Why Understanding the 1 oz of Pure Gold Price Matters Now

The 1 oz of pure gold price is the key benchmark for precious metals investors. As of November 9, 2025, it stands at approximately $4,014.23 USD, reflecting gold's enduring role as a store of wealth amid economic uncertainty.

Quick Price Overview:

| Measurement | Current Price (USD) | 24-Hour Change |

|---|---|---|

| 1 oz Gold | $4,014.23 | +$29.97 (+0.75%) |

| 1 gram Gold | $129.06 | — |

| 1 kilo Gold | $129,060.49 | — |

Prices shown are at the time of this publication.

Throughout history, gold has been a currency, an inflation hedge, and a safe haven in crises. For modern investors, understanding what drives the 1 oz of pure gold price is essential for protecting retirement savings, diversifying portfolios, and finding stability.

This guide breaks down gold pricing, the factors moving the market, and how to make smart purchases. We'll compare bars and coins and show how strategies like dollar-cost averaging, available through Summit Metals' Autoinvest program, can help you build a position consistently—like a 401(k), but with the security of physical metal.

I'm Eric Roach. With over a decade in institutional investment banking, I now help everyday investors apply the same principles to protect and grow their wealth with physical gold and silver, ensuring a resilient financial strategy.

Understanding the Live 1 oz of Pure Gold Price

When you look up the 1 oz of pure gold price, you're seeing a real-time market rate. Let's decode the key terms so you know exactly what you're paying for.

What is the Spot Price vs. the Final Price?

The spot price is the current market rate for one troy ounce of raw gold, traded on major exchanges like COMEX. Think of it as the "wholesale" price, which updates constantly during market hours. You can track it using tools like the Gold Price chart by TradingView.

However, the spot price isn't what you pay for a physical product. The final price includes a premium, which covers the costs of turning raw gold into a finished coin or bar. This includes manufacturing, secure transport, and the dealer's operational costs. At Summit Metals, our bulk purchasing power keeps premiums competitive and transparent.

A key takeaway from our guide, Spot Price vs. Premium: How Precious Metals Pricing Works, is to be wary of scams. If anyone offers gold below spot price, it's almost certainly fraudulent. Real gold always costs the spot price plus a legitimate premium. Learn more about premiums in The Price of Shine: Understanding Your Bullion's Premium.

Decoding Bid, Ask, and Spread

You'll also encounter these terms:

- Bid Price: The price a dealer will pay you for your gold.

- Ask Price: The price you will pay the dealer to buy their gold.

- Spread: The difference between the bid and ask prices, representing the dealer's margin.

For example, if the spot price is $4,014.23, a dealer might bid $4,000 and ask $4,030. The $30 difference is the spread. A narrow spread usually indicates a competitive and liquid market.

What is a Troy Ounce?

The 1 oz of pure gold price refers to a troy ounce, the standard unit for precious metals. A troy ounce is 31.103 grams, about 11% heavier than a standard (avoirdupois) ounce of 28.35 grams. This global standard ensures consistency whether you're buying in Wyoming or Singapore.

For context, one kilogram contains approximately 32.15 troy ounces. This standardization creates transparency across the market, so you can confidently compare prices from any reputable dealer. For more on gold's properties, you can learn more about gold purity.

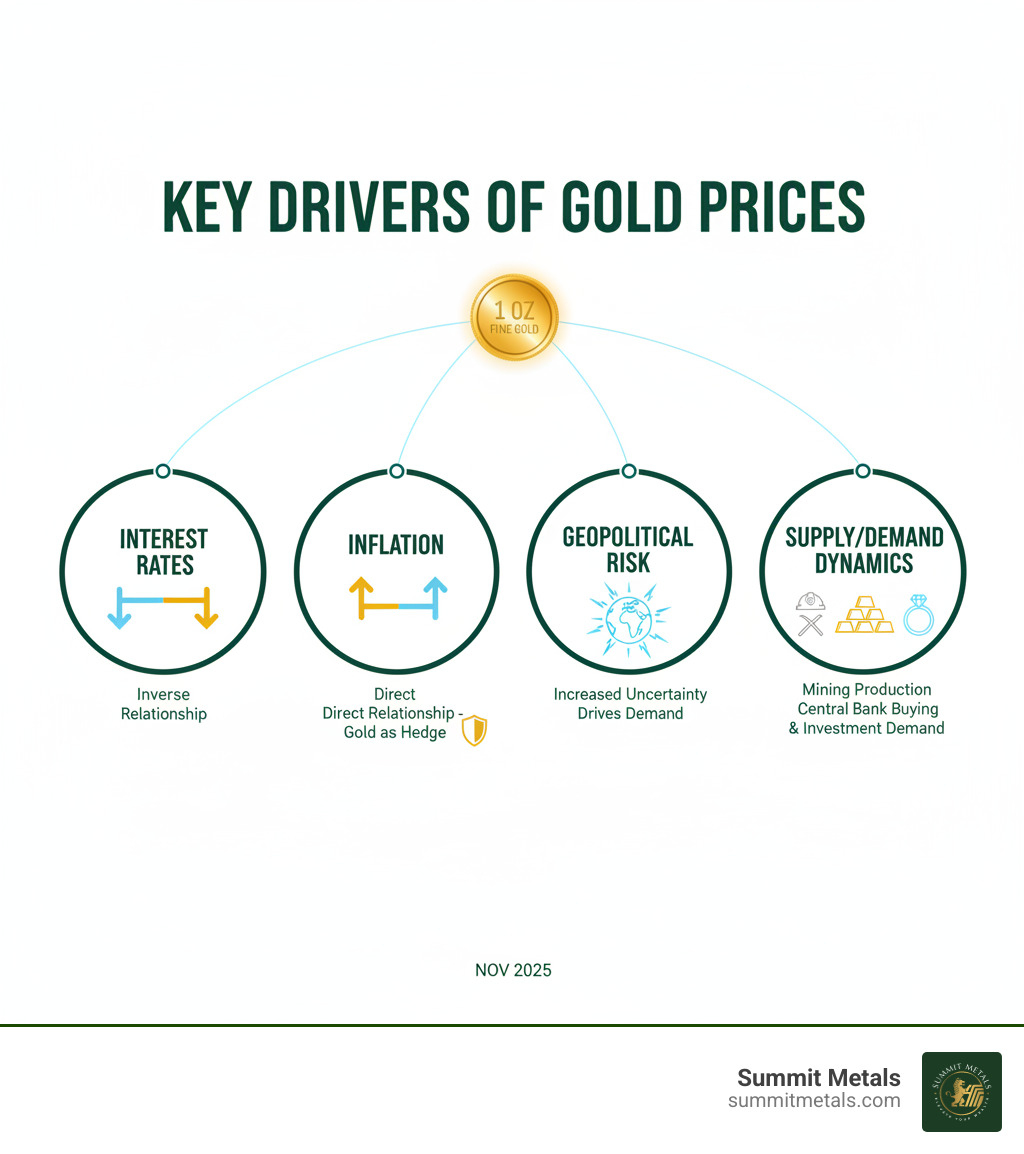

Key Factors Driving the Price of Gold

The 1 oz of pure gold price responds to a complex web of global forces. Understanding these drivers helps you see the bigger economic picture behind daily fluctuations.

Economic Indicators and Their Impact

Gold's value has a fascinating relationship with the broader economy.

- Inflation: When currencies like the dollar lose purchasing power, gold tends to hold its intrinsic value. It acts as a financial insurance policy against rising prices.

- Interest Rates: High interest rates make interest-paying assets like bonds more attractive, creating an "opportunity cost" for holding gold, which pays no dividend. Conversely, when rates are low, gold's appeal increases.

- Currency Devaluation: The gold price is typically quoted in US Dollars. A weaker dollar makes gold cheaper for foreign buyers, boosting demand and pushing the price higher. This inverse relationship is why many investors watch the Dollar Index. Learn more in The Declining Power of the US Dollar and Its Global Implications.

- Geopolitical Uncertainty: During times of political instability or conflict, investors flock to gold as a "safe-haven" asset. It's proven to be crisis insurance throughout history.

Global Supply and Demand Dynamics

The physical supply of gold is limited, which fundamentally supports its value.

- Mining Production: New gold supply is constrained by the expensive and difficult process of mining and refining. Disruptions can tighten supply and raise prices.

- Central Bank Activity: When central banks buy gold, it signals a lack of faith in other assets and boosts investor confidence in gold. We explore this in Why Central Banks Buy Gold (and Why You Should Too).

- Jewelry and Industrial Demand: Jewelry represents a large portion of gold consumption, especially in India and China. Gold is also essential in electronics and medicine due to its unique properties.

- Investment Demand: This is the most volatile factor. When investors are fearful, they shift capital into gold, driving up the 1 oz of pure gold price. The World Gold Council tracks these trends in its report on gold demand.

Investing in 1 oz of Pure Gold: Bars vs. Coins

Once you're ready to buy based on the 1 oz of pure gold price, you'll face a key choice: bars or coins? Both are tangible stores of wealth, but they have distinct advantages. Your investment goals should guide your decision. For a deeper analysis, see our guide, Bars or Coins: Your Ultimate Gold Investment Showdown.

Choosing Your Form: The 1 oz of pure gold price for Coins vs. Bars

The best choice depends on what you value most: cost efficiency, verifiability, or the security of government backing.

| Feature | 1 oz Gold Coins | 1 oz Gold Bars |

|---|---|---|

| Premium | Generally higher due to minting costs and design. | Typically lower, offering more gold for your dollar. |

| Legal Tender Status | Yes (e.g., American Gold Eagle). Adds a layer of government backing and fraud protection. | No, bars are not legal tender. |

| Verifiability | Easy to verify due to standardized designs and global recognition. | Requires assay cards or testing for verification. |

| Stackability | Can be less efficient to stack due to protective capsules. | Excellent for efficient, high-density storage. |

| Fraud Protection | Sovereign backing provides strong protection against counterfeiting. | Relies on the refiner's and dealer's reputation. |

Gold bars are ideal for investors focused on accumulating the most gold for their money. They offer lower premiums and are highly efficient for storage.

Gold coins, however, offer unique benefits for their slightly higher premium. Their legal tender status provides a government guarantee, which is a powerful defense against fraud. Coins like the American Gold Eagle are instantly recognizable and trusted worldwide, making them extremely easy to sell or trade. For many, this peace of mind is well worth the cost.

Popular 1 oz Gold Coins and Their Value

Several 1 oz gold coins are investor favorites, with values that track the 1 oz of pure gold price.

- American Gold Eagle: The U.S. Mint's flagship coin, containing one troy ounce of gold. It's minted in durable 22-karat gold (91.67% pure) to resist scratches. Learn more in Everything You Need to Know About American Eagle Coins.

- Canadian Gold Maple Leaf: Known for its .9999 fineness (24-karat), this is one of the purest gold coins available.

- British Gold Britannia: Also minted in .9999 fine gold, this coin carries a sense of history with its iconic design.

The key difference between 22k and 24k coins is durability, not gold content. A 1 oz 22k Gold Eagle contains a full troy ounce of gold, plus alloys for strength.

Where to Buy and Associated Costs

A trustworthy dealer is crucial. At Summit Metals, we offer transparent, real-time pricing to investors from Salt Lake City, Utah, to across the nation. Our guide, Your Golden Compass: Navigating to a Reputable Gold Dealer, can help you choose.

Remember to factor in insured shipping and storage. For storage, options range from a home safe to professional vaults, as detailed in The Ultimate Guide to Gold and Other Precious Metals Storage.

Instead of trying to time the market, consider dollar-cost averaging. Summit Metals' Autoinvest program lets you buy gold automatically each month, similar to a 401(k). It's a disciplined way to build your holdings over time without the stress of market timing.

Gold's Performance and Strategic Investing

Gold's value is rooted in centuries of performance as a safe-haven asset. Understanding its historical track record and using disciplined strategies are key to achieving your financial goals.

A Look at the Historical 1 oz of pure gold price

Gold has a long history of delivering steady, reliable growth. From 1971 to 2022, it produced an average annual return of about 7.78%. The current price of $4,014.23 (as of November 9, 2025) is part of a long-term upward trend, with the price consistently breaking previous records.

More importantly, gold often thrives during economic recessions when other assets falter. During the 2008 financial crisis and the 2020 pandemic panic, gold proved its worth as financial insurance, gaining value while stock markets fell. This resilience is a core reason for its inclusion in a long-term portfolio. For more context, see A Brief History of Gold as Currency and Store of Value.

Smart Investment Strategy: Dollar-Cost Averaging with Autoinvest

Trying to time the market is a losing game. A smarter approach is Dollar-Cost Averaging (DCA): investing a fixed amount of money at regular intervals, regardless of the current 1 oz of pure gold price.

This simple strategy has powerful results. When prices are low, your fixed investment buys more gold; when prices are high, it buys less. Over time, this averages out your purchase cost and smooths out market volatility. It removes emotion from investing and promotes a consistent, disciplined habit.

Summit Metals makes this easy with our Autoinvest program. You can automate your physical gold purchases monthly, just like a 401(k) contribution. Set it up once and build your tangible wealth systematically, without the stress of watching daily price charts. It's institutional-grade discipline for the everyday investor.

Learn more in The Power of Dollar Cost Averaging in Gold and Silver Investments and explore our Autoinvest options to get started.

Gold's Role in a Diversified Portfolio

The most resilient portfolios are diversified. Gold is a crucial component because it often has a low or negative correlation to stocks and bonds. In plain English: when stocks fall, gold often rises. This makes it an exceptional hedge against market volatility.

While gold is the primary safe-haven, other precious metals like silver, platinum, and palladium play different roles, often tied more to industrial demand. Understanding the relationship between them, such as the gold-to-silver ratio, can help fine-tune your strategy. Learn more with The Gold and Silver Ratio: A Timeless Measure for Precious Metals Investors.

Gold isn't meant to replace your other investments but to complement them, providing stability and protection. Read more in Why Gold and Silver Are Essential for Portfolio Diversification.

Frequently Asked Questions about the 1 oz Gold Price

We hear common questions from investors in Salt Lake City, Utah, and across the country. Here are answers to the most frequent ones about the 1 oz of pure gold price.

Is it better to buy 1 oz gold bars or coins?

The "better" option depends on your goals.

- Gold bars are for efficiency. They have lower premiums, meaning you get more gold for your dollar, and are ideal for stacking.

- Gold coins offer security and liquidity. Government-issued coins like the American Gold Eagle are globally recognized and have legal tender status, which provides an extra layer of protection against fraud.

For a full comparison, see our guide How to Compare Gold Bars vs Gold Coins: 5 Factors to Consider.

How is "pure gold" defined for investment?

Investment-grade "pure gold" is typically 24-karat (.999 or higher fineness). However, some of the most popular coins, like the 1 oz American Gold Eagle, are 22-karat. They still contain exactly one troy ounce of pure gold, with alloys added for durability. You get the same amount of gold either way; the difference is in the coin's hardness. Learn more in our guide on Understanding Karats and Purity in Gold.

Can I track the live gold price on my phone?

Yes, and you should. The 1 oz of pure gold price moves constantly, and staying informed is key. Many financial websites and mobile apps provide live gold price tracking. For accurate, real-time data, use reputable sources like major financial news outlets or dedicated commodity tracking apps. You can find these by searching for "gold price tracker" in the Apple App Store or Google Play Store. This allows you to monitor trends, set alerts, and make informed decisions from anywhere.

Conclusion: Your Next Step in Gold Investing

Understanding the 1 oz of pure gold price is about more than a number—it's about recognizing gold's role as a time-tested store of value and a stabilizer for your portfolio. Gold is financial insurance against inflation and economic uncertainty.

At Summit Metals, we serve investors from Salt Lake City, Utah, to across the country with transparent, real-time pricing and authenticated precious metals you can trust. We believe in empowering you to make informed decisions.

Your next step can be simple. Instead of trying to time the market, consider a disciplined approach. Our Autoinvest program lets you build your holdings systematically by making automatic monthly purchases of physical gold, just like a 401(k). It's a smart, stress-free way to protect and grow your wealth.

Start your gold investment journey with our Autoinvest options today. Build your tangible wealth on autopilot and gain the peace of mind that comes with owning physical precious metals.