Why Now is the Perfect Time to Sell

Selling scrap gold and silver has never been more lucrative. Gold prices are trading at all-time highs, which means that broken necklace in your drawer or those mismatched earrings could be worth serious cash right now.

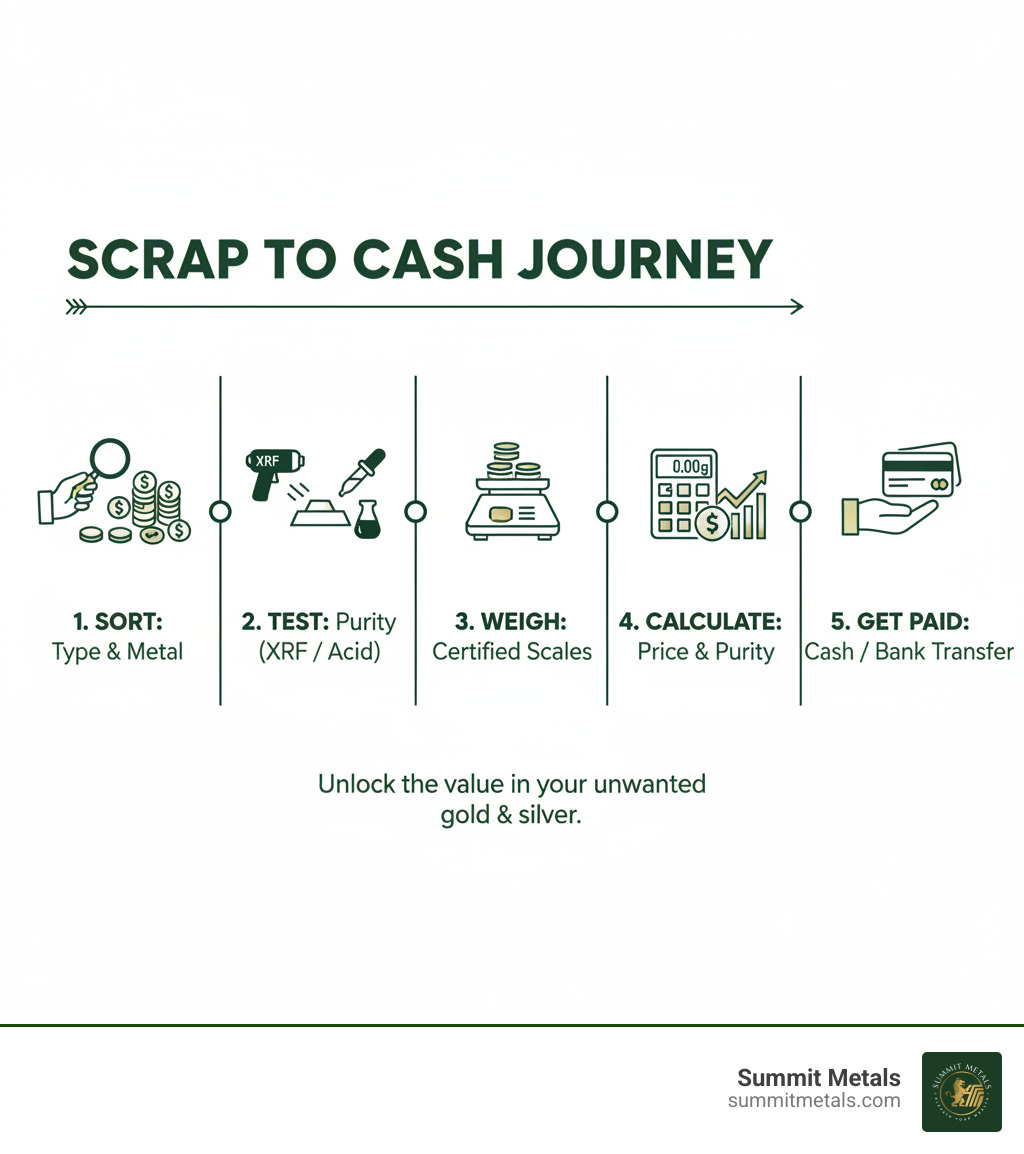

Quick Answer: The Scrap Gold & Silver Selling Process

- Gather your items - Collect broken jewelry, old coins, dental gold, or sterling silver flatware

- Find a reputable buyer - Look for BBB-accredited dealers with transparent pricing

- Get items tested - Buyer tests purity (karat) and weighs items in front of you

- Receive your offer - Based on current spot price, purity, and weight

- Get paid immediately - Cash or bank transfer on the same day

Most transactions take 15-30 minutes from evaluation to payment.

Whether you've inherited a box of old jewelry, have dental gold from a crown replacement, or simply want to declutter and profit from unwanted items, this guide walks you through the entire process. You'll learn what qualifies as scrap, how to identify precious metals at home, what to expect during the evaluation process, and most importantly—how to avoid scams and maximize your payout.

The key to getting the best return is understanding what you have and choosing a buyer who uses transparent pricing tied to live market rates. Unlike pawn shops or mail-in services that often pay as little as 40% of melt value, reputable precious metals dealers can pay 75-99% of spot price depending on the item type and quantity.

About the Author

I'm Eric Roach, and I've spent over a decade in investment banking and M&A advising Fortune-500 clients through complex hedging programs and risk management strategies. Today, I help everyday investors protect and grow their wealth through precious metals, including guidance on selling scrap gold and silver to maximize returns and reinvest wisely. My experience translating institutional strategies into clear, actionable steps for individuals ensures you get the most value from every transaction.

What Qualifies as Scrap Gold and Silver?

Here's the good news: selling scrap gold and silver doesn't require pristine, Instagram-worthy pieces. In fact, most of what we buy is the exact opposite—broken, mismatched, outdated, or simply unwanted items that are gathering dust in your jewelry box or kitchen drawer.

Scrap precious metal refers to any item whose value lies primarily in its metal content rather than its appearance or collectible appeal. That broken chain you've been meaning to fix for five years? That's scrap. The single earring whose mate disappeared on vacation? Also scrap. If it contains gold, silver, platinum, or palladium, it has value.

The most common items we see are jewelry pieces—broken necklaces, tangled chains, dented rings, single earrings, unused charms, or pieces with missing stones. Condition simply doesn't matter when you're selling scrap gold and silver. A bent ring has the same melt value as a perfect one of the same weight and purity.

Coins are another major category. While some coins have collectible (numismatic) value that exceeds their metal content, many are worth only their melt value. This includes older silver coins often called "junk silver," damaged gold coins, or common bullion coins without significant premiums. Bullion bars and rounds that you want to liquidate also qualify, whether they're gold, silver, platinum, or palladium.

Don't overlook dental gold—those old crowns, bridges, or fillings sitting in your bathroom drawer can be worth more than you think. Many people are genuinely surprised when they find their dental work is valuable.

Your grandmother's tarnished sterling silver flatware is another excellent source of scrap. Mismatched forks, spoons, knives, serving dishes, and bowls all contain 92.5% pure silver. Even if the set is incomplete or heavily tarnished, the silver content remains valuable.

We also purchase platinum and palladium, whether in jewelry form or industrial scrap. These metals command premium prices and are worth evaluating if you have any pieces you suspect contain them.

Gold-filled vs. Gold-plated Items

Not everything that looks like gold actually has meaningful gold content. Understanding the difference can save you a wasted trip.

Gold-plated items have only a microscopic layer of gold applied over a base metal—we're talking thinner than a human hair. These have virtually no melt value and aren't purchased by precious metal buyers. Gold-filled pieces are slightly better, with a thicker layer of gold mechanically bonded to base metal, but even then, the actual gold content is usually too minimal to have significant scrap value. We typically don't purchase gold-filled items for this reason.

The rule of thumb: if it's not marked as solid gold (10k, 14k, 18k, etc.), it probably won't have meaningful scrap value.

Identifying Your Precious Metals at Home

A little detective work before you visit can help you understand what treasures you're sitting on.

Most genuine precious metal items carry hallmarks—tiny stamps indicating their purity. For gold, look for numbers like 10k, 14k, 18k, 22k, or 24k (or their metric equivalents: 417, 585, 750, 916, 999). The higher the number, the purer the gold, with 24k being pure gold.

Silver items typically display "925" or "Sterling" for sterling silver. European silver might show "800." Platinum pieces are usually marked "PT950" or "PLAT."

The magnet test provides a quick preliminary check. Gold, silver, and platinum are non-magnetic, so if your item strongly sticks to a powerful magnet (like a rare-earth magnet), it's likely not solid precious metal. However, this test isn't definitive—many base metals are also non-magnetic, so passing the magnet test doesn't guarantee authenticity.

Here's the reality: hallmarks can be faked, worn off over time, or absent entirely on older or custom pieces. Home testing gives you a general idea, but professional testing is the only way to know for certain what you have and what it's worth. As we explain in our article "Don't Get Scrapped: Uncover the True Value of Your Silver Coins," professional evaluation is essential to understanding true value and avoiding costly mistakes.

The Step-by-Step Process for Selling Scrap Gold and Silver

Selling scrap gold and silver should never feel rushed or confusing. At Summit Metals, we've designed our process to be straightforward and transparent, so you can walk in with confidence and leave with cash in hand—usually within 15 to 30 minutes.

Step 1: Gather and Sort Your Items

Start by rounding up anything you think might contain precious metals. Dig through that old jewelry box, check the back of your bathroom drawer for forgotten earrings, and raid the silverware chest for those tarnished forks you never use. Don't worry if items are broken, tangled, or missing stones—their value comes from the metal itself, not their condition.

While you don't need to spend hours organizing, a quick sort by metal type (gold in one pile, silver in another) can speed things up when you arrive. But honestly? We're happy to do the sorting for you.

Step 2: Find a Reputable Buyer (Summit Metals)

This is where many people get tripped up. Not all buyers are created equal, and choosing the wrong one can cost you hundreds or even thousands of dollars. We've built our reputation in Wyoming and Salt Lake City, Utah on transparency and fair pricing. Our rates are competitive because we buy in bulk, and we tie our offers directly to live market prices—no smoke and mirrors, no lowball offers.

When you walk into our location, you're dealing with experienced professionals who will treat you with respect and explain every step of the process.

Step 3: The Evaluation Process

Everything happens right in front of you. We'll never take your items to a back room or leave you wondering what's going on.

Purity testing comes first. For gold, we determine the karat—whether it's 10k, 14k, 18k, or something else. We use a combination of visual inspection, acid testing, and when needed, advanced X-ray fluorescence (XRF) technology that gives us precise readings without damaging your items. For silver, we confirm whether you have sterling silver (92.5% pure) or fine silver (99.9% pure).

Next comes weighing, which is done on certified scales that meet industry standards. We measure in grams or troy ounces (more on that later), and you can watch the numbers on the scale yourself. If you have items of different purities, we'll weigh each group separately to ensure accurate pricing.

Step 4: Receiving Your Offer

Once we know what you have and how much it weighs, we calculate your offer based on the current spot price of gold or silver. The spot price is the live market rate that precious metals are trading at right now—it changes throughout the day just like stock prices.

We'll show you exactly how we arrived at your number. There's no vague "up to" language or mysterious formulas. You'll see the math, understand the offer, and have time to ask questions. There's zero pressure to accept on the spot if you need time to think it over.

Step 5: Getting Paid

If you're happy with the offer and ready to sell, payment happens fast. You can choose immediate cash if you prefer walking out with bills in hand, or we can arrange a bank transfer that typically hits your account the same day.

Most customers are out the door with payment completed within half an hour of walking in. It's that simple.

Required Documents and Legalities

Like any legitimate precious metals dealer, we're required by law to collect certain information. Here's what you'll need to bring:

Government-issued photo ID is mandatory—think driver's license or passport. This isn't us being nosy; it's a federal requirement designed to prevent theft and fraud. You must be at least 18 years old to sell precious metals.

You'll also sign a simple proof of ownership form confirming that the items you're selling belong to you. This protects both you and us, and it's standard practice across the industry.

These legal regulations exist for good reason. Transactions involving precious metals are subject to state and federal oversight, including record-keeping and reporting requirements. We take these obligations seriously and handle all compliance matters professionally, so you don't have to worry about the paperwork.

The entire process is designed to protect you while making selling scrap gold and silver as smooth and rewarding as possible.

Understanding the Value: How Payouts Are Calculated

Let me pull back the curtain on something that confuses a lot of people: how exactly is your scrap gold and silver valued? The good news is, it's not some mysterious formula locked away in a vault. It's actually a straightforward calculation based on real market data that you can understand and verify yourself.

Spot Price vs. Melt Value

First, let's clarify two terms you'll hear constantly when selling scrap gold and silver: spot price and melt value.

The spot price is what one troy ounce of pure precious metal is trading for right now on the global market. Think of it like a stock price—it changes throughout the day based on supply, demand, and economic conditions. When someone says "gold is at $2,000 per ounce," they're talking about the spot price for 24-karat pure gold.

Melt value is more personal to your specific items. It's what your piece is worth based purely on its precious metal content. That 14-karat gold bracelet isn't pure gold—it's mixed with other metals for durability. So its melt value is calculated by taking its weight, multiplying by the percentage of actual gold it contains, and then applying the current spot price.

Role of Purity (Karat) and Weight

These two factors are the foundation of your item's value, and understanding them puts you in control.

Purity for gold is measured in karats. Pure gold is 24 karats, meaning 24 out of 24 parts are gold. Most jewelry isn't pure because gold is soft—it needs to be alloyed with other metals like copper or silver for strength. A 14-karat piece is 14 parts gold and 10 parts other metals, which means it's 58.33% pure gold (14 divided by 24). Similarly, sterling silver is stamped "925" because it's 92.5% pure silver.

Weight matters because, well, more precious metal means more value. But here's a critical detail: precious metals are weighed in troy ounces or grams, not the regular ounces you use for weighing groceries. A troy ounce is about 31.1 grams, while a standard ounce is only 28.35 grams. Every reputable buyer uses troy ounces—if someone's using standard ounces, that's a red flag.

The Valuation Formula

Here's the actual math, and I promise it's simpler than it looks:

Weight (in grams) × Purity Percentage × Current Spot Price per gram = Melt Value

Let's say you bring in a 14-karat gold ring that weighs 10 grams. Gold's spot price today is $65 per gram. Your calculation would be: 10 grams × 0.5833 (that's 58.33% purity) × $65 = approximately $379.

You can try this yourself using online scrap metal calculators. Just plug in your numbers and it'll give you a ballpark estimate. These calculators show the theoretical melt value, not necessarily what you'll receive after accounting for business costs.

Percentage of Spot Price Paid

Now for the question everyone asks: "If my gold has a melt value of $379, why am I being offered $325?"

It's a fair question, and the answer isn't that buyers are trying to rip you off. Running a precious metals business involves real costs that come out of that melt value. There's the testing and appraisal time—accurately determining purity requires expertise and equipment. Then there are refining costs—your scrap needs to be melted down in an industrial facility where the pure gold or silver is separated from all the alloy metals and impurities. That's not cheap.

Buyers also need to cover their operational overhead and make a reasonable profit to stay in business. And there's market risk—gold prices can drop between when they buy your items and when they actually get them refined and resold.

Honest buyers typically pay between 75% and 99% of melt value, depending on what you're selling and how much. Our bulk purchasing model at Summit Metals allows us to offer more competitive percentages than many smaller buyers because our costs are distributed across larger volumes. As we discuss in "When Is the Best Time to Sell Your Silver & Gold?", timing your sale during market peaks can also help you maximize returns.

Factors That Influence the Price of Your Scrap

Beyond the basic formula, several other factors affect what you'll actually receive when selling scrap gold and silver.

Current market trends are your friend right now. With gold at record highs, your scrap is worth more today than it would have been a few years ago. You don't need to watch the charts obsessively, but understanding the general trend helps you make informed decisions about when to sell.

The type of item you're selling makes a surprising difference. Jewelry often contains lower-purity gold (10k or 14k) and may have gemstones or mechanical parts that need to be removed, affecting the net precious metal weight. Coins—especially bullion coins with only melt value—are easier to process and often fetch a higher percentage of spot price. Investment-grade bars are the simplest to verify and typically command the highest payouts because they're nearly pure and require minimal processing.

When considering investment-grade items like coins and bars, it's helpful to understand their unique advantages, especially if you plan to reinvest your proceeds.

Gold Coin vs. Gold Bar: Which is Better?

While both are excellent stores of value, gold coins often have an edge for many investors and sellers.

| Feature | Gold Coin | Gold Bar |

|---|---|---|

| Government Backing | Has a legal tender face value, which is protected by the government and adds a layer of fraud protection. | No face value; value is based solely on weight and purity. |

| Recognizability | Globally recognized (e.g., American Eagles, Canadian Maple Leafs), making them highly liquid and easy to sell. | Can require more verification upon sale, especially from lesser-known refiners. |

| Divisibility | Available in smaller denominations (e.g., 1/10 oz, 1/4 oz), making them easier to sell in smaller quantities. | Typically sold in larger weights (1 oz, 10 oz, kilos), making them less flexible for small transactions. |

| Premiums | Tend to have slightly higher premiums over spot price due to minting costs and collectibility. | Generally have lower premiums per ounce, making them ideal for large-volume investments. |

For many, the added security, recognizability, and flexibility of gold coins make them a superior choice for both selling and long-term investment.

This brings up an important distinction: numismatic versus melt value. Some coins are worth far more to collectors than their metal content alone. A good buyer will recognize when your coin has collector value and won't just toss it in the scrap pile. For more insight on this, check out "Where Can I Sell My Gold Coins for Best Price".

Buyer fees and refining costs vary significantly between businesses. Pawn shops and "We Buy Gold" stores often have higher overhead and less efficient refining relationships, which means lower payouts for you. We've structured our business to minimize these costs through volume purchasing and direct refining relationships.

Understanding these factors puts you in a stronger position. You'll know what questions to ask, what offers are fair, and how to maximize the value of your scrap metals.

Where to Sell: Why Choose Summit Metals

When it comes to selling scrap gold and silver, you have several options. However, not all buyers are created equal. Understanding the differences between various buyers can help you maximize your return and ensure a safe, transparent transaction.

Why We're Different

At Summit Metals, we've built our reputation on transparency and fairness. Based in Wyoming with locations in Salt Lake City, Utah, we're not just buyerswe're precious metals investors ourselves. We understand what matters to you because it matters to us too.

Our commitment to real-time pricing means you always know exactly what you're getting. No vague "up to" claims or surprise deductions at the counter. We display current market rates openly, and our offers are directly tied to live spot prices. This transparency builds trust, and trust is the foundation of every transaction we make.

Because we purchase precious metals in bulk, we're able to offer more competitive payouts than most local buyers. Our larger scale means lower overhead costs per transaction, and we pass those savings directly to you. Whether you're bringing in a single gold chain or an entire collection, you'll benefit from our institutional-level pricing.

We also offer something unique that turns your sale into a long-term wealth-building strategy: our Autoinvest program. Instead of just walking away with cash, you can immediately reinvest your proceeds into investment-grade bullion. This allows you to dollar-cost average into precious metalsbuying a set amount consistently every month, just like you contribute to a 401k. It's the smartest way to turn a one-time windfall from scrap items into a growing, secure asset for your future.

Summit Metals vs. Other Buyers

| Buyer Type | Pros | Cons | Best For |

|---|---|---|---|

| Summit Metals | Transparent, real-time pricing; competitive payouts due to bulk purchasing; option to reinvest with Autoinvest. | Requires visiting a physical location in Wyoming or Salt Lake City, Utah. | Sellers seeking maximum value, transparency, and long-term investment options. |

| Pawn Shops | Quick and convenient; widely available. | Typically offer the lowest payouts (as low as 40% of melt value); focus is on resale, not metal value. | Getting fast cash in an emergency when payout value is not the top priority. |

| Local Jewelers | May offer fair prices for items they can resell. | Payouts can be inconsistent; may not be equipped to handle large volumes or diverse scrap. | Selling high-quality, resellable jewelry pieces. |

| "We Buy Gold" Stores | Convenient storefront locations. | Payouts and transparency vary widely; can use high-pressure tactics. | Quick sales, but requires careful vetting of the specific store. |

| Online Mail-in Services | Convenient from home. | You ship valuables before getting an offer; risk of loss or underpayment; insurance can be limited. | Sellers who are comfortable with the risks of mailing their precious metals. |

How to Vet Any Precious Metals Buyer

Regardless of where you choose to sell, certain standards should be non-negotiable. Always check for BBB accreditationwe're proud to maintain our A+ rating through consistent, ethical business practices.

Read online reviews from multiple sources. Look for patterns in customer feedback about transparency, pricing, and overall experience. A few negative reviews are normal for any business, but pay attention to how the company responds to concerns.

Ask about their evaluation process before bringing in your items. Reputable buyers will explain exactly how they test purity and calculate offers. They should use certified scales that are regularly calibrated and visible to you during the weighing process.

Always insist on a written quote before agreeing to sell. This protects both parties and gives you time to consider the offer without pressure. If a buyer refuses to provide documentation or rushes you to make a decision, that's a red flag.

Finally, confirm what identification and documentation they require. Legitimate buyers follow legal requirements for record-keeping, which means asking for government-issued ID and proof of ownership. If someone doesn't ask for ID, they're either operating illegally or dealing in stolen goodsneither scenario you want to be part of.

The bottom line? Whether you choose Summit Metals or another buyer, prioritize transparency, competitive pricing, and a process that makes you feel informed and respected. Your precious metals have value, and you deserve a buyer who treats both you and your items accordingly.