided by the dealer. For in-person sales, do not hand over your metals until payment is secured. Wire transfers are common for large sales.

At Summit Metals, our selling process is designed to be as transparent as our buying experience. Learn more about selling your precious metals to us and let us help you realize the full value of your investment.

Frequently Asked Questions about Precious Metals Buying

These are the common questions every investor asks when starting their precious metals buying journey. Here are the straightforward answers.

How much of my portfolio should I allocate to precious metals?

Most financial advisors recommend allocating 5-10% of your investment portfolio to physical precious metals. This range provides a meaningful hedge against inflation and market crashes without overexposing your portfolio to volatility. Your personal allocation depends on your risk tolerance and financial goals. A great way to start is with an automated plan like our Autoinvest program, which allows you to build a position over time through regular, disciplined purchases, much like a 401(k) contribution. Always consult with a financial advisor to integrate precious metals into your broader strategy.

What's the difference between a troy ounce and a regular ounce?

Understanding the unit of measurement is crucial. Precious metals are weighed in troy ounces, while most other goods use the standard (avoirdupois) ounce.

A troy ounce is about 10% heavier, weighing 31.1035 grams compared to the standard ounce's 28.3495 grams. All reputable dealers, including Summit Metals, price and sell metals in troy ounces. Ensure any price you see is for a troy ounce to guarantee accurate weight measurement.

What are the main costs in precious metals buying?

The total cost of precious metals buying includes several components. Reputable dealers are transparent about these fees.

- Spot Price: The base market price for the raw metal.

- Dealer Premium: An amount charged above the spot price to cover minting, shipping, insurance, and the dealer's profit. Premiums are typically higher for coins than bars due to more complex manufacturing.

- Shipping & Insurance: Often a flat fee, though many dealers like Summit Metals offer free shipping on qualifying orders. Insurance is essential.

- Storage Costs: Varies by method, from an annual fee for a bank box to a percentage of asset value for professional vaults.

- Taxes on Sale: When you sell for a profit, you will owe capital gains tax. This varies based on how long you held the metals and your income level.

At Summit Metals, we believe in transparent, real-time pricing and competitive rates. We'll never surprise you with hidden fees.

Conclusion: Start Your Precious Metals Journey with Confidence

Starting your precious metals buying journey is a decisive step toward financial security. We've covered the types of metals, pricing, storage, and selling to give you a clear roadmap. The enduring power of precious metals lies in their simplicity: they are tangible assets that provide diversification without complexity, holding their value through economic crises.

The most important step is choosing a trusted partner. At Summit Metals, our Wyoming-based business is built on transparency and competitive pricing. Our bulk purchasing power translates to better rates, and our real-time pricing means no hidden fees.

Consistency is key. Our Autoinvest program allows you to build your holdings steadily, turning small monthly contributions into a substantial portfolio over time. You're not just buying metal; you're buying peace of mind—assets that don't depend on government promises or corporate balance sheets. That's real financial security.

Your financial future deserves the stability that physical precious metals provide. Whether you're in Salt Lake City, Utah, or across the country, we are here to guide you.

Secure your financial future with a Precious Metals IRA and see how these time-tested assets can strengthen your retirement.