Why the 2026 1oz Silver Kookaburra Deserves Your Attention

The 2026 1oz silver kookaburra marks the 36th year of the Perth Mint's most beloved bullion series. Here's what you need to know:

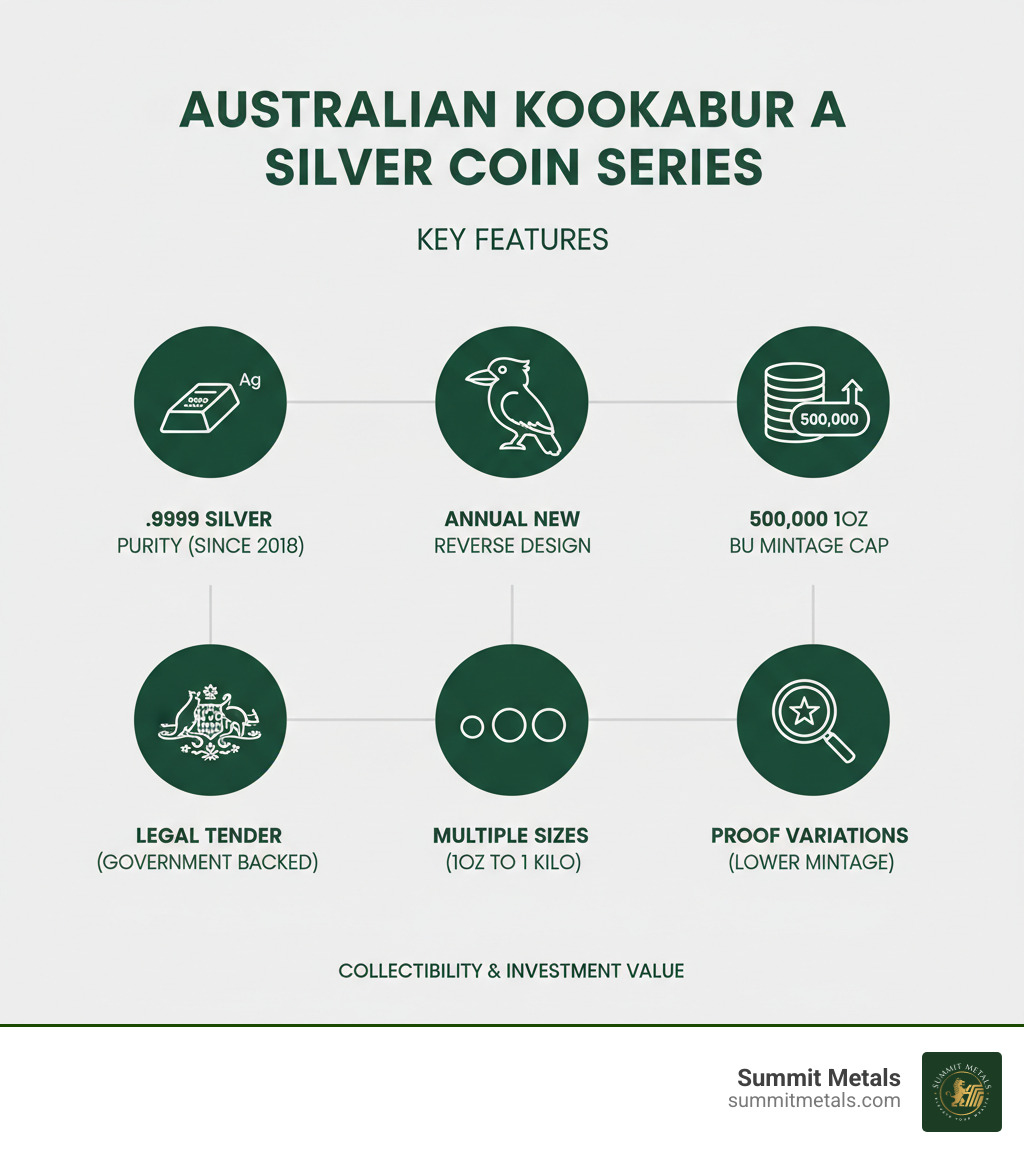

- Purity: .9999 fine silver

- Weight: 1 troy ounce

- Legal Tender: $1 AUD (Australian legal tender)

- Mintage Cap: 500,000 coins for the bullion version

- Design: New reverse design featuring the kookaburra bird; King Charles III obverse

- Availability: Expected release January-February 2026

- Sizes Available: 1oz, 10oz, and 1 Kilo bullion coins, plus proof variations

- IRA Eligible: Yes

Since 1990, the Perth Mint has released a new Silver Kookaburra design every year. This makes each release unique for collectors while maintaining strong investment value through its pure silver content.

The 2026 edition continues a tradition that dates back 36 years. Each coin combines government-backed purity guarantees with limited mintage—factors that historically drive both collector demand and long-term appreciation.

Why this matters for investors: The Kookaburra series offers something most silver bars don't—a face value backed by the Australian government. This legal tender status adds fraud protection and collectibility to your silver investment. While both contain the same amount of precious metal, the coin format provides additional security and potential numismatic value over time.

I'm Eric Roach, and during my decade advising Fortune 500 companies on hedging strategies and risk management, I've seen how physical precious metals serve as a resilient portfolio hedge—the same defensive tactics blue-chip companies use. Now I help individual investors apply that institutional approach to building wealth with coins like the 2026 1oz silver kookaburra, which combines pure silver content with collector appeal. The Kookaburra series has proven particularly effective for clients who use our Autoinvest program to dollar-cost average into silver each month, just like contributing to a 401(k).

Showing the 2026 1oz Silver Kookaburra: Design and Specifications

Every January, precious metals collectors around the world wait for the same thingthe Perth Mint's reveal of the latest Kookaburra design. It's become something of a tradition, like opening a present you know you'll love but haven't seen yet. The 2026 1oz silver kookaburra continues this 36-year legacy, combining museum-quality artistry with investment-grade silver.

These aren't just silver rounds with a bird stamped on them. Each Kookaburra coin represents the Perth Mint's commitment to creating miniature works of art that happen to contain exactly one troy ounce of .9999 fine silver.

The kookaburra itself is a large kingfisher species native to eastern and southern Australia. If you've ever heard one, you won't forget ittheir distinctive "laughing" call echoes through the Australian bush at dawn and dusk, sounding almost like human laughter. It's one of those sounds that defines a place, much like the call of a loon in northern lakes. The Perth Mint has been capturing this iconic bird in silver since 1990, and collectors have been chasing each new design ever since.

The All-New 2026 Kookaburra Reverse Design

The Perth Mint keeps the 2026 design under wraps until release, but based on 35 years of history, we know what to expectand it's always worth the wait. Each year brings a completely new depiction of the kookaburra, often perched on a eucalyptus branch or set against the rugged Australian outback.

This annual design change is what separates the Kookaburra series from most bullion coins. While American Silver Eagles and Canadian Maple Leafs maintain the same design year after year, the 2026 1oz silver kookaburra will feature artwork you've never seen before and will never see again. That's powerful for both collectors and investorsit creates genuine scarcity beyond just the silver content.

The numismatic artistry behind each release comes from some of Australia's finest coin designers. They study the bird's behavior, habitat, and character to create something fresh yet faithful to the series' heritage. Collector anticipation builds each year precisely because nobody knows what the next design will be until the Perth Mint makes their official announcement.

The Obverse: A Royal Transition

Flip the coin over, and you'll see history in the making. The 2026 Kookaburra features the effigy of King Charles III, designed by British sculptor Dan Thorne. This marks a significant transition from Queen Elizabeth II, whose portrait graced these coins for decades.

For those of us who've collected Kookaburras over the years, this royal changeover adds an extra layer of historical significance. Commonwealth coinage has carried Queen Elizabeth II's image since 1952, making her the most depicted person on currency in history. The shift to King Charles III represents a new chapter in modern coinage tradition.

The Thorne design presents a contemporary portrait that maintains the dignity of royal portraiture while feeling distinctly 21st century. It's a reminder that these coins aren't frozen in timethey evolve with the world around them while honoring centuries of Commonwealth tradition.

Key Specifications of the 2026 1oz Silver Kookaburra

Let's talk numbers, because specifications matter when you're putting real money into precious metals. The 2026 1oz silver kookaburra delivers exactly what serious investors look for in a bullion coin.

Each coin contains precisely 1 troy ounce of silverthat's 31.1 grams for those keeping track. This standardized weight makes valuation simple. When silver is trading at $25 per ounce, you know exactly what the metal content is worth.

The purity stands at .9999 fine silver, which is about as pure as silver gets without entering laboratory territory. The Perth Mint upgraded from .999 to .9999 purity in 2018, putting the Kookaburra series on par with the world's finest silver bullion. That fourth nine might seem small, but it demonstrates the mint's commitment to quality.

Here's something that separates coins from generic rounds: the $1 AUD face value. Yes, you could theoretically spend this coin at an Australian store for one dollar (though that would be spectacularly foolish given its silver content). What matters is the legal tender statusthis coin is backed by the Australian government. That government guarantee provides fraud protection you won't find with private mint products.

The mintage cap of 500,000 coins for the bullion version creates built-in scarcity. Compare that to American Silver Eagles, which often see annual mintages in the tens of millions. Lower mintage means higher potential for premium appreciation as the years go by and collectors seek specific years to complete their sets. This balance of investment-grade purity and collectible appeal is why silver coins from the Perth Mint are among the top choices for investors. If you're exploring other government-issued bullion options, you might also enjoy our article Beyond the Bullion: Exploring American Silver Eagles, which covers another cornerstone of silver investing.

Beyond the 1oz: The Complete 2026 Kookaburra Lineup

While the 2026 1oz silver kookaburra rightfully takes center stage, the Perth Mint understands that investors and collectors have different needs and budgets. That's why they've developed a complete product roundup of Kookaburra coins—each offering its own advantages depending on your investment goals and how much silver you're looking to acquire.

The Bullion Collection: 1oz, 10oz, and Kilo Coins

Think of the Perth Mint's bullion collection as offering three tiers of investment options, each with its own sweet spot. The 1oz coin is where most investors start their journey. It's the most accessible entry point, easy to store, and simple to liquidate if you ever need to convert back to cash. This is the coin we recommend for our Autoinvest program, where you can dollar-cost average by purchasing every month—just like contributing to a 401(k).

The 10oz coin strikes a nice balance for investors who want to accumulate more silver without managing dozens of individual coins. Here's where the economics start working in your favor: these larger coins typically carry a slightly lower premium per ounce compared to their 1oz counterparts. You're still getting the same .9999 fine silver and the same beautiful design, just in a more efficient package. If you're curious about the trade-offs between different sizes, our guide on Silver Stackers' Choice: Comparing 10 oz Bars and 1 oz Coins breaks down the pros and cons in detail.

For serious investors committed to bulk investing, the 1 Kilo coin (approximately 32.15 troy ounces) represents the most cost-effective way to purchase silver within the Kookaburra series. These impressive pieces offer the lowest premium per ounce, making them particularly attractive for stackers who want to maximize their silver acquisition at the most competitive rates. The size also makes quite a statement—there's something satisfying about holding a kilogram of pure silver featuring Australia's iconic laughing bird.

Each size serves a purpose. Smaller coins give you flexibility and divisibility—you can sell a few 1oz coins without liquidating your entire position. Larger coins give you efficiency—you're paying less overhead per ounce of actual silver. Many investors build a balanced stack using a combination of all three sizes.

The Collector's Choice: Proof and High-Relief Variations

Now, if you're someone who appreciates coins not just for their silver content but for their artistry, the Perth Mint's special releases will catch your eye. These aren't your standard bullion coins—they're created specifically for collectors who want something extraordinary.

Proof finish coins represent the pinnacle of minting craftsmanship. The Perth Mint strikes these multiple times using specially prepared dies and polished blanks, creating a stunning contrast between the mirrored background and the frosted, sculpted design elements. When light hits a proof coin, it's almost like the kookaburra comes alive on the surface. These coins also come with significantly lower mintages than the standard bullion versions, adding to their exclusivity and potential numismatic value.

High-relief coins take the artistry even further. These coins are struck with much greater depth than standard coins, giving the design a three-dimensional quality that you have to see to fully appreciate. They're often double-thick to accommodate the dramatic depth of the design, and their limited mintages make them genuine collector's items. Running your fingers over a high-relief coin reveals details that simply aren't possible with standard striking techniques.

These special releases cater to the numismatist in all of us—the part that appreciates the historical and artistic aspects of coinage as much as the intrinsic metal value. While Summit Metals focuses primarily on providing quality bullion for investors building wealth, we absolutely understand the appeal of these exquisite pieces. If you're interested in learning more about the difference between standard and proof coins, our article The Proof is in the Purchase: Finding Your Perfect Silver Eagle explores similar distinctions in another popular series.

Whether you're stacking bullion efficiently or building a collection of artistic treasures, the 2026 Kookaburra lineup offers something for everyone.

Investing in the 2026 Australian Kookaburra: Bullion vs. Numismatics

When you're building a precious metals portfolio, you'll eventually face an interesting question: should you focus on pure bullion, or should you invest in coins that carry collector appeal? The 2026 1oz silver kookaburra sits right in that sweet spot, offering something valuable to both types of investors.

Think of it this way: a silver bar is like owning a brick of pure value. A Kookaburra coin? That's the same brick, but with artistry, history, and government backing wrapped around it. At Summit Metals, we help our clients understand these differences so they can build portfolios that balance wealth preservation with growth potential.

| Feature | Kookaburra Coin | 1oz Silver Bar |

|---|---|---|

| Premium | Higher due to collectibility, mintage cap, and artistry | Lower, tracks closer to spot price |

| Security | Legal tender status offers fraud protection, recognized worldwide | Pure bullion, value tied to silver content |

| Collectibility | High, with annual design changes and 500,000 mintage cap | Low, valued primarily for metal content |

| Liquidity | Strong recognition from dealers and collectors globally | Excellent, easily traded with any bullion dealer |

| Storage | Often comes encapsulated for protection | Stackable, may require protective sleeves |

Why the 2026 1oz Silver Kookaburra is a Smart Investment

The 2026 1oz silver kookaburra delivers more than just good looks. It's a strategic choice for anyone serious about precious metals investing.

At its foundation, you're getting .9999 fine silver—that's about as pure as silver gets. This intrinsic silver value acts as your hedge against inflation and economic uncertainty. When paper currencies lose purchasing power, physical silver holds its ground.

But here's where it gets interesting. That 500,000 mintage cap creates genuine scarcity. Unlike generic rounds that mints can produce endlessly, the Perth Mint draws a hard line at half a million coins. This limited mintage drives collector demand and often leads to premium appreciation above the spot price of silver.

The annual design changes keep collectors coming back year after year. This isn't just speculation—there's a genuine numismatic community that actively seeks these coins. That collector base provides market support that generic bullion simply doesn't have.

Then there's the government guarantee. The 2026 1oz silver kookaburra carries legal tender status backed by the Australian government. This official recognition provides fraud protection and authenticity assurance that you don't get with private mint products. If you're wondering Is Silver a Good Investment, coins like the Kookaburra show exactly why the answer is yes.

Building Your Stack with Autoinvest

Here's a truth from my years advising Fortune 500 companies: the smartest investors don't try to time the market. They build positions consistently over time.

Dollar-cost averaging means investing the same amount on a regular schedule, regardless of whether prices are up or down. Some months you'll buy when silver is cheaper and get more ounces. Other months you'll pay a bit more. Over time, it averages out—and more importantly, it removes the emotional roller coaster from investing.

Our Autoinvest program makes this effortless for the 2026 1oz silver kookaburra and other silver products. Set it up once, and you're automatically building your stack each month, just like contributing to a 401(k). No need to watch spot prices or wonder if today's the right day to buy. You're simply accumulating silver consistently, month after month.

For our clients in Wyoming and Salt Lake City, Utah, this means building wealth without the stress. We leverage our bulk purchasing power to secure competitive rates, and our transparent, real-time pricing ensures you always know exactly what you're paying. The program handles the logistics while you focus on your long-term goals.

Think of it as putting your precious metals investing on autopilot. The market will have its ups and downs—it always does. But you'll keep building your position through all of it, which is exactly how institutional investors approach strategic assets. Learn more about The Power of Dollar Cost Averaging in Gold and Silver Investments and see why this strategy has worked for generations of successful investors.

Frequently Asked Questions about the 2026 Kookaburra

We love talking coins with our clients, and whenever a new release like the 2026 1oz silver kookaburra comes around, we hear some fantastic questions. Let's tackle the most common ones we've been getting.

What is the mintage of the 2026 1oz Silver Kookaburra?

The standard bullion version of the 2026 1oz silver kookaburra will be capped at 500,000 coins. That might sound like a lot, but in precious metals, it's actually quite limited. This cap is a key factor that makes the Kookaburra series so appealing to both collectors and investors.

Think about it this way: once the Perth Mint reaches that 500,000 mark, no more 2026 bullion Kookaburras will ever be produced. This built-in scarcity helps support the coin's collectibility and long-term value potential. The cap creates a natural supply constraint that can drive demand, especially as older issues become harder to find.

Now, if you're eyeing the special editions—like the proof or high-relief variations—those come with even tighter restrictions. These collector-focused releases typically have mintages well below the standard bullion version, making them considerably more exclusive and potentially more valuable from a numismatic standpoint.

Is the 2026 Kookaburra coin IRA-eligible?

Yes, and we get asked this question a lot! The 2026 1oz silver kookaburra meets all the requirements for inclusion in a Precious Metals IRA. The coin's .9999 fine silver purity and its production by a recognized government mint (the Perth Mint) make it eligible under IRS guidelines.

This means you can hold these beautiful coins as part of your retirement savings strategy, adding a tangible, physical asset to your long-term financial planning. Many of our clients appreciate having real silver they can see and touch as part of their retirement portfolio, rather than just numbers on a screen.

We've helped countless investors steer the process of setting up and funding Precious Metals IRAs. If you're interested in learning more about how the Kookaburra and other eligible coins can fit into your retirement strategy, we've put together a comprehensive guide on Maximizing Retirement Security Using a Precious Metals IRA to Invest in Gold and Silver with Summitmetals.com.

Where can I buy the 2026 1oz Silver Kookaburra?

When the 2026 1oz silver kookaburra hits the market, you'll want to purchase from reputable online bullion dealers who guarantee authenticity and offer transparent pricing. This isn't just about getting a good deal—it's about protecting yourself from counterfeits and ensuring you're paying a fair market rate.

Here at Summit Metals, we've built our reputation on exactly these principles. We offer transparent, real-time pricing so you always know what you're paying, and our competitive rates come from our bulk purchasing power. We pass those savings directly to you, our clients. There's no smoke and mirrors, no hidden fees—just straightforward, honest pricing on authenticated precious metals.

We also understand that not everyone wants to make a single large purchase. That's where our Autoinvest program comes in handy. You can set up regular, automated purchases of the 2026 1oz silver kookaburra or other silver products, building your stack consistently over time. It's like contributing to your 401(k), but for physical silver. This dollar-cost averaging approach helps smooth out market volatility and makes silver investing accessible regardless of your budget.

If you're new to buying precious metals online or just want to sharpen your skills, we've created a helpful resource: Don't Get Fleeced: Finding the Most Reputable Online Silver Coin Dealers. It walks you through what to look for in a dealer and how to avoid common pitfalls. For a broader overview of the buying process, check out Your Ultimate Guide to Buying Silver Coins Online.

Conclusion: Secure Your Piece of Australian Heritage

The 2026 1oz silver kookaburra represents more than just another bullion coin—it's a piece of living history. This 36th-year issue continues a beloved tradition that has captivated collectors and investors worldwide for over three decades. With its brand-new reverse design showcasing Australia's iconic laughing kookaburra and the historic King Charles III effigy on the obverse, this coin bridges natural wonder with royal heritage.

What makes this coin special goes beyond its stunning artistry. Struck from .9999 pure silver and recognized as legal tender by the Australian government, the 2026 1oz silver kookaburra delivers both intrinsic metal value and the security that comes with government backing. The 500,000 mintage cap ensures this isn't just another generic round—it's a limited-edition piece with genuine collector appeal and potential for premium appreciation over time.

Whether you're building your first silver stack or adding to an established portfolio, this coin offers something rare in today's market: investment-grade silver wrapped in collectible appeal. The Perth Mint's reputation for quality, combined with the series' proven track record, makes this a smart choice for anyone serious about precious metals investing.

At Summit Metals, we're committed to making your investment journey as straightforward as possible. Our transparent, real-time pricing means you always know exactly what you're paying—no hidden fees or inflated premiums. Thanks to our bulk purchasing power, we pass real savings directly to you, whether you're buying one coin or building a substantial position.

Consider using our Autoinvest program to make the 2026 1oz silver kookaburra part of your regular investment routine. Just like contributing to a 401(k), you can automatically purchase silver each month, building your wealth through consistent, disciplined investing. It's dollar-cost averaging made simple, and it takes the emotion and guesswork out of timing the market.

The release of this coin is just around the corner. Don't miss your chance to add this exceptional piece to your collection or portfolio. We invite you to explore everything we offer and find how physical precious metals can strengthen your financial future. For comprehensive guidance on getting started, check out Your Ultimate Guide to Buying Silver Coins Online. When you're ready to dive in, explore our full range of silver bullion products and see why investors across Wyoming, Salt Lake City, and beyond trust Summit Metals for their precious metals needs.