Why Understanding Silver Transactions Matters for Your Financial Future

Buying selling silver has become a cornerstone strategy for investors seeking to protect their wealth and diversify beyond traditional stocks and bonds. Whether you're a first-time buyer or an experienced seller, understanding how to steer silver transactions—from evaluating prices and authenticating products to choosing the right dealer and timing your exit—can mean the difference between a profitable investment and a costly mistake.

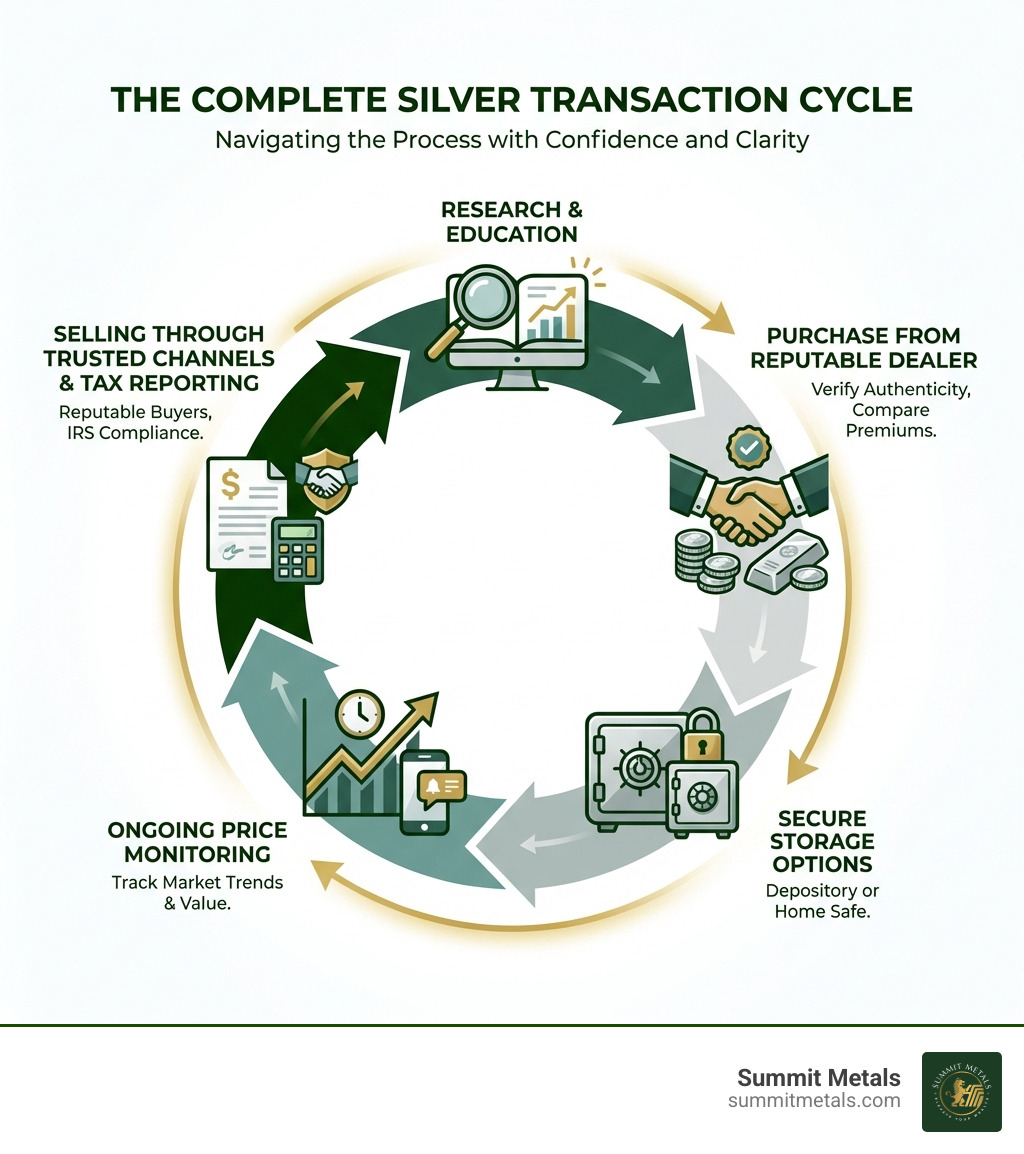

Quick Answer: The Essential Steps for Buying and Selling Silver

- Buying: Research current spot prices → Choose reputable dealers → Select your product type (coins, bars, rounds) → Compare premiums → Verify authenticity → Arrange secure storage

- Selling: Determine your silver's value → Shop multiple buyers → Understand IRS reporting requirements → Get quotes from reputable dealers → Complete the transaction securely

Throughout this guide, we'll walk you through every stage of the silver transaction process. You'll learn how to identify fair pricing, spot red flags that signal scams, understand the tax implications of your sales, and develop strategies that protect your investment from economic uncertainty. Silver has historically served as both an inflation hedge and a safe-haven asset during market volatility—but only if you know how to buy and sell it correctly.

I'm Eric Roach, and I've spent over a decade advising institutional and individual clients on precious metals as part of a disciplined wealth-protection strategy. My experience guiding Fortune 500 companies through complex hedging programs now helps everyday investors master the fundamentals of buying selling silver with confidence and clarity.

Must-know buying selling silver terms:

- how much is gold and silver selling for

- how to sell gold and silver tax free

- where to sell my silver

Why Invest in Silver? The Lure of the White Metal

Investors are drawn to silver for a multitude of compelling reasons, making it a popular choice for diversifying portfolios and safeguarding wealth. For centuries, precious metals like silver have served as an alternative to traditional investments such as stocks and bonds. When economic times get tough or the economy faces severe inflation, some investors wisely turn to silver to hedge their bets or to invest more defensively.

Here's why silver continues to captivate investors:

- Hedge Against Inflation: Many see silver, alongside other precious metals such as gold, as robust protection against inflation. For these investors, owning silver is a way to ensure they possess a currency that cannot be inflated away by excessive money printing or potentially destructive Federal Reserve policy. Silver's value tends to hold strong even as fiat currencies lose purchasing power.

- Safe-Haven Asset: During periods of economic uncertainty or geopolitical instability, silver often acts as a safe-haven asset. Its price tends to rise when traditional markets falter, as investors seek refuge in tangible assets. We've seen this in recent history; for instance, silver prices spiked in March 2023 following concerns about financial system stability.

- Portfolio Diversification: Silver's low correlation with other asset classes like stocks and bonds makes it an excellent tool for diversifying an investment portfolio. Adding silver can help reduce overall portfolio volatility and risk.

- Industrial Demand: Unlike gold, silver boasts extensive industrial applications, contributing significantly to its demand. It's a critical component in electronics, solar panels, medical instruments, and various other high-tech industries. This dual demand—from both investors and industry—provides a strong fundamental floor for its price. This industrial demand plays a crucial role in influencing its investment value, making it more sensitive to economic cycles than gold, which is primarily driven by investment demand.

- Affordability: Compared to gold, silver is significantly more affordable per ounce, allowing investors to acquire a larger quantity of metal for the same capital outlay. This makes it more accessible for smaller investors to enter the precious metals market.

- Store of Value: Silver has been recognized as a store of value for thousands of years. Its intrinsic worth is not dependent on the solvency of any government or financial institution, offering a timeless form of wealth preservation.

A Guide to Buying and Selling Silver: From Acquisition to Exit

How to Buy Physical Silver: Coins, Bars, and Rounds

Owning physical silver, whether as coins or bullion, offers a psychologically and emotionally satisfying way to invest. You have direct possession of your asset. At Summit Metals, we focus exclusively on authenticated physical silver, ensuring you receive a tangible asset you can hold and trust.

There are several methods available for purchasing physical silver, each with its own pros and cons:

-

Silver Bullion Coins: These are often the most popular choice for investors. They are minted by government entities and typically have a face value, making them legal tender (though their intrinsic silver value far exceeds their face value). Examples include the American Silver Eagle.

- Pros: Highly recognizable, easy to authenticate, often more liquid due to widespread acceptance, and their legal tender status can offer a layer of fraud protection.

- Cons: Generally carry a higher premium over the spot price compared to bars, especially in smaller denominations.

-

Silver Bullion Bars: Available in various sizes, from 1 ounce to 1,000 ounces. We find that larger bars, such as 10 oz and 100 oz, are very popular with our clients in Wyoming and Utah.

- Pros: Typically have lower premiums per ounce than coins, making them more cost-effective for bulk purchases. Efficient for storing significant wealth in a compact form.

- Cons: May require more sophisticated authentication when selling, and their larger size can make them less divisible for smaller transactions.

-

Silver Rounds: These are privately minted, circular pieces of silver that resemble coins but do not have a face value and are not legal tender. They come in various designs and sizes, often 1 troy ounce.

- Pros: Can offer lower premiums than government-minted coins.

- Cons: Less recognizable than official coins, which might slightly affect liquidity or require more trust in the seller.

-

"Junk Silver" (Pre-1964 U.S. Coins): These are U.S. dimes, quarters, and half-dollars minted before 1964, which contain about 90 percent silver. These coins are purchased for their silver content rather than their numismatic value.

- Pros: Easily recognizable, widely available, and offer a way to acquire fractional silver. You are literally holding history!

- Cons: The silver content is not 100%, and they are typically sold at a premium over their melt value. Be cautious if you're buying collectible coins, since you’ll likely pay extra for the collectibility of the coin, meaning that you’re overpaying for the actual silver content.

When considering your options, a common question arises: coins or bars?

Silver Coins vs. Silver Bars

| Feature | Silver Coins | Silver Bars |

|---|---|---|

| Recognizability | High (government-minted, specific designs) | Variable (depends on refiner, less common) |

| Legal Tender | Yes (has a face value) | No |

| Fraud Protection | Legal tender status offers some protection | Authenticity relies on refiner/dealer trust |

| Divisibility | Excellent for small transactions (e.g., 1 oz) | Less divisible, better for larger sums |

| Premium over Spot | Generally higher | Generally lower, especially for larger bars |

| Storage Space | Requires more space per dollar value | More efficient for bulk storage |

| Best For | Liquidity, smaller investments, gifts | Bulk investment, lower cost per ounce |

Why Physical Silver Matters: Tangible Ownership with Summit Metals

At Summit Metals, we believe in the power of tangible assets. We specialize in providing authenticated physical silver in the form of coins, bars, and rounds. This means you gain direct control over your investment, free from counterparty risk often associated with "paper" silver products like ETFs or futures contracts. Our focus is squarely on real, tangible assets you can hold, store securely, and pass down through generations. For us, physical ownership isn't just a preference; it's a foundational principle for secure wealth preservation.

Strategies for Getting the Best Price When Buying and Selling Silver

Getting the best price for your silver, whether you're buying or selling, involves a combination of market awareness and smart shopping.

- Understand the Spot Price: The current spot price of silver is the baseline. This is the real-time market price for one troy ounce of pure silver available for immediate delivery. Websites like Kitco, Bloomberg, or CNBC provide real-time prices. Always know this price before engaging in any transaction.

- Compare Premiums: Dealers add a "premium" to the spot price when selling, and deduct a discount when buying back. This premium covers their costs for fabrication, shipping, storage, insurance, and profit. Always compare premiums from different dealers. Our commitment at Summit Metals is to offer competitive rates, leveraging our bulk purchasing power to keep your costs down.

- Consider Bulk Purchases: Buying larger quantities of silver typically comes with volume discounts. For instance, the premium on 100 ounce bars is lower than the premium on one ounce bars, which presents a lower cost by ounce. If you have the means and storage capacity, buying larger bars, like our 100 oz silver bars, can be more cost-effective per ounce.

- Explore Secondary Market Products: Secondary market silver products, such as bars or coins sold by individual sellers or through auctions, may have lower premiums compared to brand new items. However, ensure the silver's authenticity is verified, especially if buying from non-dealer sources.

-

Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of the asset's price. This averages out your purchase price over time, reducing the risk of buying all your silver at a market peak. We strongly advocate for this systematic approach.

- Autoinvest with Summit Metals: We make dollar-cost averaging simple and effective. You can set up recurring monthly purchases with Summit Metals just like investing in your 401k. This allows you to consistently grow your silver holdings without constantly monitoring the market.

- Factor in Additional Costs: Remember to account for shipping, insurance, and potential taxes when calculating your total cost. Reputable dealers will be transparent about these fees.

Risks and Secure Storage Solutions

While buying selling silver offers significant benefits, be aware of the associated risks and plan for secure storage.

- Price Volatility: Silver's price can be more volatile than gold due to its dual role as both a precious metal and an industrial commodity. This means its value can fluctuate more significantly, offering potential for higher returns but also higher risk.

- Theft Risk: Physical silver, like any tangible asset, is subject to theft. You'll have to safeguard it carefully.

-

Storage Solutions:

- Home Safes: A common choice for smaller quantities. Ensure your safe is properly secured and fire-resistant. Be aware that homeowners insurance may not cover home-stored silver investments, so check your policy and consider a separate rider if necessary.

- Bank Safety Deposit Boxes: Offer a secure, off-site storage option. However, access is limited to bank hours, and they typically do not provide insurance for contents.

- Private Vault Storage: For larger investments, private, insured vault facilities offer maximum security and discretion. This option can also provide greater liquidity upon sale, as many dealers have established relationships with these facilities, allowing for seamless transfers.

- Sell to Us: Store with Summit Metals and enjoy a seamless, liquid exit strategy when you're ready to sell. We understand that your exit strategy is as important as your entry. Our secure storage options are designed to integrate smoothly with your future selling needs, making the process efficient and stress-free.

Silver vs. Gold: Which Metal Shines Brighter for You?

The choice between silver and gold is a common dilemma for precious metals investors. Both offer unique advantages, and the "better" option often depends on your individual investment goals, risk tolerance, and market outlook.

- Affordability: Silver is significantly more affordable per ounce than gold. This allows investors to acquire a larger physical quantity of metal for the same capital, offering greater accessibility for smaller investors.

- Volatility: Gold typically exhibits lower price volatility compared to silver, making it a more conservative option for investors seeking stability. Silver, on the other hand, can experience more significant price fluctuations due to its dual role as both a precious and an industrial metal. This higher volatility can mean greater potential for capital appreciation, but also higher risk.

- Industrial vs. Investment Demand: Gold's value is primarily driven by investment demand and macroeconomic factors, making its price less dependent on industrial cycles. Silver's extensive industrial applications mean its price is more influenced by the health of manufacturing and technology sectors.

- Gold-to-Silver Ratio: This ratio measures how many ounces of silver it takes to buy one ounce of gold. Historically, when the ratio is high, silver is considered undervalued relative to gold, and vice versa. Monitoring this ratio can help inform your buying decisions.

- Storage Space: Gold's higher value density means a smaller physical footprint for the same dollar amount. Silver, being less dense and less valuable per ounce, requires more storage space for a significant investment.

- Market Size: The gold market is substantially larger than the silver market, which can contribute to gold's relative price stability and liquidity.

Silver vs. Gold on Key Metrics

| Metric | Silver | Gold |

|---|---|---|

| Cost per Ounce | Lower | Higher |

| Volatility | Higher | Lower |

| Industrial Use | Significant | Limited |

| Primary Role | Industrial & Investment | Primarily Investment |

| Storage Efficiency | Requires More Space | More Compact Value |

Gold Coins vs. Gold Bars

| Feature | Gold Coins | Gold Bars |

|---|---|---|

| Recognizability | High (government-minted, specific designs) | Variable (depends on refiner, less common) |

| Legal Tender | Yes (has a face value) | No |

| Fraud Protection | Legal tender status offers some protection | Authenticity relies on refiner/dealer trust |

| Divisibility | Excellent for small transactions (e.g., 1 oz) | Less divisible, better for larger sums |

| Premium over Spot | Generally higher | Generally lower, especially for larger bars |

| Storage Space | Requires more space per dollar value | More efficient for bulk storage |

| Best For | Liquidity, smaller investments, gifts | Bulk investment, lower cost per ounce |

The Art of Selling Silver: Maximizing Your Returns

When the time comes to sell your silver, having a clear exit strategy is crucial. Just as with buying, a well-informed approach can help you maximize your returns and ensure a smooth transaction.

Where to Sell Your Silver for the Best Value

You have several avenues for selling your silver, each with its own advantages:

- Online Dealers: Reputable online silver dealers offer convenience and often competitive pricing. They typically provide quotes online or via phone. We at Summit Metals pride ourselves on offering transparent, real-time pricing for your silver.

- Local Coin Shops and Precious Metals Dealers: For those in Wyoming or Utah, local dealers can provide a direct, in-person selling experience. You can often get immediate cash or a check.

- Refineries: If you have a large quantity of scrap silver or unrecognized bullion, a refinery might be an option. They will melt down and assay your metal, paying you based on its pure silver content.

- Peer-to-Peer Sales: Selling directly to another individual through online forums or local meetups can sometimes fetch a higher price, as you cut out the dealer's margin. However, this method carries higher risks regarding authenticity, payment security, and personal safety.

Importance of an Exit Strategy: We always advise our clients to consider their exit strategy from the outset. Where will you store your silver? How easily can you access it when you decide to sell? Storing your precious metals in a secure private vault can significantly improve liquidity upon sale, as many dealers have established systems for transacting metals held in such facilities.

Sell to Us: Summit Metals offers a transparent, secure, and competitive process for selling your silver. Our aim is to make your selling experience as straightforward and profitable as your buying experience. We provide clear pricing and ensure a professional, trustworthy transaction every time.

Identifying Reputable Dealers and Avoiding Scams

The precious metals market, unfortunately, attracts its share of unscrupulous operators. When buying selling silver, due diligence is paramount.

- Check for Secure Websites: Always look for "https:" in the URL, indicating a secure connection. Legitimate online dealers will invest in website security.

- Verify Reputation: Check for reviews on platforms like the Better Business Bureau (BBB), Google, Yelp, and Reddit. Look for consistent positive feedback and how the dealer responds to any complaints. A long-standing, positive reputation is a strong indicator of trustworthiness.

- Look for Trust Seals: Reputable online dealers often display trust seals from organizations like the BBB, DigiCert, Norton, or McAfee.

- Transparent Pricing: A trustworthy dealer will clearly display their pricing, including premiums, and lock in prices for a reasonable period once you commit to a transaction.

- Avoid High-Pressure Tactics: Be wary of dealers who pressure you into making a quick decision, refuse to answer questions, or discourage you from comparing prices.

- Red Flags on Social Media/Forums: When dealing with individuals, exercise extreme caution. Scammers often use newly created accounts with few followers, respond instantly with generic messages, or use phrases like "My relative will pick it up." They may also ask for personal information or payment details upfront without establishing trust. Report suspicious activity to platform moderators.

At Summit Metals, transparency and trust are our core values. We provide authenticated metals and clear, real-time pricing to ensure your confidence in every transaction.

Understanding Tax Implications When Buying and Selling Silver

Navigating the tax landscape for buying selling silver is an important part of responsible investing. In the U.S., profits from the sale of precious metals are generally subject to capital gains tax.

- Capital Gains Tax: If you sell silver for more than you paid for it, the profit is considered a capital gain. For most individuals, precious metals are considered "collectibles" by the IRS. Long-term capital gains (for assets held over a year) on collectibles are typically taxed at a higher rate than other long-term capital gains, often up to 28%. Short-term capital gains (for assets held a year or less) are taxed at your ordinary income tax rate.

- IRS Form 1099-B: Dealers are required to report certain sales to the IRS. For silver, this includes sales of any combination of 90% silver U.S. coins with a face value of over $1,000, and 0.9999 fine silver bars totaling over 1,000 troy ounces. If your sale meets these thresholds, the dealer will issue a Form 1099-B to both you and the IRS.

- Record Keeping: It is crucial to maintain meticulous records of all your precious metals purchases and sales, including dates, purchase prices, sales prices, and any associated fees. This documentation will be essential for accurately calculating your gains or losses and fulfilling your tax obligations.

- Consult a Tax Professional: Tax laws can be complex and are subject to change. We always recommend consulting with a qualified tax professional to understand the specific implications for your individual situation. They can provide personalized advice and ensure you comply with all reporting requirements.

Frequently Asked Questions about Buying and Selling Silver

What's the difference between the spot price and the retail price of silver?

The spot price is the current market price for one troy ounce of pure silver available for immediate delivery. It's the raw value of the metal. The retail price, on the other hand, is what you pay a dealer. It includes the spot price plus a "premium." This premium covers the dealer's costs for fabricating, shipping, authenticating, storing, and insuring the silver, as well as their operational expenses and profit margin. So, while the spot price is your benchmark, the retail price is the actual cost of acquiring the physical metal.

Is it better to buy silver coins or bars?

The "better" choice depends on your specific goals. Silver coins, especially government-minted ones like the American Silver Eagle, offer high recognizability, are easy to authenticate, and their legal tender status can provide a layer of fraud protection. They are also highly liquid and easy to sell in smaller amounts. However, they generally carry a higher premium over the spot price. Silver bars, particularly in larger sizes (e.g., 10 oz or 100 oz), typically have lower premiums per ounce, making them more cost-effective for bulk investments. They are more efficient for storing significant value but may require more effort to authenticate when selling. For smaller, more liquid holdings, coins are often preferred; for maximizing ounces per dollar, bars are usually the way to go.

Do I have to pay taxes when I sell silver?

Yes, generally, profits from selling silver are subject to capital gains tax in the U.S. If you sell your silver for more than you originally paid, that profit is considered a capital gain. For tax purposes, silver is classified as a "collectible," meaning long-term capital gains (for silver held over a year) can be taxed at a higher rate, up to 28%. Short-term gains (for silver held a year or less) are taxed at your ordinary income tax rate. Furthermore, sales exceeding specific thresholds (e.g., over $1,000 face value for 90% U.S. silver coins or over 1,000 troy ounces for fine silver bars) must be reported by the dealer to the IRS on Form 1099-B. Always keep detailed records of your purchases and sales, and consult with a tax professional for personalized advice.

Conclusion: Your Next Move in the Silver Market

Navigating the buy and sell waves of the silver market requires knowledge, strategy, and a trusted partner. We've explored why investors are drawn to silver, the various ways to acquire and sell physical metal, how to optimize your pricing, and the crucial considerations around storage and taxes. The journey of buying selling silver is a powerful way to diversify your portfolio and protect your wealth against economic uncertainties.

Due diligence is your best friend. Research current prices, understand premiums, and always verify the reputation of your dealer. For a seamless and secure experience, consider working with a trusted dealer like Summit Metals. We are committed to providing transparent pricing and authenticated metals, ensuring you receive genuine value for your investment.

Ready to take the next step in your precious metals journey? Explore our blog for more insights on selling gold and silver or contact us directly to discuss your investment goals.